This chapter describes the market situation and highlights the medium-term projections for world cotton markets for the period 2020-29. Price, production, consumption and trade developments for cotton are discussed. The chapter concludes with a discussion of important risks and uncertainties affecting world cotton markets during the coming ten years.

OECD-FAO Agricultural Outlook 2020-2029

10. Cotton

Abstract

10.1. Current market conditions

After a fall in 2018, global cotton production and mill consumption1 increased in the 2019 marketing year.2 Production increases were mainly seen in India and the United States, while supply decreased in the People’s Republic of China (hereafter “China”). Nonetheless, China remained the largest consumer, accounting for around one-third of total cotton mill use (see below). In recent years, strong growth of the spinning and textile industry has spurred the consumption of cotton in Bangladesh,3 Turkey and Viet Nam, a trend that continued in the 2019 marketing year.

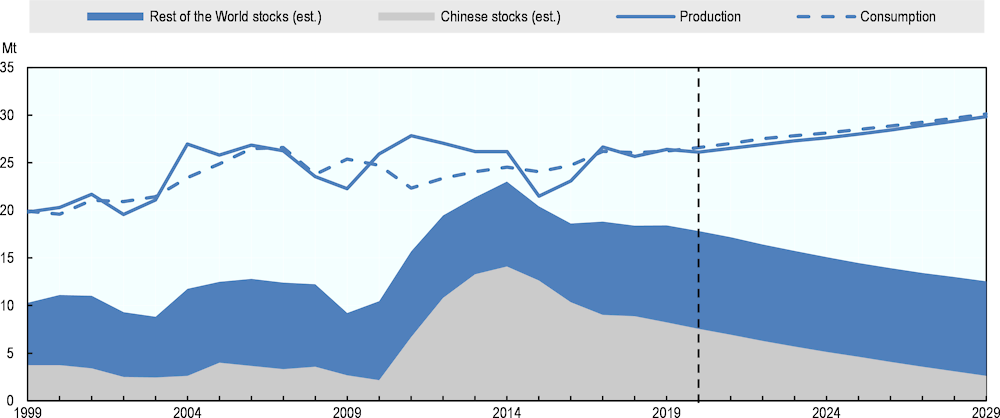

Estimated global stocks declined by 1% to 18.2 Mt, which amounts to about eight months of world consumption. Hitherto, changes in stocks have been determined by China, which currently holds 45% of global stocks. Since 2014 the country has sought to reduce its cotton stocks, and in 2019 these decreased by 7%. This decrease was largely offset by increasing stocks in Brazil, which enjoyed two good cotton crops in a row.

Global cotton trade remained at 9.3 Mt in 2019, or around one-third of global production. Export growth was registered for the United States (the world’s main exporter), India, and Brazil, the latter increasingly supplying cotton to South and East Asia. By contrast, Australia’s exports shrank markedly. On the demand side, imports decreased in China but increased in Viet Nam and Bangladesh.

The Cotlook A index, the main reference for international cotton prices, is expected to decrease to an average of USD 1702/t for the 2019 marketing year, following the upward momentum that had been observed since August 2019. Cotton prices continue to be high compared to prices of polyester, the main substitute for cotton, and although the ratio of prices has stabilised in recent years it did increase in 2019.

10.2. Projection highlights

Driven by the assumption that the price ratio between cotton and other fibres will be more stable than in recent years, global mill consumption is expected to grow slightly faster than world population in the coming decade. The distribution of consumption across the globe depends on the location of cotton mills, which are often located in proximity to clothing and apparel industries. Over the past decades, there has been a marked shift in cotton mill activity from the developed world and the former Soviet Union towards Asia, especially China. Chinese consumption peaked in 2007 and has been declining since, as stricter regulations and rising labour costs have stimulated a move of the industry to other Asian countries, notably Viet Nam and Bangladesh. Since 2016, the decline in Chinese mill consumption seems to have ceased and the Outlook assumes a slight upward trend for the coming decade. In India, another major cotton consumer, government policies that support the domestic textile industry are expected to also stimulate continuous but slower growth in cotton mill use (slower than in the past decade).

