This chapter describes the market situation and highlights the medium-term projections for world dairy markets for the period 2020-29. Price, production, consumption and trade developments for milk, fresh dairy products, butter, cheese, skimmed milk powder and whole milk powder are discussed. The chapter concludes with a discussion of important risks and uncertainties affecting world dairy markets during the coming ten years.

OECD-FAO Agricultural Outlook 2020-2029

7. Dairy and dairy products

Abstract

7.1. Market situation

World milk production (81% cow milk, 15% buffalo milk, and 4% for goat, sheep and camel milk combined) grew by 1.3% in 2019 to about 852 Mt. In India, the largest milk producer in the world, production increased by 4.2% to 192 Mt, although this had little impact on the world dairy market as India trades only marginal quantities of milk and dairy products.

Milk production of the three major dairy exporters, New Zealand, European Union and the United States, increased only slightly. As domestic consumption of dairy products in these three countries is stable, the availability of fresh dairy products1 and processed products for export increased. In the People’s Republic of China (hereafter “China”), the world’s largest importer of dairy products, milk production increased by 3.6% in 2019. Its dairy imports, especially of whole milk powder (WMP) and of skim milk powder (SMP), nevertheless increased in 2019 due to increasing demand.

International dairy prices refer to dairy products other than unprocessed milk, which is practically not traded. Butter is the reference for milk fat and SMP for other milk solids. Milk fat and other milk solids together account for about 13% of the weight of milk, with the remainder being water. Although the world butter price continued to decline compared to its record 2017 price levels, it remained high in real terms. The strength of milk fat prices (butter) is supported by strong demand in North America and Europe for cream, butter, and other full-fat milk products. SMP prices recovered during 2019 from low levels after the European Union sold its intervention stocks, purchased in 2016 when prices fell below the set threshold of EUR 1 698 per tonne. Consequently, the difference between butter and SMP prices declined.

7.2. Projection highlights

World milk production is projected to grow at 1.6% p.a. over the projection period (to 997 Mt by 2029, faster than most other main agricultural commodities). In contrast to the previous decade, the projected growth of cowherds (0.8% p.a.) is slightly higher than the projected average yield growth (0.7%) as cowherds are expected to grow faster in countries with low yields. It is expected that India and Pakistan, important milk producers, will contribute more than half of the growth in world milk production over the next ten years, and will account for more than 30% of world production in 2029. Production in the second largest milk producer, the European Union, is expected to grow more slowly than the world average due to environmental restrictions and limited domestic demand growth.

Milk must be processed shortly after its collection as it cannot be stored for more than a few days. Most dairy production is consumed in the form of fresh dairy products, which are unprocessed or only slightly processed (i.e. pasteurised or fermented). The share of fresh dairy products in world consumption is expected to increase over the coming decade due to strong demand growth in India, Pakistan and Africa, driven by income and population growth. World per capita consumption of fresh dairy products is projected to increase by 1.0% p.a. over the coming decade. In Europe and North America, overall per capita demand for fresh dairy products is stable or even declining, but the composition of demand has been shifting for several years towards dairy fat. In addition, the consumption of plant-based dairy substitutes in the liquid market is expected to grow strongly in East Asia, Europe and North America, albeit from low volumes.

Most cheese consumption, the second most important dairy product consumed in terms of milk solids (after fresh dairy products) occurs in Europe and North America where per capita consumption is expected to continue to increase, especially as ingredient in processed food. The demand for milk powders is partly driven by its use in the food industry, including in regions where animal protein demand is increasing faster than production. In Africa, only a small share of SMP supplies is produced locally and demand for this product is expected to grow fast over the coming ten years. The strongest demand growth for butter is expected in Asia, but this growth is starting from a low consumption base.

