This chapter describes the market situation and highlights the medium-term projections for world cereal markets for the period 2020-29. Price, production, consumption and trade developments for maize, rice, wheat and other coarse grains are discussed. The chapter concludes with a discussion of important risks and uncertainties affecting world cereal markets during the coming ten years.

OECD-FAO Agricultural Outlook 2020-2029

3. Cereals

Abstract

3.1. Market situation

Successive record harvests of major cereals in recent years have led to a significant build-up of inventories and much lower prices on international markets than were seen towards the end of the previous decade. Although world production of cereals increased again in 2019, stocks declined. This was due to a reduction in maize stocks – the result of gradual destocking of maize in the People’s Republic of China (hereafter “China”). Wheat and barley output recovered in the European Union, the Russian Federation, and Ukraine after lower harvests than usual in 2018. Australia, however, witnessed a major crop failure after two years of already poor harvests. Global maize production increased in 2019 with higher crop harvests in Brazil and Argentina. For rice, adverse weather and weak producer margins translated into a slight reduction in global rice production from the 2018 all-time record. However, record stock levels from the previous season sustained an expansion of global supplies of rice in 2019. Higher production of wheat and coarse grains and ample cereal stocks generally meant that international prices for all cereals were weaker in 2019 compared to 2018.

Global trade of maize in 2019 remained around the average of the previous two years, with larger export from South America, while wheat exports expanded, especially from the European Union, Argentina, and the Ukraine. Global trade in rice fell to a three-year low in 2019, depressed by reduced Asian import demand, in particular from Bangladesh, China, and Indonesia. In view of high local stocks, growth of Chinese rice exports remained high in 2019. Global trade of other coarse grains recovered from its low in 2018, due primarily to stronger barley exports from the Ukraine.

3.2. Projection highlights

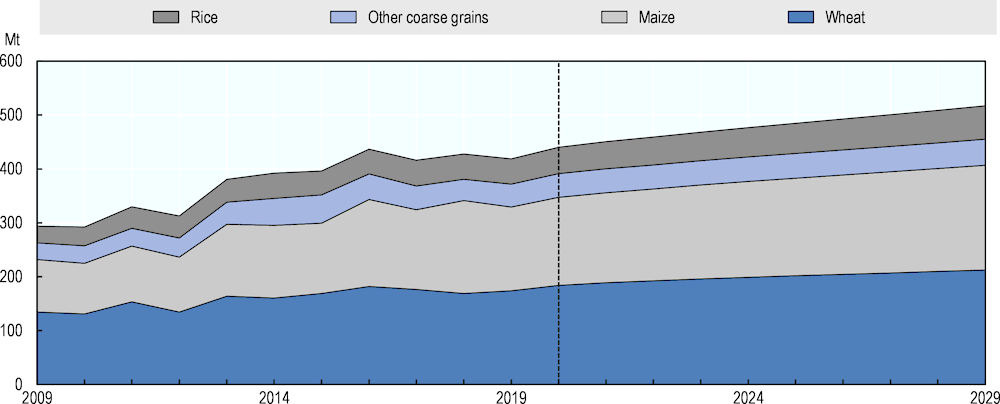

In the last ten years, cereal production growth outpaced demand growth, leading to ample stocks and lower prices. Over the outlook period of 2020 to 2029 prices are projected to decrease further in real terms, while recovering slightly in nominal terms. Increased production and destocking will continue to exert downward pressure on cereal prices despite increasing demand. Lower anticipated prices, however, could weigh on planting decisions and reduce future supply.

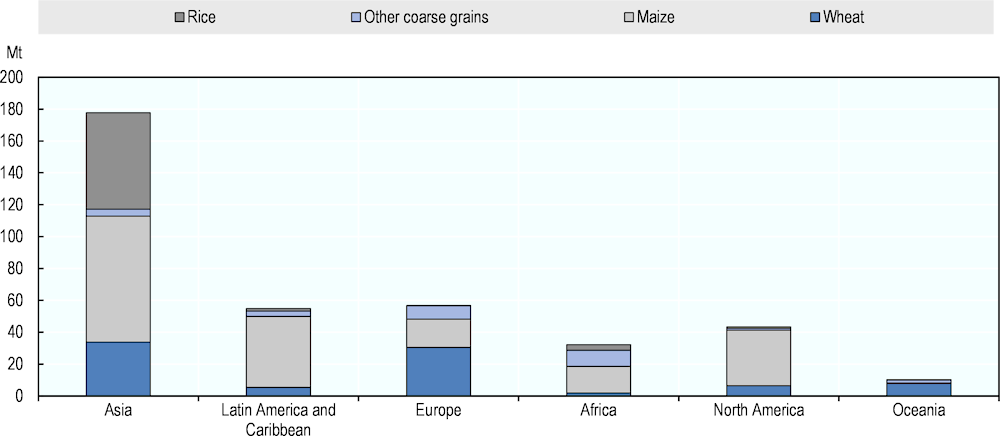

Global cereal production is projected to expand by 375 Mt, to reach 3 054 Mt in 2029, mainly driven by higher yields. Maize production is projected to increase the most (+193 Mt), followed by wheat (+86 Mt), rice (+67 Mt), and other coarse grains (+29 Mt). Advances in biotechnology, resulting in improved seed varieties together with increasing use of inputs and better agricultural practices, will continue to drive increases in yields; however, these gains could be restrained by the impact of climate change and related production constraints like lack of investment or land tenure problems in developing countries. The global average cereal yield is projected to increase by 1.1% p.a. over the next ten years, markedly lower than the 1.9% registered in the previous decade, while total crop area is expected to increase only modestly. These changes are influenced by increasing profitability in the Black Sea region where production costs are lower compared to other major exporters.

