This chapter looks into pension developments over the past two years. It presents an overview of pension reforms introduced in OECD countries between September 2021 and September 2023. The chapter also describes recent trends in life expectancy and healthy life expectancy as well as inequalities in life expectancy. It provides an overview of long-term trends in employment rates for older age groups and labour market exit ages, and evolutions since COVID‑19. The chapter assesses to what extent pension indexation protected pensioners’ purchasing power throughout the surge in inflation since 2021.

Pensions at a Glance 2023

1. Recent pension reforms

Abstract

Introduction

The COVID‑19 pandemic, Russia’s war of aggression against Ukraine and the policy response to these challenges have triggered an inflation wave felt across the globe. The inflation surge since 2021 has increased expenditures somewhat more for older people than for others in many countries, as energy and food make up a larger share of the consumption baskets of many older people compared to other age groups. Yet, pensioners’ purchasing power is likely to be affected less than that of working-age people in countries indexing pension benefits to price increases. Over half of OECD countries tend to protect earnings-related pensions fully from inflation shocks over time. The impact of inflation on pensioners’ purchasing power is particularly limited in countries where pensions are price adjusted shortly after prices rise, for instance through frequent indexation or by adjusting when the index crosses a certain threshold.

The impact of COVID‑19 on both future life expectancy and employment is likely to be temporary in most OECD countries. Life expectancy dropped due to excess mortality in most OECD countries in 2020, but by the end of 2021, trends reversed in many of them. Concerns over a permanent reduction of labour supply (“great resignation”) have not materialised, despite some concrete evidence of increasing inactivity among older individuals in some OECD countries in the initial stages of the pandemic. The employment rates of older workers grew between 2019 and 2022, resuming the trend of increasing employment at older ages since the turn of the millennium. Over the last two years, several countries took initiatives to further increase employment of older workers though reduced taxation, providing deferral incentives or reducing or eliminating the withdrawal of pension income against earned income.

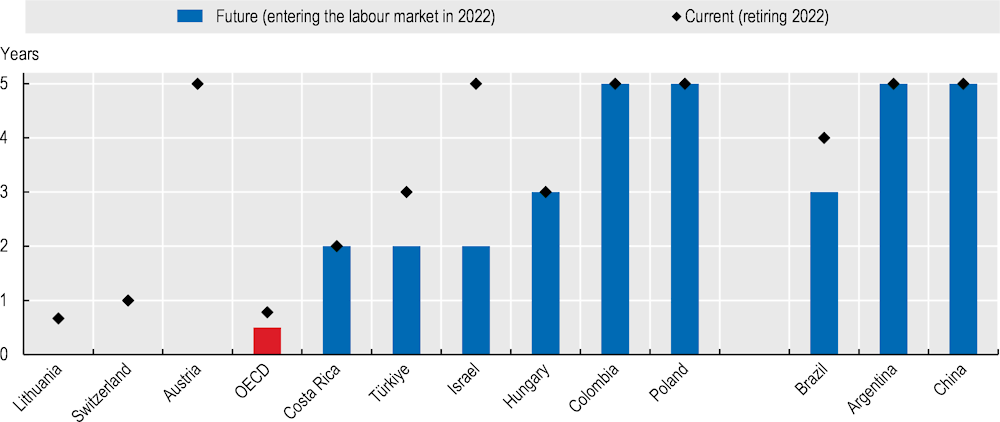

Several countries have passed pension reforms increasing retirement ages, consistent with the general trend in the OECD since the 1990s. As three in five OECD countries will have a higher normal retirement age in the future, increasing retirement ages remains a common strategy to improve financial sustainability without reducing pension levels. Now that the Slovak Republic and Sweden introduced a link between their retirement ages and life expectancy over the last two years, one in four OECD countries now boast such a link. Costa Rica and Czechia tightened eligibility to early retirement and France raised the minimum retirement age over the last two years. In addition, Switzerland and Israel decided to gradually increase the retirement age for women, gradually closing and reducing the gender gap in retirement ages, respectively.

Concerns over financial sustainability remain an important driver of pension reform. Beyond adjusting retirement ages, this can also entail adjustments to benefits and contributions. The Netherlands passed a systemic pension reform entailing a transition of pension funds from funded defined benefit to funded defined contribution schemes to improve solvency. Costa Rica and Spain passed parametric reforms to contributions and benefits to improve pension finances.

Pension protection has been improved in several OECD countries over the last two years, in particular for low earners. Chile replaced its targeted public pension scheme with a quasi‑universal scheme in January 2022, increasing the benefit and expanding coverage to 90% of the older population. Furthermore, Canada, Estonia, France, Italy, Lithuania, Spain, Sweden and Türkiye substantially increased basic pensions, minimum pensions and/or targeted benefits. Moreover, in their respective earnings-related pension systems, Hungary sped up the introduction of the 13th month payment, and Poland introduced a 14th month payment.

Finally, coverage of various pension schemes has been extended in several countries. The Slovak Republic has become the sixth OECD country to have introduced automatic enrolment, joining Lithuania, New Zealand, Poland, Türkiye and the United Kingdom. Australia and Costa Rica respectively removed and reduced minimum earnings thresholds to participate in earnings-related pension schemes, removing barriers to participate for low-income earners, and the Netherlands lowered the minimum age when workers can enter a pension scheme. Chile and Mexico extended coverage to platform and domestic workers, respectively, who previously were not covered by mandatory pensions. At the same time, New Zealand and Sweden tightened residency requirements to qualify for certain pension benefits.

Key findings

Inflation and pensions

The ongoing episode of high inflation reverses the standard way of thinking about pension indexation. In normal circumstances, wages grow faster than prices due to productivity gains, and in the past many countries shifted from wage to price indexation to limit pension expenditures. In the short term, due to falling real wages, price indexation has become more favourable for pensioners. But it is more costly than initially anticipated for public finance or pension providers more generally.

Over half of OECD countries protect pensioners fully from inflation trends over time. These countries index pensions to prices, to prices plus real-wage growth if positive, or to the higher of prices or wages. A few other countries index to a mix of prices and wages, or fully to wages.

Frequent indexation is necessary to uphold pensioners’ purchasing power. Belgium’s fixed-threshold indexation, increasing pensions every time the price index increases by 2%, has provided good protection. By contrast, the real value of old-age safety-net benefits dropped drastically in Latvia and Poland as they are only indexed every three years and inflation was particularly high, resulting in both countries deviating from their indexation rules in 2023, and Latvia moving to annual indexation from January 2024.

Loss of purchasing power can also be caused by delays when the indexation indicator is smoothed over long periods, as in Lithuania, or from a lag between the reference period and pension adjustment, as in Denmark.

Applying indexation rules consistently is key to building confidence in pension promises. However, protecting all pensioners against high inflation has been costly. Depending on the fiscal space and national preferences, temporary deviations from full price adjustment for all can include flat-rate payments or full adjustment up to a threshold only. It may be fair in exceptional times of economic and fiscal pressure that pensioners with retirement income above a certain threshold share some of the pain with the working-age population in terms of reduced benefit adjustments.

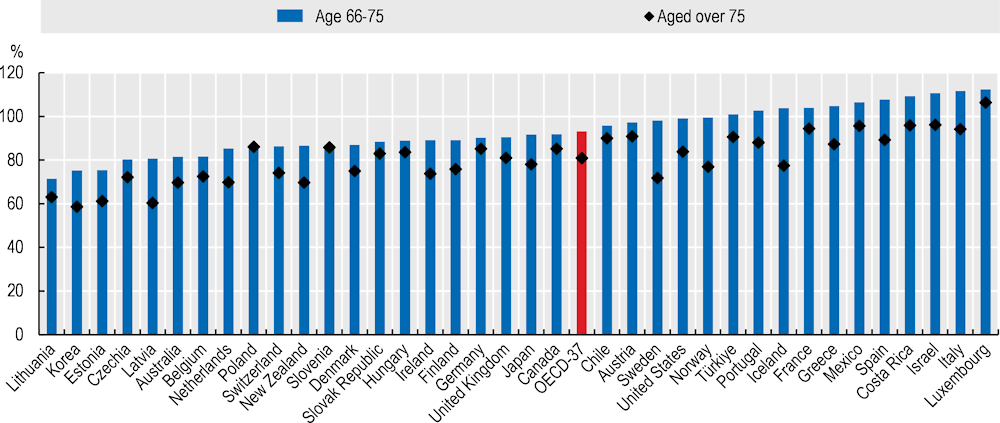

Current income of pensioners

On average across the OECD, people aged 66‑75 have a disposable income of 93% of that of the total population, falling to 81% among people aged over 75. The disposable income of people aged 66+ is below 75% of that of the total population in the Baltic states and Korea whereas it is 100% or more in Costa Rica, France, Israel, Italy, Luxembourg and Mexico.

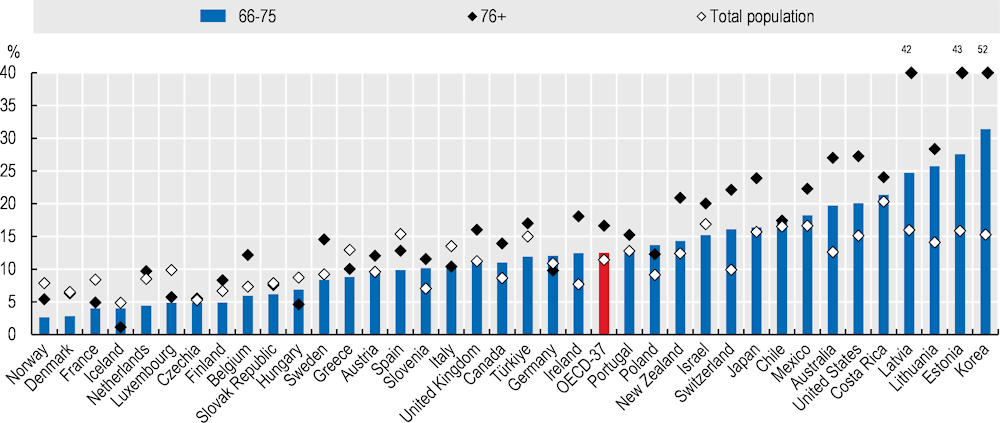

Across all OECD countries, 12.5% of people aged 66‑75 and 16.6% of those aged 76+ are in relative income poverty (equivalised disposable income below 50% of the median), compared to 11.4% of the total population. The relative income poverty rate among people aged 66+ exceeds 25% in the Baltic states and Korea and is below 6% in Czechia, Denmark, France, Iceland, Luxembourg and Norway.

Main recent pension policy measures in OECD countries

The Netherlands passed a systemic reform of funded private pensions from defined benefit to defined contribution.

The Slovak Republic reintroduced a one‑to‑one link between the retirement age and life expectancy. Sweden raised the retirement age and will link it to two‑thirds of life‑expectancy gains, which will boost pensions from the notional defined contribution scheme. One in four OECD countries now link retirement ages to life expectancy, including Denmark, Estonia, Finland, Greece, Italy, the Netherlands and Portugal.

