This chapter provides a market overview and a description of the current market situation for roots and tubers (i.e. cassava, potato, yams, sweet potato, taro), pulses (i.e. field peas, broad beans, chickpeas, lentils), and banana and major tropical fruits (i.e. mango, mangosteen and guava, pineapple, avocado, and papaya) markets. It then highlights the medium term (2020-29) projections for production, consumption and trade for these products and describes the main drivers of these projections.

OECD-FAO Agricultural Outlook 2020-2029

11. Other products

Abstract

11.1. Roots and tubers

Market overview

Roots and tubers are plants that yield starch, either derived from their roots (e.g. cassava, sweet potato and yams) or stems (e.g. potatoes and taro). They are destined mainly for human consumption (as such or in processed form) and, like most other staple crops, they can also be used for animal feed or industrial processing, notably for manufacturing starch, alcohol, and fermented beverages. Unless they are processed, they are highly perishable once harvested, which limits opportunities for trade and storage.

Within the roots and tubers family, potato dominates in worldwide production, with cassava a distant second. Regarding global dietary importance, potato ranks fourth after maize, wheat and rice. The crop provides more calories, grows more quickly using less land and can be cultivated in a broader range of climates than any other staple food crop. However, the dominant position of potatoes is increasingly being eroded by cassava. In fact, potato production, which forms the bulk of the root and tuber sectors in developed countries, has seen a long-standing decline for several decades with growth in production falling well below that of population.

Output of cassava is currently growing at well over 3% p.a., almost three times the rate of population growth. Cultivated mainly in the tropical belt and in some of the world’s poorest regions, cassava production has doubled in a little over two decades. Once considered a subsistence crop, cassava is now seen as a commodity and key for value-addition, rural development and poverty alleviation, food security, energy security and for bringing about important macroeconomic benefits. These factors are driving the rapid commercialisation and large-scale investments in upscaling the processing of cassava which have contributed significantly to the global expansion of the crop.

Current market situation

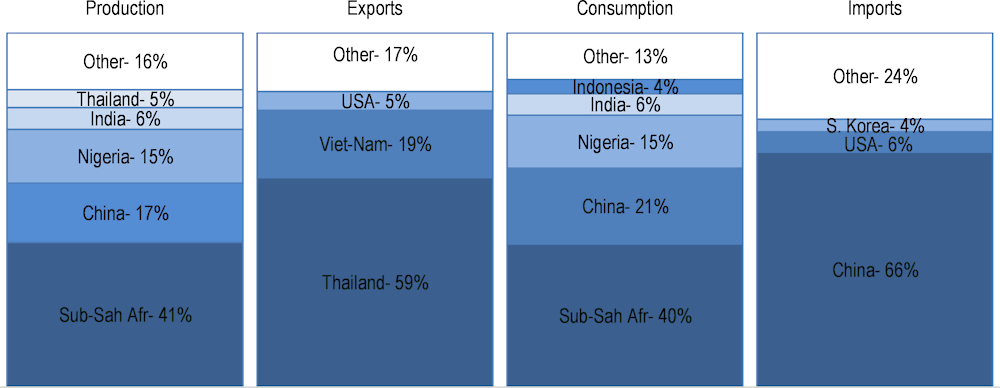

The largest producing regions of roots and tubers today are Asia (95 Mt) and Africa (90 Mt). Particularly in Sub Saharan Africa, roots play a significant role as a staple crop. Globally, about 124 Mt are used as food, 55 Mt as feed and 55 Mt for other uses, mostly biofuel and starch. As the perishable nature of the crops prohibits significant international trade in fresh produce, countries tend to be self-sufficient. About 14 Mt are currently traded internationally, mostly in processed or dried form. Thailand and Viet Nam are the leading exporters and the People’s Republic of China (hereafter “China”) is the main destination of their shipments.

In 2019, global production of roots and tubers reached 237 Mt (dry matter), 3 Mt more than in 2018. These additional quantities were mainly consumed as food. Roots and tubers prices (measured by the Cassava (flour) wholesale price in Thailand, Bangkok) was weaker in 2019 as yields in many major producing regions were favourable. As a consequence, global quantities traded also increased by 0.5 Mt.

Main drivers for projections

Producing cassava requires few inputs and affords farmers great flexibility in terms of timing the harvest, as the crop can be left in the ground well after reaching maturation. Cassava’s tolerance to erratic weather conditions, including drought, makes it an important part of climate change adaptation strategies. Compared with other staples, cassava competes favourably in terms of price and diversity of uses. In the form of High Quality Cassava Flour (HQCF), cassava is increasingly being targeted by governments in Africa as a strategic food crop which does not exhibit the same levels of price volatility as other imported cereals. Mandatory blending with wheat flour helps to reduce the volume of wheat imports, therefore lowering import bills and conserving precious foreign exchange. The drive towards energy security in Asia, combined with mandatory blending requirements with gasoline, has led to the establishment of ethanol distilleries that use cassava as a feedstock. With regard to trade, processed cassava manages to compete successfully on the global arena, such as with maize-based starch and cereals for animal feeding applications.

Potatoes are mostly confined to food use and are a substantial component of diets of developed regions, particularly Europe and North America. As overall food intake of potato in these regions is very high and may have reached saturation, the scope for consumption increases to outpace population growth remains limited in that part of the world. Rising food use in developing regions, provides some growth momentum to potato production at the world level.

Global sweet potato cultivation has declined in recent years, mostly due to a sharp acreage decline (which shows no sign of abating), in China – the world’s foremost producer. Food demand largely defines the growth potential of sweet potato and other less prominent roots and tuber crops given the limited commercial viability for diversified usage. Consequently, consumer preferences along with prices play important roles in shaping consumption.

Projection highlights

World production and utilisation of roots and tubers is projected to expand by about 18% over the next decade. Growth in low-income regions could reach 1.7% p.a. while a slight annual reduction is expected in industrialised countries. Global land use is projected to increase slightly to 71 Mha, but there will be some regional shifts. African countries are expected to increase their cultivation, while some reductions are projected in Europe and America. Production growth is mainly attributed to investments into yield improvements in Africa and Asia as well as an intensification of land use in these regions.

By 2029, an additional 1.5 kg/capita per year of root crops will enter global diets, driven mostly by consumers in Africa where per capita intake of roots and tubers could surpass 41 kg per year. Biofuel use, albeit from a low basis (2% of use), is expected to double over the next ten years driven by the Chinese biofuel industry. Feed and other industrial use will remain significant, albeit seeing slower growth of only about 10% over the decade.

Figure 11.1. Global players in roots and tubers markets (2029)

Notes: Presented numbers refer to shares in world totals of the respective variable

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

International trade in roots and tubers only comprises around 6% of the global market. Over the medium term, this share is expected to remain constant. Exports from Thailand and Viet Nam are growing and are expected to reach a combined 13 Mt, mainly to supply the growing biofuel and starch industries in China.

Given the substitutability between roots and tubers and cereals on food and feed markets, the roots and tubers prices are projected to follow a similar path to cereal prices: namely, an increase in nominal prices but a decline in real terms

11.2. Pulses

Market overview

Pulses are the edible seeds of plants in the legume family. Commonly, eleven types are recognised.1 They provide protein, dietary fibre, vitamins, minerals, phytochemicals and complex carbohydrates. Apart from the nutritional benefits, pulses also assist in improving digestion, reducing blood glucose, minimising inflammation, lowering blood cholesterol, and preventing chronic health issues such as diabetes, heart diseases and obesity. However, their consumption levels differ from region to region depending on the dietary patterns, availability and prevailing conditions.

Cultivation of pulses has a long tradition in almost all regions of the world. For centuries, legumes have played a fundamental role in the functioning of traditional agricultural systems. Before 2000, global production of pulses stagnated due to the widespread disappearance of small farms in developing countries, resulting in a decline of traditional farming systems that included pulses in their crop rotation. Production was further hampered by low resilience to diseases because of low genetic diversity, limited access to high-yield varieties and the lack of policy support to pulses growers. When demand started to pick up again in the early 2000s, the sector began to recover and has since seen an annual increase of about 3% globally, led by Asia and Africa. Combined, these two regions accounted for about 64% of the 19 Mt production increase during the previous decade.