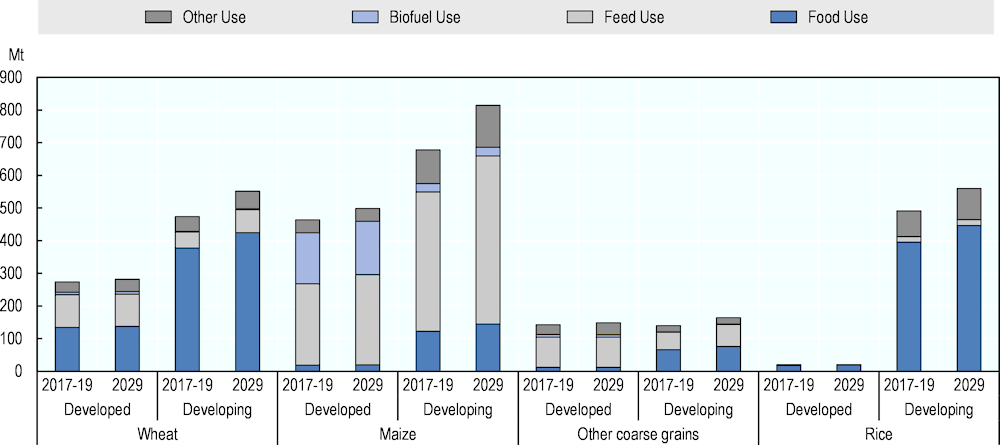

Over the medium term, growth in overall cereal demand should be more subdued than in the previous decade as growth in feed demand is expected to continue to slow in China. The increase in the industrial use of cereals, notably of starch and biofuels, is likely to be more modest than in the previous decade. On the food demand side, per capita consumption of most cereals has reached saturation levels in many countries around the world. Overall food demand is nevertheless expected to continue to rise, driven by rapid population growth in Africa and Asia where cereals remain a major component of the diet. Wheat consumption is projected to increase by 86 Mt compared to the base period, largely destined for food. The use of maize is projected to increase by 172 Mt, largely driven by expanding livestock sectors in Asia and the Americas. Maize for human consumption is projected to increase by 23 Mt, especially in Sub-Saharan Africa where white maize is an important food staple and population growth remains high. Global consumption of rice is projected to increase by 69 Mt by 2029, with Asia and Africa accounting for most of the projected increase and direct human consumption remaining the main end-use of this commodity. The use of other coarse grains is projected to increase by 30 Mt, with higher food use expected in Africa.

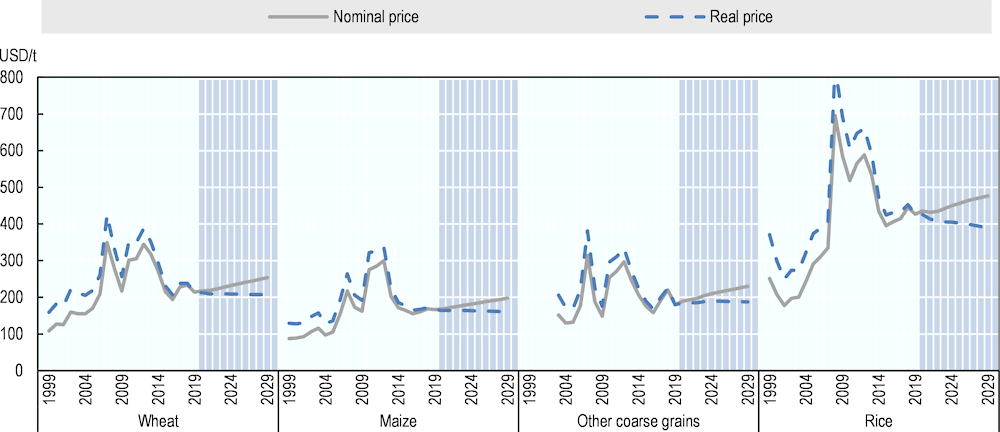

Figure 3.1. World cereal prices

Note: Wheat: US wheat, No.2 Hard Red Winter, fob Gulf; maize: US Maize, No.2 Yellow, fob Gulf, other coarse grains: France, feed barley, fob Rouen, rice: Thailand, 2nd grade milled 100%, fob Bangkok.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

