Many individuals have interrupted careers because of having children and this indicator shows how this affects future pension entitlements. Average‑wage women with two children and taking five years out of the labour market to care for the children will have a pension equal to 95% of that for a full-career female worker with two children but not taking a break on average across the 38 OECD countries. Hungary, Ireland, Mexico, New Zealand, Spain and the United States offer benefits at the same level as the interrupted career case, whilst in Colombia, Israel, Korea, Poland and Türkiye the impact is large as future benefits are about 90% of the full-career workers. For low earners, the negative impact of such breaks on future pensions is more limited in most countries.

Pensions at a Glance 2023

Impact of childcare breaks on pension entitlements

Key results

Five countries give credits just for having had children, irrespective of whether a career break occurred to take care of children. Extra years of credit are given in France and Germany, a more favourable conversion factor being applied in Italy and a pension bonus is given in Czechia and Spain. For example, at the average‑wage level, the full-career mother will get a higher replacement rate compared with the no-children female worker of 3, 2, 4, 3 and 2 percentage points in Czechia, France, Germany, Italy and Spain, respectively. In Germany having a child gives one parent a credit of one pension point annually for three years, thereby making it equivalent for pension purposes to earning the average wage throughout the credit period, resulting in a much higher benefit entitlement (11 percentages point higher) for low earners. In addition, in both France and the Slovak Republic it is possible to retire one year earlier for the no-break with children case in comparison to the full-career worker without children. The results shown are a comparison between those women taking a career break having had two children compared to those who continued to work.

Most OECD countries aim to protect some periods of absence from the labour market to care for children. Credits for childcare typically cover career breaks until children reach a certain age. They are generally less generous for longer breaks and for older children. Many OECD countries credit time spent caring for very young children (usually up to 3 or 4 years-old) as insured periods and consider it as paid employment. However, once children are aged 6 years or older any credit given for this extended period is usually only to determine eligibility for early retirement and the minimum pension, and not to raise benefits. Some countries (Czechia, Greece, Hungary and Luxembourg) factor childcare into assessments of eligibility but disregard them when computing the earnings base, thereby limiting the negative impact. In Greece and Slovenia for both 5‑ and 10‑year breaks and in Costa Rica, France, Hungary, Luxembourg and Portugal for the 10‑year break, workers have to retire later to be entitled to a pension without penalty due the rules governing required contribution periods. In Slovenia, for example, a worker who enters paid employment at 22 but takes ten years out of work will have contributed for less than 40 years at age 62 and will therefore have to work until 65 to be able to retire without penalty.

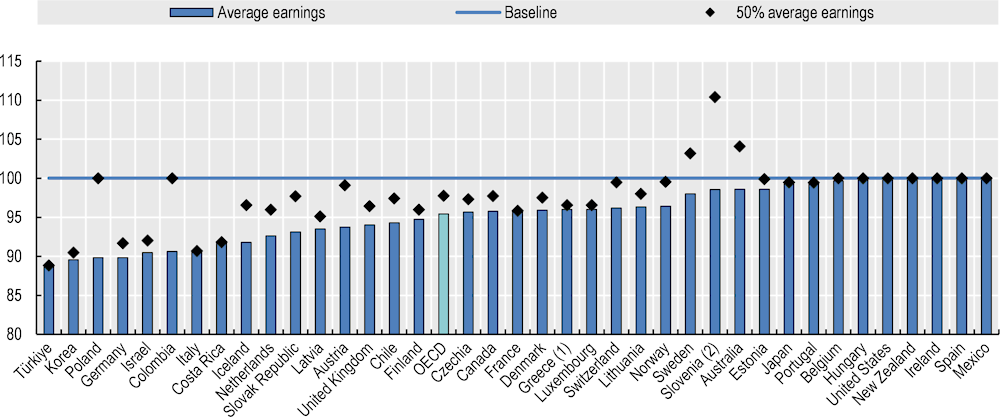

On average, a 5‑year break lowers future benefit entitlements at the average wage by 5%, and by 2% for low earners (Figure 5.3). In Colombia, Germany, Israel, Korea, Poland and Türkiye the future benefit is about 90% of the full-career workers at the average earnings level as there is limited credit given for periods not working, and in the case of Korea credit is only given to the second child. Conversely, in Hungary, Ireland, Mexico, New Zealand, Spain and the United States, for women with two children the benefit is exactly the same as for the full-career case. Low earners in both Colombia and Poland are protected by the minimum pension, as is also the case in Slovenia where women have to retire two years later in comparison to the no-break case.

