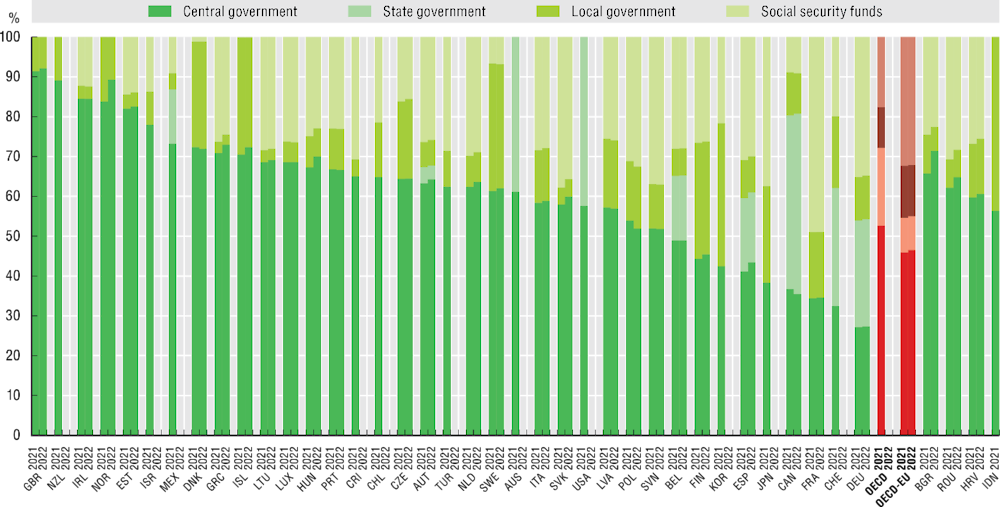

Government revenues are collected by each of the different levels of government which exist in a country: central, state and local. On average across the OECD in 2021, central government collected 52.6% of general government revenues, state governments collected 19.5%, local governments 10.2% and social security funds 17.6% (Figure 10.7). However, there is very wide variation around these averages, and different OECD countries have very different funding structures across the different levels of government. The most important difference is whether government is unitary or federal. In countries with unitary governments, central government often collects a high proportion of government revenue. This is the case in the United Kingdom, which had the highest proportion of tax revenue collected by central government in 2021 (91.2%), and also in countries such as New Zealand (89.2%) and Ireland (84.6%). In contrast, in countries with federal systems, state governments often collect a significant proportion of revenues. Canada (43.6%) and the United States (42.4%) had the highest proportion of revenues collected by state governments among OECD countries in 2021. Local governments typically collect a smaller proportion of revenues than central and state governments. However, local governments in some countries collect a substantial proportion of revenues, for example Korea (35.9%) and Sweden (35.0%). This may occur where local government is responsible for managing and delivering important public services. This is the case in Sweden, and also in Finland (29.1%), where until recently local government had substantial responsibility for delivering health care and emergency services.

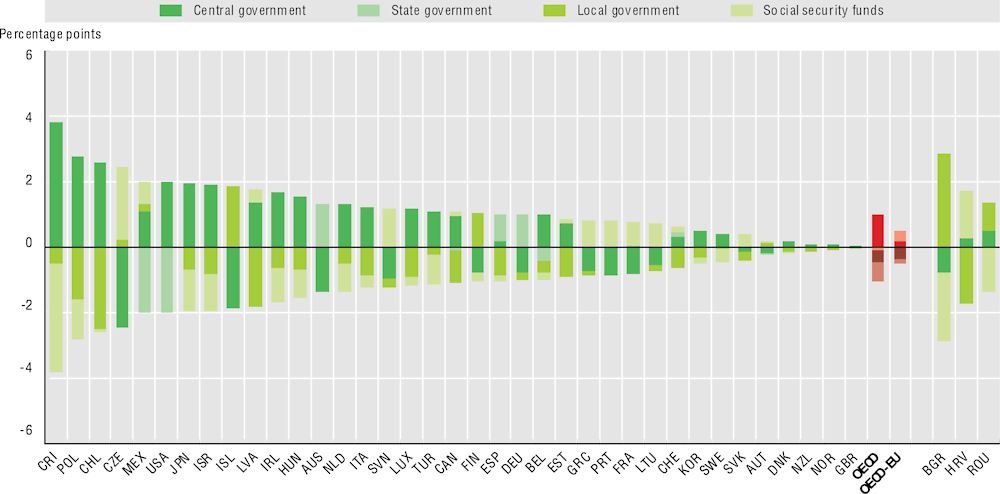

Tax revenues have become somewhat more centralised in recent years (Figure 10.8). On average across the OECD, the proportion of revenues collected by central governments increased by 1 percentage point between 2019 and 2021. The share of revenues collected by central government increased in 25 out of 37 countries for which data are available. The largest increases were in Costa Rica (3.8 p.p.) and Poland (2.8 p.p.). Offsetting this, the share of revenues collected by social security funds fell by 0.6 p.p and the share collected by local governments by 0.4 p.p.. The trend of collecting a smaller proportion of revenue via local government was widespread. In 29 out of 37 OECD countries, the share of revenues collected by local government fell, with the greatest falls occurring in Chile (2.5 p.p.) and Latvia (1.8 p.p.).