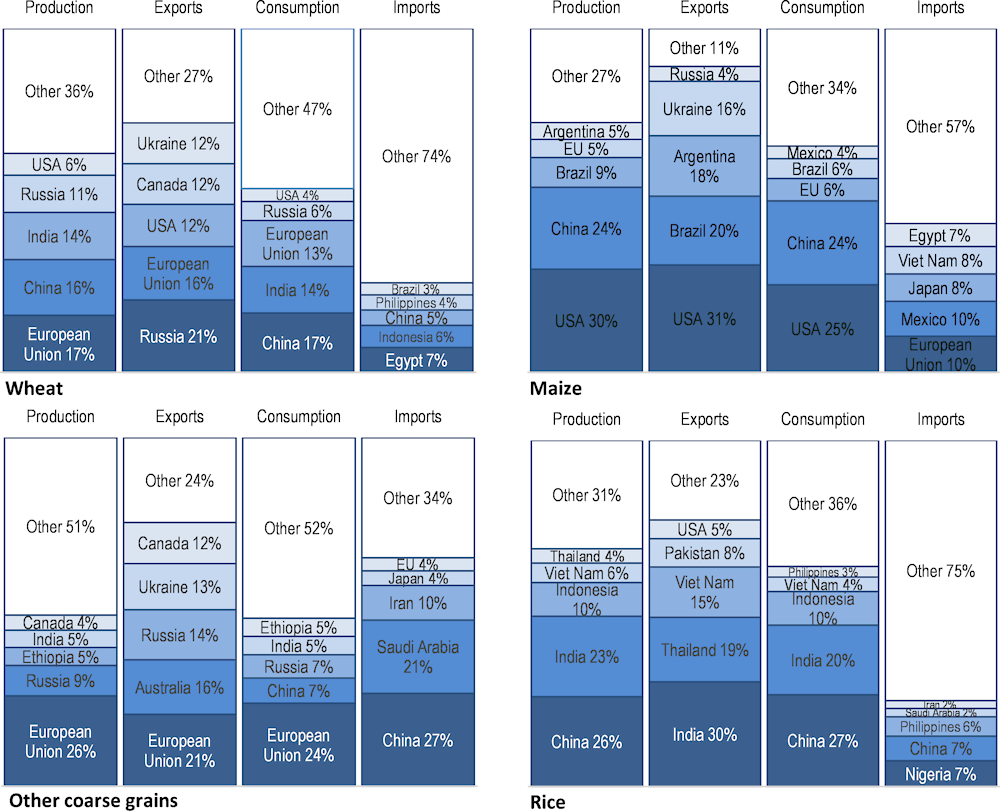

World trade in cereals is projected to increase by 96 Mt, to reach 517 Mt by 2029. The Russian Federation has become a major player in international wheat markets over the past few years, surpassing the European Union in 2016 to become the top exporter. It is expected to maintain its lead role throughout the projection period, accounting for 21% of global exports by 2029. Ukraine is expected to remain the fifth largest wheat exporter, continuously gaining shares in world trade and reaching 12% of global exports in 2029. For maize, the United States will remain the leading exporter although its market share will decrease as Brazil, Argentina, Ukraine, and the Russian Federation increase their shares of the global maize market. The European Union, Australia, and Belarus are expected to continue to be the main exporters of other coarse grains (mainly barley and sorghum), although growth in these exports will be restrained by increasing competition from maize in feed markets and consumer preferences in Africa that favour the domestic varieties of millets and sorghum. India, Thailand, Viet Nam, and Pakistan will remain the leading global suppliers of rice but Cambodia and Myanmar are expected to play an increasingly important role in global rice exports. Exports from China are expected to remain above the lows seen between 2010 and 2016.

In view of China’s efforts to reduce its maize and, to a lesser extent, rice inventories, world cereal stocks are projected to contract over the outlook period. This will result in a decline in the global aggregate cereal stocks-to-use ratio from 32% during the base period to 26% in 2029. While in principle lower stocks should support a price recovery in principle, in practice global cereal stocks will remain at generally high levels over the outlook period, even increasing for wheat, other coarse grains, and rice. Chinese demand for feed, and its overall level of domestic supplies and associated changes in stocks are some of the main uncertainties over the projection period.

3.3. Global overview of cereal market projections

The global supply of cereal is dominated by a few major players. Figure 3.2 shows the projected shares of the top-five producers, consumers, and traders in world totals for 2029. Production, consumption and exports are concentrated in these countries or regions, while imports are generally more widespread, except for wheat. Exports are particularly concentrated for the four commodities, with the five top exporters accounting for between 72% and 89%. Over the years, however, the concentration of cereal markets has declined markedly, both for production and even more so for exports. Relative to other commodities, such as soybeans, the cereals market is less concentrated.

Figure 3.2. Global players in cereal markets in 2029

Notes: Presented numbers refer to shares in world totals of the respective variable

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Future cereal supplies will largely depend on the ability to increase yields. This in turn will depend on investments in improved cultivation practices, seed breeding, advances in biotechnology, structural changes towards larger farms, improved cultivation practices, and the ability to adapt technologies and enhance knowledge transfer across regions. Growth in harvested areas will play a minor role for cereals as the competitiveness of cereals relative to alternative crops does not improve. Total cropland expansions are expected to remain limited by constraints to converting forest or pasture into arable land or because of ongoing urbanisation. This Outlook assumes that despite the existing challenges arising from environmental restrictions and sustainability considerations, productivity growth for cereals will remain ahead of demand growth and lead to real declining prices.

Producers’ support policies will continue to shape cereal markets. As this Outlook assumes no changes to existing policies, this will not change production incentives in the projections for most countries. The recent introduction in Mexico of a programme targeting small producers (less than 2.5 ha) in order to make them self-sufficient is worth mentioning. Farmers signing up for this programme receive a monthly income subsidy if they use their land for multi-cropping. As smallholder maize producers account for a considerable share of harvested maize areas in Mexico (20%), this programme could reduce the country’s growth in import demand for maize with potential spill-over effects into other cereals markets.

Most of the increase in global cereal production is expected to occur in Asia, Latin America, Africa, and Eastern Europe, where national food self-sufficiency policies and investments in exporting countries will sustain production increases. In the past, such policies – which included input subsidies, support prices, direct payments, agricultural loans, insurance at preferential rates, access to improved seed varieties, and extension services – had an impact in increasing production. However, success was largely dependent on the timing and implementation of the policy itself.

Figure 3.3. Regional contribution of growth in cereal production, 2017-19 to 2029

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

As the major use for maize and other coarse grains is feed and not much growth is expected from additional ethanol feedstock demand, the major demand driver in the coming decade will be the development of the livestock sector. This Outlook projects that global meat demand will continue to grow at a slightly slower pace than during the past decade. For wheat and rice, food use will drive demand in the coming decade. Since per capita demand of these cereals is stagnating at the global level, it is expected that increases of wheat and rice in the diets of lower income regions will continue to be offset by decreases in higher income regions, where these diet staples are losing importance. Therefore, the main driver for wheat and rice markets will remain population growth.

Figure 3.4. Cereal use in developed and developing countries

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

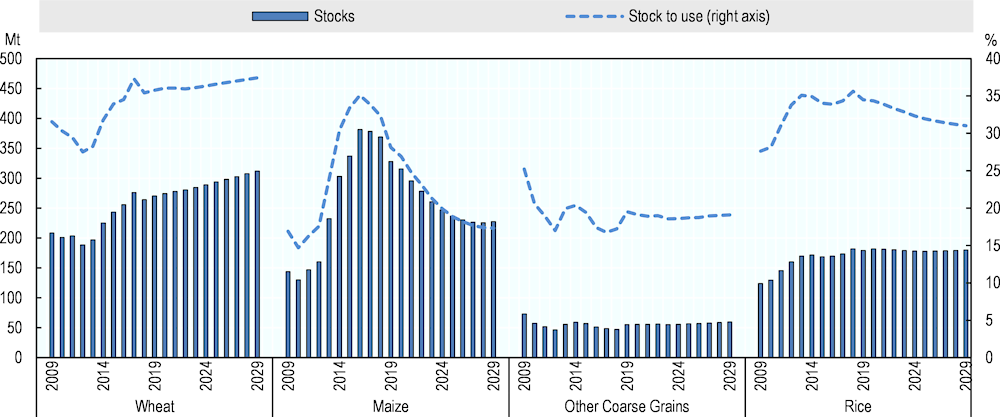

Figure 3.5. World cereal stocks and stocks-to-use ratios

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Global cereal stocks are expected to remain high over the outlook period, except for maize, where the global picture is dominated by the assumption that temporary stocks in China will be eliminated in the coming years (Box 3.2). As a consequence, the stock-to-use ratio for maize will fall from about 31% in the base period to about 17% in 2029 globally as China reaches levels of this ratio similar to those in other major countries. Stocks as a share of total consumption are expected to increase for wheat and rice, and remain similar to current levels for other coarse grains.

