The competitiveness of any economy is heavily influenced by its energy policies. This chapter investigates the energy policies to ensure that energy markets are well-regulated, sustainable and competitive. The first sub-dimension, governance and regulation, focuses on how the energy markets are governed and whether policy is conducive to establishing efficient and competitive energy markets. The second, energy security, explores measures taken to make the energy sector more resilient, including through the diversification of energy supply. The third sub‑dimension, sustainability, focuses on the energy sector decarbonisation, including promoting renewable energy and energy efficiency policies. The fourth sub-dimension, energy markets, analyses how energy markets are operated, whether competition is used to promote efficient allocation of energy resources and the degree of regional integration.

Western Balkans Competitiveness Outlook 2024: Serbia

13. Energy policy

Abstract

Key findings

With a score of 3.0, Serbia’s rating is stable and remains comparable to the regional average. On the one hand, Serbia has made good progress in developing its energy market structure and efficiency. However, additional efforts should be geared towards crisis response and resilience and the diversification of energy supply – policy areas which lowered Serbia’s score in this cycle.

Table 13.1. Serbia’s scores for energy policy

|

Dimension |

Sub-dimension |

2018 score |

2021 score |

2024 score |

2024 WB6 average |

|---|---|---|---|---|---|

|

Energy |

12.1: Governance and regulation |

3.5 |

3.3 |

||

|

12.2: Energy security |

2.5 |

2.5 |

|||

|

12.3: Sustainability |

3.0 |

2.8 |

|||

|

12.4: Energy markets |

3.2 |

3.3 |

|||

|

Serbia’s overall score |

2.2 |

3.0 |

3.0 |

3.0 |

|

The key findings are:

The development of the National Energy and Climate Plan (NECP) constitutes an important step towards transposing the EU acquis such as the Governance Regulation. Along with other key policy documents, such as the Low Carbon Development Strategy 2023-30, the Plan provides the basis for decarbonising Serbia’s energy sector. However, the NECP lacks a climate neutrality target.

Serbia heavily relies on imports from only one economy, Russia, for its natural gas supply. However, recent developments, such as the natural gas supply agreement with Azerbaijan and the launch of a new interconnector with Bulgaria in December 2023, have the potential to contribute to diversifying Serbia’s gas consumption (around 3 billion cubic metres annually) by adding an additional import capacity of up to 400 million cubic metres.

Serbia became the first economy in the Western Balkans to establish an intraday electricity market in July 2023. However, the benefits of markets are limited since deregulation is only taking place to a limited extent. Despite an advanced legal framework, in practice, the dominant position of the established supplier prevents the formation of truly competitive power markets.

Serbia reached an important milestone in the deployment of renewable energy capacity under market-based mechanisms through the first-ever auctions for solar capacity (50 MW) and wind capacity (400 MW), completed in 2023 and procured through a contract for difference (CfD) model, ensuring price stability and risk reduction for investors.

Unbundling of the gas transmission system is experiencing delays – leading to a lack of compliance with the Third Energy Package – and impeding the development of a competitive natural gas market. Moreover, third-party access rules in natural gas still do not comply with the Third Energy Package, leading to discriminatory market access practices.

State of play and key developments

Sub-dimension 12.1: Governance and regulation

The energy policy, legal and institutional framework in Serbia is currently undergoing significant changes. Key developments include the preparation of the Integrated National Energy and Climate Plan, the new Energy Development Strategy and the Low Carbon Development Strategy (covering the period until 2030). These documents, which are foreseen to be adopted once the formation of the Serbian government has been completed,1 aim to define Serbia's new energy policy in line with its obligations pursuant to the EU and Energy Community acquis.

The process, however, has faced delays, partly due to the regional and national impacts of the recent energy crisis caused by the Russian war of aggression against Ukraine. This necessitated additional analyses, pushing back the timeline for adopting the new strategy. Legislative changes have also been a part of the landscape, with amendments to the Law on Energy and the adoption of new laws on renewable energy sources (RES) and energy efficiency.

