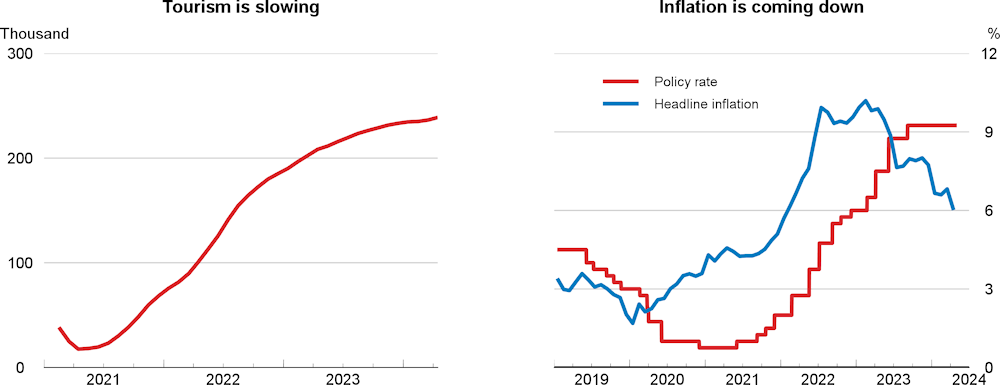

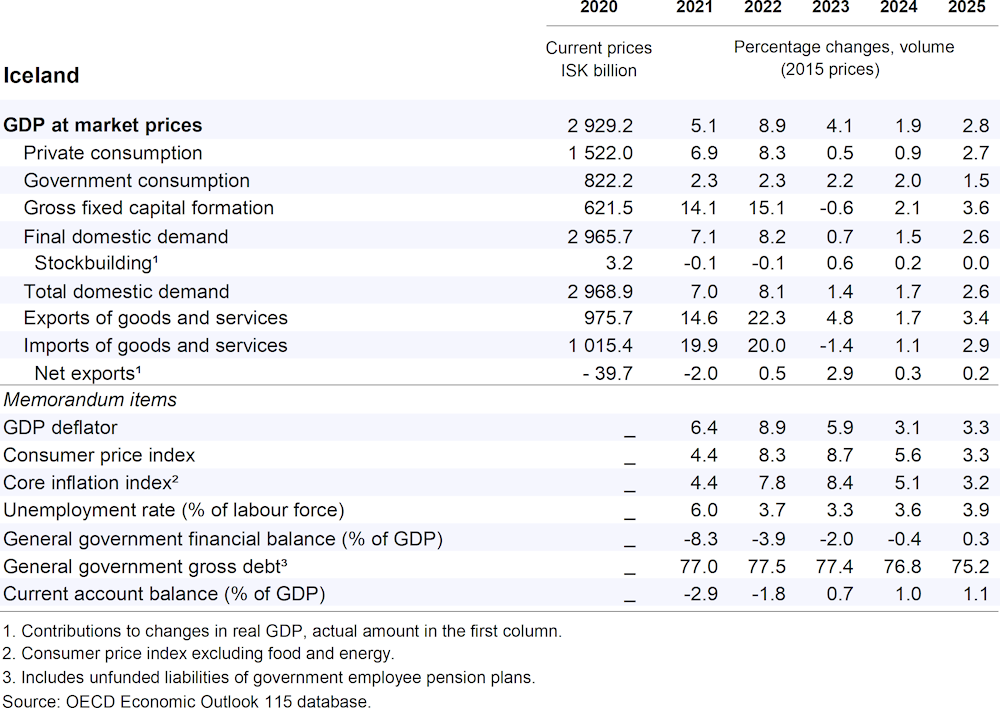

Economic growth will decline to 1.9% in 2024 as exports slow but rebound to 2.8% in 2025. Private consumption will remain lacklustre in the near term, reflecting subdued real wages, but will pick up in 2025 as disposable income strengthens. Business investment will remain weak in 2024 as confidence is fragile but will regain momentum in 2025 as financial conditions ease. Housing investment will resume after three years of contraction. Foreign tourism will hardly grow due to capacity constraints. The unemployment rate will edge up to near 4%.

The central bank has left the policy rate unchanged at 9.25% since August 2023. Consumer price inflation is still high at close to 7%, and inflation is projected to remain above the target of 2.5% in 2024 and 2025, warranting continued central bank vigilance. Fiscal policy was contractionary in 2023 and is set to tighten further despite additional disaster‑related spending, to help reduce inflationary pressures and maintain fiscal space. Lower barriers to business entry, notably for foreigners, and less red tape in the professions could help spur underlying growth and diversify the economy.