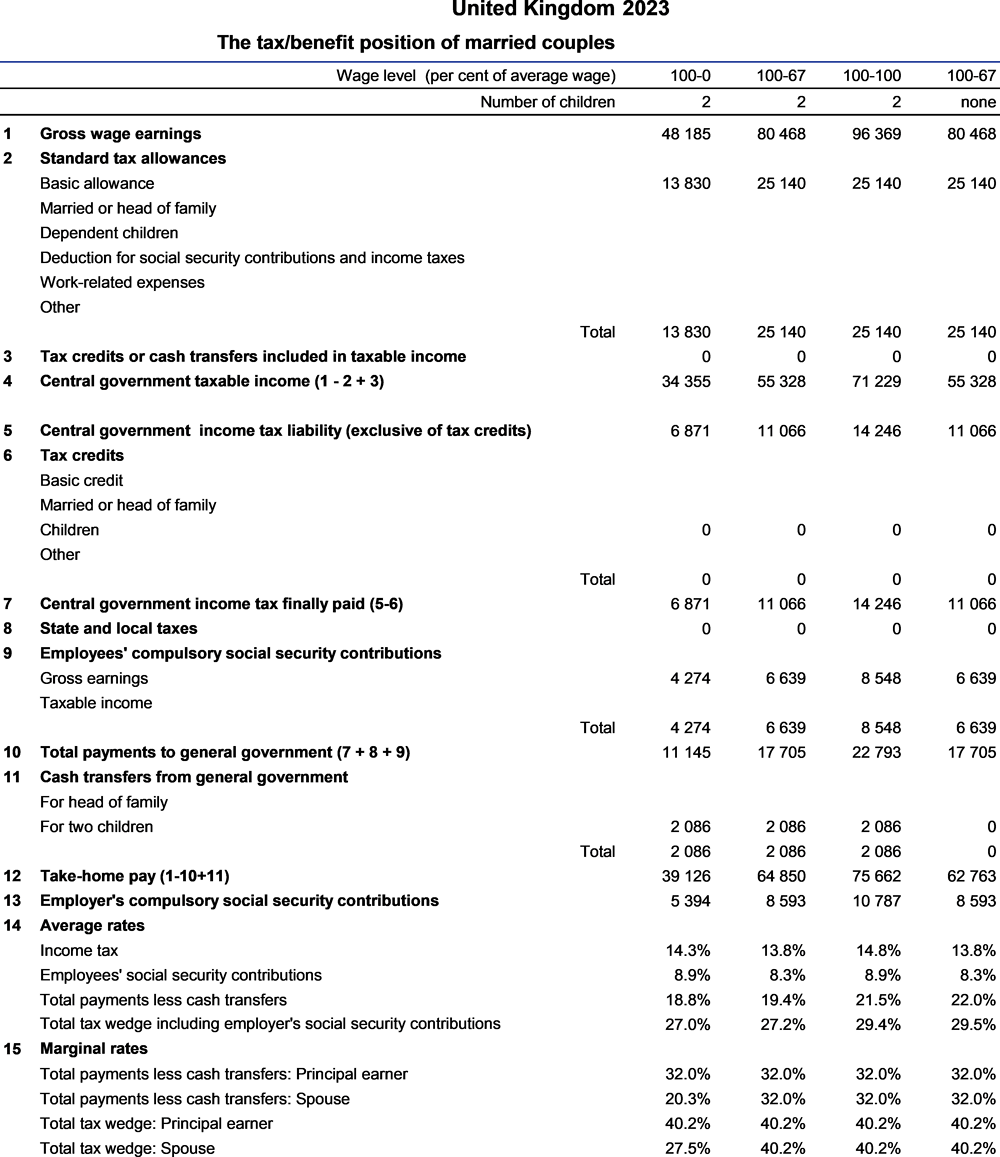

Child Benefit: GBP 24.00 per week is paid in respect of the first child in the family up to the age of 19 (if the child aged 16-19 is in education or training) with GBP 15.90 per week paid for each subsequent child.

Since January 2013, a tax charge has applied for any taxpayer who has income over GBP 50 000 and either they or their partner are in receipt of Child Benefit. For those with adjusted net income (ANI, pre-tax income less certain allowances) between GBP 50 000 and GBP 60 000, the amount of the charge will be 1% of the Child Benefit for every GBP 100 of income over GBP 50 000. For those with income over GBP 60 000, the amount of the charge will equal the amount of Child Benefit. Child Benefit recipients can opt out of receiving payments as an alternative to paying the charge. Where both adults are over the threshold, the liability falls on the adult with the highest ANI.

Universal Credit (UC): a payment available to low income families with or without children which is gradually replacing a number of benefits and tax credits (including Working and Child Tax Credit). The maximum amount depends on the age of the claimant(s), whether they are single or in a couple, the number of children, whether claimant(s) have a disability or health condition that limits their capability for work, if claimant(s) have disabled children, whether the claimant(s) are carers, and childcare and housing costs. A couple where one is aged over 25 with a child born prior to 6 April 2017 would receive a maximum UC monthly amount of GBP 893.82 or GBP 10725.84 per year, assuming no other elements are payable. UC is reduced by a “taper rate” of 55 pence for each GBP of earnings (net of income tax and employee social security contributions) above a threshold (or “work allowance”) of GBP 631 per month; a different threshold of GBP 379 per month is applied if the claimant has housing costs.

Claimant(s) receive a work allowance if they have limited capability for work or have children. UC may also be reduced by other income the claimant may have. There are further rules around the amount of savings held by claimants, and for some claimants the total amount payable is subject to a cap.