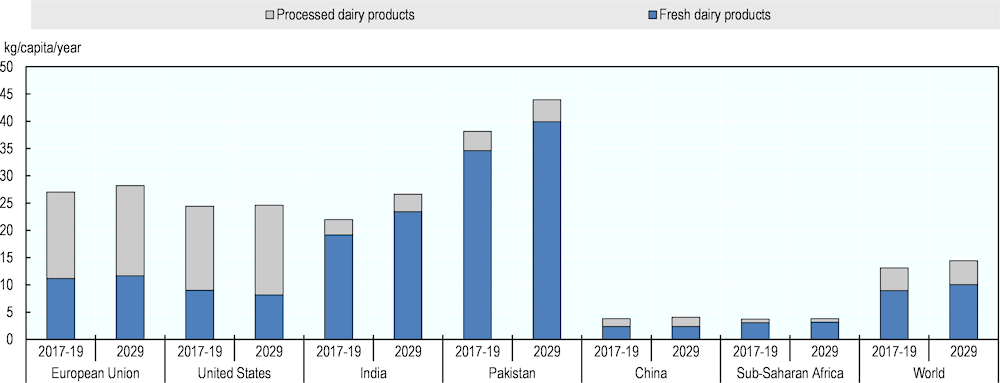

Figure 7.1. Per capita consumption of processed and fresh dairy products in milk solids

Note: Milk solids are calculated by adding the amount of fat and non-fat solids for each product; processed dairy products include butter cheese, skim milk powder and whole milk powder.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Milk is traded internationally mainly in the form of processed dairy products. China consumes small amounts of dairy products per capita, but is expected to remain the most important importer of milk products, especially of whole milk powder (WMP). Japan, the Russian Federation, Mexico, the Middle East and North Africa will continue to be important net importers of dairy products. Compared with rest of the world, per capita consumption of dairy products is low in Asia, especially in South-East Asia. However, economic and population growth, and a shift toward higher-value foods and livestock products are expected to continue to drive increasing import demand for dairy products in many Asian countries. International trade agreements (e.g. CPTPP, CETA, and the preferential trade agreement between Japan and the European Union) have specific arrangements for dairy products (e.g. tariff rate quotas) which create opportunities for further trade growth.

Dairy trade flows could be substantially altered by changes in the trade policy environment. For example, large amounts of cheese and other dairy products are traded between the European Union and the United Kingdom, and this trade could be affected by the new trade relationship which still needs to be agreed upon. The United States-Mexico-Canada Agreement (USMCA) is expected to influence dairy trade flows in North America. To date, the big milk consuming countries, India and Pakistan, have not integrated into the international market, but greater engagement in trade by these two countries could have a significant effect on world markets.

Since 2015, the price of butter has been considerably higher than SMP prices. This development is attributed to stronger demand for milk fat compared to other milk solids on the international market and is assumed to remain a defining feature over the coming decade, although the gap is expected to narrow over the projection period.

Environmental concerns and regulations could alter the projections for the dairy sector. In several countries, dairy production accounts for a substantial share of overall greenhouse gas (GHG) emissions, resulting in discussions on how adjustments to dairy production could contribute to reducing such emissions. Many technical adjustments are being considered, with different implications for commodity balances. In regions with high stocking densities, nitrogen and phosphate run-off can create environmental problems. The regulations planned or implemented to address these could have a significant effect on dairy farming, notably in the Netherlands, Denmark and Germany. On the other hand, these pressures could lead to innovative solutions improving long-term competitiveness.

The COVID-19 pandemic will also influence international dairy markets, although the extent remains uncertain. Confinement measures affect away-from-home consumption, which often includes a large share of dairy products, especially cheese. The perishable nature of milk and dairy products requires a smoothly working food chain domestically and internationally, and any disruption could have considerable impact.

