Since the launch of the Ðổi Mới economic reforms in 1986, Viet Nam has achieved tremendous economic and social progress. Today, it is one of the most open economies in the world, has enjoyed robust growth and performed well in human development and social inclusion. Viet Nam now has a window of opportunity to leverage past successes and climb the development ladder. However, reforms are necessary as the global economic outlook is increasingly sluggish, this window of opportunity is potentially quite short and the need for action is mounting. This overview summarises the report, presenting Viet Nam’s strengths and constraints to development, as well as global and domestic trends that could strengthen or endanger future sustainable growth. It then provides a strategic outlook to help Viet Nam refine priority policy areas to create an integrated, transparent and sustainable economy.

Multi-dimensional Review of Viet Nam

1. Overview: Viet Nam’s window of opportunity to create an integrated, transparent and sustainable economy

Abstract

This Multi-dimensional Review (MDR) has been undertaken to support Viet Nam in the preparation of its next Socio-Economic Development Strategy (SEDS) 2021-2030. The report consists of three parts: 1) the initial assessment; 2) strategic recommendations; and 3) from analysis to implementation.1 All parts are the result of extensive consultation which allowed for a progressive two-way learning process.

The Multidimensional Constraints Assessment (Part I) builds on the OECD well-being framework and the 2030 Agenda for Sustainable Development and Sustainable Development Goals (SDGs) to identify the main constraints to achieving inclusive sustainable development. Wherever relevant and subject to data availability, Viet Nam is compared with a set of benchmark countries in Asia (Cambodia, China, India, Indonesia, Korea, Malaysia, Myanmar and the Philippines) and beyond (Mexico, Morocco, Poland, Turkey and the OECD).

The strategic recommendations (Part II) build on this assessment and provide a deeper analysis of some of the key transitions that Viet Nam must address over the coming years. The recommendations aim to support Viet Nam in this endeavour and to apply the experiences of the OECD and other countries where these are useful.

From Analysis to Implementation (Part III) addresses cross-cutting challenges and reform needs to help Viet Nam get things done. It concludes with a suggestion for a scorecard to track progress in implementing the recommendations presented in this report.

This overview chapter begins with a brief history of Viet Nam’s development and a presentation of global and domestic trends that could strengthen or endanger future sustainable growth. It then summarises Viet Nam’s strengths and constraints to development and provides a strategic outlook on the window of opportunity Viet Nam faces to create an integrated, transparent and sustainable economy. It concludes with a table of priority recommendations.

Coronavirus COVID-19

This report is based on information and data available up to February 2020. The analysis presented does not consider any potential environmental and socio-economic effects of the COVID-19 epidemic.

A brief history of Viet Nam’s development

Viet Nam has a long and proud history dating back more than 2 000 years (the first mention of Viet referring to the people in the Red River delta) (Goscha, 2016[1]). Given its fertile river deltas, lush highlands and long coastline, agriculture and trade with surrounding Asia and the world have been at the centre of economic activity since antiquity. Similarly, culture and administration have developed from the long interplay between foreign concepts and local traditions. Following centuries of both peaceful and violent evolution across the region, a unified and independent kingdom named Viet Nam, stretching from the Red River delta in the North to the Mekong River delta in the South, was forged for the first time in the early 19th century.

Modern and unified Viet Nam emerged in 1975 as the Socialist Republic of Viet Nam, following Viet Nam’s declaration of independence in 1945 and the ensuing wars driven by external interference and internal divisions. The Communist Party of Viet Nam initially structured the country along the Soviet model of organisation of the state and the economy. However, the initial pursuit of central planning and self-reliance as principles of economic management quickly proved untenable. Confronted with increasingly widespread scarcity, poverty and eventually hyperinflation, the country’s leadership chose pragmatism over ideology and in 1986 initiated the Ðổi Mới reforms, introducing the market as the organising principle of the economy.

Today’s system is referred to as a law-ruled socialist market economy. The 2013 Constitution designated the state to play the leading role, providing favourable environments for the private sector on the basis of respecting market rules. The political and administrative organisation remains socialist with the Communist Party of Viet Nam as the supreme institution.

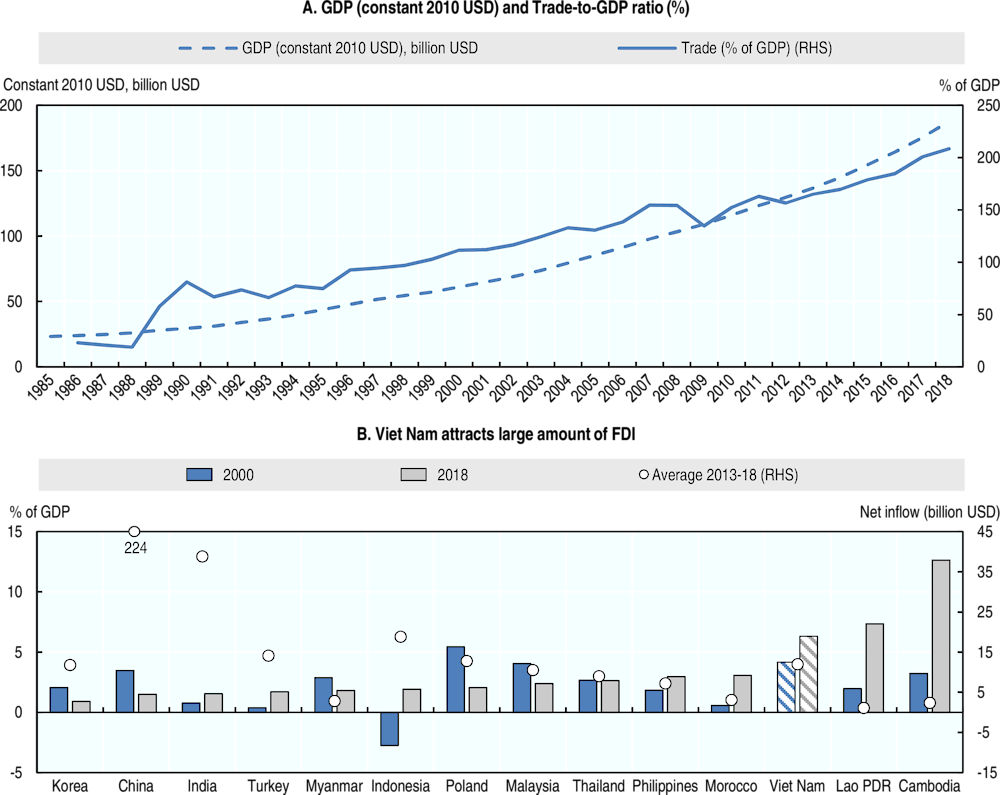

In the 33 years since the first market reforms, Viet Nam has experienced a remarkable economic transformation, built on pragmatism and flexibility. GDP doubled every decade, multiplying almost six fold over the entire period (Figure 1.1, Panel A). In the late 1980s, half of the population lived in absolute poverty (less than USD 1.9 per day), a figure that has now dropped to less than 4% in 2019.

Viet Nam has embraced economic opening and integration into the global economy as central to its reform and development path. Beginning with its accession to ASEAN in 1995, then to the WTO in 2007 and the new “Comprehensive and Progressive Agreement for Trans-Pacific Partnership” (CPTPP) in early 2019 and the approval of the European Union - Vietnam Free Trade Agreement (EVFTA) in early 2020, Viet Nam has pursued a fast-paced integration strategy and uses trade agreements not only for obtaining market access, but also as blueprints for building capacity through foreign standards, domestic reforms and institutional design.

Today, Viet Nam’s share of trade (export and import) to GDP is 200%, one of the highest of any economy. The country has become a central assembly hub in several global value chains (GVCs), ranging from garments to mobile phones and computers, and continues to attract large and increasing amounts of foreign direct investment (Figure 1.1, Panel B). Viet Nam is also among the world’s top exporters of a range of agricultural products including coffee and rice.

Figure 1.1. Viet Nam has embraced economic opening and enjoyed high growth

Note: Panel A: The trade-to-GDP ratio is represented on the right-hand vertical axis. Trade is defined here as the sum of exports and imports of goods and services. Panel B: The left-hand vertical axis shows net inflow of FDI as a share of GDP in 2000 and 2017. The right-hand vertical axis shows the average annual net inflow of FDI over 2013-17. For Indonesia, the FDI-to-GDP value in 2000 is negative and equal to -2.85.