In France, the minimum retirement age of the main mandatory scheme was increased from 62 to 64 and some special pension schemes will be gradually eliminated. In Costa Rica, the tightening of early retirement ages results in the increase of the normal retirement age by three years for both men and women to 65 and 63, respectively. Czechia tightened early retirement eligibility from five to three years before the statutory retirement age. By contrast, Italy extended the early retirement options that were supposed to expire. In Türkiye, for people who entered employment before the statutory retirement age was legislated in 1999, the statutory retirement age was scrapped; among them, women can access a pension after at least 20 years of contributions and men after at least 25 years.

Switzerland will close the gender gap in normal retirement ages, and Israel will reduce it from five to two years.

Spain formally removed the automatic adjustment mechanisms previously legislated to address financial sustainability and reintroduced price indexation of pensions in payment. Instead, contributions were raised, especially for high earners, while income protection for low-income pensioners and workers with irregular careers, including mothers, was increased.

Chile significantly raised low pensions by replacing its means-tested public pension scheme by a quasi‑universal scheme. In addition to Chile and Spain, Canada, Estonia, France, Italy, Lithuania, Sweden and Türkiye substantially increased first-tier pensions, which benefit more the retirees with low pensions.

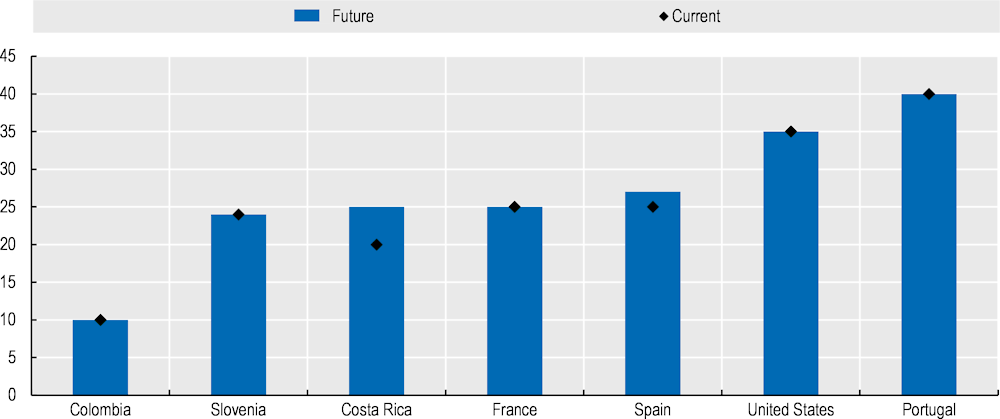

Costa Rica extended the reference period for past wages used to calculate pensions from 20 last years to 25 best years, as well as Spain from 25 to 27 years from 2044. The only other countries that still continue to calculate earnings-related pensions on earnings for only part of the career are Colombia (10 years), Slovenia (24), France (25), the United States (35) and Portugal (40).

Implications

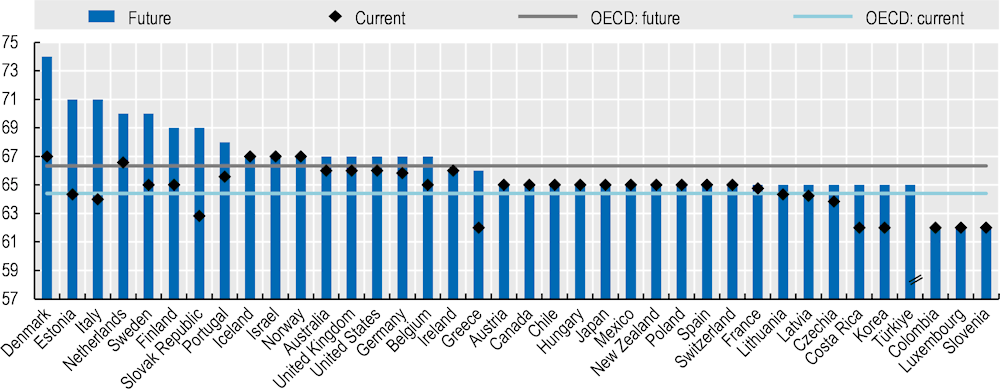

In 2022, men with a full career from age 22 could retire with a full pension between 62 (Colombia, Costa Rica, Greece, Korea, Luxembourg and Slovenia) and 67 years (Denmark, Iceland, Israel and Norway), except Türkiye, with a current normal retirement age of 52.

Normal retirement ages are set to increase in three‑fifths of OECD countries. Only Colombia, Costa Rica, Hungary, Israel, Poland and Türkiye still maintain lower normal retirement ages for women than for men for labour market entrants in 2022. The average normal retirement age among OECD countries will increase from 64.4 years for men retiring now to 66.3 years for those starting their career now. Future levels range from 62 years in Colombia, Luxembourg and Slovenia to 70 years or more in Denmark, Estonia, Italy, the Netherlands and Sweden.

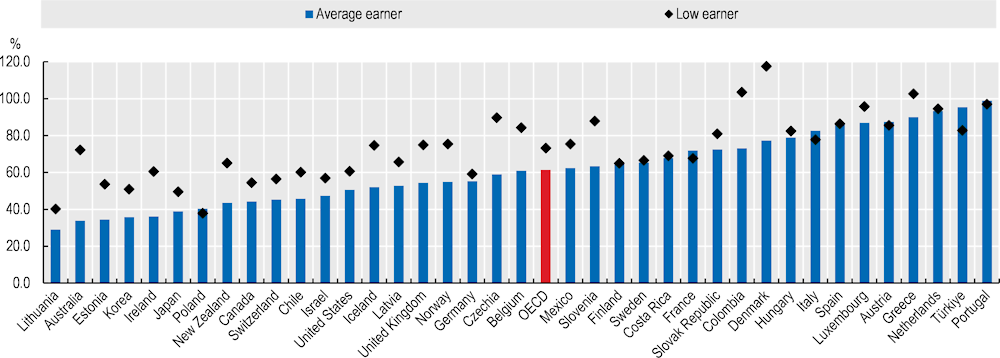

On average across the OECD, full-career average‑wage workers entering the labour market in 2022 will receive a net pension at 61% of net wages. Future net replacement rates are at 40% or below in Australia, Estonia, Ireland, Japan, Korea, Lithuania and Poland; they exceed 90% in Greece, the Netherlands, Portugal and Türkiye.

The future net replacement rate of workers earning half the average wage is higher at 74% on average. In Japan, Lithuania and Poland, it is below 50%, while it exceeds 100% in Colombia, Denmark and Greece.

As a result of recent pension reforms, net replacement rates of full-career workers will increase significantly in Chile, Spain and Sweden, and to some extent in the Slovak Republic, whereas they will decrease significantly in Costa Rica, although less so for workers with declining earnings towards the end of the career.

Other findings

Life expectancy at older ages bounced back in most OECD countries from 2021 after a drop of about half a year in 2020 on average. Since 2012, the trend in life expectancy gains at age 65 has slowed significantly to 0.9 years per decade, from a fast pace of 1.4 years per decade between the mid‑1990s and the early 2010s.

It is sometimes argued that retirement ages should be linked to changes in healthy life expectancy instead of changes in life expectancy. Analysis in this chapter shows that available indicators of healthy life expectancy are not suited to determine how retirement ages should evolve.

Most OECD countries have resumed the pre‑COVID trend of growing employment at older ages, although employment rates did decline significantly between 2019 and 2020 in several Latin American countries.

Denmark, France, Italy, Luxembourg and Slovenia have lower retirement ages without penalty for people with long careers who started working at a young age. In Germany and Portugal, early starters are exempt from the penalties that otherwise apply in case of early retirement.

This chapter is structured as follows. The first section takes stock of evolutions in life expectancy at older ages, including the impact of COVID‑19, in inequalities in life expectancy and in healthy life expectancy. The second section provides an overview of employment at older ages and labour market exit ages. The third section analyses to what extent the various pension indexation mechanisms have managed to help shield older people from losing purchasing power given the recent surge in inflation. The chapter closes with a section on pension reforms legislated in OECD countries since the previous edition of Pensions at a Glance.

Population ageing: COVID‑19 and life expectancy

The COVID‑19 pandemic has left its mark on populations worldwide, affecting people’s health and raising mortality especially among older people. Across OECD countries, excess mortality reached about 13% for the population aged 65+: the actual number of deaths exceeded the expected number of deaths based on 2015‑19 figures by 13%.1

Trends in life expectancy gains and inequality

Life expectancy dropped due to excess mortality from COVID‑19 in most OECD countries in 2020 (OECD, 2021[1]). Increased mortality among people aged 60+ is the most significant contributor to excess mortality, in particular in countries with lower full vaccination rates in this age group (Schöley et al., 2022[2]). By the end of 2021, trends had reversed in several countries and some already returned to their 2019 life‑expectancy levels (OECD/European Union, 2022[3]; Schöley et al., 2022[2]).

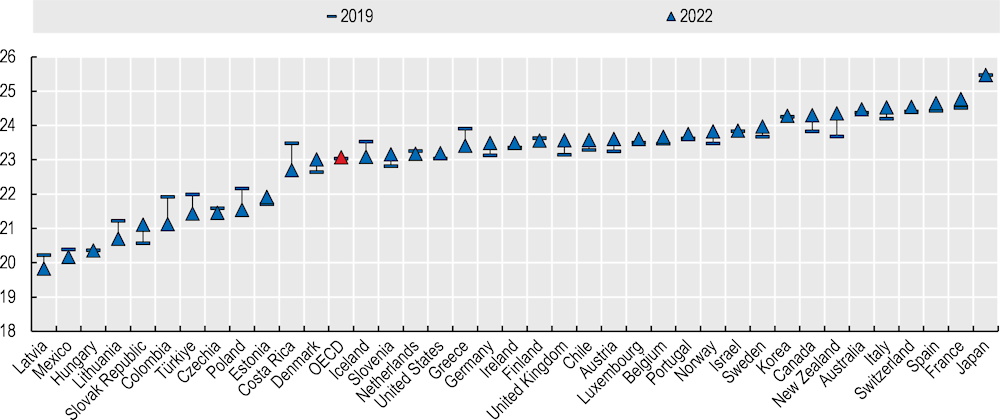

New long-term projections of old-age life expectancy do not factor in any significant impact of COVID‑19. The United Nations’ 2022 projections of life expectancy at age 65 for the period 2050‑55 are stable on average across OECD countries compared with projections made before COVID‑19 (Figure 1.1). However, the new projections of remaining life expectancy at age 65 are at least half a year higher for New Zealand and the Slovak Republic, while they are at least half a year lower in Colombia, Costa Rica, Lithuania, Poland and Türkiye. As a result, cross-country differences in projected life expectancy have increased between 2019 and 2022 as countries with below-average life expectancy projections in 2019 have been particularly prone to downward adjustments in the 2022 projections, although the adjustments are not correlated with excess mortality due to COVID‑19.

Figure 1.1. Projected remaining life expectancy at 65 for the period 2050‑55

Source: United Nations, Department of Economic and Social Affairs (2022). World Population Prospects, Online Edition.

