Sébastien Miroudot

Cemre Balaban

Ruth Lopert

Suzannah Chapman

Philip Haywood

Sébastien Miroudot

Cemre Balaban

Ruth Lopert

Suzannah Chapman

Philip Haywood

The effective functioning of health systems relies on an adequate and reliable supply of equipment and therapeutics, including essential medicines and medical devices. While shortages of both types of products occurred prior to the COVID‑19 pandemic, it highlighted some key vulnerabilities in their respective supply chains. This chapter outlines the nature of medicine and medical device supply chains, and presents several case studies – both pre‑ and post-pandemic. Finally, it identifies policy options for improving the responsiveness and reliability of supply of medicines and medical devices, to support the resilience of OECD countries’ health systems and, by extension, their economies.

The effective functioning of health systems relies on the availability of adequate and reliable supplies of equipment and therapeutics, such as essential medicines and medical devices (including consumables). Medicines and medical devices are sophisticated products, subject to complex regulatory frameworks and manufactured via long international supply chains.

Before the COVID‑19 pandemic, issues of quality, concentration of markets and profitability of some products contributed to supply disruptions and shortages. Supply chains showed considerable elasticity in the face of extreme stress in the initial stages of the pandemic. Nonetheless, disruptions and shortages of key medicines, testing reagents, and personal protective equipment (PPE) were experienced, due to spikes in demand and bottlenecks in supply. For example, almost all OECD countries (23 of 25) that responded to the OECD Questionnaire on Resilience of Health Systems 2022 experienced problems securing PPE early in the pandemic.

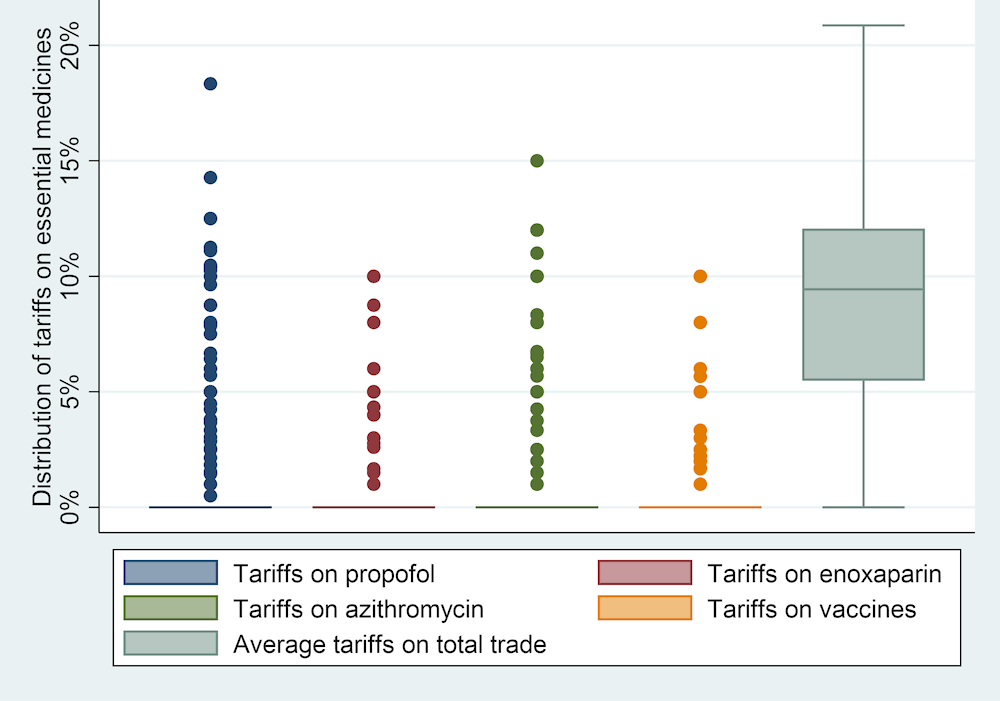

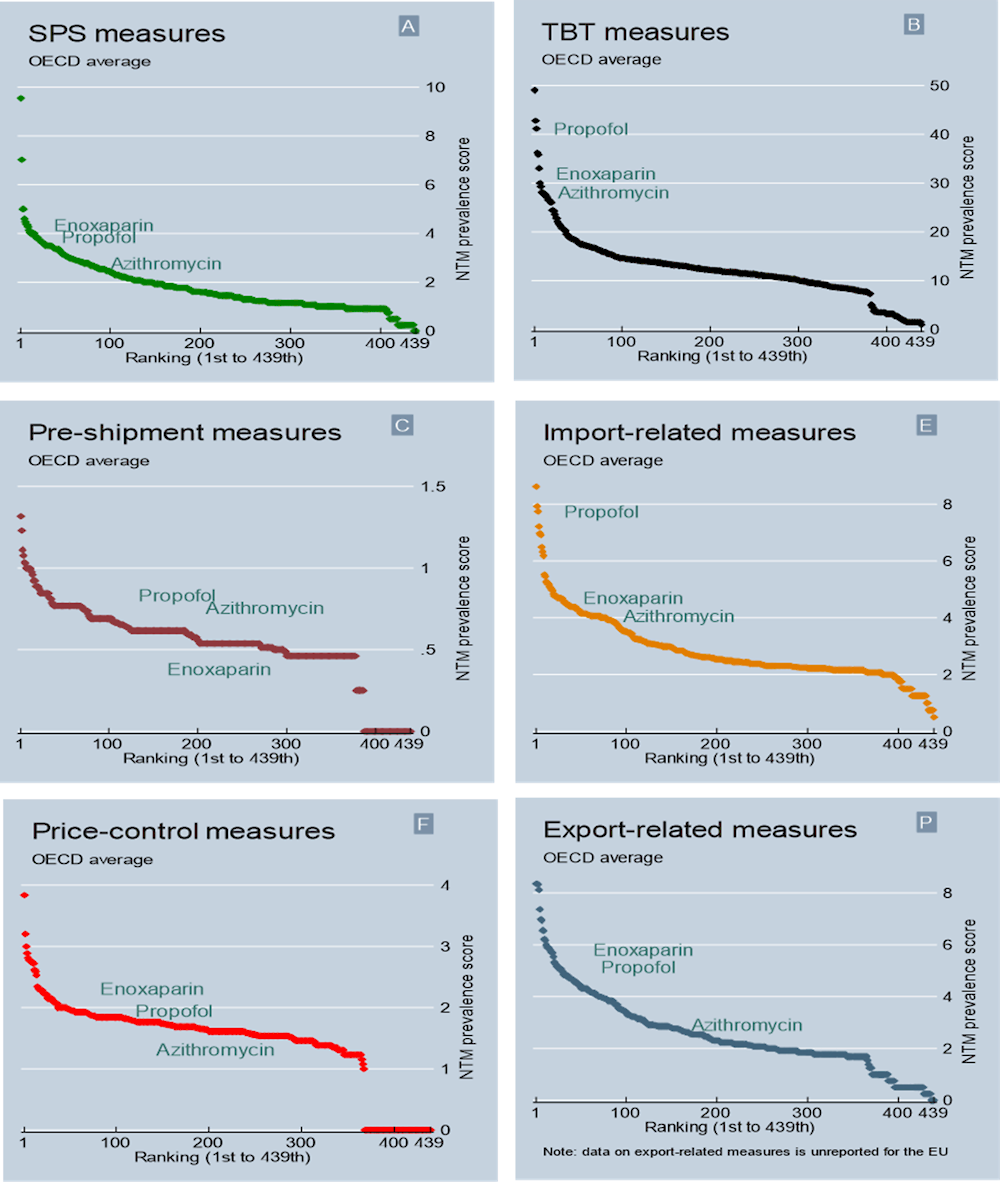

Against this backdrop, this chapter presents case studies of three medicines (propofol, low-molecular-weight heparins and macrolide antibiotics) essential for future health crises. A suite of policy options to improve the responsiveness and reliability of medical supply chains follow:

Promoting the long-term resilience of medical supply chains would benefit from collaborative approaches that balance measures best undertaken by the private sector with those more appropriately managed by governments, as well as internationally harmonised and co‑ordinated approaches to regulation and stockpiling.

Difficulties in identifying the suppliers and countries involved in medical device supply chains can undermine assessment and mitigation of risks by governments. Greater transparency and improved reporting are needed to ensure resilient and secure supply. Real-time information and co‑operation between countries and manufacturers may be required to anticipate and address issues.

Quality issues may be at the origin of shortages of some medicines and medical devices. Rules and standards exist to avert quality issues, but implementation and enforcement can be challenging. Having sufficient manufacturing capacity drawing on diversified sources of supply helps to prevent quality issues from driving shortages.

Market dynamics and regulatory requirements may discourage investment in production capacity and limit diversification in supply. Greater supplier diversity and increased capacity require a reassessment of current procurement and pricing practices for some products. While industry policies may support long-term stability and predictability for firms, caution should be exercised to ensure that policy instruments do not disrupt the smooth functioning of international supply chains.

Trade and transnational production are important to enhance diversification of supply and create additional capacity at the global level. In particular, trade is important for access to technology and equipment. Economies of scale create efficiencies that also contribute to the resilience of health systems.

As a first-tier resilience strategy to mitigate spikes in demand, stockpiling is important. To be efficient and effective, stockpiling strategies should be planned and co‑ordinated with the private sector and across countries.

Securing supply chains for essential medicines and medical devices will improve outcomes during crises, strengthening overall health system resilience. It will also encourage predictability and reliability between disruptions.

The COVID‑19 pandemic was an enormous shock for health systems and the source of massive levels of morbidity and mortality. Dramatic shortages were observed globally for some essential medical devices, such as personal protective equipment (Gereffi, 2020[1]). Supply chains for medicines showed relatively greater resilience in the face of extreme stress. Nonetheless, demand increased significantly for essential medicines1 used in intensive care units, such as anaesthetics, creating disruptions in supply and local shortages (Choo and Rajkumar, 2020[2]; Dey et al., 2021[3]; Gereffi, Pananond and Pedersen, 2022[4]).

The effective functioning of health systems relies on the adequate and reliable supply of equipment and therapeutics, including essential medicines and medical devices. Transparency regarding available stocks and production capacity between private and public stakeholders, and between countries, would improve co‑ordination and predictability.

Medicines are sophisticated products, subject to complex regulation. Medical devices represent a wider spectrum of product types with commensurate diversity in regulation. Shortages of prescription medicines are not unusual; shortages were a growing problem even before the pandemic, with issues of quality, concentration of markets and poor profitability of some products contributing to frequent supply disruptions and stock-outs in many countries (Tucker et al., 2020[5]; Chapman, Dedet and Lopert, 2022[6]; FDA, 2019[7]). Vulnerabilities associated with global supply chains for medical devices were also recognised prior to the pandemic. These vulnerabilities are generally similar to those for medicine supply chains, including concentration of markets, a paucity of incentives to invest in resilience to ensure adequate supply, and poor visibility and transparency.

