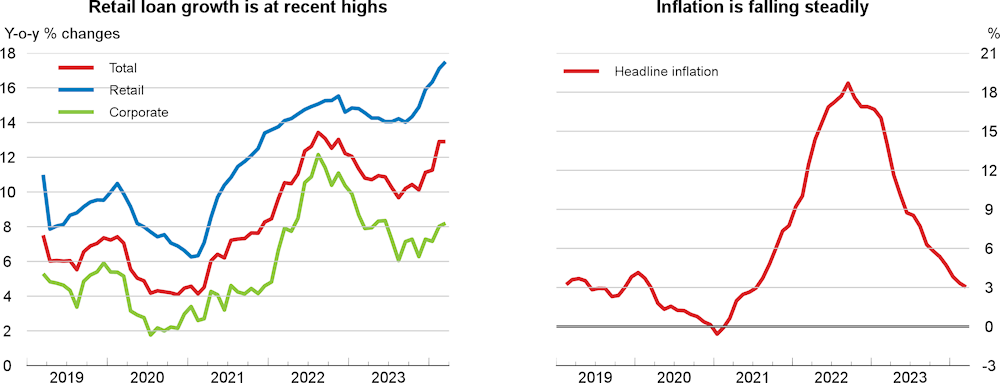

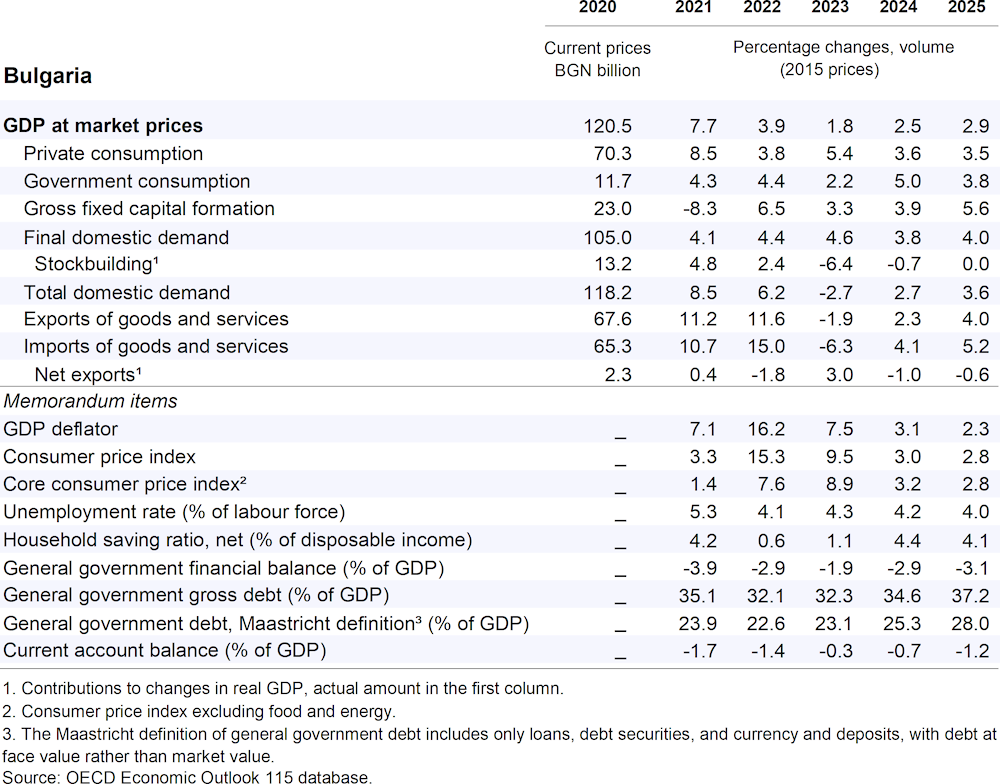

Growth is expected to strengthen to 2.5% in 2024 and 2.9% in 2025, as government investment picks up, along with the rollout of EU funds. Private consumption growth will moderate, but it will remain strong, supported by high wage and credit growth. Improving external conditions and easing constraints on production are expected to lift trade volumes. While headline inflation has been slowing, high wage growth is an obstacle to faster disinflation. Continued political uncertainty places planned reforms and investments at risk.

Interest rates have followed those in the euro area, consistent with the currency board, but transmission to the Bulgarian economy is slow and incomplete, contributing to a household credit boom. Further macroprudential measures should be deployed to slow the pace of loan growth. The fiscal deficit is set to widen substantially with further rises in spending in 2024. A more prudent fiscal policy would therefore be warranted to manage demand and prepare for longer-run challenges. Commitments to fully implement Recovery and Resilience Facility reform measures and a comprehensive green transition roadmap would allow Bulgaria to boost trend growth and green the economy.