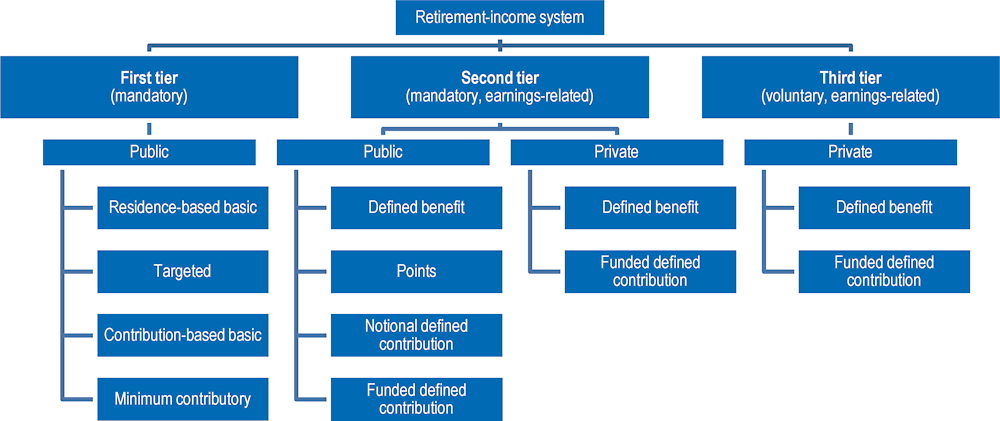

Retirement-income regimes are diverse and often involve a number of different programmes. The taxonomy of pensions used here consists of two mandatory “tiers”; the first generates retirement income independent of past earnings level with the second covering earnings-related components. Voluntary provision, be it personal or employer-provided, comprises the third tier.

Pensions at a Glance 2023

Architecture of national pension systems

Key results

Figure 3.1 is based on the role of each part of the system. The first tier comprises programmes offering the first layer of social protection in old age, and for which past earnings are irrelevant in the calculation of retirement income. Such schemes often target some minimum standard of living in retirement. Mandatory earnings-related components (second tier) contribute to smoothing consumption, and therefore standards of living, between working life and retirement. Pensions at a Glance focuses mainly on these mandatory components, although information is also provided on some widespread voluntary private schemes (third tier, see Chapter 4).

Table 3.1 shows the architecture of pension systems in OECD countries based on the rules that determine eligibility and benefit level while categorising mandatory earnings-related pensions as public or private in accordance with national accounts. Panel A describes the latest legislation applying to future retirees while Panel B shows where those rules have changed compared to current retirees.

Basic pensions can take two different forms: a residence‑based benefit or a benefit that is only available to those who contributed during their career (i.e. contribution-based). The level of the benefit may vary with the number of residence or contribution years but is independent of earnings levels during the career. Eight OECD countries have a residence‑based basic pension for future retirees while Norway is replacing it with a targeted scheme that involves a means test. Nine OECD countries feature a contribution-based basic pension.

Eligibility for targeted plans requires meeting some residence criteria. In these plans, the value of the benefit depends on income from other sources and possibly also assets. Hence, poorer pensioners receive higher benefits than better-off retirees. All countries have general safety nets of this type but only those countries are marked in which full-career workers with very low earnings (30% of average) would be entitled. This holds for eight OECD countries, both currently and in the future.

Minimum contributory pensions can refer to either the minimum of a specific contributory scheme, or to all schemes combined and are currently found in 18 OECD countries, with Chile and Italy phasing it out for future retirees. In most countries, the value of entitlements only takes account of pensions rather than testing for other income. Minimum contributory pensions either define a minimum for total lifetime entitlements, which may increase in level once the length of the contribution period exceeds certain thresholds, or they are based on minimum pension credits that calculate year-by-year entitlements of low earners based on a higher earnings level.

There are three kinds of second-tier pension schemes, defined benefit, points or defined contribution. For future retirees, public pay-as-you-go schemes follow a general defined benefit (DB) format in 20 OECD countries, with pension’s dependent on the number of years of contributions, accrual rates and individual pensionable earnings. In another eight countries, DB schemes apply to current retirees but have been or will be closed to new workers (Table 3.1 Panel B). Private occupational DB schemes are currently mandatory or quasi-mandatory in two OECD countries – Switzerland and the Netherlands, respectively – however, in the Netherlands, they are being replaced by defined contribution (DC) pensions from 2028 at the latest.

There are points schemes in five OECD countries: French occupational plans managed by social partners under public supervision and the Estonian, German, Lithuanian and Slovak public schemes. Workers earn pension points based on their earnings. At retirement, the sum pension points is multiplied by the pension-point value to convert them into a regular pension payment.

Defined contribution schemes can follow one of two paths, either being funded or notional. Funded defined contribution (FDC) plans are compulsory for future retirees in 14 OECD countries. In these schemes, contributions flow into an individual account. The accumulation of contributions and investment returns is usually converted into a monthly pension at retirement. Five of these countries, Denmark, Iceland, the Netherlands, Sweden and the United Kingdom, also have quasi-mandatory, occupational FDC schemes in addition to either compulsory earnings-related public plans or basic pensions.

The notional defined contribution (NDC) schemes are at the core of the pension system in five OECD countries (Italy, Latvia, Norway, Poland and Sweden). In addition, the smaller supplementary component of the pension system in Greece is also NDC for current retirees but will be funded defined contribution (FDC) for future retirees. These are pay-as-you-go public schemes with individual accounts that apply a notional rate of return to contributions made, mimicking FDC plans. The accounts are “notional” in that the balances exist only on the books of the managing institution. At retirement, the accumulated notional capital is converted into a monthly pension using a formula based on life expectancy or mortality rates.