The pandemic introduced three additional pressures on medicine and medical device supply chains (Fox, Stolbach and Mazer-Amirshahi, 2020[8]; Miller et al., 2020[9]; Socal, Sharfstein and Greene, 2021[10]). First, it led to unprecedented spikes in demand for medicines and medical devices needed to treat COVID‑19 patients. Second, lockdown policies and other measures taken by governments to contain the spread of the virus created disruptions in production and international transport networks. Third, export restrictions introduced by some governments exacerbated existing shortages. The compounding effect of these pressures led to extraordinary tensions in the procurement of essential medicines and medical devices at a time when supply chains were already vulnerable.

A supply chain may be defined as the flow of goods and services needed from production to consumption of a product. A supply chain failure is said to occur when supply is unable to meet demand, and may be categorised as the result of one or more of the following:

demand surges

capacity reductions2

co‑ordination failures (National Academies of Science Engineering and Medicine, 2022[11]).

All three categories of supply chain failure were observed during the COVID‑19 pandemic. With this in mind, this chapter identifies policy options to improve the responsiveness and reliability of supply of essential medicines and medical devices, to support the resilience of the health systems and economies of OECD countries. This chapter has two separate, but related, objectives:

to increase understanding of the structure and exposure to risk of global supply chains, and identify possible approaches to ensuring resilient response capacity

to improve preparedness for future health crises in which demand surges or interruptions occur on the supply side, by managing and reducing supply chain risk exposure.

Section 11.2 describes the nature and context of pharmaceutical supply chains and identifies some of their particular vulnerabilities. It presents in-depth case studies of three medicines that were essential during the COVID‑19 pandemic and are potentially important in future health crises: propofol; low-molecular-weight heparins (using the example of enoxaparin); and macrolide antibiotics (using the example of azithromycin). The products were selected for the case studies because they are:

essential in the response to an outbreak of an infectious respiratory disease (such as COVID‑19 or other viral respiratory infection) – e.g. medical oxygen, endotracheal tubes, pulse oximeters, intravenous anaesthetics, neuromuscular junction blocking drugs, parenteral nutrition

essential for future health crises, for general health system functioning and required in intensive care settings – e.g. intravenous anaesthetics, heparins, broad spectrum antibiotics, iodine and selected vaccines.

Section 11.3 outlines some of the vulnerabilities of medical device supply chains – particularly those highlighted by the pandemic – and presents the results of the OECD Resilience of Health Systems Questionnaire 2022. Drawing on the medicine and medical device case studies and broader OECD work on the resilience of supply chains, Section 11.4 presents the key policy implications.

This section describes some of the vulnerabilities of pharmaceutical supply chains. First, it describes the general nature and context of pharmaceutical supply chains and explores their internationalisation and concentration (at an aggregate level). It presents a schematic of a generalised pharmaceutical supply chain to illustrate its complexity.

The next three sections present in-depth case studies of supply chains for medicines that were essential during COVID‑19 and are likely to be important for managing different types of future health emergencies, irrespective of their nature: the intravenous anaesthetic agent propofol; enoxaparin, a low-molecular-weight heparin; and azithromycin, a macrolide antibiotic.

For each product, a stylised supply chain is presented to demonstrate the manufacturing process and potential bottlenecks, referring to the schematic introduced in Section 11.2.1. Stylised supply chains are needed because each product is different – they treat different patient populations and require different manufacturing and distribution processes. The case studies are based on publicly available information and interviews with pharmaceutical companies.

Supply chains differ across products, companies and regions. While the examples included in this section distil some policy implications for the resilience of health systems, they do not reflect the way production is organised for all medicines, or all essential medicines. The three products chosen for the case studies are also no longer patent protected. Although the expiration of patents allows more firms to enter the market, thus increasing the sources of supply, it also often leads to downward pressure on prices that are specific to off-patent markets; this may result in a decline in the number of suppliers over time, with implications for supply security. While not specifically considered in this analysis, patented products may, however, also be subject to a variety of challenges in security of supply.

Most medicines are produced in sophisticated transnational supply chains. While organisation of production is driven in part by cost containment, it also reflects the complexities of production processes and product lifecycles (Lakdawalla, 2018[12]).

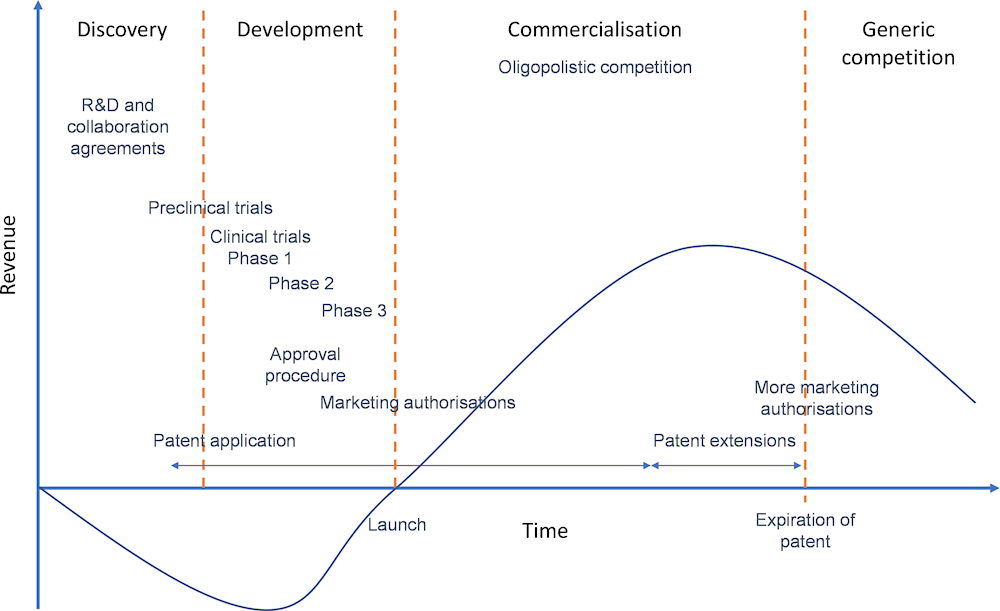

The lifecycle of a new medicine typically comprises four steps: discovery; development; commercialisation; and generic competition. Figure 11.1 provides an indicative timeline, illustrating the evolution of revenues for pharmaceutical firms along this cycle and the main regulatory steps to introduce medicines in different markets.

Sources: Based on Prajapati and Dureja (2012[13]), “Product lifecycle management in pharmaceuticals”, https://doi.org/10.1177/1745790412445292, and Lakdawalla (2018[12]), “Economics of the Pharmaceutical Industry”, https://doi.org/10.1257/jel.20161327.

Developing a new medicine is a complex and expensive process that may take 12‑15 years from the discovery of the molecule to the launch of the finished product (Hughes et al., 2011[14]). Research requires expertise and international collaboration, and R&D often involves partnerships and agreements between firms in different countries. The development phase involves clinical trials, authorisations and certifications that are specific to the pharmaceutical industry and have to be carried out in different markets, often involving the experience and expertise of partner firms. Finally, mitigating the risk and cost of developing new medicines with cutting-edge technologies requires access to international capital and large markets.

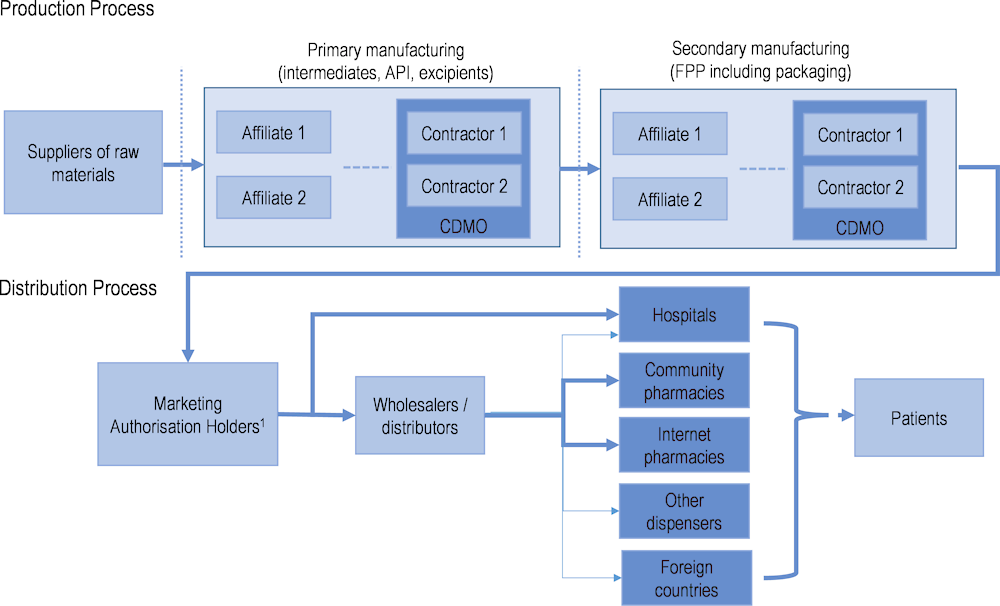

It is during the development phase that supply chains become important to the manufacture of medicines. The complexity of pharmaceutical supply chains is illustrated in Figure 11.2. They involve a variety of stakeholders and steps that are generally undertaken in different facilities, and often in different countries (Chapman, Dedet and Lopert, 2022[6]).

Note: Dotted vertical lines represent the possibility of an international border. FPP: finished pharmaceutical product; CDMO: contract development and manufacturing organisation. 1. This includes parallel traders, who are only relevant for distribution of products within the European Union (EU) and European Economic Area market. Parallel traders can act by buying from one wholesaler in one country and selling to another wholesaler in another country. They can supply third country markets, as well as community pharmacies, internet pharmacies and other dispensers.

Source: Chapman, Dedet and Lopert (2022[6]), “Shortages of medicines in OECD countries”, https://doi.org/10.1787/b5d9e15d-en.

As an example, the production of a small-molecule medicine begins with raw materials that are chemical compounds used as the base for the extraction of intermediates. Primary manufacturing sites are responsible for producing active pharmaceutical ingredients (APIs) – the chemically active components of a medicine that produce the intended pharmacological effect on the body – from these raw materials. Secondary manufacturing is concerned with taking the API produced at the primary site and using it to create the finished pharmaceutical product. Excipients are added to APIs at this stage. Secondary manufacturing sites are often geographically separate from primary ones, and there are often many more secondary sites, serving local or regional markets (Shah, 2004[15]).

