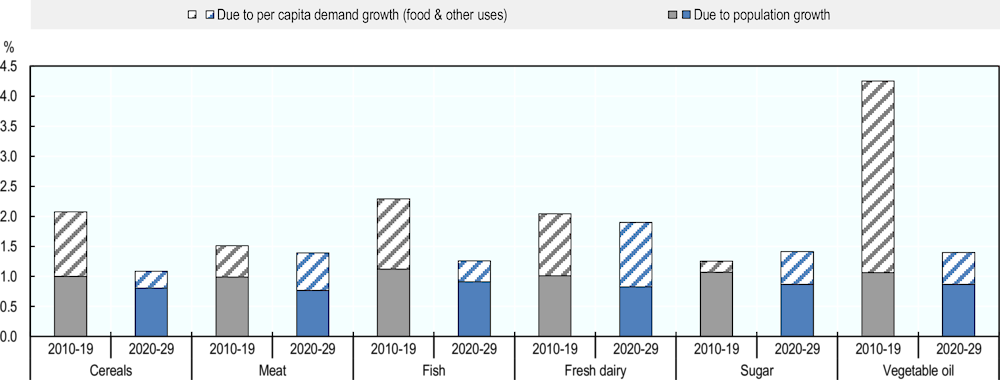

This chapter provides an overview of the latest set of quantitative medium-term projections for global and national agricultural markets. The projections cover consumption, production, trade, and prices for 25 agricultural products for the period 2020 to 2029. The weakening of demand growth is expected to persist over the coming decade. Population will be the main driver of consumption growth for most commodities, even though the rate of population growth is projected to decline. Per capita consumption of many commodities is expected to be flat at the global level. The slower demand growth for agricultural commodities is projected to be matched by efficiency gains in crop and livestock production, which will keep real agricultural prices relatively flat. International trade will remain essential for food security in food-importing countries, and for rural livelihoods in food-exporting countries. World agricultural markets face a range of new uncertainties that add to the traditionally high risks agriculture faces. The most significant source of uncertainties relates to the COVID-19 pandemic that has impacts on consumption, production, prices and trade. Other uncertainties relate to changes in consumers preferences, plant and animal diseases, and the heightened uncertainty with respect to future trading agreements between several important players on world agricultural markets.

OECD-FAO Agricultural Outlook 2020-2029

1. Overview

Abstract

1.1. Introduction

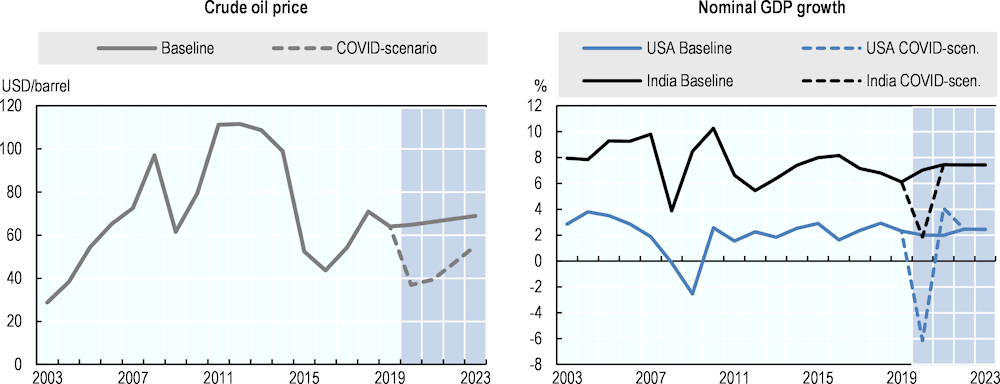

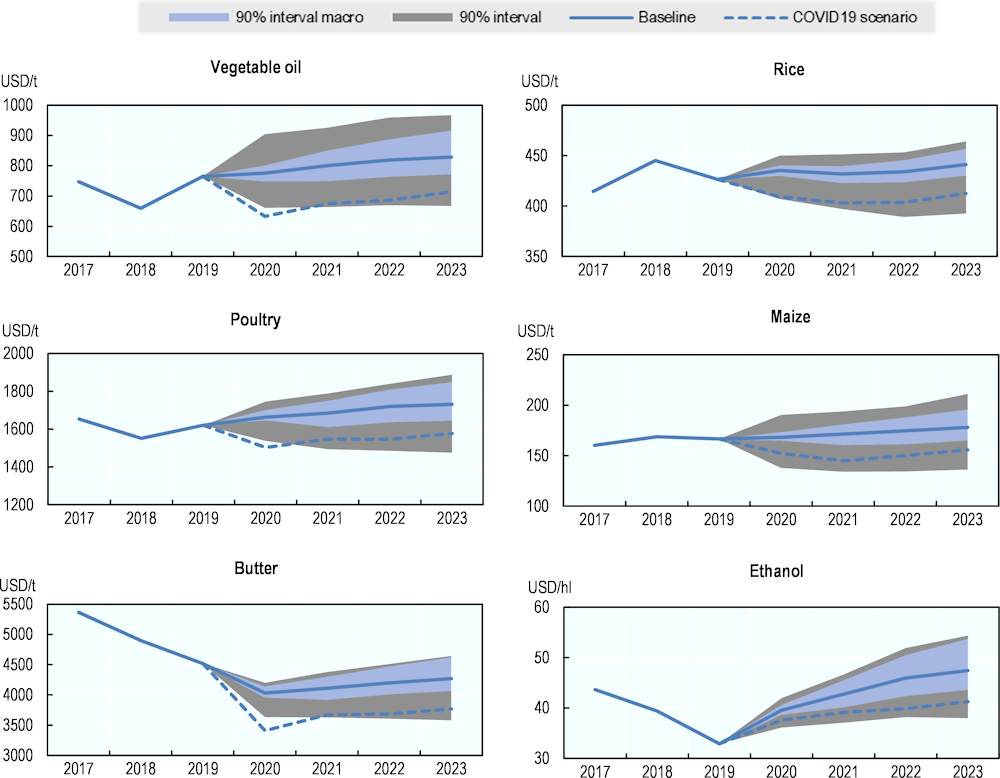

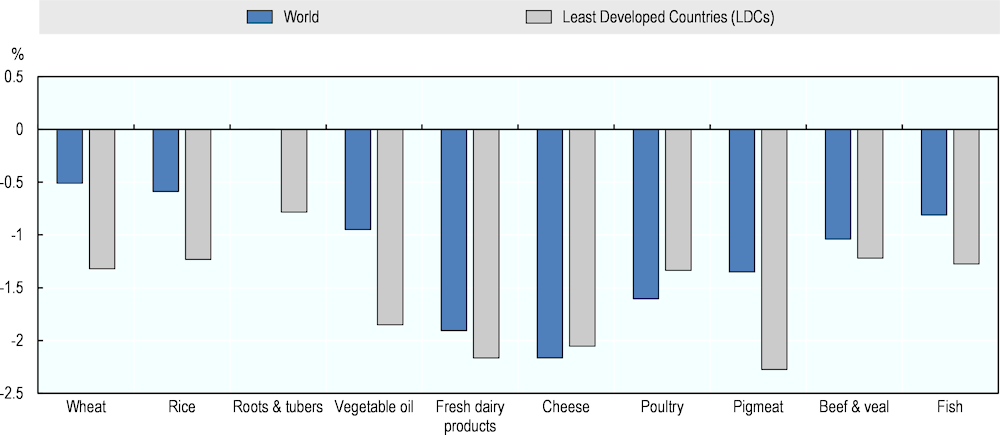

The OECD-FAO Agricultural Outlook presents a consistent baseline scenario for the evolution of agricultural and fish commodity markets at national, regional and global levels over the coming decade (2020-2029). The Outlook thus focuses on the medium term, complementing both short-term market monitoring, outlook publications, and long-term projections. This current edition of the Outlook was being finalised under the unique circumstances generated by the COVID-19 pandemic. As the full impact of the pandemic on agricultural and fish markets remain uncertain, at least in quantitative terms, they were not incorporated into the baseline projections. However, an initial scenario presented in Section 1.6 explores the likely macroeconomic impacts of the pandemic on agricultural markets over the short term. The Outlook projections for the early years of the projection period thus need to be qualified and remain more uncertain than projections for the later years. However, since agriculture and the overall economy are expected to recover over the next decade, the projections for the following years of the Outlook are consistent with the underlying economic drivers and trends affecting global agricultural markets. Therefore, the short-term impacts of the pandemic on agricultural and fish markets do not alter the medium term baseline scenario.

The OECD and the FAO developed the projections in the Outlook in collaboration with experts from member countries and international commodity bodies. These are projections, not forecasts, which present a plausible and consistent scenario of the medium term outlook for agricultural commodities. The OECD-FAO Aglink-Cosimo model defines linkages among the sectors covered in the Outlook to ensure consistency and a global equilibrium across all markets. It allows follow-up analysis, including an analysis of market uncertainties. A detailed discussion of the methodology underlying the projections as well as documentation of the Aglink-Cosimo model are available online at www.agri-outlook.org. Regional briefs present projection highlights for the six FAO regions. Projections by commodity are discussed in detail in the commodity chapters.