Source: Panel A: IMF; (World Bank, 2019[2]). Panel B: (World Bank, 2019[2]).

Social improvements have been equally impressive. Beyond the reduction in poverty, education and health in particular have been areas of significant achievement. Average years of schooling among the working population – a measure of a country’s human capital – have doubled from four in 1990 to eight today (UNDP, 2018[3]). Viet Nam has also outperformed a range of OECD countries on PISA scores, an international assessment of student competencies at the age of 15.2 In health matters, extension of primary care to all but the most remote areas has benefitted the local population and average life expectancy has increased from 61 years in 1975 to 75 years today, just three years less than the United States. Importantly, while still struggling with lower average outcomes, the trend for strong improvement in social outcomes has also been true for many ethnicities that are not members of the Kinh and Hoa, the majority ethnicity in Viet Nam.

As with any country that has undergone fast-paced development in an already dynamic region, Viet Nam has faced numerous macro-economic challenges. The country quickly overcame the initial difficulties of inflation, resulting in a highly successful first decade, with growth reaching 10% by the mid-1990s. However, the external shock of the 1997 Asian Financial Crisis jolted the system; and while growth recovered quickly, it never returned to pre-crisis levels. The subsequent decade saw reforms continue at a fast pace and foreign direct investment (FDI) pick up until the Global Financial Crisis of 2008. However, weaknesses in the management of the macro economy and state-owned firms began to manifest themselves, planting the seeds for future difficulties. Thus, while Viet Nam managed to cushion the impact of the global crisis, in the early 2010s it had to contend with domestic problems consisting of a housing bubble, double-digit inflation and a banking crisis resulting from significant non-performing loans, mainly to state-owned firms.

As in the past, lessons were drawn quickly and Viet Nam today is in a stronger position. The banking system has been stabilised and is becoming more open. Improved management of public debt and the money supply is accompanied by an increasingly ambitious move towards equitisation of state-owned enterprises (SOEs). However, each of these areas continues to demand further reform and upgrading of capabilities towards greater efficiency and transparency in management and investment.

Indeed, while Viet Nam’s institutions (understood here as the set of rules, relationships and organisational structures that govern society and the economy) have evolved continually in response to challenges, they need further upgrading. Given the country’s turbulent history, family ties and personal relationships have consistently played a paramount role in ensuring safety and success. Today, this heritage translates into a high level of positive social connections, which are important for individual well-being. However, it also translates into informal rules that collide with formal processes. For example, gift giving for favours in both the public and private sector persists, with negative impacts on the quality of the public administration and its ability to collect revenue, deliver services, implement regulation and ensure efficient investment decisions.

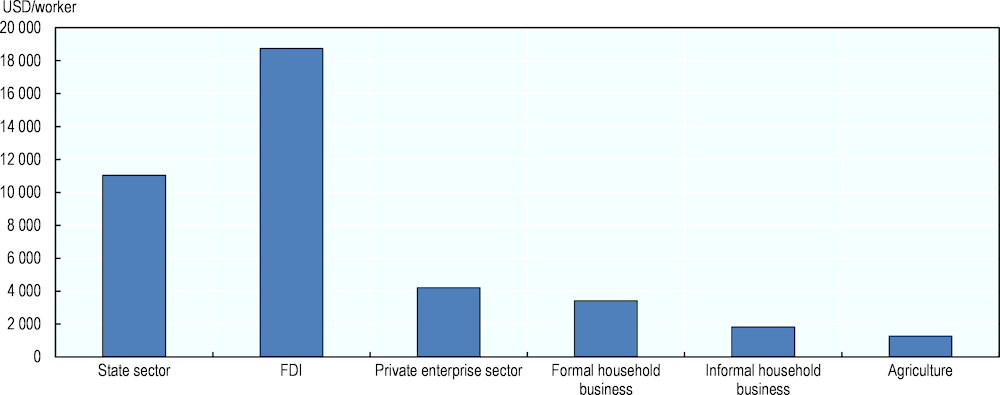

In terms of structure, next to highly successful exporters and international players, a large part of Viet Nam’s economy consists of small firms that are often informal, alongside numerous SOEs and a fledgling formal private sector (Figure 1.2). This threefold economic structure operating at different speeds represents the next significant challenge for Viet Nam’s development path, and seems to become increasingly pronounced as the number of private firms increases while the average size declines (World Bank, 2016[4]). This points to a lack of capacity and many persistent formal and informal barriers to the full participation of domestic private firms in either the value chains of international firms or markets dominated by SOEs, which continue to enjoy preferential access to financing and regulators.

Figure 1.2. Viet Nam’s economy moves at three speeds

Looking ahead to 2030 and beyond, Viet Nam will need to focus on sustainability and upgrade its capabilities to tackle increasingly complex economic, social, institutional and environmental challenges. Economic progress will see society continue to evolve at a fast pace, with demographic change, a growing middle class and urbanisation creating new opportunities but also new demands. The use of cheap production to attract FDI will necessarily run its course, as Viet Nam continues to become richer and prices and wages increase. At the same time, Viet Nam’s impressive natural capital will require greater care to ensure its preservation. Institutions will need to evolve to accompany Viet Nam’s transformation from a society playing catch-up to a modern creative economy.

Future trends

Strategies are informed by past experience but are made to navigate the future. Following the historical overview, this section switches perspective and presents the key domestic and international trends likely to impact Viet Nam in the near to medium-term future. Together, the historic and future perspective form the basis of the multidimensional constraints assessment and the strategic recommendations.

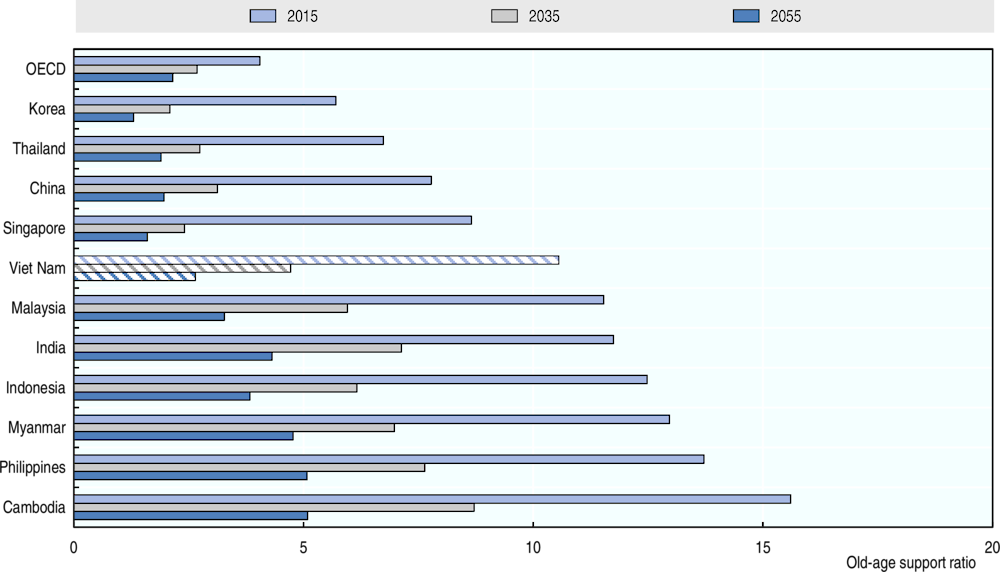

Rapid population ageing

Viet Nam will experience an extremely rapid ageing process. Driven by a rise in life expectancy and declining birth rates, by 2055 for every person over 65 years old, Viet Nam will have just 2.5 people of working age, compared to 10.5 today (Figure 1.3).

Figure 1.3. Viet Nam’s old-age support ratio will more than halve in the next 30 years

Note: The old-age support ratio is defined as the number of the population aged 15-64 per member of the population aged 65+.

Source: (OECD, 2019[6]).