Serbia has largely transposed the Third Energy Package into national law, and the transposition of the Clean Energy Package is also progressing, though alignment with specific directives and regulations needs completion. Additionally, the transposition and implementation of the New Electricity Integration Package and network codes are yet to be finalised. Regarding market dynamics, the legal framework theoretically allows customers to choose their suppliers. However, the reality differs, with only a small fraction of customers participating in the competitive market and changing their suppliers.

A broad range of energy indicators and data is being collected and published in annual reports. However, while a database of key indicators exists, evaluation procedures appear to lack full institutionalisation and are limited to standard consultation procedures without regular evaluation cycles.

The legislation concerning the energy regulator complies with the EU and Energy Community acquis, establishing a legal framework for an independent regulator. Decision making within the Energy Agency of the Republic of Serbia (AERS) is designed to be fully independent from executive authorities, with its decisions subject to review only by relevant courts. Despite this framework, there are concerns about the regulator's effectiveness and true independence, highlighted by its failure to enforce deregulation and unbundling obligations fully.

Staffing and capacity building at AERS present notable challenges. With 42 full-time employees, the agency's staffing levels are inadequate for managing the comprehensive tasks outlined in the Third Energy Package and the Clean Energy Package. Efforts such as task prioritisation, twinning projects, and IT support have been undertaken, yet the regulator still faces resource limitations. Financial resources are mostly sufficient, but hurdles in hiring additional staff persist, which could also result from AERS’ salaries, which are not at industry standard. Full-time staff at AERS only increased marginally over the past years (Table 13.2).

Table 13.2. Full-time staff at the Energy Agency of the Republic of Serbia

|

Year |

2019 |

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|---|

|

Number of full-time staff |

38 |

40 |

41 |

41 |

42 |

Source: Data collected from the Energy Agency of the Republic of Serbia as part of the Competitiveness Outlook 2024 assessment.

AERS has not been involved with the Agency for the Cooperation of Energy Regulators (ACER) in the past. While extensive monitoring and auditing processes are in place with clear accountability mechanisms, assessment and co-ordination appear limited to internal review procedures and regular reporting to the parliament. A noteworthy development concerning institutional co-ordination is that AERS has signed memorandums of understanding with the Competition Protection Authority to streamline the exchange procedures between those two institutions.

Sub-dimension 12.2: Energy security

In response to the energy crisis, a series of measures have been implemented along with relevant planning documents to strengthen crisis response and resilience. These measures include setting retail price caps, initiating support schemes for specific customer groups, and launching energy efficiency and saving campaigns. Additionally, there have been investment incentives in energy savings, energy efficiency, generation, and storage. Promoting state investments in these areas, along with regional co‑operation for generation and supply adequacy, has been a key focus.

A risk resilience plan is set to be developed following the transposition of the Risk Preparedness Regulation. This plan is expected to enhance the sector's preparedness for future challenges and to provide a comprehensive framework for disaster response and resilience policy, but its drafting has yet to be commenced, pending the alignment of the legal framework with the necessary EU acquis. Network Development Plans have been revised to increase resilience against external factors, including the impact of climate change. While a broad range of measures has been taken to address the crisis, a more structural approach to managing crisis response and building resilience is still needed, and the extent to which the envisaged risk resilience plan will tackle that remains to be seen.

Monitoring and evaluating these measures are overseen by a government working group dedicated to energy supply security. This group regularly assesses the situation and proposes measures to ensure supply security. The composition and frequency of meetings of this working group have been revised to address the ongoing challenges better. While co-ordination meetings are held regularly, it remains unclear to what extent these discussions and conclusions are translated into policy changes.

Several planned investments in energy infrastructure projects have been delayed or not implemented on time due to budget constraints, issues with land purchase or usage rights, and a lack of human resources.