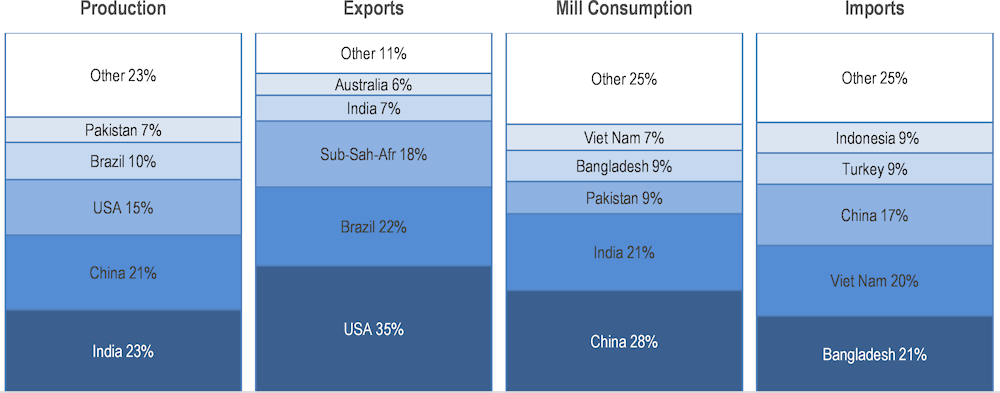

World cotton production is projected to grow 1.5% p.a. to reach almost 30 Mt in 2029. This growth will come from an expansion of the cotton area (0.5% p.a.) as well as growth in average global yields (1% p.a.). Yields have been flat since 2004 as several countries struggled with pest problems and water scarcity, and because production shares of low-yielding countries have been increasing. Better genetics and the adoption of better agronomic practices for sustainable cotton production could bring improvement over the coming decade, but yield growth could remain a challenge in several countries. India will continue to be the world’s largest cotton producer, but in line with recent trends cotton area expansion is expected to be limited. In general, the global players in cotton markets in 2029 will be the same as in the base period, which also means that Sub-Saharan Africa as a region is still expected to be the third largest exporter of raw cotton in 2029 (Figure 10.1).

Figure 10.1. Global players in cotton markets (2029)

Notes: Presented numbers refer to shares in world totals of the respective variable.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

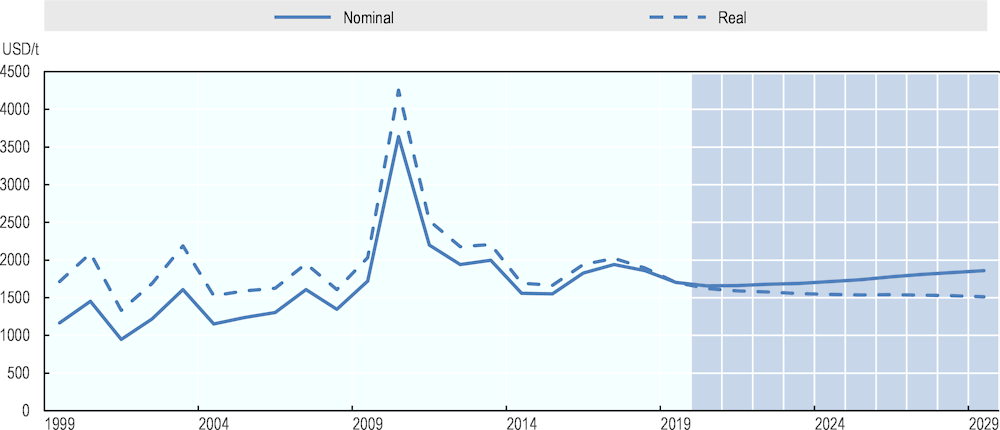

After trending downwards since 2017, global cotton prices are expected to increase over the projection period in nominal terms, while decreasing slightly in real terms. As the ratio between cotton and polyester prices appears to have stabilised and assuming China resumes its efforts towards a greener economy, polyester production should be dampened. This decrease in the rate of growth of polyester production and a slowdown in production growth in India should lead to increasing nominal cotton prices in the coming years.

