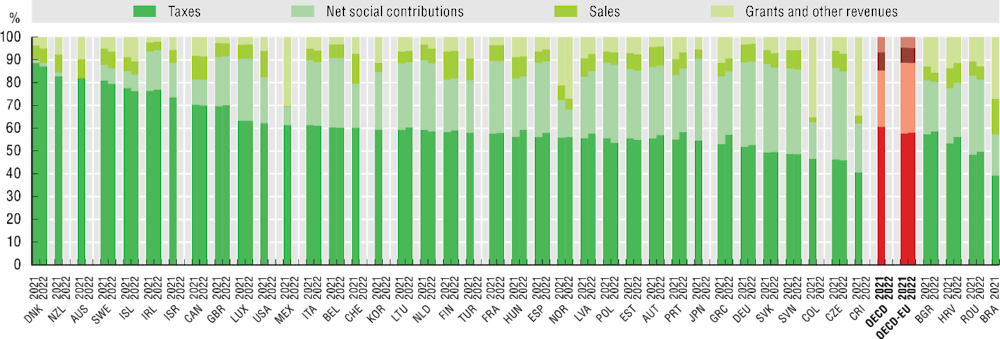

The structure of government revenues shows the sources from which governments collect their revenues, and how these change over time. Taxes are the most significant source of government revenues in all OECD countries (Figure 10.4). In 2021, the most recent year for which data are available for all countries, 60.6% of revenues in OECD countries were raised through taxes. In most OECD countries, taxes accounted for more than 50% of total government revenues. However, there was still a wide variation in their relative importance. The countries raising the highest share of revenues from taxes in 2021 were Denmark (88.5%) and New Zealand (82.8%), while Costa Rica had the lowest share (40.5%). The second most important source of revenues for OECD governments is social contributions, that is, payments into social insurance schemes. On average, these formed 24.7% of government revenues in OECD countries in 2021. Most countries which collected a relatively low share of their revenues from tax instead collected a relatively high share from social contributions, for example the Czech Republic (40.0% of revenues from social contributions) and the Slovak Republic (38.8%). OECD countries also collect a small proportion of their revenues from sales of goods and services (7.9% on average) and from grants and other sources (6.8%).

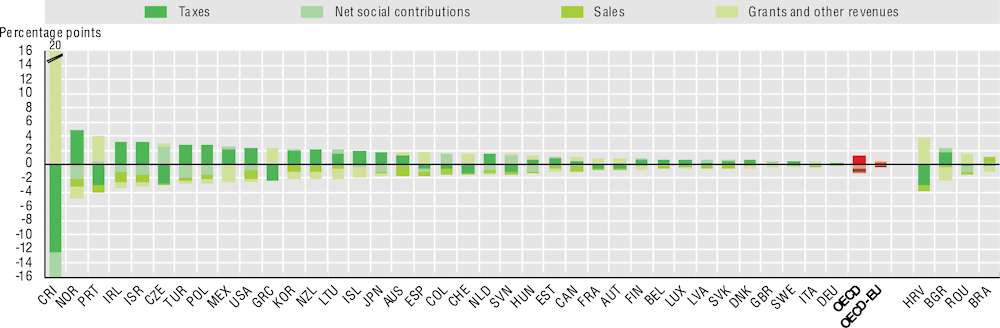

The structure of government revenues altered notably during the COVID-19 pandemic (Figure 10.5). In 35 out of 37 countries the proportion collected from sales of goods and services fell. On average, this fell by 0.5 percentage points across the OECD between 2019 and 2021. This suggests that many countries may have cut or removed fees for some public services during the COVID-19 pandemic. Most countries also saw a fall in the share of revenue from social contributions (by 0.6 p.p.) and grants and other sources (0.1 p.p.). Balancing this, 27 out of 37 governments collected an increased share of revenues from taxes. On average across the OECD, this rose by 1.2 p.p. between 2019 and 2021, with the largest increase in Norway (4.9 p.p.). Costa Rica was an exception to this general pattern, with a very large increase (20.4 p.p.) in the proportion of its revenues coming from grants and other revenues during the COVID-19 pandemic.

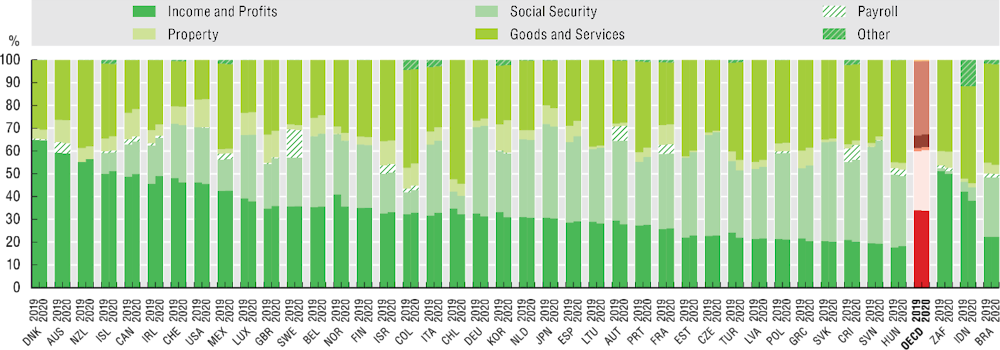

Government tax revenues typically come from three main sources: taxes on income and profits (33.8% of government revenue on average across the OECD), taxes on goods and services (32.1%), and social security contributions (26.7%) (Figure 10.6). These three sources account for at least 80% of tax revenue in every OECD country, although the specific mix varies. Denmark has the largest share of revenue from taxes on income and profits (64.7%) and one of the smallest from social security contributions (0.1%). In contrast, Slovenia has the second highest share from social security contributions (45.2%) and among the lowest from taxes on incomes and profits (19.4%).