The NECP contains objectives and measures aiming to contribute to the diversification of energy supply. A significant development in this regard was the completion and operation of a new interconnector with Bulgaria, enhancing interconnection with neighbouring economies. A key concern, nevertheless, remains the dependence on Gazprom, which poses challenges to diversification and security of supply for natural gas. However, important positive developments have taken place in this regard, as Serbia signed a gas supply agreement with Azerbaijan in November 2023. This supply will be enabled by another interconnector with Bulgaria, commissioned in December 2023. Serbia also leased an annual capacity of 300 million cubic metres for liquefied natural gas (LNG) imports from Greece’s Alexandroupolis terminal, the construction of which is planned to be completed in 2024. These developments are anticipated to impact diversification and strengthen the security of the energy supply positively.

No progress has been made in establishing competitive wholesale or retail markets for natural gas in compliance with the EU Third Energy Package. Despite positive developments, there is insufficient information to fully assess the extent to which existing initiatives and plans comprehensively address the issue of energy diversification.

Sub-dimension 12.3: Sustainability

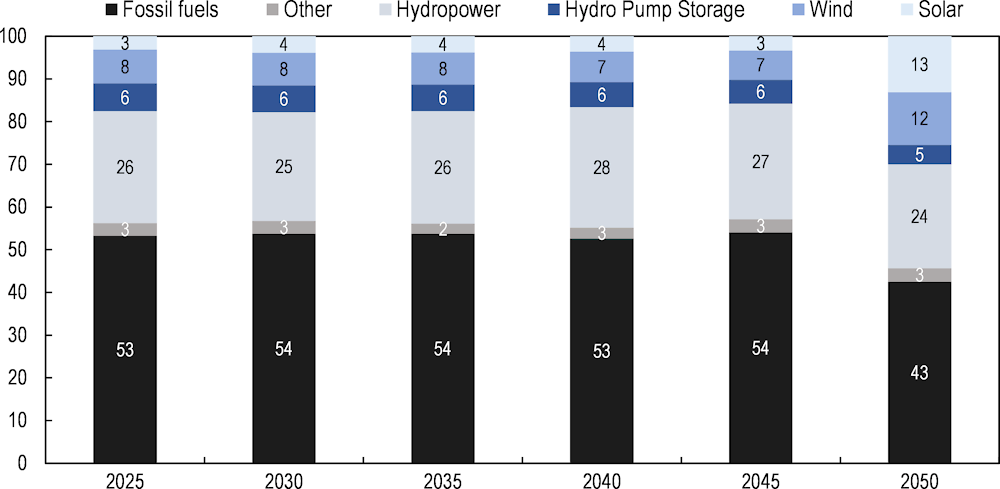

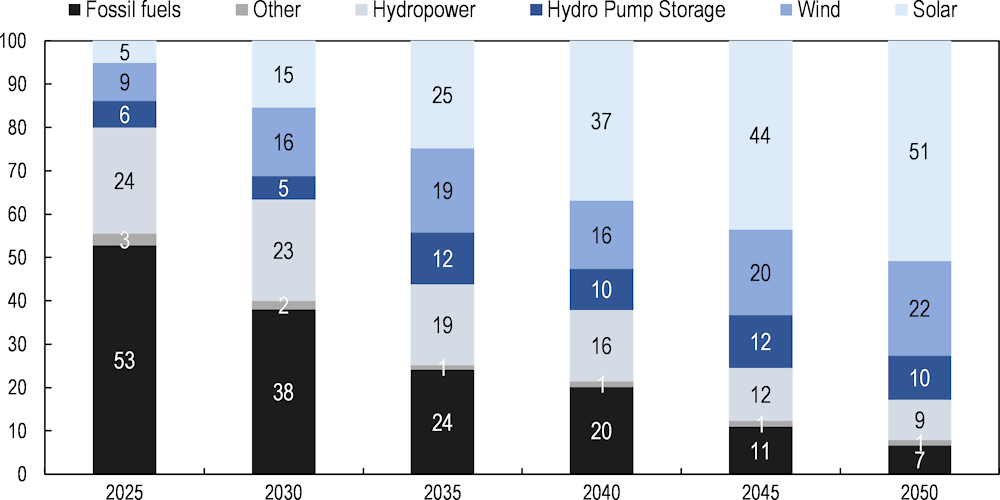

Serbia has recently placed additional focus on energy sector decarbonisation, which is in line with the EU and Energy Community acquis. The Governance Regulation has been successfully transposed through the Law on Climate Change and the Law on Energy. Additional secondary legislation implementing the Law on Climate Change has also been adopted to further the implementation of the Governance Regulation. In June 2023, the National Energy and Climate Plan (NECP) was submitted to the Energy Community Secretariat, which issued its feedback in November 2023, asking for a revision of the plan to bring it in line with the Energy Community’s 2030 targets on renewable energy and energy efficiency (Energy Community Secretariat, 2023[1]). A revised version of the NECP was prepared by December 2023, partially integrating the Secretariat’s recommendations. In addition to the NECP, a Low Carbon Development Strategy covering the timeframe from 2023 to 2030 was adopted by the government in June 2023. This strategy also sets forth an outlook until 2050 but does not include a carbon neutrality target. Figures 13.1 and 13.2 show the difference in the scenarios planned under the NECP, as under the scenario comprising additional measures (WAM), Serbia plans to reduce its share of coal-fired generation while increasing its renewable generation capacity. Significant efforts will be needed to ensure the reduction in coal-based capacity is effective and takes place in a gradual timeline, in a way that is more ambitious compared to the scenario with existing measures (WEM).

Figure 13.1. Serbia’s electricity generation capacity sources under the National Energy and Climate Plan's scenario with existing measures (2025-2050)

Share of each electricity source is denoted in percentage

Notes: “Fossil fuels” is a grouping of data on solid fuels and natural gas from the source document. “Other” is a grouping of bioenergy and waste and industrial combined heat and power.

Source: Ministry of Mining and Energy (2023[2]).

The Serbian government has indicated its intention to gradually reduce budget allocations to subsidise fossil fuel production, particularly coal. However, there is currently no greenhouse gas (GHG) pricing mechanism in place. This point is particularly concerning given the upcoming introduction of the EU’s Carbon Border Adjustment Mechanism (CBAM), which could have significant impacts on Serbia’s exports to the EU if an appropriate GHG pricing mechanism is not introduced. The Serbian NECP does plan to introduce a carbon pricing scheme in its WAM scenario, which would start in 2027 with a price of EUR 4 per ton, to be increased to EUR 40 per ton in 2030, and only matching the EU-ETS price in 2045. A national GHG inventory system is in place, as mandated by the Law on Climate Change. This system is established, maintained, and continuously improved to assess GHG emissions following the requirements of the United Nations Framework Convention on Climate Change.

Figure 13.2. Serbia’s electricity generation capacity sources under the National Energy and Climate Plan's scenario with additional measures (2025-2050)

Share of each electricity source is denoted in percentage

Notes: “Fossil fuels” is a grouping of data on solid fuels and natural gas from the source document. “Other” is a grouping of bioenergy and waste and industrial combined heat and power.

Source: Ministry of Mining and Energy (2023[2]).

A just transition plan is paramount when phasing out coal, as it addresses the complex economic, social, and environmental challenges associated with this necessary shift (Box 13.1). Progress towards decarbonisation goals in the energy sector is regularly monitored and evaluated by the Ministry of Mining and Energy and the Ministry of Environment. Additionally, a study on just transition is under way, and includes a broad range of consultations. This study is integral to understanding and managing the socio-economic impacts of transitioning from fossil fuels to a more sustainable energy mix, ensuring that the shift towards greener energy sources is effective and equitable. However, there is currently insufficient political commitment to drive such a just transition, which presents a big risk, as societal engagement and acceptance are of the utmost importance for a successful phaseout of fossil fuels.

