Payments through either social security or through taxes play an important role in old-age support as pensioners commonly do not pay the former and the latter is often reduced. Personal income taxes are progressive and pension entitlements are usually lower than earnings before retirement. Hence, overall the average total tax rate on pension income is typically less than on labour income. In addition, half of OECD countries give additional tax concessions to pensioners through either increased personal allowances or extra tax credits.

Pensions at a Glance 2023

Tax treatment of pensions and pensioners

Key results

Half of OECD countries provide either higher personal allowances or extra tax credits to older people than to working-age individuals (Table 4.3). In many cases – Canada and the United Kingdom, for example – this additional relief is phased out for older people with higher incomes.

In addition, 16 OECD countries have specific tax rules for pension income, from either public or private schemes. For example, between 15% and 50% of income from public pensions in the United States (social security) is not taxed, depending on the total income of the pensioner. In Australia, pension contributions and investment returns are not taxed, and, in addition, pension benefits are not taxable in payment for individuals aged over 60 years. This applies to both mandatory and voluntary contributions.

By contrast some countries such as Denmark, Iceland, the Netherlands and Sweden tax earned income from work less than pensions, which helps limit tax disincentives to work.

Overall, 28 OECD countries have some concession for older people or pension income under their personal income taxes. In only ten countries are the income tax rates or allowances applied to pensions and pensioners at least equal to those for people of working age.

Virtually all OECD countries levy employee social security contributions on workers: Australia and New Zealand are the only exceptions, where payments are either covered by the employer or the State. By comparison, 21 OECD countries do not levy social security contributions on pensioners. For the 17 countries that do levy social security contributions the rate for retirees is always lower than the rate charged for workers. Typically, old-age retirement income is not subject to contributions for pensions or unemployment (for obvious reasons). However, pensioners can be subject to levies to pay for health or long-term care, which can be higher than the level applied to workers, and, in some cases, are liable for “solidarity” contributions to finance a broad range of benefits.

Empirical results

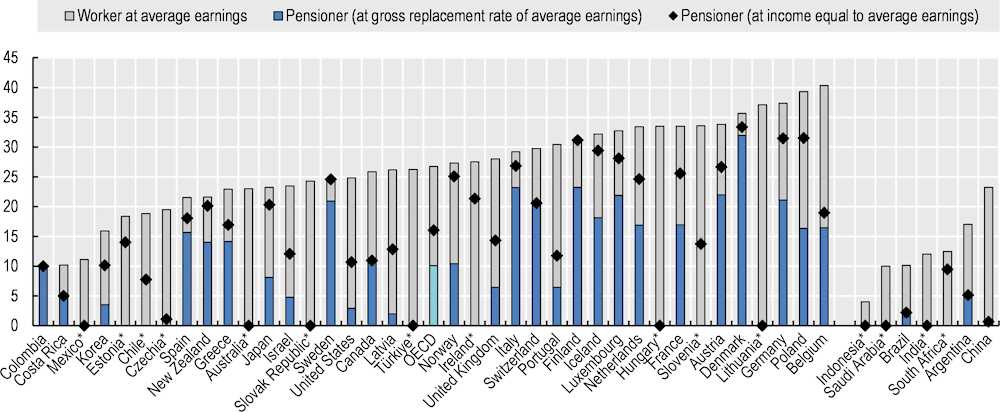

Figure 4.3 shows the percentage of income paid in personal taxes and social security contributions by workers and pensioners. Starting with workers, countries have been ranked by the proportion of income paid in total taxes (including social contributions paid by employees) at the average‑wage level. This is then compared to the total tax rate paid by a pensioner after a full-career at the average wage, hence receiving the gross replacement rate in the base case (Table 4.1, as set out in the indicator “Gross pension replacement rates” above).

In 11 OECD countries and four other major economies, such a pensioner would not pay any tax in retirement. In some cases, such as the Slovak Republic and Türkiye, this is because pensions are not taxable. In the United States it is because the pension income would be less than the income‑tax personal allowance offered to older people. Pensioners with the gross replacement rate of a full-career average earner would pay 10% of their income in taxes and contributions on average across the OECD, and under 1% in the other G20 countries. By comparison, taxes and contributions paid by an average earner – so not including any contributions from the employer – average 27% of the gross wage in OECD countries and 13% in other G20 countries. The last series in the chart shows how much a pensioner would pay if her income before tax is equal to the gross average wage. The total tax rate is 16% on average in OECD countries, some 11 percentage points lower than what workers’ pay with the same level of income.

The difference between this 16% rate for pensioners with an income equal to average earnings and the 10% paid in taxes and contributions paid on the income which is equal to the gross replacement rate for an average earner illustrates the impact of progressivity in income‑tax systems for pensioners.

Table 4.3. Treatment of pensions and pensioners under personal income tax and mandatory public and private contributions

|

|

Extra tax Allowance/credit |

Full or partial relief for pension income |

Mandatory contributions on pension income |

|

Extra tax Allowance/credit |

Full or partial relief for pension income |

Mandatory contributions on pension income |

||

|---|---|---|---|---|---|---|---|---|---|

|

Public scheme |

Private scheme |

Public scheme |

Private scheme |

||||||

|

Australia |

✓ |

✓ |

✓ |

None |

Luxembourg |

✓ |

Low |

||

|

Austria |

Low |

Mexico |

✓ |

None |

|||||

|

Belgium |

✓ |

Low |

Netherlands |

✓ |

Low |

||||

|

Canada |

✓ |

✓ |

✓ |

None |

New Zealand |

None |

|||

|

Chile |

✓ |

None |

Norway |

✓ |

✓ |

✓ |

Low |

||

|

Czechia |

✓ |

✓ |

None |

Poland |

Low |

||||

|

Colombia |

Low |

Portugal |

✓ |

None |

|||||

|

Costa Rica |

Low |

Slovak Republic |

✓ |

None |

|||||

|

Denmark |

None |

Slovenia |

✓ |

Low |

|||||

|

Estonia |

✓ |

None |

Spain |

✓ |

None |

||||

|

Finland |

✓ |

Low |

Sweden |

✓ |

None |

||||

|

France |

Low |

Switzerland |

Low |

||||||

|

Germany |

✓ |

✓ |

Low |

Türkiye |

✓ |

None |

|||

|

Greece |

Low |

United Kingdom |

✓ |

None |

|||||

|

Hungary |

✓ |

✓ |

None |

United States |

✓ |

✓ |

None |

||

|

Iceland |

None |

||||||||

|

Ireland |

✓ |

Low |

Argentina |

✓ |

Low |

||||

|

Israel |

✓ |

Low |

Brazil |

✓ |

None |

||||

|

Italy |

✓ |

✓ |

None |

China |

None |

||||

|

Japan |

✓ |

✓ |

✓ |

Low |

India |

✓ |

None |

||

|

Korea |

✓ |

✓ |

None |

Indonesia |

None |

||||

|

Latvia |

✓ |

None |

Saudi Arabia |

Low |

|||||

|

Lithuania |

✓ |

✓ |

None |

South Africa |

✓ |

None |

|||

Source: See online “Country Profiles available at http://oe.cd/pag.

Figure 4.3. Personal income taxes and social security contributions paid by pensioners and workers, percentage of income

Note: *Pensioners at the gross replacement rate of average earnings have zero income tax and social security. Workers in Colombia at the average earnings pay 8% in taxes and social security contributions, lower than that of pensioners at the gross replacement rate of average earnings.

Source: OECD pension models; OECD tax and benefit models.