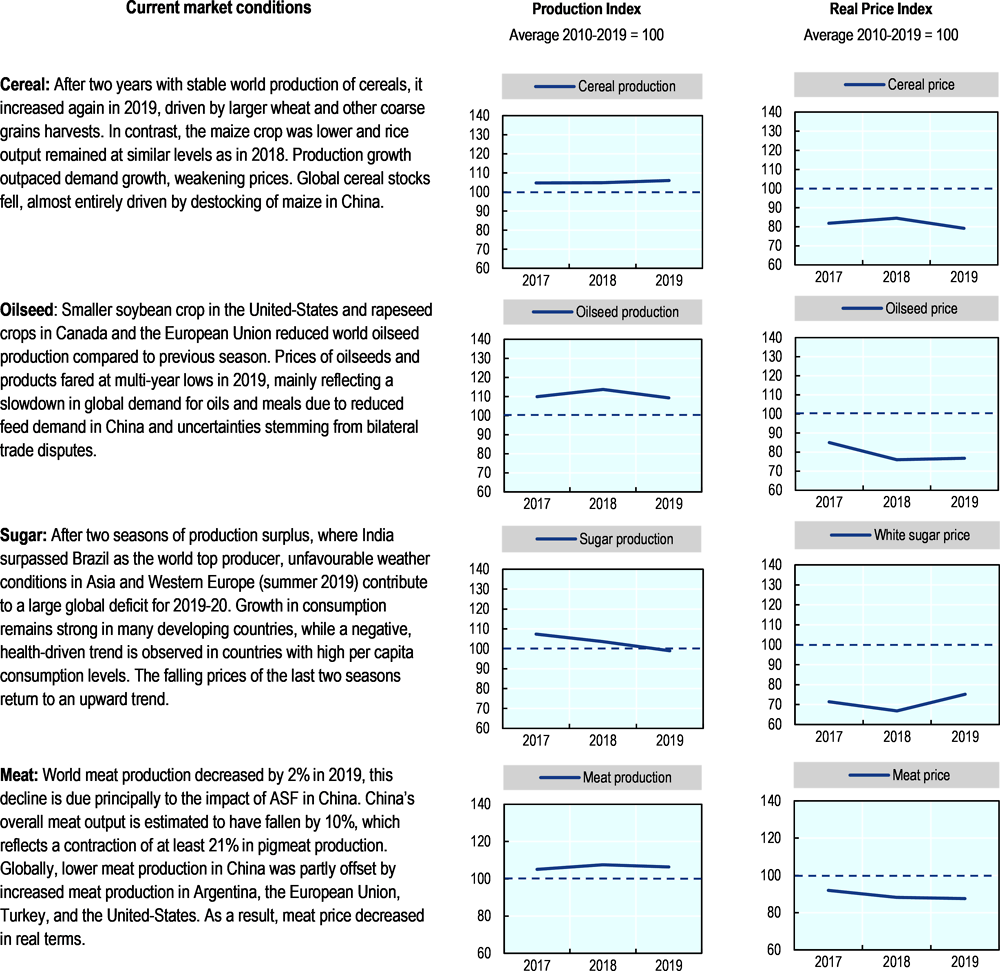

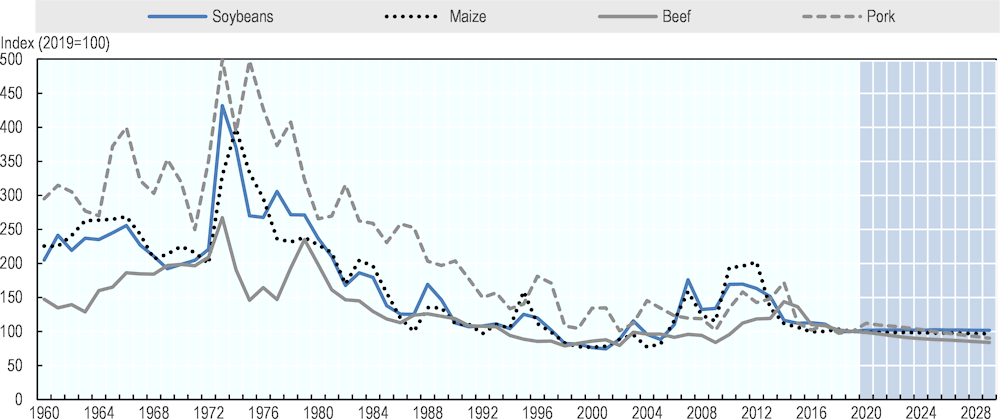

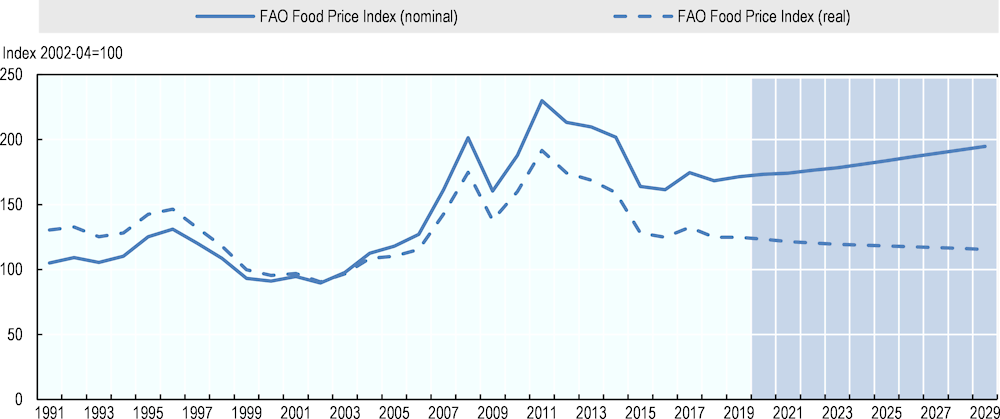

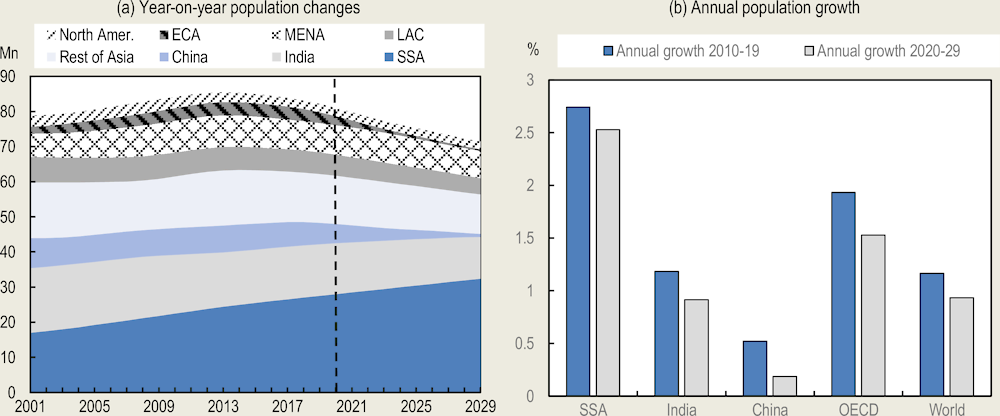

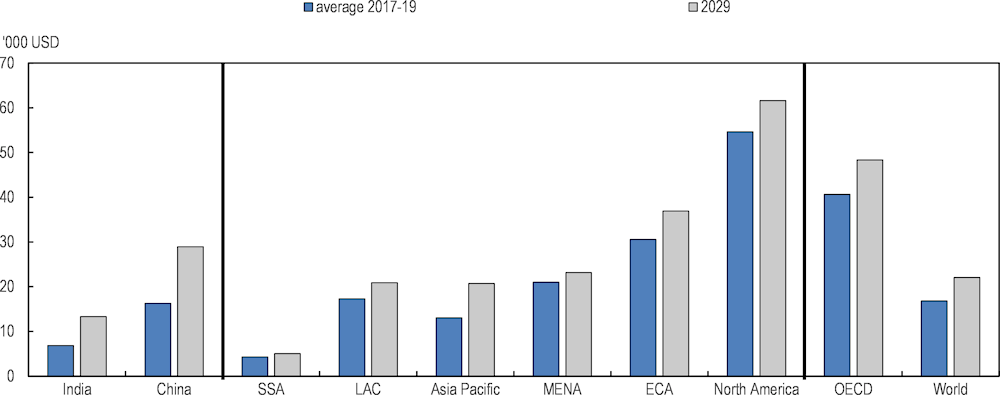

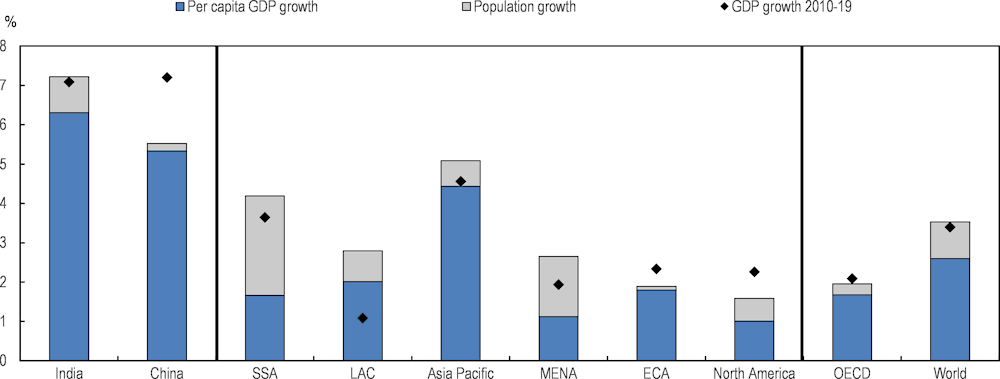

The Outlook projections are influenced both by current market conditions (summarised in Figure 1.1) and by specific assumptions concerning macroeconomic developments, the policy environment, technological change, weather, demographic trends, and consumer preferences. Over the outlook period, world population is expected to reach 8.4 billion people; economic growth will continue to be unevenly spread around the world, with robust per capita income growth in emerging markets (more details in Box 1.4). Both population growth and economic growth are the main drivers of demand for agricultural commodities while the assumptions on continued productivity growth and on resource availability are shaping the production of agricultural commodities.

The Outlook projections are inevitably uncertain because they extend ten years into the future and are based on assumptions regarding economic and policy conditions. These uncertainties are discussed in detail at the end of this chapter and in each of the commodity chapters. The most significant source of uncertainties obviously relate to the COVID-19 pandemic. While most primary agricultural production may be only marginally affected by the pandemic, interruptions to downstream food processing, trade in agricultural commodities, forced adjustments of consumer demand, and shortages of seasonal labour will certainly impact agricultural and fish markets, especially in the short term, as discussed in Section 1.6.

Figure 1.1. Market conditions for key commodities

Note: All graphs expressed as an index where the average of the past decade (2010-2019) is set to 100. Production refers to global production volumes. Price indices are weighted by the average global production value of the past decade as measured at real international prices. More information on market conditions and evolutions by commodity can be found in the commodity snapshot tables in the Statistical Annex and the online commodity chapters.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database) http://dx.doi.org/10.1787/agr-outl-data-en.

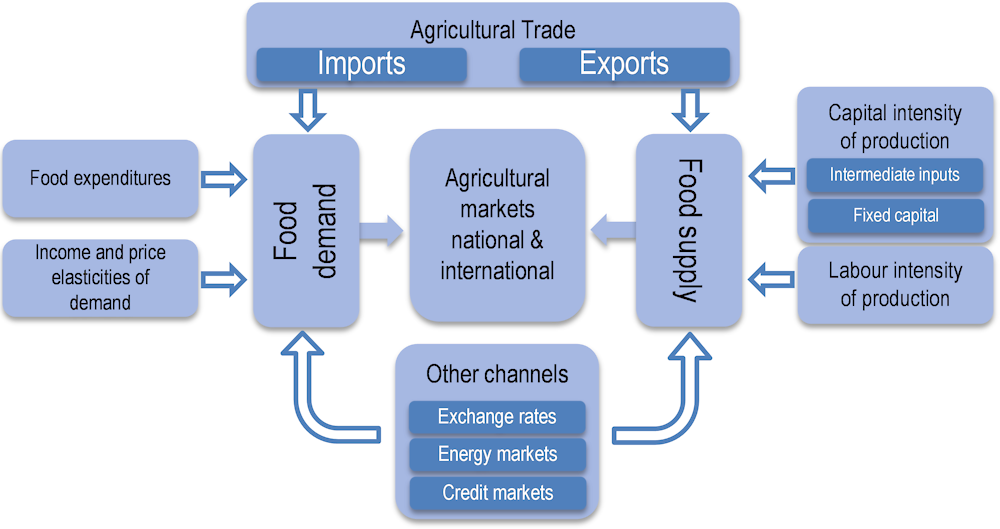

1.2. Consumption

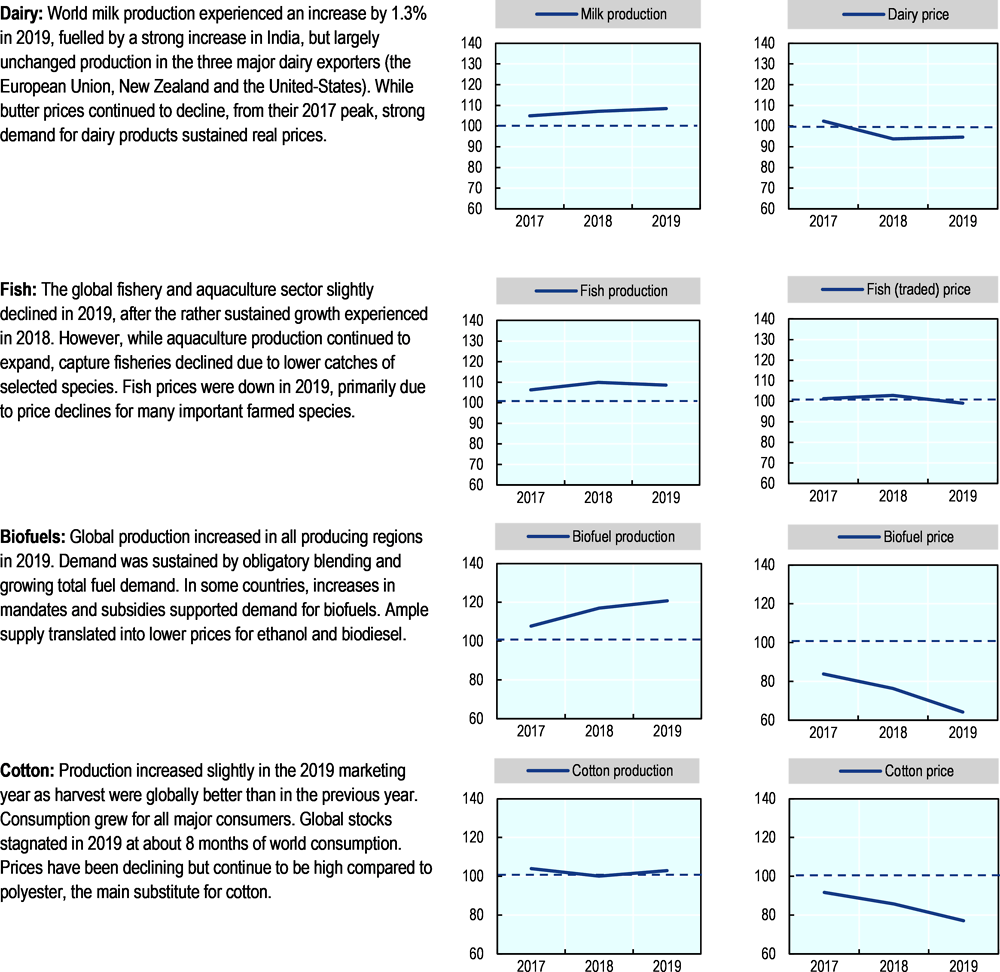

The OECD-FAO Agricultural Outlook projects the use of agricultural commodities as food, feed and raw materials for industrial applications, including biofuel. The baseline covers the direct use of crops as minimally processed food, but also includes first level processing, such as the crush of oilseeds and the subsequent use of the derived products as food and feed. Among livestock products, the food consumption of meat, eggs, fish and dairy products is covered by the Outlook. Accounting for direct feed use of cereals, as well as the use of processed products such as protein meal, fishmeal, cereal bran and other by-products in the livestock sector allows the Outlook to identify the sector’s net contribution to human nutrition. Biofuels have become the dominant industrial use of agricultural commodities in recent years. Their production utilises cereals and sugar crops directly, but also processed products such as molasses and various vegetable oils. “Other” uses, mostly industrial applications of agricultural commodities for commercial production, such as grains for industrial starch production, have also become increasingly important in recent years and are expected to gain importance in the future. The decomposition of commodity consumption into the different categories of use primarily considered in the Outlook is shown in Figure 1.2.

Figure 1.2. Main commodity uses by agricultural sector

Notes: Boxes indicate agricultural sectors, diamonds refer to final use categories, the circle represents an intermediate use.

Solid lines represent main commodity flows, dashed lines indicate minor or secondary flows. For example, biofuel production (ethanol) is a main use of crops and the residues (DDG) go to feed. Food is the main use of livestock products and a minor part (MBM) flows back to feed.

The final use category ''other'' refers to seed use, waste and all industrial applications, except biofuel.

What drives changes in global demand for agricultural products and fish?

The demand for agricultural commodities to fulfil the various uses outlined above is influenced by a set of common elements, such as population dynamics, urbanisation, disposable income, consumer preferences, prices, policies and various social factors. These elements will determine the structure of agricultural commodity demand over the coming decade.

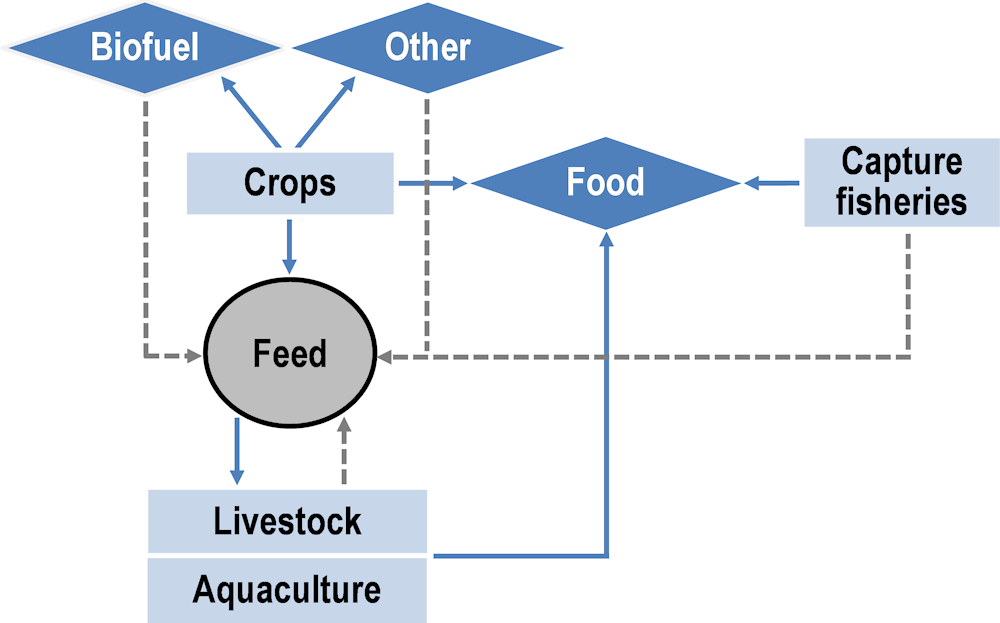

Globally, population growth is expected to remain the dominant driver of total agricultural commodity demand over the outlook period, in particular for commodities that have high levels of per-capita consumption in regions with fast expanding populations. For food grains, the importance of population as a driving factor tends to remain high across regions as per capita food demand is stagnant or even decreasing in several high-income countries. For vegetable oils, sugar, meat and dairy products, the impact of population dynamics is lower as income and individual preferences play a greater role (Figure 1.3).

Figure 1.3. Annual growth in demand for key commodity groups

Note: The population growth component is calculated assuming per capita demand remains constant at the level of the year preceding the decade. Growth rates refer to total demand (for food, feed and other uses).