Marketing authorisation holders may rely on contractors (such as contract development and manufacturing organisations) to manufacture their products in the primary or secondary manufacturing stage. These contractors may operate under a development manufacturing contract to ensure appropriate quality along the supply chain. This may give rise to complex supply chain co‑ordination issues. Moreover, the techniques used to manufacture APIs may require workers from a variety of disciplines and specialised firms to create economies of scale. Finding the necessary expertise and suppliers of inputs in a single economy is extremely challenging and may not be possible.

Once a medicine is produced and batches are released, they must be transported from the manufacturing site, stored at a wholesaler and distributed to the retail points of dispensing. Here, wholesalers are the principal stakeholders. In many countries, however, hospitals source their products directly from marketing authorisation holders, bypassing wholesalers.

By serving several markets or focusing on very large markets (such as the United States), sales may reach the level needed to recoup the costs of drug development during the commercialisation phase (Figure 11.1). Intellectual property protection (especially patents) plays a role in the financial sustainability of the product lifecycle, guaranteeing oligopolistic competition and higher revenues until the market reaches maturity. Various strategies are also available to firms to extend the duration of market exclusivity.

Once patents have expired, another business model is needed to ensure that essential medicines are still produced with sufficient commercial incentives during the generic competition phase. While the production processes of multisource medicines (those no longer protected by patent or market exclusivity, that are marketed or sold by two or more manufacturers) remain similar to those described in Figure 11.2, the firms involved in primary and secondary manufacturing, as well as contractors, are likely to be different once generic competition occurs. The involvement of firms from emerging economies with lower costs often features in this part of the product lifecycle. However, generic medicines are produced in many countries, and firms in emerging economies also participate in R&D and production of novel products.

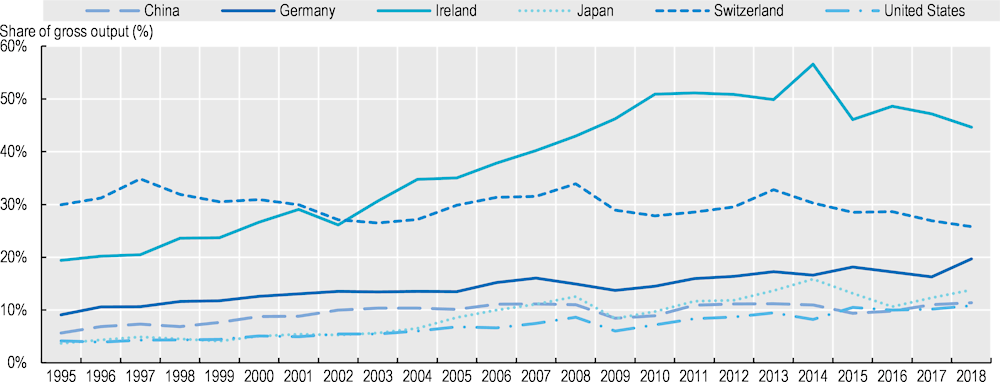

The production of medicines, both branded and generic, generally involves imported inputs, but the share of foreign value added in output (i.e. the value that corresponds to the contribution of imported inputs). varies across countries. One determinant is the size of the producing country, as large economies rely less on foreign sourcing than smaller economies. The OECD Trade in Value Added (TiVA) database provides an indication of the extent to which pharmaceutical supply chains are internationalised. Data in this section refer to the production of pharmaceutical products (output of the pharmaceutical industry) and all intermediate inputs needed (goods and services) along the supply chain.

Over the period 1995‑2018, there was a slight increase in the share of foreign value added for pharmaceutical products produced in the United States, the People’s Republic of China and Germany, but the share declined in Switzerland. In Ireland, it increased substantially in the 2000s before declining after 2014 (Figure 11.3).

Note: Foreign value added as a share of total output of the pharmaceutical industry in each country. The foreign value added corresponds to value added originating in foreign countries and embodied in foreign and domestic intermediate inputs used by the pharmaceutical industry in each country. Countries included based on the size of their industry in world production of pharmaceutical products.

Source: OECD TiVA database.

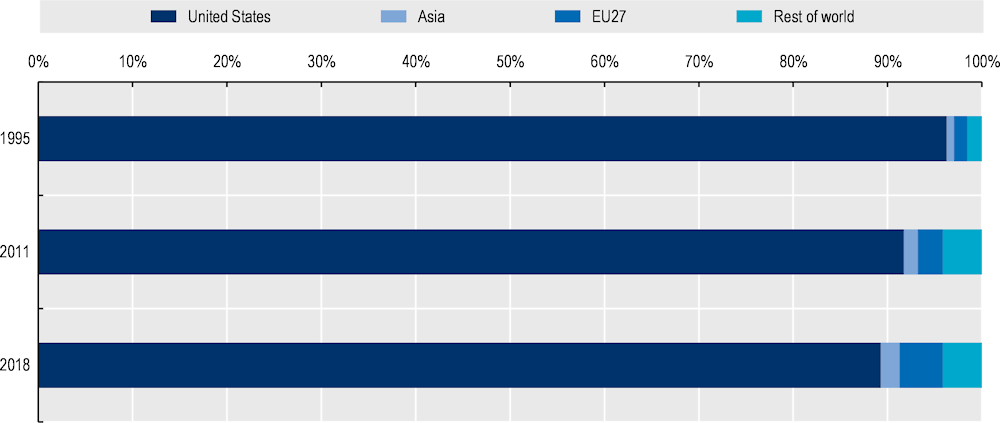

When looking at the origin of value added in final demand of US pharmaceuticals (i.e. the consumption of finished pharmaceutical products produced by the US pharmaceutical industry), the additional foreign value added mostly came from the European Union (Figure 11.4). There was an increase in the value added sourced from Asia over time, but this still accounted for a very low share of final demand (less than 3%).

Note: This chart depicts by country of origin the value added in final medicines produced by the US pharmaceutical industry and sold in any destination market.

Source: OECD TiVA database.

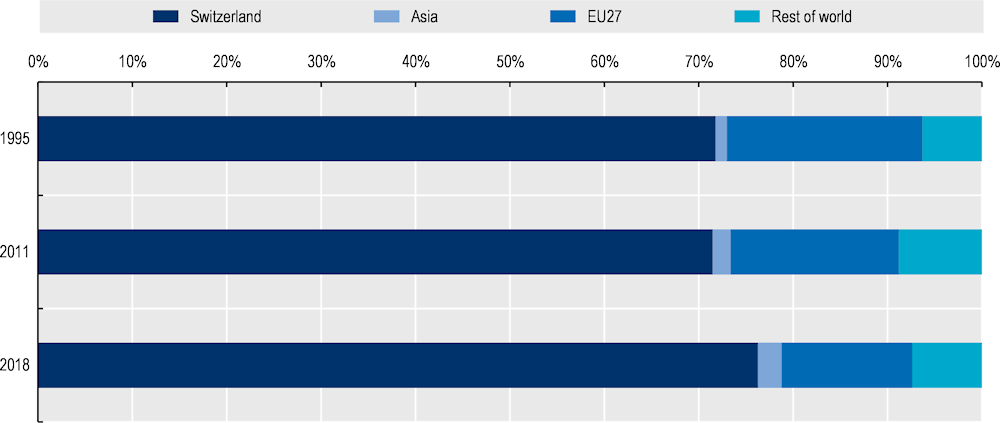

In the case of Switzerland, there was an increase in the share of domestic value added between 2011 and 2018 (Figure 11.5).3 A decrease in the share of value added sourced from the European Union explains the higher share of domestic value added. There was a slight increase in foreign sourcing from Asia, but Asia accounted for a small share of value added in Swiss pharmaceuticals in 2018 (4%).

These data are only available at an aggregate level for the whole pharmaceutical industry. It is possible that specific products have higher shares of foreign value added, but no such trend is seen at the aggregate level.

Note: This chart depicts by country of origin the value added in final medicines produced by the Swiss pharmaceutical industry and sold in any destination market.

Source: OECD TiVA database.

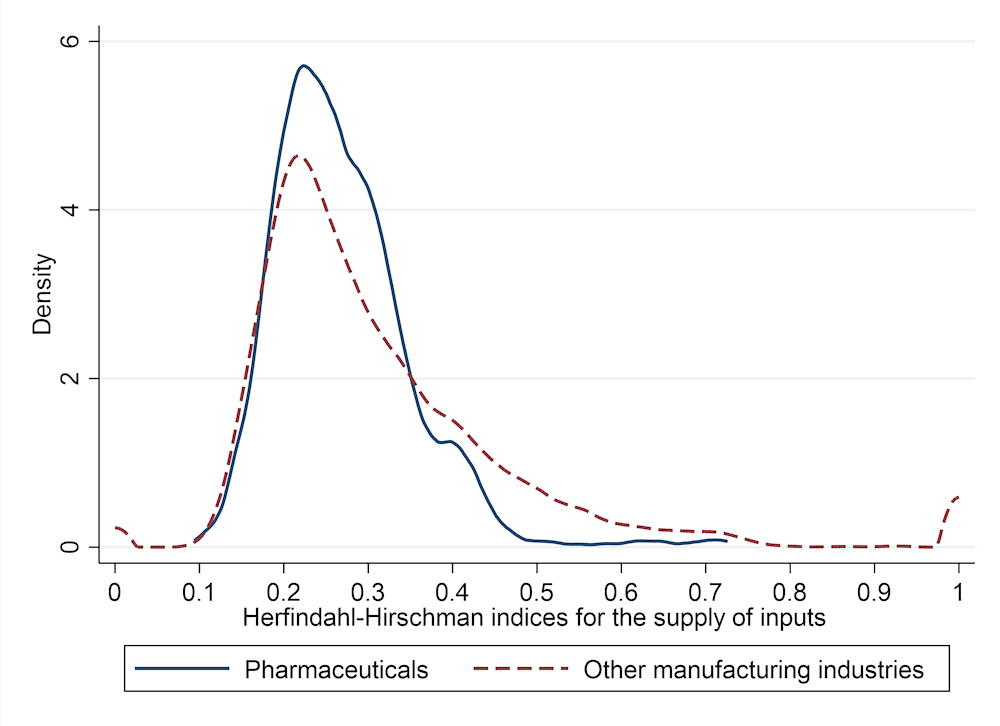

The OECD TiVA data can also be used to assess the concentration of supply in pharmaceutical supply chains, and whether final producers depend on a limited number of inputs coming from specific countries. The level of concentration is assessed with Herfindahl-Hirschman indices (HHI),4 which have a value of 1 when there is full concentration (i.e. all inputs in the whole supply chain come from a single supplying country and industry) and a value close to 0 when sourcing is fully diversified (i.e. all inputs come equally from all countries and industries). Compared to other manufacturing supply chains, the distribution of HHI for pharmaceuticals (across producing countries) shows fewer occurrences of concentration (HHI values above 0.4). The peak in the distribution is slightly above 0.2, as most countries have diversified sources of supply (Figure 11.6).