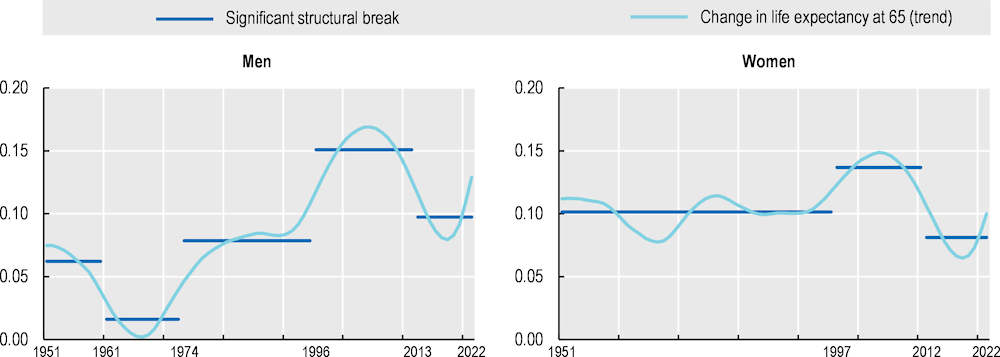

After a period of faster longevity growth between the mid‑1990s and the early 2010s, improvements in remaining life expectancy at age 65 have slowed significantly for both men and women in recent years. On average in all 38 current OECD countries, life expectancy at age 65 increased at a pace of around 1.5 years for men per decade and 1.4 years for women during that period of faster life‑expectancy increases (Figure 1.2). Since about 2012, this pace has slowed to 1.0 and 0.8 years per decade for men and women respectively, with the break in the trend being magnified by COVID‑19.

Figure 1.2. Life expectancy gains have been smaller over the last decade

Note: The breaks are significant at the 99% confidence level. To limit interferences from short-term fluctuations in change in period life expectancy, the breaks are estimated on the Hodrick-Prescott filtered trend series (lambda=100).

Source: See Chapter 6, Figure 6.4, https://stat.link/kqwb6l.

There are substantial inequalities in life expectancy between socio‑economic groups in all countries, whether based on occupation, income and education (Mosquera et al., 2018[4]; OECD, 2017[5]). Lifestyle factors, in particular smoking, play an important role in explaining for example educational differences in life expectancy (Mackenbach et al., 2019[6]), and educational attainment and life expectancy have some common determinants such as the socio‑economic status of the family one grew up in. Income redistribution from those dying early to those dying late is the core insurance function of pension systems. As low earners have a shorter life expectancy and thus receive benefits over a shorter period, this effect is regressive and thus it reduces the progressivity of pension systems.

Addressing longevity inequality is a challenge for pension policies. One theoretical solution would be to differentiate retirement ages by socio‑economic groups based on differences in life expectancy, but those groups would be very difficult to define in a practical way and implementation of differentiated rules would be very difficult (Deeg, De Tavernier and de Breij, 2021[7]). Hence, policy makers should take this inequality into account when determining benefit levels for low-income workers as large longevity gaps can justify high redistribution within the pension benefit formulae. However, when dealing with adequate measures to respond to rising longevity, it is not the existence of inequalities in life expectancy but changes in life expectancy gaps over time that matter most for the distributive impact of linking retirement ages to life expectancy (OECD, 2021[8]). If inequalities in life expectancy are broadly stable, this means that improvements in life expectancy tend to benefit the different socio‑economic groups equally.

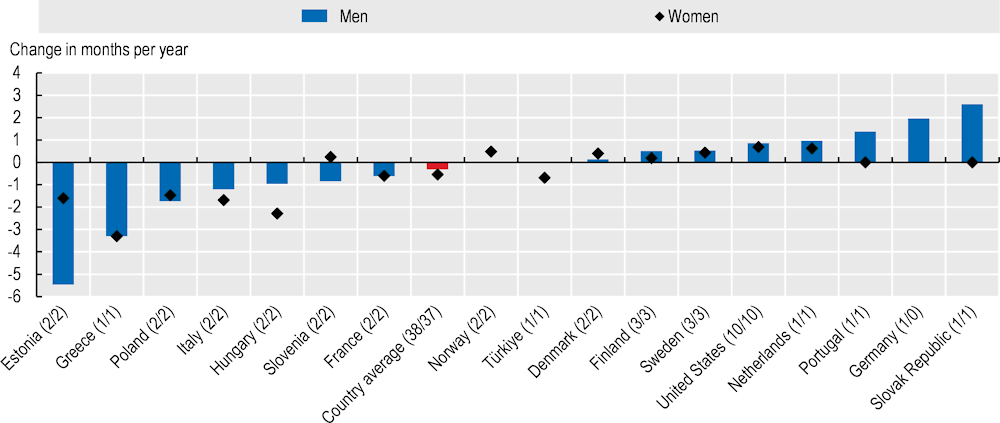

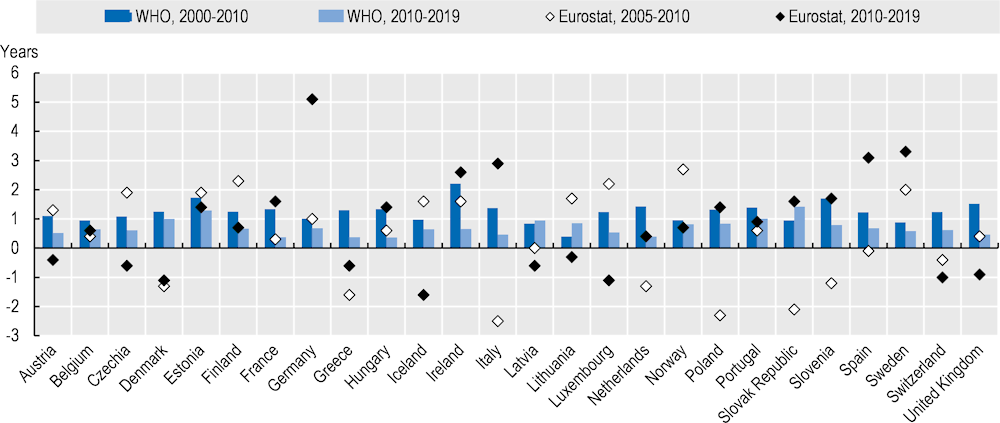

While socio‑economic inequalities in longevity are well-documented, the evidence on changes in these inequalities is mixed, varying across OECD countries and inequality measures. This updates and confirms the assessment in the previous edition of Pensions at a Glance (OECD, 2021[9]) based on accumulated evidence so far. Studies analysing how educational inequalities in life expectancy at age 60 or 65 evolve over time, show no general trend over time (Figure 1.3). There is wide evidence of a general trend of increasing inequalities in life expectancy in the United States (Crimmins and Saito, 2001[10]; Olshansky et al., 2012[11]; Solé-Auró, Beltrán-Sánchez and Crimmins, 2015[12]). Limited evidence for Germany suggests increasing educational inequalities among men between the mid‑1990s and around 2010 (Grigoriev and Doblhammer, 2019[13]) and in Portugal and the Slovak Republic between 2010 and 2017 (Eurostat, 2020[14]). The gap has shrunk sharply in Estonia especially among men, and to a lesser extent in Greece, Hungary, Italy and Poland, between 2007 and 2017 (Eurostat, 2020[14]). These estimated sharp changes should not be extrapolated as they are likely to be temporary: just like a decline in the gap of more than five months per year in Estonia and three months per year in Greece cannot be sustained, the sharp increases found by single studies in Germany and the Slovak Republic could only reflect a snapshot rather than a sustainable long-term trend.

Figure 1.3. No international trend in the evolution of the educational gap in life expectancy

Note: Study periods are weighted by the length of the period assessed so that an evolution in life expectancy assessed over a 10‑year period has double the weight of an evolution in life expectancy assessed over a five‑year period. There is no change in the gap over time for men in Norway (covered by two study periods) and Türkiye (one study period).

Source: Crimmins and Saito (2001[10]), ”Trends in healthy life expectancy in the United States, 1970-1990: gender, racial, and educational differences”, https://doi.org/10.1016/s0277-9536(00)00273-2; Eurostat (2020[14]), “Life expectancy by age, sex and educational attainment level (demo_mlexpecedu)”, https://ec.europa.eu/eurostat/databrowser/view/DEMO_MLEXPECEDU/default/table?lang=en; Gheorghe et al. (2016[15]), “Health inequalities in the Netherlands: trends in quality-adjusted life expectancy (QALE) by educational level”, https://doi.org/10.1093/eurpub/ckw043; Grigoriev and Doblhammer (2019[13]), “Changing educational gradient in long-term care-free life expectancy among German men, 1997-2012”, https://doi.org/10.1371/journal.pone.0222842; Insee (2016[16]), “Les inégalités sociales face à la mort”, https://www.insee.fr/fr/statistiques/1893092?sommaire=1893101; Olshansky et al. (2012[11]), “Differences In Life Expectancy Due To Race And Educational Differences Are Widening, And Many May Not Catch Up”, https://doi.org/10.1377/hlthaff.2011.0746; Solé-Auró, Beltrán-Sánchez and Crimmins (2015[12]), ” Are Differences in Disability-Free Life Expectancy by Gender, Race, and Education Widening at Older Ages?”, https://doi.org/10.1007/s11113-014-9337-6; Zarulli, Jasilionis and Jdanov (2012[17]), “Changes in educational differentials in old-age mortality in Finland and Sweden between 1971-1975 and 1996-2000”, https://doi.org/10.4054/demres.2012.26.19.

Based on the few studies analysing changes in occupational or income inequalities in remaining life expectancy at 60 or 65, it is not possible to exclude a potential widening of the occupational life‑expectancy gap. Change in occupational inequalities in life expectancy at 60 or 65, often measured as the difference between manual workers and professionals or managers, was only assessed for France (Cambois, Robine and Hayward, 2001[18]; Insee, 2016[16]), Germany (Kibele, Jasilionis and Shkolnikov, 2013[19]) and Sweden (Burström, Johannesson and Diderichsen, 2005[20]). In France, the occupational gap in remaining life expectancy has been stable over time for women and at most increased slightly for men – by about one week per year. In Germany, the gap increased by 1.5 months per year for men, whereas in Sweden it increased by one month per year for men and 0.4 months per year for women. One German study on income inequalities in life expectancy at 65 found that inequalities increased for both men and women between the early 1990s and the early 2010s (Lampert, Hoebel and Kroll, 2019[21]).

Including studies assessing remaining life expectancy also at younger ages, there is no clear trend in educational and occupational inequalities in life expectancy for most OECD countries. This is the case for Australia, Austria, Denmark, Finland, France, Greece, Hungary, Iceland, Israel, Korea, Mexico, the Netherlands, New Zealand, Norway, Portugal, the Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Türkiye and the United Kingdom. The lack of a clear trend can either be the consequence of inequalities having remained stable or of contradictory trends between studies or over time periods. Among studies assessing life expectancy around age 30, educational gaps did grow in Belgium during the 1990s (Deboosere, Gadeyne and Van Oyen, 2009[22]), in Canada from the mid‑1990s to around 2010 (Bushnik, Tjepkema and Martel, 2020[23]) and in Lithuania from 2001 to 2014 (Mesceriakova-Veliuliene et al., 2021[24]),2 while they have decreased in Czechia between 2010 and 2016 (OECD, 2013[25]; OECD, 2019[26]).