The labour market, health care and social protection will have to respond to this challenge. Efficient investments in human capital will be essential to maintain productivity growth, given the decline in the working-age population. Today, Viet Nam relies heavily on families and traditional norms to provide for the elderly, both financially and in terms of care. However, as seen in more advanced countries in the region, such as Korea, the norms around intra-family care giving are likely to change rapidly as the demands of shrinking younger populations increase dramatically. Much of this pressure and change in norms will be concentrated on women, who bear the brunt of expectations for elderly care, and will also be required to play an increasing and extended role in the shrinking work force. A sustainable and universal social protection system (including pensions, social assistance and adapted health care) will also be crucial (Cunningham, Alidadi and Helle, 2018[7]; Kawaguchi, 2017[8]; UN, 2016[9]).

Viet Nam’s middle class is growing fast

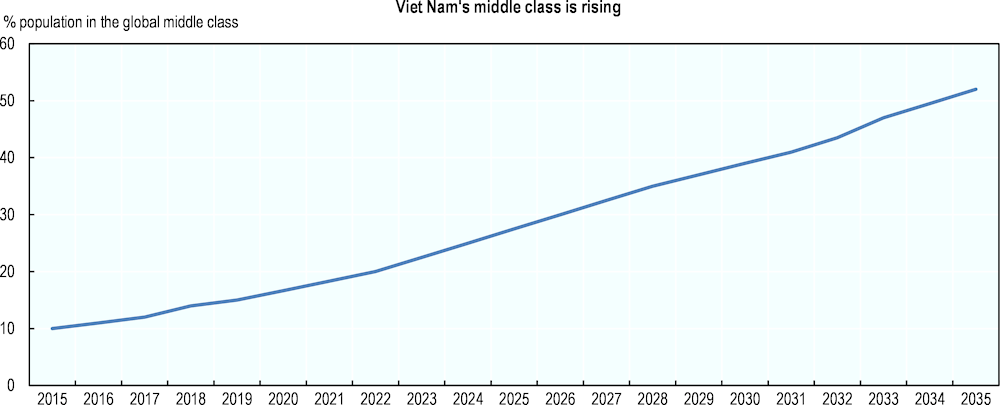

By 2035, more than half of Viet Nam’s population is projected to join the ranks of the global middle class (11% of the population are classified as such today, consuming USD 15 a day or more; Figure 1.4). This new population, the majority of which will live in urban areas, will represent a huge domestic market and the potential to drive development in the future, counterbalancing existing dependence on exports and foreign markets. However, this middle class will also expect better jobs and will have higher educational, social and civic aspirations. Expectations regarding public services are also likely to rise, as will demands for greater transparency and civic participation.

Figure 1.4. Viet Nam’s middle class is growing fast

Climate change

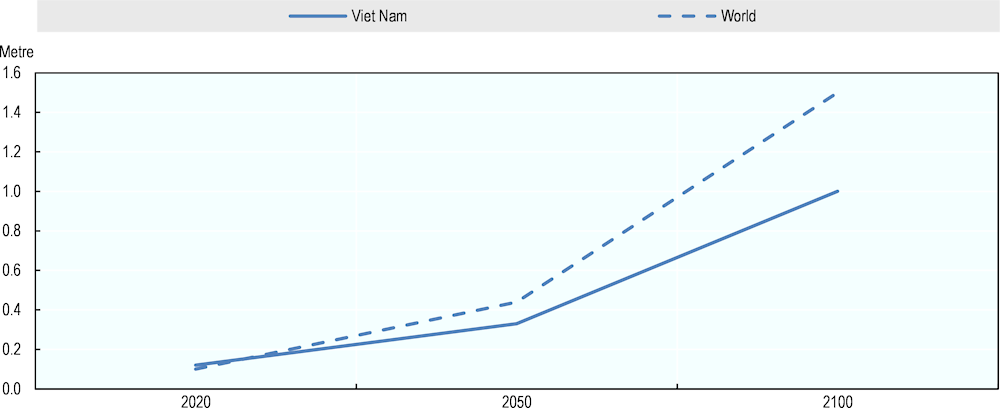

Impacts of climate change in Viet Nam are likely to intensify. According to the medium-high emission scenario, by 2100 Viet Nam will have less rainfall in the dry season, higher average temperatures (about 3.5 degrees Celsius) and rising sea levels by up to one metre (Turral, Burke and Faurès, 2011[10]); Figure 1.5). This would cost 10% of GDP and directly affect 10.8% of the population, the largest percentage among 84 affected countries worldwide (Dasgupta et al., 2007[11]). The most vulnerable groups including the poor, the ethnic minorities and children would be more severely affected. As the majority of Vietnamese and their economic activities are located in two river deltas, sea level rise could have significant consequences. The Mekong River Delta, the “rice bowl” of Viet Nam, might be under water by 2200 (Turral, Burke and Faurès, 2011[10]).3

Figure 1.5. Viet Nam might experience a one-metre sea level rise by 2100

Note: Sea level rise is calculated under the medium-high emission scenario.

Digitalisation and changing global trade patterns

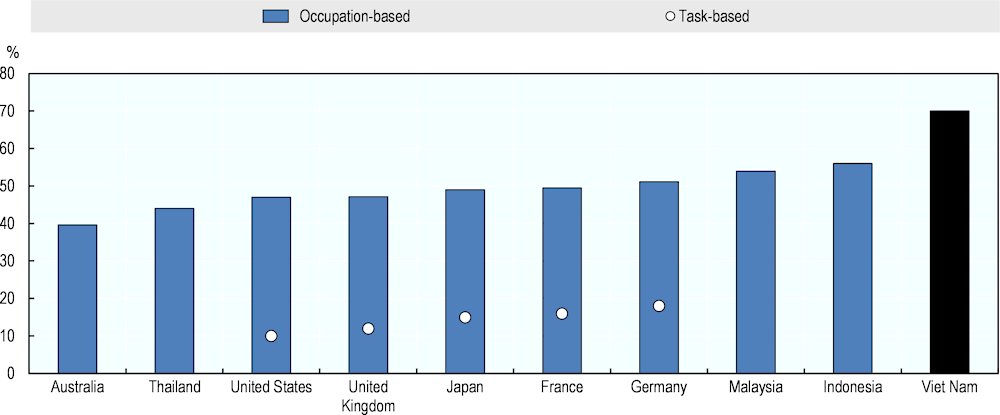

Ongoing digitalisation will create immense opportunities for Viet Nam, but could also present challenges. Technological transformation can lower production costs and generally speed up innovation (OECD, 2018[13]). The rise of Artificial Intelligence (AI) and the growth in data could provide a foundation for new businesses and new jobs, and help address pressing social and global challenges such as ageing populations, climate change and energy security. However, automation might increase the risk of job losses if workers are not equipped with adequate skills to transition to new career opportunities (Figure 1.6).

Figure 1.6. Skills development is needed to make the most of the benefits of digitalisation

Note: Jobs are at high risk of automation if the likelihood of their being automated is at least 70%. Jobs are categorised by a spectrum of tasks (routine versus non-routine) and skills (manual versus cognitive). Occupations in which the bulk of tasks are more routine and follow explicit, codifiable procedures tend to be more adaptable to automation. The occupation-based estimates are based on Frey and Osborne (2017), whereas task-based estimates come from Nedelkoska and Quintini (2018). Data for Indonesia, Thailand and Viet Nam are from Chang and Huynh (2016).

Advancements in technology could also give rise to back-shoring. Recent years have seen an increase in reports of manufacturing companies in OECD economies transferring activities back to their home country (back-shoring) or to a neighbouring country (near-shoring) (De Backer et al., 2016[18]), due in part to cost reductions brought about by technology advancement. However, this trend would have a negative impact on booming FDI in Viet Nam, weakening its growth momentum.

Good governance for technologies and a forward-looking policy approach are key to reaping the full benefits of technological transformation. The large number of students abroad specialising in Science, Technology, Engineering and Mathematics represent a significant human capital potential that could help Viet Nam seize unprecedented opportunities, if the right incentives were provided.

The broader outlook on trade is mixed, with a very favourable near term and an uncertain longer term. Contrary to these technology trends, the near term presents Viet Nam with a positive outlook on trade, with the trade altercations between China and the United States causing significant diversion of exports and investments from China to Viet Nam.

