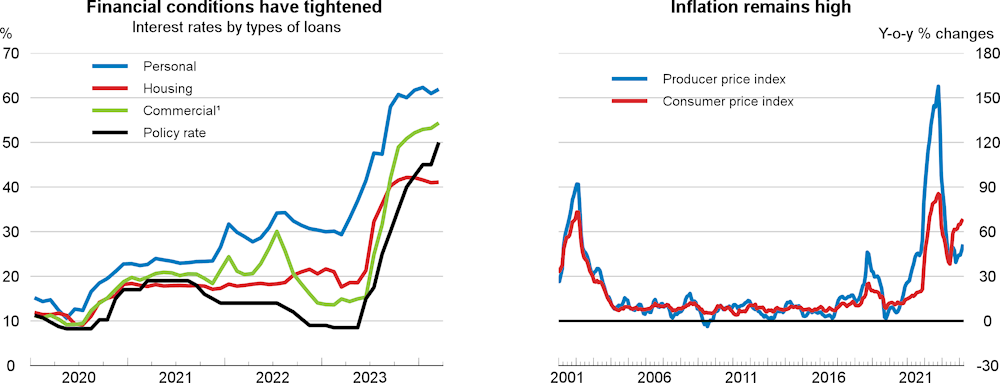

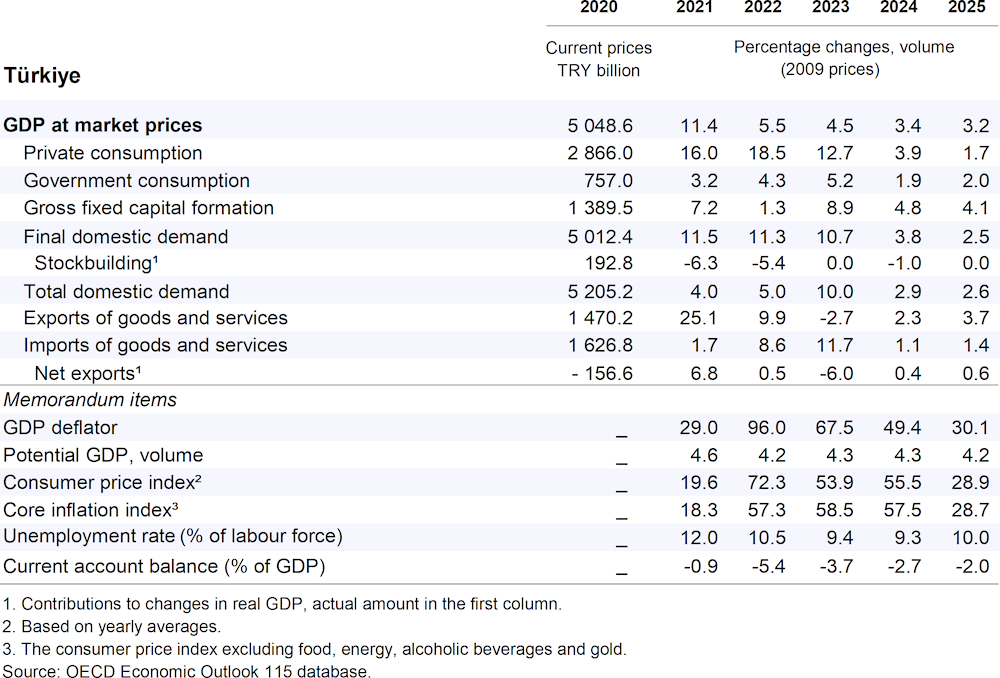

Real GDP growth is projected to slow from 4.5% in 2023 to 3.4% in 2024 and 3.2% in 2025. Tighter financial conditions and the adverse impact of inflation on purchasing power will subdue household consumption. Investment activity is expected to remain strong partly due to the ongoing reconstruction following the 2023 earthquake. Exports will gradually strengthen reflecting an improved external environment. Inflation peaked at the beginning of this year but will remain elevated over 2024 and 2025.

Fiscal policy is expected to be contractionary following the significant deficit increase in 2023 that was driven partly by earthquake-related expenditures. Monetary policy has rightly become restrictive, and the key interest rate has climbed by a cumulative 41.5 percentage points since May 2023. However, if inflation remains high, further monetary and fiscal tightening may be necessary. Structural reforms can support the efforts to stabilise macroeconomic conditions and raise long-term growth potential. Notably, labour-market reform would help increase high-quality formal job creation.