The measures that national governments implement to facilitate or to hinder trade can play an important role in the development of future cereal trade. For example, export taxes such as those implemented in Argentina will reduce the country’s potential to expand cereal exports. On the other hand, import duties, which have recently become more popular, will reduce the demand of importing countries. However, the United States-China trade deal, in particular its commitments to expanding imports from the United States, may increase the future trade potential of cereals. During the past ten years the Tariff Rate Quota (TRQ) fill rates for maize and wheat in China where only about 40% and 75% for rice. This Outlook assumes that China will fill the TRQs of wheat and maize from 2021 onwards, adding 3 Mt to maize and 6.3 Mt to wheat traded globally and that its rice exports increase by about 1.4 Mt. However, since these quantities constitute only small shares of global exports, they will not be a game changer for the international cereal markets.

Figure 3.6. Global cereal trade volumes by commodity

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

3.4. Wheat

Wheat is the most important source of vegetable protein and food calories at the global level, and is part of many food products, such as bread, pasta, pastries, noodles, semolina, bulgur or couscous. It is also the food crop that covers the largest share of the global crop area (about 14%) and has the largest share in global food trade. However, since its yields are much lower than for maize, wheat is only the second most produced cereal after maize (752 Mt in the base period). Global production of wheat is dominated by the European Union, China, and India.

Global wheat production is projected to reach 839 Mt by 2029, growing at a more moderate pace compared to the last decade. Among the developed countries, increases in wheat production are expected to be highest in the European Union given its high yields, competitive prices, and grain quality. While developed countries are projected to increase production by 50 Mt by 2029, developing countries are projected to add 36 Mt to global output, equivalent to a marginal increase of their share of global production. India, the world’s third largest wheat producer, is expected to increase its wheat production, largely sustained by its minimum support price policy that guarantees farmers a stable income. Production increases in the Russian Federation and Ukraine result from their domestically-produced hybrid seeds and fertilisers, low energy costs, large commercial farms, and soil quality.

Growth in global wheat consumption is mainly expected in the five largest wheat consuming regions – China, India, the European Union, the Russian Federation, and the United States – accounting together for 55% of global wheat use. Food use, which is expected to remain stable at about two-thirds of total consumption, is projected to represent 60% of the total increase in demand, while global per capita consumption will stagnate. As global livestock production slows and maize feed becomes more competitive, feed use of wheat is projected to increase more slowly than in the past decade. Global production of wheat-based ethanol is projected to increase by only 0.6 Mt, supported by efforts in China to boost ethanol production. In the European Union (a major user of wheat in ethanol processing in the past decade), biofuel policies are assumed to no longer support further growth of first generation biofuels. With global wheat production consistently higher than consumption throughout the projection period, the global stocks-to-use ratio is expected to reach 37% in 2029, up 3.5 percentage points from the base period.

The world wheat price, as measured by the benchmark US wheat No. 2 Hard Red Winter fob Gulf, should average USD 214/t in 2019, the first drop after two consecutive yearly increases. The world wheat price is projected to decline in real terms over the outlook period, but to slightly increase relative to the base period, reaching USD 258/t in 2029 (Figure 3.1). This decrease is a result of assumed low (and flat) real oil prices, average harvest expectations, and moderate growth in exports.

Global trade of wheat, the world’s most traded cereal (Figure 3.6) is projected to expand from 2019 to 2029 by a similar amount as in the last decade. This increase in wheat trade reflects both changing yields and changing policies. Egypt, the world’s largest wheat importer, recently signalled a preference for Black Sea wheat with reduced protein content supporting future export growth from that region. In the past decade, supply in the major wheat-producing countries of the Black Sea region – the Russian Federation, Kazakhstan, and Ukraine – has been volatile mainly due to yield fluctuations, thus rendering exports volatile as well. Nonetheless, production growth has been outpacing that of consumption on average due to the adoption of improved seed varieties.

Further increases in production are expected from these countries as a result, thus increasing their share of global wheat exports. The Russian Federation surpassed the European Union as the top exporter in 2016, driven by competitive prices and geographical proximity to major importing countries in the Middle East and North Africa. The Russian Federation is projected to remain the lead wheat exporter, accounting for about 20% of global wheat exports by 2029. The export share of the European Union is expected to increase slightly, given its competitive prices, grain quality, and proximity to major export markets in Africa and Asia. Wheat imports are expected to be spread more widely among many importing countries, with the top five – Egypt, Indonesia, Algeria, Brazil, and the Philippines – accounting for a combined share of 26% by 2029.

3.5. Maize

Maize is one of the oldest plants that humans have domesticated. It is also known as corn, the word used mainly in the United States, the world’s largest producer, consumer and exporter. The success of maize is partly due to its high productivity and its exceptional geographic adaptability. Maize is generally categorised into one of two broad groups: yellow and white. Yellow maize accounts for the bulk of the total world maize market. It is grown in most northern hemisphere countries and is predominantly used for animal feed. White maize is produced for food in Latin America, southern Africa, and south Asia under a wide range of climate conditions. Market prices are usually higher for white than for yellow maize because consumers perceive it as a superior good.

Global maize production is projected to grow by 193 Mt to 1 315 Mt over the next decade, with the largest increases in China, the United States, Brazil, Argentina, and Ukraine. Maize production in China is projected to grow more slowly (2.1% p.a.) than over the previous decade (3.1% p.a.) as policy changes in 2016 eliminated maize price support and its associated stockpiling programme; these were replaced with direct farm subsidies and market-oriented purchasing. As a result, in the near term, planting areas in China will shift from maize to other commodities, such as soybeans and wheat, although may shift back to maize in a few years as stocks decline to more sustainable levels. In the United States, the maize planted area will remain stable and production increases will be due mainly to higher yields. Increased production in Brazil and Argentina will be sustained by slightly larger planted areas and productivity increases, motivated by favourable domestic policies (e.g. loans at preferential rates) and the depreciation of the respective currencies. Ukraine’s production will be sustained by the cultivation of high yielding domestic varieties grown in rain-fed systems.