7.3. Prices

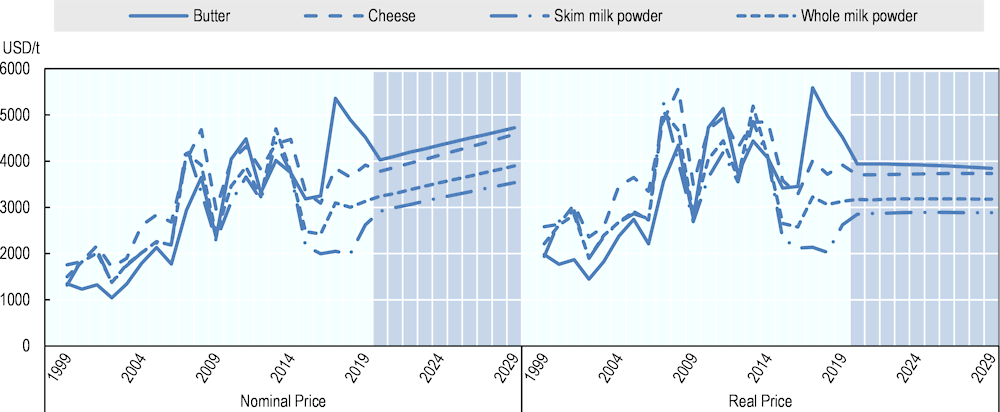

International reference prices for dairy refer to processed products of the main exporters in Oceania and Europe. The two main reference prices for dairy are for butter and SMP. Since 2015, the price of butter has increased considerably more than SMP prices due largely to stronger demand for milk fat on the international market compared to other milk solids. This is expected to continue over the coming decade, although the gap between butter and SMP prices is expected to narrow compared to the last five years (Figure 7.2).

Following the complete disposal of intervention stocks in the European Union, SMP prices recovered in 2019. Consequently, it is expected that SMP prices will remain stable in real terms throughout the projection period. Annual butter prices peaked historically in 2017 and have been declining since. Butter prices are expected to continue to decline slightly in real terms, in line with most other agricultural commodities over the projection period. World prices for WMP and cheese are expected to be affected by butter and SMP price developments, in line with the respective content of fat and non-fat solids.

Figure 7.2. Dairy product prices

Note: Butter, FOB export price, butter, 82% butterfat, Oceania; Skim Milk Powder, FOB export price, non-fat dry milk, 1.25% butterfat, Oceania; Whole Milk Powder, FOB export price, 26% butterfat, Oceania; Cheese, FOB export price, cheddar cheese, 39% moisture, Oceania. Real prices are nominal world prices deflated by the US GDP deflator (2019=1).

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The strong volatility of international dairy prices stems from its small trade share (approximately 8% of world milk production), the dominance of a few exporters and importers, and a restrictive trade policy environment. Most domestic markets are only loosely connected to those prices as fresh dairy products dominate consumption and only a small share of milk is processed as compared to that which is fermented or pasteurised.

7.4. Production

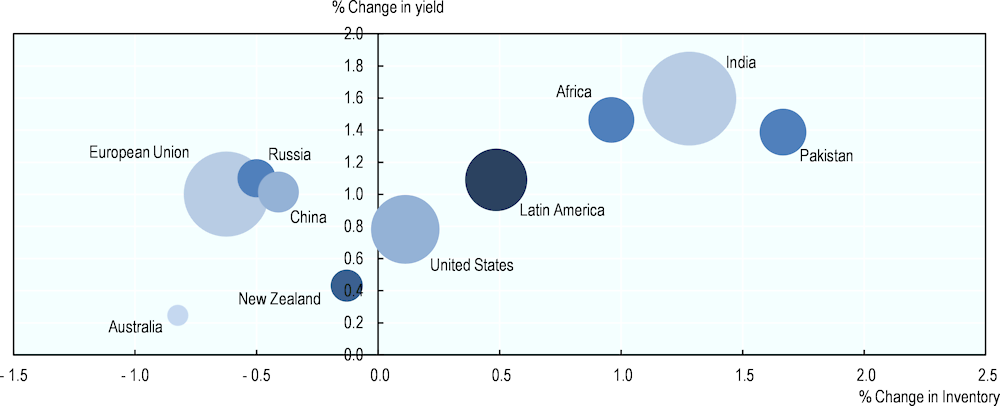

World milk production is projected to grow at 1.6% p.a. (to 997 Mt by 2029) over the next decade, faster than most other main agricultural commodities. While the world average growth of herds (0.8% p.a.) is greater than the world average yield growth (0.7%), the changing averages are the result of herds growing faster in countries that have relatively low yields. In almost all regions of the world, yield growth is expected to contribute more to production increases than herd growth (Figure 7.3). The drivers of yield growth include the optimisation of milk production systems, improved animal health, improved efficiencies in feeding, as well as better genetics.