In Estonia and Sweden, credits are given based on the nationwide average income and 75% thereof, respectively, resulting in higher benefits for low earners. Other countries where low-wage mothers are much more protected than average‑wage mothers for childcare breaks are: Austria and the Slovak Republic as they provide flat-rate credits during childcare breaks which are worth more to lower earners, and Australia, Colombia, Iceland and Poland due to safety-nets and minimum pensions providing greater protection to low earners.

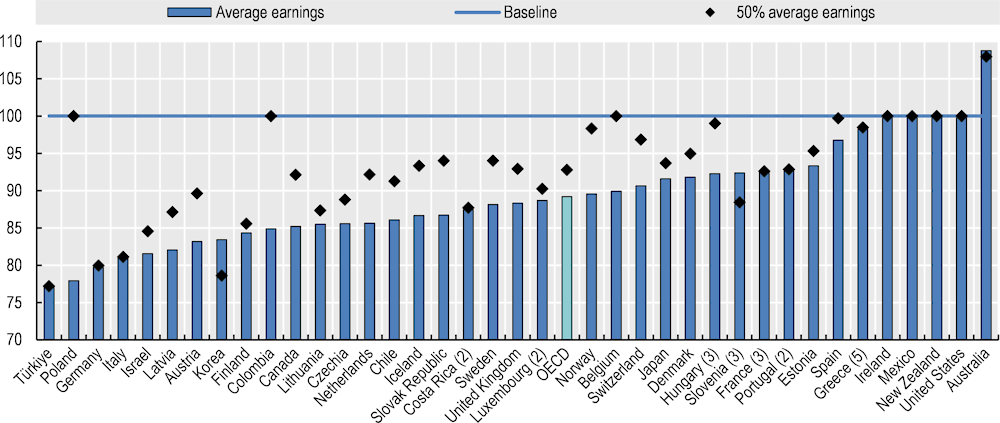

For the 10‑year break case, the average loss in benefit increases to over 11% for average earners and 7% for low earners (Figure 5.4). Average earners in Germany, Poland and Türkiye have future pensions under 80% of the full-career worker with low earners being similarly affected in Germany and Türkiye, whilst in Poland the minimum pension maintains low earners at 100% of the no-break woman. In Australia the benefit is actually higher by around 9% for both earnings levels as the career-break individuals have greater entitlement to the asset-tested Age Pension.

Definition and measurement

The OECD baseline full-career simulation model assumes labour market entry at the age of 22. For the childcare career case, women are assumed to embark on their careers as full-time employees at 22, and to stop working during a break of up to ten years from age 30 to care for their two children born when the mother was aged 30 and 32; they are then assumed to resume full-time work until normal retirement age, which may increase because of the career break. Any increase in retirement age is shown in brackets after the country name on the charts, with the corresponding benefits for the full career worker indexed until this age. The simulations are based on parameters and rules set out in the online “Country Profiles” available at http://oe.cd/pag.

Figure 5.3. Gross pension entitlements of low and average earners with a 5‑year childcare break versus women with two children with an uninterrupted career

Note: Figure in brackets refers to increase/decrease in retirement age. Individuals enter the labour market at age 22 in 2022. Two children are born in 2030 and 2032 with the career break starting in 2030. Low earners in Colombia, New Zealand and Slovenia are at 64%, 63% and 56% of average earnings, respectively, to account for the minimum wage level.

Reading note: In Canada, the gross replacement rate is 36.8% for a full‑career female average earner with two children, the same as for a single female earner without children (see Table 4.1). When taking a five‑year break the pension falls to 95.8% of this value thereby giving a replacement rate of 35.3%.

Source: OECD pension models.

Figure 5.4. Gross pension entitlements of low and average earners with a 10‑year childcare break versus women with two children with an uninterrupted career

Note: Figure in brackets refers to increase/decrease in retirement age. Individuals enter the labour market at age 22 in 2022. Two children are born in 2030 and 2032 with the career break starting in 2030. Low earners in Colombia, New Zealand and Slovenia are at 64%, 63% and 56% of average earnings, respectively, to account for the minimum wage level.

Source: OECD pension models.