Public spending on pensions has been on the rise in most OECD countries for the past decades, as shown in Table 8.2. Long-term projections show that public pension spending is projected to keep growing in 22 OECD countries, for which information is available, and fall in 9. On average across 31 OECD countries, public pension expenditure would increase from 8.9% of GDP in 2020‑23 to 10.2% of GDP in 2050.

Pensions at a Glance 2023

Long-term projections of public pension expenditure

Key Results

The main driver of growing pension expenditures is demographic change. The projections shown in Table 8.4 are derived either from the European Commission’s 2021 Ageing Report – which covers the EU27 members plus Norway – or from countries’ own estimates. In the main table, data are presented forwards to 2060 for those countries where the figures are available. However, data are only available for 2030 for Switzerland and not available at all in six OECD countries.

Long-term projections are a crucial tool in planning pension policy: there is often a long time‑lag between when a pension reform occurs and when it begins to affect expenditure. There are some differences in the range of different programmes covered in the forecasts, reflecting the complexity and diversity of national retirement-income provision. For example, data for a number of countries include special schemes for public-sector workers whilst in others they are not included. Similarly, projections can either include or exclude spending on resource‑tested benefits for retirees. The coverage of the data also differs from the OECD Social Expenditures Database (SOCX), from which the data on past spending trends in the previous two indicators were drawn. The numbers for 2020‑23 may differ between the SOCX database and the sources used here because of the different range of benefits covered and the definitions used.

Public pension spending is projected to grow from 8.9% of GDP to 10.0% of GDP by 2040 on average across all OECD‑31 countries. The OECD‑31 average only refers to the countries for which data is available across the entire timeframe, so Switzerland is not included. In the EU27 it is projected to increase from 9.9% of GDP in 2020 to 11.3% of GDP in 2050, after which it is projected to stabilise. This would be a significant achievement given the demographic change throughout the period. The indicator of the “Demographic Old-Age to Working-Age Ratio” in Chapter 6 shows a 72% increase in the number of people above age 65 per 100 people aged between 20 and 64 from 2022 until 2052. Legislated cuts in benefits for future retirees at least relative to wages, through lowered indexation and valorisation of benefit formulae, together with increases in the age at which individuals can first claim pension benefits, help limit the future growth in public pension expenditure.

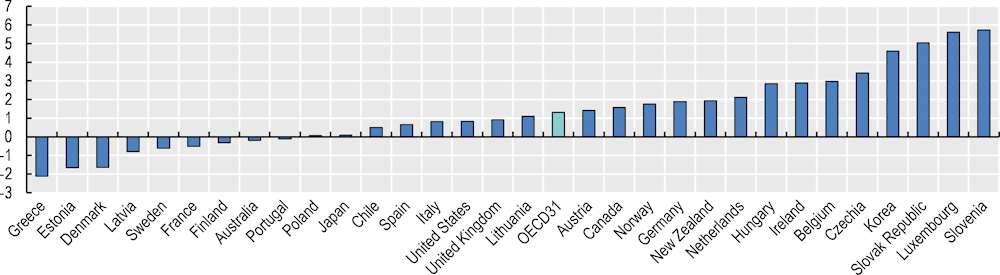

Public pension expenditure is expected to increase in 22 OECD countries by 2050 (Figure 8.2). In Korea, the rapid increase reflects both the ageing process and the still maturing pension system. In Slovenia, public spending is projected to keep rising from above the OECD average at 10.0% of GDP in 2020‑22, to 15.7% of GDP by 2050. According to these projections, five other countries would record an increase of about 3 percentage points or more of GDP: Belgium, Czechia, Hungary, Ireland and Luxembourg. Conversely, Denmark, Estonia and Portugal would have a fall of around two percentage points of GDP, and Greece of more than 3 percentage points.

Further reading

European Commission (2021), 2021 Ageing Report; Economic and budgetary projections for the 27 EU Member States (2019-2070), https://ec.europa.eu/info/publications/2021-ageing-report-economic-and-budgetary-projections-eu-member-states-2019-2070_en.

Table 8.4. Projections of public expenditure on pensions, 2020‑60, percentage of GDP

