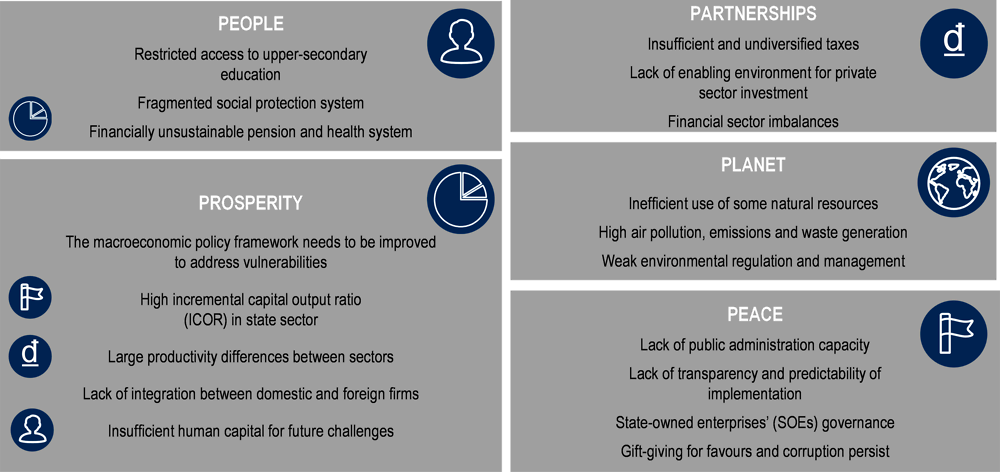

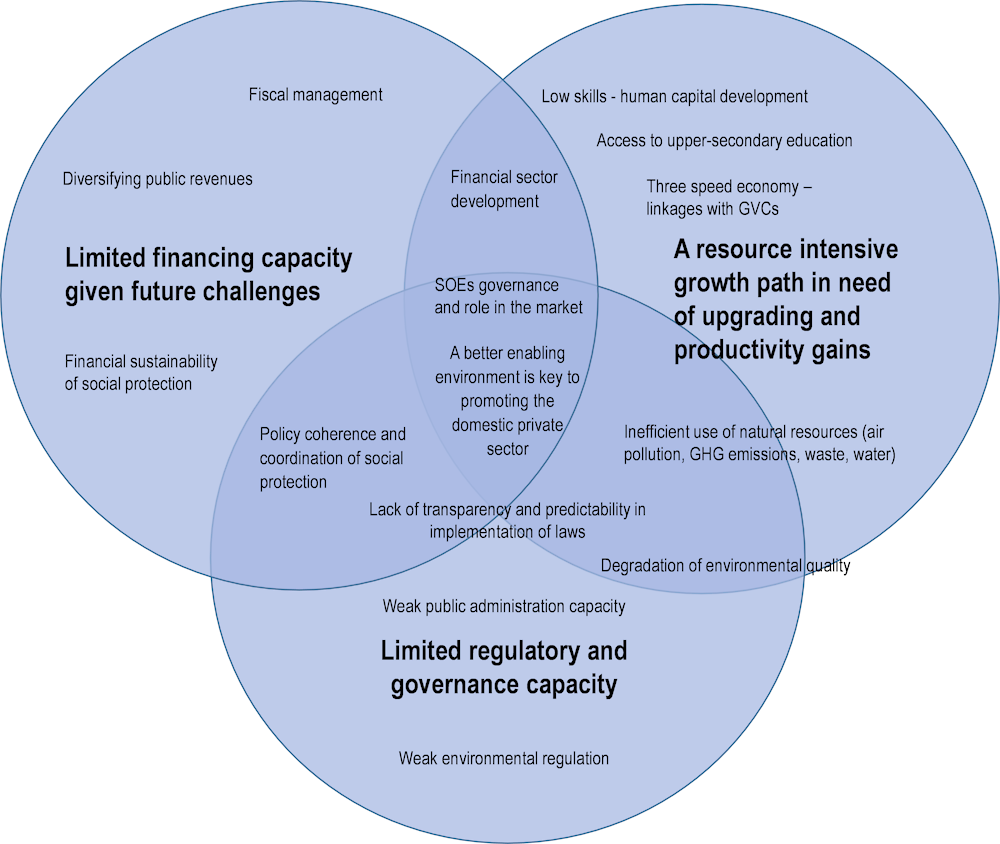

Second, Viet Nam will need to upgrade its capabilities for financing its development. The upcoming demographic change towards an older society and the need to move to a model of economic development that is more sustainable and productive, imply enormous needs for investment and expenditure. While Viet Nam’s current fiscal situation is stable, its capabilities of managing expenditure and collecting revenue need to grow. At the macro level, the current expenditure path suggests that the debt ceiling will be reached in four years’ time, with growth staying at its current high level. At the management level, weaknesses in fiscal co-ordination between central and provincial governments and incentives that are not fully aligned with sustainable and inclusive growth must be addressed. On the revenue side, Viet Nam remains far behind what should be possible to mobilise in taxes. This is an issue of the tax structure, as much as of the way taxes are collected and inspected. More fundamentally, raising more taxes requires a social contract that includes taxes as the contribution citizens willingly pay in return for services and participation. Future proofing social protection services, especially health and pensions for the looming shift in needs and expectations vis-à-vis the state will be one crucial element of ensuring such a social contract.

Third, Viet Nam needs to chart a path towards building the government and regulatory capabilities necessary for sustainable development. In all areas of this assessment government management, co‑ordination and regulation have come up as constraints. The public payroll is large, but capacity is limited. Gift-giving in return for favours persists and has negative consequences for civil service quality, investment efficiency and the ability of government to regulate, collect and inspect taxes and enforce norms. Many policy areas require better co‑ordination between various levels of government. This is the case for health and pensions, but also for urban development and the environment. Mobilising private investment will need transparency and predictability of rules and rights. Predictability and trust in turn require the ability of the state to commit credibly to rules and rights. To this end, checks and balances such as a more independent judiciary, a stronger separation of regulators and managers, and more opportunities for citizens to participate in rule-making and monitoring would be important.