These data are also at an aggregate level and different results might well be observed for individual pharmaceutical products. The diversification measured in Figure 11.6 could be the result of aggregation of imports of intermediate inputs used to make different products, each of which would rely on a limited number of sourcing countries. The case studies presented in Section 11.2 offer some insights into this.

Source: Authors’ calculations based on OECD inter-country input-output tables.

Propofol is an intravenous anaesthetic agent that is also widely used for continuous sedation of invasively ventilated patients in intensive care units. Consequently, it was in high demand during the COVID‑19 pandemic. Propofol is on the Model List of Essential Medicines of the World Health Organization (WHO) because of its wide use and efficiency in general anaesthesia. Developed in 1977, it is now a multisource medicine. The propofol supply chain is complex, as it involves manufacturing a stable emulsion (Box 11.1).

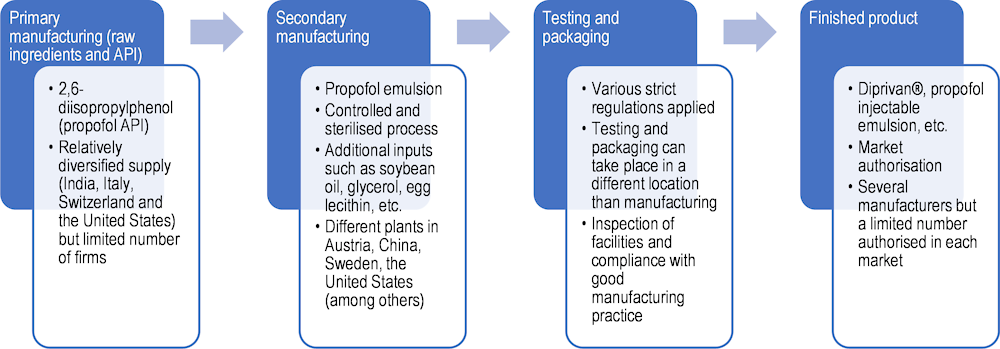

Propofol’s manufacturing process begins with the production of 2.6‑diisopropylphenol, which is its API (Figure 11.7).

Source: Based on Zhu (2022[16]), “A study of 3 COVID‑19 treatment substances’ global value chains [Unpublished dissertation]”, and OECD interviews with companies.

The primary manufacturing process is complex, as the API has to be part of a stable emulsion. An emulsion is a mixture of two substances that are not normally miscible, such as oil and water. Propofol is a solution, in which small droplets of the API are maintained stably within a lipid emulsion. Supply of the API is relatively diversified, with production capacity in India, Italy, Switzerland and the United States; however, the overall number of suppliers remains low (fewer than 10). Firms interviewed relied on several suppliers and not on single‑sourcing in this production stage, as a strategy to mitigate risks.

The secondary manufacturing stage consists of creating the emulsion and preparing the final product to be administered to patients. It is generally done by another firm, either a subsidiary of the brand manufacturer (the company that markets the product and sells it to final consumers) or an independent company through contract manufacturing. Different brand manufacturers may rely on the same suppliers, suggesting a rather concentrated industry. Production remains global, as firms serve different markets from the same supply chain, rather than through specific regional supply chains.

Emulsion instability is the first challenge and a potential quality issue in producing propofol. Due to its high “lipophilicity” (its ability to dissolve in fats, oils and lipids), dispersion of the API in the emulsion requires complex production techniques and rigorous controls along the supply chain. In addition, propofol is sensitive to air exposure, as contact with oxygen can cause impurities to develop. This is another constraint in the supply chain that creates additional costs (for specific storage conditions) and risks. As the number of suppliers is low, quality issues or delays in production may quickly create bottlenecks and shortages. This is the main weakness of the propofol supply chain.

Additional inputs are required to create the emulsion, such as refined soybean oil, glycerol and egg lecithin (phosphatides). These are generally supplied by a large number of firms, but the sterile process requires purified inputs of high quality. As such, switching suppliers may not always be easy. However, this part of the supply chain has not been regarded as a source of bottlenecks by manufacturers.

Once propofol is manufactured, testing and packaging occurs next. This is where brand manufacturers contribute. This involves implementing strict quality checks and dealing with complex regulations to be authorised to distribute the final product to a variety of markets. Authorisations include inspections at facilities and compliance with the code of good manufacturing practice. Testing and packaging generally occurs in locations separate from secondary manufacturing (involving flows of products across countries). While a reasonable number of firms sell propofol, not all products are authorised for sale in each market. This is one reason why there are often delays and sometimes shortages.

A significant shortage of propofol occurred in the United States in 2009‑10 (Jensen and Rappaport, 2010[17]; Hvisdas et al., 2013[18]). At this time, three domestic companies were producing propofol for the market in the United States, but two had to recall products because of quality problems. One manufacturer closed its plant temporarily to address the quality issues, while the other ceased production altogether and left the market,5 leaving a sole manufacturer supplying the entire US market at that time.

About 63% of drug shortages in the United States involve sterile injectable solutions, such as intravenous anaesthetic agents (FDA, 2019[7]). This is largely due to higher barriers to market entry for producing sterile injectable medicines (as opposed to oral solid-dose forms) because of the complexity of the production processes. As such, the pressure on prices may be lower than for other generic medicines when it comes to market competition. However, demand for lower prices may also come from health agencies and hospitals through procurement processes. A lack of economic incentives to produce propofol was cited as the main reason for the regular shortages observed around the world.

During the COVID‑19 pandemic, spikes in demand put additional pressure on manufacturers, exacerbating existing tensions in the supply of anaesthetics. Several countries reported shortages and authorised special importations from companies whose products did not have domestic marketing authorisation (but were authorised in foreign countries with similar quality standards). For example, propofol was added to the Canadian list of drugs for exceptional importation and sale in April 2020. In the same month, France decided to centralise procurement of all sedatives and redistribute available supply to intensive care units based on the number of resuscitation beds (Montmeat et al., 2020[19]; Chapuis et al., 2022[20]). In the United States, the American Society of Health-System Pharmacists reported many propofol shortages in its dedicated database, mostly caused by increased demand and shipping delays. Propofol has also been categorised as a drug in shortage since April 2020 by the US Food and Drug Administration (FDA).

Low-molecular-weight heparins (LMWHs) are a class of anticoagulants derived from unfractionated (full-length) heparin and used in the prevention and treatment of venous thromboembolism and a range of other conditions requiring anticoagulation. This case study focuses on enoxaparin, one of the most widely used LMWHs.6 Heparin and other anticoagulants have been used to treat COVID‑19 patients found to be at a high risk of developing thromboses (Hippensteel et al., 2020[21]). The LMWH supply chain illustrates potential shortages related to the unavailability of a key input (Box 11.2).

LMWHs are derived from unfractionated heparin. Heparin is a heterogeneous preparation of long heparan sulfate and is a natural product extracted mainly from porcine intestines (Chandarajoti, Liu and Pawlinski, 2016[22]). Crude heparin can also be extracted from ovine and bovine lungs, but most production is derived from pigs.

The production process of enoxaparin starts with extracting crude heparin (Figure 11.8). Porcine intestines are boiled and dried to collect mucosal membranes. In the case of China, this process involves small farmers in rural areas. China is an important producer: 60% of crude heparin used to manufacture heparin sodium in the United States is sourced from China (Rees, 2019[23]). Once purified in a laboratory, heparin extracts are transformed into heparin sodium. China is one of the main suppliers of heparin sodium, although production capacity also exists in Singapore and the United States. Bottlenecks in the supply of crude heparin and heparin sodium, often in relation to diseases affecting pork or contaminations, are responsible for most shortages in this supply chain.

The next step in the production process is to transform the full-length heparin into smaller fragments that acquire new chemical properties (the LMWHs). Enoxaparin is obtained through depolymerisation, which involves sophisticated techniques and creates more challenges to ensure the stability and quality of the resulting product. This step is done either by the brand manufacturer or by a specialised firm through contract manufacturing. As with propofol, testing and packaging, as well as obtaining marketing authorisation, constitute the step in the supply chain before distributing the final product.

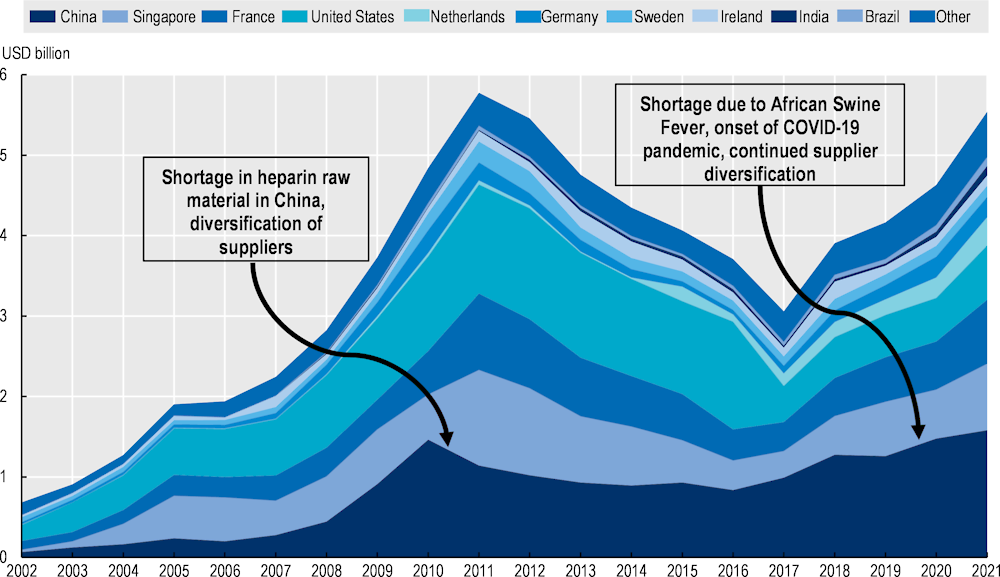

Production of LMWHs is affected by the size and health of the pig population because porcine intestines are at the beginning of the supply chain. Countries that export crude heparin are also the top exporters of pork meat, such as China in Asia or the Netherlands in Europe. For example, the outbreak of African swine fever in China in 2019 reduced Chinese exports of heparin (Fareed, Jeske and Ramacciotti, 2019[24]). Figure 11.9 shows, however, that lower Chinese exports were compensated by higher exports from other countries, highlighting the existence of alternative sources of supply.7

Note: The Harmonised Commodity Description and Coding System, generally referred to as “Harmonised system or HS”, categorises products according to 6‑digit codes. This figure shows exports of HS 300 190, which includes exports of heparin and its salts but is not limited to these products as it also includes other organs of animals for therapeutic use.

Source: Trade Map of the International Trade Center.

Exports of heparin increased significantly during the pandemic, confirming the capacity of the supply chain to meet the spike in demand and the role of trade in achieving this outcome. Economies such as the Netherlands have been increasing their share in the global market. The diversification of suppliers overall is reflected in the decreasing share of the top five suppliers to the global market. China continues to be the biggest exporter, but its share of the global market has been declining.