Nevertheless, the longer-term outlook on trade is highly uncertain. The global economic outlook is decelerating, with negative consequences for trade that will likely impact Viet Nam, once the one-off effects of the China-US altercations have run their course.

Assessing Viet Nam’s strengths and weaknesses

This section summarises the Multidimensional Constraints Assessment, which serves as the main diagnostic tool for the strategic recommendations.

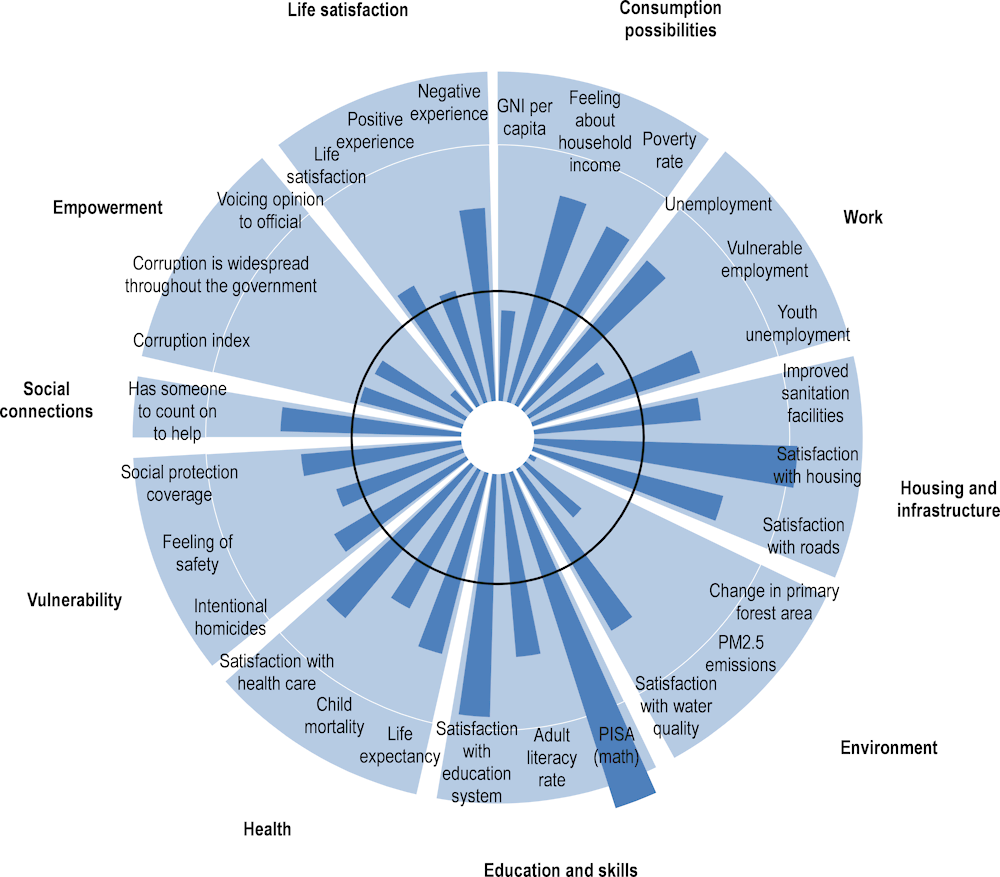

How’s life in Viet Nam? Through the OECD well-being lens

Viet Nam’s performance on the well-being of its citizens can be comprehensively assessed with the OECD’s “How’s Life?” toolbox. Well-being encompasses people’s diverse experiences in all dimensions that matter to them, and includes not only the material conditions of households (e.g. income, jobs and housing), but also their broader quality of life (e.g. health, education, environment and life satisfaction). In recognition of the importance of how people themselves evaluate their lives, the OECD Framework for Measuring Well-Being and Progress uses a mix of objective and subjective indicators (OECD, 2017[19]).

Using a well-being lens can help to identify trade-offs between different policy goals and reduce departmental silos. A growing number of countries in the OECD and beyond are taking steps to embed well-being more deeply and systematically into policy processes (Durand and Exton, 2018[20]). Compared to countries at a similar level of development, Viet Nam performs relatively well across most well-being dimensions (Figure 1.7). Performance is especially strong with respect to educational and health outcomes, social connections, security, and housing and infrastructure. The picture is more mixed when it comes to other dimensions, such as the environment, empowerment and governance, or employment. For instance, while levels of unemployment are low, the quality of working conditions and the level of informal employment are worse than might be expected given Viet Nam’s level of development, and levels of deforestation and air pollution are also worrying. Similarly Viet Nam shows low levels of citizen empowerment and participation: for example, much fewer people in Viet Nam voice their opinion to officials than in other countries.

Figure 1.7. Current and expected well-being outcomes for Viet Nam: Worldwide comparison

Note: The observed values falling inside the black circle indicate areas where Viet Nam performs poorly in terms of what might be expected from a country with a similar level of GDP per capita. Expected well-being values (the black circle) are calculated using bivariate regressions of various well-being outcomes on GDP, using a cross-country dataset of around 150 countries with a population over a million. All indicators are normalised in terms of standard deviations across the panel.

Assessing Viet Nam’s performance across the five pillars of the Sustainable Development Goals

The Sustainable Development Goals (SDGs) consist of 17 goals and 169 targets which have the ultimate objective of ending poverty, protecting the planet and ensuring prosperity and peace for all. They came into effect in January 2016 and provide guidelines for all countries up to 2030. Viet Nam has committed to achieving these goals and participates in the United Nation’s voluntary national reporting process (Ministry of Planning and Investment, 2018[24]).

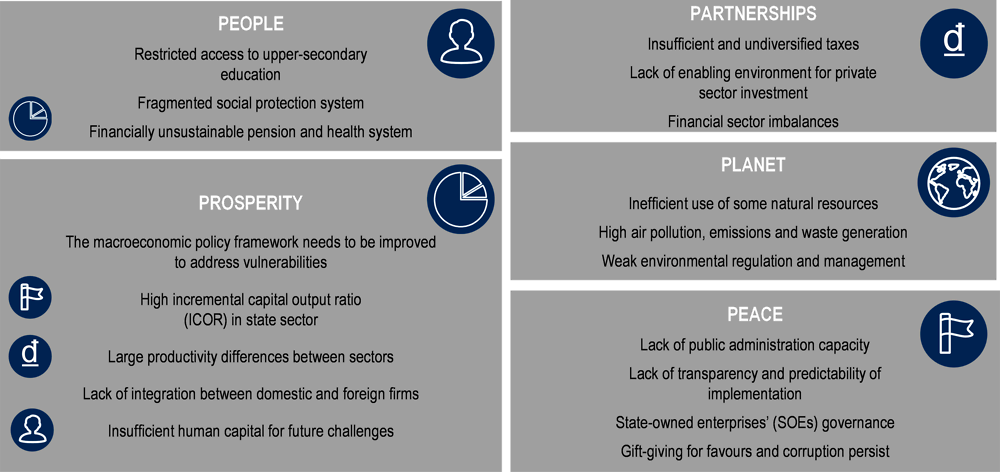

The Multi-dimensional Reviews cover the five pillars of the SDGs, using People, Prosperity, Partnerships (Financing), Peace and Institutions and Planet as the basic structure for assessment. Assessment for each pillar consists of two components: a comparison of past performance against the objectives for 2030 for a few selected SDG indicators, followed by a deeper constraints analysis based on an assessment of the main drivers and policy initiatives in the respective pillar. The latter analysis across the five pillars results in a matrix of key constraints that build the basis for the strategic recommendations.