Different measures of healthy life expectancy

In the debate on increasing retirement ages as people live longer it is sometimes proposed to link retirement ages to healthy life expectancy instead of life expectancy as not all extra years are spent in good health. Retirement-age links should be based on a robust indicator to ensure that changes in retirement ages are predictable and that people can adjust their retirement expectations in time.

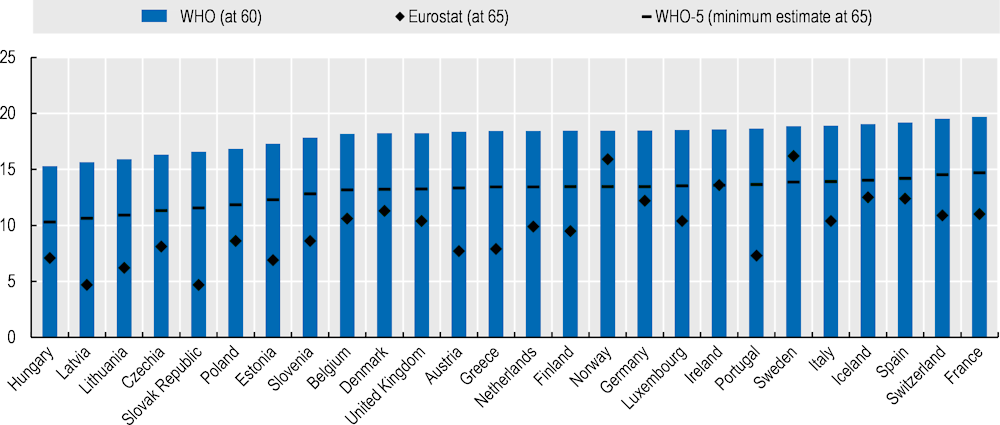

The World Health Organization (WHO) and Eurostat use different methodologies to produce estimates of healthy life expectancy.3 The WHO defines healthy life expectancy (HALE) as the average number of years in good health a person (e.g. at age 60) can expect to live based on current rates of ill-health and mortality. The WHO publishes estimates by age and sex based on the disability-adjusted life years (DALY) methodology.4 These estimates are produced from objective health data on 369 diseases and injuries gathered from a wide array of sources including among others censuses, household surveys, civil registration and vital statistics, disease registries and health service use (Vos et al., 2020[27]). Disability is not measured directly but estimated based on the expected disabling burden of conditions (Saito, Robine and Crimmins, 2014[28]).

Eurostat, on the other hand, defines healthy life years (HLY) as the number of remaining years that a person of specific age is expected to live without any severe or moderate health problems. Health problems are measured using the Global Activity Limitation Instrument (GALI) that is included in the annual EU Statistics on Income and Living Conditions (EU-SILC) survey. GALI is a single subjective question to assess health: “For at least the past six months, to what extent have you been limited because of a health problem in activities people usually do?”. Respondents can select one of the following options: severely limited; limited but not severely; and, not limited at all. Respondents are considered to be living without any severe or moderate health problems if they indicate not to be limited at all in performing usual activities (Eurostat, 2020[29]). The subjective nature of the indicator makes it unsuitable as a condition for automatic adjustments in pension policies such as retirement-age links for a number of reasons, including the need for reliable survey research with a large enough sample and the possibility for people to reply strategically to the survey question if they are aware that it can influence pension policy.

The WHO’s healthy life expectancy estimates are almost consistently higher than the ones produced by Eurostat. Numbers cannot be expected to be similar as the WHO calculates healthy life expectancy at age 60 while Eurostat analyses it at age 65, but based on the WHO estimate at age 60 a range of possible values at age 65 can be roughly estimated. The Eurostat estimates of healthy life expectancy at age 65 only fall in the range of possible WHO estimates for Ireland, Norway and Sweden (Figure 1.4).5 However, the Eurostat and WHO measures are correlated, with a linear correlation coefficient of 0.63.

Figure 1.4. WHO estimates higher healthy life expectancy than Eurostat

Note: Healthy life expectancy at 65 following the WHO calculation is likely to fall between the lines and the top of the blue bars. The top of the bar shows healthy life expectancy at age 60 (HLE60); the bottom shows HLE60 – 5. Hence, the bottom of the bar shows life expectancy at age 65 under the assumption that all life years between 60 and 65 are in good health. Eurostat data refer to 2018 for Iceland and the United Kingdom.

Source: Eurostat, Healthy life years by sex (HLTH_HLYE); WHO, Healthy life expectancy (HALE) at age 60 (WHOSIS_000007).

The WHO estimates show a stable growth in healthy life expectancy over time compared to Eurostat. According to the WHO calculations, all countries for which comparable data are available experienced growth in healthy life expectancy over both the first and the second decade of the 21st century (Figure 1.5). Eurostat estimates in contrast are less stable over time and show negative growth in 15 countries either between 2005 and 2010 or between 2010 and 2019 – or in both periods. For instance, in Denmark, the WHO calculated that healthy life expectancy grew by at least one year in each period, whereas Eurostat found a decrease of at least one year for both periods. The Eurostat measure changes a lot in an erratic manner over time for individual countries, potentially as a result of limited sample sizes.

The WHO indicator, while being more stable, provides little added value over measures of remaining life expectancy. The cross-country correlation between healthy life expectancy (as measured by WHO) and remaining life expectancy (as measured by UN) is very strong, with a linear coefficient of 0.95. Moreover, based on the WHO indicator, the share of remaining life expectancy people can expect to live in good health is remarkably stable across countries and over time. On average across the OECD, 76% of life expectancy at age 60 was in good health based on the WHO estimates in 2019, ranging from 71% in the United States to 78% in France, Israel and Japan. This share has remained stable since 2000 (OECD, 2023[30]). While the WHO measure may seem more robust, these limited cross-country differences are puzzling, which may suggest that the measure captures the reality only partially. Using the WHO measure for automatic links in pension policies would thus entail a complex procedure requiring more data and entailing a higher risk of errors than using remaining life expectancy, for little gain. Based on these estimates, retirement age links to life expectancy designed to keep the share of adult life spent in retirement constant (e.g. increasing the retirement age by two‑thirds of life‑expectancy increases) are unlikely to result in a shortening of healthy life expectancy at retirement.

Figure 1.5. WHO show more stable growth in healthy life expectancy over time than Eurostat

Note: Eurostat data refer to 2007 instead of 2005 for Switzerland and to 2018 instead of 2020 for Iceland and the United Kingdom. Eurostat data are imputed for Italy for 2010 as data are missing for that year but the estimates for 2009 and 2011 are the same.

Source: Eurostat, Healthy life years by sex (HLTH_HLYE); WHO, Healthy life expectancy (HALE) at age 60 (WHOSIS_000007).

Special rules for early starters

Some countries (see below) have introduced special rules for people who started working early as a way to account for inequalities in health and life expectancy. The reasoning is that those people have enjoyed fewer years of education and are unlikely to have a tertiary education degree, and therefore are more likely to perform physical labour or to work in hazardous environments, impacting their health and life expectancy. However, the analysis of such a scheme in France shows that mortality rates are not higher for people who retired through the early-starter scheme and that they in fact are in better health at retirement than people who retired in the general old-age pension scheme. A key explanatory factor is that early-starter schemes typically entail a long career requirement, so that only comparably healthy people can benefit from the scheme (Aubert, 2023[31]; Börsch-Supan et al., 2022[32]).

In most countries with special rules for early starters, early retirement rules are relaxed for this group. Denmark legislated a new flat-rate benefit in 2020 allowing people to retire early as of 2022. Access to the benefit requires between 42 and 44 years worked or credited between age 16 and six years before the statutory retirement age, resulting in between 1 and 3 years of early retirement, respectively. With the statutory retirement age currently at 67, the scheme can only be accessed by people who started working between age 16 and 19. In 2022 the benefit was equal to 35% of gross average earnings. France allows people who started working before age 16, 18, 20 and 21 to retire at age 58, 60, 62 and 63, respectively, on the condition of having a full career, which is increasing from 42 to 43 years (see Recent pension reforms). Italy allows people who worked at least 12 months before age 19 to retire after 41 years worked. In Luxembourg, early old-age pension is in principle available as of age 60 for people with a career of at least 40 years worked or credited with study years between age 18 and 27 counting as periods credited. However, early retirement is accessible already as of age 57 for people who effectively worked for 40 years. Hence, the scheme requires labour market entry before age 20. Slovenia allows men to retire two years earlier and women three years earlier if they started to pay contributions before age 18 and have a 40‑year career.

Germany and Portugal allow for early retirement without a penalty for early starters. In Germany, people can access early retirement without a penalty between 2 and 2.5 years (depending on year of birth) before the statutory retirement age in case of a 45‑year career. For birth cohorts until 1952 this required entering the labour market latest at age 18; from the 1964 cohort it will require entering latest at age 20. Portugal allows people to access early retirement without a penalty after a 48‑year career or after 46‑year career with contributions first paid before age 17. In addition, for people who paid 40 years of contributions by age 60 – requiring labour market entry latest at age 20 –, old-age benefits are accessible without penalty four months earlier for each extra year contributed after 40 years of contributions, but not before age 60.

Austria and Switzerland treat years worked before age 20 in a special way although it does not grant access to early retirement. Austria provides a bonus to people who worked at least for one year before age 20. The bonus equals EUR 1 per month for each month worked before age 20 with a maximum of 60 months, corresponding to a monthly benefit of between EUR 12 and EUR 60. The bonus was introduced in 2022 to replace an early retirement scheme and is meant to improve pension adequacy of people who started early as they often have low pension build-up in their first years of employment. In Switzerland, the pension calculation in principle only accounts for contributions made as of age 20, but contributions paid between age 17 and 19 can be used to compensate up to three years of missing contributions later in the career.

In contrast to special rules for people who entered the labour market early, some countries credit periods of education in pension build-up. This is a regressive policy as it strengthens the pensions of those who can expect to live longer and to do so in good health. A few OECD countries credit study periods. Germany credits up to eight years of studies from age 17, and Luxembourg credits all study years between age 18 and 27. Finland credits three to five years depending on the type of study, and in Sweden period are credited for students receiving certain types of government support such as study grants. Three countries abolished crediting new study periods but will still pay pensions based on credited study periods for decades to come: Czechia credits secondary education that took place before 1996 and tertiary education that took place before 2010; Hungary credits vocational and higher education study years before 1998 with the number of years credited depending on the type of study; and the Slovak Republic credits secondary and tertiary education as of age 16 that took place before 2004. In addition, study periods can be purchased in nine OECD countries, either through schemes that allow a certain number of years of education to be purchased (Austria, Belgium, Greece, Hungary, Italy and the Slovak Republic), or through a general purchase option (Czechia, Slovenia and the United Kingdom). Japan and Switzerland stand out as the only countries where students have to pay mandatory contributions as of age 20.