Only Ireland and New Zealand in the OECD do not have second-tier pensions.

Further reading

OECD (2019), “Will future pensioners work for longer and retire on less?”, Policy brief on pensions, OECD, Paris, https://www.oecd.org/pensions/public-pensions/OECD-Policy-Brief-Future-Pensioners-2019.pdf.

Figure 3.1. Taxonomy: Different types of retirement-income provision

Table 3.1. Structure of retirement-income provision through mandatory schemes

|

First tier |

Second tier |

First tier |

Second tier |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Residence‑based |

Contribution-based |

Residence-based |

Contribution-based |

||||||||||

|

Basic |

Targeted |

Basic |

Minimum contributory |

Public |

Private |

Basic |

Targeted |

Basic |

Minimum contributory |

Public |

Private |

||

|

Panel A. Latest legislation (applying to future retirees entering the labour market in 2022 at age 22) |

|||||||||||||

|

Australia |

|

ü |

|

|

|

FDC |

Luxembourg |

|

|

ü |

ü |

DB |

|

|

Austria |

|

|

|

ü |

DB |

|

Mexico |

ü |

|

|

ü |

|

FDC |

|

Belgium |

|

|

|

ü |

DB |

|

Netherlands |

ü |

|

|

|

|

FDC [q] |

|

Canada |

ü |

ü |

|

|

DB |

|

New Zealand |

ü |

|

|

|

|

|

|

Chile |

|

ü |

|

|

|

FDC |

Norway |

|

ü |

|

|

NDC |

FDC |

|

Colombia |

|

|

|

ü |

DB |

FDC |

Poland |

|

|

|

ü |

NDC |

|

|

Costa Rica |

|

|

|

|

DB |

FDC |

Portugal |

|

|

|

ü |

DB |

|

|

Czechia |

|

|

ü |

ü |

DB |

|

Slovak Republic |

|

|

|

ü |

Points |

|

|

Denmark |

ü |

ü |

|

|

FDC |

FDC [q] |

Slovenia |

|

|

|

ü |

DB |

|

|

Estonia |

|

|

ü |

|

Points |

|

Spain |

|

|

|

ü |

DB |

|

|

Finland |

|

ü |

|

|

DB |

|

Sweden |

|

ü |

|

|

NDC + FDC |

FDC [q] |

|

France |

|

|

|

ü |

DB + Points |

|

Switzerland |

|

|

|

ü |

DB |

DB |

|

Germany |

|

|

|

|

Points |

|

Türkiye |

|

|

|

ü |

DB |

|

|

Greece |

ü |

|

|

|

DB + FDC |

|

United Kingdom |

|

|

ü |

|

|

FDC [q] |

|

Hungary |

|

|

|

ü |

DB |

|

United States |

|

|

|

|

DB |

|

|

Iceland |

ü |

ü |

|

|

|

FDC [q] |

|

||||||

|

Ireland |

|

|

ü |

|

|

|

Argentina |

|

|

ü |

ü |

DB |

|

|

Israel |

ü |

|

ü |

|

|

FDC |

Brazil |

|

|

|

ü |

DB |

|

|

Italy |

|

|

|

|

NDC |

|

China |

|

|

|

ü |

NDC + FDC |

|

|

Japan |

|

|

ü |

|

DB |

|

India |

|

|

|

ü |

DB + FDC |

|

|

Korea |

|

ü |

ü |

|

DB |

|

Indonesia |

|

|

|

ü |

DB + FDC |

|

|

Latvia |

|

|

|

ü |

NDC + FDC |

|

Saudi Arabia |

|

|

|

ü |

DB |

|

|

Lithuania |

|

|

ü |

|

Points |

|

South Africa |

|

ü |

|

|

|

|

|

Panel B. Current legislation where different from Panel A (applying to new retirees in 2022)* |

|||||||||||||

|

Chile |

|

✓ |

|

✓ |

DB |

FDC |

Mexico |

|

|

|

✓ |

DB |

|

|

Estonia |

|

|

✓ |

|

DB / Points |

FDC |

Netherlands |

✓ |

DB |

||||

|

Greece |

✓ |

|

|

|

DB + NDC |

|

Norway |

✓ |

✓ |

|

DB |

FDC |

|

|

Italy |

|

|

|

✓ |

DB + NDC |

|

United Kingdom |

✓ |

DB |

||||

Note: A tick for the column “Targeted” is only shown if a full-career worker at 30% of the average wage is eligible. [q] = Quasi-mandatory scheme based on collective agreements with very high coverage rate, see Chapter 8. DB = defined benefit, FDC = funded defined contribution, NDC = notional defined contribution. In Canada, the basic pension (OAS) is income‑tested but only through the tax system (“claw back”). The contribution-based basic pension in Israel is a 2% top-up (total maximum 50%) on the residence‑based basic pension for each contribution year beyond 10 years. In the Netherlands workers entering in 2022 would normally be in a quasi-mandatory private DB scheme, but these will all be converted to FDC by 2028 (Chapter 1). In Mexico, the government pays a transfer to the individual private FDC account of a contributing employee every month. In Switzerland, the government sets the contribution rate, the minimum rate of return or/and the annuity rate at which the accumulation is converted into a pension for mandatory occupational plans. These schemes are therefore implicitly defined benefit.

Source: See “Country Profiles” available at http://oe.cd/pag.