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

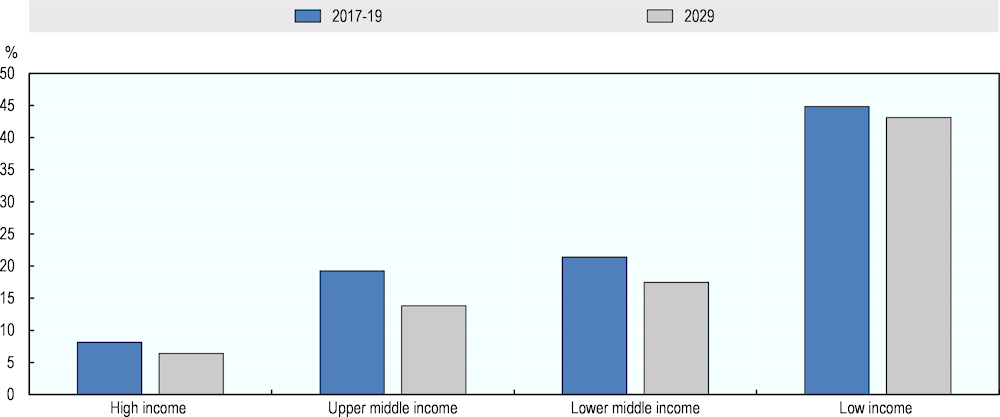

Besides population dynamics, demand growth depends on the individual consumption patterns of the population. These patterns are determined by the respective consumption preferences and the available income to realise them. As a result of global economic development, per capita food expenditures across all income groups are expected to increase in absolute terms with an increasing proportion devoted to higher value items such as vegetable oils, livestock products and fish. However, as incomes rise, people’s propensity to spend their extra income on food declines and consequently the food expenditure share in total disposable income falls. Figure 1.4shows this for different groups of countries classified by income.

Based on the projected income growth in high-income countries, the share of food in total household expenditure is expected to fall from about 8% in the base period to 6% by 2029.

The absolute decrease is expected to be larger in the emerging economies of upper and lower middle-income countries, where food expenditure shares are expected to fall from 21% to 17% for lower middle-income countries, and from 19% to 14% for upper middle-income countries by 2029 (Figure 1.4).

The projected reduction in the food share of household expenditures will be less pronounced in low-income countries, where per-capita income growth is expected to stagnate during the coming decade. By the end of the projection period, the proportion of household income spent on food is projected to remain on average at 43% in 2029. Food security of people in the lowest income groups in these countries remains very vulnerable to income and food price shocks.

The Outlook assumes that developments in the use of agricultural commodities will be additionally shaped by socio-cultural and income-driven changes in consumer preferences over the projection period. The continuing urbanisation and rising female participation in the workforce especially in high-income and emerging economies is expected to contribute to a higher consumption of processed and convenience food, and an increasing tendency to eat outside the home. These trends are underpinning the projected increases in the consumption of sugar and vegetable oils. The effects of ageing populations and more sedentary lifestyles, particularly in high-income countries, are also considered in the projections of daily calorie requirements.

Figure 1.4. Food as a share of household expenditures, by income group

Note: Calculated on per-capita GDP and excludes food consumed away from home.

The 38 individual countries and 11 regional aggregates in the baseline are classified into the four income groups according to their respective per-capita income in 2018. The applied thresholds are: low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high: > USD 13 000.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The baseline projections also account for increasing consumer awareness of the links between diets and health, which is expected to boost the consumption of poultry and fish and reduce the consumption of red meat and sugar. Policies seeking to promote healthy dietary choices and curb the consumption of items that may cause overweight, obesity and diet-related non-communicable diseases such as diabetes have been implemented or are being considered in numerous countries, including Chile, France, Mexico, Norway, South Africa, and the United Kingdom. The introduction of food product labels that provide nutrition information as well as regulations limiting the youth-targeted advertising of ultra-processed products are additional measures that have been incorporated into the assessment of future consumer preferences.

The expectation of a growing awareness of the impact of consumption choices on the environment is moderating the demand growth projections for items such as palm oil, beef, and non-organic cotton. Such concerns are, at the same time, supporting the growing demand for renewable raw products for non-food uses, such as biofuels and industrial applications in packaging, cosmetics or the pharmaceutical industry.

Limited change expected in structure of commodity demand

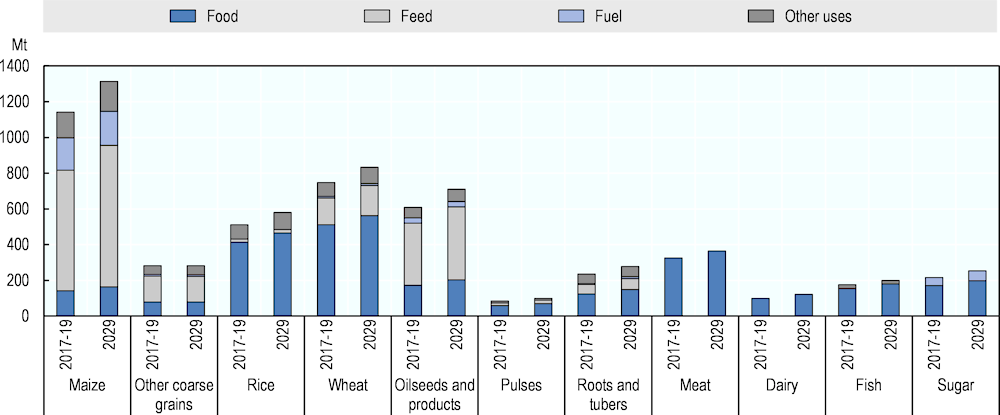

As shown in Figure 1.2, the Outlook accounts for four major use categories of basic agricultural commodities. Food is the primary use of agricultural commodities, currently accounting for 52% of calories produced by global agriculture. Feed is taking up about 31% of calories produced, while the remaining 17% are used as either biofuel, seed, or raw products in industrial applications.

Over the coming decade, the shares of the respective uses by commodity are not projected to change significantly, as no major structural shifts in consumption are expected (Figure 1.5). Food will continue to be the dominant use of food grains (rice, wheat), roots and tubers, pulses, sugar, vegetable oils and all animal products. Feed will continue to be the main use of coarse grains and protein meals.

Figure 1.5. Global use of major commodities

Note: Crushing of oilseeds is not reported as the uses of 'vegetable oil' and 'protein meal' are included in the total; Dairy refers to all dairy products in milk solid equivalent units; Sugar biofuel use refers to sugarcane and sugarbeet, converted into sugar equivalent units.

Source: OECD/FAO (2019), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

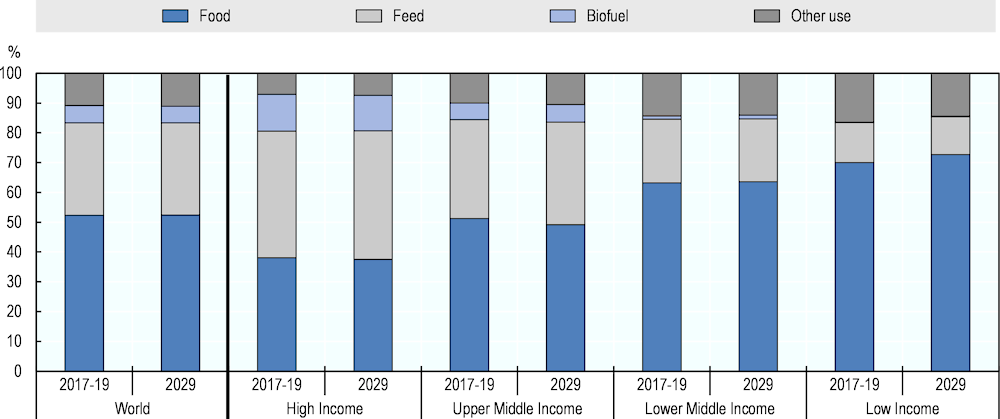

The use of agricultural commodities varies depending on the development status of countries (Figure 1.6). Consumers in low-income countries consume the bulk of their calories from vegetal sources. Their standard of living does not allow them to invest a large share of their domestic crop production into the production of feed for non-ruminant animals, as they cannot afford to consume high-priced calories of animal origin.1 The food share of the consumed calories is additionally elevated, because livestock products are imported from high-, upper- and lower-middle income countries, where the calories are counted as feed. The food share in low-income countries is projected to rise to 74% by the end of the outlook period, as growth in domestic food demand outpaces the growth in domestic demand for feed and for renewable industrial raw products. By contrast, the structure of demand for agricultural commodities in high-income countries favours further processing, and direct food use accounts for only 43% of total consumption. In North America for example, the sizable biofuel sector as well as the large and feed-intensive livestock sector, take up the bulk of crop production. The feed use of agricultural commodities is also expected to expand particularly in upper-middle income regions over the outlook period, mainly due to export-driven growth in the meat sector. These countries are projected to further capitalise on their resources and competitiveness to capture the additional value of the livestock sector.

Figure 1.6. Uses of agricultural commodities: share of calories, by income group

Note: The 38 individual countries and 11 regional aggregates in the baseline are classified into the four income groups according to their respective per-capita income in 2018. The applied thresholds are: low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high: > USD 13 000.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Population growth will be the main driver of food use

Population is the key determinant of total food use. Income, relative prices, other demographic factors, consumer preferences and lifestyles, meanwhile, determine a person’s desired food basket. On account of an expected 11% expansion in the global population (an increase of 842 million people between 2017-19 and 2029) as well as notable gains in per capita income in all regions, total consumption of the food commodities covered in this Outlook is expected to rise by 15% by 2029, as measured on a calorie basis. Asia Pacific, the world’s most populous region, will continue to play the most significant role in shaping global demand for food over the outlook period as it is projected to account for 53% of the global population in 2029 (i.e. 4.5 billion people). Given the significant regional differences in demographic developments, income distribution as well as culture-derived consumer preferences, the relative impact of these factors on food demand differs by country and region.

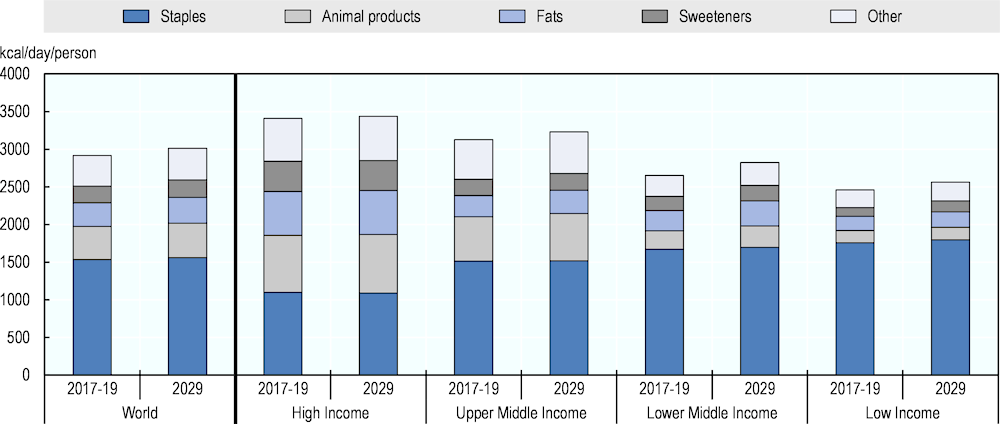

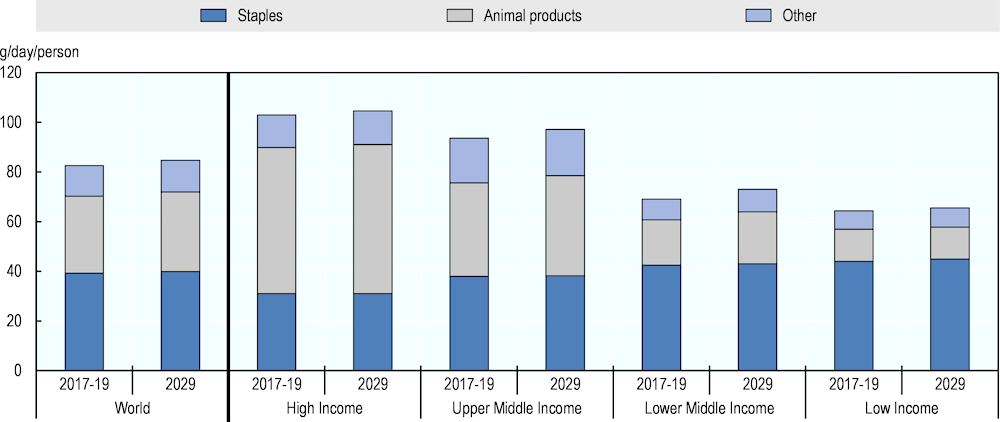

Differing income levels and varying income growth projections will underlie continuing differences in dietary patterns between countries over the coming decade (Figure 1.7).

Globally, aggregated food consumption (measured in calories) is projected to grow by about 3% over the projections period, reaching just over 3 000 kcal in 2029, fats and staples accounting for about 50% of the additional calories. By far the highest growth rate is projected for fats at 9% over the coming decade. Staples remain the most significant food group across all income groups. With the exception of high-income countries, consumers in all other countries are projected to consume more energy from staples. Nevertheless, on the account of the ongoing transition in global diets towards higher shares of animal products, fats, sugar and other foods, the share of staples in the food basket is projected to decline by 2029 for all income groups though at different rates.

The per capita food energy consumed in high-income countries will remain at current levels. Ongoing income growth and changing consumer preferences will further the substitution of staples, sweeteners and fats for higher-value foods, most importantly foods dense in micronutrient content such as fruits, vegetables, seeds and nuts and, to a lesser extent, animal products.2 As many of these fruits, nuts and vegetables have to be imported by high-income countries, this shift offers market opportunities for countries with export potential in these commodities. Increased domestic and foreign investments in producing regions (e.g. Sub-Saharan Africa) are expected to develop such market opportunities. Growth in the consumption of animal products will be limited by near saturation levels of consumption of meat and dairy products as well as increasing health and environmental concerns.

In upper-middle income countries, total food consumption is expected to expand by about 4% by 2029. Based on the strong preferences for meat in many of these countries, 38% of the additional calories will be provided by animal products and 26% by fats and other foods.

Consumers in lower-middle income countries are projected to increase their food consumption by 7% (173 kcal) over the coming decade, the largest gain of all four income groups. However, due to limited disposable income, fats and staples will still account for half of the increase, while the growth in the consumption of relatively more expensive options such as fruits, vegetables and animal products will remain limited.

Average diets in low-income countries remain heavily based on staples, which will continue to provide 70% of daily calories. Almost 40% of additional calories over the coming decade are still expected to come from cereals, and roots and tubers. The second most important source of calorie growth will be sweeteners, accounting for 30% of the total increase. Growth in the consumption of animal products and other high value foods (e.g. fruits and vegetables) will, however, remain limited due to income constraints. Given the higher cost of these food items, consumers in lower-middle and low-income countries will only be able to take a small step towards more diversity in their diets.