Global maize consumption is projected to increase at slower rates than in the past decade, in line with production. This is a result of a combination of factors including feed demand, biofuel policies, and human consumption. Feed use is projected to account for the largest share (68%) of the increase in maize consumption. During the outlook period, gains in feed-use efficiency and slower growth in livestock production have dampened feed demand. In addition, growth of maize for biofuel production is expected to be limited as current biofuel policies will not likely support further expansion in major producing countries. Maize for human consumption is projected to increase by 23 Mt, driven by both population growth and increasing global per capita consumption. Sub-Saharan Africa, where white maize is an important dietary staple and population is growing rapidly, is projected to have the strongest food consumption growth (+14 Mt).

The world maize price, as measured by the benchmark US maize No. 2 Yellow fob Gulf, is projected to average USD 167/t in 2019, thus unchanged from 2018. Declining global maize stocks, assumed higher energy and input prices, and expected slower growth in export demand compared to the previous decade will limit real gains in the international maize price. Accordingly, while the nominal price is projected to increase to USD 201/t by 2029, this increase will lag behind inflation and, as a result, the real price will decrease (Figure 3.1).

Trade in maize is projected to expand by 36 Mt to 194 Mt by 2029. The export share of the top five exporters – the United States, Brazil, Ukraine, Argentina, and the Russian Federation – is projected to account for about 89% in 2029. Although the United States is projected to remain the top maize exporter, its export share will decline (from 34% to 31%) as traders in Southeast Asia signal their preference for South American corn due to perceptions over moisture levels and kernel hardness. As a region, Latin America is projected to increase its export market share from 38% in the base period to 40% in 2029 owing to production gains supported by favourable domestic policies (e.g. loans at preferential rates) and the depreciation of local currencies. It is also expected that the Ukraine and the Russian Federation will be rising maize exporters given that their domestic supplies are expected to increase faster than domestic consumption, with the surpluses entering the global market.

The top five destinations for maize will continue to be Mexico, the European Union, Japan, Egypt, and Viet Nam. Viet Nam, which has experienced a steady increase in maize imports since 2012, is expected to replace Korea to become the fourth largest maize importer, driven by its expanding livestock and poultry sectors. Malaysia is expected to further increase its imports as its livestock sectors continues to grow.

3.6. Rice

Rice is widely cultivated around the world, mainly as an annual crop even though it may survive as a perennial. It is grown predominantly under flooded conditions as this facilitates fertilisation and reduces the incidence of weeds and pests. Most of the global rice production is located in Asia, with many countries in the region growing more than one crop per season. More than half of global rice production is concentrated in China and India. The path of production systems in developing Asian countries largely influences global markets, i.e. increasing yields in Asian countries, significantly impacts increases in global availability and trade.

Global rice production is projected to reach 582 Mt in 2029. Asia is projected to contribute the majority of additional global production, accounting for 61 Mt of the increase during the outlook period. The highest growth is expected in India, the world’s second largest rice producer. Production gains here are expected to be sustained through yield improvements supported by policy measures that promote the use of new seed varieties and the expansion and maintenance of irrigation facilities. The maintenance of the minimum support price over the outlook period should support plantings in India that are similar to those in China. In China, however, production is projected to grow at a slower pace than the previous decade amid expectations that efforts to move the least productive lands out of cultivation will continue as part of a broader effort to improve the quality of rice production. Production gains in Thailand and Viet Nam will mainly depend on yield improvements, given the price expectations over the outlook period and assuming governmental efforts to promote a shift towards alternative crops are effective.

In addition to infrastructure and input-related impacts, future production of rice will largely depend on the varietal structure of plantings and the adoption of improved seed strains. In developed markets, production is expected to fall in Korea and Japan below the base period’s level, but to increase in the United States and European Union, although not to exceed the 2010 peak for the United States nor the 2009 peak for European Union. Least Developed Asia – comprised of Myanmar, Cambodia, the Lao People's Democratic Republic, and Bangladesh – is expected to continue to increase its productivity levels as higher-yield varieties and implement better agricultural practices are adopted. While rice production is expected to increase in many African countries, this Outlook assumes that African rice production will be constrained by rain-fed water systems, limited use of inputs, and inadequate farm infrastructure.

The world price for rice (Thailand grade B milled 100%, fob Bangkok) decreased to USD 426/t in 2019. Over the outlook period, rice import demand in Sub-Saharan Africa (where the population is increasing rapidly) is expected to be strong. However, large policy-driven production gains in major importing countries in Asia are expected to limit global growth of rice imports to less than half the rate seen in the previous decade. Consequently, the increase of the nominal price, which is projected to reach USD 476/t by 2029, will lag behind inflation and the real price will decrease (Figure 3.1).

Box 3.1. Global Indica and Japonica rice markets

There are many varieties of rice produced and consumed which all can be put into two major categories of rice traded on the global market: Indica and Japonica rice.1 The differences in the Indica and Japonica rice market structures appear to be based on the differences in their characteristics, production zones, consumer preferences, and government policies. The frequent divergence in their price movements is due to differences in these characteristics and strong consumer preference for one rice over the other. The Japonica rice market is assumed to be composed exclusively of temperate Japonica rice, and the Indica rice market of all the other varieties (including tropical Japonica rice). Global Japonica rice production was estimated at 71.3 Mt in 2017 and increased by an average of 3.0% p.a. over 2003–2017 (Table 3.1).

China accounted for 72% of the global Japonica rice production in 2017. World Japonica rice exports and imports were estimated at 2.3 Mt in 2017, accounting for an estimated 14.6% of global rice production, 14.4% of global rice consumption, and 4.8% of global rice trade. The global Indica rice production was estimated at 417.3 Mt in 2017, almost six times that of Japonica, and it increased by 1.4% p.a. between 2003 and 2017. World trade in Indica rice stood at 45.9 Mt in 2017, with India and China accounting for 49% of the global Indica production. Indica rice trade increased by about 5% p.a. during the 2003-2017 period, much higher than that of Japonica rice. The projections for the coming decade envisage stronger growth of Indica rice than of Japonica rice production, and trade growth will be greater for Indica rice, thus further reducing the share of Japonica on international markets.

