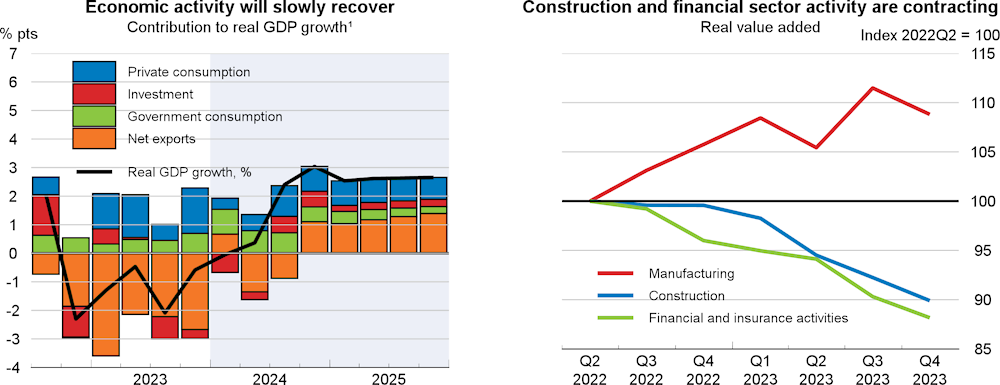

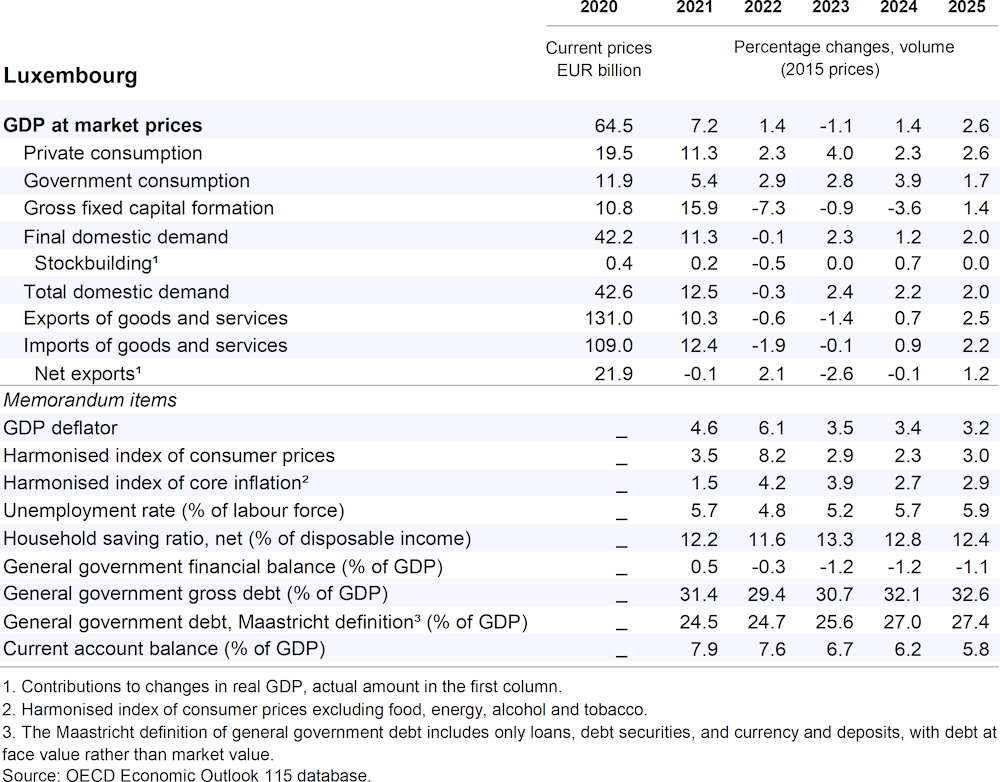

Real GDP is projected to grow by 1.4% in 2024 and 2.6% in 2025. The main driver of growth will be private consumption, as rising nominal wages and receding inflation support households’ real disposable income. Exports are expected to strengthen on the back of growing demand from euro area trading partners, whereas investment is projected to remain weak in 2024, mainly due to the downturn in construction. Risks are moderately to the downside. A larger-than-expected and more persistent downturn in the housing market could lead to a weaker recovery in activity, while an earlier-than-expected easing of global financial conditions could boost activity, especially in the financial sector.

The stance of fiscal policy in 2024 will be mildly restrictive. The partial phase-out of energy policy support more than offsets the reduction in personal income taxes from the adjustment of tax brackets to inflation. To maintain low public debt, energy policy support should be fully unwound in 2025. In the medium term, the authorities should address long-term fiscal pressures stemming from the pension system and reduce work disincentives due to the joint taxation of couples.