Figure 7.3. Annual changes in inventories of dairy herd and yields between 2019 and 2029

Note: The size of the bubbles refer to the total milk production in the base period 2017-19.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

India and Pakistan are expected to contribute to more than half of the growth in world milk production over the next ten years. They are also expected to account for more than 30% of world production in 2029. Production will occur mostly in small herds of a few cows or buffaloes. It is expected that yields will continue to grow fast and contribute more to production growth. Nevertheless, the growing herd sizes and limited growth in pasture area require an intensification of pasture use. In both countries, the vast majority of production will be consumed domestically as few fresh products and dairy products are traded internationally. The link between dairy and beef production is less strong in India where for cultural reasons fewer calves and old dairy cows enter the beef market. Beef production in Pakistan remains primarily a by-product of dairy production.

Production in the European Union, the second largest milk producer, is projected to grow more slowly than the world average. Dairy herds are projected to decline (-0.6% p.a.), but milk yields are projected to grow at 1% p.a. over the next decade. The European Union production originates from a mix of grass- and feed-based production systems. In addition, a growing share of milk produced is expected to be organic. At present, more than 10% of dairy cows are within organic systems located in Austria, Sweden, Latvia, Greece, and Denmark. With about 3% of European Union milk production coming from organic farms that have relatively low yields, there is a considerable price premium on EU milk production. In general, domestic demand (cheese, butter, cream, and other products) is expected to grow only slightly, with most additional production destined for export.

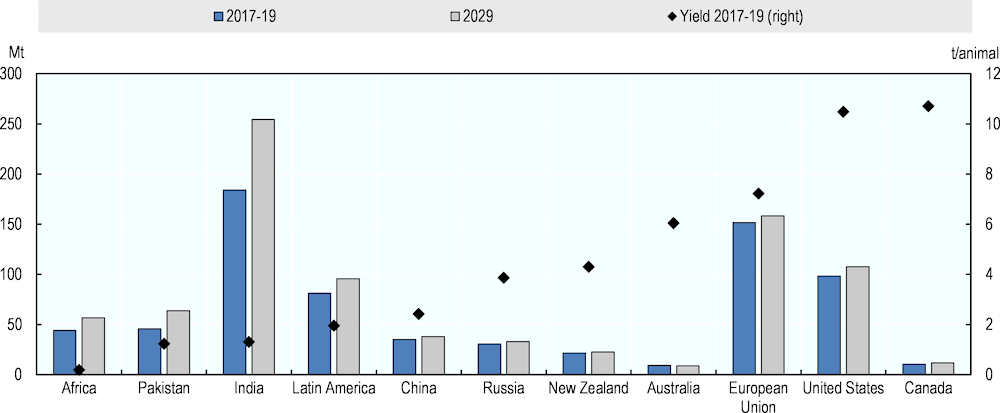

The highest average yield per cow is observed in North America as the share of grass-based production is low and feeding is focused on high yields from specialised dairy herds (Figure 7.4). Dairy cowherds in the United States and Canada are expected to remain largely unchanged and production growth is expected to originate from further yield increases. As domestic demand is projected to remain stronger for milk fats, the United States will mostly export SMP.

Figure 7.4. Milk production and yield in selected countries and regions

Note: The yield is calculated per milking animal (mainly cows but also buffaloes, camels, sheep and goats)

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

New Zealand is the most export-orientated producer and has seen very modest growth in milk production in recent years. Milk production is mainly grass-based and yields are considerably lower than in North America and Europe. The efficiency of grass management and year-round grazing, however, allow New Zealand to be competitive. The main constraining factors for growth are land availability and increasing environmental restrictions. A change to a more feed-based production is not expected. As New Zealand has only a small domestic market, milk production growth will be entirely destined for export which faces larger uncertainties, e.g. due to trade measures following the COVID-19 pandemic.