Several uncertainties affect the outlook period under study, including the COVID-19 pandemic. In addition, it is unclear how per capita consumption of cotton textiles in developing and emerging economies will evolve as incomes grow and urbanisation continues, especially given competition from polyester. On the production side, projections are sensitive to pests and weather conditions. Climate change, with its impact on the occurrence and magnitude of events such as droughts and storms, constitutes an additional factor of uncertainty in the future. Sustainability considerations will continue to influence the future demand and supply of cotton. Trade tensions are another source of uncertainty for cotton markets.

10.3. Prices

International cotton prices are expected to decrease in real terms throughout the projection period, as world cotton demand remains under pressure from synthetic fibres, notably polyester. The decrease in real prices is equivalent to a slight increase in nominal terms. Since the early 1970s, when polyester became price-competitive with cotton, cotton prices have tended to follow polyester prices; on average. For example, cotton prices were only 5% above polyester staple fibre prices between 1972 and 2009. Since 2010, however, cotton prices have been on average almost 40% above the polyester price. This seems likely to be in large part due to temporary factors, including low production in 2015-16 and Chinese stockpiling. This Outlook expects a partial correction, bringing cotton prices closer in line with the historical pattern. Polyester prices themselves are not part of the outlook projections, but are expected to track oil prices, which are assumed to be flat in real terms.

Figure 10.2. World cotton prices

Note: The reference cotton price is the Cotlook price A index, Middling 1 1/8”, CRF far Eastern ports. Data shown represent the marketing year average (August/July).

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The cotton market has historically been sensitive to external shocks that have led to large price swings. In 2010/11, cotton prices more than doubled due to a mix of high oil and polyester prices and an unexpectedly high demand (beginning of Chinese stockpiling and the additional demand resulting from the high polyester prices). The subsequent correction was only partial as both the additional demand from China and polyester prices progressively decreased (Chinese stockpiling progressively decreased until 2014 and polyester prices until 2015/16).

The potential for external shocks to create volatility still exists, but a repetition of the 2010/11 price peak seems unlikely given higher global stocks. However, decisions on destocking in China can affect the projections. This Outlook assumes that Chinese public stocks will gradually return to pre-2011 levels, in line with recent trends. The future path of cotton prices is clearly sensitive to this assumption.

10.4. Production

Cotton is grown in subtropical and seasonally dry tropical areas in both the northern and southern hemispheres, although most of the world’s production takes place north of the equator. The main producing countries are India, China, United States, Brazil, and Pakistan. Together, these countries account for more than three-quarters of global production.