|

2020‑23 |

2025 |

2030 |

2035 |

2040 |

2045 |

2050 |

2055 |

2060 |

|

|---|---|---|---|---|---|---|---|---|---|

|

Australia |

2.3 |

2.5 |

2.4 |

2.3 |

2.2 |

2.1 |

2.1 |

2.0 |

2.0 |

|

Austria |

13.3 |

14.6 |

15.1 |

15.4 |

15.1 |

14.9 |

14.7 |

14.7 |

14.6 |

|

Belgium |

12.2 |

13.2 |

14.0 |

14.6 |

14.9 |

15.1 |

15.2 |

15.2 |

15.2 |

|

Canada |

6.5 |

7.2 |

7.8 |

8.0 |

8.1 |

8.1 |

8.1 |

8.1 |

8.3 |

|

Chile |

3.4 |

3.8 |

3.8 |

3.7 |

3.7 |

3.8 |

3.9 |

4.1 |

4.2 |

|

Colombia |

|||||||||

|

Costa Rica |

|||||||||

|

Czechia |

8.0 |

8.8 |

8.8 |

9.1 |

9.8 |

10.7 |

11.4 |

11.8 |

11.8 |

|

Denmark |

9.3 |

8.9 |

8.5 |

8.3 |

8.1 |

7.8 |

7.6 |

7.4 |

7.2 |

|

Estonia |

7.8 |

7.1 |

6.9 |

6.6 |

6.5 |

6.3 |

6.1 |

6.0 |

5.8 |

|

Finland |

13.0 |

13.6 |

13.7 |

13.4 |

12.8 |

12.6 |

12.7 |

13.0 |

13.5 |

|

France |

14.8 |

15.4 |

15.6 |

15.5 |

15.2 |

14.6 |

14.3 |

13.8 |

13.4 |

|

Germany |

10.3 |

10.9 |

11.5 |

12.0 |

12.0 |

12.1 |

12.2 |

12.4 |

12.5 |

|

Greece |

15.7 |

14.2 |

13.8 |

13.7 |

14.0 |

13.7 |

13.6 |

12.7 |

12.0 |

|

Hungary |

8.3 |

8.6 |

8.3 |

8.8 |

9.7 |

10.8 |

11.2 |

11.5 |

11.9 |

|

Iceland |

|||||||||

|

Ireland |

4.6 |

5.3 |

5.9 |

6.4 |

6.9 |

7.2 |

7.5 |

7.5 |

7.5 |

|

Israel |

|||||||||

|

Italy |

15.4 |

16.2 |

17.3 |

17.9 |

17.8 |

17.3 |

16.2 |

15.0 |

14.1 |

|

Japan |

9.0 |

8.7 |

8.4 |

8.4 |

8.6 |

8.8 |

9.1 |

9.3 |

9.5 |

|

Korea |

1.3 |

2.0 |

2.5 |

3.2 |

4.2 |

5.1 |

5.9 |

6.5 |

7.5 |

|

Latvia |

7.1 |

7.1 |

6.9 |

6.8 |

6.6 |

6.3 |

6.3 |

6.4 |

6.2 |

|

Lithuania |

7.1 |

7.5 |

7.9 |

8.2 |

8.4 |

8.3 |

8.2 |

8.2 |

8.1 |

|

Luxembourg |

9.2 |

10.3 |

11.4 |

12.3 |

13.0 |

13.9 |

14.8 |

15.8 |

16.7 |

|

Mexico |

|||||||||

|

Netherlands |

6.8 |

7.3 |

8.1 |

8.8 |

9.1 |

9.0 |

8.9 |

8.8 |

8.9 |

|

New Zealand |

4.9 |

5.2 |

5.7 |

6.1 |

6.5 |

6.6 |

6.8 |

7.2 |

7.7 |

|

Norway |

11.0 |

11.7 |

12.3 |

12.6 |

12.6 |

12.6 |

12.7 |

13.0 |

13.2 |

|

Poland |

10.6 |

11.4 |

11.0 |

10.6 |

10.5 |

10.6 |

10.7 |

10.8 |

10.8 |

|

Portugal |

12.7 |

13.3 |

14.2 |

14.6 |

14.4 |

13.7 |

12.6 |

11.4 |

10.5 |

|

Slovak Republic* |

8.3 |

9.7 |

10.2 |

10.7 |

11.6 |

12.5 |

13.4 |

14.2 |

14.5 |

|

Slovenia |

10.0 |

10.1 |

10.8 |

12.1 |

13.6 |

14.8 |

15.7 |

16.1 |

16.1 |

|

Spain* |

12.3 |

12.7 |

12.3 |

12.5 |

12.8 |

13.2 |

13.0 |

12.5 |

11.7 |

|

Sweden* |

7.6 |

7.7 |

7.4 |

7.2 |

7.0 |

7.0 |

7.0 |

7.3 |

7.4 |

|

Switzerland |

6.5 |

6.4 |

6.8 |

||||||

|

Türkiye |

|||||||||

|

United Kingdom |

7.2 |

7.3 |

7.0 |

7.4 |

7.5 |

7.7 |

8.1 |

8.7 |

9.3 |

|

United States |

5.2 |

5.5 |

5.8 |

6.0 |

6.0 |

6.0 |

6.1 |

6.1 |

6.2 |

|

OECD31 |

8.9 |

9.3 |

9.5 |

9.8 |

10.0 |

10.1 |

10.2 |

10.2 |

10.3 |

|

Brazil |

|||||||||

|

EU27 |

8.5 |

8.5 |

8.8 |

9.4 |

10.2 |

11.3 |

12.3 |

13.2 |

13.9 |

Note: EU27 figure is a simple average of member states. Pension schemes for civil servants and other public-sector workers are generally included in the calculations for EU member states: see European Commission (2021), 2021 Ageing Report. *: Since the Ageing Report was released, many reforms have been enacted that will affect future spending levels but are not reflected here. For example, both the Index for Pension Revaluation and the Sustainability Factor have been removed in Spain, which, according to the alternative scenarios shown in the 2021 Ageing Report country fiche, would substantially increase spending in 2050. Conversely, both the Slovak Republic and Sweden have enacted legislation to increase their retirement ages which is expected to limit spending increases significantly.

Source: European Commission (2021), 2021 Ageing Report for all EU countries and Norway; Australia: 2023 Intergenerational Report (published August 2023), Chart 7.21; Canada: 18th Actuarial Report on the Old Age Security Program, 31st Actuarial Report of Canada Pension Plan, Actuarial Valuation of the Québec Pension Plan as at 31 December 2021 (QPP data for 2036, 2041 etc. has been used for 2035, 2040 etc.); Chile: Ministry of Finance-Budget Office; Japan: About future social security reform – Looking ahead to 2040; Korea: 2018 National Pension Actuarial Valuation Long-Term Actuarial.

Projection for the National Pension Scheme; New Zealand: Review of retirement income policies 2019 – Facing the future; Switzerland: BSV – Financial perspectives of the AHV; United Kingdom: Office for Budget Responsibility; United States: The 2023 OASDI Trustees Report.