Figure 1.7. Per capita consumption of main food groups (calorie equivalent), by income group

Note: The 38 individual countries and 11 regional aggregates in the baseline are classified into the four income groups according to their respective per-capita income in 2018. The applied thresholds are: low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high: > USD 13 000. Staples includes cereals roots and pulses. Animal products include meat, dairy products (excluding butter), eggs and fish. Fats include butter and vegetable oil. The category others include fruits, vegetables etc.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

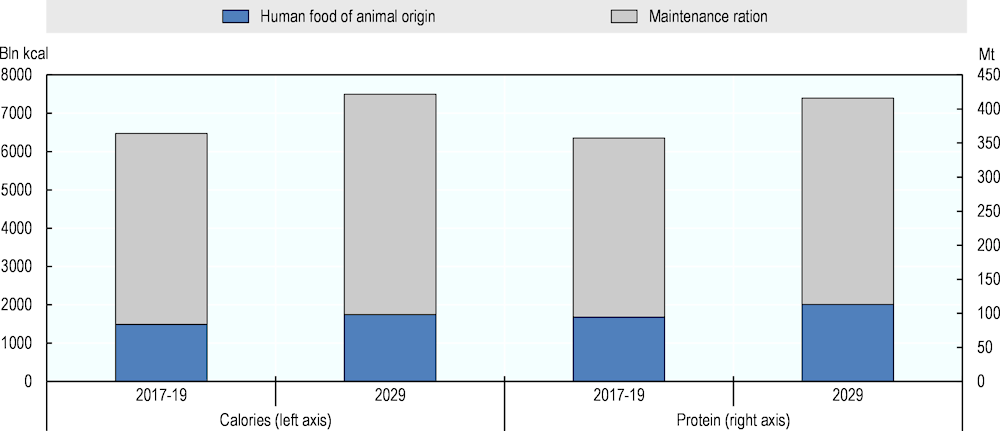

Food proteins play a vital role in food security and nutrition. They are essential in growing, maintaining and providing structure to tissues; they serve to form antibodies and perform essential functions in the human metabolism; and serve as a source of energy. While plant sources such as pulses, and cereals such as wheat, can provide a significant part of the overall protein requirements, essential amino acids are found mostly in proteins from animal sources.

Due to globally rising per capita incomes and declining real food prices, the demand for animal products has risen over the last decade. This increase has also been sustained by urbanisation, which facilitates large-scale meat and dairy processing. Moreover, the retail sector has invested in improving cold chains, allowing perishable food, including animal products, to travel longer distances at lower costs from producers to consumers, preserving its nutrients and organoleptic features. In line with these past developments, total per capita availability of protein is expected to rise at the global level to 85 g per day in 2029, from 83 g per day in the base period. Income-related differences in the composition of protein sources will persist, with lower middle- and low-income countries expected to remain heavily dependent on proteins from crop sources, given lower average household incomes and a lower availability of protein from animal sources due to the lack of adequate supply chains to trade and preserve fresh meat (Figure 1.8). Protein from animal sources, meanwhile, will continue to account for the bulk of protein consumption in the high-income regions of North America, and Europe and Central Asia.

Figure 1.8. Per capita consumption of main food groups (protein equivalent), by income group

Note: The 38 individual countries and 11 regional aggregates in the baseline are classified into the four income groups according to their respective per-capita income in 2018. The applied thresholds are: low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high: > USD 13 000. Staples includes cereals roots and pulses. Animal products include meat, dairy products (excluding butter), eggs and fish. The category others include fruits, vegetables, etc.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Overall, protein from animal sources are expected to account for a greater share of total daily per capita availability. Growth in animal protein consumption will be particularly pronounced in upper middle- and lower middle-income countries, where daily per capita meat and fish availability is expected to rise by 8% and 16%, respectively. Income-driven growth in demand for meat and fish in China, which is expected to see an 11% increase in daily per capita availability, will be the main contributor to the upper middle-income country group. Although consumers in lower middle-income countries increase their consumption of animal protein faster than consumers in any other income group, their per capita intake remains significantly below consumption levels in upper middle- and high-income groups. India’s traditionally low consumption of animal protein, especially meat, considerably influences the lower-middle income group trend.

Consumers’ growing environmental and health-consciousness, on the other hand, is expected to support a transition from animal-based protein towards alternative sources of protein (e.g. plant-based and insect protein), as well as the more immediate substitution away from red meat, notably beef, mainly towards poultry and fish, which consumers perceive as healthier alternatives. These shifts will be particularly pronounced in high-income countries. Demand for poultry in lower-income countries, meanwhile, will be driven by the affordability of poultry against other meat types, its presumed superior health attributes and its broad cultural acceptability.

Increasing demand for livestock products and fish will increase feed use

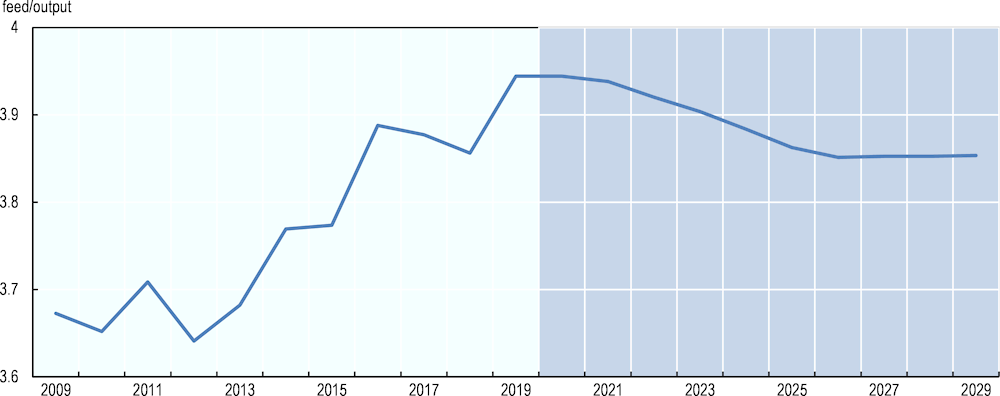

The ongoing evolution of global nutrition patterns towards a higher share of foods from animal origin results in a larger amount of crops and other agricultural and fish products being used as feed. Currently, about 1.7 bln t of cereals, protein meals and various processing by-products (e.g. dried distillers grain, cereal bran) are used as feed. By 2029, this amount is expected to reach almost 2 bln t. This growth is mainly due to the continuing expansion of the livestock herd and aquaculture production in low- and middle- income countries. The Outlook also assumes a further intensification of livestock and fish production, whereby more feed per unit of output is used, mostly in order to accelerate the finishing process thus providing a higher return on fixed capital investments. Therefore, advanced economies with capital intensive production technologies typically use feed intensively. They also tend to use the most advanced animal and fish breeds, which provide the most efficient feed conversion rates. Therefore, two offsetting trends in feed demand are expected over the coming decade: intensification and efficiency gains. The Outlook assumptions on technology project that after a period of global feed use intensification since 2010, which outweighed the shift of global production to more feed-efficient poultry production, the ongoing commercialisation of the livestock sector in emerging economies will result in further feed use intensification, which, however, will be offset by efficiency gains through investments into genetics, feed technology and herd management that will be achieved in more advanced operations over the coming decade (Figure 1.9)

Commercially raised livestock is mainly fed on compound feed rations to produce high value proteins in the form of meat, fish, eggs and milk. This process uses a wide variety of concentrate feeds that have a high energy and protein concentration. However, only part of this energy and protein is recovered as human food in the form of livestock and fish products (Figure 1.10). The larger part is consumed by the so-called “maintenance ration” which is just sufficient to meet the requirements of the animal to maintain its life. An animal receiving only this ration will neither lose nor gain weight. The rate of conversion of feed into the desired animal products depends on the type of animal, breed and production technology, and on the type of feed. Both the total use of feed energy and protein will grow by about 15% over the coming decade, and despite the ongoing innovation in the livestock sector the share of feed energy that is converted into human food is expected to stay globally at about 23%. The bulk of energy is still spent to maintain the animal and cannot be harvested.

The baseline projections also point to a globally fixed relationship between animal food production and the necessary protein feed over the coming decade. The share of recoverable feed protein is slightly higher (27%) than calculated for the energy component. Non-ruminant animals need plant protein as they do not have ruminant’s ability to convert grass and other non-protein feed into meat and milk. However, the protein in meat, fish, eggs and milk is considered of higher value for human nutrition compared to the protein in soybean meal or wheat.

Figure 1.9. Feed to production ratio

Note: This ratio includes only feed prepared from cereals, oilseeds and a number of by-products, it therefore slightly overestimates the feed efficiency of the livestock and aquaculture sector. Pasture-based cattle and sheep convert feed that cannot be accessed directly by humans into meat and milk. Similarly, pigs and poultry are still being raised on organic residues in non-commercial operations. Simple forms of aquaculture rely solely on naturally available feed. Because the nutritional value of these feed sources is difficult to quantify, it is excluded from the above calculation.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 1.10. Global feed energy and protein use

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

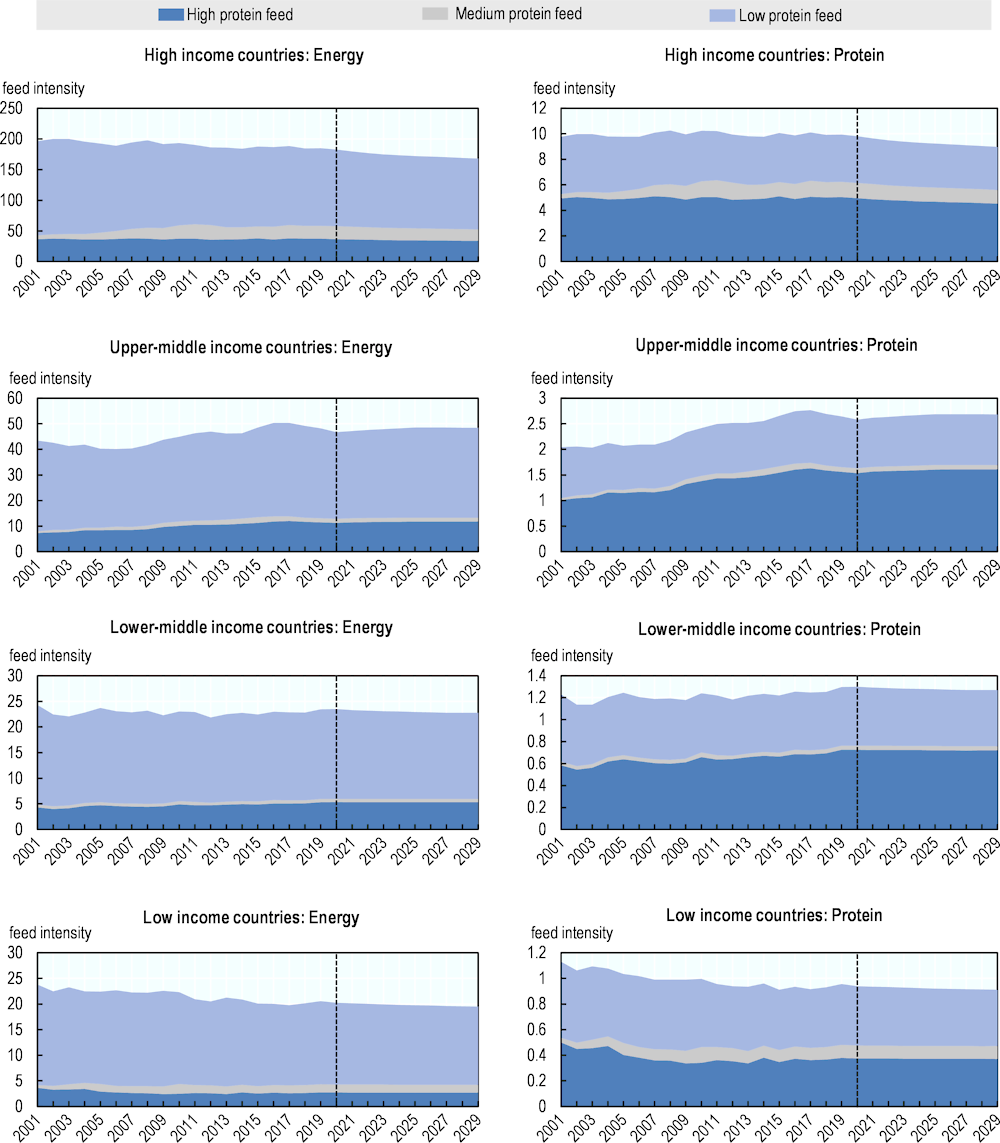

Structure of feed demand

There are many different types of animal feed that are customarily classified according to their protein content. High-protein feeds are mainly meals derived from oilseeds, dried distiller grains are a typical medium-protein feed, while cereals are classified as low-protein feeds. Figure 1.11 shows the use of compound feed in non-ruminant production and the composition of feed rations by energy and protein content. Feed intensity and respective shares of high-, medium-, and low-protein feeds vary significantly between high-, middle-, and low-income countries because of their differences in production technology.

The group of high-income countries is expected to improve the feed conversion for both energy and protein feed further through breeding and herd management advances, without changing the ration composition. These ongoing reductions are possible as a result of breeding progress and other technological advances within a highly feed intensive technology compared to less developed countries.

Upper middle-income countries currently use much less feed per unit of non-ruminant output. The pork, poultry and egg sectors in these countries are expected to intensify their technology as their operations are becoming more commercialised. Feed rations are expected to incorporate slightly more high protein feed over time.

Farmers in lower-middle income countries are expected to maintain their level of feed use per unit of output of non-ruminant livestock production. The composition of rations is not expected to change significantly, only a very slight increase in the share of high-protein feed is projected. The predominantly smallholder and small family farmers in these countries are not expected to significantly intensify the technology of their operations.

Animal husbandry in low income countries is expected to remain largely dependent on small-scale producers, who are using mostly locally sourced feed. Poultry operations tend to be the most commercialised and are projected to expand the fastest. The projected reduction in feed use per unit output is due to the growing share of poultry in total non-ruminant production. The intensification of production technology is constrained by a lack of investment capital stemming mostly from the small-scale structure of the sector, underdeveloped financial markets and value chains in the agriculture of these countries.

Figure 1.11. Structure of feed use, by income group

Note: Feed intensity indicates the amount of feed energy per unit of non-ruminant animal product production. Feed intensity indicates the amount of feed protein per unit of non-ruminant animal product production.

