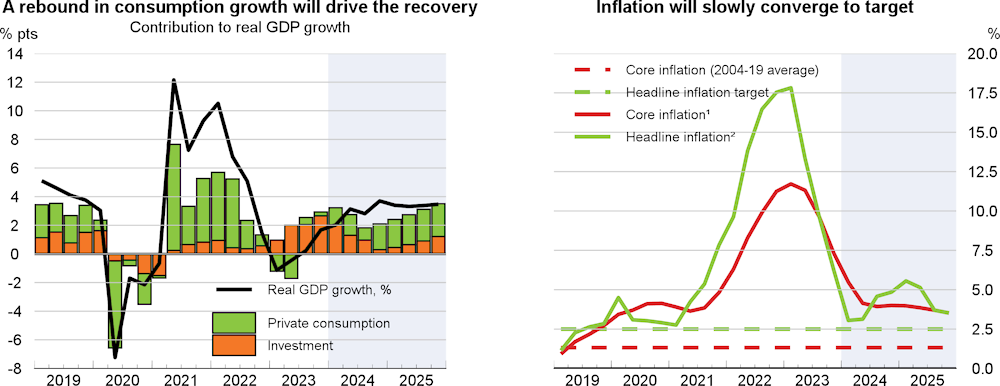

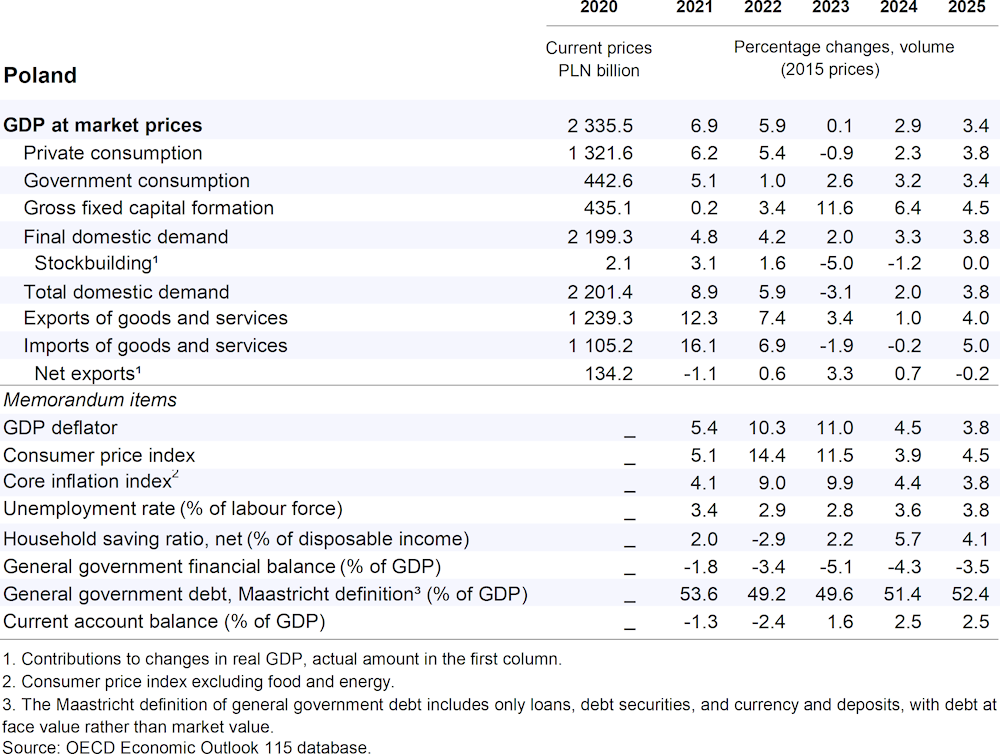

Real GDP growth is expected to recover to 2.9% this year with rising real wages and fiscal policy supporting consumption growth, despite weaker investment growth. Headline inflation has been falling, but will rise to 4.8% by the end of 2024 due to a withdrawal of food and energy support measures before declining to 3.5% in 2025. In 2025, real GDP will grow by 3.4% as EU funds lead to a pickup in investment and inward foreign direct investment (FDI) remains strong, although consumption growth will still be tempered by inflation and a further withdrawal of fiscal support. Slower than anticipated fiscal consolidation and higher investment could pose upside risks to inflation, while an escalation of the war in Ukraine could disrupt the economy.

Monetary policy should remain restrictive and, given the risk of persistent inflation and the uncertainty in the outlook, ease only slowly. Gradual fiscal consolidation as part of a medium-term strategy is needed to avoid overheating and improve long-term fiscal sustainability. In the medium term, enhancing lifelong learning programmes could alleviate skills shortages and help support greener growth.