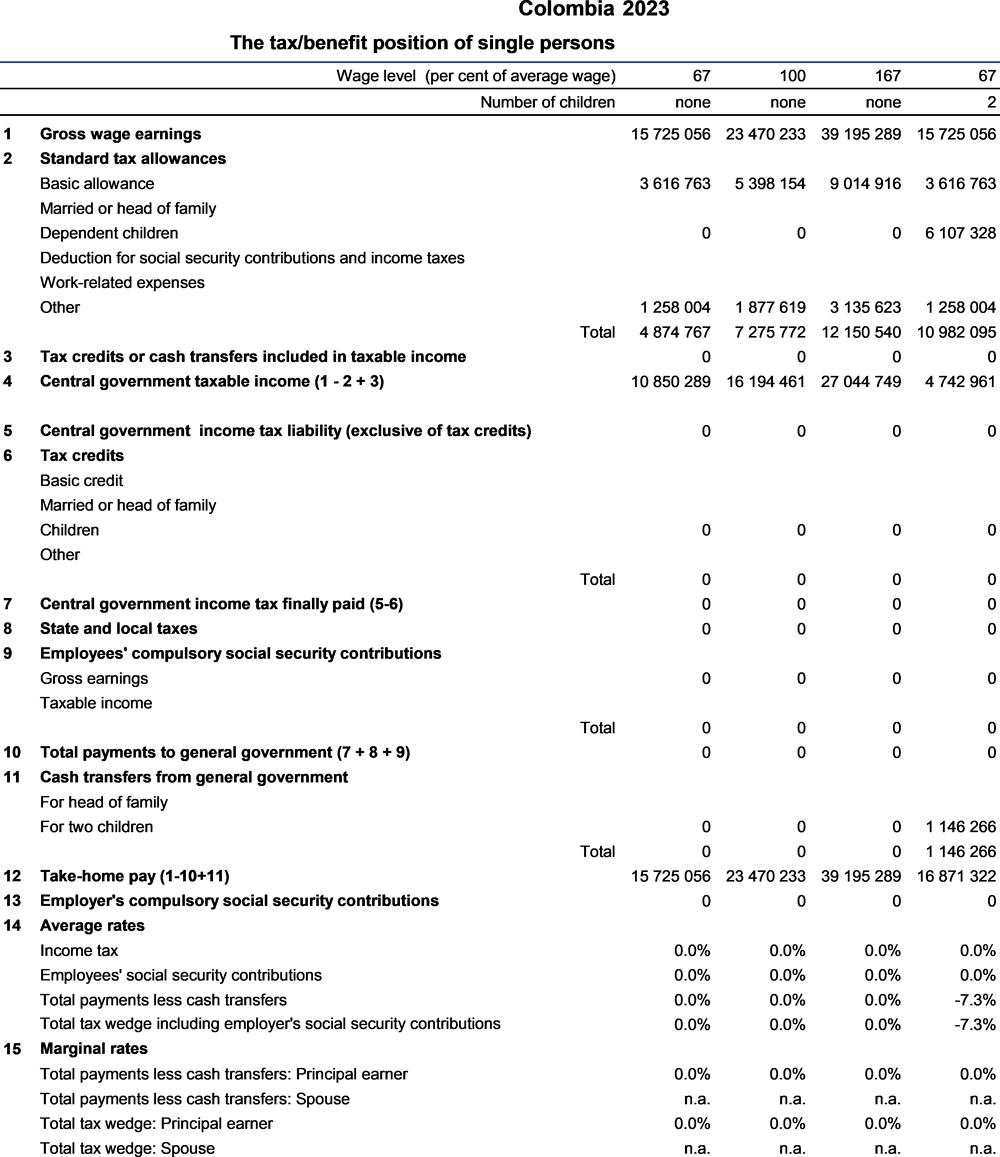

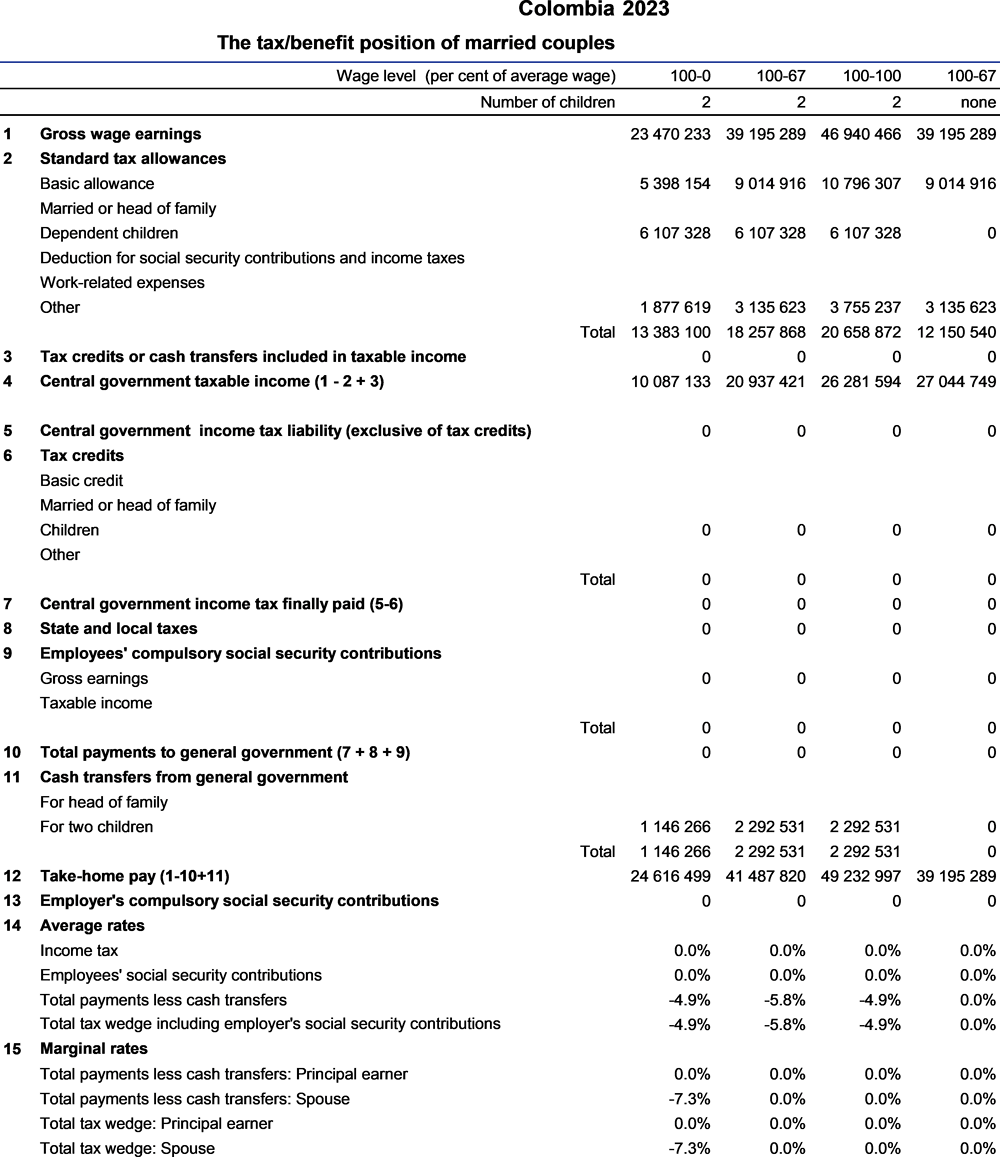

Because Law 1943 of 2018 was deemed unconstitutional by the Constitutional Court at October 2019, at the end of that year the Congress approved the Law 2010, which kept the income tax regime to individuals in the same way as it was established in the previous tax reform. This tax regime split the individual’s income in three “baskets”: a general basket, that covers labor, capital, and non-labor income; a pension basket, and a dividends basket.

The income received by employees is reported in the general “basket”. The taxable income assessed under this basket is the result of summing all earnings realized during the taxable year, minus: (a) all excluded items (refunds, reductions, discounts, and earnings not considered taxable items of income), (b) all allowed deductions (costs, expenses, and other deductions), and (c) all exempt items.

This system keeps the top introduced by Law 1819 of 2016 but now in the general basket, in which the sum of allowed deductions and exempt items should be lower than COP 56 832 080 (1 340 UVT) or 40% of the taxable income (earnings minus excluded items). However, the legislation allows the recognition of costs and expenses related with capital and non-labor income that comply with the requirements for their use into the assessment of the taxable base.

Regarding on the income tax rate, individuals must sum the taxable income that comes from the general basket and the one comes from the pension basket, as well as from dividends basket since 2023, following the adjustment introduced by Law 2277 of 2022 with respect to dividends The income tax rate that applies to this final amount is as provided in the table below: