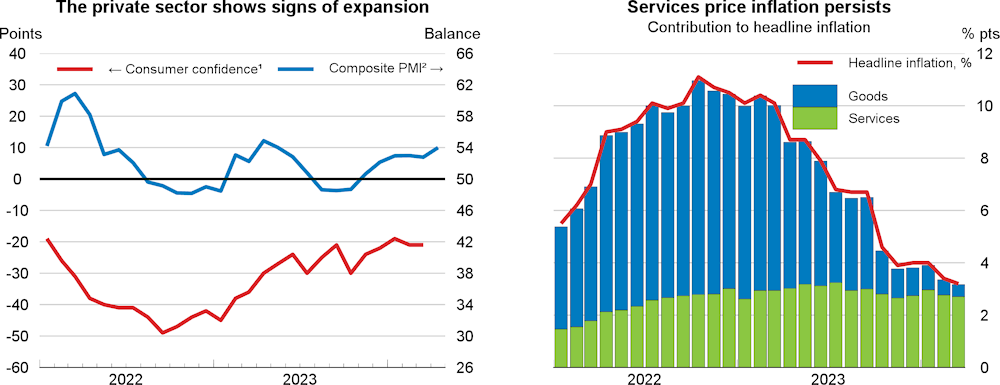

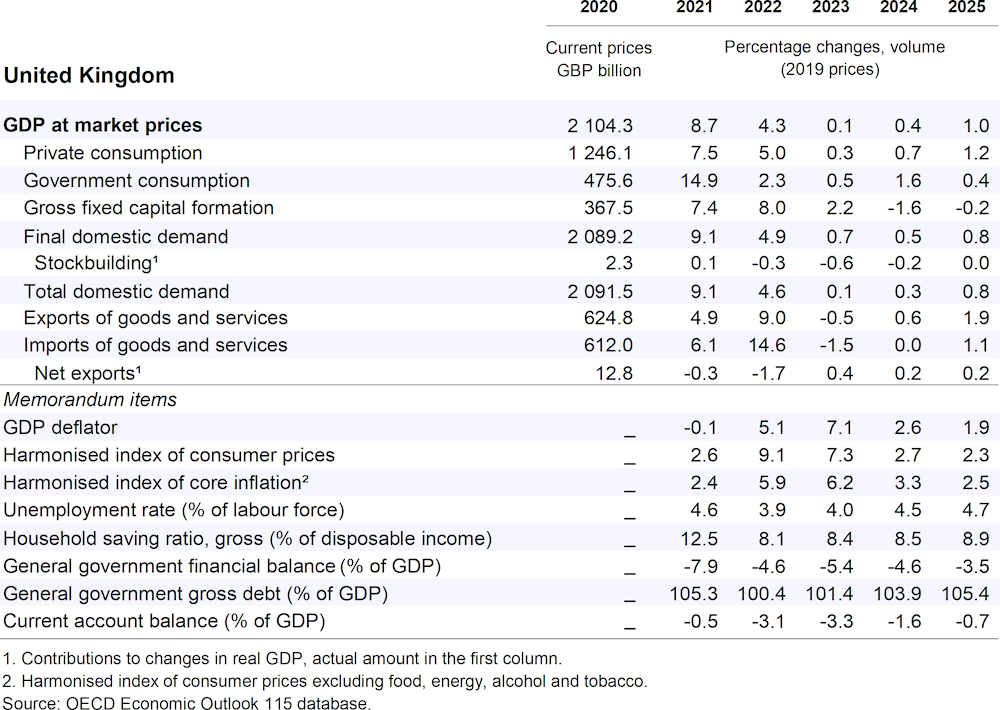

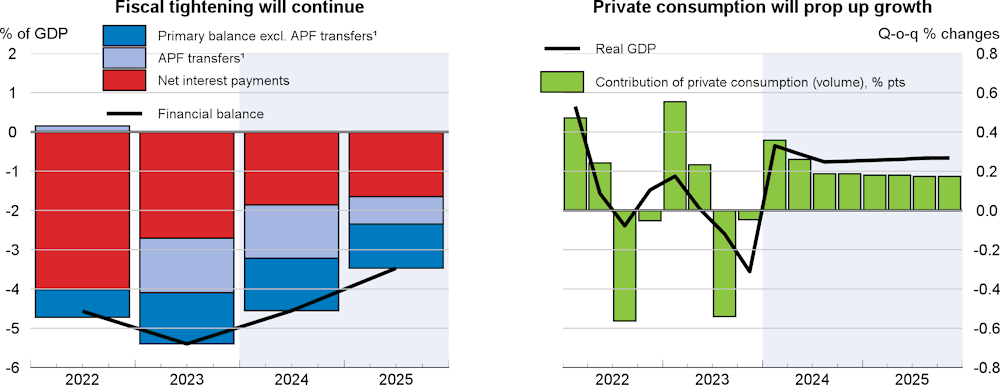

GDP growth is projected to remain sluggish at 0.4% in 2024 before improving to 1.0% in 2025, reflecting the waning drag from past monetary tightening. Stronger real wage growth will support a modest pick‑up in private consumption. Headline inflation is expected to continue moderating towards target as energy and food prices have eased substantially, but persistent services price pressures will keep core inflation elevated at 3.3% in 2024 and 2.5% in 2025. Unemployment will continue increasing and reach 4.7% in 2025 as the labour market cools, although the actual degree of slack remains uncertain.

The fiscal and monetary policy mix is adequately restrictive and should remain so until inflation returns durably to target. Fiscal policy should remain prudent and focus on productivity-enhancing public investment when the monetary stance normalises. Reforming property taxation can help rebuild fiscal buffers and promote both efficiency and progressivity. Further advancing supply-side reforms while avoiding policy churn is essential to increase potential growth, especially by continuing to address economic inactivity and stagnant investment.