Still increasing employment of older ages throughout COVID‑19

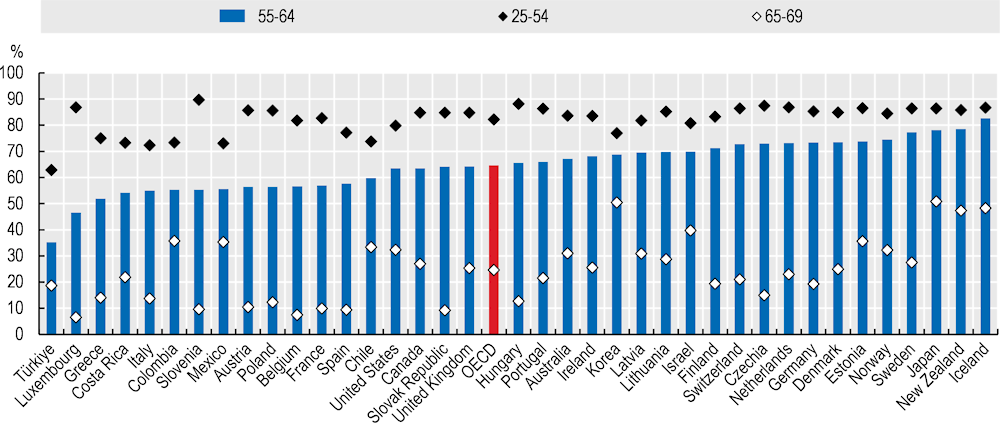

The employment rate of older age groups is well below that of prime‑age workers. On average across the OECD, 64.6% of people aged 55‑64 and 24.7% of those aged 65‑69 are in employment, compared to 82.2% of those aged 25‑54 (Figure 1.6). Less than half of people in the age group 55‑64 are in employment in Luxembourg and Türkiye, compared with more than three‑quarters in Iceland, Japan, New Zealand and Sweden. In the age group 65‑69, fewer than one in ten are employed in Belgium, France, Luxembourg, the Slovak Republic, Slovenia and Spain against around half in Iceland, Japan, Korea and New Zealand. Moreover, in Iceland, Japan, Korea, New Zealand, Norway and Sweden the gap in employment rates between people aged 55‑64 and those aged 25‑54 is 10 percentage points. or less. That gap is between 25 and 30 percentage points in Austria, Belgium, France, Poland and Türkiye, and it is even larger in Luxembourg and Slovenia.

Figure 1.6. Employment rates for older adults lag behind those of prime‑age individuals

Source: OECD Labour Force Statistics, Australian Bureau of Statistics table LM9 for Australian employment rates 65‑69.

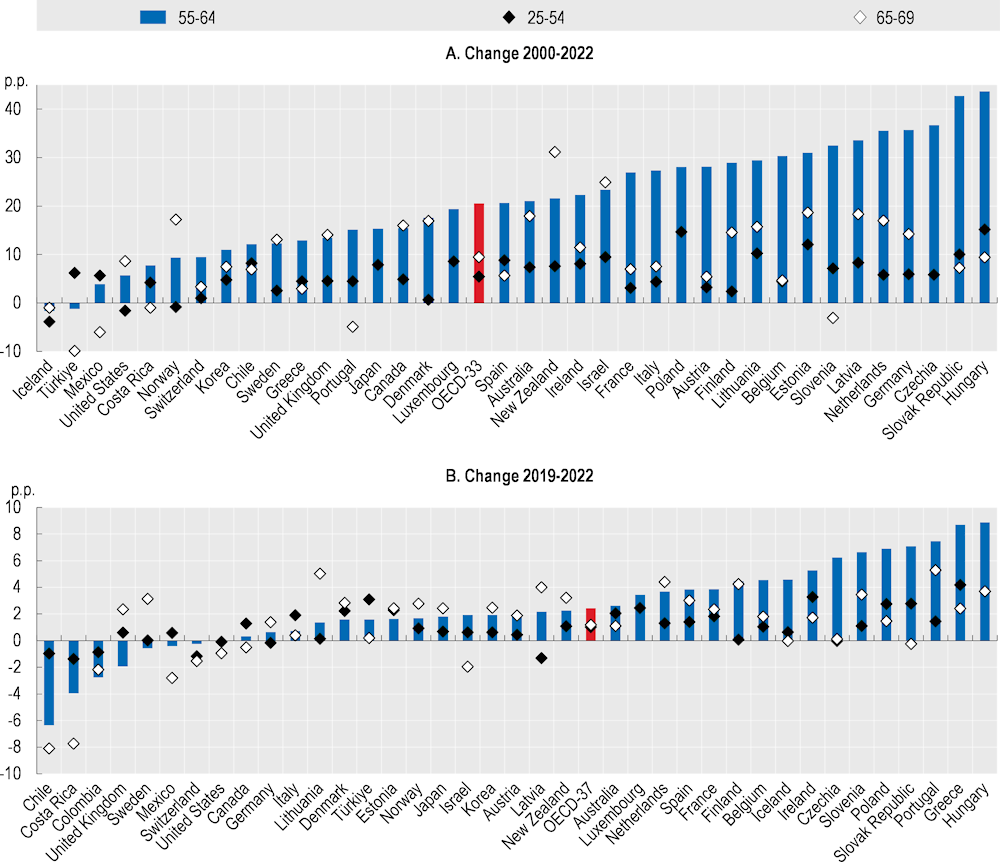

However, the situation has sharply improved over the last decades. Since 2000, the employment rates of older individuals have substantially increased in most OECD countries. Across the 33 OECD countries for which data are available for the entire 2000‑22 period for all age groups, the employment rate among 55‑64 year‑olds grew by 20.5 percentage points (Figure 1.7, Panel A). The increase exceeded 40 percentage points in Hungary and the Slovak Republic, which had employment rates around half of the OECD average at the start of the period and have basically closed the gap in 2022.6 Among the 65‑69, the employment rate grew by 9.4 percentage points on average across the 33 OECD countries.

The impact of the COVID‑19 pandemic has not reversed the trend of increasing employment at older ages. Concerns over a permanent reduction of labour supply (“great resignation”) have not materialised (OECD, 2023[33]), despite some concrete evidence of increasing inactivity among older individuals in some OECD countries in the initial stages of the pandemic. The employment rates for the age groups 55‑64 and 65‑69 grew by 2.4 percentage points and 1.2 percentage points, respectively, compared to 1.0 percentage points among people aged 25‑54, between 2019 and 2022 on average (Panel B). Among the 55‑64, the increase was particularly strong in Greece and Hungary whereas Finland, Latvia, Lithuania, the Netherlands and Portugal saw substantial increases in employment among the 65‑69 age group. However, the COVID‑19 pandemic and its economic impact did result in declining employment rates in some countries in particular in Latin America, with declines of more than 1 percentage point for the age group 55‑64 in Chile, Colombia, Costa Rica and the United Kingdom, and for the age group 65‑69 in Chile, Colombia, Costa Rica, Israel, Mexico and Switzerland.

Figure 1.7. Most OECD countries have resumed the pre‑COVID trend of growing employment at older ages

Note: In Panel A, Czechia, Japan, Luxembourg and Poland are not included in the average as no data are available for the 65‑69 age group; Colombia is not included as no data are available for all age groups for the year 2000. In Panel B, Luxembourg is not included in the average as no data are available for the 65‑69 age group.

Source: OECD Labour Force Statistics, Australian Bureau of Statistics table LM9 for Australian employment rates 65‑69.

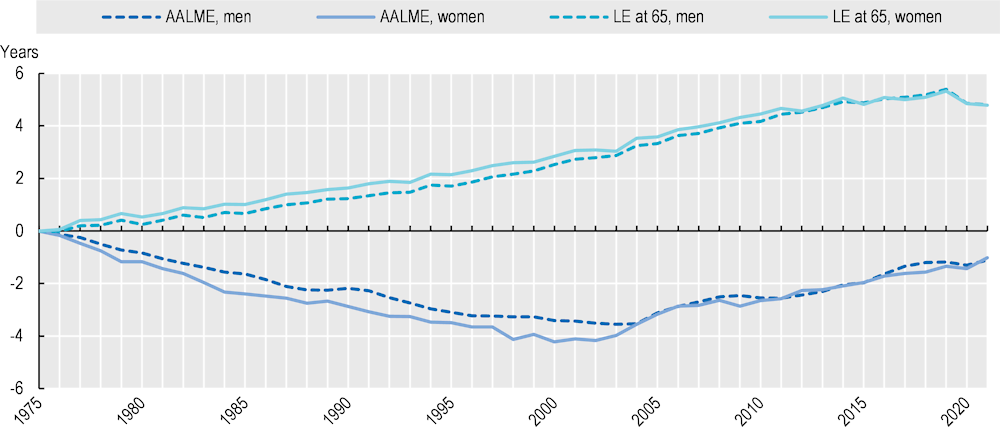

Combining long-term trends in life expectancy and labour market exit age suggests that health is currently not a key obstacle to higher participation rates at older ages. People on average still leave the labour market at an earlier age than in 1975 despite strong increases in life expectancy. With the exception of the impact of the COVID‑19 pandemic in 2020, life expectancy at age 65 has been increasing steadily since 1975, by 5.3 years in total for both men and women by 2019, before dropping by half a year for both sexes in 2020 (Figure 1.8). At the same time, labour market exit ages had drifted lower until the turn of the millennium. Across 25 OECD countries for which data are available for the entire time series, men and women left the labour market 3.4 and 4.2 years earlier, respectively, in 2000 than in 1975. After a couple of years of stability in the average age of labour market exit, the trend was reversed in the first half of the 2000s and people on average have been gradually exiting the labour market later, and in total by 2.3 years for men and 3.2 years for women since 2000. Since the mid‑2000s, the labour market exit age has increased roughly at the same pace as remaining life expectancy at age 65.

Figure 1.8. Average time in retirement from the labour market increased substantially since 1975

Note: Average of 25 OECD countries for which data on effective age of labour market exit and life expectancy at the age of 65 are available for both men and women for all years in the period 1975‑2021. Due to missing data, Austria, Canada, Chile, Colombia, Costa Rica, Germany, Ireland, Israel, Latvia, Lithuania, Slovenia, Türkiye and the United Kingdom are not included in the OECD average.

Source: OECD calculations.

Pensioners’ income security and inflation

The COVID‑19 pandemic, Russia’s war of aggression against Ukraine and adjustments of macroeconomic policies have triggered an inflation wave felt across the globe. While energy prices are declining since the end of 2022 and food price inflation has slowed down since spring 2023, core inflation (excluding food and energy) remains at an elevated level. Inflation has not hit all OECD countries equally, as Japan and Switzerland saw consumer prices increase by only 6% between January 2021 and August 2023, whereas Colombia, Czechia, Estonia, Hungary, Latvia, Lithuania, Poland and the Slovak Republic experienced price increases of between 25% and 40% over the same period. In Türkiye, the CPI even more than tripled over the same period. People facing increasing expenditures due to inflation are affected if their incomes are not adjusted at a similar pace in a timely manner. The extent to which older people are exposed to a potential loss in purchasing power thus depends on pension indexation mechanisms and their effective application. These mechanisms vary greatly across OECD countries as well.

