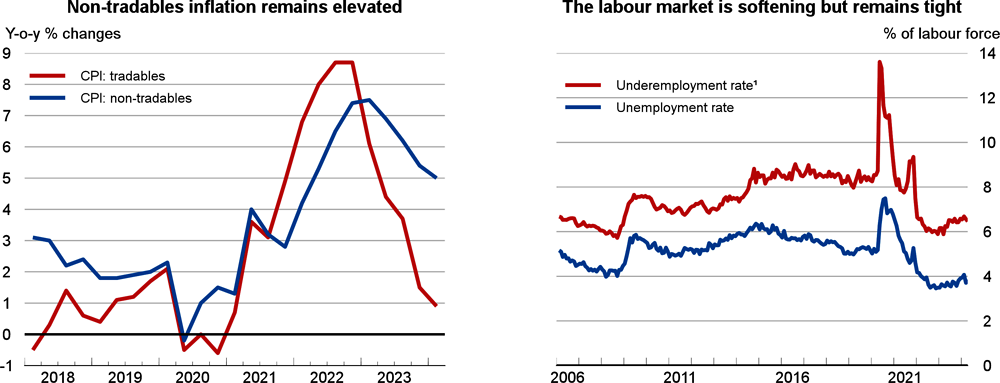

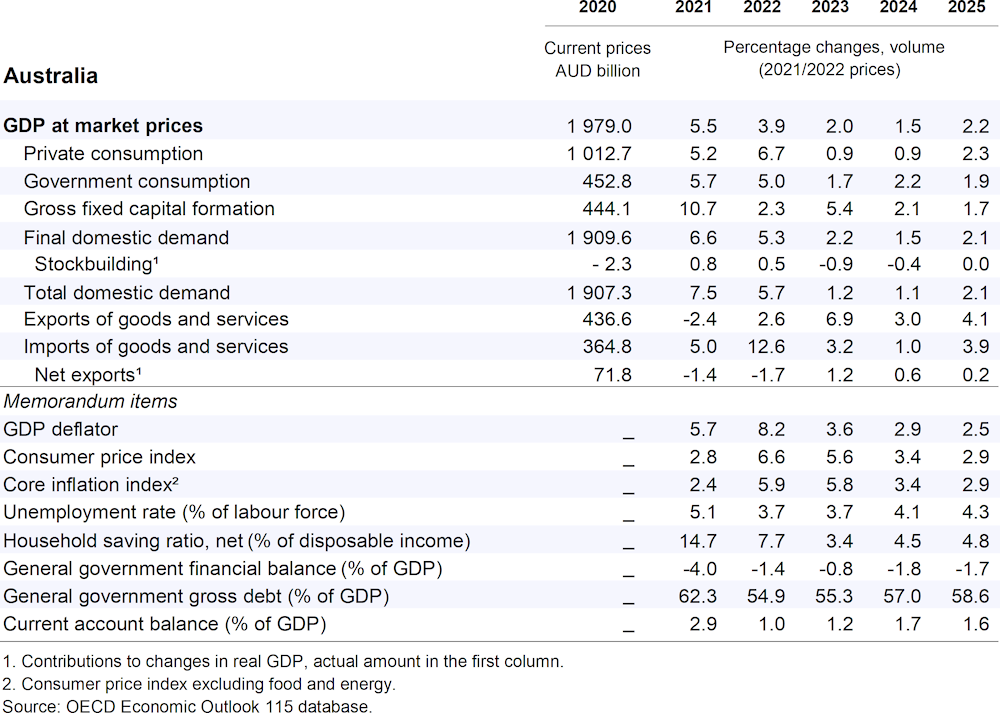

Real GDP growth is projected to slow to 1.5% in 2024 before recovering to 2.2% in 2025. The impact of higher interest rates will continue to damp spending by households and businesses over the coming year. The unemployment rate is projected to rise further, reaching 4.3% in 2025. Price pressures will continue to ease, although inflation of some services components is anticipated to remain elevated throughout 2024. A downside risk to economic growth is that taming stubborn services inflation may require tighter monetary policy than currently assumed.

Monetary policy should remain restrictive in the short term to tame inflation and the fiscal deficit should be narrowed in the coming years. Productivity-enhancing policy measures would boost medium-term economic growth prospects. Policies that help promote competitive markets, such as aligning product standards with other advanced economies, should be complemented by those that improve labour mobility, including eliminating unnecessary occupational licenses or unnecessary non-compete agreements in employment contracts.