The 38 individual countries and 11 regional aggregates in the baseline are classified into the four income groups according to their respective per-capita income in 2018. The applied thresholds are: low: < USD 1 550, lower-middle: < USD 3 895, upper-middle: < USD 13 000, high: > USD 13 000.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

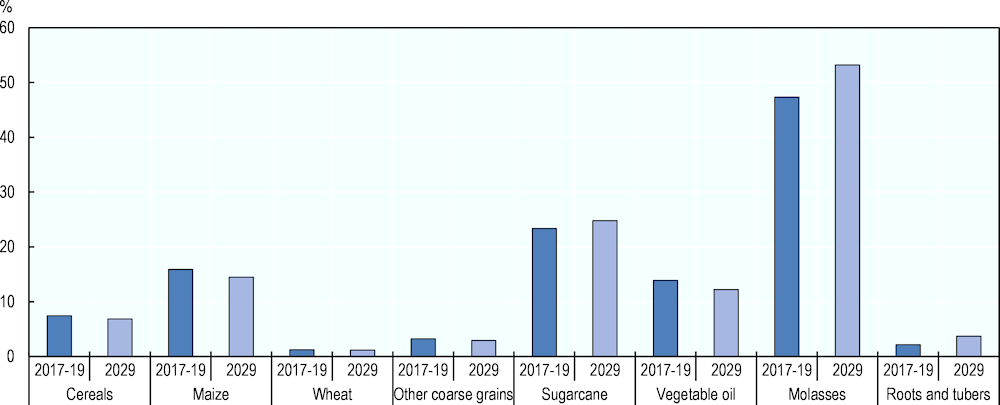

Limited growth in biofuels demand

Over the past decades, demand for biofuels has increased significantly following the implementation of policies with three main objectives: (i) support countries’ commitments to reduce their carbon dioxide (CO2) emissions, (ii) reduce the dependency on imported fossil fuels and (iii) create additional demand for feedstock crops to support domestic producers.

While these drivers are assumed to persist over the coming decade, biofuels are not expected to generate a lot of additional demand for feedstock crops. Biofuels are not expected to receive the same kind of political support as in the past, due to the growing proliferation of electric and hybrid vehicles, which offer better efficiency in the reduction of greenhouse gas (GHG) emissions. Additionally, the use of gasoline-type transportation fuel in two of the main ethanol markets, the United-States and the European Union, is projected to decline over the next decade. This decline is only partly compensated by an increase in the blend rate in the United-States, resulting in a slower growth in demand for maize as the main feedstock. Globally, biofuel use of maize is expected to expand only slightly over the coming decade, thus reducing its share of total use from 16% in the base period to about 14% in 2029 (Figure 1.12).

Figure 1.12. Share of biofuel in total use

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

By contrast, biofuel is expected to increase its share in global sugarcane use to about 25% in 2029 from 23% in the base period. This gain can be largely attributed to the projected expansion of the Brazilian RenovaBio program, which aims to reduce GHG emissions from transportation fuel by 2028. In Brazil, fuel ethanol is consumed either blended with gasoline or as pure anhydrous ethanol fuel, which significantly increases the ethanol share of total transportation fuel compared to countries that mainly use low blends. The higher blends of ethanol are supported by lower taxes, making ethanol more competitive than fossil fuel. These policies will continue to help Brazil to meet its GHG emissions reduction commitments, to decrease its dependency on imported gasoline, and to support the country’s sugar cane sector, which provides 1.15 million direct jobs. In other Latin American countries, such as Colombia, Paraguay and Peru, the sugar cane sector is similarly labour intensive and provides a significant share of farmers’ income in rural areas. In order to protect these jobs, governments will support the biofuel demand for sugar cane by restricting ethanol imports in combination with mandatory fuel blending.

Asian countries barely use sugar cane for ethanol production, in part because increasing its use would require additional land, which could negatively affect the production of cereals for food consumption and thereby threaten food security. Given those constraints, sugarcane molasses, a by-product of refining sugar, is one of the main feedstock in ethanol production. Over the outlook period, the share of molasses used for biofuel is expected to increase from 49% in the base period to 54% in 2029. Biofuel demand is projected to increase its share of global roots and tubers demand from 2% in the base period to about 4% in 2029, with China accounting for most of the increase.

While the use of vegetable oil as biofuel is expected to remain constant at about 30 Mt, its share in global vegetable oil use is expected to decline from about 14% in the base period to about 12% in 2029. In addition to the expected decline in biofuel-blended diesel fuel use in the European Union, a new regulatory framework limits the use of feedstock (mostly palm oil) grown in carbon-capturing ecosystems such as forests, wetlands and peatlands. However, increasing demand for palm oil-based biodiesel, mainly in South East Asian countries will compensate the reduction in the European Union. Indonesia and Thailand are expected to continue to support the use of domestically produced palm oil in the production of biodiesel. Indonesia, for instance, employs a variable levy system to ensure the domestic supply of feedstock to the local biofuel industry by taxing palm oil exports.

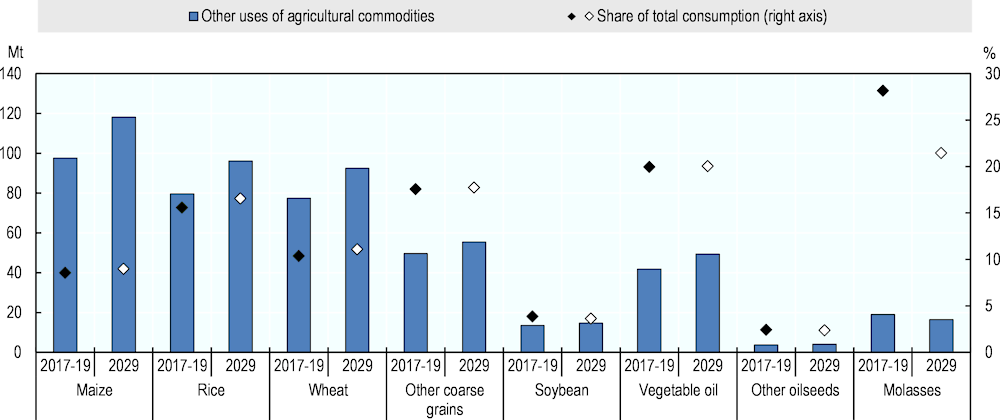

Other uses

Apart from food, feed and biofuel use, the agricultural commodities covered in the Outlook are used for a broad range of additional purposes. The Outlook combines seed use, postharvest losses, waste and all industrial applications, except biofuel, into the summary category “other uses”. The industrial applications include the use of cereals for the production of industrial starch, spirituous liquors, and for the paper, textile and pharmaceutical industries. Maize in particular has an increasing importance in the production of bioplastic for food packaging, bottles, kitchen utensils, straws, etc. Rice is projected to have a growing importance in the cosmetics industry. Face washes, liquid shower soaps and hair products, especially in Asian countries, are going to contain more rice ingredients. Molasses, a by-product of beet or cane sugar production, is used in the production of products like yeast, vinegar, citric acid, vitamins, amino and lactic acid. Vegetable oils are used as ingredients in cosmetics and personal care products, lipid-based excipients in pharmaceutical products, pet feed additive, etc. The role of plant-based ingredients is increasingly important in cosmetics which will likely result in a growing demand for vegetable oil, mainly olive oil, for cosmetic products. Cotton is mainly grown for its fibrous content (cotton lint), which is spun into yarn that is subsequently used for the production of garments and other textile products.

Other use of maize will increase by about 20% over the projections period, which is slightly faster than the projected overall consumption growth, thereby increasing the other use share from currently 8.5% to 9% in 2029. The share of other use of wheat and rice is also expected to slightly expand over the coming decade, indicating a heightened demand for renewable raw products (Figure 1.13).

The use of molasses as an industrial raw product is expected to decrease significantly as its biofuel feedstock use is expanding further during the projection period. The share will drop from nearly 30% in the base period to about 20% in 2029.

The other use shares of the remaining commodities, oilseeds, including vegetable oil and other coarse grains, are expected to remain at current levels during the outlook period. No structural changes in their consumption profile are foreseen, the industrial applications, the seed use and waste will follow the overall consumption patterns.

Global consumption of lint cotton will grow at a slightly higher rate than global population in the coming decade. Ongoing income growth should lead to a higher demand for cotton products. The geographical distribution of demand depends on the future location of spinning mills. China has been the world’s largest consumer of raw cotton since the 1960s. However, major shifts are taking place, with yarn production gradually moving from China to other Asian countries, mainly Bangladesh and Viet Nam. Growth in raw cotton processing is also expected in India, Turkey and Central Asia.

Figure 1.13. Other use in absolute value and as share of total consumption

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

1.3. Production

The OECD-FAO Agricultural Outlook projects future trends in production of the main livestock (meat, dairy, eggs and fish) and crop commodities (cereals, oilseeds, roots and tuber, pulses, sugar cane and sugar beet, palm oil and cotton) to be used for human consumption, as animal feed or as biofuel feedstock. The Outlook projections break down agricultural output growth into its main determinants; namely growth in crop yields, area harvested intensification, cropland expansion, growth in output per animal and herd expansion. This reveals how the production responses to meet growing demand for agricultural commodities, varies across different sectors and regions.

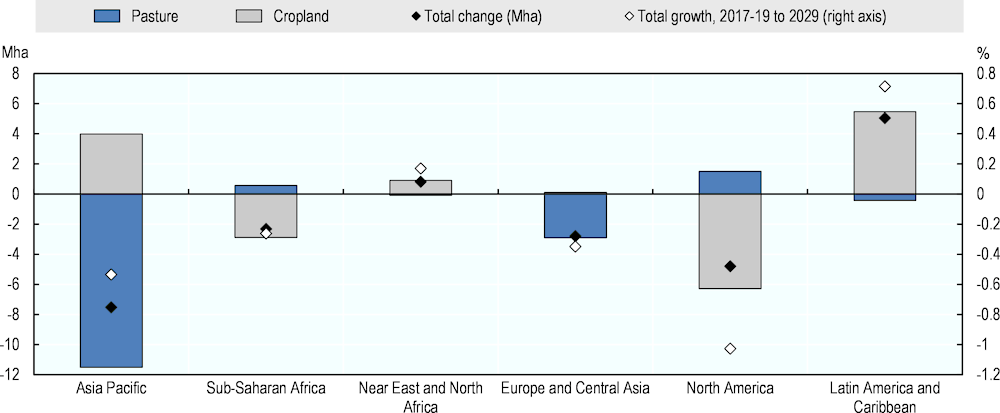

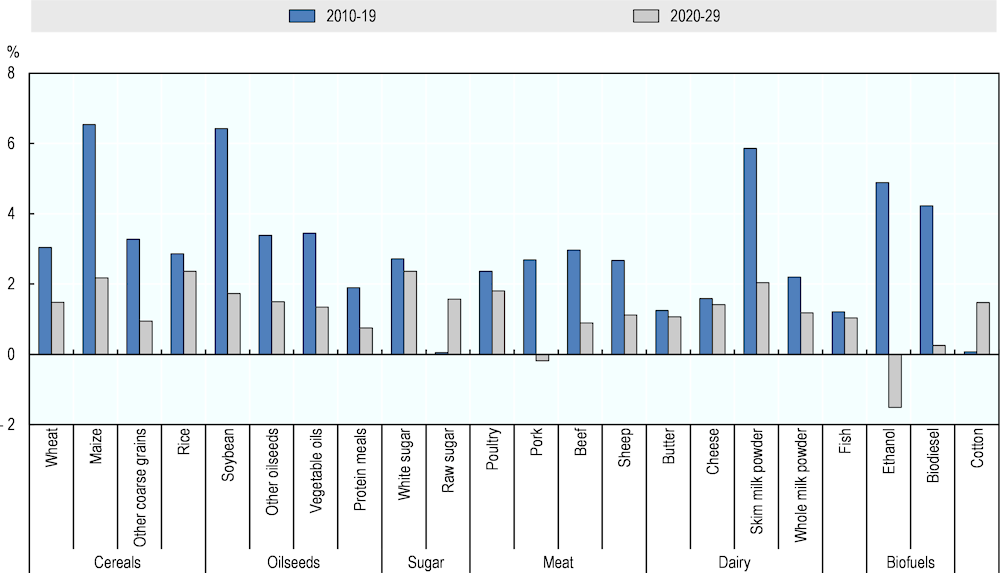

Global agricultural production is projected to increase over the coming decade, in response to growing demand, albeit at a slower rate than observed over the previous decades (Figure 1.13). Most of the growth in production is projected to occur through productivity improvements, due to intensification and ongoing technological change leading to a further decline in real commodity prices, despite increasing constraints on expanding agricultural land in some regions.

For crops in particular, yield improvements are projected to account for almost all of the additional output, with only a small expansion of cropland area being required at the global level. However, the relative importance of increased productivity (i.e. higher yields and cropping intensity) and cropland expansion will vary between world regions and commodities, reflecting differences in availability and cost of land and other resources. Productivity gains will come from more intensive use of agronomic inputs (fertiliser, pesticides, and irrigation), which can lower land use requirements, as well as through technical changes (e.g. improved crop varieties) and technical efficiency improvements (e.g. better cultivation practices) that reduce the inputs required per unit of output.

Global growth in livestock output will rely on a combination of yield improvements (i.e. higher output per animal) and an expansion of the production base (i.e. more animals). As with the crop sector, a combination of intensification (e.g. increasing use of high energy and high protein feed), technical changes (e.g. ongoing progress in breeding), and technical efficiency improvements (e.g. disease control and improved management practices), will support productivity growth at the global level. Increase in animal numbers will also play a significant role, especially in low income and emerging countries, which are expected to account for the majority of output growth over the next decade.

The agriculture sector is not only under pressure to increase production in line with growing demand but also to do so sustainably. While the intensification of agricultural production has enabled the sector to feed a growing population and limit increases in agricultural land use, some intensification practices, however, have also exacerbated environmental problems and threatened sustainability. The Agriculture Forestry and Land Use (AFOLU) sector is one of the main contributors to climate change; accounting for a fifth of global GHG emissions. It thus has a key role to play in mitigating global GHG emissions, and meeting the Paris Agreement’s target of limiting global temperature increases to well below 2oC. Agriculture is also one of the most exposed sectors to climate change, which will harm crop and animal productivity in most regions, particularly if no adaptation measures are implemented, and will also lead to a relocation of agricultural production. This could give rise to more volatile food supplies and prices over the coming decades.

