The structural or underlying fiscal balance is the difference between government revenues and expenditures corrected for effects that could be attributed to the economic cycle and one-off events. Removing the effects of economic fluctuations from the figures enables policy makers to identify the underlying trends of economic aggregates and allows them to better assess the sustainability of public finances in the long run. Government revenues tend to decline during economic downturns, as incomes fall. At the same time, public spending tends to increase, as more people claim social assistance or unemployment benefits. Governments may also increase public expenditure to stimulate the economy. All these effects were visible during the COVID-19 pandemic. The structural balance is a measure of the budget balance a government would have with its current policies if the economy was operating at its full potential (“potential GDP”).

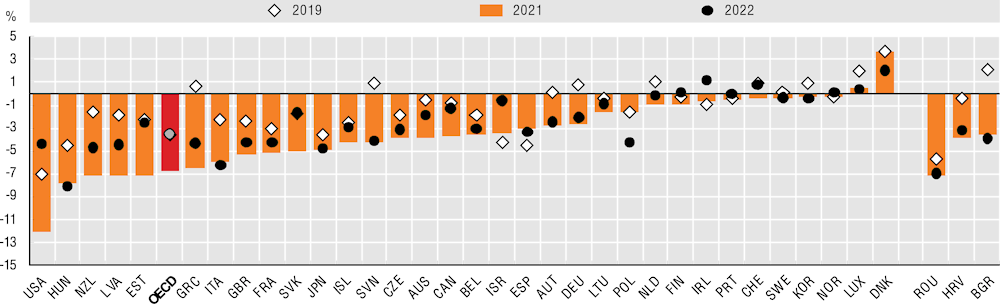

In 2022, the average general government structural balance across OECD countries was ‑3.5% of potential GDP, the same value as in 2019 (Figure 11.20). Denmark (2.1%), Finland (0.1%), Ireland (1.2%), Luxembourg (0.4%), Norway (0.1%) and Switzerland (0.8%) reported structural surpluses in 2022. Between 2021 and 2022 the average general government structural deficit decreased by 3.3 percentage points, from an average deficit of 6.8% of potential GDP in 2021. Over that period, structural deficits decreased the most in the United States (7.7 p.p.), Estonia (4.7 p.p.) and the Slovak Republic (3.4 p.p.).

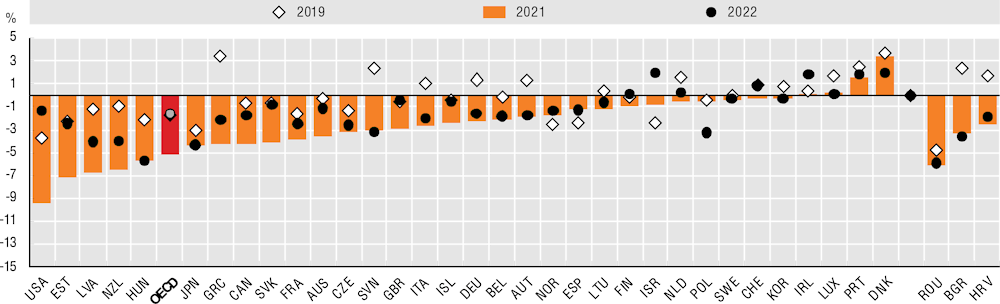

The general government structural primary balance is the primary balance adjusted for the impact of net interest payments on general government liabilities (i.e. interest payments minus interest receipts). In 2021 the average structural primary balance in OECD countries amounted to -5.2% of potential GDP, improving to ‑1.6% in 2022 (Figure 11.21). In the period 2007-22 the average level of structural primary deficit across OECD countries peaked in 2020 at 5.7% of potential GDP (see Online Figure G.6.10). The 2020 value records the structural deterioration of economic conditions resulting from the COVID-19 pandemic that triggered economic changes, such as an uptick on spending and supply chain disruptions (OECD, 2021).

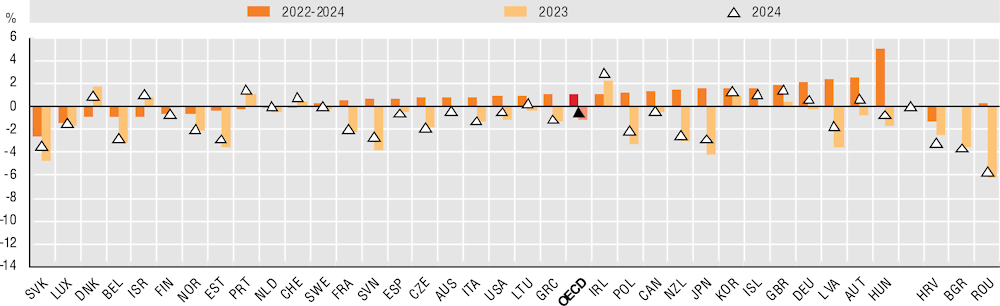

By 2024, the average structural primary balance is projected to be closer to equilibrium at ‑0.5% of potential GDP (Figure 11.22). The greatest improvements in the structural primary balance between 2022 and 2024 are forecast to be the highest in Hungary (5.0 p.p.), Austria (2.5 p.p.), Latvia (2.4 p.p.) and Germany (2.2 p.p.). While the economic outlook is still fragile, this positive trend is driven by positive expectations of businesses and consumers, weak but positive economic growth, food and energy prices starting to decrease and an overall mitigation of inflationary trends (OECD, 2023).