The renewable energy policy framework has seen significant developments in recent years. A National Renewable Energy Action Plan (NREAP) has been drafted and adopted, marking a crucial step towards renewable energy development. The Law on Renewable Energy Sources and its amendments have significantly advanced Serbia's alignment with the EU's Renewable Energy Directive. Secondary legislation related to the sustainability criteria for biofuels, bioliquids, and biomass fuels has also been enacted in November 2023.2 In June 2023, Serbia launched its first auctions for solar capacity (50 MW) and wind capacity (400 MW) after adopting the necessary bylaws related to the RES auction. Serbia has opted for the Contract for Difference (CfD) model to procure this renewable capacity. In the area of wind capacity, the entire 400 MW were successfully auctioned, with the successful bids ranging between EUR 64.5 and EUR 79 per MWh. Moreover, four solar photovoltaic projects were allocated 25.2 MW, with their winning bids varying from EUR 88.7 to EUR 98.8 per MWh. The capacity of prosumers in Serbia remains relatively low compared to other Western Balkan economies, with an installed capacity of 40 MW.

Box 13.1. Need for and importance of just transition plans

First and foremost, a just transition plan ensures that the individuals and communities reliant on the coal industry are not left behind. It focuses on retraining and upskilling workers, offering alternative job opportunities in clean energy sectors. This safeguards livelihoods and capitalises on the existing workforce's skills and expertise.

Moreover, a just transition plan prioritises environmental justice. It aims to minimise the adverse effects of coal mining on marginalised communities, which often suffer the most from pollution and its health consequences. Additionally, such a plan fosters economic diversification. By investing in renewable energy projects and green technologies, regions can create new industries, attract investments, and revitalise their economies. This helps offset the economic impact of coal phaseouts and positions communities for long-term growth and sustainability.

In conclusion, a just transition plan for coal phaseouts is indispensable for mitigating the negative impacts on workers, communities, and the environment. It ensures fairness, equity, and resilience in the face of a necessary energy transition.

Renewable Guarantees of Origin (GOs) are certificates that provide transparency and verification of the renewable origin of electricity generated from renewable energy sources (Box 13.2). Serbia has a functional system for Guarantees of Origin and is a full member of the Association of Issuing Bodies. This system is crucial for tracking renewable energy generation and ensuring transparency and reliability in the renewable energy market.

Box 13.2. Guarantees of Origin as a tool to strengthen the uptake of Renewable Energy Sources

Renewable Guarantees of Origin (GOs) are certificates that provide transparency and verification of the renewable origin of electricity generated from renewable energy sources. They serve as a valuable tool to promote renewable energy and bring several advantages to both producers and consumers, as they offer a reliable and standardised method for verifying the renewable origin of electricity. This helps consumers make informed choices about their energy sources, ensuring they are supporting environmentally friendly options.

Furthermore, Guarantees of Origin enhance transparency in the energy market by clearly identifying the source of electricity generation. This transparency holds producers accountable for their claims regarding their energy sources and fosters consumer trust. At the same time, such guarantees empower consumers to make conscious choices about their energy consumption. They can choose electricity from specific renewable sources like wind, solar, or hydro, aligning their energy consumption with environmental values.

Having a functional system for Guarantees of Origin in place and being a full member of the Association of Issuing Bodies, Serbia is a forerunner in the Western Balkan region.

Source: Association of Issuing Bodies (2024[5]).

In Serbia, there have been significant legislative and policy developments aimed at enhancing energy efficiency. The primary legislation in this area saw adoption of the new Law on Energy Efficiency in April 2021, transposing the first Energy Efficiency Directive. However, full alignment with the EU's Clean Energy Package in Energy Efficiency is still outstanding, as the revised Energy Efficiency Directive and the Energy Performance of Buildings Directive have not been fully transposed.

In terms of secondary legislation, plans, and policies, there has been considerable activity in the past two years. Over 30 new bylaws and regulatory acts were adopted during 2022 and 2023. This includes the establishment of certification schemes for energy managers and energy auditors, with the schemes for energy auditors introduced for the first time. Also, the Framework Labelling Regulation was transposed in March 2023, introducing a comprehensive system for labelling energy-related products with the aim of providing consumers with clear, standardised information on the energy efficiency of products.3

Article 14 of the Energy Efficiency Law provides the legal basis for mandatory energy savings. In line with saving goals defined by the government of Serbia, big energy consumers in the industrial sectors are required to achieve energy savings of 1% of their primary energy consumption from the previous year. Serbia has also put in place a Long-Term Building Renovation Strategy to increase energy efficiency in buildings. A challenge that remains is the absence of consumption-based metering and billing in district heating, which is a barrier to investment in building sector refurbishment.