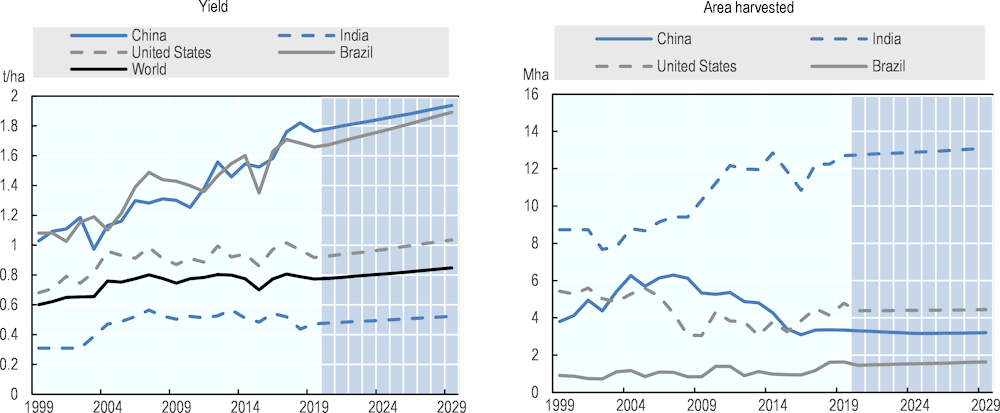

Most of the production growth in the coming decade is expected to come from these countries, with India accounting for more than a fifth of the increase. At the global level, the cotton area is projected to grow by 6% while yields are projected to increase by 7% compared to the base period. In the last decade, global yields were stagnant, reflecting stagnant yields in some major producers (United States, Pakistan, India), declining cotton area in China (where yields are well above average), and expanding cotton area in India (where yields are well below average). These factors are expected to continue to affect global yield trends in the coming decade, despite growth in both yields and cotton area in Brazil.

Figure 10.3. World cotton production, consumption, and stocks

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Production in India is projected to grow by around 1.3% p.a. over the coming decade due in large part to a growing demand for cotton for the domestic apparel industry. After a rapid increase in yields between 2000 and 2007 (linked to an increase in irrigation, fertiliser use, and the adoption of genetically modified Bt cotton), yields were stagnating in recent years as producers struggled with adverse weather and pests, such as the pink bollworm, which has become resistant to Bt cotton. While it is possible that new technologies will provide relief, the development and roll-out of solutions may take several years. In addition, cotton yields in India are influenced by the monsoon pattern in rain-fed regions and are hence vulnerable to climate change. This Outlook assumes that yield growth for Indian cotton will follow demand for cotton in the country while cotton area is projected to stay flat.

Figure 10.4. Cotton yields and area harvested in major producing countries

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Chinese cotton producers currently achieve yields that are more than double the world average. Even though yields continue to be below the country’s potential levels, since further improvement may become more difficult, yield growth is projected to slow down to 0.9% p.a. Although in general the cotton area in China has been declining over the past decade mostly due to changing government policies, this decline seems to have halted in the last two years. Nevertheless, this Outlook expects a slowly decreasing cotton area in China.

In Brazil, cotton is grown in part as a second crop in rotation with soybeans or maize, and output has recently grown strongly in the main growing areas, such as Mato Grosso. Favourable growing conditions and a high rate of adoption of modern technologies have driven rising cotton yields and areas over the past years. The Outlook assumes that these factors support further production growth.

