The base case in Chapter 4 concentrates on full-career replacement rates when individuals are at a constant level of earnings relative to the average during their whole career. In the alternative earnings profile shown here individuals start at a lower salary before steadily progressing until age 55 from which the wage remains at a constant share of the average wage. For comparison purposes, this scenario is calibrated such that over the career the average wage is equal to 100% of the average wage for the whole economy, which allows comparisons for the same lifetime earnings. Under this scenario the benefit level for male workers is 52.0% of the average wage, slightly higher than for the base case at 50.7%. For women, it is 51.3%, compared to the base case of 50.1%.

Pensions at a Glance 2023

Impact of different earnings profile on pension entitlements

Key results

Full-career male workers at the average wage throughout their career have, on average, a future gross replacement rate of 50.7%, when they start working at age 22. For the earnings profile shown here the benefit level as a percentage of the average wage is slightly higher at 52.0%. That is, while under this scenario, the relative wage increases throughout the career – from 60% of the average wage at age 22 to 123.33% at retirement age, ensuring the same lifetime earnings (see below) – the pension amount is similar to that of the base case scenario. Figure 5.5 shows the earnings profile for the retirement at age 66 case. However, whilst in the base case final earnings and lifetime average earnings are the same this is not the case for the alternative profile case as the final earnings are higher, implying a benefit level of 42.2% of final earnings on average. The equivalent figures for female workers are 50.1% for the base case and 51.3% for the earnings profile, equivalent to 41.6% of final earnings.

In some countries, the pension benefit level is identical in the earnings profile and the base cases, as pension systems that have flat-rate benefits, or points systems or constant accrual rates with wage valorisation of past earnings are not affected, as career average earnings are the same and any ceilings to contributions do not come into play. These countries are Austria, Canada, Czechia, Germany, Hungary, Ireland, Japan, Lithuania, Luxembourg, Mexico, New Zealand and the Slovak Republic.

By contrast, countries that do not use the entire career earnings and price uprate past wages when calculating pensions have higher benefit values using the earnings profile scenario compared to the base case. The countries in question are Colombia, Costa Rica, France, Portugal, Slovenia, Spain and the United States as only 10, 25, 25, 40, 24, 27 and 35 years of earnings, respectively, are used. For example, in Costa Rica the final 25 years are now used to calculate the reference wage for pension calculations. Under the base case this gives a reference wage equivalent to 79% of the average wage at retirement, as past earnings are only adjusted for inflation, whereas for the earning profile it is 92%, with Spain showing a similar increase. The impact is not as large in Portugal because 40 of the 46 years of career are used, nor in France as there is a ceiling to contributions to the general DB scheme so the higher earnings at the end of the career are less relevant as the pensionable salary is around the average wage.

For countries that have large defined contribution pension schemes, the lower earnings at the start of the career – while having the same average over the career – has a greater effect on reducing the future benefit level, assuming the level of returns are higher than wage growth, than is countered by the higher earnings at the end of the career as there is less time for these increased contributions to accumulate. The largest falls are found in Australia, Chile, Denmark, Iceland, Israel, the Netherlands, Norway and the United Kingdom, but even in the highest case in the Netherlands the effective future replacement rate only falls by 2.2 percentage points with all the others around 1 percentage point. In Sweden the replacement rate actually increases as the contribution rate to the occupational pension increases from 4.5% to 30% for earnings above 108% of the average.

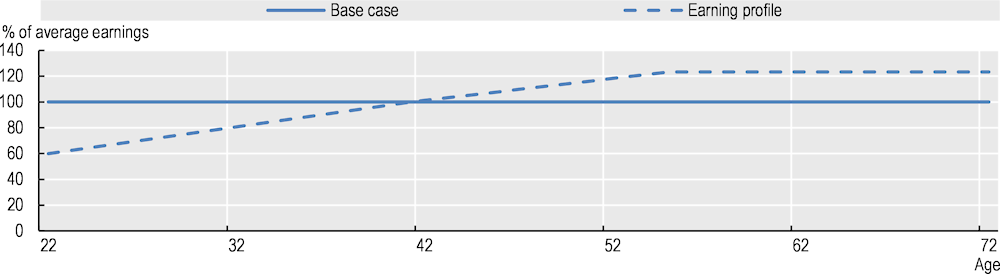

Definition and measurement

Under the baseline assumptions, workers earn the same percentage of average worker earnings throughout their career. However, although the average wage over the career is maintained at 100% (past wages are uprated based on average‑wage growth), the individual starts at 60% of average earnings, increasing to average earnings between 12 and 25 years later – the exact year depends on the retirement age so as to ensure that the career average is equal to 100% of average wage -, then increasing to 123.33% of average earnings at age 55 and remaining at this level until retirement age. Therefore, final earnings are no longer equal to lifetime average earnings revalued in line with economy-wide earnings growth. The benefit levels shown are expressed as a percentage of career average earnings.