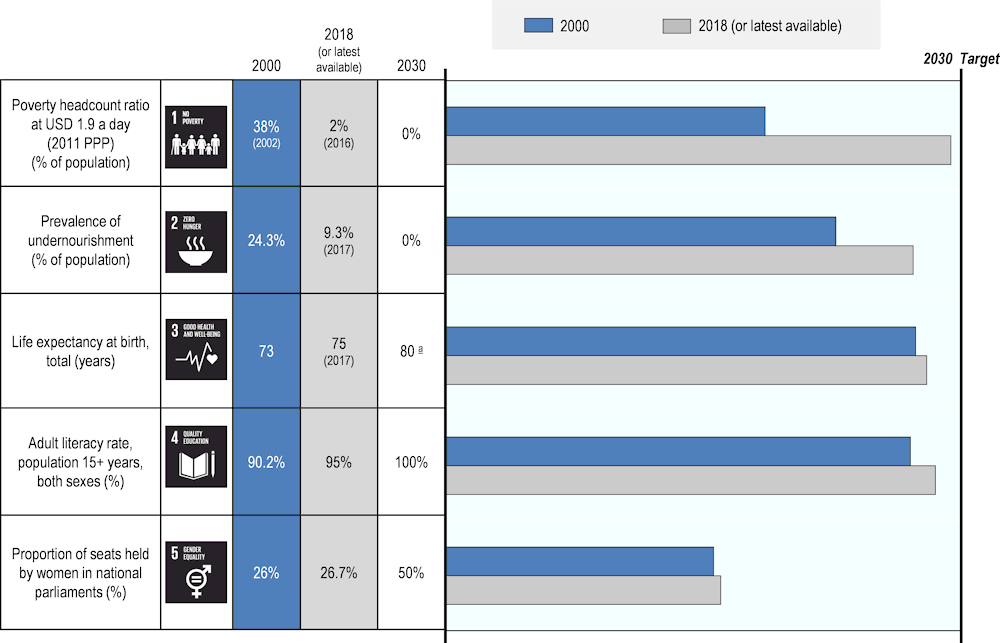

People: Towards better lives for all

The People pillar of the 2030 Agenda for Sustainable Development focuses on quality of life in all its dimensions, and emphasises the international community’s commitment to ensuring all human beings can fulfil their potential in dignity, equality and good health.

Viet Nam has made tremendous progress in human development and social inclusion without escalating inequalities since the launch of Ðổi Mới reforms. Over the last decade, household spending has risen in line with GDP per capita and nearly doubled. From 2010-15, the share of the population living below the national poverty line has halved to 5.8% (according to the General Statistical Office); extreme poverty (USD 1.90 per day) decreased from 52.9% in 1992 to 2% in 2016. Undernourishment has been reduced considerably from 24.3% in 2000 to 10.8% in 2016 (Figure 1.8). Multidimensional poverty (which has been officially adopted by the government and takes into account deprivations in healthcare, education, water and sanitation, housing and access to information) also halved to 7.9% from 2012-17 (Ministry of Planning and Investment of Vietnam, 2019[25]). However, important challenges remain with regard to vulnerable groups, the informal economy, education, health care, pensions and the gender gap (Table 1.1).

Figure 1.8. People: Towards better lives for all

Note: The bars measure Viet Nam’s performance in 2000 and 2016 (or latest year – as indicated accordingly) for a selection of 26 indicators across the 17 Sustainable Development Goals (SDGs). The 2030 aspirational target values refer to the pre-defined UN target (established by the UN IAEG and available at: https://unstats.un.org/sdgs/iaeg-sdgs/metadata-compilation). Targets are all normalised to 100 for representation and comparison purposes.

a. When UN 2030 targets were not quantifiable, targets were calibrated to the average performance of OECD countries.

b. When UN 2030 targets were not quantifiable, targets were calibrated to the average value of the top 3 performers in the ASEAN region for that indicator.

Source: (World Bank, 2019[2]); United Nations Educational, Scientific, and Cultural Organization (UNESCO) Institute for Statistics; OECD International Energy Agency; International Monetary Fund; Gallup World Poll and Bertelsmann Stiftung’s Transformation Index (BTI).

Table 1.1. People – three major constraints

|

1. Access to upper-secondary education is restricted and students are not equipped with job-relevant skills |

|

2. The social protection system is characterised by low coverage and high fragmentation |

|

3. Current pension and health care arrangements, including primary and old-age care, are not financially sustainable and do not guarantee adequate and equal benefits for all population groups |

In terms of challenges, vulnerable groups are at risk of being left behind in the country’s remarkable development story. These include women and the elderly, people with disabilities and, importantly, ethnic minorities. Urban migrants also lack full equality of opportunity, due to the “hộ khẩu” (“family register”) system, which links household registration to public service access.

A large share of Viet Nam’s employed population earn their livelihood in the informal economy. In 2018, informal economy workers accounted for 54.9% of non-agricultural employment. This number is higher than expected for a country of Viet Nam’s level of development. Formalisation is important for informal workers to be able to contribute to and participate in social protection programmes.

With regard to education, Viet Nam has made huge strides in expanding access to primary and lower-secondary education as well as pre-school education, while simultaneously improving learning outcomes. Upper secondary attendance has also increased in past decades, but access is restricted to the highest-performing and most advantaged students. Further, there is evidence that students frequently do not acquire job-relevant skills: a recent employer survey suggests that between 70% and 80% of Vietnamese graduates do not have the required skill sets for professional or technical high-paying jobs (World Bank, 2019[2]). Education reform should therefore aim to narrow disparities in access to secondary education and integrate more job-relevant skills into school curricula.

Viet Nam has generally good health outcomes given its level of development, and health insurance coverage has expanded significantly in recent years. However, changing disease patterns imply pressure on health care costs. In addition to direct spending on health care, further efforts are necessary to create basic health-related infrastructure, such as sanitation, and overcome poor hygiene practices. Furthermore, increased insurance coverage rates have failed to achieve lower costs and access to quality care for patients. Improving skills and resources at the primary care level, within an integrated and more efficient overall health system, will be essential going forward.

In terms of pensions, Viet Nam has made remarkable progress in expanding social insurance coverage beyond public-sector workers in recent years, although overall coverage remains below the 2020 target of 50% and the newly adopted goal of universal coverage by 2035. There are also concerns around the long-term financial sustainability of the Social Insurance Fund. In the future, the government needs to focus on expanding the fund’s contribution base by enrolling a higher proportion of the workforce, while improving the fund’s financial outlook. The introduction of automatic balancing mechanisms could further help maintain long-term solvency.

The level of discrimination against women in laws and social norms is relatively low in Viet Nam and the gender wage gap has been falling since 2011. However, women are far less likely to work in leadership positions and often face worse working conditions than men. Furthermore, traditional gender roles tend to be upheld in Viet Nam, with women having greater responsibility for housework, and child and elderly care, which can be a barrier to entering the labour market. Viet Nam also has one of the most imbalanced ratios of sex for children aged 0-4 in the world, pointing to discriminatory practices that favour the birth of sons.

In summary, to ensure that future growth is sustainable and inclusive, Viet Nam’s government needs to i) improve the outcomes of vulnerable groups, including ethnic minorities, people with disabilities and urban migrant workers; ii) increase enrolment in upper-secondary education and ensure students leave with job-relevant skills; iii) adopt a systemic approach to social protection and continue to increase adequate coverage, particularly for informal workers; iv) provide high quality and affordable primary health care services and develop solutions for long-term old age care; and v) further narrow the gender gap. Achieving these objectives will require significant public expenditure and hence also higher revenue.

Prosperity: Boosting productivity

The Prosperity pillar of the 2030 Agenda for Sustainable Development calls for policies that combine structural transformation with a fair distribution of the growth dividend. In the long run, growth and transformation depend on continuous gains in productivity (i.e. the ratio of outputs to inputs).

If productivity gains and labour participation can be ensured, Viet Nam’s future outlook is decidedly positive. The economy performs relatively well among its regional peers and is advancing quickly. Growth has been driven increasingly by domestic demand, reflecting the rising income of consumers. Exports have also contributed to resilient economic growth. Viet Nam’s structural reform efforts have focused on lowering trade barriers, integrating into GVCs and, notably, accession to ASEAN, APEC and the WTO. Large-scale inflows of FDI have created a globally competitive manufacturing base, especially in the semiconductor sector. However, efforts to ensure macroeconomic stability, sustain productivity growth and address population ageing will be essential for continued economic growth and development (Table 1.2).