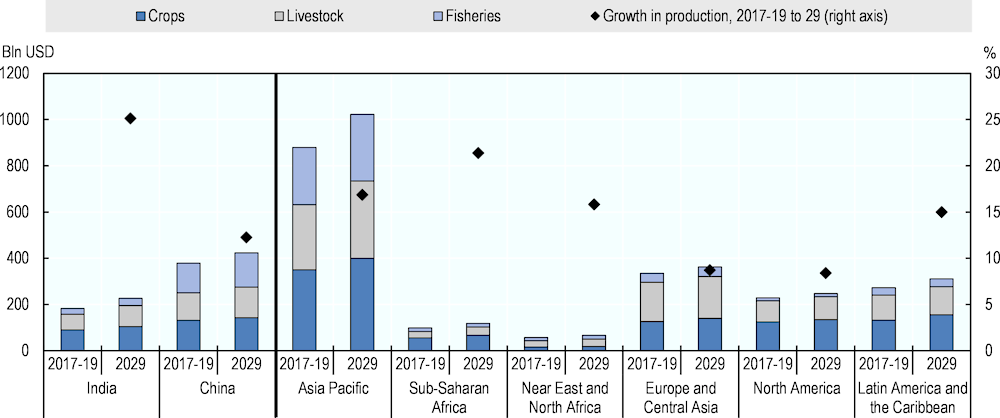

Figure 1.14. Regional trends in agriculture and fish production

Note: Figure shows the estimated net value of production of agricultural and fish commodities covered in the Outlook, in billions of USD, measured at constant 2004-6 prices.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Currently, the Asia Pacific region contributes most to global agricultural production, accounting for almost half of global output. Europe and Central Asia and the Americas are responsible for another 45% (Figure 1.14). Over the coming decade, crop, livestock and fish production are expected to grow most strongly in Asia Pacific (17%) – mainly driven by strong output growth in India (25%) – and in Latin America (15%). Production growth will be more muted in Europe and Central Asia, and in North America as agricultural productivity is already at high levels, and policies constraints (e.g. environmental and animal welfare policies) will limit further output growth. Sub-Saharan Africa and Near East and North Africa, on the other hand, currently account for a small share of global output of basic agricultural commodities. However, from their small production base and low productivity levels, strong production growth is projected in these two regions over the next ten years (21% and 16%, respectively). The significant output growth in emerging and low-income regions reflects greater investment and technological catch-up, as well as resource availability. Producers in these regions also respond to higher expected returns due to export opportunities (e.g. in Latin America) or comparative advantages in satisfying a growing domestic demand induced by population and income growth (e.g. in Sub-Saharan Africa and India). Such opportunities might be particularly important for fruits and vegetables (see Chapter 11 “Other Products”).

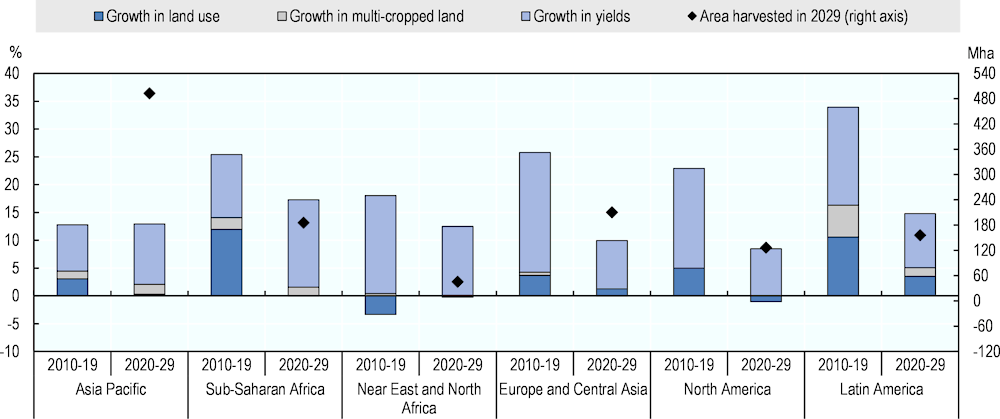

Productivity improvements drive crop production growth

Main drivers of global crop production growth

Over the coming decade, most production growth is expected to come from increased productivity (i.e. higher yields and cropping intensities) with only limited expansion of agricultural land at the global level. The Outlook projects global crop production to increase by almost 15% by 2029 (582 Mt), with cereals output projected to expand by 375 Mt, 80 Mt for oilseeds, 42 Mt for roots and tubers, 16 Mt or pulses and 3.5 Mt for cotton. Cropland expansion, on the other hand, is expected to be limited at the global level (1.3%). Globally, crop output is expected to increase more slowly than over the last decade, as yield growth starts from a higher base and less land will be brought into production (Figure 1.15).

Figure 1.15. Global growth in crop production

Note: Figure shows the decomposition of total production growth (2010-19 and 2020-29) into growth in land use, land intensification through growth in multi-cropped land, and growth in yields. It covers the following crops: cotton, maize, other coarse grains, other oilseeds, pulses, rice, roots and tubers, soybean, sugarbeet, sugarcane, wheat and palm oil.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Low income and emerging regions with greater availability of land and labour resources are expected to experience the strongest growth in crop production over the next ten years, accounting for about 50% of global output growth. National food self-sufficiency policies will also support this expansion, and in particular for cereals. In Asia Pacific only, crop output is projected to grow at the same rate than over the last ten years (13% or 248 Mt), mainly on the account of strong production growth in India. High crop output growth is also projected in Latin America (15% or 115 Mt), and in Sub-Saharan Africa (17%), albeit from a lower production base, adding 62 Mt. Europe and Central Asia and North America will continue to significantly contribute to global crop production, maintaining their share of global output by 2029, at 19% and 17%, respectively. However, production growth in these regions will be more limited; despite strong output growth in Eastern Europe.

Yield growth is expected to be responsible for 88% of global crop output growth over the next ten years. In the high yielding regions of North America and Europe and Central Asia, yields will grow at a slower rate than over the last decade as they are already at high level for most crops. In these regions, further yield growth will be mainly achieved through the adoption of advanced technologies (e.g. plant breeding) and the implementation of better cultivation pratices. Yields will grow strongly in Sub-Saharan Africa (16%) and in Near East and North Africa (12%), reflecting the important production potential of these regions, increasing use of agronomic inputs and the implementation of better farm management practices, but also the relatively low yields experienced so far. These higher growth rates will thus translate into a lower absolute increase in yields for several crops.

Harvested area intensification will also contribute to global crop production growth, especially in Latin America, Sub-Saharan Africa, and Asia Pacific where it is projected to account for 10% to 15% of total output growth. Overall, area harvested of the main crops reflected in the Outlook is projected to expand by 19.6 Mha between 2020 and 2029, with 30% of this occurring in Brazil and Argentina. In these two countries, the expanding practice of double cropping of maize/wheat and soybean is expected to raise output through more intensive use of already cultivated land. Double cropping also plays an increasing role in other regions and for other crops, in particular for rice.

Cropland area expansion, on the other hand, is projected to account for only 5% of global crop production growth and will play a much smaller role than over the last decade, in all regions. In Sub-Saharan Africa, for instance, growth in land use accounted for about half of total crop production growth over the last decade. Over the outlook period, output growth is expected to be achieved without expansion of the cropland area due to productivity improvements (i.e. higher yields and cropping intensities), and investors focus on acquiring and consolidating existing farm land into larger units rather than investing into the expensive clearing of additional land, as it was the case in the past. Growth in land use will only be a substantial contributor to crop production growth in Latin America, where it is expected to account for 25% of total output growth, reflecting greater land availability and lower costs associated with land expansion in the region (Section 1.3).

Crop yield variations

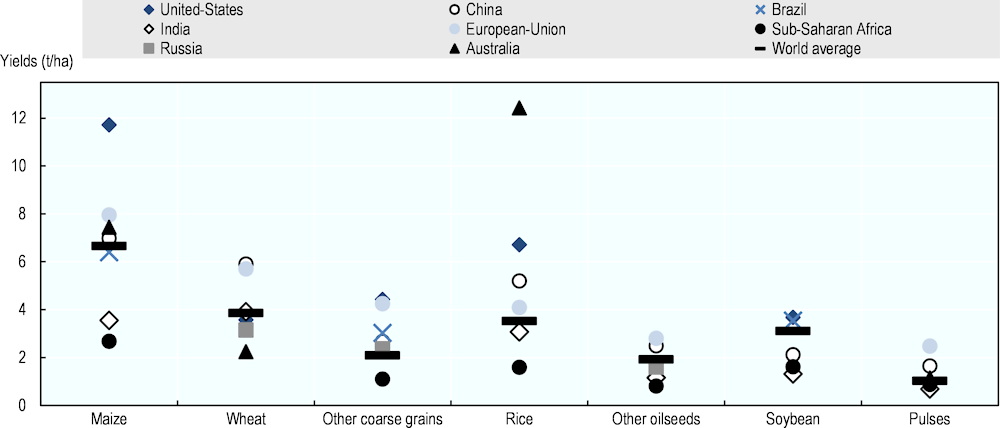

Despite the significant growth in yields projected in emerging and low-income regions over the coming decade, large disparities in yield levels between countries and regions are expected to remain. This is partly due to differences in agro-ecological conditions but it also reflects differences in access to agronomic inputs including fertiliser and improved crop varieties as well as differences in access to technologies and human capital. Inter-regional variation in yields also tend to differ widely between crop types (Figure 1.16).

Maize yields in 2029 are projected to range between 2.7 t/ha in Sub-Saharan Africa and almost 12 t/ha in the United-States, the largest maize producer and exporter in the world. In the later, intensive input use together with ongoing progress in plant breeding will enable further yields growth over the coming decade. Similarly, average rice yield in Australia is expected to reach 12.4 t/ha in 2029, due to intensive use of agronomic inputs (fertiliser, pesticide, irrigation) and the implementation of good cultivation practices on the most suitable lands. This is almost eight times higher than the projected average rice yield in Sub-Saharan Africa (1.6 t/ha), where fertilizer availability and quality are limited and application rates are the lowest among all regions. Average yields are also influenced by harvest failures caused by drought or locust plagues, which are frequent in Sub-Saharan Africa. Overall, these trends in cereal yields highlight the need for increased technology transfer across world regions in order to further reduce yield gaps. Nevertheless, sustained growth in cereal yields in all regions will enable most of global output growth to be achieved without an expansion in the cropland area.

For oilseeds and traditional crops such as pulses, yield gaps are more limited. In 2029, pulses yields in the European Union, one of the highest yielding regions, are expected to be only three times higher than pulses yields in India, the world largest producer. For oilseeds and pulses, growth in global production is expected to come in part from greater land use as yield growth will be more limited over the coming decade. Area expansion will also remain important for other crops such as cotton (not represented in Figure 1.16) as yield improvement in key producing countries (e.g. India) are expected to be insufficient to meet global demand growth.

Overall, the strongest yield growth in low income and emerging regions will translate into relatively small absolute increases in yields, given their low base levels. By 2029, average crop yields in both India and Sub-Saharan Africa, for instance, are projected to remain well below yield levels in all high yielding countries, including countries/regions with comparable natural conditions (e.g. South East Asia, Latin America). This indicates that many countries will still be far from their yields potential and therefore from their potential output by the end of the outlook period.

Figure 1.16. Projected crop yields for selected countries and regions in 2029

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Potential for sustainable intensification

Given appropriate incentives, further intensification in crop production will occur to meet growing demand for crop commodities, especially in regions that have not reached their potential yields and output. Output growth through the intensification of crop production (i.e. higher output per unit of land) is assumed to be more economically efficient than through large expansion of agricultural land given the prevailing policy and economic conditions. More intensive use of agronomic inputs, in particular, has made it possible to feed a growing population with relatively small increase in agricultural land use. However, the intensification of agricultural practices (e.g. drainage, tillage), and in particular the more intensive use of fertilisers and pesticides, can exacerbate some environmental problems and threaten sustainability (Section 1.3). In most world regions, there is scope for efficiency gains through the adoption of more advanced technologies (e.g. precision farming) or the implementation of better management practices, which would allow to produce a greater output without an increase, or with less than proportional increase, in inputs use, including natural resources and chemical inputs.

In addition to conventional, high input systems, alternative crop production systems have emerged. By reducing or eliminating the use of chemical inputs or shorting supply chains, some of these approaches aim to reduce the environmental footprint of commercial agriculture. Organic agriculture, for instance, achieves better environmental impact per unit of land used, although it produces less food per unit of agricultural land. Studies have showed that organic yields are at least 20% lower than yields in conventional agriculture, which implies that it requires much more land to produce the same output (De Ponti, Rijk and Van Ittersum, 2012[1]). This raises a number of concerns given the limited availability of land suitable for agriculture, and the negative environmental impacts associated with agricultural land expansion (Section 1.3).

Organic agriculture is rising globally. It already accounts for 7.5% of total agricultural area in the European Union for instance, with this share being higher than 20% in some Members States (e.g. Austria, Estonia, Sweden) (Eurostat, 2020[2]). Over the coming decade, the share of organic area in the European Union could be sufficiently high to influence average fertiliser use by hectare, and potentially average crop yields. Crop production in other main producing regions, however, should continue to mostly rely on conventional high-input systems.

Intensity of livestock production varies by type of product and by world region

Location of global production growth

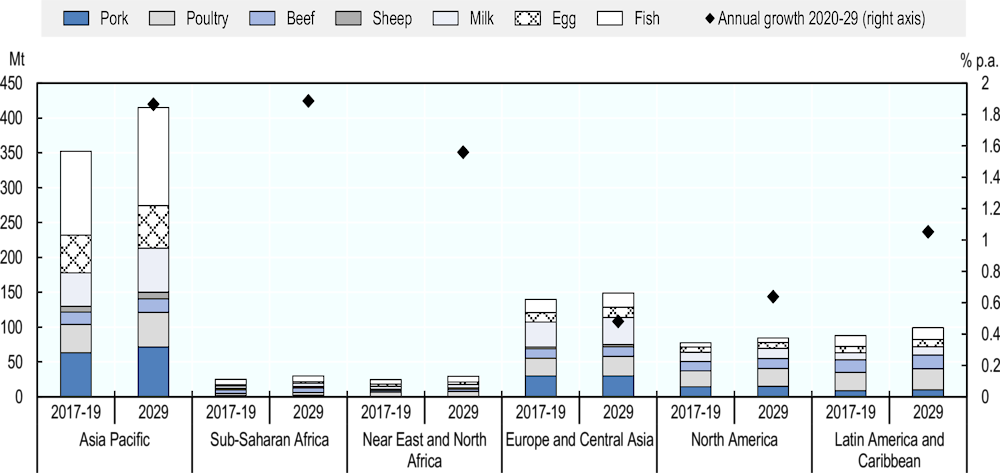

The Asia Pacific region currently accounts for half of global livestock production. Europe and Central Asia, and the Americas are responsible for another 20% and 23%, and these shares are expected to remain stable by the end of the outlook period. A few countries, in particular (i.e. China, India, Brazil and the United-States), and the European Union, will continue to dominate livestock production globally. Over the outlook period, global livestock production (i.e. meat, milk, egg and fish) is expected to expand by 14% (99 Mt), supported by lower feed prices and stable product prices ensuring remunerative profit margins to producers (Figure 1.17).