Table 3.1. Global Japonica and Indica rice markets

|

(1 000 t) |

2003 |

2017 |

Annual growth rate (2003-2017) |

(1 000 t) |

2003 |

2017 |

Annual growth rate (2003-2017) |

|||

|---|---|---|---|---|---|---|---|---|---|---|

|

Japonica rice production |

Japonica rice exports |

|||||||||

|

World |

47 329 |

71 255 |

3.0% |

World |

2 067 |

2 329 |

0.9% |

|||

|

|

China |

29 690 |

51 116 |

4.0% |

China |

72 |

765 |

18.3% |

||

|

|

Japan |

7 091 |

7 586 |

0.5% |

United States |

506 |

674 |

2.1% |

||

|

|

Egypt |

3 900 |

4 300 |

0.7% |

EU28 |

no data |

263 |

- |

||

|

|

Korea |

4 451 |

3 972 |

-0.8% |

Korea |

211 |

63 |

-8.3% |

||

|

|

EU28 |

no data |

1 497 |

- |

||||||

|

Japonica rice consumption |

Japonica rice imports |

|||||||||

|

World |

53 661 |

69 286 |

1.8% |

World |

2 067 |

2 329 |

0.9% |

|||

|

|

China |

34 626 |

47 267 |

2.2% |

Japan |

547 |

494 |

-0.7% |

||

|

|

Japan |

8 148 |

8 259 |

0.1% |

Korea |

193 |

290 |

2.9% |

||

|

|

Korea |

4 512 |

4 755 |

0.4% |

EU28 |

no data |

156 |

- |

||

|

|

Egypt |

3 225 |

4 351 |

2.2% |

United States |

5 |

19 |

10.1% |

||

|

|

EU28 |

no data |

1 473 |

- |

||||||

|

Indica rice production |

Indica rice exports |

|||||||||

|

World |

345 168 |

417 349 |

1.4% |

World |

25 397 |

45 994 |

4.3% |

|||

|

|

India |

88 522 |

110 000 |

1.6% |

|

India |

3 100 |

12 800 |

10.7% |

|

|

|

China |

82 772 |

94 873 |

1.0% |

|

Thailand |

10 137 |

10 500 |

0.3% |

|

|

|

Indonesia |

35 024 |

37 000 |

0.4% |

|

Viet Nam |

4 295 |

7 000 |

3.6% |

|

|

|

Bangladesh |

26 152 |

32 650 |

1.6% |

|

Pakistan |

1 868 |

4 300 |

6.1% |

|

|

|

Viet Nam |

22 082 |

28 943 |

2.0% |

|

Myanmar |

130 |

3 300 |

26.0% |

|

|

|

Thailand |

18 011 |

20 370 |

0.9% |

|

United States |

2 804 |

2 184 |

-1.8% |

|

|

Indica rice consumption |

Indica rice imports |

|||||||||

|

World |

357 714 |

412 077 |

1.0% |

World |

22 946 |

45 846 |

5.1% |

|||

|

|

India |

85 622 |

97 350 |

0.9% |

|

China |

1 121 |

5 499 |

12.0% |

|

|

|

China |

97 474 |

95 433 |

-0.2% |

|

Bangladesh |

850 |

3 200 |

9.9% |

|

|

|

Indonesia |

36 000 |

38 000 |

0.4% |

|

Nigeria |

1 448 |

2 600 |

4.3% |

|

|

|

Bangladesh |

26 700 |

35 200 |

2.0% |

|

Indonesia |

650 |

2000 |

8.4% |

|

|

|

Viet Nam |

18 230 |

22 100 |

1.4% |

|

EU28 |

No data |

1 744 |

- |

|

|

|

Philippines |

10 250 |

13 100 |

1.8% |

|

Cote d'Ivoire |

743 |

1 500 |

5.1% |

|

1. This separation does not focus on genetic strictness of rice types, but explores the conventional major rice types, Indica and Japonica rice, based on practical rice market separation

Sources: Koizumi and Furuhashi (2020) Global Rice Market Projections distinguishing Japonica and Indica rice under climate change, JARQ, Vo.54.1, pp.63-91. https://www.jstage.jst.go.jp/article/jarq/54/1/54_63/_article/-char/en.

Direct human consumption continues to be the main end-use of rice. A major driver for global rice consumption is growing demand from developing countries in Asia and African countries. World rice consumption is projected to increase by 69 Mt by 2029. It is expected to continue to be a major food staple in Asia, Africa, Latin America and the Caribbean. The expected additional consumption is almost entirely attributable to increasing food demand in developing countries (Figure 3.4). In some Asian countries, where most of the production is consumed domestically, demand is expected to decrease. In India, however, an additional 4 kg to the annual per capita consumption is projected over the next ten years, partly driven by the government’s social policy to improve food security of vulnerable households through the public distribution of food grains. In Africa, where rice is gaining in importance as a major food staple, per capita rice consumption is projected to grow by about 4 kg over the outlook period. With rice utilisation projected to grow at a slightly faster pace than world supply, the global stocks-to-use ratio is projected decrease marginally, from 35% in the base period to 31% by 2029.

