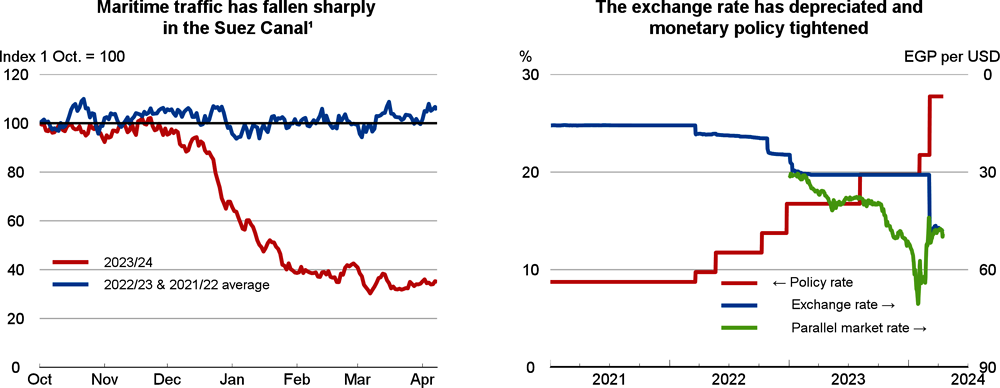

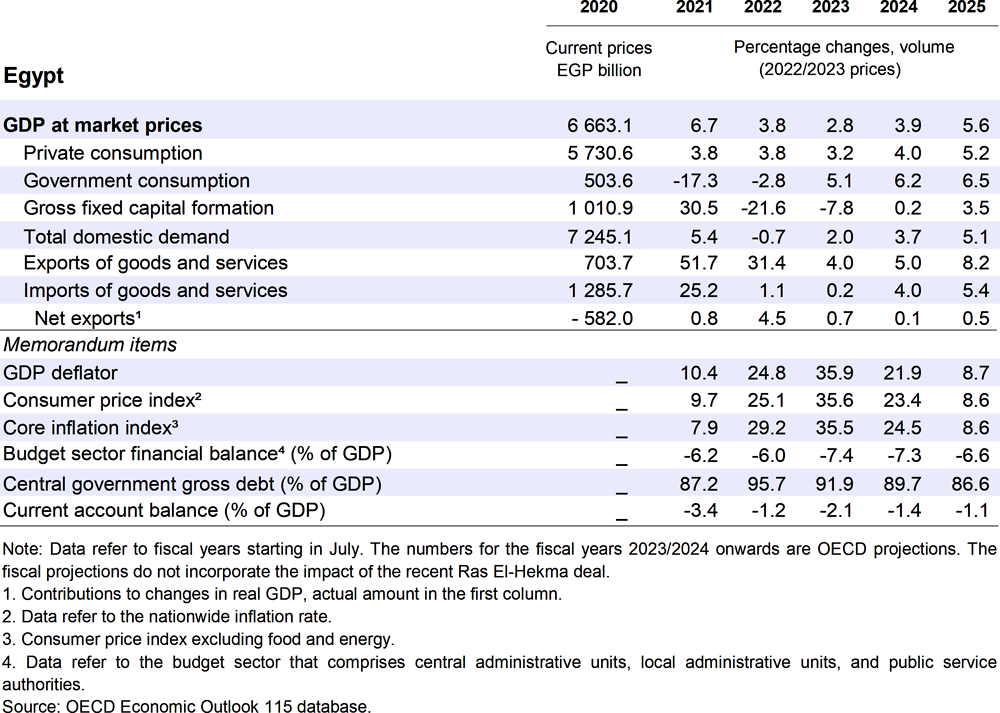

Growth slowed to 2.8% in FY 2023-24 but is expected to regain strength gradually, to 3.9% in FY 2024-25 and 5.6% in FY 2025-26. The shift to a flexible exchange rate regime has eased balance of payments tensions and improved confidence. Private consumption will gain momentum as inflation declines. A weaker exchange rate will boost exports but they will remain below potential due to adverse geopolitical conditions.

Regaining control of inflation, improving public financial management and increasing the role of the private sector are essential to reestablish the foundations for strong and sustainable growth. This requires a restrictive monetary policy stance and structural reforms to reduce public indebtedness. Government spending, including subsidies and investments, must be rationalised, and the announced plan of asset sales and removal of tax exemptions for state‑owned enterprises must be implemented fully and timely.