The fiscal balance is the difference between a government’s revenues and its expenditures. It signals if public accounts are balanced or if there are surpluses or deficits. Recurrent deficits over time imply the accumulation of public debt and may send worrying signals to consumers and investors about the sustainability of public accounts which, in turn, may deter consumption or investment decisions. Nonetheless, if debt is kept at a sustainable level, deficits can help to finance necessary public investment, or in exceptional circumstances, such as unexpected external shocks (e.g. pandemics, wars or natural disasters), can contribute to maintaining living conditions and preserving social stability.

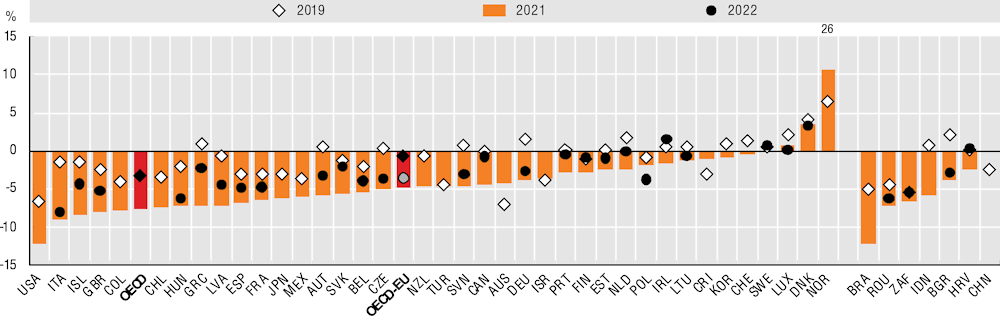

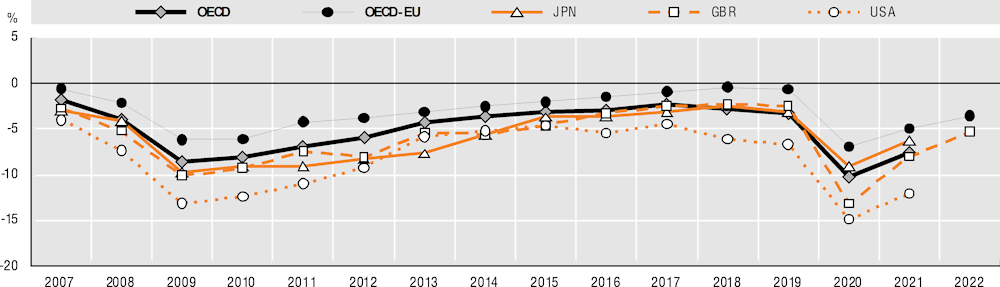

In 2021, the average general government fiscal balance in OECD countries amounted to -7.5% of GDP (Figure 11.17). Only Norway (10.6% of GDP), Denmark (3.6%) and Luxembourg (0.7%) reported surpluses while accounts were balanced in Sweden. These four countries were also the only ones that reported surpluses in 2022 among the 27 OECD countries for which 2022 data are available. The general government fiscal balance in the OECD overall and its largest economies followed a similar trend in the period 2007-22 (Figure 11.18). The most acute effects of two major global shocks were recorded in 2009, during the global financial crisis (when the OECD average deficit reached 8.5% of GDP), and in 2020, during the COVID-19 pandemic (average deficit of 10.2% of GDP). After 2009, both the OECD as a whole and the largest OECD economies made consolidation efforts, with different degrees of intensity (Figure 11.18). The rebound to smaller deficits in 2021 and 2022 after the deep low of 2020 has been faster than expected (OECD, 2023).

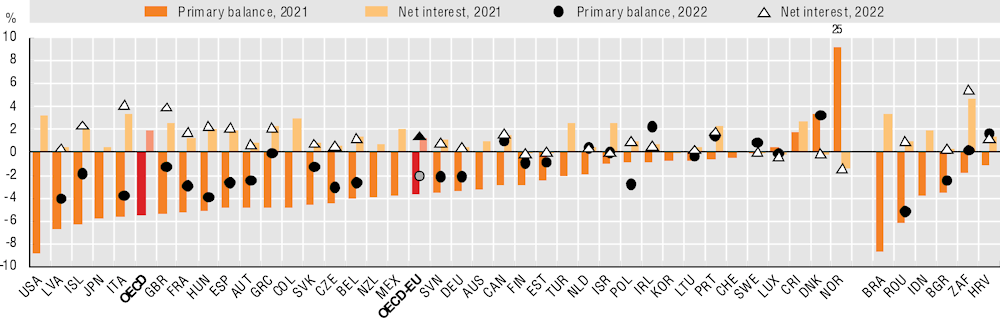

The general government primary balance is the difference between revenues and expenditures excluding interest payments. It sheds light on a government’s capacity to honour its financial commitments without incurring extra debt. It is a more accurate indicator of the overall state of public finances in a country than the general fiscal balance. In 2021, the average primary balance across OECD countries was -5.6% of GDP (Figure 11.19). This indicates that governments were borrowing money to pay for some of the goods and services they were providing for citizens and businesses in that year. Norway (9.1% of GDP), Denmark (3.4%), Costa Rica (1.7%) and Luxembourg (0.4%) were the only OECD countries that recorded a primary surplus. Among OECD-EU countries the primary balance improved in 2022, from an average deficit of 3.6% of GDP in 2021 to an average deficit of 2.1% of GDP in 2022.

Net interest payments for debt servicing are an inflexible part of public budgeting and have to be honoured to guarantee access to international financial markets and multilateral funds. On average, net interest payments among OECD countries in 2021 amounted to 1.9% of GDP (11.19). The countries with the highest payments as a share of GDP were Italy (3.4% of GDP), the United States (3.2%) and Colombia (3.0%). In OECD countries with available information, the largest increases in net interest payments between 2021 and 2022 occurred in the United Kingdom (1.4 percentage points), Italy (0.8 p.p.) and France (0.5 p.p.). The largest decrease was in net interest payments over this period was Portugal, in where payments fell by 0.5 p.p.