Regulation usually defines a contribution rate for mandatory and auto‑enrolment plans, varying across countries. They are fixed at more than 10% of the salary in Australia, Colombia, Denmark, Iceland, Israel and Switzerland. The actual effective amount of contributions per member was sometimes higher than mandatory rates, through additional voluntary contributions, or lower when members were having a plan but not contributing after they left their job.

Pensions at a Glance 2023

Contributions paid into pension plans

Key results

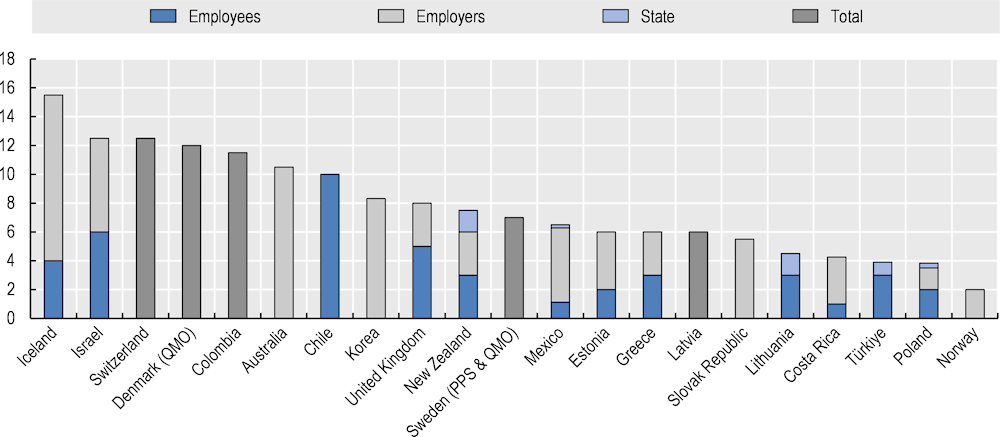

Regulation usually defines a (minimum) contribution rate for mandatory and auto‑enrolment plans. The responsibility to pay the contributions may fall on the employees (e.g. in Chile), on the employers (e.g. in Australia, Korea, Norway, the Slovak Republic) or on both (e.g. in Estonia, Iceland, Israel, Mexico, Switzerland). This obligation may only apply to certain employees or under certain conditions (e.g. employees aged between 22 and the state pension age and earning at least GBP 10 000 a year in the United Kingdom). Contributions may be complemented by state matching contributions (e.g. New Zealand, Türkiye) or subsidies (e.g. social quota in Mexico).

Mandatory contribution rates vary across countries (Figure 9.1). Iceland sets the highest mandatory contribution rate at 15.5% of salary, split between employers (11.5%) and employees (4%). Mandatory contribution rates also represented over 10% of the salary in Australia, Colombia, Denmark (defined in collective agreements), Israel and Switzerland. By contrast, Norway has the lowest mandatory contribution rate (2% paid by the employer). Employers and employees can however agree on whether employees have to contribute on top of employers. Mandatory contribution rates sometimes vary by income (e.g. ITP1 and SAF-LO plans in Sweden) or by type of work (e.g. different contribution rates to the new first pillar pension fund for people in arduous and unhealthy professions in Greece).

On top of the minimum mandatory contributions, individuals or their employers may have the option of making additional voluntary contributions. In New Zealand, the minimum contribution rate for KiwiSaver plans for employees is 3%. Members can however select a higher personal contribution rate of 4%, 6%, 8% or 10% of salary. In Poland, the minimum contribution rate for employee capital plans (PPK) is 2% for employees and 1.5% for employers. Employers and employees have the option of making additional contributions of up to 2.5% (for employers) and 2% (for employees). In Australia, employees have no obligation to contribute to a plan but can make voluntary contributions on top of their employer’s contributions.

