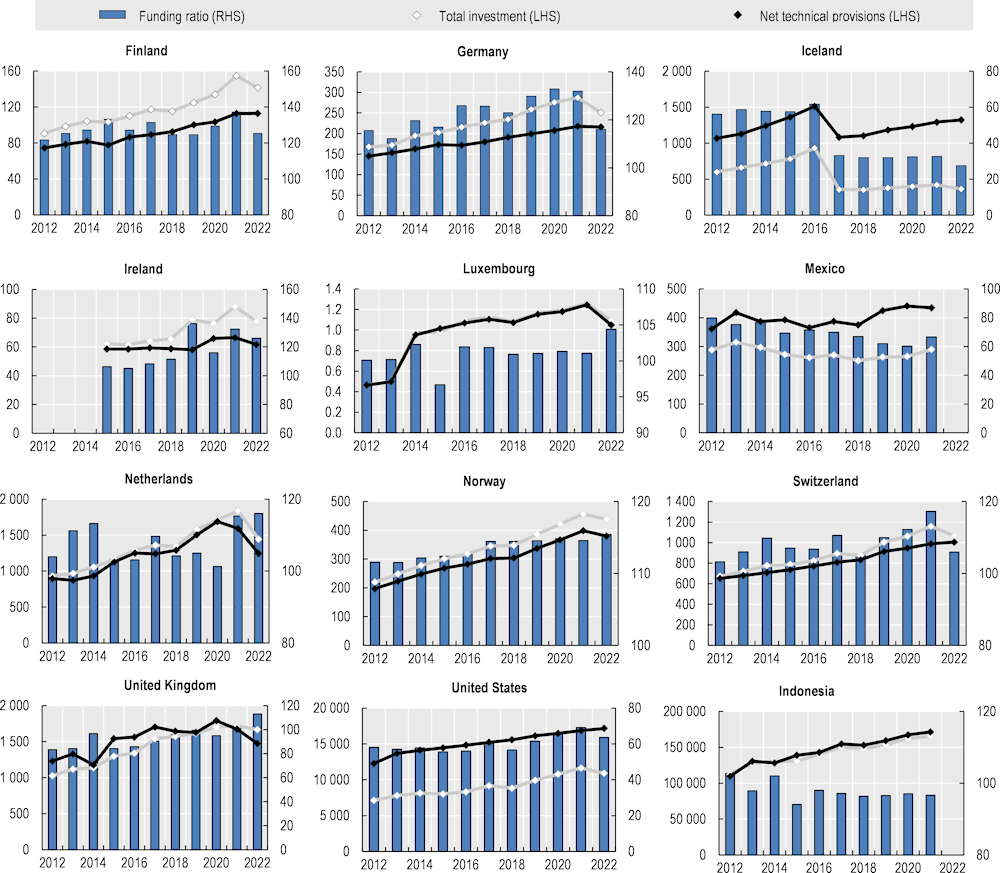

Funding ratios, which measure the amount of liabilities that available assets cover in defined benefit (DB) pension plans, have evolved differently over the years across countries but tended to improve over the last decade in most cases. Despite a fall in the value of assets in 2022, the funding ratio of DB plans improved in 2022 in Luxembourg, the Netherlands, Norway and the United Kingdom as the liabilities of DB plans fell more than assets. Funding levels of DB plans were above 100% at the end of 2022 (or latest available date) in all reporting countries but four: Iceland, Mexico, the United States among OECD countries, and Indonesia. Funding levels are calculated using national (regulatory) valuation methodologies of liabilities that differ across countries and affect the comparability across countries.

Pensions at a Glance 2023

Funding ratios of defined benefit plans

Key results

Funding ratios of DB plans, which measure the amount of liabilities that available assets cover, have evolved differently over the years across countries, but tended to improve in most of them. Among the 12 reporting countries, 9 recorded a stronger funding ratio than a decade or so before, with the largest improvement occurring in the United Kingdom (30 percentage points more between end‑2012 and end‑2022), Ireland (20 percentage points more between end‑2015 and end‑2022) and the Netherlands (12 percentage points more between end‑2012 and end‑2022) (Figure 9.6). The funding ratio of DB plans also improved but to a lesser extent in Finland, Germany, Luxembourg, Norway, Switzerland, and the United States. By contrast, the funding ratio deteriorated in Iceland (by 29 percentage points between end‑2012 and end‑2022), Mexico (by 13 percentage points between end‑2012 and end‑2021) and Indonesia (by 6 percentage points between end‑2012 and end‑2021).