Older people’s consumption patterns and inflation

The inflation surge since 2021 has increased expenditures somewhat more for older people than for others in many countries. As older people tend to have lower incomes than the total population in most OECD countries, they tend to spend a larger share of their budgets on energy and food. Yet, not all older people were affected in the same way: the impact of inflation differs substantially between older people themselves according to French data, with a higher variation in cost-of-living increases than for any other age group (Insee, 2023[34]). Certainly not all older people have thin budgetary margins to absorb price increases. Older people generally dissave at a much slower pace than the life‑cycle model would imply, with a substantial part of older people even continuing to accumulate savings in retirement (Horioka and Ventura, 2022[35]; Niimi and Horioka, 2019[36]). In the majority of OECD countries studied in Causa et al. (2022[37]), inflation has had a bigger negative effect on the expenditures of older people relative to those of middle‑aged people.7

Beyond lower incomes, some structural factors explain why inflation had a bigger impact on older people’s cost of living. Increasing food prices8 and, in particular, heating costs have weighed on older people’s budgets. In France, for instance, heating accounts for 3% of expenditures of people younger than 30, compared to 6% for people aged 60‑74, and about 9% for those aged 75+ (Insee, 2023[34]), while in Ireland, energy costs accounted for 49% of the cost-of-living increase of people aged 65+ in December 2021, compared to 35% for people younger than 35 (Lydon, 2022[38]). Related to the high home‑ownership rates among older people (Cournède and Plouin, 2022[39]), people often stay in the same family home after the children moved out and even after losing their spouse. Not only do older people lose economies of scale on heating expenses as a result of staying in their homes, these older homes are often also less energy efficient (European Construction Sector Observatory, 2019[40]) and more likely to use heating systems based on fossil fuels (Insee, 2023[34]).9 The large heterogeneity in the energy efficiency of older people’s dwellings and in the types of energy sources they use for heating contribute to the higher variation in impact of inflation among older people compared to other age groups.

Inflation disparities between urban and rural areas also contribute to variation in inflation across age groups in most OECD countries as older people live relatively more often in rural areas (OECD, 2022[41]). On average across 10 OECD countries, for instance, the difference in the loss of purchasing power between rural and metropolitan areas was bigger than between the lowest and the highest income quintile over the period between August 2021 and August 2022 (Causa et al., 2022[37]).

Indexation rules and pensioners’ exposure to inflation shocks

While the cost of living has risen faster for older people than for other age groups in many countries, pensioners may still be less affected in terms of purchasing power thanks to the indexation of pension benefits. Indexation mechanisms vary significantly across countries and across pension schemes within countries. The extent to which indexation prevented a real income loss among retirees depends on whether pensions are indexed to prices or another indicator such as wages, as well as on the timing of adjustments and the reference periods they are based on.

Price versus wage indexation

During a surge in inflation resulting from a negative supply shock, price indexation provides better protection against a drop in standards of living than wage indexation. While price indexation is meant to stabilise the purchasing power of retirees, in normal times wage indexation generates greater benefits over time as productivity gains translate in positive real-wage growth. However, with a sudden increase in prices and falling real wages, wage indexation does not protect the purchasing power of pensioners and price indexation becomes more costly than initially anticipated for public finance or pension providers more generally: the ongoing episode of high inflation thus reverses the standard way of thinking about pension indexation (OECD, 2022[42]).10

Price indexation may even have overcompensated pensioners in some countries. First, pensioners may have been compensated twice for high energy prices, first via energy cheques and subsequently via price indexation of pensions. Second, average price inflation may have effectively been lower than indicated by CPI in countries where fixed-price or regulated energy contracts are commonplace. Indeed, at any given moment, CPI accounts for how much an average household would pay for energy if it were to sign a new energy contract today. When there is a temporary jump in energy prices, this is fully reflected in the index even if it does not affect those households with a fixed-price energy contract. For instance, in Belgium, the CPI indicates that energy was 81% more expensive in 2022 compared to 2018, whereas the average energy bill was estimated to be only 17% higher – the difference is only partially explained by reduced energy consumption. The overestimation of the price most people pay for energy would result in an overestimation of CPI by 3.3% on average over the whole of 2022 (Peersman, Schoors and van den Heuvel, 2023[43]). Similarly, in the Netherlands, year-on-year inflation would have been around half the official number for several months throughout 2022 if fixed-price contracts were accounted for (Statistics Netherlands, 2023[44]). Hence, Statistics Netherlands has decided to adjust its CPI calculations as of June 2023 to account for people with fixed-price contracts. However, these effects are temporary as CPI inflation is likely to underestimate price increases when energy prices come down, as some consumers will be locked in energy contracts with a higher fixed price.11

Price indexation is the most common form of indexation of pensions in payment across OECD countries, in particular for targeted benefits (Table 1.1). Targeted benefits are adjusted to prices in 21 OECD countries, basic pensions in four (out of 17) countries and earnings-related pensions in 18 countries. Japan adjusts basic and earnings-related pensions below prices when the number of active contributors to the pension scheme declines. Price indexation is typically based on the consumer price index (CPI), although some countries deviate from this standard.12 The Slovak Republic indexes both targeted and earnings-related pensions to a pensioner-specific cost-of-living index, and Czechia will do so as well for the price component in its mixed indexation of earnings-related pensions as of 2025 – it currently uses highest of either CPI or a pensioner-specific cost-of-living index, as does Australia for its targeted pensions.13 Spain reintroduced price indexation in November 2021, effective as of 2022, after the previous adjustment mechanism resulted in a decline in pensions in real terms several years in a row (OECD, 2021[8]).

Several countries index pensions in payment to prices, and in addition, partially or fully, to real-wage growth if positive. Within the OECD, 5 countries do so in their targeted scheme, 4 in their basic scheme and 4 in their earnings-related scheme.14 Israel, Luxembourg and the United Kingdom adjust all their public pensions to the highest of either price or wage growth, with the latter applying in addition a minimum increase of 2.5% as part of the triple lock that was temporarily suspended in 2022 (see below). Czechia, Latvia and Poland index their earnings-related pensions fully to prices and in addition partially adjust to the growth rate of real wages (Czechia, Poland) or the real wage bill (Latvia) if the latter is positive. The targeted pension in Australia15 and the basic pension in New Zealand are indexed to prices but are in practice over time adjusted to wages as their lower-bound level is defined relative to wages.

Finally, some OECD countries index pensions in payment to a mix of price and wage growth. Estonia, Switzerland and Norway since its 2022 pension indexation reform 16 combine partial indexation to CPI with partial indexation to nominal wages (Norway, Switzerland) or the wage bill (Estonia) in all their public pension schemes; Finland and Slovenia do so in their earnings-related scheme and Germany in its targeted scheme.

Table 1.1. Overview of OECD countries by way of indexing pensions in payment

|

Less than prices |

Prices |

At least prices |

Mix of prices and wages |

Wages |

Less than wages |

Discretionary |

||

|---|---|---|---|---|---|---|---|---|

|

CPI or similar |

100% prices + x% real wages if positive |

Highest of prices or wages |

Part prices, part wages (%p+%w) |

Avg. wage or similar |

||||

|

TARGETED BENEFITS |

||||||||

|

0 |

21 |

5 |

4 |

3 |

0 |

4 |

||

|

AUT |

JPN |

AUS |

CHE (50+50) |

DNK |

COL |

|||

|

BEL |

KOR |

GBR (or 2.5%) |

DEU (70+30) |

LVA |

CRI |

|||

|

CAN |

LTU |

ISL |

EST (20+80, wb) |

NLD |

CZE |

|||

|

CHL |

POL |

LUX |

NOR (50+50) |

IRL |

||||

|

ESP |

PRT |

NZL |

||||||

|

FIN |

SVK |

|||||||

|

FRA |

SVN |

|||||||

|

GRC |

SWE |

|||||||

|

HUN |

TUR |

|||||||

|

ISR |

USA |

|||||||

|

ITA |

||||||||

|

BASIC PENSIONS |

||||||||

|

1 |

4 |

4 |

2 |

4 |

0 |

2 |

||

|

JPN |

CAN |

ISR |

GBR (or 2.5%) |

EST (20+80, wb) |

CZE |

IRL |

||

|

GRC |

KOR |

ISL |

NOR (50+50) |

DNK |

MEX |

|||

|

LUX |

LTU (wb) |

|||||||

|

NZL |

NLD |

|||||||

|

EARNINGS-RELATED PENSIONS |

||||||||

|

1 |

18 |

4 |

5 |

2 |

1 |

0 |

||

|

JPN |

AUT |

HUN |

CZE (50%) |

LUX |

CHE (50+50) |

DEU |

SWE |

|

|

BEL |

ITA |

LVA (wb, 50‑80%) |

EST (20+80, wb) |

LTU (wb) |

||||

|

CAN |

KOR |

POL (20%) |

FIN (80+20) |

|||||

|

CHL |

MEX |

NOR (50+50) |

||||||

|

COL |

NLD |

SVN (40+60) |

||||||

|

CRI |

PRT |

|||||||

|

ESP |

SVK |

|||||||

|

FRA |

TUR |

|||||||

|

GRC |

USA |

|||||||

Note: The Statlink contains a more detailed overview of OECD countries’ pension indexation policies. FDC annuities are not included with the exception of Chile and Mexico where CPI indexation is mandatory for FDC annuities. Wb = wage bill. Some countries indexing to prices do not use the (full) CPI but use similar metrics. This includes alternative cost-of-living measures (Australia, the Slovak Republic and the United States, as well as Japan for targeted benefits), CPI measures where certain types of goods are removed from the basket (Belgium, France and Portugal), and measures where indexation in principle follows CPI but can be higher or lower depending on other metrics (the Netherlands and Portugal). The targeted pension in Australia and the basic pension in New Zealand are indexed to prices but in practice adjust to wages over time as they cannot fall below a certain percentage of average earnings (see Statlink for more information). In Austria, Italy, Latvia and Portugal, full price indexation is only applied for pensions below a certain threshold. In Canada, indexation is frozen if there is a projected deficit in the pension system and a political agreement on how to restore long-term financial sustainability cannot be reached, although this has so far never happened. Czechia will reduce the wage‑growth component in indexation of earnings-related pensions from 50% to 33.3% from 2025. Since 2023, the targeted benefit in Germany is additionally adjusted to full price inflation over the last year as a proxy for inflation over the current year, although this supplementary adjustment in the current year is not taken into account in the calculation of the benefit in the next year. Greece adjusts pensions to less than CPI if real GDP declines. Japan indexes earnings-related and basic pensions to the wage bill until age 67, and applies price indexation as of age 68. Ireland currently adjusts targeted and basic pensions on a discretionary basis but is expected to introduce indexation following a smoothed-earnings method.

Some countries only apply full indexation to low pensions and index pensions above a certain threshold at a lower rate or not at all. This is the case in Austria, Colombia,17 Italy,18 Latvia19 and Portugal. While Colombia, Latvia and Portugal20 have clear rules about the thresholds above which pensions are adjusted at a lower rate than prices, these thresholds change very regularly in Austria and Italy resulting in quasi-discretionary indexation.

More than half of OECD countries tend to protect earnings-related pensions fully from inflation shocks. These include countries where earnings-related pensions are fully indexed to prices – CPI or similar, 100% prices plus real-wage growth if positive, highest of prices or wages (Table 1.1, columns “Prices” and “At least prices”). However, whether price‑indexed pensions are adjusted quickly after the shock or with some delay resulting in a temporary loss of purchasing power depends on timing aspects of indexation mechanisms, which are discussed below. A few countries index pensions in payment to a mix of prices and wages or fully to wages, which should enable catching up over time as positive real-wage growth tends to generate higher indexation than prices in the long term.