Strong production growth is expected in Africa, mostly due to larger herds. These will usually have low yields, and a considerable share of milk production will come from goats and sheep. Most cows, goats and sheep graze and are used for other purposes as well, such as meat production, traction, and savings. The additional grazing is expected to occur on the same pasture area, leading to a more intensive use which may in turn lead to local over-grazing. Over the projection period, about a third of the worldwide herd population is projected to be located in Africa and to account for about 5% of world milk production.

It is projected that less than 30% of milk will be further processed into products such as butter, cheese, SMP, WMP, or whey powder. There is considerable direct food demand for butter and cheese, especially the latter, and they presently account for a large share of consumption of milk solids in Europe and North America. SMP and WMP are highly traded and largely produced for trade only. Both are used in the food-processing sector, notably in confectionary, infant formula, and bakery products.

Production of butter is projected to grow at 1.6% p.a., of SMP at 1.6% p.a. and of WMP at 1.7%; all at similar growth rate than overall milk production. Only cheese production is projected to grow slower at 1.2% p.a. The slower growth rate for cheese is due to the importance of slow growing food markets in Europe and North America.

7.5. Consumption

Most of the dairy production is consumed in the form of fresh dairy products, including pasteurised and fermented products. The share of fresh dairy products in world global consumption is expected to increase over the coming decade due to stronger demand growth in India and Pakistan in particular, which in turn is driven by income and population growth. World per capita consumption of fresh dairy products is projected to increase by 1.0% p.a. over the coming decade, slightly faster than over the past ten years, driven by higher per-capita income growth.

The level of milk consumption in terms of milk solids per capita will vary largely worldwide (Figure 7.1). Country income per capita and the impact of regional preferences will be important factors driving this consumption variation. For example, the per capita intake is expected to be high in India and Pakistan, but low in China. The share of processed dairy products (especially cheese) in the overall consumption of milk solids is expected to be closely related to income development, with variations due to local preferences and level of urbanisation.

In Europe and North America, overall per capita demand for fresh dairy products is stable to declining, but the composition of demand has been shifting over the last several years towards dairy fat, e.g. full-fat drinking milk and cream. Consumers may be influenced by recent studies that have shed a more positive light on the health benefits of dairy fat consumption. In addition, this shift may reflect increasing consumer preference for less processed foods.

The largest percentage of total cheese consumption occurs in Europe and North America, where per capita consumption is expected to continue to increase. Consumption of cheese will also increase where it was not traditionally part of the national diet. This is the case, for example in South East Asian countries urbanisation and income increases have resulted in more away-from-home eating, including fast food such as burgers and pizzas. The dominant use of SMP and WMP will continue to be in the manufacturing sector, notably in confectionary, infant formula, and bakery products.

While some regions are self-sufficient, e.g. India and Pakistan, total dairy consumption in Africa, South East Asian countries, and the Middle East and North Africa is expected to grow faster than production, leading to an increase in dairy imports. As liquid milk is more expensive to trade, this additional demand growth is expected to be met with milk powders, where water is added for final consumption or further processing.

A small share of dairy products, especially SMP and whey powder, are used in animal feed. China imports both products for feeding and the African Swine Fever (ASF) outbreak reduced its demand. With the expected recovery (see Chapter 6 on meat), the feed demand for SMP and whey powder is expected to grow over the coming decade.

7.6. Trade

Approximately 8% of world milk production is traded internationally. This is primarily due to the perishability of milk and its high water content. However, imports of liquid milk by China from the European Union and New Zealand have increased considerably in recent years. China’s net imports of fresh dairy products over the base period were about 0.7 Mt, and this is projected to increase over the projection period by 3.6% p.a. The trade share of WMP and SMP is high at more than 40% of world production, but these products are often produced only as a means to store and trade milk over a longer period or distance.