In the realm of incentives and awareness raising for energy efficiency, Serbia has taken proactive steps. The Rulebook on conditions for the allocation and use of resources from the budget fund for improving energy efficiency is published on the Ministry of Mining and Energy website, complemented by public calls. These calls and mechanisms for awarding subsidies have also been announced in the media. International Financial Institutions (IFIs) such as KfW (Credit Institute for Reconstruction, Germany) and EBRD (European Bank for Reconstruction and Development) offer various financing lines through commercial banks, providing accessible options for different users. However, the capacities of the newly established Administration for Financing and Promoting Energy Efficiency need to be strengthened to effectively implement energy efficiency measures across various market segments.

In Serbia, the issue of energy poverty has been gaining increasing attention, leading to the development of specific legal and policy frameworks. A government decree on vulnerable customers sets the criteria for acquiring that status. Based on the decree, there are three direct financial support measures for vulnerable consumers in the domains of electricity, gas and heating. These supports are in the form of monthly deductions from the energy bills. Additionally, local measures in the form of direct financial support are implemented in municipalities such as Belgrade, Novi Sad and others.

The above-mentioned decree does not contain a definition of energy poverty. However, a definition is provided in the Law on Energy Efficiency, which also cites reducing energy poverty as one of the objectives of energy efficiency. According to Article 73 of the same law, the newly established Administration for Financing and Promoting Energy Efficiency is responsible for designing programmes and implementing measures to support energy-vulnerable consumers and reduce energy poverty.

Sub-dimension 12.4: Energy markets

Regarding market operation, Serbia has made notable progress, largely driven by amendments to the Energy Law and Law on the Usage of Energy from Renewable Sources, as well as the introduction of new legislation. These amendments have introduced new concepts that are pivotal for the evolving energy landscape, including electricity prosumers, aggregators, energy communities, and electricity storage. Additionally, amendments to the Energy Law have facilitated the transposition of the EU Electricity Connection Codes and all five Gas Network Codes. These codes are crucial as they minimise market barriers for new entrants by containing transparent and non-discriminatory rules for Transmission System Operator (TSO) operations.

Another noteworthy development is that Serbia became the first economy in the Western Balkans to establish an intraday electricity market in July 2023. Legally, market liberalisation is also very advanced in Serbia. However, despite these advancements, the deregulation of the market is still not sufficiently advanced in practice due to the dominant position of the incumbent power supplier, joint-stock company Elektroprivreda Srbije (EPS). Nevertheless, the electricity market can be regarded as well developed, in line with the EU and Energy Community acquis. The gas market, however, is significantly lagging behind.

The so-called “REMIT Light” has been transposed

regarding transparency and surveillance in the energy market

. This establishes a framework to ensure the integrity of the wholesale market by banning specific types of market abuse and improving transparency. Additionally, it grants national regulatory bodies or other relevant authorities the power to implement actions against those participating in abusive practices within the wholesale energy market. This is of ever-increasing importance, given the further development of markets that have taken place in Serbia, which needs to be accompanied by appropriate transparency and surveillance standards. Thus, it is also a positive development that the Transparency Regulation has been fully transposed and implemented, with the fundamental data being submitted to the central data platform.

In the area of unbundling, a differentiation needs to be made between the electricity and the gas sector. In the electricity sector, Serbia advanced significantly by unbundling the new electricity distribution company from EPS. AERS has since approved the distribution system operator (DSO)’s compliance programme; in March 2023 a Compliance Officer was nominated. The Serbian Transmission System Operator is also legally and functionally unbundled. In the gas sector, however, unbundling has not progressed and non-compliance with the EU and Energy Community acquis persists (Energy Community Secretariat, 2023[6]). The 2023 European Commission enlargement report on Serbia also highlights that the process of certifying and separating gas companies is experiencing delays and that the current roadmap targets the completion of the gas sector utilities’ unbundling by the end of 2024 – a notable and unfortunate postponement, extending the longstanding non-compliance with gas legislation (European Commission, 2023[7]).