Timing and reference periods for adjustments

Pension indexation mechanisms’ ability to maintain the real value of pensions throughout the inflation shock also depends on various timing aspects of the mechanisms, including adjustment frequency, smoothing and the time between the reference period and indexation.

There are two general approaches to the timing of adjustments: fixed-frequency and fixed-threshold indexation. Almost all OECD countries apply fixed-frequency indexation, typically indexing once per year in a specific month, most often January. Australia, Hungary, the Netherlands and Türkiye index twice per year, Canada’s targeted pension is indexed quarterly and the annuities in Chile’s FDC scheme are even adjusted on a monthly basis. By contrast, Switzerland only indexes its earnings-related pensions every two years and Poland indexes its targeted benefits only every three years.21 Facing similar lags, Latvia has recently decided to increase the frequency of adjustments of its targeted benefit and minimum pension from every three years to annually from 2024.

Belgium and Luxembourg do not adjust at fixed times but instead when an index exceeds a certain level (fixed-threshold indexation), and several other countries use fixed-threshold indexation as a secondary indexation mechanism to protect pensioners at a time of high inflation. In Belgium, pensions are increased by 2% whenever the CPI index exceeds the level it had at the time of the previous indexation by 2%. Luxembourg has the same rule in steps of 2.5% and combines it with fixed-frequency indexation for adjustments to real-wage growth, although indexation was temporarily suspended (see below). Several countries supplement fixed-frequency indexation with fixed-threshold indexation with higher thresholds than the ones used in Belgium and Luxembourg to provide income protection to pensioners at times of exceptionally high inflation: Chile for its targeted scheme (fixed threshold of 10%), Czechia and, since 2023, the Slovak Republic (5%) and Switzerland (4%). Czechia deviated from this rule in 2023 (see below).

Smoothing is a useful tool to avoid that indexation is too much affected by month-to-month fluctuations in prices or wages, but long smoothing periods also delay the adjustment after an inflation shock. Most OECD countries smooth adjustments over 12‑month periods.22 This is the case for pension schemes in Austria, Denmark, France, Germany, Greece, Hungary, Italy, Latvia, Norway, Poland, Portugal, Slovenia, Spain and Sweden, as well as Canada’s mandatory earnings-related scheme and Lithuania’s targeted scheme. Schemes in Chile, Czechia, Estonia, Israel, New Zealand, Switzerland, Türkiye and the United Kingdom do not apply any smoothing, and merely compare the index in a single month to the index in another month. Other countries apply smoothing over three months (Canada, Finland and the United States), four months (Belgium) or six months (Australia, Luxembourg and the Slovak Republic). Lithuania is an absolute outlier smoothing wage‑bill growth over seven years in its contributory pension scheme.

Timely adjustment matters as the gap between the end of the reference period and the pension adjustment taking effect contributes to pensioners temporarily losing purchasing power when inflation accelerates. For most countries pensions are adjusted three or four months after the end of the assessment period. However, for some it is substantially longer: six months in Austria, seven months in Czechia, Germany23 and the United Kingdom and for the Swedish targeted scheme, and even a full year in Denmark and two years in Latvia’s targeted scheme.24 By contrast, in Belgium, Israel, Luxembourg and Türkiye, pensions are adjusted in the month after the end of the assessment period, and the gap is two months in France and Spain as well as for the earnings-related scheme in Mexico. Slovenia indexes earnings-related pensions two months after the end of the assessment period, but the adjustment is applied retroactively starting from the previous month.

Finally, some countries index pensions based on projections of how inflation or wages will develop over the current year; they implement corrections afterwards to adjust for the difference between projected and observed changes.25 Hungary indexes in January to the projected annual change in CPI, with a retroactive correction from January applied in November. Italy similarly indexes to the projected CPI inflation but implements the correction together with next year’s January indexation. The Netherlands adjusts its basic and targeted schemes based on the projected increase in minimum wages set in collective bargaining over the current year. In both January and July, indexation equals 50% of the projected increase for the current year, plus a correction of the gap between projection and effective evolution over the last six months. Finally, Sweden indexes to projected wage growth minus 1.6% and Norway now to a mix of projected wage growth and price inflation for the current year, while correcting for differences between effective and projected changes in the past year.

A surge in inflation may create early-retirement incentives depending on indexation rules, in particular when pensions in payment are indexed (mostly) to prices whereas past earnings are either not uprated around the time of retirement or uprated based on wages. In those cases, there is an incentive to retire early and benefit from a high first indexation of the pension in payment to prices. In Finland, for instance, past earnings are uprated based on 80% wages and 20% prices whereas pensions in payment are indexed to 20% wages and 80% prices. Hence, it was financially beneficial to retire at the end of 2022 rather than at the beginning of 2023 as high inflation has created an incentive to retire as long as price inflation persists and wages lag. As a result, the number of people claiming a pension increased sharply in the autumn of 2022. In particular in December, the number of new pension claimants bounced to very high levels compared with the monthly average for both old-age and partial old-age pensions (Finnish Centre for Pensions, 2023[45]). Similarly, in Austria, in the calendar year of retirement, past earnings are not uprated and pensions are not indexed, while pensions are indexed on a pro-rata basis in the year after retirement depending on the exact month one retired. After the inflation shock, these rules generated an incentive to retire early and receive the full price indexation in the year after retirement; they were subsequently revised.

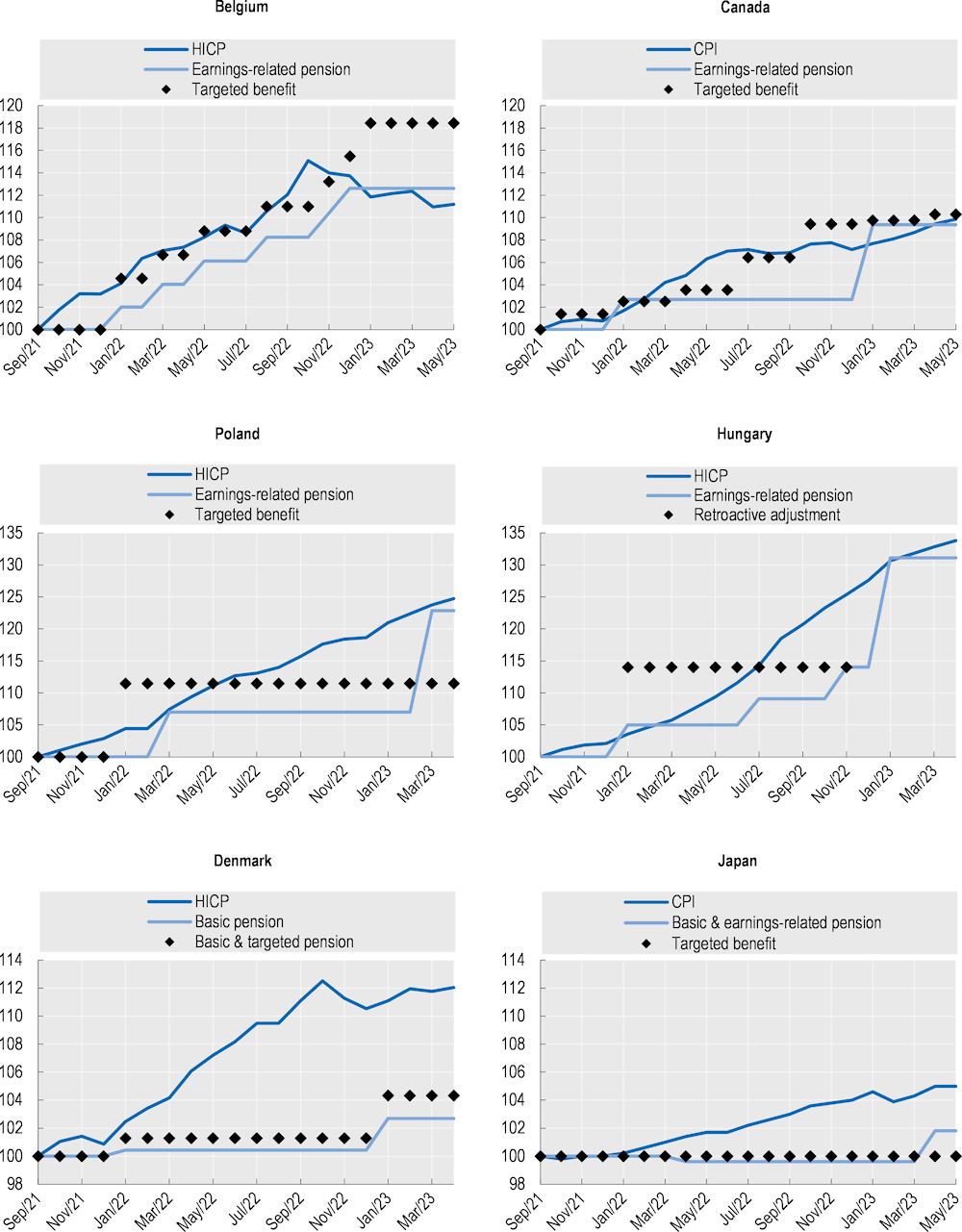

In sum, the impact of inflation on the purchasing power of pensioners is very dependent on the characteristics of the indexation mechanism. Figure 1.9 illustrates this with developments recorded in six countries. In Belgium, where indexation is based on a fixed threshold of 2% as discussed above, there were six indexations between September 2021 and May 2023. This resulted in earnings-related pensions rising roughly at the same pace as inflation overall and with limited lags. Targeted benefits grew even faster due to some previously scheduled supplementary benefit increases taking effect over this period (Figure 1.9). In Canada, targeted and earnings-related pensions are indexed to CPI on a quarterly and annual basis, respectively. The more frequent adjustment of targeted benefits provided better protection of purchasing power throughout the inflation surge.

In Poland earnings-related pensions recorded steadily growing losses in real terms between April 2022 and March 2023 due to the sharp rise in consumer prices, but once pensions were adjusted in March 2023 their value caught up again. Hungary faced an even steeper increase in prices. Hungary adjusts pensions at the start of the year to projected CPI inflation for that year, and then applies corrections throughout the year as needed. These corrections are applied retroactively from January through lump-sum payments covering the difference between the initial and the corrected benefit level. This projection-based approach is complex and not well suited to deal with sharp price increases: inflation for the year 2022 was severely underestimated in the January indexation and even after a supplementary correction in July. However, the November adjustment and its retroactive implementation has resulted in pensions being fully adjusted to 2022 inflation.

Denmark and Japan have been much less successful in upholding pensioners’ purchasing power in the short term. As Denmark combines wage indexation with smoothing over a full year and a one‑year gap between the end of the reference period and indexation taking effect – pensions are indexed to the change in average wage between the third and the second year before indexation –, all aspects of its indexation mechanism result in a delayed response in case of an inflation shock and pensioners’ incomes falling behind. This resulted in pensioners losing significant purchasing power over a longer period of time, although wage indexation will ultimately provide higher benefits as wage growth usually exceeds price growth. In Japan, pensions have also not kept up with price increases over this period – although the increase in inflation has been less steep than in other OECD countries. Basic and earnings-related pensions are indexed to less than prices which results in pensions losing value in real terms. Targeted benefits, which are only adjusted every five years, were not adjusted at all over this period.