Table 3.2. Rice per capita consumption

|

kg/capita |

2017-19 |

2029 |

Growth rate (% p.a.) |

|---|---|---|---|

|

Africa |

26.9 |

30.8 |

1.16 |

|

Asia and Pacific |

77.6 |

78.1 |

-0.05 |

|

North America |

13.1 |

13.1 |

-0.39 |

|

Latin America and Caribbean |

28.2 |

28.3 |

-0.20 |

|

Europe |

6.4 |

6.7 |

0.37 |

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Rice is a thinly traded commodity compared to other cereals (Figure 3.6). Global growth in trade is projected to be 2.8% p.a. over the outlook period, with the volume exchanged increasing by 15 Mt to 62 Mt in 2029. India is expected to remain the world’s largest rice exporter, with demand from its traditional African and Near Eastern markets expected to drive export gains. Thailand, where shipments have traditionally been largely composed of higher quality rice, is expected to remain the second largest rice exporter. In Viet Nam, expected growth is partly linked to ongoing efforts to diversify the varietal make-up of the country’s rice shipments, which could underpin an increase in deliveries to the Middle East, Africa, and East Asia. As a group, however, the top five rice exporters – India, Thailand, Viet Nam, Pakistan, and the United States – are expected to see their export shares reduced slightly compared to the past decade. This reflects expectations of Chinese shipments remaining well over the lows seen between 2010-2016, albeit at a somewhat lower level than recorded in 2019. Moreover, amid expectations of large exportable surpluses, shipments by Cambodia and Myanmar are expected to continue making headway, passing from a total base period level of about 4 Mt to 7 Mt by 2029. The largest import growth is projected to take place in African countries where demand – driven by income growth, urbanisation, and rapid population growth – is expected to continue to outpace production. This would increase Africa’s share of world rice imports from 37% to 51%, thus becoming the prime destination of global rice flows.

3.7. Other coarse grains

Other coarse grains comprise a heterogeneous group of cereals, including barley, oats, rye, sorghum and millets. Production is constrained in regions that rely on rain-fed systems. There has been limited progress on improved seeds in Africa and Asia, thus constraining sorghum and millets food availability in these regions. Production can more easily expand in regions that are naturally endowed for cultivating these crops and through improved technology, specifically in Europe and the Americas. Although other coarse grains production costs are higher than for wheat and maize, production is expected to remain attractive in regions where weather and technology facilitate the production of multiple crops, in which rotation patterns help maximise the returns per hectare.

This Outlook projects that growth in global production of other coarse grains will reach 319 Mt by 2029. With global planting area expected to decrease, production growth will be sustained by yield gains; these are projected to increase by about 0.9% p.a. Africa is projected to account for almost one-third of global growth (+10 Mt), with yields increasing at 1.7% p.a. The absolute yields remain low compared to other regions, mainly because Africa produces its own indigenous varieties of millet and sorghum. In Europe, the largest production gains will originate from the European Union Member countries, Ukraine, and the Russian Federation. Overall, the planted area in Europe is expected to decline, reflecting the lower profitability of barley against other crops such as maize and wheat. Production gains are sustained by yield gains; Ukraine is projected to increase yields by 1.5% p.a., assuming increasing crops rotation in combination with better agricultural practices and abandonment of non-productive land. In Asia, the largest expansion of production is projected to occur in China. Production in India is expected to contract due to decreased harvested area without compensating yield gains. Although millets were included in the country’s National Food Security Act in 2013 for distribution through the public procurement system, the support effect has been limited in part because small farmers were not included, as well as to poor soils and limited water availability.

Total demand for other coarse grains is projected to increase by 30 Mt by 2029, with feed demand accounting for nearly half of that increase (+14 Mt), followed by food (+10 Mt) and industrial use (+6 Mt). Feed demand is expected to remain relevant in Europe, although contracting, as barley is a reliable source of protein and energy in feeding livestock. Specifically, for dairy production, barley is expected to remain an important feed ingredient. Globally, the expected intensification in the dairy and meat production systems favours the use of industrial feed for which maize and soybeans are the prominent ingredients, thus slowing feed demand growth for other coarse grains. China is expected to increase feed demand, driven by the meat sector, similar to North Africa, Iran, Turkey and Saudi Arabia. In the latter three countries, albeit the intensification of their production systems, barley is expected to remain as a high-quality feed, in particular for ruminants such as camels, sheep and goats. Global food demand of other coarse grains is expected to increase only in Africa, although decreasing on a per capita basis as already observed during the past decade.

The world price for other coarse grains, as measured by the price for feed barley (France, fob Rouen) recovered to USD 186/t in 2019. Over the previous decade, the major driver that sustained other coarse grain prices was feed demand, particularly from China due to higher domestic maize prices. Over the outlook period, maize prices are expected to be competitive, therefore reducing the demand for substitutes such as barley and sorghum. Nominal prices could recover over the projection period, reaching USD 234/t by 2029.

Global exports of other coarse grains are projected to reach about 48 Mt in 2029. Ukraine would account for most of the additional exports, followed by the Russian Federation, Australia, the European Union, Kazakhstan, and Argentina, However, the European Union is expected to remain the largest exporter, followed by Australia, the Russian Federation, Ukraine, and Canada. By 2029, although China is projected to remain the most important destination for other coarse grains, reaching 11.4 Mt in 2029, import expansion will be modest. This Outlook assumes that the current phytosanitary protocols that China has with major exporters will remain in place, thus facilitating trade. Other major importers are Middle Eastern countries, where in general weather conditions and water availability allow for only one crop per calendar year. These countries therefore focus their resources on producing food cereals (wheat) rather than feed crops, which is the ultimate use of sorghum and barley in the Middle East. Sub-Saharan Africa is expected to become a net importer by 2029, although imports will be constrained by consumer preferences and market structure. Other coarse grains will be mainly consumed and produced by self-sufficient farmers, such that consumption of imported millet or sorghum will be limited to urban areas.

3.8. Main issues and uncertainties

The COVID-19 pandemic in 2020 will not change the general situation of ample cereal supply and good harvest prospects in the near-future marketing seasons. Short-term risks due to this pandemic are mainly related to distributional aspects and supply problems in some countries which rely on seasonal workers. While cereal production in developed countries is highly mechanised, in some developing countries production depends on seasonal workers that might not be available due to restrictions to labour movement. This is particularly the case for cereal production in Africa, India and some South East Asian countries. The extent of the impact will depend on the measures adopted by each country to control the disease. The pandemic could have two types of impacts on cereal demand and each has different implications for prices. The current slowdown in economic growth could weaken cereal demand further which could lead to downward pressure on cereal prices in the short term.. However, as long as the movement of people is restricted, this might also lead to less consumption outside the home and raise the demand for staple food (not only related to panic buying of pasta and flour), thereby potentially supporting prices.

Nonetheless, securing domestic food supply is among the major concerns of countries in this crisis. Trade-hindering policies, such as export restrictions to secure domestic supply, are often discussed in this context. However, such policies would place availability in import-dependant countries at risk and disrupt international markets and global cereal trade.