Table 1.2. Prosperity – major constraints

|

1. The macroeconomic policy framework needs to be improved to address vulnerabilities (fiscal consolidation, banking sector and exchange rate management) |

|

2. Low efficiency of investment in the state sector |

|

3. There are persistent large pockets of low-productivity firms |

|

4. There is a lack of integration between domestic and foreign firms |

|

5. Human capital is insufficient to cope with future challenges |

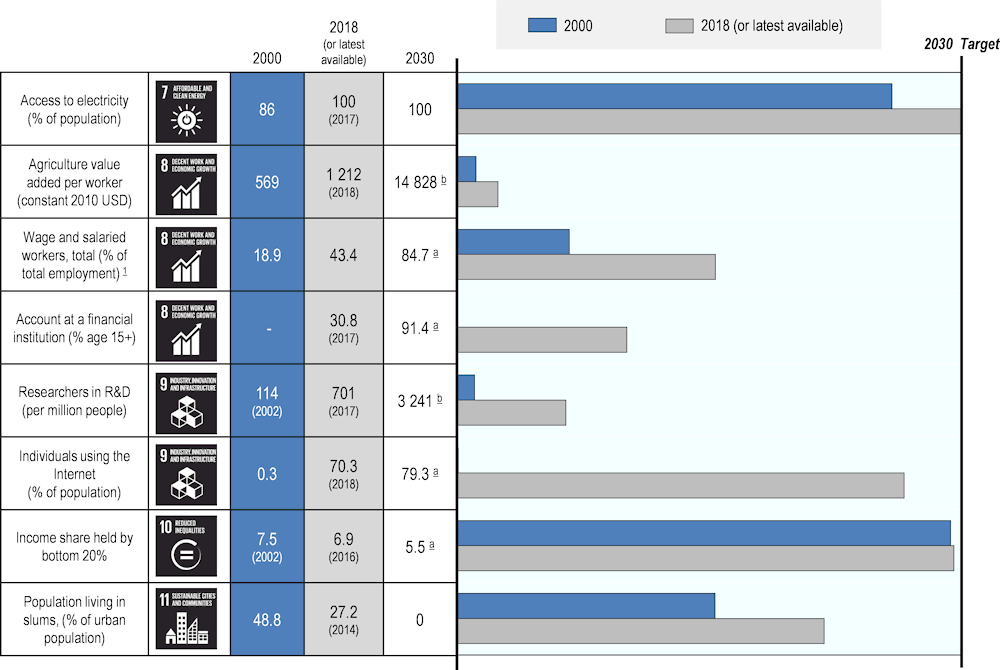

In terms of the SDGs, Viet Nam met its target for universal electricity access in 2018, as well as the share of income held by the bottom 20% of the population, which surpassed the target of 5.5% by 2030 in 2016. Agriculture value added per worker and wage and salaried workers, as a share of total employment, have both doubled since 2000, but much more needs to be done to meet the 2030 targets. Policy efforts need to focus on financial inclusion, research and development, Internet access and usage, and the population living in slums (Figure 1.9).

Figure 1.9. Prosperity: Boosting productivity

To guarantee macroeconomic stability, Viet Nam needs to ensure fiscal stability, maintain efforts to improve the monetary policy framework and develop the financial sector. Recent fiscal consolidation efforts contributed to reducing the debt-to-GDP ratio and has taken some pressure off public debt. The monetary policy framework has improved thanks to reforms such as an annual inflation target set by the government, the establishment of a monetary policy advisory committee (the National Financial and Monetary Policy Advisory Council) and a roadmap to strengthen the central bank’s independence. More flexibility of foreign exchange rates would enhance resilience in the face of external shocks. Additionally, financial sector development will be key to the allocation of resources towards productive activities. Improving the credit standards of the banking sector, which is dominated by state-owned banks, will be essential in tandem with reform of SOE governance.

Key to productivity improvements in Viet Nam will be the reallocation of misaligned resources, greater linkages between foreign and domestic firms, and an increase in the labour productivity of household enterprises, SMEs, and the agricultural and informal sectors. Investment in many SOEs remain inefficient compared to other sectors of the economy. At the same time, the SOE sector continues to receive significant financing which could be put to more productive use elsewhere. The level of input from domestic firms to foreign manufacturing firms operating in the country is low. Enhancing linkages between FDI firms and domestic firms would be beneficial for spill overs of knowledge and technology. At present, the government promotes SMEs in the private sector with targeted support measures and by easing the regulatory environment. However, SMEs are mostly family-owned and have limited access to finance and improvement of technology and managerial skills. Household enterprises play an important role in the Viet Nam economy, but, labour productivity in the household business sector, especially in its informal part and in agriculture, is low and needs to be enhanced.

Human capital development and efforts to address population ageing are essential to sustain economic growth and development in Viet Nam. The country’s labour participation rate is relatively high and, going forward, labour input is projected to decline due to rapid ageing. Gradual raising of the retirement age beyond current reform proposals to align with longer life expectancy could mitigate the negative impact of shrinking labour force. Skills development will also boost productivity gains. The demand for skills is changing as a result of several trends such as technological progress, digitalisation, globalisation and demographic changes. However, skills shortages are a challenge for employers in Viet Nam and more investment in vocational training and technical skills is required (OECD/ERIA, 2018[26]). Around 25% of the population fall into the 15-29 age group, and among those aged 25-29 (out of school) only 31% have an upper secondary education or above. Moreover,many employed youth are either over or underqualified for their job (OECD Development Centre, 2017[27]).

In summary, ensuring future fiscal capacity and a stronger banking sector is a fundamental step to mobilise domestic resources and thus secure productivity gains. A more flexible exchange rate regime would also provide resilience against shocks. Most importantly, inefficiencies in investment must be overcome and persistent large pockets of low-productivity firms addressed. More integration between domestic firms and foreign ones, for example through participation in supply chains, can help in this regard. Finally, human capital needs a boost to enable Viet Nam to transform itself into a hub for high value-added activities.

Partnerships: Sustainably financing development

The Partnerships pillar of the 2030 Agenda for Sustainable Development cuts across all the goals, focusing on the mobilisation of resources needed to implement the agenda. It is underpinned by the Addis Ababa Action Agenda, which provides a global framework to align all financing flows and policies with economic, social and environmental priorities (Table 1.3).

Table 1.3. Partnerships – major constraints

|

1. Domestic Revenue Mobilisation: tax revenue is insufficient and the tax structure and administration are in need of simplification and upgrading |

|

2. There is a lack of an enabling environment for private sector investment |

|

3. The financial sector misses diversification |

Viet Nam is moving away from Official Development Assistance (ODA) and tapping into alternative sources. Following reforms in the 1980s and 1990s, the country enjoyed access to ODA; however, with its recent graduation from the International Development Association in 2017 and the Asian Development Bank’s concessional lending window in January 2019, volumes of ODA have started to decrease. Consequently, Viet Nam has started to develop domestic capital markets, with considerable success. As a result, between 2011 and 2017 the domestic share of public sector debt has increased by almost 20 percentage points.

At the same time, Viet Nam has taken a prudent approach to debt management by imposing a statutory debt ceiling of 65% of GDP and creating a new legal framework to tighten oversight of debt management. Public borrowing slowed significantly between 2016 and 2018, placing Viet Nam on a stronger fiscal footing. Given the strict fiscal stance, broadening the tax base and strengthening tax collection, as well as revising and improving the quality of public expenditure, are important to mobilise the necessary resources for future investments.

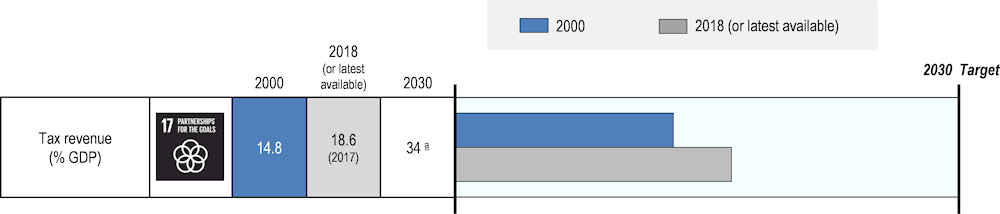

In the 1990s, a comprehensive legal framework was introduced to modernise the tax system. As a result, tax revenues became the main revenue source of the national budget. However, in recent years, tax revenues have decreased as a share of GDP due to a reduction in corporate taxes, a reduction in tariffs following numerous trade agreements, and a generous system of tax incentives. Moreover, the large size of the informal economy significantly undermines Viet Nam’s fiscal capacity. The tax-to-GDP ratio has increased from 14.8 in 2000 to 18.6 in 2017 (Figure 1.10), but decreased with respect to 2008 (when it amounted to 22.5%). This downward trend raises concerns, especially considering demographic pressures that constrain the financial sustainability of the social protection system. A broader tax base and updated tax structure will thus be essential to finance Viet Nam’s future development needs. Simplification of tax collection could also boost revenues.