10.5. Consumption

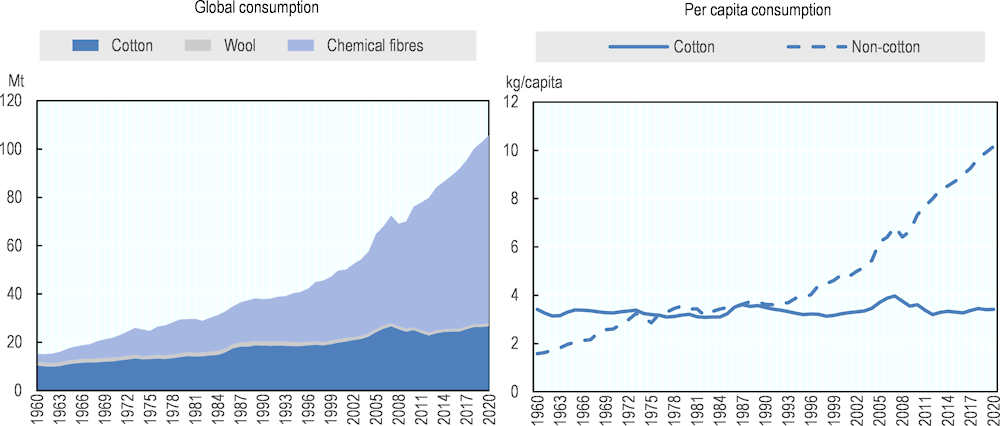

Cotton consumption statistics in this Outlook refer to the use of cotton fibres by mills for the production of yarn. This mill use depends on the global demand for textiles as well as on competition from substitutes such as polyester and other synthetic fibres. Over the past decades, global demand for textile fibres has grown strongly, but most of this demand has been met by synthetic fibres (Figure 10.5). Per capita consumption of non-cotton fibres overtook that of cotton in the early 1990s and has continued to grow strongly. By contrast, global per capita consumption of cotton fibres has not increased much over time and has even decreased in recent years. As a result, global cotton consumption peaked in 2007 at 27 Mt, but decreased to around 26 Mt in 2017-19.

Figure 10.5. Historical trends in consumption of textile fibres

The prospects for global cotton use depend on developments in developing and emerging economies. Data collected by the International Cotton Advisory Committee (ICAC) suggests that global per capita demand for cotton products decreased between 2007 and 2012 but since then global per capita demand has slightly increased (Figure 10.5). The effects of income growth should lead to a higher demand for cotton products. However, strong population growth in regions where per capita demand for cotton products is below average dampens this effect. On the other hand, demand from developing regions with lower absolute levels of consumption but higher income responsiveness will put an upwards trend on global demand as both, incomes and population in these countries are projected to rise. As a result, this Outlook expects that global consumption of cotton products will grow at a slightly higher pace than global population in the coming decade. Correspondingly, global mill use is projected to grow by around 1.3% p.a. over the outlook period.

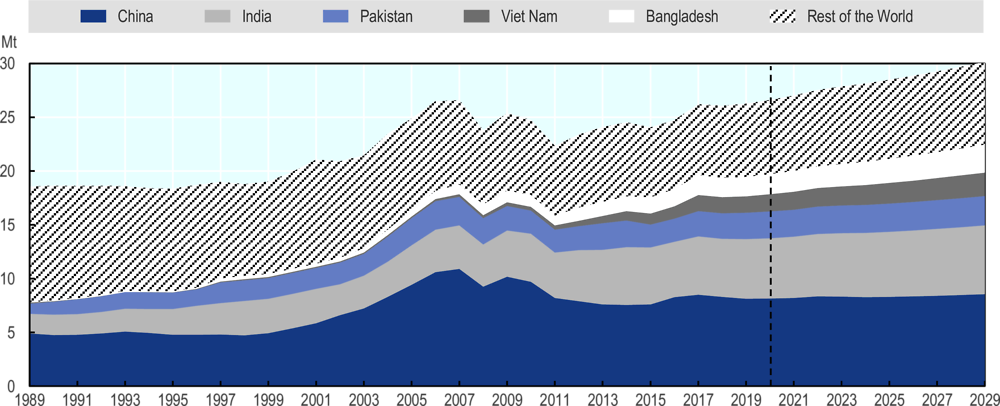

The distribution of demand for cotton fibres depends on the location of spinning mills, where cotton and synthetic fibres are spun into yarn. The greatest amount of yarn spinning occurs in countries where downstream industries are located, mostly in Asian countries with lower labour costs. China has been the world’s largest consumer of cotton since the 1960s. Major shifts are taking place, however, with yarn production gradually moving from China to other Asian countries.

From its peak in 2007, China’s consumption has fallen since by 25%. This decline has been partly due to a decrease in government purchases of cotton, which had provided higher prices to farmers but also induced a shift from cotton to synthetic fibres on the demand side. The decline also reflects structural change as higher labour costs and more stringent labour- and environmental regulations stimulated a move of the industry to other Asian countries, notably Viet Nam and Bangladesh. In the last four years, mill consumption has regained some lost ground, in part because cotton prices have become more competitive when compared to polyester. Polyester also appears to have suffered a setback due to government measures to combat industrial pollution. Chinese spinning mill use is therefore assumed to continue at similar levels as seen today over the next decade.