Figure 11.9 also illustrates another important shock that affected production of heparin and initiated this trend towards diversification of supply. In 2008, contamination of heparin sodium produced by a Chinese subsidiary of a US firm caused 150 deaths in the United States and 68 in other countries (Rosania, 2010[25]). Affecting the main supplier of unfractionated heparin in the US market, the contamination also created shortages due to recall of contaminated products and suspicions about the supply chain, with a further impact on health. The crisis was global, as several other countries were affected – including Germany and France, where the contaminant was also found in some batches of LMWHs. In Australia, where the product branded as Clexane® comprised more than 90% of the LMWH market, much of the supply was found to be contaminated and was recalled. The crisis put the emphasis on the responsibility of manufacturers and regulators to ensure the quality of inputs in the pharmaceutical value chain. New chemical tests were devised, and new rules implemented to avoid similar contamination.

Azithromycin is a macrolide antibiotic commonly used for a variety of bacterial infections. It is included in the WHO’s Model List of Essential Medicines. During the COVID‑19 pandemic, azithromycin was in high demand following studies suggesting that it could be used as a treatment for mild forms of SARS‑CoV‑2. Randomised controlled trials later established that there was no clinical benefit associated with its use for this indication (Rodríguez-Molinero, 2021[26]).

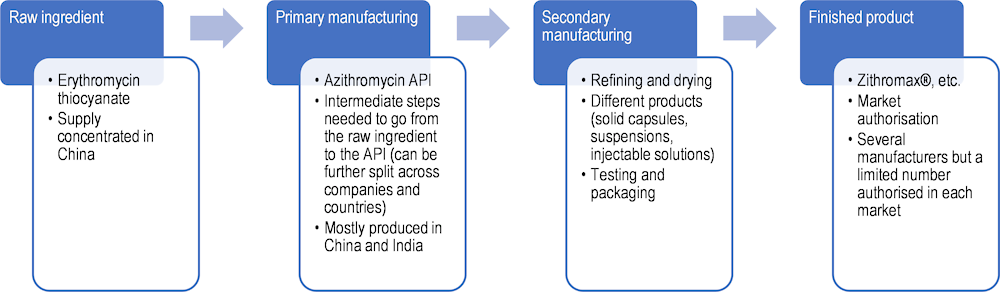

The manufacturing process for azithromycin requires fermentation techniques (to produce erythromycin) and chemical techniques (to derive azithromycin). A simplified manufacturing process is shown in Figure 11.10. It was confirmed in several interviews with professionals and experts that only China currently has the capacity to produce erythromycin on a large scale. Thus, all macrolide antibiotics depend on China upstream in their supply chains. This type of organisation is referred to as a diamond-shaped supply chain and is known to increase systemic risks (Sheffi, 2015[27]). There are, however, several suppliers in China, located in different regions.

Source: Based on Zhu (2022[16]), “A study of 3 COVID‑19 treatment substances’ global value chains [Unpublished dissertation]”, and OECD interviews with pharmaceutical companies.

The fermentation at the beginning of the manufacturing process is a complex step that requires clean water and a favourable climate, as well as adequate infrastructure to deal with waste. Antimicrobial resistance is an important health issue and action is necessary throughout the antibiotic supply chain to prevent its development. One of the reasons for China’s specialisation in production of antibiotic APIs is government support through the creation of biopharmaceutical industrial parks that provide the infrastructure and various services – such as third-party testing – to improve the quality of products (Deloitte, 2021[28]). Government support may also take the form of various types of subsidies (Table 11.1), leading to questions of potential market distortions and the absence of a level playing field that could otherwise promote more diversified supply (International Monetary Fund et al., 2022[29]).

China also produces the azithromycin API derived from erythromycin, although the primary manufacturing of the API is also performed in other countries. India is playing an increasing role in the supply chain of macrolide antibiotics, both as an importer of raw ingredients and as an exporter of APIs. Azithromycin API suppliers are found outside Asia, but the information gathered during the interviews suggests that their location of production might also be in Asia (through subsidiaries or contract manufacturing).

|

Company |

Type of subsidy |

Subsidies in 2021 |

|

|---|---|---|---|

|

USD equivalent |

Proportion of turnover |

||

|

Guobang Pharmaceutical Co Ltd. |

Grants |

2 726 173 |

0.39% |

|

Tax concessions |

15 144 916 |

2.17% |

|

|

Below-market borrowing |

1 799 326 |

0.26% |

|

|

Total |

19 670 415 |

2.82% |

|

|

HEC Pharm Co. Ltd |

Grants |

10 130 757 |

7.15% |

|

Tax concessions |

2 295 248 |

1.62% |

|

|

Below-market borrowing |

- |

0.00% |

|

|

Total |

12 426 006 |

8.77% |

|

|

Shanghai Shyndec Pharmaceutical Co. Ltd. |

Grants |

18 118 018 |

0.84% |

|

Tax concessions |

7 114 706 |

0.33% |

|

|

Below-market borrowing |

13 141 652 |

0.61% |

|

|

Total |

38 374 377 |

1.77% |

|

Note: Estimation of government support is based on OECD methodology, see OECD (2019[30]), “Measuring distortions in international markets: the aluminium value chain”, https://doi.org/10.1787/c82911ab-en, and OECD (2021[31]), “Measuring distortions in international markets: Below-market finance”, https://doi.org/10.1787/a1a5aa8a-en.

Source: OECD (internal database) and Wind (commercial dataset), https://www.wind.com.cn/portal/en/WDS/index.html.

More geographically diversified production is found in the rest of the supply chain at the formulation stage. However, due to pressures on prices in OECD countries and the low profitability associated with the production of generic antibiotics, very few companies produce azithromycin. The product regularly appears on lists of medicines in shortage, as is also the case for other antibiotics. These shortages are often temporary and explained by delays in restocking and increasing production to meet demand. They are not directly related to supply chain issues in the sense of shortages of key inputs.

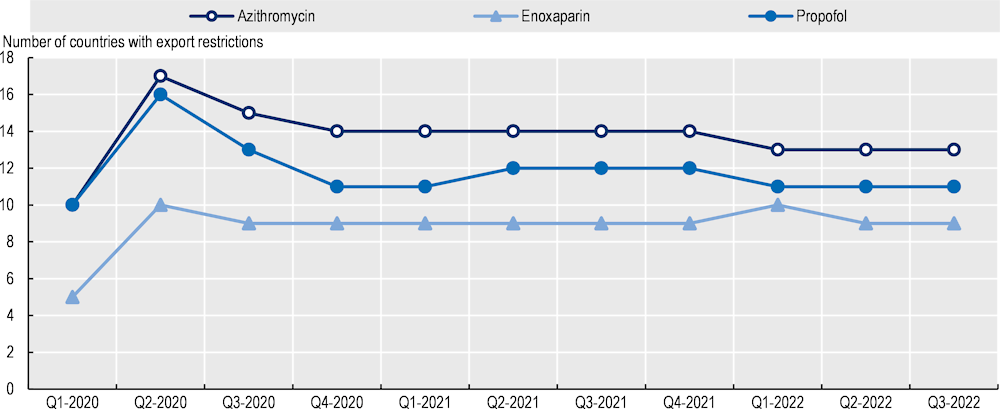

During the COVID‑19 pandemic, azithromycin producers were generally successful in coping with spikes in demand. However, they had to use most of their inventories and lead times increased (from 45‑90 days to six months). Antibiotics (and particularly azithromycin) were also subject to export restrictions that further contributed to tensions in their supply (Figure 11.11.) These were either export bans or export licensing requirements aimed at increasing the availability of medicines for the domestic market and preventing parallel exports (exports to third countries of medicines destined for the domestic market).

Even when these restrictions had exceptions for medicines specifically produced for export, they created delays for exporters and additional costs (for approval procedures and additional controls at the border) that exacerbated shortages (Hoekman, Fiorini and Yildirim, 2020[32]). Furthermore, export bans and logistics issues affect some markets to a higher degree than others due to lack of domestic production capacity (e.g. in Canada).

Note: Data relate to export restrictions on azithromycin, enoxaparin and propofol. The dataset covers all countries, but the list of countries with export restrictions may not be exhaustive, based on available information for the specific medicines covered.

Source: Global Trade Alert, Expanded Essential Goods Monitoring Initiative (August 2022 update).

This section describes some of the vulnerabilities of medical device supply chains, particularly as they pertained to the COVID‑19 pandemic – a context that generated unprecedented demand. First, it outlines the nature and context of medical device supply chains and some of the differences between these and pharmaceutical supply chains. It then presents the results of the OECD Resilience of Health Systems Questionnaire 2022, exploring both the approaches taken and the strategies implemented to improve the security of supply of essential medical products – predominantly medical devices – during the pandemic.

Medical devices are products or equipment intended for a medical purpose (European Medicines Agency, n.d.[33]). The term covers a wide variety of goods, from simple tongue depressors to complex scanners and ventilators. They are generally subject to higher levels of oversight than many non-medical products. They are regulated based on their intended purpose and according to the risk of harm they may pose, although classification schemas vary across jurisdictions (TGA, 2021[34]). However, the level of risk is not reflective of the complexity of the supply chains for these products. Many low-risk products have complex supply chains, with multiple steps in several countries (National Academies of Science Engineering and Medicine, 2022[11]).

A key difference between medicines and medical devices is that medical devices may be produced for both health care and non-health care markets. For example, respiratory protective devices, which are a type of mask (Box 11.3), are a component of personal protective equipment (PPE), which also usually comprises gowns and gloves (Chen et al., 2021[35]). Prior to the pandemic, non-medical respiratory protective devices using the same materials were available for use in construction and home repairs. This additional capacity could be used in time of crisis, but it also represents an alternative source of demand.

The product lifecycles of medicines and medical devices also differ, with the latter generally much shorter. The much wider variation in the nature and risk profiles of medical devices renders them subject to a broader range of regulations than medicines. Moreover, while many medical devices are designed for single use, others can be reused. Importantly, the nature of medical device supply chains is very variable: some more closely resemble supply chains for clothing or electrical goods than those for medicines.

There are several different types of face masks. During the COVID‑19 pandemic, all the various types of masks were used for the public, patients or health care workers to reduce transmission of SARS‑CoV‑2 and protect against COVID‑19 (FDA, 2022[36]).

Cloth masks are made from a variety of fabrics and may have multiple layers. They primarily capture droplets from coughing and sneezing, potentially reducing the chance of those who have SAR-CoV‑2 spreading the virus.

Procedure, medical or surgical masks consist of multiple layers of non-woven material and have a nose wire. They are designed to be a physical barrier to protect against splashes and sprays. They may capture droplets from coughing and sneezing. They generally fit loosely, as the edges are not designed to form a seal nor to capture very small particles. They are disposable.