Over the medium term, once supply chain disruptions are resolved, the impact of the COVID‑19 pandemic on cereal markets should be limited unless national policies move towards sustained higher self-sufficiency goals or to a sustained increase in the levels of stock holding. Similarly, if the development of the global economy cannot resume the path it has been on in recent years, demand for cereals ten years ahead could be lower than projected in this Outlook.

While normal assumptions for weather lead to positive production prospects for the main grain-producing regions, plant diseases, pests and adverse weather events accentuated by climate change may cause higher volatility in crop yields, thereby affecting global supplies and prices. Historically, deviations of crop yields from trends have been more pronounced in Australia, Kazakhstan, the Russian Federation, and Ukraine. Crop yields in South American countries, such as Argentina, Brazil, Paraguay and Uruguay, also show high variability. Over the last few years, the increasing participation of the Black Sea region in global cereal markets has decreased some of the risks associated with crop shortages in traditional major exporting countries. However, given the higher yield variability in that region, global supplies to world markets are becoming more volatile, which may lead to more pronounced swings in world market prices. In addition, the impact of pests, such as the fall army worm, in large producing and exporting countries could be severe for world markets. Finally, production in many African countries relies on rain-fed systems and thus have a low resilience to extreme weather events.

China’s feed demand, and its overall level of domestic supplies and associated changes in stocks remain a major uncertainty in global cereal markets. In 2018, based on its third National Agricultural Census, Chinese authorities revised their crop production estimates, reporting significant changes for maize (+266.0 Mt) in the last ten years. Feed and stock figures, however, were not provided and are thus only estimates. Nonetheless, even with this revision, maize production in China has been decreasing over the last three years owing to the 2016 policy change, which replaced the market price support system with a direct maize subsidy programme. It is assumed this policy change will continue to result in the further release of China’s accumulated stocks over the projection period. However, if the actual level of stocks are considerably below current estimates, there is a possibility that China could become a major maize importer sooner than expected if the country changes its import policies. This could greatly influence future developments in the global cereal markets. Box 3.2 provides an assessment of this uncertainty.

Cereal prices could be affected by a potential further slowdown in economic growth of major importers and exporters, and lower energy prices. Moreover, the reinforcement of food security and the sustainability criteria in the reform and design of biofuel policies (in the European Union, Brazil, and the United States) may also impact the demand for cereals.

In addition to the uncertainties associated with policy responses to COVID-19 which could have short term impacts, changes in the international trade environment for cereals due to trade frictions and evolving regional agreements may also influence trade flows. Further trade protection, the resolution of existing trade tensions or disputes (e.g. the dispute between China and Australia concerning barley), and the emergence of new regional trade agreements may shift trade patterns in cereal markets.

The impact of Brexit on cereal markets should not be severe as trade flows in general can be redirected relatively easily. The United Kingdom is, however, the world’s largest producer of oats, although most of its production is consumed by its domestic market. However, processed oat products, such as porridge, are exported to other European countries and depending on the final trade deal, this could influence the future of oats markets in the United Kingdom.

Box 3.2. China’s grain reserves, price support and import policies: Examining the medium-term market impacts of alternative policy scenarios

China removed its support prices for maize in 2016 and began destocking its large public reserves of maize. A recent OECD study (Deuss and Adenauer, 2020) investigates what would happen if China were to also eliminate its support prices for rice and wheat and reduce public stocks of these two commodities. The analysis examines domestic and international market impacts over the next ten years by comparing a baseline (or business-as-usual scenario) with three scenarios that each assume support prices are eliminated, but incorporate different assumptions about China’s import policies.

The probability that China might eliminate its support prices and revise its import policies has increased in recent years due to multiple factors. First, China has abolished support prices for several other commodities. Second, it has introduced pilot programmes where support prices for wheat and rice were replaced by more market-oriented mechanisms. In addition, China is facing international pressure to remove support prices. In February 2019, the WTO dispute panel determined that China had exceeded its allowed level of support for rice and wheat. Furthermore, it is also becoming more probable that China might increase its grain imports by revising the way it administers its grain tariff rate quotas (TRQs). Since their introduction in 2001, China’s TRQs for maize, rice and wheat have been consistently under-filled. In April 2019, the WTO dispute panel determined that China administered its TRQs in a manner inconsistent with its Accession Protocol obligations.

The scenario results show that a drastic change in China’s support price and public stockholding policy is expected to affect domestic and international markets significantly, especially during the transition period (2019-2021) when temporary public stocks are depleted. The actual level of public stocks plays an important role during this period as larger volumes of reserves imply that more reserves would be released and hence the effects amplified. Removing support prices for rice and wheat is projected to lead to big drops in domestic prices during the transition period. Over the medium term, domestic prices under the scenarios are expected to recover as stock levels stabilise and the market adapts to an environment without support prices.

For China’s policy makers, this analysis has two important implications. First, to avoid severe negative impacts on farm income due to the lower domestic prices, policy makers could provide support to farmers, which should be limited in time since the market impacts dissipate over the medium term. Second, policy makers should consider carefully how long the destocking period should last, keeping in mind the costs and benefits of extending the destocking period. Extending the destocking period could lead to lower fiscal revenues from the sales of the stored commodities as the quality of the commodities deteriorates the longer they are stored. A longer destocking period also implies a longer period of compensatory payments to farmers and of managing the temporary reserves. In contrast, a slower destocking process would give farmers more time to adjust gradually to the new market environment and could spread and potentially weaken the severity of the price and production impacts.

Crucial in the policy maker’s decision process on the amount of temporary support and period of destocking is the knowledge about the size and quality of the stored commodities. For producers and consumers in both domestic and international markets, transparency in the reporting of stock levels and stockholding policies is necessary to help them deal with the significant impacts they could face during the initial years a new policy is implemented.

Source: Deuss, A. and M. Adenauer (2020), "China’s grain reserves, price support and import policies: Examining the medium-term market impacts of alternative policy scenarios", OECD Food, Agriculture and Fisheries Papers, No. 138, OECD Publishing, Paris, https://doi.org/10.1787/f813ed01-en.