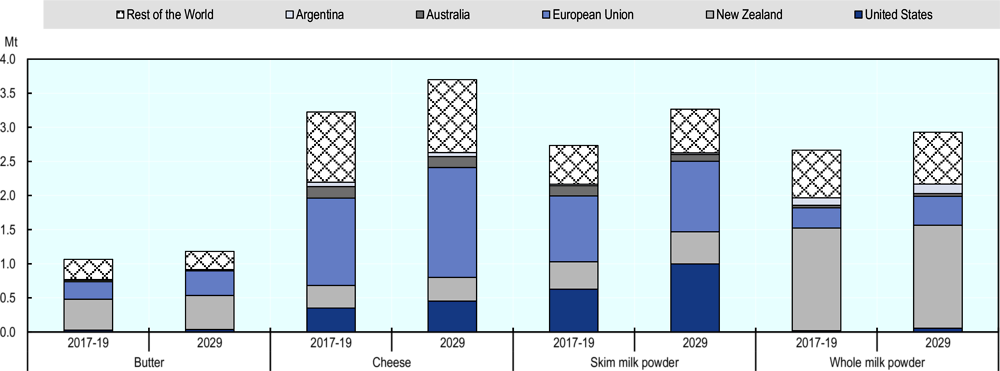

The three major exporters of dairy products in the base period are the European Union, New Zealand and the United States. These three countries are projected to jointly account for around 65% of cheese, 68% of WMP, 76% of butter, and 77% of SMP exports in 2029 (Figure 7.5). Australia, another exporter, has lost market shares although it remains a notable exporter of cheese and SMP. In the case of WMP, Argentina is also an important exporter and is projected to account for 5% of world exports by 2029. In recent years, Belarus has become an important exporter, orientating its exports primarily to the Russian market.

Figure 7.5. Exports of dairy products by region

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The European Union will continue to be the main world cheese exporter, followed by the United States and New Zealand. It is projected that the European Union’s share in world cheese exports will be around 44% by 2029, sustained by increased cheese exports to Canada via the CETA agreement and to Japan following the ratification of the bilateral trade agreement in 2019. The United Kingdom, the Russian Federation, Japan, the European Union, and Saudi Arabia are projected to be the top five cheese importers in 2029. These countries are often also exporters of cheese and international trade is expected to increase the choice of cheeses for consumers.

New Zealand remains the primary source for butter and WMP on the international market, and its market shares are projected to be around 42% and 52%, respectively, by 2029. In the case of WMP, trade between New Zealand and China, the principle importer of WMP, is expected to be considerably less dynamic over the projection period. The expected growth in domestic milk production in China limits the growth in WMP imports. It is expected that New Zealand will diversify and slightly increase its production of cheese over the outlook period.

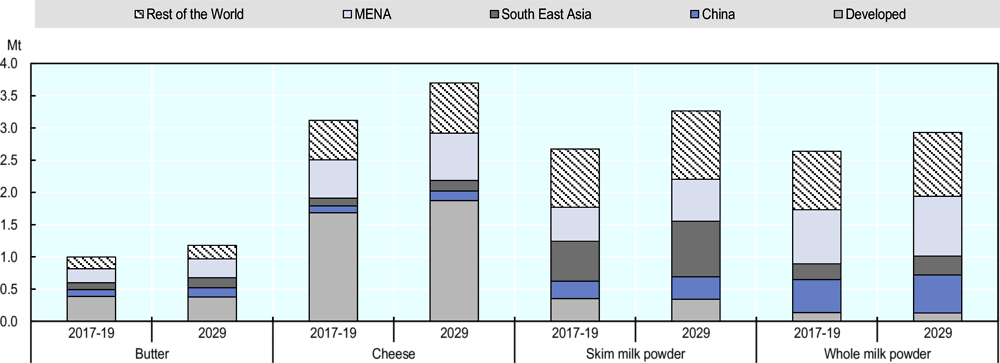

Imports are spread more widely across countries, with the dominant destinations for all dairy products being the Middle East and North Africa (MENA), developed countries, South East Asia, and China (Figure 7.6). China is expected to continue to be the world’s major dairy importer, particularly for WMP. Most of its dairy imports come from Oceania, although in recent years the European Union has increased its exports of butter and SMP to China. Imports by the Middle East and North Africa are expected to originate primarily from the European Union, while United States and Oceania are expected to be the main suppliers of milk powders to South East Asia. Developed countries import a high level of cheese and butter, around 54% and 39% respectively of world imports in 2017-19. These percentages are expected to decline slightly by 2029.