Regarding third-party access rules, while the Connection Codes have been transposed into national legislation, transparent, non-discriminatory rules are in place only within the electricity sector. In the gas sector, third-party access to the Horgos gas interconnection pipeline is still refused, and effective third‑party access is not granted to all gas entry points, indicating areas for much-needed improvements.

In the realm of regional market integration, the Serbian Power Exchange (SEEPEX) was designated as the nominated electricity market operator (NEMO) by the Serbian government. This designation aligns with the EU’s Capacity Allocation and Congestion Management Regulation requirements. Following this designation, the Energy Community Secretariat was notified in June 2023, marking a step towards formalising SEEPEX’s role in the regional energy market. Transposition of the Electricity Integration Package is ongoing and needs to be completed to establish a complete legal framework for market coupling. This transposition is essential for aligning Serbia’s energy market with EU standards and facilitating more efficient electricity trading.

In its 2023 report the Energy Community Secretariat highlighted that insufficient progress was being made in using the Joint Allocation Office (JAO) and the Coordinated Auction Office in South East Europe (SEECAO) for capacity allocation and additional interconnection. Serbia has made some recent progress in this regard, as since January 2024, cross-zonal border capacity on the border with Hungary has been allocated through the Joint Allocation Office. However, additional efforts are needed for further expansion of the use of JAO and, in particular, SEECAO in order to not further impede regional integration.

Overview of implementation of Competitiveness Outlook 2021 recommendations

Serbia has made progress in transposing the Third Energy Package and switching to market-based mechanisms for RES promotion (Table 13.3). However, additional efforts are needed to tackle the persisting shortcomings in unbundling, third-party access, and regional integration.

Table 13.3. Serbia’s progress on past recommendations for energy

|

Competitiveness Outlook 2021 recommendations |

Progress status |

Level of progress |

|---|---|---|

|

Finalise the transposition of the EU Third Energy Package |

The Third Energy Package has been largely transposed. New requirements for the Clean Energy Package have not yet been fully transposed. Concerning approximation with the EU target model and the focus on competitive energy markets particularly, the transposition and implementation of the Network Codes of the Electricity Integration Package need to be advanced. |

Moderate |

|

Improve implementation across all sub-dimensions. In particular: i) fully unbundle TSOs and DSOs and ii) implement non-discriminated and transparent third-party access to transmission and distribution systems |

Insufficient progress. Unbundling remains incomplete, and third-party access has not been fully granted. In the electricity sector, Serbia made advances by unbundling the electricity distribution company, approving the DSO’s compliance programme, and appointing a Compliance Officer. Progress was also made regarding the unbundling of the transmission system operator. Unbundling in the gas sector has not progressed, and non-compliance with the EU and Energy Community acquis persists. Non-discriminatory third-party access is only given in the electricity sector, not the gas sector. |

Moderate |

|

Improve regional integration and market coupling |

Moderate progress was made on extending cross-border capacity allocation through the Joint Allocation Office, particularly on cross-zonal capacity on the border with Hungary. |

Moderate |

|

Implement a new approach to support renewable energy and diversification |

The Law on Usage of Energy from Renewable Sources (2021), its 2023 amendments, and the Law on Energy Efficiency and Rational Usage of Energy introduced market premiums for electricity producers and feed-in tariffs for small generators. Two auctions were launched in 2023, both subject to a CfD regime. Diversification efforts, however, have not been sufficient. |

Moderate |

|

Increase the share of renewable energy by streamlining the approval process at every stage |

Framework conditions for the approval of projects still need to be further improved. |

Limited |

The way forward for energy policy

Even though Serbia has improved in several areas since the last Competitiveness Outlook, more work is required to overcome existing challenges and further align with the EU and Energy Community acquis. The following recommendations offer a perspective on key issues that, if effectively managed, could significantly enhance the Serbian energy sector and its efforts to comply with the relevant acquis.