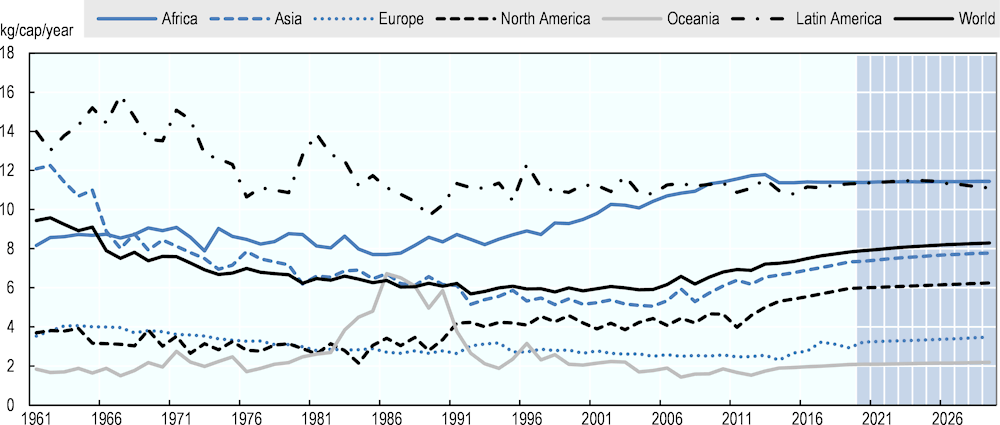

Global per capita consumption of pulses started to decline in the 1960s (Figure 11.2). Slow growth in yields and the resulting rise in prices weakened demand. Furthermore, income growth and urbanisation shifted preferences away from pulses as human diets became richer in animal proteins, sugar and fats. Nonetheless, pulses have remained an important source of protein in developing countries and average global per capita consumption increased to about 8 kg/year by today. This growth was mainly driven by income gains in countries were pulses are an important source of protein, most of all India, were vegetarians account for about 30% of the population.

Pulses can be processed into different forms such as whole pulses, split pulses, pulse flours and pulse fractions like protein, starch and fibre. The flour and fractions find diverse applications in industries like meat and snack food, bakery and beverages, and batter and breading.

Figure 11.2. Per capita food consumption of pulses per continent

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Current market conditions

India is by far the largest producer of pulses accounting for about 25% of global production during the past decade. Canada (8%) and the European Union (4%) are the next largest producing countries. The Asian market accounts for more than half of all consumption, but only about 40% of the production, making it the most significant import destination. About 20% of global production is traded internationally and Canada (40% of global trade) is the by far largest exporter and India the largest importer (30% of global trade). Africa has further expanded its production and consumption during the past decade, remaining largely self-sufficient.

In 2019, the global pulses market reached a volume of 88 Mt, after an average annual growth of 2.8% p.a. during the previous decade led by Asia and Africa. Growth between 2018 and 2919 has been especially high in the European Union (+10%). World trade registered at 17 Mt, 0.5 Mt higher than in 2018. Due to an ample supply situation, international prices for pulses, approximated by the Canadian field pea price, have dropped to USD 320/Mt, the lowest value since 2017.

Main drivers for projections

As pulses are associated with various health benefits, health-conscious consumers are increasingly incorporating dishes made from pulses into their everyday diets, in turn, propelling the growth of the global pulses market. As a result of rapid urbanisation, changing lifestyle and hectic work schedules, healthy snack foods are becoming popular amongst the working population. Pulses are increasingly being used in the processing of those ready-to-eat (RTE) food products.

As the global population is rapidly increasing, the gap between the demand and supply of pulses is widening. In order to minimise this difference, the governments of pulses-producing countries are providing assistance to the farmers, in turn, strengthening the growth of the market. Support to pulses production plays also an important role in the Protein Strategy of the European Union. Pulses are also the major basis of booming products like artificial meat. Depending on the future dynamics of demand for such products, this could significantly change the future importance of pulses in the agricultural production mix.

Projection highlights

Pulses are expected to regain importance in the diets and farming systems of Africa, Asia and Latin America and also the European Union. The Outlook foresees the global trend to continue and expects global average per capita food use to increase to 8.3 kg in 2029. Per capita consumption is projected to level off in Latin America and Africa, at just above 11 kg/year, while in Asia it is expected to increase from 7 kg to 8 kg per year over the coming decade.

Global supply is projected to grow by another 16 Mt. More than half of this increase is expected to come from Asia, particularly India, the world’s largest producer. Sustained yield improvements are expected to raise India’s domestic production by an additional 5.8 Mt to 2029. India has now introduced high-yielding hybrid seeds, has supported mechanisation, and has implemented a minimum support price aimed at stabilising farmers’ income. In addition, the central government and some state governments have included pulses in their procurement programmes, although not with the same geographical coverage as in the case of wheat and rice.