Figure 1.10. Partnership: Sustainably financing development

Viet Nam needs to strengthen its financial sector in order to mobilise private investments. On the one hand, the banking sector remains inefficient. State-owned banks monopolise the industry and often offer favourable treatment to SOEs that end up crowding out potentially more promising private companies that are willing to expand. State-owned banks, moreover, have a low (average) capital ratio by Basel II standards, raising concerns about their future sustainability. On the other hand, capital markets are still not sufficiently developed to effectively channel resources into the domestic private sector, and the bond market is predominantly tilted towards public sector borrowing. Institutional investors, which usually help build the capacity of domestic capital markets in developing countries, currently represent only 1% of Viet Nam’s securities markets.

Peace and institutions: Strengthening governance

The Peace and Institutions pillar of the 2030 Agenda for Sustainable Development encompasses peace, stability and trust, as well as effective governance and the performance of the public sector more broadly.

Over the past 30 years, Viet Nam has significantly reformed its institutions and legislative framework in order to establish an effective and accountable law-ruled state. The process of Ðổi Mới reforms initiated in 1986 was accompanied by profound reforms to the country’s institutions. The administrative reforms of 1994 were the first attempt to reduce the burden for businesses and citizens, and since 2001, numerous public reforms have set in place masterplans to improve state efficiency. The 2013 Constitution opened up legislative drafting for the first time to consultative and participatory policy-making processes (World Bank, 2016[4]). The simplification of administrative procedures and the legislative framework promoted competition and secured property rights, leading to improvement of the business environment.

Lack of participation and increasing constraints on liberties raise concerns about the future. Moreover, a number of important challenges remain, including: (i) the efficiency and capacity of the public administration; (ii) the unpredictable regulatory framework; (iii) governance of SOEs; and (iv) persistent gift-giving for favours (Table 1.4).

Table 1.4. Peace – major constraints

|

1. Public administration lacks capacity |

|

2. There is a lack of transparency and predictability surrounding implementation |

|

3. SOE governance needs reforms to improve efficiency |

|

4. Gift-giving for favours and corruption persist |

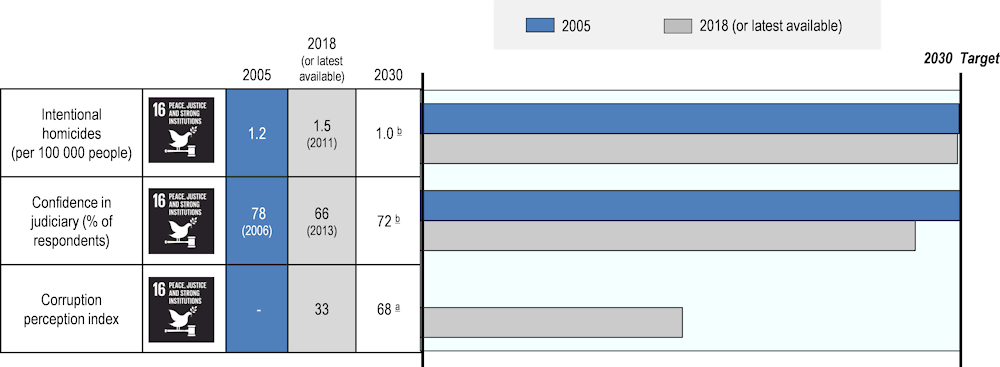

In terms of major challenges, bribery and gift-giving in exchange for favours and advantages, as well as patronage, persist (Figure 1.11), in spite of recent steps that Viet Nam has taken to fight corruption.

Figure 1.11. Peace: Strengthening governance

The major obstacles to public administration performance are: (i) horizontal fragmentation; (ii) partial decentralisation; and (iii) non-competitive processes for recruitment and remuneration of talent in the civil service. Recent reforms have improved public spending accountability and capacity in Viet Nam. However, insufficient co-ordination between government agencies, lack of budget transparency and oversight continue to hamper efficiency, in areas such as the effectiveness of the social protection system, environmental regulation, and the design and implementation of urban policies. Viet Nam also needs to improve the incentives and mechanisms used to select, promote and retain the best-quality officials, and to reduce localism. A portion of civil servants tend to lack practical administrative and management skills, and promotions are not always based on performance and skills. Furthermore, low remuneration encourages corruption, and the immobility of civil servants may lead to collusion between locally influential actors and officials.

Viet Nam has made significant progress in improving its judicial system. However, many laws and regulations are too vague and frequent contradictions between laws remain. Courts in charge of law enforcement in Viet Nam are not independent. These constraints reduce productive investment in the Vietnamese economy.

Viet Nam will soon enforce a new regulatory framework designed to improve the capacity of authorities to detect harmful anti-competition practices. In spite of the progress this implies, however, the new competition law still has some limitations. Several norms do not apply to firms that enhance Viet Nam’s competitiveness on international markets and the new competition authority lacks autonomy.

Since the 1980s, the state has successfully transferred rights over land to individuals while retaining formal ownership. However, the land law leaves the appropriation of land for public use non-transparent and does not guarantee adequate compensation. Furthermore, land users lack appropriate instruments to fend off compulsory land acquisitions by the state. The current land law restrains land users’ rights through restrictions on deal size and land use prescriptions, for example, in agriculture. This hampers agricultural productivity.

Since the Đổi Mới reforms, Viet Nam has embarked on an ambitious equitisation process. However, the process has slowed over the past two years and still faces challenges. Investors are only rarely able to access information about companies about to begin equitisation. Moreover, lack of transparency and a persistent state presence still allow certain SOEs to escape market laws, thus obstructing competition and hindering productivity growth.

While Viet Nam’s national statistical system is prepared to respond to domestic and international data requirements, efforts to improve standards and quality assurance in production and dissemination of statistics should continue. There remains scope for improvement in areas such as public finance, national accounts, and monetary and trade statistics. Quality assurance of data produced in the statistical system and transparency in the statistical processes adopted could also be significantly improved.

In summary, this section highlights the following institutional weaknesses that, if addressed, could enhance the integrity of the public sector: (i) capacity of the government and public administration; (ii) predictability of the legislative framework; and (iii) management of State Owned Enterprises (SOEs). The need to build adequate statistical capacity underlies all these issues.

Planet: Conserving nature

The Planet pillar of the 2030 Agenda for Sustainable Development covers six environmental areas: water, clean energy, responsible production and consumption, climate action, life below water and life on land.

Viet Nam’s rich natural resources, including minerals, oil, gas and hydropower, and a diverse ecosystem, have contributed to the country’s wealth and development, including important sectors such as tourism and agriculture, providing jobs for more than 20 million Vietnamese. However, the current growth model has placed the environment under increasing pressure.

In response, the government has started to focus on a green and sustainable growth path. In 2012, the government put green economic development at the core of its socio-economic agenda. The “Strategy of Renewable Energy Development to 2030, Vision to 2050” outlines an increase in feed-in tariffs for renewables. More recently, Viet Nam set a target of reducing greenhouse gas (GHG) emissions by 8% by 2030 through the “Intended Nationally Determined Contributions” (INDC) under the Paris Agreement.

However, challenges with inefficient resource management and declining environmental quality continue, threatening the country’s green growth ambitions. Much more needs to be done to address emerging environmental challenges, in particular in terms of management of water resources and biodiversity conservation (Table 1.5).

Table 1.5. Planet – major constraints

|

1. Use of some natural resources is inefficient |

|

2. Air pollution, emissions and waste generation levels are high |

|

3. Environmental regulation and management is inadequate (roles and responsibilities, economic instruments, local participation) |

|

4. Fragmented management of the impact from natural hazards |

One of Viet Nam’s key challenges is water management. As a relatively water-rich country, Viet Nam should not be susceptible to water stress; however, climatic characteristics and poor infrastructure expose the country to droughts and floods. Cycles of floods and droughts have significant consequences, resulting in much higher damage in Viet Nam than in comparator countries since agriculture, a major economic activity, is dependent on water and most of the affected areas are agro-based. In addition, unsustainable exploitation of groundwater has resulted in falling groundwater levels and resultant land subsidence (Erban, Gorelick and Zebker, 2014[28]).