Respiratory protective devices fit more closely, forming an effective seal around the mouth and nose (when worn correctly). They protect against inhalation of hazardous material including small particles and are designed to provide very efficient filtration of particles. Some types of respiratory protective devices can be disposable (e.g. filtering facepiece respirators, such as N95, FFP2 and K95 respirators), while others can be reusable (e.g. elastomeric respirators).

Initially, it was not possible to isolate procedure and surgical masks from respiratory protective devices in trade data, but later in the pandemic it became possible to make the distinction (see Section 11.3.4) (FDA, 2022[37]).

Source: OECD (2020[38]), “The Face Mask Global Value Chain in the COVID‑19 Outbreak: Evidence and Policy Lessons”, https://doi.org/10.1787/a4df866d-en.

Some of the vulnerabilities associated with global supply chains for medical devices were recognised prior to the pandemic and are like those discussed for medicines. They include concentration of markets, a lack of incentives to invest in capacity to ensure adequate supply, and poor visibility and transparency of the supply chain.

Concentration (or bottlenecks) may occur outside the production and manufacturing process – for example, in transport links, where ports or specific land, air or sea routes without alternatives are potential points of vulnerability. The blockage of the Suez Canal by the Ever Given in 2021 demonstrated this vulnerability to bottlenecks in transportation (Lee and Wong, 2021[39]).

Ensuring access to critical care and protecting health care workers and the public were essential to the response to the COVID‑19 pandemic. Critical care (see the chapter on critical care surge) required sufficient supplies of essential medical devices (such as ventilators) and certain medicines. PPE was necessary to protect health care workers, patients and others from infection. Workers employed in other critical sectors and the wider public also relied on protective garments, such as cloth masks, to reduce transmission. Adequate supplies of testing materials were also imperative for containment (test, trace and isolate) strategies (see the chapter on containment and mitigation).

Over the course of the pandemic, demand for certain medical devices increased. Initially, they were used to treat critically ill patients; to prevent transmission and, where this was not possible, to detect and trace infections; and to treat COVID‑19 patients in the community. Later, uses included administering the newly available vaccines. Some increases in demand were very substantial and many times that of pre‑existing production (for example, of PPE) – a level of demand considered unprecedented (Chen et al., 2021[35]).

As with medicines, production of medical devices also became more difficult during the pandemic. Policies implemented to contain and mitigate COVID‑19 – such as physical distancing – and a reduced labour supply increased costs and reduced capacity. The concentration of some production processes exacerbated the impact of this situation. For example, factories in China responsible for most disposable respirator production closed temporarily due to COVID‑19 (OECD, 2020[40]).

Other issues included: disruptions to transport and logistics; the combined result of labour shortages due to infections; new regulations for protection and physical distancing; border closures; and a reduction in air cargo with the collapse of passenger transport (OECD, 2021[41]). Further, once health systems received medical devices, there were also distributional issues. Some systems were unable to distribute devices effectively to locations where they would have had greatest value (see chapters on digital foundations and critical care surge).

Shortages of medical device supplies developed quickly during the COVID‑19 pandemic, as demand increased drastically, and supply could not meet it. This scenario was repeated numerous times during 2020 and 2021 with different products, including PPE, ventilators, testing components and vaccines.

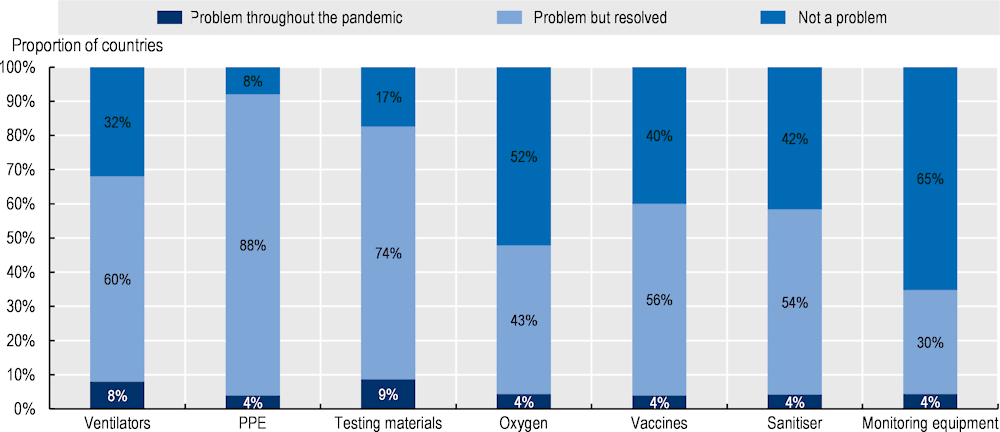

More than two‑thirds (70%) of countries responding to the OECD Resilience of Health Systems Questionnaire 2022 reported a problem with supplies of essential medical devices prior to January 2022. Most respondents reported that problems were limited in duration (Figure 11.12). The vast majority stated that supplies of three types of essential medical devices – PPE (92%), testing materials (83%) and ventilators and ventilation products (68%) – were major issues, but most indicated that these were resolved prior to January 2022. Fewer than 10% of countries suggested that problems with the supplies of essential medical products were ongoing.

Problems with the supply of essential medical devices were correlated across the different categories within countries. Countries that identified a problem throughout the pandemic with one type of medical device tended to report it for other categories, while countries without problems with one type of medical device tended not to have ongoing problems obtaining supplies of the other types.

PPE was nominated most frequently (by 67% of countries) as the most important type of medical device subject to shortages. Other product types nominated included ventilators, vaccines and advanced resuscitation equipment such as extra-corporeal membrane oxygenation machines, which extract, oxygenate and pump blood back into the body.

The OECD Resilience of Health Systems Questionnaire 2022 also asked about supply chain visibility – described as knowledge of suppliers, the suppliers of suppliers, supply chain mechanics and logistics. One‑third of countries reported that the supply chain for the most important medical device they nominated was not visible.

Note: There were 25 respondents; only countries that completed the relevant section are included.

Source: OECD Resilience of Health Systems Questionnaire 2022.

No country reported that problems of supply were primarily the result of local disruptions. More than half (55%) indicated that disruptions were primarily international, while the remainder said that disruptions were both local and international. Many respondents said the international disruptions included both production and transportation. The impact of COVID‑19 in reducing staff in domestic distribution and manufacturing was commonly highlighted.

Respiratory protective devices and procedure masks are an example of a basic medical device that is typically cheap to produce but has a manufacturing chain that demonstrated the challenges for supply during the COVID‑19 pandemic, when production had to increase significantly in a relatively short time. Respirators require several types of inputs and assembly of different parts in a relatively sophisticated process (OECD, 2020[38]). One of the specialised components – non-woven (melt blown) polypropylene, which is electrically charged so that the virus particles are attracted while air passes through – was a bottleneck in the supply chain. This component requires specialised machinery and is produced in a limited number of countries (Fabra, Motta and Peitz, 2020[42]).

The very significant increase in demand for filtering facepiece respirators meant that all countries required a greater number than they were producing – thus, for a period, every country was attempting to be a net importer of filtering facepiece respirators. This resulted in further bottlenecks in distribution, with many countries introducing export restrictions or compulsory purchasing arrangements. Disruptions in both domestic and international freight exacerbated the supply shock.

Another important example is ventilators. These are durable goods, designed to be used multiple times, albeit in combination with disposable parts (Chen et al., 2021[35]). Demand for ventilators increased by a factor of 20 during the early absorb phase of the pandemic (see the chapter on critical care surge).

Some OECD countries (Belgium, the Czech Republic, Greece, Israel, Italy, Japan, Slovenia and Türkiye) reported more limited disruptions in supply chains, according to responses to the OECD Resilience of Health Systems Questionnaire 2022. OECD countries identified several different policies as important in averting and mitigating supply chain disruptions, including for essential medical devices. Changed and especially simplified regulation, a multi-stakeholder approach to mount and guide a complex intervention, monitoring and co‑ordination, and local production were all nominated as policies that averted supply chain disruptions (Table 11.2). Slovenia noted that sufficient stocks of key materials were important to maintaining normal operation despite issues in supply chains.

|

Country |

Changes in regulations |

Multi-stakeholder approach |

Monitoring and co‑ordination |

Local production |

|---|---|---|---|---|

|

Belgium |

- |

Creation of a taskforce of authorities and stakeholders to guide appropriate approaches |

Stock monitoring system combined with epidemiology forecasting |

- |

|

Canada |

Introduction of interim orders for expedited authorisation |

Creation of a logistics advisory committee, composed of all provinces and federal government leads |

- |

Made in Canada initiatives for new manufacturers |

|

Czech Republic |

Use of national level derogations for entry to the market |

- |

Internet platforms and other tools to co‑ordinate delivery |

- |

|

Israel |

- |

- |

- |

Development of local production chains |

|

Italy |

Issuing of import determinations and simplification of regulations (such as simplification of oxygen management procedures) |

Creation of a community of experts and several crisis committees to supervise and intervene as required |

Monitoring, co‑ordination and guarantee of supply to institutions using real-time information |

In case of shortages, providing technological transfer to the Military Pharmaceutical Chemical Plant in Florence for manufacture1 |

|

Switzerland |

Introduction of a compulsory stockpiling system |

Creation of a taskforce by the Federal Office of Public Health co‑operating with hospitals and the private sector to ensure adequate supply of essential medicines |

Stock monitoring system for medicines that were essential in the fight against the pandemic |

- |

Note: The question was “If ‘No’ (to experiencing supply chain disruptions of essential medical products), please describe the most effective policies that were used to avoid supply chain disruptions”.

1. A collaboration agreement between the Italian Medicines Agency and Agenzia Industrie difesa signed on December 2021, aiming to consolidate production activities to address medicine shortages in the national and European markets.

Source: OECD Resilience of Health Systems Questionnaire 2022; data on Switzerland were added after an interview with the Swiss Federal Office of Public Health (FOPH).

Most countries engaged in a range of strategies to secure supply of essential medical devices. Diversification of the final source of supply – both international and domestic – was a common strategy to address disruptions in supply chains. This often involved simplification, guidance or acceleration of the regulatory process. For example, Canada used interim orders to allow foreign labelled pharmaceuticals to fill supply gaps until Canadian-authorised products were available – this was later transitioned to a permanent regulation (Health Canada, 2021[43]). Canada also has an exceptional importation framework for medical devices. Rapid approval of ventilator variations increased access in Australia (Productivity Commission, 2021[44]).

Expanded domestic production and manufacture of PPE were widespread, according to responses to the OECD Resilience of Health Systems Questionnaire 2022. Increased international and domestic diversification resulted in large increases in numbers of suppliers. For example, the US Government invoked the Defense Production Act to encourage manufacturers to produce critical medical equipment. The Irish Health Services Executive placed orders with 150 suppliers of PPE in 2020, of which 115 were newly on-boarded as suppliers.