In voluntary plans, there may be no required nor minimum amount of contributions defined at the national level. Personal plans may however include a ceiling to benefit from tax advantages. Occupational plans may define specific contribution rates for employees and employers in the plan rules. The contribution rates may vary according to the funding of the plan in the case of defined benefit plans.

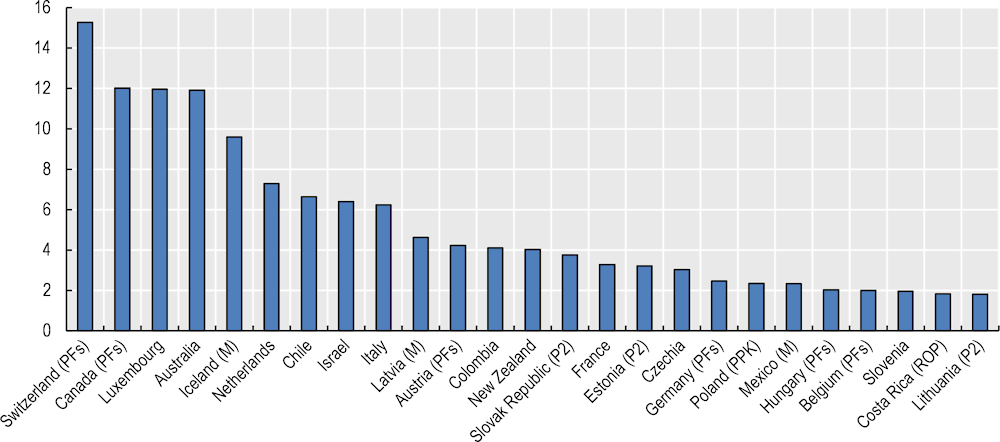

The average effective annual contributions per member (relative to average annual wages) vary a lot across countries (Figure 9.2). Some of the largest amounts of contributions per member in 2022 were paid in Australia, Iceland and Switzerland where the participation rate in a pension plan and the mandatory contribution rates are relatively high. Additional voluntary contributions from employees into superannuation schemes may also account for the high ratio in Australia, above the mandatory 10.5% contribution rate. Contributions per member (relative to the average wage) are lower in some other countries, and sometimes lower than the minimum mandatory contribution rates such as in Chile and Mexico, which may be due to some people not making contributions in a plan (even if they have one) when they move from the formal to informal sectors or become unemployed.

Definition and measurement

The term “pension plans” refers to plans that individuals access via their employer or a financial institution, and in which they accumulate rights or assets. Assets belong to plan members and finance their own future retirement. These assets may accumulate in pension funds, through pension insurance contracts or in other savings vehicles offered and managed by banks or investment funds. Employers may set up provisions or reserves in their books to finance the retirement benefits of occupational pension plans.

Average effective annual contributions may be expressed per account instead of member, as the exact number of members holding one (or several) pension plans is sometimes unknown. This is the case for instance in France where individuals can have an occupational (e.g. PER Collectif) and a personal plan (e.g. PER Individuel).

The population holding a pension plan may not be representative of the population on which the average annual wages were calculated and used for the assessment of the average effective annual contributions per member (or account).

Figure 9.1. Minimum or mandatory contribution rates (for an average earner) in mandatory and auto‑enrolment plans (unless specified otherwise), 2022 (or latest year available)

Note: The category “Total” shows the cases where the contribution rates cannot be split precisely between employer, employee (and state). “PPS” means premium pension system. “QMO” means quasi-mandatory occupational plans. Additional country specific details are provided in the statlink.

Source: ISSA Social Security Country Profiles and other sources.

Figure 9.2. Average annual contribution per active account or member in selected OECD countries, latest year available

Note: “M” means mandatory. “P2” means second pension pillar. “PFs” means pension funds. “PPK” refers to employee capital plans in Poland. “ROP” refers to a mandatory supplementary pension scheme in Costa Rica. Data for New Zealand refer to KiwiSaver plans only and exclude members below 18 and those above 65 from the calculation.

Source: OECD Global Pension Statistics and other sources.