Figure 1.9. Different types of pension indexation and their impact

Note: HICP = harmonised index of consumer prices. For Hungary, additional indexations throughout the year are retroactively applied from January.

Source: OECD Consumer Price Indices database; OECD calculations based on information provided by Member States.

Deviations from pension rules

In addition to the permanent changes in indexation rules in Norway and Spain (see above), several countries applied temporary deviations from their standard indexation rules since September 2021 (Table 1.2). Norway, Poland, Portugal and Spain increased low pensions above what the indexation rule would have required as CPI underestimated the cost-of-living increase for low-income people during the inflation shock. Norway increased its targeted benefits by 1.72% above regular indexation in January 2023. Poland adjusted earnings-related pensions following the general indexation rule in March 2023, but set a minimum flat-rate increase of 8.6% of the average pension26 so that lower pensions were increased at a higher rate than inflation. Similarly, Portugal followed the general indexation rule but increased pensions by at least EUR 10 in 2022.27 In Spain, on top of the re‑introduction of price indexation on contributory benefits at the end of 2021 (see Recent pension reforms), non-contributory benefits were increased by 6.5% above inflation in January 2023. Finally, Lithuania, Slovenia and Türkiye increased all earnings-related pensions by more than the rule required. Lithuania, adjusting earnings-related pensions to wage‑bill growth, implemented a supplementary 5% indexation in June 2022 to help people cope with the inflation surge. Slovenia increased earnings-related pensions in January 2022 by between 1.0% and 3.5% depending on the date the pension was claimed. Türkiye increased pensions by 30% in January 2023 ahead of the elections, exceeding the 16.5% adjustment The indexation rule would have required.

Czechia, Italy and the United Kingdom adjusted pensions at a lower rate than the index required (Table 1.2). In Czechia, the supplementary fixed-threshold indexation rule would have triggered an indexation of 11.5% in June 2023,28 but due to its budgetary impact the rule was deviated from and an indexation of 2.3% plus a fixed sum of around 1.6% of the average pension was implemented instead. Italy applies reduced indexation to higher pensions. Finally, the United Kingdom temporarily suspended the triple‑lock mechanism in 2022. In 2021, pensions were increased by 2.5% given yearly (as of September 2020) low inflation and negative wage growth. As COVID‑19 restrictions were eased and wages rebounded in 2021, pensions would have had to increase by around 8% in 2022 if the triple lock was upheld. Due to the suspension, pensions were instead indexed in line with inflation (3.1%).

Some countries also adjusted the timing of indexation, with Finland, France and Latvia advancing indexation and Luxembourg and Portugal postponing it. Finland in principle indexes its targeted pension benefit once per year in January but moved forward part of that indexation to August 2022 to avoid that the purchasing power of people on these benefits drops too much (Table 1.2). After a long period of sub-indexation (OECD, 2022[42]), France similarly advanced part of the January 2023 indexation, increasing earnings-related and targeted benefits by 4% in July 2022. Latvia advanced indexation by two months in 2022. In addition, Italy advanced the correction for the underestimation of inflation in 2023 with one month: normally, the correction for the difference between projected and confirmed inflation takes place together with the next indexation in January, but the correction for 2023 (0.8%) is exceptionally applied in December. By contrast, Luxembourg, which applies threshold indexation to prices, suspended indexation between June 2022 and April 2023 to avoid further boosting inflation. In Portugal, indexation in January 2023 was only about half the amount it should have been if the rule was followed, although in combination with ad hoc supplements paid in 2022, low-income pensioners have received somewhat more than if the rule would have been followed. An additional adjustment in July 2023 increased pensions to the level of the full indexation required by the rule.

Table 1.2. Several countries have deviated from their pension indexation rules

Deviations from indexation rules since September 2021

|

Amount |

Timing |

|||

|---|---|---|---|---|

|

Better than index |

Worse than index |

Advanced |

Delayed |

|

|

Czechia |

2.3% + flat amount equal to 1.6% of average pension compared with an increase of 11.5% |

|||

|

Finland |

5 months |

|||

|

France |

6 months |

|||

|

Italy |

Lower indexation in higher pension income bands |

1 month |

||

|

Latvia |

2 months |

|||

|

Lithuania |

Earnings-related pensions: +5% |

|||

|

Luxembourg |

9 months |

|||

|

Norway |

Targeted benefits: +1.72% |

|||

|

Poland |

General indexation rule, but with a minimum flat-rate increase of 8.6% of the average pension |

|||

|

Portugal |

General indexation rule, but with minimum increase of EUR 10 (2.2% of average pension of private‑sector workers) |

6 months |

||

|

Slovenia |

Earnings-related pensions: +3.5% for pensions in payment since before 2011 +1.7% for pensions in payment since 2011 +1.0% other pensions and minimum pensions |

|||

|

Spain |

Targeted pension: +6.5% |

|||

|

Türkiye |

+13.5% |

|||

|

United Kingdom |

Suspension of triple lock: price instead of wage indexation |

|||

Note: While France advanced indexation through an intermediary indexation based on the evolution of CPI in part of the reference period and Finland did so for its targeted benefits, Latvia advanced indexation by reducing the gap between the end of the reference period and implementation of the adjustment. Germany terminated a deviation from its indexation rule. As Germany does not apply negative indexation, a catch-up factor offsets non-implemented negative indexation by lowering the positive indexation in the following years. That factor was suspended in 2018 as there was a fear that it could result in the replacement rate for a standard worker falling below 48% before 2025 (OECD, 2021[8]). The catch-up factor was reinstated in July 2022, hence regular indexation was reduced by 1.17 percentage points to compensate for the lack of negative indexation in 2021 as a result of wages falling the year before due to the pandemic.

Source: Information provided by countries.

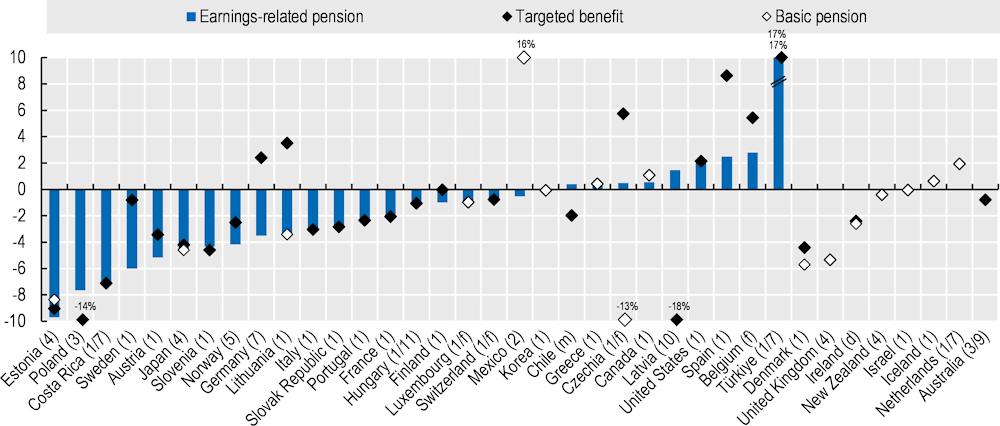

Pensions fell in real terms in many OECD countries

Bringing together both inflation trends and pension adjustments, the real value of pensions was lower in January 2023 compared to January 2022 in most OECD countries (Figure 1.10). The period is arbitrarily selected to cover the lion’s share of the inflation surge and to correspond to the most-used indexation cycle in OECD countries, i.e. annual indexation in January. These results should be interpreted with care as the precise indexation timing plays a key role in the outcome shown in the chart for many countries, as the case of Poland discussed above illustrates. In a given country, the graph would show no change in the real value of pensions if indexation to inflation in the previous year were applied in January whereas it would show a significant loss if the same indexation rule is only applied in February.

First, earnings-related pensions in payment lost more than 5% of their real value in Austria, Costa Rica, Estonia, Poland and Sweden. Among these countries, Sweden does not index to prices at all and pensions are only partially adjusted to prices in Costa Rica and Estonia (20%). In Austria and Poland, there is some delay in pensions adjusting to price increases as they all apply a smoothed price indicator comparing inflation between two 12‑month periods.

Second, targeted benefits were more than 5% lower in real terms in Costa Rica, Estonia, Latvia, Poland and the United Kingdom in January 2023 compared to January 2022. Latvia’s targeted pension lost around 18% and Poland’s 14% of their real value due to high inflation combined with an indexation rule that only requires adjustments once every three years so that no indexation took place during this period. Both countries decided to index their targeted benefits before the end of the three‑year period: Latvia increased targeted benefits in nominal terms by 14.7% in July 2023 and by 9.6% in January 2024, and has moved to annual indexation from 2024 (see Recent pension reforms); in Poland, targeted benefits are scheduled to increase by 39% in January 2024.

Third, basic pensions were more than 5% lower in real terms in Czechia, Denmark, Estonia and the United Kingdom in January 2023 compared to January 2022. Basic pensions in Czechia, Denmark and Estonia are adjusted to wages or the wage bill, which resulted in a loss of purchasing power over this period, further exacerbated in Denmark by the lag between wage increases and pension adjustments (see above). The loss of value of the basic pension in the United Kingdom is related to the suspension of the triple lock indexing pensions to the highest of inflation, wage growth or 2.5%.

Only a few countries saw their pensions improve in real terms over the same period. In Türkiye, the real value of earnings-related and targeted pensions increased by around 17% over this period due to deviations from the indexation rule discussed above. In addition, Lithuania and Spain saw steep increases in the real value of their targeted benefits. In Lithuania the steep increase is the consequence of the importance of food prices in indexation of targeted benefits. In Spain, on top of the re‑introduction of price indexation on contributory benefits at the end of 2021 (see below), non-contributory benefits were increased by 6.5% above inflation in January 2023. Targeted benefits also steeply increased in Czechia over this period following a discretionary adjustment. In Mexico, the basic pension increased by about 16% in real terms in Mexico as part of a wider reform to bolster old-age income.

Figure 1.10. Pensions were lower in real terms in many countries in January 2023 compared to January 2022

Note: The numbers between brackets refer to the month(s) of indexation of the earnings-related pension or, if that is not included, the basic pension (targeted pension for Australia). d = discretionary adjustments; f = fixed-threshold indexation; m = monthly indexation. Colombia is not included as no data are available. HICP is used for EU countries and Norway, CPI for all other countries. For countries indexing pensions at different rates based on pension height (Austria, Italy, Latvia and Portugal) or career length (Latvia), the scenario for the average pensioner is shown (average male pensioner for Austria).

Source: OECD calculations based on information provided by Member States.

Other measures reducing the impact of inflation on pensioners

Some countries have made other interventions to support retirement income in response to the inflation surge. Australia temporarily loosened (between July 2022 and June 2024) the means test to qualify for the targeted pension benefit for people with investment income. The Netherlands relaxed its funding requirements for pension funds to be able to better index pensions in payment ahead of the systemic reform leading to the transition to the new occupational pension scheme (see below). Hungary moved forward the introduction of its 13th-month pension payment, reaching the full amount in 2022 instead of 2024.