Despite a fall in the value of assets in 2022, the funding ratio of DB plans improved in 2022 in Luxembourg, the Netherlands, Norway and the United Kingdom as the liabilities of DB plans fell more than assets. The United Kingdom saw the largest improvement in the funding ratio of DB plans in 2022 (10 pp more between end‑2021 and end‑2022). By contrast, the funding ratio of DB plans worsened in jurisdictions where the liabilities remained broadly the same or slightly increased (e.g. Germany, Iceland, Finland, Switzerland and the United States).

Funding levels of DB plans were above 100% at the end of 2022 (or latest available year) in all reporting countries but four: Iceland (28%), Mexico (67%), the United States (64%) among OECD countries, and Indonesia (97%).

Funding levels are calculated using national (regulatory) valuation methodologies of liabilities and hence cannot be compared across countries. Some countries like Finland, Iceland and Luxembourg use fixed discount rates (at 3%, 3.5% and 5% respectively), while others like the Netherlands and the United Kingdom use market rates as a discount rate. In the Netherlands, pension funds can use an Ultimate Forward Rate (UFR) for the valuation of liabilities. The UFR is an extrapolation of the observable term structure to take into account the very long duration of pension liabilities. The Pension Protection Fund in the United Kingdom uses conventional and index-linked gilt yields to calculate the liabilities of the DB plans in the scope of its index (PPF 7 800). The choice of the discount rate that is used to express in today’s terms the stream of future benefit payments can have a major impact on funding levels. The recent increase in interest rates led to a decline in the value of the liabilities in countries using a market-based discount rate while it had little impact on those using a fixed discount rate.

Definition and measurement

The funding position of DB plans is assessed in this publication as the ratio between investments and technical provisions (net of reinsurance). Investments of DB plans may be a low estimate of assets of DB plans as they would not include receivables and claims against the plan sponsor to cover the funding shortfall. Technical provisions represent the amount that needs to be held to pay the actuarial valuation of benefits that members are entitled to. This is the minimum obligation (liability) for all DB pension plans.

Liabilities are estimated using country-specific methodologies. Methodologies differ across countries with respect to the formula used, the discount rate (e.g. a market discount rate, or a fixed discount rate), or with the way future salaries are accounted for (e.g. liabilities can be based on current salaries or on salaries projected to the future date that participants are expected to retire) for example.

The evolution of the number of DB plans for which the aggregated funding ratio is calculated may influence the trends. In Iceland, the funding ratio dropped between 2016 and 2017 as a public-sector scheme for state and municipal employees (one of the most highly funded) was converted into a DC plan and therefore not included anymore in the aggregated funding ratio from 2017 onwards.

Further reading

OECD (2020), OECD Pensions Outlook 2020, OECD Publishing, Paris, https://doi.org/10.1787/67ede41b-en.

Figure 9.6. Assets and liabilities of defined benefit plans (in billions of national currency) and their ratio (in percent) in selected jurisdictions, 2012‑22

Note: LHS: left-hand side axis. RHS: right-hand side axis. The funding ratio has been calculated as the ratio of total investment and net technical provisions for occupational DB plans managed by pension funds using values reported by national authorities in the OECD questionnaire. Data for Finland refer to DB plans in pension funds only. All liabilities of DB plans (instead of technical provisions only) are considered for Ireland, Mexico (occupational DB plans in pension funds only) and the United States. Data for Luxembourg refer to DB traditional plans under the supervision of the CSSF. Data for the Netherlands and Switzerland include all types of pension funds. Data for the United Kingdom come from the Purple Book 2022 published by the Pension Protection Fund and show assets, liabilities valued on an s179 basis (instead of net technical provisions) and the ratio of the two. Data for Indonesia refer to EPF DB funds and come from OJK Pension Fund Statistics reports before 2016.

Source: OECD Global Pension Statistics.