Figure 7.6. Imports of dairy products by region

Note: MENA refers to Middle East and North Africa; South East Asia contains Indonesia, Malaysia, Philippines, Thailand and Viet Nam.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

7.7. Main issues and uncertainties

The COVID-19 pandemic has affected daily life worldwide. It is assumed that food chains are less affected by the constraints implemented to limit its spread, although significant disruption of supply chains could occur for perishable products such as milk and dairy products. In addition, some dairy products like cheese are often consumed away from home (e.g. in burgers and pizzas) and may see a reduction in consumption levels. The effects over the coming decade are more uncertain as these depend on how long the constraints are kept in place, how fast the world economy will recover, and whether there will be any structural changes in global interactions.

World milk production could be constrained due to unforeseen weather events, especially as this concerns grazing-based milk production, the dominant production method worldwide. Climate change increases the chances of drought, floods, and disease threats all of which can affect the dairy sector in several ways (e.g. price volatility, milk yields, cow inventory adjustments).

Environmental legislation could also have a strong impact on the future development of dairy production. GHG emissions from dairy activities make up a high share of total emissions in some countries (e.g. New Zealand, Ireland) and any changes in related policies could affect dairy production. The increasing trend towards sustainable practices such as water access and manure management are additional areas where policy changes could have an impact. Nevertheless, stricter environmental legislation could also lead to innovative solutions that improve the long-term competitiveness of the sector.

Animal diseases and their spread could impact milk production. Mastitis is the most common infectious disease in dairy cattle worldwide and across all types of farm sizes. It is also the most damaging from an economic point of view, with a significant impact on milk yield and milk quality. Future developments in awareness, identification and treatment of this disease could lead to significant increases in milk production through smaller losses. In order to control many diseases, including mastitis, treatments based on antimicrobials are commonly used. This has raised concerns on the overuse of antimicrobials and the development of antimicrobial resistance, which would reduce the effectiveness of existing treatments and require the development of new ones. The evolution of this process remains an uncertainty for the next decade.

In recent years, the role of plant-based dairy substitutes (e.g. soya, almond, rice and oat drinks) in the fluid milk sector has increased in many regions, e.g. North America, Europe and East Asia. Causes include lactose intolerance, as well as discussions on the health and environmental impact of dairy products. The growth rates of plant-based dairy substitutes are strong, albeit from a low base, but conflicting views exist regarding their environmental impact and relative health benefits. As a result, there is uncertainty on the long-term impact these will have on dairy demand.

Changes in domestic polices also remain an uncertainty. In Canada, the SMP export projections are uncertain due to changes in its domestic dairy industry as a result of the World Trade Organization Nairobi Decision, which eliminates the use of export subsidies in agriculture beyond 2020. In the European Union, intervention buying of SMP and butter at fixed prices remains possible and this has had a considerable market impact in recent years.

Changes to or the creation of trade agreements would affect dairy demand and trade flows. For example, large amounts of cheese and other dairy products are traded between the European Union and the United Kingdom, and its continuation will depend on the determined trade relations following Brexit, while the USMCA is expected to influence dairy trade flows in North America. The Russian Federation’s embargo on several dairy products from major exporting countries is expected to end in 2020 and imports are expected to increase slightly, although they are not likely reach the pre-ban levels.

Dairy trade flows could be substantially altered by changes in the trade environment. To date, India and Pakistan, the big dairy consuming countries, have not integrated the international dairy market as domestic production is projected to expand fast to respond to growing internal demand.

Note

← 1. Fresh dairy products contain all dairy products and milk which are not included in processed products (butter, cheese skim milk powder, whole milk powder, whey powder and, for few cases casein). The quantities are in cow milk equivalent.