By contrast, spinning mill use is expected to grow in India as the government favours the development of the domestic textile industry. Textiles form an important component of Indian industrial production and are considered an engine of employment generation. Policies are expected to continue supporting its development, e.g. through support for the adoption of faster looms.

Figure 10.6. Cotton mill consumption by region

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en ; historical data from ICAC.

The phase-out in 2005 of the Multi Fibre Arrangement (which had fixed bilateral quotas for developing country imports into Europe and the United States) was expected to favour Chinese textile producers at the cost of smaller Asian countries. In practice, countries such as Bangladesh, Viet Nam and Indonesia experienced strong growth in their textile industry. In the case of Viet Nam, this was partly driven by foreign direct investment (FDI) of Chinese entrepreneurs and its accession to the World Trade Organization in 2007. The rapid growth in these countries is expected to continue over the next decade, with Bangladesh and Viet Nam expanding their mill use by about 45% and Indonesia by more than 30% relative to the base period. Further growth is also expected in Turkey and Central Asia, where the textile industry is expanding in part thanks to growing exports to the European Union and the Russian Federation.

10.6. Trade

Cotton has historically been traded in bales of raw cotton fibres, although trade in cotton yarn has been growing recently. The global trade in raw cotton (the focus in this Outlook) is projected to surpass 11 Mt in 2029, 23% higher than during the base period. Trade is therefore expected to grow slightly faster than overall consumption given the demand growth in countries without much domestic cotton production, such as Bangladesh and Viet Nam, and stagnating domestic mill use in Brazil.

Bangladesh and Viet Nam are expected to be the leading importers over the next decade. By 2029, both countries are projected to increase imports by more than 43%. Together, they will account for over 40% of global imports (Figure 10.1). The United States will remain the world’s largest exporter throughout the outlook period, accounting for more than one third of global exports in 2029. Brazilian exports are expected to grow strongly over the next decade as Brazil emerges as the second-largest exporter by 2029.

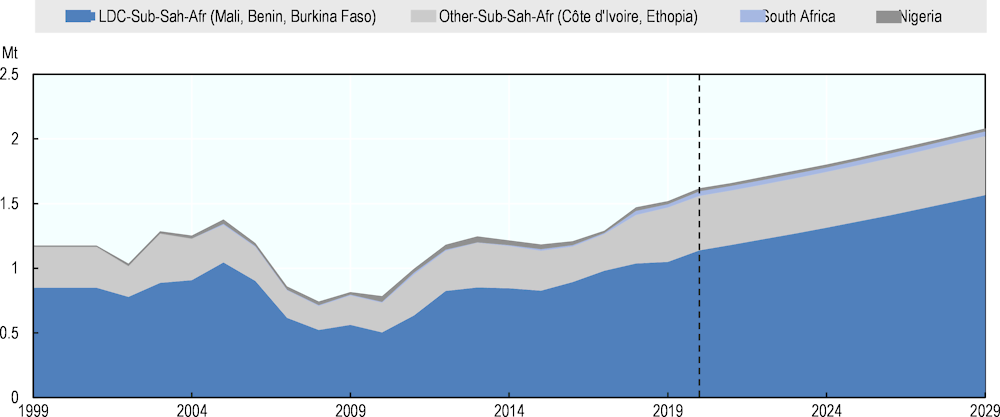

Cotton is an important export crop for Sub-Saharan Africa, which currently accounts for 15% of global exports (with West Africa accounting for almost 75% of the region’s production and shipments). Burkina Faso, Benin, Mali, and Côte d’Ivoire, the leading producing countries, have seen their volumes expanding due to area expansion and government support. Spinning mill consumption remains limited throughout Sub-Saharan Africa and many countries export virtually all of their production. However, the apparel manufacturing industry has started to develop in some countries of East Africa, especially Ethiopia, as the region presents some attractive conditions for FDI. In the long run, this might change the net export condition of Sub-Saharan Africa that has been observed in the past. Nonetheless, Sub-Saharan African exports are projected to continue growing at around 2.9% p.a. in the coming decade, increasing the region’s market share to 18%, with Asia and Southeast Asia being the major destinations for shipments.

