Government revenues are government income. The main sources of revenue in OECD countries are typically taxes and social contributions, with some income from charges for services provided by the state. In some countries, revenues may include a significant portion from non-tax sources, such as income from state-owned enterprises or royalties on natural resources. Revenue policy is typically designed to serve multiple purposes. The most fundamental is to collect funds to pay for the provision of goods and services for the public, such as health care and defence. Revenue policies will often also be designed not to worsen inequality, such as by levying higher income taxes on those with larger incomes. Revenue policies can also be used to encourage socially beneficial activities (e.g. tax breaks on research and development) and discourage harmful ones (e.g. taxes on carbon emissions or tobacco). In some cases, these different purposes may conflict with each other.

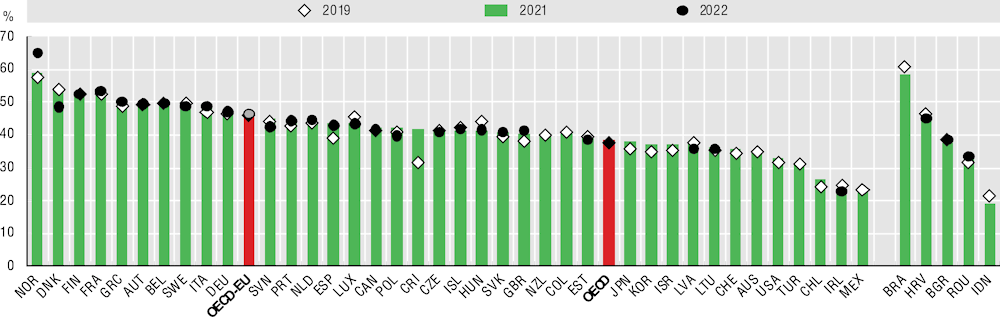

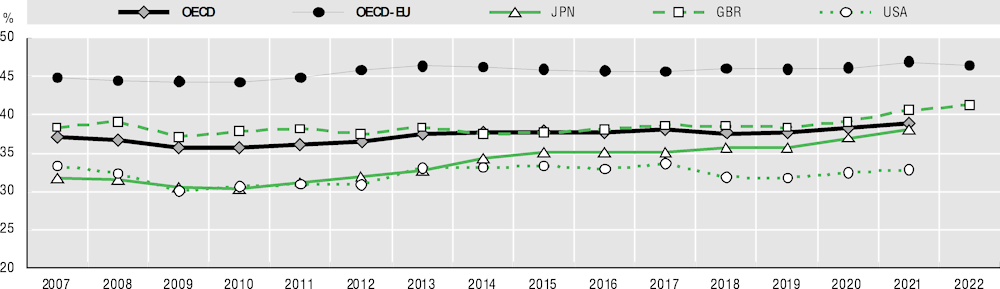

On average, general government revenues across the OECD were 38.8% of GDP in 2021 (Figure 10.1). Most OECD countries (25 out of 38) collected between 30% and 45% of GDP as government revenues in 2021. However, the range is wide, from 58.9% of GDP in Norway to 23.0% in Mexico. On average across the OECD, revenues as a percentage of GDP were very stable during the period 2007-19, always remaining between 35% and 38% of GDP (Figure 10.2). There was a slight increase during the COVID-19 pandemic with revenues rising to 38.2% of GDP in 2020 and 38.8% in 2021. This change does not indicate that taxes were raised during the pandemic, but rather that GDP fell sharply. In fact, as incomes and profits fell during the pandemic, so did the amount of taxes owed by many individuals and businesses. However, the aggregate figures do obscure significant changes in revenue as a percentage of GDP in some countries between 2019 and 2020. For example, there was a substantive decreases in Greece, and a substantive increase in Mexico (OECD, 2022).

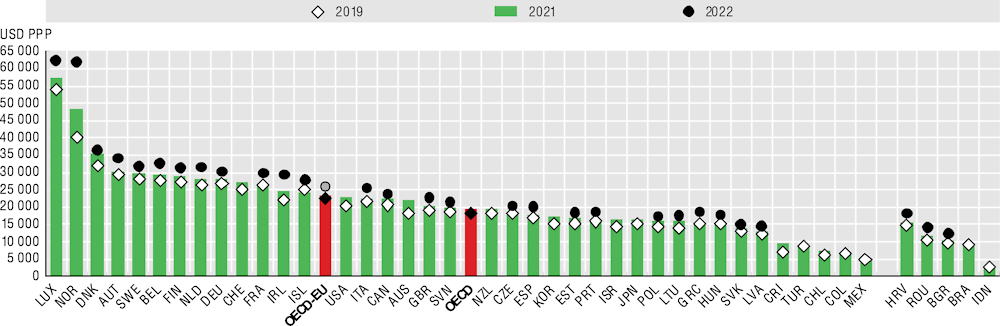

General government revenues per capita vary widely across the OECD (Figure 10.2). This is partially driven by differences in income per capita among OECD members. The three OECD countries with the lowest government revenues per capita (Chile, Colombia and Mexico) are also among those with the lowest income per capita. The two OECD countries with the highest government revenues per capita (Luxembourg and Norway) are among those with the highest income per capita. Between these extremes, variation is also driven by policy choices. For example, the United States, which ranked 5th among OECD countries in income per capita in 2021, ranked 16th in revenues per capita. This partly reflects policy decisions to set relatively lower tax rates and/or have narrower tax bases than in many OECD countries. Notably, as countries have exited the COVID-19 pandemic, per capita revenue has increased. Revenues per capita were higher in 2022 than in 2021 in every country for which data are available. Between 2021 and 2022 the real increase was 2.4% on average in OECD-EU countries (see Online Figure G.5.1).