Figure 1.17. Global livestock production

Note: Milk production is expressed in Mt of milk solids.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Globally, meat production is projected to expand by 12%, supported by favourable meat-to-feed price ratios. Most of the growth in meat output will originate from emerging and low-income countries (Brazil, China, India, Mexico, Pakistan, and Turkey in particular).

Poultry is expected to be the fastest growing meat, with a projected increase in production of 16% (20 Mt). This accounts for about half of the projected increase in total meat output. Rising poultry production in Asia Pacific and Latin America, in particular, is expected to account for 60% of the global increase in poultry meat. This growth in output will be encouraged by low production costs, a short production cycle, high feed conversion ratios and growing consumer demand in most world regions, which will keep prices stable.

Sheep meat production is significantly lower than the production of other meat types at the global level, but it is also expected to grow strongly over the next ten years. The projected increase of 14% or 2 Mt in sheep meat output will mainly be supported by strong demand growth in China and Africa, most of which will be sourced locally. More limited output growth is projected in Oceania (6%), due to the ongoing competition for pastureland from beef and dairy in New Zealand, and the prolonged drought condition in Australia, which has resulted in a decrease in sheep flocks.

Globally, beef production is projected to expand by about 9% over the outlook period. Most of this increase will originate from Asia Pacific (2 Mt), China and Pakistan, in particular, and from Latin America (1.5 Mt), together accounting for more than half of global output growth. Beef production will also expand in North America (0.8 Mt) supported by low feed costs and positive price expectation due to sustained domestic demand. In the European Union, however, the low profitability of the beef sector, which can partly be explained by declining domestic demand, together with large efficiency gains in the dairy sector have led to a reduction in the cowherd in recent years. This is expected to result in a decrease of 6% (-0.4 Mt) in the beef output over the next ten years.

Pigmeat production is projected to grow by 11 Mt by 2029 (9%). This expansion will be largely concentrated in China, which is expected account for nearly 60% of global output growth over the coming decade (6.5 Mt). While the African Swine Fever outbreak is projected to continue to negatively impact pork production in China and in other countries in East and South-East Asia in the first years of the projection period, pigmeat output is expected to gradually recover by 2025. In the European Union environmental restrictions are expected to cause pigmeat production to fall by 2% (-0.5Mt) over the outlook period.

Among all livestock commodities, dairy is expected to experience the strongest growth over the next decade in response to strong demand. Milk production is projected to increase by 20%, with India and Pakistan accounting for 60% of global output growth. The sector is responding to low production costs and high prices expectations. Milk prices are supported by strong demand, especially for fresh dairy products in Asian countries (India, Pakistan). In Africa, strong population growth and the introduction of cooling systems are also expected to result in growing demand for dairy products. Globally, egg production is projected to increase by 13%; China and India accounting for 45% of the global increase.

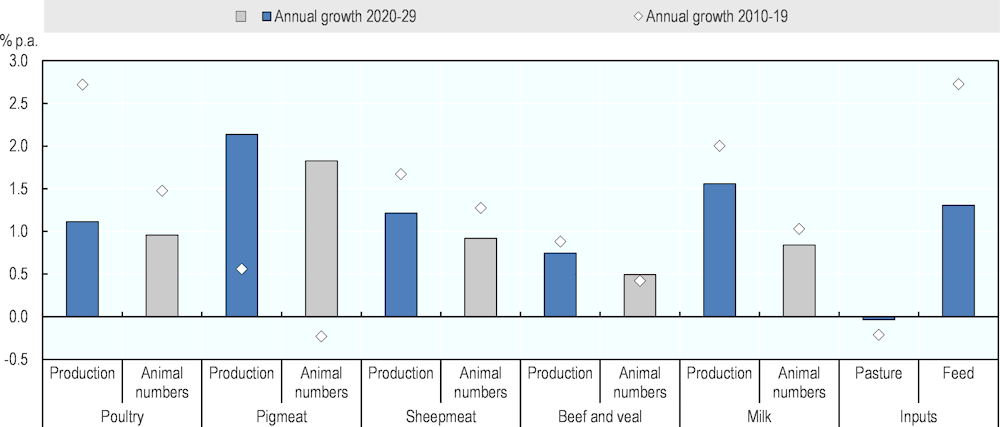

Main drivers of global production growth

The global expansion in livestock production will rely on a combination of two main growth factors (Figure 1.18). First, improvements in genetics and animal health together with better management and feeding practices will enable higher livestock production intensity (i.e. higher output per animal per year) in all regions. More intensive meat production will occur through higher slaughter weight per animal and shortening the time to finish an animal for slaughter. In addition to further intensification, output growth will also be supported by an increase in animal numbers. The relative importance of these two growth factors will vary by type of livestock commodity, and by world region.

Globally, poultry output and animal numbers are projected to grow in step over the coming decade (1% p.a.) (Figure 1.18). In some important producing regions such as North America and the European Union, where productivity per animal is already high, further intensification options will be limited. However, greater feed efficiency is expected to be achieved, thus reducing production costs and pressure from feed availability. In emerging and low-income countries, however, there is still significant scope for intensification in the poultry sector. For instance, the modernisation of the poultry supply chain which has occurred in a several countries in Sub-Saharan Africa (e.g. South Africa, Tanzania) is expected to continue and lead to strong output growth over the coming decade (2.4% p.a.).

Figure 1.18. Growth in global livestock production

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Sheep meat production and animal numbers are also projected to grow in line over the next ten years, as sheep in most part of the world are farmed extensively in pastoral production systems. Strong output growth in Sub-Saharan Africa (2.3% p.a.), in particular, will be supported by a large increase in animal stocks, as breeding progress has so far been limited in the region. Overall, intensification in Africa is still constrained by structural issues such as lack of investment capital, the limited availability of feed and environmental factors such as desertification or locust plagues. These factors are particularly pronounced for ruminants production (cattle, sheep and goats).

Milk, beef and pork outputs, on the other hand, are projected to grow faster than animal numbers in all regions due to further intensification of these livestock sectors. Global milk production, in particular, is projected to intensify; however, this trend hides important structural differences between main world producers as discussed in the next section. Beef production will also intensify further, including in key producing countries of Latin America, where it will enable strong production growth (0.7% p.a.) with a limited increase in animal numbers (0.2% p.a.). In Argentina, the intensification of production processes through feedlots is continuously improving yields while in pasture-based systems like in Brazil, intensification will be mainly achieved through improved grazing management.

At the global level, livestock production growth will be achieved alongside declining pasture land due to further intensification of pasture and ruminant production, and the growth in non-ruminant meat sectors (poultry and pork) that do not require pasture. This process will be supported by a robust growth in the use of concentrate feed (1.3% p.a), with pasture land mainly declining in regions where the use of this feed is projected to expand most strongly (Section 1.3).

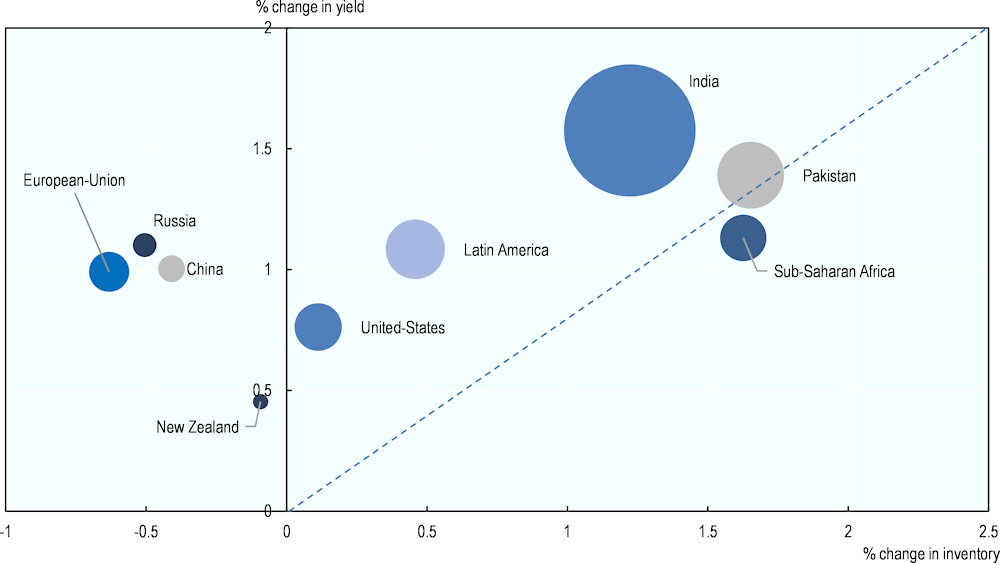

Dairy: Large structural differences persist between major producing countries

Over the coming decade, most dairy production growth will originate from low-income and emerging countries (India and Pakistan in particular) where milk is mostly produced by smallholders in extensive pastoral production systems (Figure 1.19). In these regions, output growth will rely strongly on an increase in dairy inventories, by 21 million and 29 million in India and Sub-Saharan Africa, for instance. This represents two-third of the projected increased in global dairy inventories. Yields will also increase over time, however, given their low base level, the absolute increase in yield will remain small. India’s dairy yields, for instance, are expected to reach 1.57 t/head in 2029, seven times lower than projected average yield in the United-States. Dairy productivity in these regions is still constrained by poor quality feed, diseases and dairy animal low genetic potential for milk production. An important share of milking animals in Sub-Saharan Africa for instance is goats, which are characterised by a low productivity per head.

Figure 1.19. Changes in inventories of dairy herds and yields, 2020 to 2029

Note: The size of the bubble reflects absolute growth in dairy production between 2017-19 and 2029.

Source: OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Lower production growth is projected in leading producers in developed countries (e.g. the United-States) as well as in key milk exporters, the European Union and New Zealand, where increasing environmental requirements (e.g. phosphate, nitrate, GHG emissions), together with land constraints for the latter will also limit further output growth. Production growth, however, will be achieved with stagnant or declining animal inventories, and sustained growth in yields, coming from a combination of improvements to animal genetics, greater feeding efficiency and adjustment to management practices. Absolute yield growth in tonnes per milking animal might still increase faster in developed countries and lead to larger absolute differences in yields.

Livestock intensification and animal welfare

Productivity improvements in animal agriculture can alleviate food security, land use and GHG emissions concerns, as higher production intensity is associated with lower GHG emissions per unit of output. However, the impact of intensification on animal welfare is more complex. At low levels of productivity (e.g. in pastoral production systems), further intensification might lead to improvements in animal nutrition and health care, thereby increasing animal welfare but at higher productivity levels, some production practices (e.g. small pens and cages limiting mobility in confined production systems) might put animal welfare at risk (Leenstra, 2013[3]). Animal welfare policies, which already play an important role in some developed countries, set welfare requirements for farming activities including, for instance, minimum access to outdoor activities for farm animals, housing design standards or caps on farm size. These policies could limit further intensification of some livestock sectors over the next ten years (e.g. poultry and pig).

Global outlook for fish production

Over the outlook period, world fish production is projected to grow at 1.3% p.a., to 200 Mt in 2029 (+24.6 Mt). Asia Pacific, the main producing region, will account for 80% of the global increase. Lower production growth is projected in Latin America, and Europe and Central Asia, two other important fish producers. Strong output growth, however, is expected in Near East and North Africa (1.7% p.a.) and in Sub-Saharan Africa (1.1% p.a.), albeit from lower base levels, together adding less than 2 Mt (Figure 1.16).

Until the 1990s, almost all fish and seafood was obtained through capture fisheries, but since the last 20 years, capture fisheries production has been relatively flat. Aquaculture production, on the other hand, has been growing steadily – notably in China – increasing its role in total fish supply. Over the outlook period, aquaculture production will continue to grow while fish capture production is expected to be remain broadly flat. As a result, by 2024, aquaculture is projected to overtake capture fisheries as the most important source of fish worldwide (Chapter 8).

Despite the projected growth in fish production, global output is expected to grow at a significantly slower pace than over the past decade (1.3% p.a. compared to 2.3% p.a.). This mainly reflects the expectation that China, the main fish producer in the world, will implement more sustainable fisheries and aquaculture policies, in line with its 13th Five-Year Plan. This is expected to lead to an initial reduction in capacity but will result in productivity improvements in the aquaculture sector over the second half of the projection period.

Environmental impact of agricultural production

Direct GHG emissions

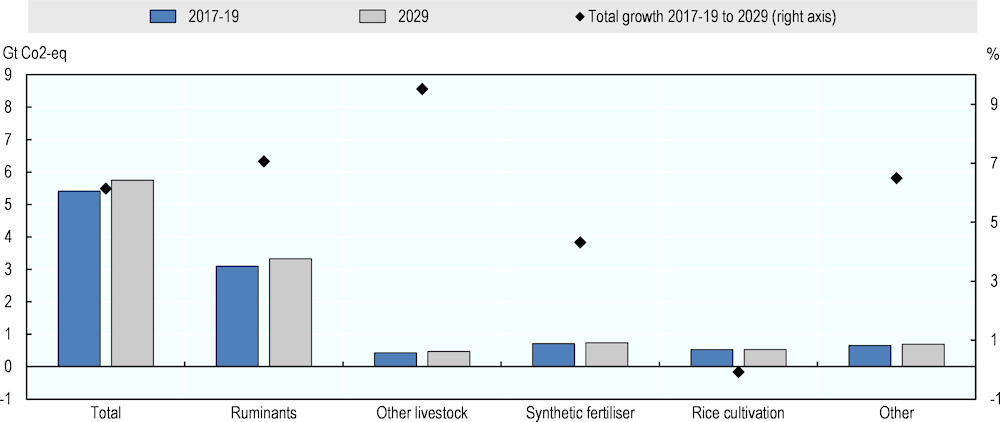

Direct emissions from agriculture account for about 11% of global GHG emissions. Livestock (in particular ruminants) are currently responsible for two-thirds of agriculture’s direct emissions, mainly through enteric fermentation. Other important sources of direct GHG emissions include the application of synthetic fertilisers to agricultural soils (13%) and anaerobic decomposition of organic matters on paddy rice fields (10%) (Figure 1.20).

Over the outlook period, and assuming no changes in current policies and technologies, projections suggest a growth in direct GHG emissions of 6%, an increase of 332 MtCO2-e from the base period. Livestock will account for 80% of this global increase. Geographically, most of the increase in direct emissions is projected to occur in emerging and low-income regions due to higher output growth in production systems that are more emission intensive. Sub-Saharan Africa alone is expected to account for 48% of the global increase in direct GHG emissions, and Asia Pacific for another 46% (50% of which will originate from India and China).