Figure 10.7. Cotton exports in Sub-Saharan Africa

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

10.7. Main issues and uncertainties

As discussed above, economic growth and urbanisation will affect the per capita demand for cotton textiles in developing and emerging economies. Since the consumption of textiles and apparel is more income responsive than the consumption of food commodities, deviations from the economic conditions assumed for the developing world could lead to important changes in global consumption, production and trade projections.

Such a situation is observed with the current COVID-19 pandemic where economic conditions and consumer behaviour have changed abruptly as a result of the confinement policies all around the world to reduce the spread of the virus. The decrease in the demand for textiles and apparels forced producers to cut their demand for fibre products, essentially yarns and fabrics. In turn, cotton mills have slashed their demand for cotton, leading to a significant fall in international prices. For the current 2019/20 season, cotton crops in the major producing areas have already been harvested. However, the current depressed cotton prices will have a determining role in farmers’ planting decisions, affecting the production of the next season. An expansion of the COVID-19 measures could also affect the labour-intensive planting operations in West Africa, which typically begin in May.

Other demand trends could also affect the projections. For instance, recycling by the textile industry is creating a steady secondary market that competes to provide raw material to producers of lower-quality textiles and non-textile products. This trend could further reduce the demand for cotton and other fibres. However, in high-income countries there appears to be an increasing consumer preference for natural fibres that could favour cotton over polyester.

Policy measures can also affect consumption trends. For instance, several East African countries are moving towards discouraging second-hand clothing imports, which could give a push to cotton consumption and encourage value addition in Africa.

Cotton production is sensitive to pests and weather conditions. Given cotton’s dependence on water, projections are sensitive to climate change, which could lead to droughts and other adverse weather conditions. As noted above, yield growth has been slow in several countries in the past decade. Faster than expected improvements in genetics (e.g. facilitated in part by a better understanding of the cotton genome) and better pest management have the potential to lead to higher yield growth than what is expected in this Outlook. However, such innovations take time to develop and deploy, and in the case of genetically modified cotton, are sometimes controversial. In India, pink bollworm appears to have become resistant to Bt cotton, resulting in significant crop losses. In Burkina Faso, the introduction of Bt cotton in 2008 was effective in combatting bollworms, but resulted in a shorter staple length (and hence lower quality premiums). This prompted the government to phase out Bt cotton in 2015.

Policies play an important role in global cotton markets. This is notably the case for Chinese stockholding policies. Other policy initiatives (e.g. support for domestic textile industries, input subsidies) may also affect projections.

Sustainability considerations will continue to influence the future demand and supply of cotton. Globally, an estimated 19% of cotton was produced under the sustainability standards of the Better Cotton Initiative in 2017-18 and further growth is expected. Related segments, such as organic cotton, are also expected to grow. One implication of these trends is an increased need for transparency and traceability along the supply chain.

Notes

← 1. Consumption data in the Outlook refer to cotton mill use, i.e. the processing of raw cotton into yarn.

← 2. In line with the convention used by the International Cotton Advisory Committee, the marketing year for cotton is defined as running from 1 August to 31 July. Data for 2019 thus refer to the period from 1 August 2019 to 31 July 2020 and are forecasts based on available data.

← 3. The Outlook reports data for least-developed countries in Asia as a single aggregate, which in addition to Bangladesh includes Afghanistan, Bhutan, Cambodia, East Timor, Laos, Myanmar, and Nepal. For cotton, Bangladesh accounts for nearly all the activity in this aggregate. For simplicity, this chapter therefore describes the data as referring to Bangladesh only.