Figure 5.5. Earnings profile compared to base case, retirement at age 66

Table 5.2. Gross and net pension benefit level by earnings profile

Percentage of average wage at retirement

|

Pension age |

GRR |

NRR |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Base case |

Earning profile |

Base case |

Earning profile |

|||||||

|

Australia |

67 |

26.0 |

(23.8) |

25.4 |

(23.3) |

33.7 |

(30.9) |

33.0 |

(30.2) |

|

|

Austria* |

65 |

74.1 |

74.1 |

87.4 |

87.4 |

|||||

|

Belgium |

67 |

43.5 |

46.6 |

60.9 |

54.9 |

|||||

|

Canada* |

65 |

36.8 |

36.8 |

44.2 |

44.2 |

|||||

|

Chile |

65 |

37.1 |

(34.9) |

36.3 |

(34.2) |

45.7 |

(43.0) |

44.7 |

(42.4) |

|

|

Colombia |

62 |

(57) |

74.8 |

91.6 |

(89.2) |

73.1 |

89.6 |

(87.3) |

||

|

Costa Rica |

65 |

(63) |

64.1 |

(61.5) |

71.2 |

(67.2) |

67.8 |

(65.0) |

75.3 |

(71.0) |

|

Czechia* |

65 |

47.4 |

47.4 |

58.9 |

58.9 |

|||||

|

Denmark |

74 |

73.1 |

72.6 |

77.3 |

76.8 |

|||||

|

Estonia |

71 |

28.1 |

28.0 |

34.4 |

34.3 |

|||||

|

Finland |

69 |

58.4 |

58.8 |

65.1 |

65.5 |

|||||

|

France |

65 |

57.6 |

59.7 |

71.9 |

73.9 |

|||||

|

Germany* |

67 |

43.9 |

43.9 |

55.3 |

55.3 |

|||||

|

Greece |

66 |

80.8 |

80.3 |

90.0 |

75.0 |

|||||

|

Hungary* |

65 |

(62) |

52.4 |

(49.0) |

52.4 |

(49.0) |

78.8 |

(73.7) |

78.8 |

(73.7) |

|

Iceland |

67 |

43.1 |

41.7 |

52.1 |

50.8 |

|||||

|

Ireland* |

66 |

26.2 |

26.2 |

36.1 |

36.1 |

|||||

|

Israel |

67 |

(65) |

38.0 |

(35.2) |

36.5 |

(33.8) |

47.3 |

(43.9) |

45.5 |

(43.5) |

|

Italy |

71 |

76.1 |

77.5 |

82.6 |

87.2 |

|||||

|

Japan* |

65 |

32.4 |

32.4 |

38.8 |

38.8 |

|||||

|

Korea |

65 |

31.2 |

30.6 |

35.8 |

35.1 |

|||||

|

Latvia |

65 |

39.8 |

39.9 |

52.8 |

52.9 |

|||||

|

Lithuania* |

65 |

18.2 |

18.2 |

28.9 |

28.9 |

|||||

|

Luxembourg* |

62 |

74.8 |

74.8 |

86.9 |

86.9 |

|||||

|

Mexico* |

65 |

55.5 |

55.5 |

62.4 |

62.4 |

|||||

|

Netherlands |

70 |

74.7 |

72.5 |

93.2 |

91.7 |

|||||

|

New Zealand* |

65 |

39.7 |

39.7 |

43.5 |

43.5 |

|||||

|

Norway |

67 |

44.5 |

43.6 |

54.8 |

52.8 |

|||||

|

Poland |

65 |

(60) |

29.3 |

(22.9) |

30.0 |

(23.4) |

40.3 |

(31.5) |

41.3 |

(32.1) |

|

Portugal |

68 |

73.9 |

78.6 |

98.8 |

104.1 |

|||||

|

Slovak Republic* |

69 |

54.9 |

54.9 |

72.5 |

72.5 |

|||||

|

Slovenia |

62 |

42.1 |

47.5 |

63.4 |

70.1 |

|||||

|

Spain |

65 |

80.4 |

92.5 |

86.5 |

97.6 |

|||||

|

Sweden |

70 |

62.3 |

64.7 |

65.3 |

67.6 |

|||||

|

Switzerland |

65 |

39.9 |

40.1 |

45.3 |

(45.2) |

45.5 |

(46.4) |

|||

|

Türkiye |

65 |

(63) |

70.3 |

(67.6) |

71.8 |

(68.2) |

95.4 |

(91.6) |

97.3 |

(92.4) |

|

United Kingdom |

67 |

41.9 |

40.9 |

54.4 |

53.4 |

|||||

|

United States |

67 |

39.1 |

41.7 |

50.5 |

53.8 |

|||||

|

OECD |

66.3 |

(65.8) |

50.7 |

(50.1) |

52.0 |

(51.3) |

61.4 |

(60.6) |

62.2 |

(61.4) |

|

Argentina |

65 |

(60) |

78.7 |

(75.8) |

89.8 |

(86.4) |

90.1 |

(86.9) |

102.8 |

(98.9) |

|

Brazil |

65 |

(62) |

88.4 |

(93.3) |

91.1 |

(95.4) |

96.9 |

(102.0) |

99.7 |

(104.1) |

|

China |

60 |

(55) |

68.3 |

(53.8) |

77.5 |

(61.6) |

88.3 |

(70.1) |

100.0 |

(79.9) |

|

India |

58 |

38.9 |

(37.8) |

43.6 |

(42.5) |

44.2 |

(42.9) |

49.6 |

(48.3) |

|

|

Indonesia |

65 |

53.5 |

(50.6) |

53.9 |

(51.1) |

55.8 |

(51.7) |

56.2 |

(52.1) |

|

|

Saudi Arabia |

47 |

59.6 |

N/A |

66.2 |

N/A |

|||||

|

South Africa* |

60 |

8.0 |

8.0 |

9.2 |

9.4 |

|||||

|

EU27 |

66.7 |

(66.4) |

54.8 |

(54.3) |

54.4 |

(53.9) |

68.1 |

(67.5) |

66.7 |

(66.0) |

Note: * Individuals have the same gross benefit under both the base case and earnings profile scenarios.

Source: OECD pension models.