This expected production expansion is driven by the assumption of continued intensification of the pulses production systems, due to improved yields and intensified land use. About 80% of the production growth can be attributed to yield improvements; the remaining 20% is due to land use intensification, mainly in Asia and Africa. Particularly in Africa, a combination of area expansion and yield growth is estimated to add about 0.2 Mt annually to the regional production.

The Outlook assumes that growth will be sustained by increased intercropping of pulses with cereals, in particular in Asia and Africa, where smallholder farmers represent a large share of producers. The projected yield improvements of pulses will still lag behind cereals and oilseeds, because in most countries pulses are not included in the development of high-yielding varieties, improved irrigation systems and agricultural support policies.

As a result of increasing demand for pulses in consuming regions, world trade grew from 11 Mt to 17 Mt over the past decade and is projected to remain at this level up to 2029. India’s recent efforts to become self-sufficient in pulses are the major factor driving the anticipated restructuring of global pulses trade where Africa will become the main importing region. After a continued increase in imports in the near term, India is expected to experience a reversal in this trend by 2025, reducing its import by about 1 Mt by 2029.

Canada remains the main exporter of pulses, with volumes expected to grow from 6.5 Mt currently to 7.5 Mt in 2029, followed by Australia with 2 Mt of exports in 2029. However, since their major trading partner India is not expected to increase imports, they need to diversify its export markets.

Sustained by increasing demand for pulses, international prices are expected to increase in nominal terms over the coming decade while real prices will decline slightly.

11.3. Bananas and major tropical fruits

Bananas rank as a leading crop in world agricultural production and trade. In response to fast population growth in producing countries as well as rapidly expanding global import demand, bananas have experienced a rapid increase in production and trade volumes in recent decades. Moreover, export volumes of the four major fresh tropical fruits – mango, pineapple, avocado and papaya – have experienced some of the fastest average annual growth rates among internationally traded food commodities, significantly outpacing growth in exports of cereals, livestock products, vegetable oils, sugar, and other fruits and vegetables. Bananas and major tropical fruits play a vital role in the nutrition and livelihood of smallholders in producing countries. For all these underlying reasons, it is important to assess the potential future market development of these agricultural commodities.

Global banana production is estimated to have grown from 69 Mt in 2000-2002 to 116 Mt in 2017-2019 (an approximate value of USD 31 billion). Since the bulk of banana cultivation is conducted informally by smallholder farmers, these figures are only estimates. To satisfy a growing demand, producing countries have mainly relied on an expansion in the harvested area. In India, for instance, the harvested area for banana crops has increased from 0.47 Mha in 2000 to 0.87 Mha in 2018. Improved productivity at the farm level involving better irrigation systems but also a substantially higher application of fertilisers and pesticides have also contributed to this increase in banana output. The main driver of the expansion in production has been the increasing consumption requirements of rising populations in producing countries. Accordingly, most of the global increase in production has taken place in the top producing countries that are also top consumers, in particular in India and China, but also in Brazil and the Philippines. In addition, income growth and a rising health awareness in import markets have also contributed to higher demand, with banana consumption having substantially risen in the European Union and the Russian Federation, for example.

In many producing regions, per capita consumption of all types of bananas well exceeds 100 kg per year. Available data also suggest that bananas provide up to 25% of the daily calorie intake in the rural areas of producing countries. More than 1 000 varieties of bananas are reportedly produced and consumed locally in the world. In Africa, the third largest producing region of bananas globally, some 70%-80% of production are local varieties, mostly cooking bananas that importantly contribute to food security in the region. However, due to the informality of production and trade in most consuming regions, data and information on these local varieties remain largely unavailable. The most commercialised banana variety is the Cavendish type, which is estimated to account for around 40%-50% of global production and for virtually all trade. This variety is able to achieve high yields per hectare and, due to its short stems, is less prone to damage from adverse weather events such as storms. Cavendish banana plantations are also able to recover quickly from natural disasters given the short time this variety needs to reach maturity (approximately nine months).

Based on 2017 figures, the global banana export industry generates around USD 12 billion per year. However, it is important to note that only around 15% of global banana production is traded in international markets. In exporting countries, which are mostly low-income economies, revenue from banana production and trade can weigh substantially in agricultural GDP. For instance, banana (export) revenue represented about 30% of agricultural export revenue in Ecuador in 2018, and 15% in Guatemala.