Enhance efforts to enforce deregulation. A true market will only develop within Serbia if alternative suppliers are incentivised to enter the market. Thus, the regulator should play a more active role in this regard to prepare for a true de facto deregulation and liberalisation of the market. The relevance of this is further underlined by the fact that a broader opening of the market would also enhance both diversification and the security of supply. These steps are essential in ensuring a more resilient and diverse energy landscape in Serbia, reducing reliance on single sources and bolstering the overall energy infrastructure.

Complete the transposition of the Clean Energy Package. The revised Energy Efficiency Directive and the Energy Performance of Buildings Directive have not yet been fully transposed into national law. Transposition of the Clean Energy Package should also entail the Electricity Integration Package, as the network codes thereunder in the electricity sector have not yet been transposed but are an essential part of preparing Serbia’s legal framework for further regional integration. The legal framework could also be further amended to facilitate the creation of energy communities and further strengthen the role of prosumers.

Closely monitor the implementation of decarbonisation plans. Serbia should ensure that its decarbonisation policies under the NECP and other documents are properly monitored and evaluated on a regular basis to ensure that interim targets are met and to adjust the planned measures in case of delay or challenges to implementation.

Bring unbundling and third-party access regime in line with the Energy Community acquis. The shortcomings in those areas have already persisted for some time and need to be rectified. This should entail the unbundling and certification of all network operators in the gas sector in line with the applicable acquis and end the discriminatory third-party access regime in the gas sector.

Develop a comprehensive diversification strategy. To alleviate supply security concerns, a fully fledged approach to diversification should be developed. In this regard, particular attention should be paid to striking a good balance between an increase in renewable generation capacity and other means, such as additional regional cooperation, which also can increase supply security.

Enhance regional integration. Slow progress on the extension of cross-border capacity allocation hampers regional integration, so Serbia should make additional efforts to find a solution.

References

[5] Association of Issuing Bodies (2024), Renewable Energy Guarantees of Origin, https://www.aib-net.org/certification/certificates-supported/renewable-energy-guarantees-origin.

[6] Energy Community Secretariat (2023), Annual Implementation Report 2023, https://www.energy-community.org/implementation/report.html.

[1] Energy Community Secretariat (2023), Secretariat Publishes its Recommendations on the Draft National Energy and Climate Plan of the Republic of Serbia, https://www.energy-community.org/news/Energy-Community-News/2023/11/13.html.

[7] European Commission (2023), Serbia 2023 Report, https://neighbourhood-enlargement.ec.europa.eu/serbia-report-2023_en.

[2] Ministry of Mining and Energy (2023), Revised Serbian National Energy and Climate Plan, Republic of Serbia, https://www.mre.gov.rs/extfile/sr/3036/NACRT%20INECP%20NAKON%20JAVNIH%20KONSULTACIJA_Serbia_Final_ENG_DECEMBAR%202023.docx.

[3] Smith, S. (2017), Just Transition, A Report for the OECD, https://www.oecd.org/environment/cc/g20-climate/collapsecontents/Just-Transition-Centre-report-just-transition.pdf.

[4] World Bank (2021), The World Bank’s Approach to Just Transition for All: Methodology for Energy Transition in Coal Regions, https://unece.org/sites/default/files/2021-10/31.%20WB%20approach%20to%20JT_UNECE%20CMMJT%20GoE_September21_rev02.pdf.

Notes

← 1. Serbia held early elections in 2023; see also www.politico.eu/article/serbian-pm-will-continue-on-the-reform-path.

← 2. Serbia’s legal act on sustainability criteria for biofuels, bioliquids and biomass fuels was adopted and published in the Official Gazette of RS, No. 96 of 2 November 2023.

← 3. Articles 63-67 of the Energy Efficiency Law provide the legal basis for this, and additional bylaws and regulatory acts were adopted to give full effect to the labelling requirements.