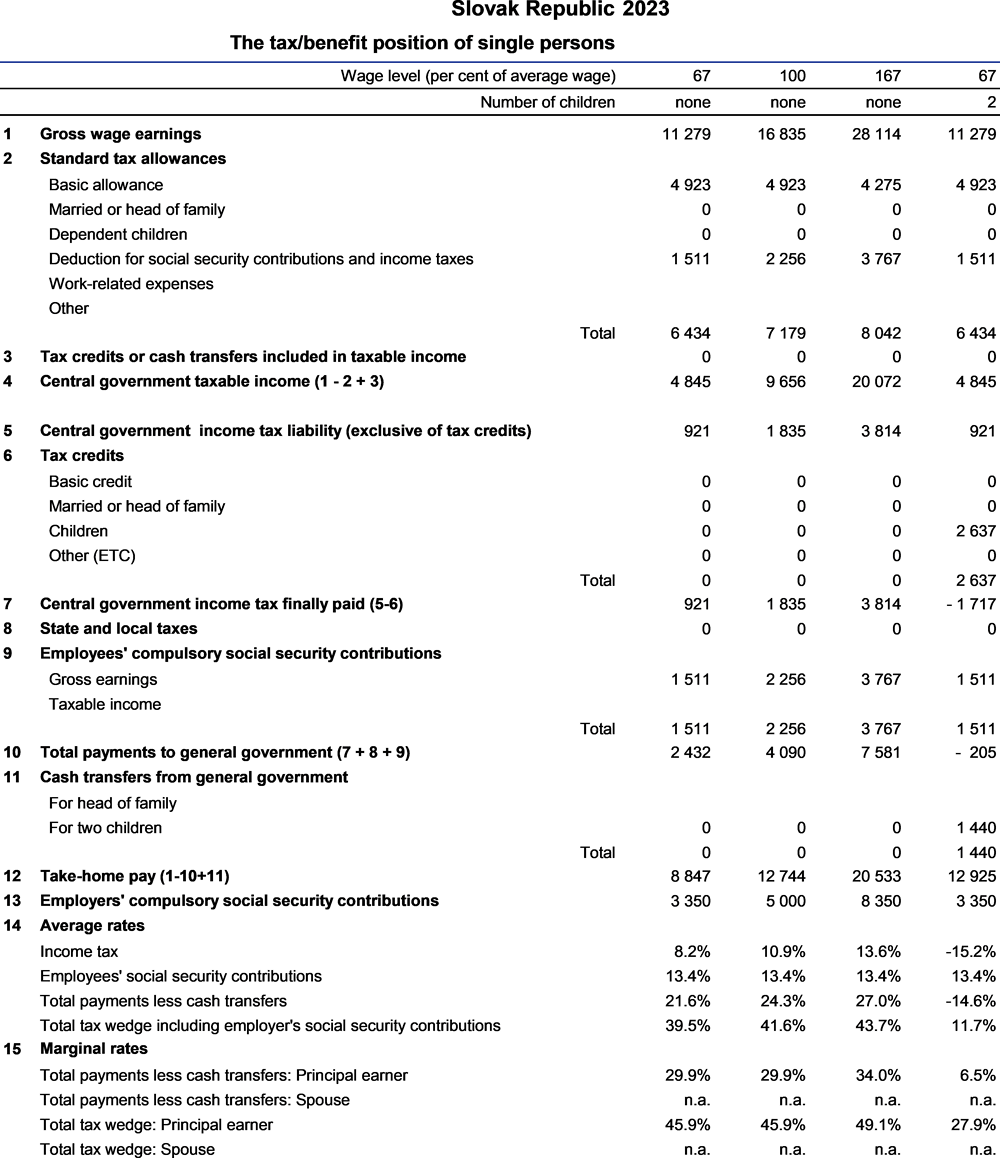

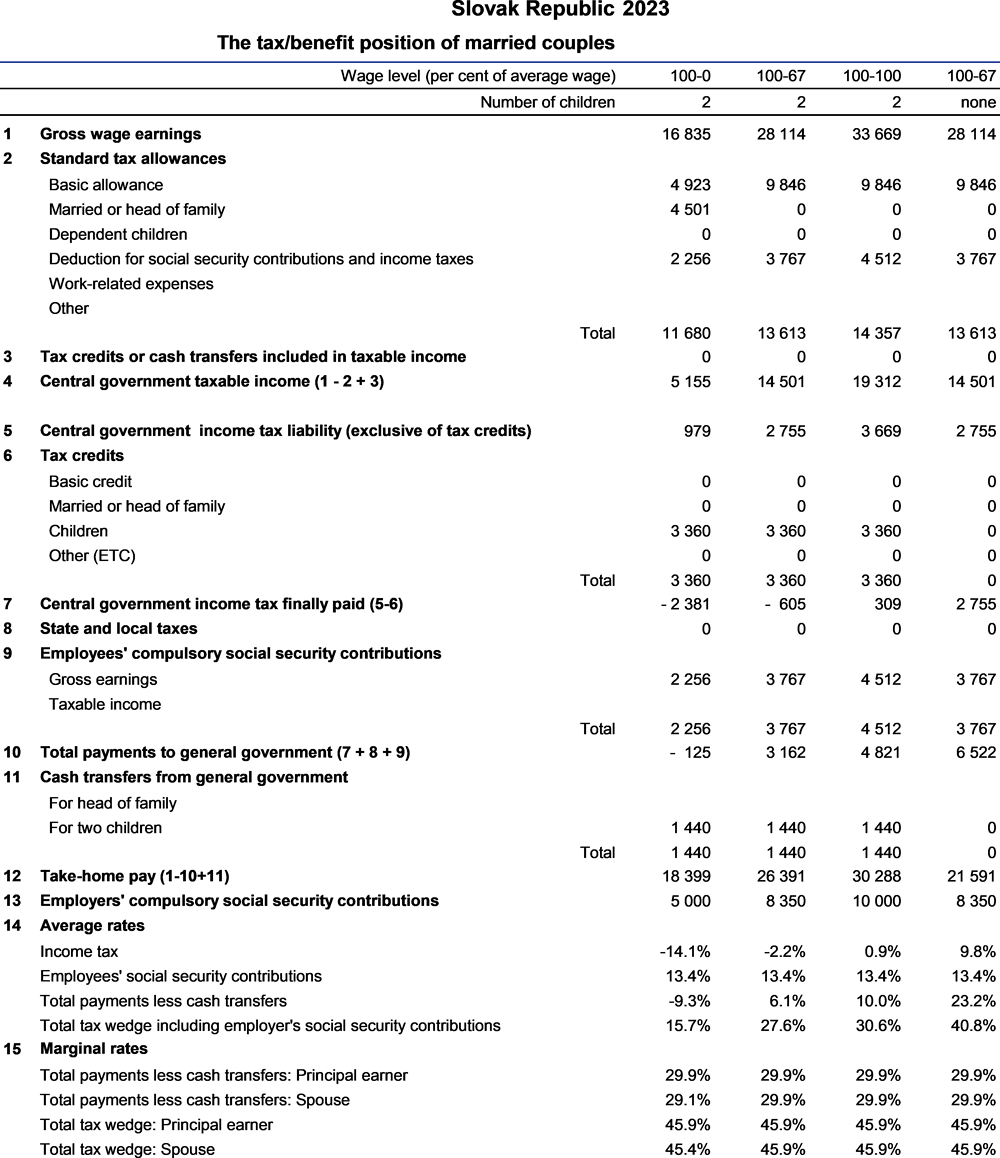

Only for the second half of 2022, 50% of the partial tax base enters the calculation of the tax credit cap. Due to legislative reasons, both the old and the new system of the tax credit are in force in July-December 2022 and the tax payer claims whichever value is higher for them. As of January 2023, only the new system will be in force.

As of January 2023, the annual indexation of the child tax credit is abolished. Instead, the amounts are temporarily increased in years 2023 and 2024 to EUR 140 for children younger than 18 years and to EUR 50 for children aged 18 years or older. From 2025, the higher amount is set at a new permanent level of EUR 100 and the age threshold is set at 15 years.

Since 2023, the cap on the child tax credit is calculated using the sum of the partial tax bases of both the principal earner and the spouse.

The benefit for each dependent child has been increased as from July 2022 to EUR 30.00 and its annual indexation in line with the growth of the MLS has been abolished. The benefit increased to EUR 60.00 in January 2023.

As from March 2022, the employer social insurance contributions for financing of short-time work support of 0.5% of the assessment base and an equivalent reduction of the employer contribution rate for unemployment insurance from 1% to 0.5% were introduced.

In 2023, the social insurance contribution (SIC) allowance was introduced for seasonal workers. The allowance decreases the employee’s and employer’s assessment base on retirement and unemployment insurance. It amounts to 50 % of the average wage in the economy two years prior.

In 2023 the minimum HIC for employees was introduced, set at 14 % of the MLS per employee. The difference between the total HIC paid (employee and employer) and the minimum HIC is to be paid by the employee.

Since April 2023, the annual indexation of the MLS is done based only on the low-income inflation rate (i.e. the growth in the net disposable income per household member is no longer used.