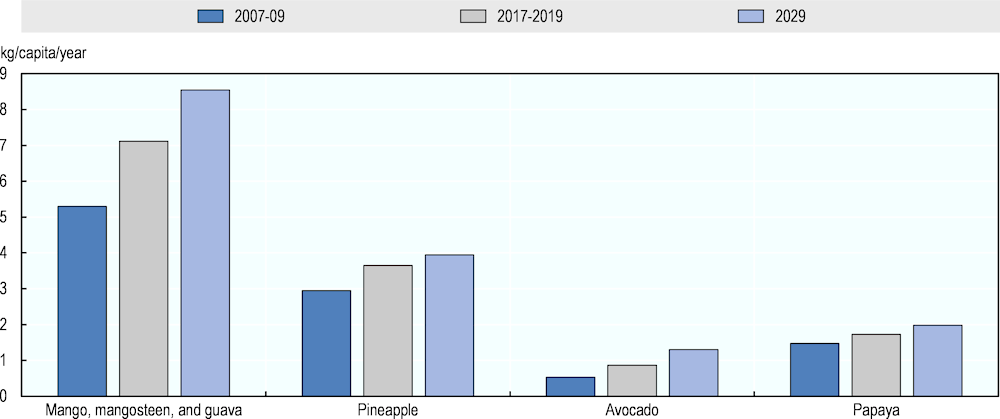

Global production of tropical fruits has been growing steadily over the past decade. An estimated 99% of tropical fruit production originates from low-income countries, mostly cultivated at subsistence rather than at commercial level by smallholder farmers who typically are endowed with, or have access to, less than 5 ha of land. As such, tropical fruits contribute directly and importantly to food security and nutrition in most producing zones. The growth in global production of tropical fruits over the outlook period is assumed to be mainly driven by area expansion, supported by higher per hectare returns compared to competing crops. Due to rising incomes in key producing and importing regions, the role of tropical fruits in nutrition has made significant advancements over the past decade, as reflected by the rising world per capita consumption of all four major tropical fruits. However, given the high perishability of tropical fruits, especially those that are harvested when ripe, only a small fraction of total tropical fruit production is traded in national markets, and an even smaller one in international markets. While unprocessed, fresh or dried tropical fruits occupy a comparatively niche position in global agricultural trade in volume terms, their high average export unit value in excess of USD 1 000 per tonne places them as the third most valuable fruit group globally, behind bananas and apples. As such, trade in tropical fruits has the potential to generate significant export earnings in producing countries. Income growth and changing consumer preferences in both emerging and high-income markets will act as the main factors facilitating growth in trade, alongside improvements in transport and supply chain management. Under these assumptions, the projections indicate that tropical fruits will continue to be among the fastest growing agricultural sectors.

Bananas

Market situation

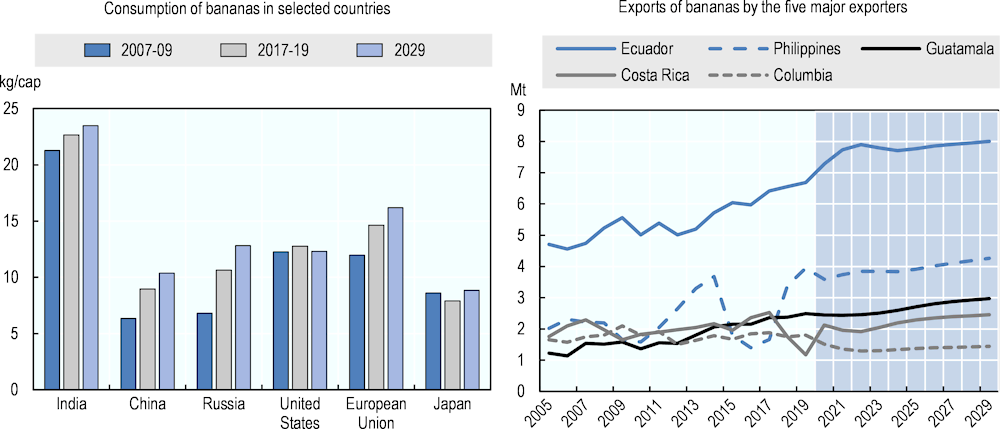

Global exports of bananas, excluding plantain, are estimated to have reached a new record high of 20.2 Mt in 2019, an increase of 5% compared to 2018. Data from the first nine months of the year indicate that strong supply growth in Ecuador and the Philippines, the two leading exporters, is again chiefly accountable for this rise. Adverse weather conditions attributed to the El Niño weather phenomenon, meanwhile, have continued to affect shipments from several key suppliers, most severely from Costa Rica and the Dominican Republic, and to a lesser extent from Colombia. Global net import volumes of bananas are estimated to have reached 18.9 Mt in 2019, an increase of 3% compared to 2018. Preliminary data indicate a contraction in imports of, respectively, 1% and 4% in the two largest net importers, the European Union and the United States. Conditions of supply outstripping demand continued to put downward pressure on prices in both destinations in 2019, particularly during the summer months, when competition from temperate fruits was strong. Imports by China, meanwhile, are estimated to have reached 2.2 Mt, an expansion of 36% compared to 2018. Chinese import demand for bananas continued to be driven by weather- and disease-related disruptions to domestic production as well as by fast income growth and associated changes in consumer preferences. As a result, China expanded its volume share to an estimated 12% of global net imports, overtaking the Russian Federation as the third largest importer of bananas globally.

Projection highlights

Assuming average weather conditions and no further spread of banana plant diseases, the Outlook projects world production of bananas to grow at 1.5% p.a., to reach 132.6 Mt in 2029. Demand for bananas is expected to become saturated in most regions and primarily driven by population growth. However, in some emerging economies – principally in India and China – fast income growth is anticipated to stimulate changing health and nutrition perceptions and support growth in demand for bananas beyond population growth. Accordingly, Asia is expected to remain the leading global producer, with a global volume share of 51.8%. India, in particular, is projected to reach 35.5 Mt of banana production in 2029 and a per capita consumption of 23.5 kg. Production from the leading exporting region – Latin America and the Caribbean – is expected to reach 34.8 Mt, encouraged by rising demand from key importing markets, most importantly the European Union, the United States and the Russian Federation. The largest exporters in Latin America and the Caribbean (Ecuador, Guatemala, Colombia, and Costa Rica) should benefit from this rise in import demand, assuming that production growth can be shielded from the adverse effects of weather events and disease outbreaks. Exports from the Philippines are expected to be mainly driven by burgeoning import demand from China, where per capita consumption is expected to rise by 1.1% p.a., as well as sustained income-driven demand from Japan, the primary export destination for Philippine bananas. Successful disease management and ample investments into yield improvements and area expansion are expected to support export growth in the Philippines on the supply side. As such, the Philippines is set to expand its volume share in global banana exports from 15.6% in the base period to 18.6% in 2029, thereby consolidating its position as the second largest exporter behind Ecuador. Among the key import markets, the largest increase in per capita consumption is expected to be seen in the Russian Federation, from 10.7 kg in the base period to 12.8 kg in 2029, based on positive macroeconomic developments. This is expected to support export growth from Ecuador, currently the main supplier of bananas to the Russian Federation. Facilitated by investments in yield improvements, Ecuador is projected to expand its share of global exports by one percentage point over the outlook period, to 35% in 2029 or 8 Mt.

Figure 11.3. World banana outlook

Mango, mangosteen and guava

Market situation

Global exports of fresh mangoes, mangosteens, and guavas2 are estimated to have grown to 2 Mt in 2019, an increase of 23% from the previous year. This places the commodity cluster as the fastest growing group among the major tropical fruits in 2019. The main driver is a near 90% expansion in exports from Thailand, which reached an estimated 0.48 Mt in 2019. Exports from Thailand benefited from exceptionally fast growth in import demand for mangosteen from China, with shipments increasing by a reported 265% year-on-year between January and October 2019, to 0,29 Mt. Rising incomes and changing consumer preferences in China can be considered as the main drivers of this expansion, with mangosteen being particularly sought after due to the fruit’s assumed health benefits. With an average export unit value of USD 1 300 per tonne for shipments from Thailand to China during the first ten months of 2019, mangosteens are among the most valuable tropical fruits traded.

Projection highlights

Global production of mangoes, mangosteens and guavas is projected to reach 72.8 Mt by 2029, increasing at 2.9% p.a. over the next decade. Asia, the native region of mangoes and mangosteen, is expected to account for 71% of global production in 2029. Average per capita consumption in Asia is expected to reach 12.1 kg in 2029, compared to 9.8 kg in the base period. Income growth and associated shifts in dietary preferences in the two main consuming countries, India and China, will be the main drivers. The two countries are expected to experience increases in per capita consumption of 2% to 3% p.a. over the outlook period, reaching 17.6 kg and 4.3 kg in 2029, respectively. Mango production in India is destined largely for local informal markets and is projected to account for 26.7 Mt in 2029, or 36.6% of global production. China, whose domestic mango production is comparatively low at a projected 5.8 Mt in 2029, is expected to experience a growth in imports of 5.1% p.a. This is mainly due to a strong increase in demand for mangosteen. Chinese demand for mangosteen is expected to be predominantly met by an increase in imports from Thailand, the largest global exporter of mangosteen. Mexico, the leading supplier of mangoes globally, is expected to benefit from further growth in import demand from its major market, the United States, and register 4% p.a. growth over the outlook period, to reach a 25.7% share of world exports in 2029.

Figure 11.4. World consumption of major tropical fruits

Pineapple

Market situation

Ample supplies led to an estimated rise in global exports of fresh pineapples of 5%, to 3.2 Mt in 2019. This expansion is mainly due to a 50% increase in exports from the Philippines, the second largest world exporter. Following substantial investments in area expansion and productivity, exports from the Philippines reached an estimated 0.67 Mt in 2019, representing about 21% of world exports. Data available until September 2019 indicate that, in addition to higher supplies, exports of pineapples from the Philippines benefited from a strong increase in import demand from China, reaching 0.17 Mt in January-September 2019, a 122% increase on the year. Filipino pineapples of the MD2 variety are well received by the Chinese market due to their high brix levels and the fact that supplies are available year round, while domestic Chinese production is largely restricted to the harvesting period between March and May. Exports from Costa Rica, the world’s largest producer and exporter of pineapples, meanwhile, were substantially hindered by excessive rainfall throughout the year as well as destructive tropical storms in the fall of 2019. Overall, shipments from Costa Rica are anticipated to decline by approximately 8%, from 2.1 Mt in 2018 to slightly below 2 Mt in 2019.

Projection highlights

On account of a 2% expansion in harvested area, global production of pineapple is projected to grow at 2.3% p.a., to reach 33 Mt in 2029. Among the major tropical fruits, pineapple is the least concentrated in terms of geographic distribution, with no single country producing more than 12% of global output. Asia is expected to remain the largest producing region, and account for 41% of global production; pineapple production being sizeable in the Philippines, Thailand, India, Indonesia and China. Only the Philippines exports approximately 16% of its production, otherwise pineapple cultivation in Asia predominantly caters to domestic demand and is expected to grow in response to changing demographics and income growth. Similarly, pineapple production in Latin America and the Caribbean, the second largest producing region accounting for 36% of world production, will be primarily driven by the evolving consumption needs of the region’s growing and increasingly affluent population. Global exports of pineapple are expected to grow at 1.5% p.a., to 3.6 Mt in 2029, predominantly driven by import demand from the United States. With projected imports of 1.3 Mt in 2029– equivalent to a 35% global share – the country is expected to remain the largest importer, ahead of the European Union, which is expected to account for 28% of global imports. In both key import markets, demand for pineapples is expected to benefit from low unit prices.

Avocado

Market situation

Global exports of avocado are estimated to reach approximately 2.3 Mt in 2019, following an expansion of 7% from 2018. Ample global demand and lucrative export unit prices continue to be the main drivers of growth, stimulating substantial investments in area expansion in both major and emerging production zones. However, weather-related production declines in a number of producing countries, most notably in Peru and South Africa, hampered the overall potential of the market, which grew at a significantly lower rate than over the 2014-2018 period. The leading exporter, Mexico, is estimated to have increased its share of global exports to 58% in 2019, on account of area expansion, favourable weather and improved yields.

Projection highlights

Avocado has the lowest production level of this group of tropical fruits but has experienced the fastest growth in output in recent years, underpinned by rapidly expanding import demand. Production is projected to slightly exceed 11 Mt by 2029 – more than two and a half times its level in 2009. Avocado production is concentrated in a small number of regions and countries, with the top ten producing countries accounting for over 80% of global output. In particular, about 70% of avocado production is taking place in Latin America and the Caribbean. In response to rapidly growing global demand, output in Mexico, the world’s largest producer and exporter, is expected to grow by 4.9% p.a. over the next ten years. As such, and despite increasing competition from emerging exporters, Mexico is expected to further increase its share of global exports, to 67.6% in 2029. The United States and the European Union, where consumer interest in avocados is fuelled by the fruit’s assumed health benefits, are expected to remain the main importers, reaching 50.5% and 28.7% of global imports in 2029, respectively.