Countries also made changes to governance arrangements for purchasing, often centralising the process (Zhang et al., 2022[45]). Diversification was aided by countries organising and investing in transportation. However, export restrictions made the process of diversification and increasing supplies more difficult. In turn, this made international co‑operation more important.

Another common approach was substitution of different products or devices to mitigate shortages. The use of substitution was accompanied by increased information and guidance to minimise risk. For example, Italy issued guidelines on the use of alternative products. In the United States, the FDA issued guidance on use of medical devices to increase their availability – for example, recommending product alternatives where appropriate. However, in some cases, such as Canada, substitute devices recommended by manufacturers facing shortages were not aligned with health care professionals’ preferences, which led to continuous disruptions in supply.

As well as substitution, reuse of previously single‑use items, such as N95 respirators, was a common strategy, accompanied by risk mitigation guidance (CDC, 2020[46]). The use of substitution was greater for medical devices than for medicines for which reuse is not an option. For example, in a crisis care situation with no common alternatives, substitution could be used (CDC, 2020[47]). Medical devices that were not of sufficient quality for frontline health care use were slated for potential use in low-risk, non-health care settings, according to respondents. Consideration of “ventilator splitting”, where one ventilator could be used for multiple patients, was analogous but this was not undertaken at scale (Chen et al., 2021[35]; Beitler et al., 2020[48]).

Assuring the quality of the products might have been an issue during the global shortage, especially given the rapid increase in diversification of suppliers and the urgency of securing supplies. Nonetheless, most countries took steps to assure the quality of products or to mitigate risks. This involved expanded testing and compliance activities, accompanied by increased information provision.

Australia undertook post-market contractual and regulatory compliance testing across stockpiled products. Austria submitted products to additional quality controls. Belgium put in place an alternative testing protocol. Canada developed and delivered information sessions about quality requirements. If the quality of equipment could not be determined through established testing protocols, it was not distributed to the frontline health care response. The Czech Republic and Ireland noted that some products could not be deployed clinically because of poor quality. Italy also conducted a survey about medical devices received during the pandemic to ensure compliance with quality requirements. Lithuania registered all potential suppliers. After three months, Luxembourg undertook a detailed quality analysis of its PPE stock to ensure compliance with quality requirements. Switzerland mandated quality assurance checks.

Medical device supply increased dramatically during the pandemic, albeit with a significant time lag. However, the lack of availability, even for a relatively short time, resulted in significant morbidity and mortality. Increased risk of infection with SARS‑CoV‑2 because of a lack of PPE was one example (Nguyen et al., 2020[49]). At the early stages of the pandemic, PPE was in extremely short supply worldwide relative to demand, and it was subject to all three categories of supply chain disruption – increased demand, reduced supply and co‑ordination problems, including export restrictions. However, even without reduced supply and co‑ordination problems, at its peak it would not have been possible to meet the increased demand for filtering facepiece respirators (OECD, 2020[38]).

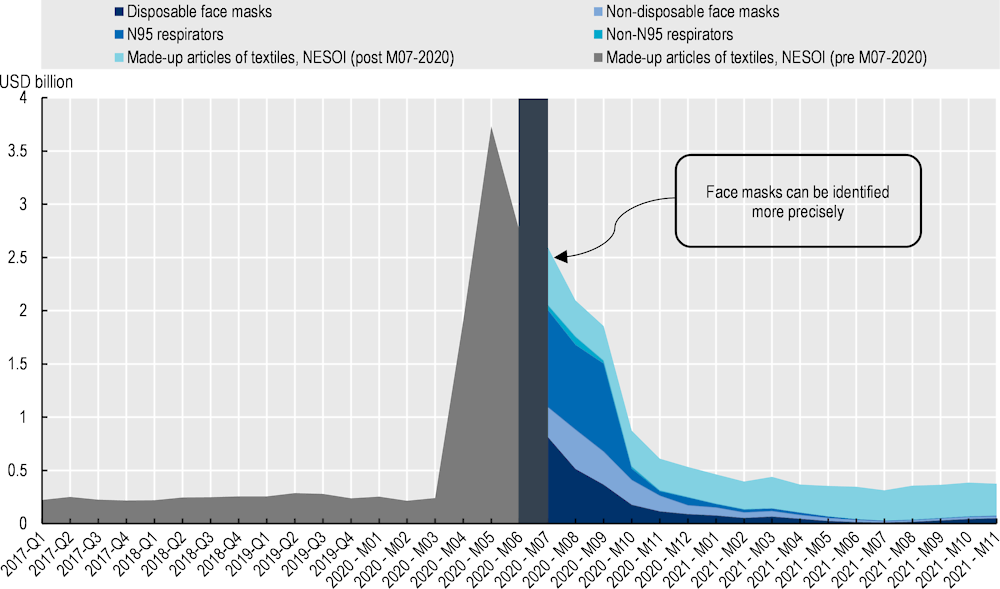

The importance of trade in overcoming shortages in medical masks and respiratory protective devices in the United States is demonstrable (Figure 11.13). There was a 1 500% increase in importation during the pandemic – from 600 million to 9.4 billion items. This was accompanied by diversification in origin, with increasing imports from Mexico and Korea (OECD, 2022[50]). Similar profiles of increased imports occurred in Canada, the European Union and Japan. With the increased importance of distinguishing different types of masks, greater disaggregation in statistical collection was applied from June 2020, increasing the ability to track products on a granular level.

Note: The figure shows imports into the United States from all partners for Harmonised Tariff Schedule of the United States (HTS) code 6307.90.98.89 (“Other made‑up articles of textile, not elsewhere specified or included”) from January 2017 to July 2020, and imports of textile disposable face masks (6307.90.98.70), textile non-disposable face masks (6307.90.98.75), textile N95 respirators (6307.90.98.45), textile non-N95 respirators (6307.90.98.50), and other made‑up articles of textile, not elsewhere specified or included (after July 2020, code 6307.90.98.91). The average quarterly value is shown for 2017‑19.

Source: OECD (2022[50]), “Global supply chains at work: A tale of three products to fight COVID‑19”, https://doi.org/10.1787/07647bc5-en; United States International Trade Commission (USITC) DataWeb (2022).

The consequences of a shortfall in the supply of essential medical devices were substantial in the context of the COVID‑19 pandemic. Ensuring that any future shortfall in the supply of essential medical devices is as limited as possible requires a mix of policy responses, given the multitude of potential threats and vulnerabilities.

Many countries are planning to implement policies over the medium term to improve the security of supply of medical devices and medicines. Those outlined in the OECD Resilience of Health Systems Questionnaire 2022 included: increasing knowledge to promote awareness of potential vulnerabilities; reducing the risk of supply shortages caused by disruptions in supply chains through changes in governance arrangements; and absorbing or buffering supply shortages when they occur (Box 11.4).

Improved transparency and monitoring of supply chains (Canada, Italy, Spain, United States).

Increased knowledge of available stocks (Austria, Belgium, Italy).

Horizon scanning to anticipate and adjust to changes (Austria).

Review of difficulties experienced during the pandemic and review of supply chain vulnerabilities (Slovenia, United Kingdom).

Increased co‑ordination between levels of government to support procurement activities (Australia).

Introduction of responsible entities – for example, establishment of an Office of Supply Chain Resilience in 2021 to identify and monitor vulnerabilities in supply chains and to co‑ordinate responses (Australia).

Ensuring sufficient barriers to poor-quality goods in health care (Czech Republic).

Use of regional procurement (Europe through the European Commission, United Kingdom engaging international partners, building on areas such as PPE and critical medical supplies).

Centralised procurement – for example the newly legislated National Centralised Health Procurement Authority with a commitment to centralise 40% of total health spending during 2022 (Greece).

Brokers – procuring services to be called upon in the event of supply chain disruption (Ireland).

Inclusion of backup suppliers for critical products (Spain).

Inclusion of diversification of supply in decisions with suppliers regarding essential medical devices or pharmaceuticals (Portugal, United Kingdom).

Strengthening national and regional value chains of critical products (Austria, United States).

Long-term contracts (Canada securing long-term contracts with domestic manufacturers to support replacement of its stockpile of PPE; France undertaking work to enable domestic manufacturers to be able to supply for priority products when required; Ireland encouraging on-shore and near-shore manufacturing through contracts).

Shortening of existing supply chains – for example, geographically local production of active ingredients in medicines (Spain).

Increased investment (Korea actively investing in development of Korean-made vaccines; United Kingdom identifying long-term opportunities to strengthen supply through increased domestic production; United States increasing domestic production to promote diversification and redundancy).

Increased stockpiling (Germany, Slovenia; Austria establishing a mid- to long-term PPE stockpile; the European Union implementing regional co‑ordination and stockpiling; France establishing public stocks of several priority products; Ireland establishing national stockpiles to ensure no lag in availability during crises; United Kingdom fortifying local supply, including through stockpiles).

Explicit guidelines for procurement and stocks for health and emergency entities – for example, amending the law to require institutions offering personal health care services to have sufficient PPE (and other measures) to ensure performance of their activities for 30 days, placing a similar obligation on municipal administrations, and ensuring that the state reserve should be sufficient for 60 days (Latvia).

Use of long-term contracts and capacity buffering (Ireland engaging in long-term contracts and contracts for supply in the event of a future incident such as a pandemic; Latvia discussing the potential for the European Commission to conclude advance procurement agreements to secure deliveries of essential medicinal products).

Source: OECD Resilience of Health Systems Questionnaire 2022.

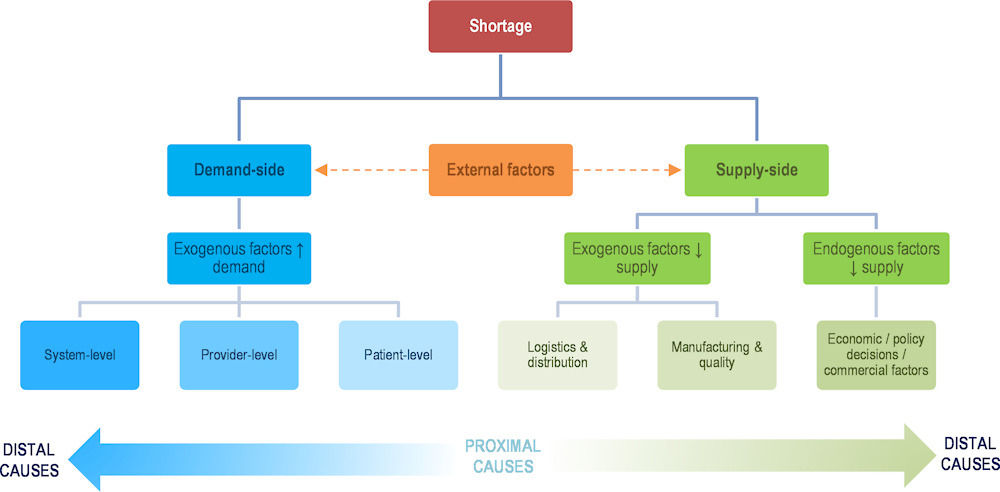

The previous sections highlight the existence of broader challenges whose origins lie outside the organisation of supply chains. They illustrate the different issues that need to be addressed to ensure continuity of access to essential medicines and medical devices during health crises, and thereby to contribute to health system resilience. For medicines, while the issues described are derived from analyses of off-patent or multisource products, single‑source (or patented) products are also subject to challenges in security of supply, albeit with potentially different root causes. While the debate on access to essential goods during the COVID‑19 pandemic has emphasised supply chain issues, the case studies and Figure 11.14 illustrate the complex nature of shortages and their varying root causes.