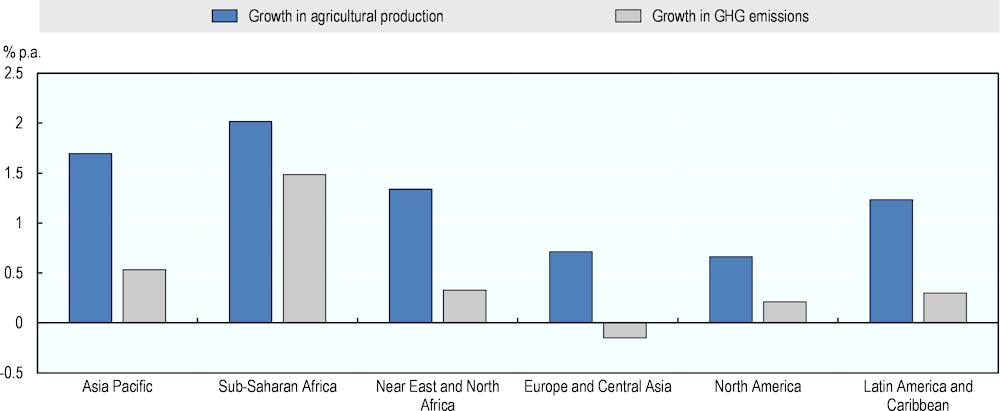

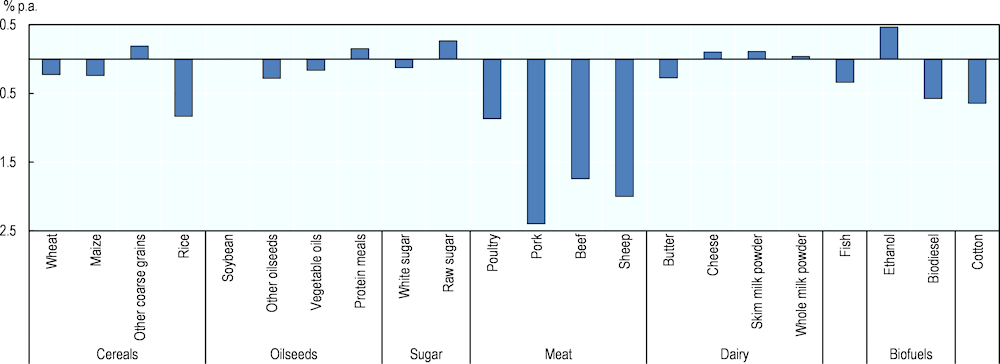

Global agricultural emissions are set to increase but the carbon intensity of production is declining over time. Over the next ten years, most world regions are expected to further reduce the emission intensity of their agricultural production (Figure 1.21). In Europe and Central Asia, output growth is projected to be matched with a decrease in direct GHG emissions (-0.15% p.a.), partly due to further yield improvements, but mostly as a result of a declining share of ruminant production in total production. This is mainly driven by the projected decline in beef output in the European Union over the next ten years. In the Americas, Asia Pacific and Near East and North Africa, strong growth in crop and livestock production are expected to be achieved with a much slower growth in direct GHG emissions. In Sub-Saharan Africa, however, agricultural production and direct GHG emissions are projected to grow more in step, mainly because output growth will be strongly reliant on increasing animal numbers in extensive ruminant production systems. A further reduction of the carbon intensity of agricultural production could be achieved by large-scale adoption of emission reducing technologies. The effect of technology adoption on direct GHG emissions from agriculture requires a more detailed reporting to be visible in GHG emission statistics.

Figure 1.20. Direct GHG emission from crop and livestock production, by activity

Note: The category ''other'' includes direct GHG emissions from burning crop residues, burning savanna, crop residues, and cultivation of organic soils.

Source: FAO (2019). FAOSTAT Emissions-Agriculture Database, http://www.fao.org/faostat/en/#data/GT; OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

Figure 1.21. Annual change in agricultural production and direct GHG emissions, 2020 to 2029

Note: Figure shows projected annual growth in direct GHG emissions from agriculture together with annual growth in the estimated net value of production of crop and livestock commodities covered in the Outlook (in billions of USD, measured at constant 2004-6 prices).

Source: FAO (2019). FAOSTAT Emissions-Agriculture Database, http://www.fao.org/faostat/en/#data/GT; OECD/FAO (2020), “OECD-FAO Agricultural Outlook”, OECD Agriculture statistics (database), http://dx.doi.org/10.1787/agr-outl-data-en.

The agricultural sector has a key role to play in climate change mitigation as it is a major emitter of GHG emissions worldwide. A number of supply-side and demand-side policy options exist to reduce GHG emissions from agriculture, although so far their uptake has been limited. Effective mitigation strategies in the agricultural sector also require collaboration at the national and international level (Box 1.1).

In parallel to public policies, an increasing number of private industry initiatives are emerging, particularly in livestock sectors, which seek to measure and benchmark GHG emissions and in some cases set ambitious mitigation goals (OECD, 2020[4]). In the European Union (e.g. Ireland, Netherlands, France), New Zealand, Australia, and the United States, for example, the dairy industry has recently committed to reduce GHG emissions from the sector through a number of actions, including the promotion of good agricultural practices among farmers (e.g. soil conservation measures, grazing preservation, improved feed efficiency) and the development of tools to monitor on-farm GHG emissions (Origin Green IRELAND, n.d.[5]; Zuivelketen, n.d.[6]; CNIEL, 2020[7]; DairyNZ, n.d.[8]; Dairy Australia, 2019[9]; U.S. Dairy, n.d.[10]). In addition to their branding and marketing benefits, these initiatives can support the achievement of national mitigation goals for the agriculture, forestry and land use (AFOLU) sector.

Box 1.1. The role of agriculture for climate change mitigation

The agriculture, land use and forestry sector is the second largest contributor to global greenhouse gases (GHG) emissions, after the energy sector. Overall, there is a growing recognition of the large mitigation potential of the sector and an increasing awareness of the need to reduce GHG emissions from agriculture. In recent years, a number of countries have set GHG emission reduction targets for agriculture, either as part of their Nationally Determined Contributions to the Paris Agreement or, more typically, as part of their national mitigation strategies. However, the implementation of policies to incentivize these emission reductions is still ongoing. Moreover, governments face social and political challenges for implementing mitigation policies in the sector, not least in balancing emission reductions with the need to feed billions of people every day. If no further collective progress is made over the coming decade, direct and indirect emissions from agriculture could become the largest source of global emissions by mid-century, as more rapid decarbonisation in is anticipated in other sectors (e.g. energy). Recent OECD work on the topic offers a number of recommendations for effective mitigation strategies in the agricultural sector

Governments should, first, roll back market-distorting agriculture subsidies. It has been shown that the most distortive forms of support also tend to be the most environmentally harmful. Many countries have taken significant steps in reforming support policies in the early 2010s, but further progress has been limited since then.

Market-based instruments that aim to reduce GHG emissions, such as carbon taxes, emissions trading schemes, and abatement payment schemes, are the most cost-effective ways to cut emissions from agriculture, even though they introduce different trade-offs for farmers, consumers and taxpayers and are challenging to implement. A significant implementation challenge for all of these policies include difficulties in measuring agriculture emissions, which are mainly from diffuse heterogeneous sources.

Co-operation at the national and international level is key for climate change mitigation in the agricultural sector, because unilateral approaches, using carbon pricing, can cause emissions leakage by increasing emissions in unregulated countries. Countervailing measures like carbon border taxes can reduce, but not eliminate this effect.

Reducing food losses and waste along the supply chain through to consumers could significantly lower GHG emissions, but might be costly to achieve. Information about the emission contents of products could encourage people to switch to lower emission diets.

Increased agriculture productivity growth can help to reduce GHG emissions while alleviating food security concerns. One example is precision agriculture, where global positioning systems and sensors, for instance, are helping to lower fertilizer use in crop production. For cattle, improving feed rations and breeding technologies can help reduce associated GHG emissions.

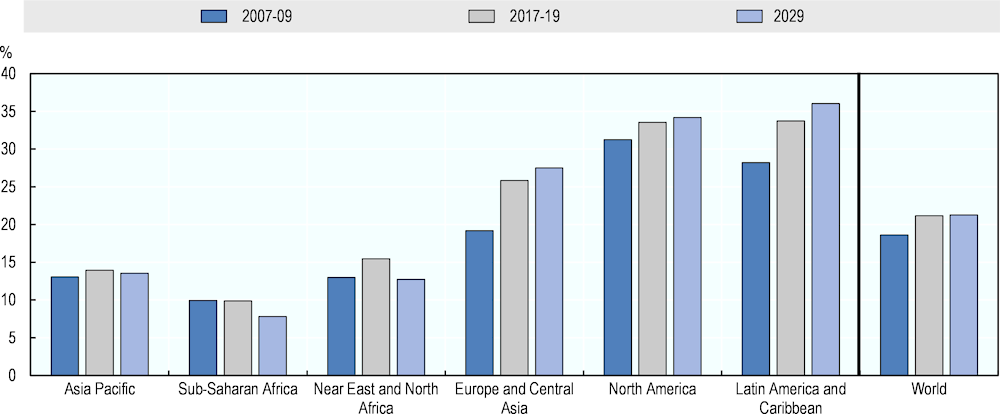

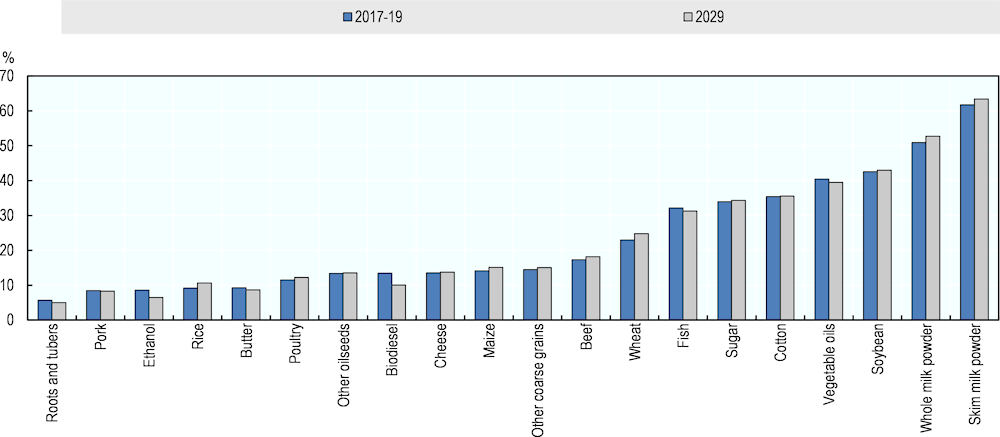

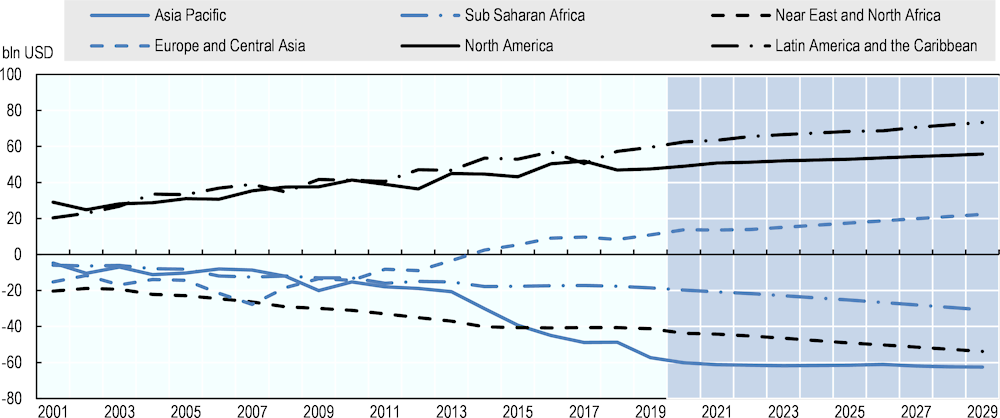

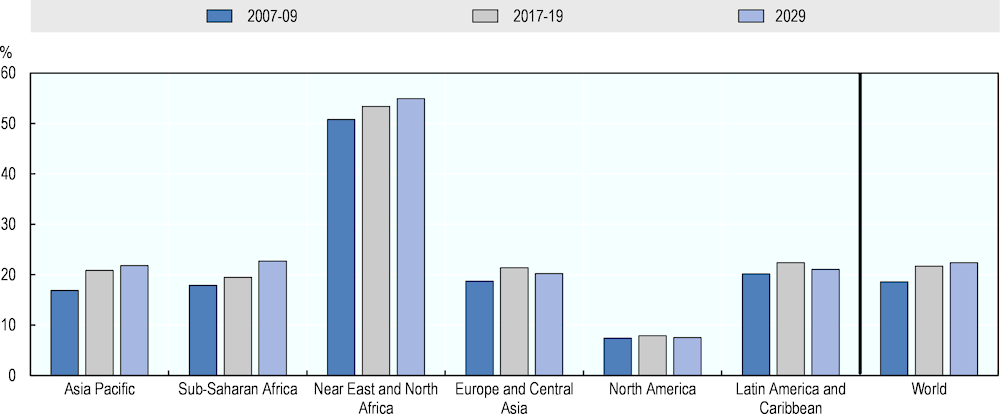

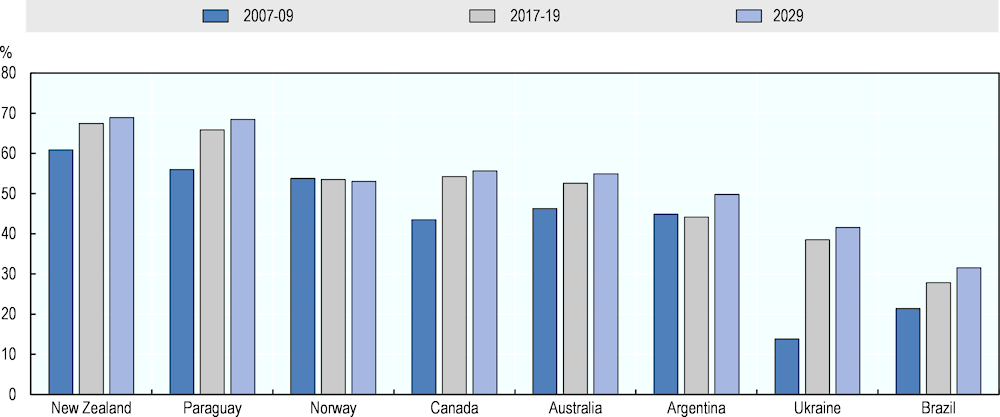

Forestry and agro-forestry play important roles as a carbon sink. Even though the amount of carbon that can be captured is limited, natural and sustainably managed forests can considerably help to mitigate GHG emissions from the AFOLU sector