Papaya

Market situation

Global exports of papayas are estimated to increase by 8% in 2019, to approximately 0.31 Mt, reflecting a recovery from the weather-related declines experienced in 2017 and 2018. As the largest global exporter of papayas, Mexico is estimated to expand shipments by 7% in 2019 to approximately 0.17 Mt, 99% of which is exported to the United States. Despite the recovery in production and increase in exports over this period, Mexican shipments of papayas continued to be affected by recurring contamination with several strains of the salmonella bacterium, which had first been reported in August 2017.

Projection highlights

Global papaya production is projected to rise by 2.1% p.a., to 16.6 Mt in 2029. The strongest growth is expected to be experienced in Asia, the leading producing region globally. Asia’s share of world production is set to rise from 59% in the base period to 61% in 2029. The world’s largest producer, India, is projected to increase its papaya production at a rate of 2.4% p.a., thereby expanding its share of global output to 48% by 2029. Income and population growth will be the main factors behind this rise, with Indian per capita consumption of papayas expected to reach 5.5 kg in 2029, up from 4.4 kg in the base period. Global exports will predominantly be shaped by production expansion in Mexico, the largest global exporter of papayas, and higher demand from the key importers, the United States and the European Union. However, a major obstacle to a significant expansion in international trade remains the fruit’s high perishability and sensitivity in transport, which makes produce problematic to supply to far afield destinations. Innovations in cold chain, packaging and transport technologies promise to facilitate a broader distribution of papaya, particularly in view of rising consumer demand for tropical fruits in import markets.

Uncertainties

The markets for bananas and major tropical fruits are affected by the COVID-19 pandemic. The trade of perishable products is more at risk of disruption than that of other agricultural products. Due to their high value and the long distance between production and consumption regions, a share of tropical products is transported by air freight, which is particularly disrupted. These impacts may be considerable for producers of those perishable tropical fruits that need to be airfreighted in the short term. The medium-term impact is more uncertain as it depends on the recovery path following the current pandemic. Projections of trade in tropical products and bananas would be sensitive to different economic growth assumptions.

Given the perishable nature of tropical fruits in production, trade and distribution, environmental challenges and insufficient infrastructure continue to challenge production and supply to international markets. This is a particularly acute challenge since the vast majority of tropical fruits are produced in remote, informal settings, where cultivation is highly dependent on rainfall, prone to the adverse effects of increasingly erratic weather events and disconnected from major transport routes.

The presented projections assume average weather conditions, and do not include the potential impacts of climate change, established and emerging plant diseases, or events such as the El Niño weather phenomenon, which periodically affect production in the Latin American region. However, the effects of climate-driven changes on global tropical fruit area, changes in actual and attainable yields as well as the impact of increased frequencies of extreme weather events on production and trade could be assessed by making respective changes to the model specifications.

Banana Fusarium Wilt disease, which has been severely affecting banana plantations in several growing regions since the late 19th century, continues to be a serious concern to the global banana industry. The currently expanding strain of the disease, described as Tropical Race 4 (TR4), poses particularly high risks to global banana supplies as it can affect a much broader range of banana and plantain cultivars than other strains of Fusarium wilt, and because no effective fungicide or other eradication method is currently available. According to official information, TR4 is currently confirmed in 17 countries, predominantly in South and Southeast Asia, but also in the Middle East and Latin America, with Colombia reporting the first infection in August 2019. A recently conducted assessment of the potential economic impact of the TR4 disease on global banana production and trade showed that a further spread of TR4 would, inter alia, entail considerable loss of income and employment in the banana sector in the affected countries, as well as significantly higher consumer costs in importing countries, at varying degrees contingent on the actual spread of the disease.3.

Notes

← 1. Pulses types: dry beans, dry broad beans, dry peas, chickpeas, cow peas, pigeon peas, lentils, Bambara beans, vetches, lupines and minor pulses (not elsewhere specified).

← 2. International commodity classification schemes for production and trade do not require countries to report the fruits within this cluster separately, thus official data remain sparse. It is estimated that, on average, mango accounts for approximately 75% of total production volume, guava for 15% and mangosteen for the remaining 10%.

← 3. Most recently, an alternative simulation was run to assess the potential economic impact of the Banana Fusarium Wilt Tropical Race 4 disease on global banana production and trade. The results of this scenario were published in the November 2019 issue of FAO’s biannual publication Food Outlook (http://www.fao.org/3/CA6911EN/CA6911EN.pdf).