The international nature of supply chains creates risks when countries resort to export restrictions or when, as seen during COVID‑19, international transport networks experience bottlenecks in supply. Medical products that experienced the greatest demand during the pandemic – such as procedure masks and respiratory protective devices – became the subject of export restrictions, further restricting the supply for some countries.

However, the core issues identified in the case studies relate principally to the economic and commercial incentives that would facilitate more diverse and robust production networks, and to the role of regulators and governments in ensuring sufficient capacity and diversity in the production of medical goods. A key question is what policy makers should or can do to ensure that global supply chains run smoothly.

Source: Chapman, Dedet and Lopert (2022[6]), “Shortages of medicines in OECD countries”, https://doi.org/10.1787/b5d9e15d-en.

Strategies need to balance different risks and vulnerabilities. The COVID‑19 pandemic was an extreme shock to supply chains, but the next shock may not be an infectious disease, and some strategies may increase vulnerability to specific disruptions while decreasing vulnerability to others. Improving supply chain resilience for essential medical devices and medicines needs to consider not only extreme shocks but also less extreme and more common events.

The main policy implications of the analysis, applicable to both essential medicines and medical devices, are summarised in the following sections.

Promoting the long-term resilience of medical supply chains in the face of both known and unanticipated threats would benefit from collaborative, internationally harmonised and co‑ordinated approaches to regulation and stockpiling.

Strategies need to balance mitigation measures best undertaken by firms within the supply chains with those more appropriately managed by governments (Productivity Commission, 2021[44]). For example, stockpiles should arguably be managed by governments, but could be held by firms.

The stakeholders best placed to improve supply chain resilience may also be determined by the potential scale of the disruption. For instance, prolonged health crises occurring on a global scale may require different policy options from a localised temporary disruption, such as a fire or earthquake.

Private and public actors took steps to resolve supply chain issues during the pandemic, but incentives are needed for private actors to maximise the public good (see the chapter on global public goods). Ensuring the stability and predictability of the trading environment also supports the resilience of supply chains.

Difficulties in identifying the suppliers and countries involved in medicine and medical device supply chains may undermine the assessment of risks by governments. The COVID‑19 pandemic highlighted that governments did not have sufficient information on the origins of medicines and medical devices sold in their domestic markets, the availability of alternative suppliers or countries from which essential inputs are sourced (for domestic or foreign production).

A lack of transparency may hamper co‑ordination and collaboration between governments, leading in some cases to excessive stockpiling and in others to preventing early detection of potential shortages. A global information and transparency mechanism on supply chains for essential medicines and medical devices could help governments to assess the concentration of supply, prepare for potential shortages and co‑operate with other countries and firms to ensure continuity of supply.

The World Health Assembly resolved to improve the transparency of markets for medicines, vaccines and other health products at an international level in resolution WHA72.8 (WHO, 2019[51]). While focusing on price transparency, this also references the importance of collecting information on inputs along supply chains. Recent OECD publications have also highlighted the issue of transparency in pharmaceutical markets (OECD, 2018[52]; Chapman, Dedet and Lopert, 2022[6]; Wenzl and Chapman, 2019[53]).

To improve government assessments of risks and preparations for crises, more detailed information on supplies (including flows and volumes), suppliers and countries of origin of finished products and key inputs are needed. Regulators could mandate provision of this information,8 or governments could use public – private dialogue and collaboration with firms through transparency initiatives or platforms to collect such evidence, while ensuring appropriate degrees of confidentiality in the treatment and use of the data.

One issue may be the costs to firms of reporting this information in a setting of low profitability and limited incentives to produce essential medicines or medical devices. This reporting should, therefore, not be overly burdensome or add to cost pressures. Greater transparency could be included in criteria applied in public procurement and pricing processes.

Real-time information about medical devices and medicines can help issues to be anticipated and addressed quickly. Several countries are pursuing diversification, including local manufacturing and use of long-term contracts and relationships to mitigate disruption. This would be aided by being able to predict demand early. Prior to the pandemic, both the availability of real-time data about capacity and usage (see the chapter on digital foundations) and the ability to predict supplies were limited (see the chapter on critical care surge). These limitations are being addressed, and greater confidence in predicting the required supply may provide a lead time for manufacturers to institute capacity buffers (Chen et al., 2021[35]).

Better preparedness by countries and improved resilience in the supply of medicines and medical devices involves effective reporting systems and medicine shortage platforms (Shukar et al., 2021[54]). Most OECD countries have such systems, but monitoring could be improved in several ways (Chapman, Dedet and Lopert, 2022[6]). First, reporting requirements differ widely across countries. Harmonisation would facilitate actions by governments to effectively address shortages through international co‑ordination and co‑operation. Second, not enough information is generally collected to identify the root cause of the shortage and to implement solutions. Some supply chain information would help to identify exactly where there is a bottleneck and what might help solve the shortage. Third, early warning notices would be more useful for mitigation strategies than gathering information on shortages that are under way.

Reporting platforms could also be improved through developing new information systems and data analytics to detect shortages in advance based upon real-time variations in supply and demand. Some countries already have such stock monitoring systems in place. In Türkiye, the Turkish Medicines and Medical Devices Agency has a national product-tracking system with individual follow-up in the sales, distribution, purchase and usage processes of medical goods from production or import. Through a single tracking infrastructure, the stock status of economic operators and health facilities within Türkiye can be determined on a product group basis.

Volatility in demand for medical products may be unavoidable, but there are different ways to ensure that variations in demand are anticipated, and productions adjustments are agile and responsive. Technologies such as smart labelling may also help to introduce more transparency and traceability in medicine and medical device supply chains. Diprivan® (a brand of propofol) is one of the first medications to benefit from a radio-frequency identification system (Fresenius Kabi, 2022[55]). “Smart labels” may help hospitals with inventory management and allow manufacturers to anticipate changes in demand.

In addition to smart labelling, various supply chain technologies (including digital technologies relying on predictive analytics, artificial intelligence and blockchain) are available to monitor supply chains and anticipate risks (Ye et al., 2022[56]). For example, encrypted blockchain technology can help to build trust along the value chain, while also facilitating exchange of information and collaborative relationships (Hosseini Bamakan, Ghasemzadeh Moghaddam and Dehghan Manshadi, 2021[57]). Governments can assist by ensuring that regulatory environments are favourable to deploying digital technologies, and by addressing specific issues (such as privacy and security in data transmission) which are particularly important in the context of health systems (see the chapter on digital foundations).

Stress testing supply chains to better understand their vulnerabilities over time could also be a useful strategy. This would require quantification of resilience (Linkov et al., 2020[58]) and testing would need to be conducted regularly. Stress tests must, however, take a holistic approach to how health systems respond to health crises and large‑scale shocks. Such tests should consider both supply chain vulnerabilities and medical needs, thereby avoiding a restricted evaluation of supply chain resilience without appreciating the changes that will occur in the delivery of medical care in crises.

Many of the shortages identified in the medicine case studies were related to quality issues in the production of medicines that led to the unexpected removal of significant quantities of products from the market. The existence of only a limited number of manufacturers (either at the global level or with authorisation for a specific market) accentuates the risk of quality issues leading to severe shortages.

Quality issues are not limited to contamination. They include breaks in cold chains, variations in concentration or changes in stability, defective packaging and poor calibration. These issues may happen throughout the supply chain and may affect one or multiple batches of a product. Quality issues with medical devices may also be associated with the rapid expansion of suppliers at a time of extreme demand.

Offshoring should not be viewed as an additional source of risk to quality, but longer supply chains with multiple suppliers in countries with different regulations or standards may increase the complexity of the supply chains and risks related to quality.

It is, therefore, important for regulators and firms to ensure that the appropriate level of controls is in place. All pharmaceutical manufacturing sites (whether in China, the European Union, India or the United States) are subject to the same standards and inspections (e.g. the code of good manufacturing practice). Thus, the issue is less about the existence of rules and standards and more about the effective implementation of procedures. This involves ensuring that manufacturers have sufficient incentives to invest in quality management and control, including with contractors and foreign suppliers.

As quality issues cannot be fully avoided, and risks will always exist, having a sufficient number of manufacturers relying on a diverse set of suppliers would ultimately help to prevent quality issues resulting in shortages of medicines and medical devices. As discussed in Section 11.3.3, once the pandemic began, most countries took steps to enhance quality assurance of medical devices in the context of a rapid diversification of suppliers.

Profit margins on generic medicines are generally lower than those on patented products. Where public procurement accounts for the bulk of sales, significant downward pressure on prices can occur. Prices may become too low for firms to have sufficient commercial incentives to manufacture essential medicines or to invest in resilience and capacity. This issue was observed in the three medicine case studies and confirmed by interviews with pharmaceutical firms. Similar issues exist with medical devices.

Having a limited number of suppliers of essential medicines and medical devices may be regarded as a key cause of shortages. As highlighted above, if there are enough suppliers with production capacity in different countries, quality issues in a given facility need not affect the availability of a medicine or medical device. What is not produced in one location can, in theory, be replaced with augmented production elsewhere, if spare capacity exists. Thus, resilience in supply chains in the face of spikes in demand is also influenced by the number of suppliers and economic incentives to add or retain “buffer” capacity. Firms can accept factories and supply chains not running at 100% capacity in “normal” times, with flexibility to increase production during crises, only if their revenue is sufficient to accommodate the excess capacity. At the same time, countries must be able to balance the risks of diversification. A single reliable supplier may, in some cases, be preferred over multiple small suppliers.

More diversified supply chains and increased production capacity for essential medicines and medical devices require procurement practices and pricing mechanisms to be reviewed. Novel procurement and reimbursement models are being explored in some countries for new antimicrobials – for example, in pilot projects conducted by the United Kingdom and Sweden (Gotham et al., 2020[59]). However, new models may also be needed for generic medicines and medical devices. Improving the resilience of health systems is not cost free. Preventing disruptions during future crises involves revising the commercial incentives currently in place for pharmaceutical firms to produce essential medicines, especially generics.