Governments accumulate debt to finance expenditures greater than their revenues. Government debt can be raised to finance current expenditures or invest in physical capital, but it comes at a cost in the form of interest payments and should be based on the objective appraisal of economic capacity gaps, infrastructural development needs and sectoral/social priorities as well as a prudent assessment of costs and benefits. As a result of the COVID-19 pandemic, many OECD countries increased spending through stimulus packages and interventions to support households and businesses, thereby incurring public debt.

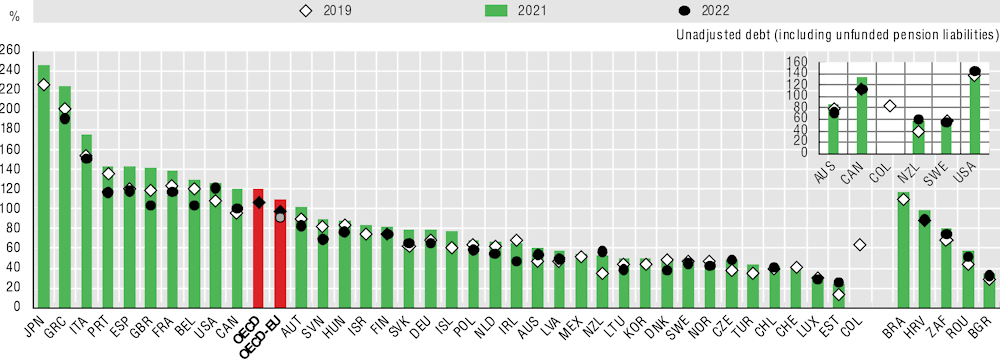

Government debt reached on average 121% of GDP across OECD countries in 2021 (Figure 10.9). Between 2019 and 2021 average debt levels as a share of GDP increased by 14.1 percentage points. Debt levels increased in 36 out of 37 OECD countries with available information. The only exception was Ireland, where public debt fell by 3.2 p.p. During the COVID-19 pandemic, Ireland’s fiscal policy had enough room to react to the crisis forcefully and although spending rose, strong revenue growth, including from excess corporate tax receipts, meant budget balances did not deteriorate as much as elsewhere in the OECD (OECD, 2022).

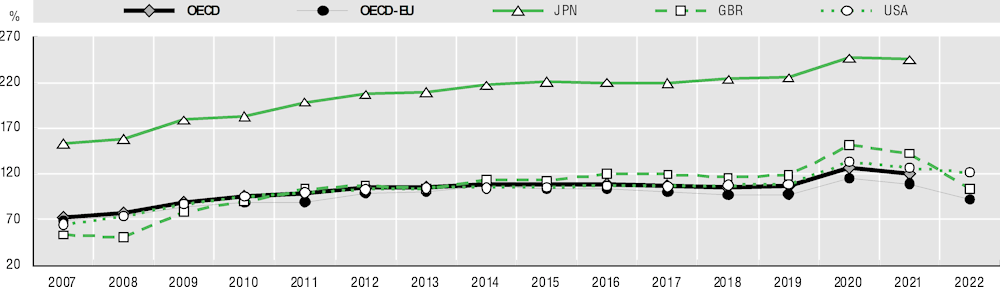

Between 2007 and 2021, with some corrections for specific years, the average trend in OECD countries and the largest economies has been for public debt to steadily increase, with spikes in 2009 following the global financial crisis (12.3 p.p. increase over 2008), and in 2020 during the COVID-19 pandemic (20 p.p. increase over 2019). Since 2021, debt levels have generally fallen in the OECD-EU countries and the United States (Figure 10.10). While the economic outlook shows some positive signs, the recovery remains fragile (OECD, 2023).

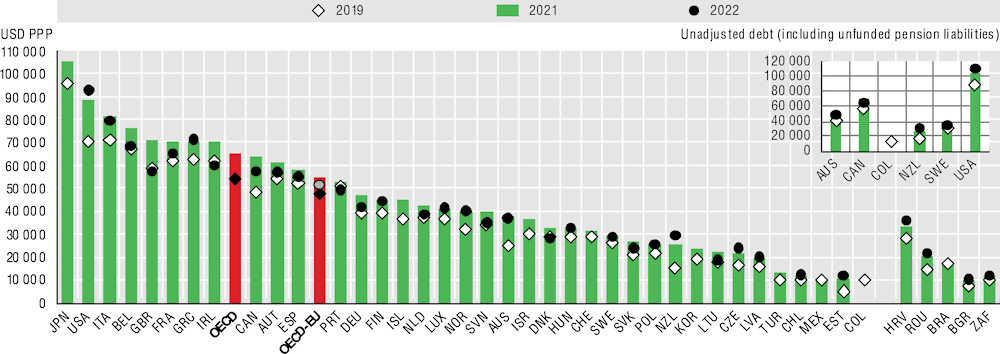

Per capita gross debt reached on average USD 64 845 PPP in 2021 (Figure 10.11). Most government gross debt across OECD countries in 2021 is held in debt securities, which account for 83.8% of all public debt on average, ranging from 92% in the United States to 22.8% in Greece. Loans account for 7.4% on average across OECD countries, but make up a much larger part of the liability in countries like Greece (68%), Norway (54.7%) and Estonia (45.7%) (see Online Figure G.5.2).