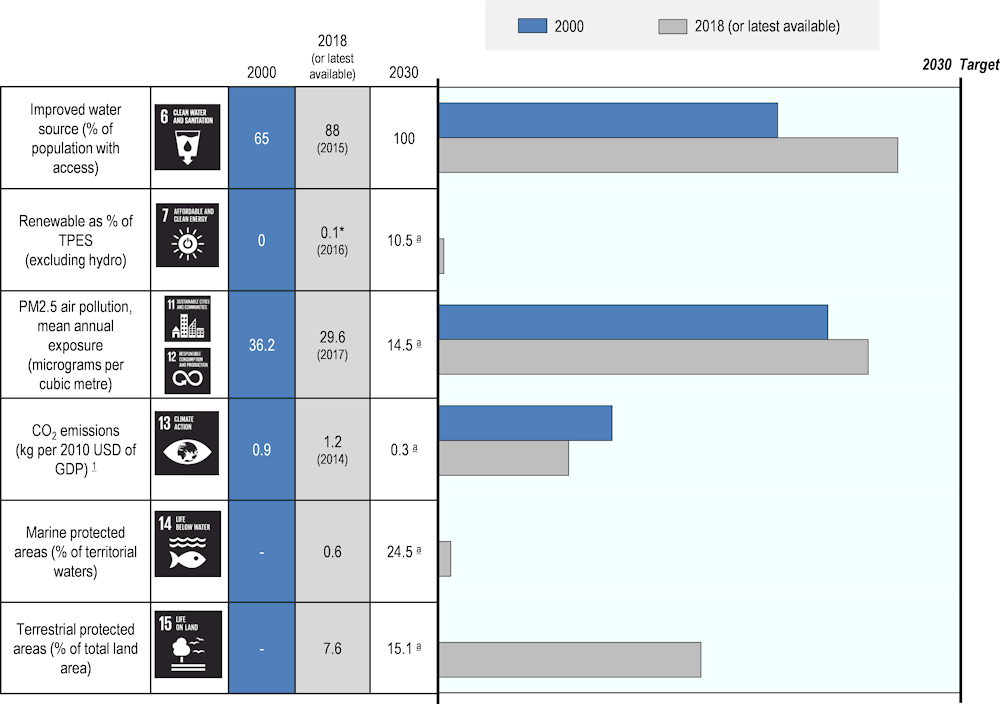

Biodiversity has been decreasing in Viet Nam. An increasing number of species are at risk of extinction while the extent of marine and terrestrial protected areas remains low (Figure 1.12). Forest cover is increasing but this is mostly due to plantation forest that has a low biomass and low biodiversity. Land conversion and the current land use policy, urban development, climate change, pollution and the overexploitation of resources, including biological resources, all threaten biodiversity.

Figure 1.12. Planet – conserving nature

Air pollution, solid waste and wastewater are challenges for Viet Nam, especially with increasing pressures from a high population growth rate, rapid urbanisation and accelerating industrialisation.

Viet Nam is among the 20 countries with the most polluted air in the world. Bad air quality can hamper economic growth, decreasing labour productivity due to worsened health conditions and reducing tourism revenue. High use of private vehicles and limited access to public transport networks further drive air pollution. The degradation of air quality is not expected to halt as Viet Nam has become more reliant on coal and shows no sign of decoupling emissions from output.

Initiatives to support renewable energy have emerged; nevertheless, incentives may not suffice to encourage adequate investments in this sector. There are several key challenges, including weaknesses in the legal and regulatory framework for renewable energy and poor transmission infrastructure.

Another challenge for the environment is inappropriate disposal of waste through illegal dumping and open burning. Poor waste management contributes to adverse environmental outcomes and significant economic loss. Tackling concerns about mounting waste would require more effective policies for incentive-based financing schemes and the promotion of waste separation at source.

Environmental protection and management of risks from natural hazards are being jeopardised by a lack of clear roles and co-ordination framework in the public sector, as well as the use of regulations rather than economic instruments, and a policy-making process lacking participation. Clear mandates and co-ordination of environmental protection are notable by their absence. Environmental protection is also undermined by lack of financial and technical capacity. Environmental policy tends to be dominated by regulations, but implementation is weak; economic policy instruments are still not widely used, and where they exist are not effective.

Summarising the constraints assessment

The multi-dimensional constraints analysis produced 18 critical constraints across the five pillars that Viet Nam needs to address in order to reach the next level of development (Figure 1.13). These can be divided into three broader cross-cutting needs for upgrading capabilities to guide future strategy and inform the strategic recommendations.

Figure 1.13. Constraints on sustainable development in Viet Nam

Source: Multi-dimensional constraints analysis in this document.

Strategic outlook and recommendations

Development is not about getting everything right, but about getting right what matters most. This pertains both to objectives and the actions to achieve these objectives. Multi-dimensional Reviews have been developed based on the understanding that development is not just about money and growth, but also about sustainability and good stewardship of natural resources, as well as human well-being and providing all citizens with the opportunity to develop their full potential. Viet Nam’s new Socio-Economic Development Strategy 2021-2030 is an opportunity to make important choices about the objectives of development and the actions to achieve these objectives.

To make the most of the next decade and ensure future progress, Viet Nam must address three overlapping sets of reform pressures, as identified in the Initial Assessment (Part I) of this report:

1. Creating a more integrated, transparent and sustainable economy: This includes strengthening the economy through more transparency and better conditions and incentives for the growth of high-performance firms, creating better linkages between FDI and domestic firms, reforming SOEs to gain efficiency and allowing free competition as a driver of productivity. Success along this path will also require upgrading the tertiary education system to equip the workforce with new skills. At the same time, Viet Nam needs to shift to a more balanced pattern of growth, with rising importance of domestic demand, including consumer spending and the well-being of average citizens. Last but by no means least, significant efforts must be made to protect the environment and place the use of natural resources on a sustainable footing.

2. Strengthening financing for the future: Viet Nam is far behind in terms of mobilising taxes. Action is necessary, especially given the large investment needs for infrastructure and the enormous challenges involved in building a social protection system, especially in regard to health and pensions. Both the tax structure and collection and inspection need revision. Ultimately, mobilising more domestic resources will require citizens to willingly contribute in return for services and participation.

3. Improving governance and regulatory capabilities: Government management, co-ordination and regulation have surfaced as constraints in all areas of the assessment. The public payroll is large, but capacity is limited. Gift-giving in return for favours persists and has negative consequences for civil service quality, investment efficiency, and the ability of government to regulate, collect and inspect taxes and enforce norms. Many policy areas require better co-ordination between various levels of government. Mobilising private investment will require transparency and predictability of rules and rights. Checks and balances such as a more independent judiciary, a stronger separation of regulators and managers, and more opportunities for citizens to participate in rule-making and monitoring will be important.

In Part II, this report provides an in-depth analysis and concrete recommendations for the first of these challenges: creating an integrated, transparent and sustainable economy. Integration is understood here as a broad concept, covering integration with the global economy and within the domestic market. The opposite of this strategic objective would be an economy caught in a low-productivity trap by inefficient allocation of resources and a lack of absorptive capacity for the opportunities provided by international integration.

Over the next few years, Viet Nam faces a unique window of opportunity to engage in necessary reforms. It should use this moment to undertake strategic action to strengthen the domestic economy while using its insertion into GVCs to upgrade productive capabilities. The remainder of this strategic outlook summarises the main recommendations necessary to strengthen the productive sectors, agriculture, manufacturing and services, make the economy more dynamic by reforming SOEs, build a stronger skills system and create the capabilities to protect the environment and ensure sustainability. Further recommendations from the other elements of the initial assessment follow. However, implementation is everything. The final section provides a set of key recommendations to create the governance capabilities for effective reform implementation and follow up.

Viet Nam faces a unique but short window of opportunity to engage in crucial reforms

With the right choices, Viet Nam has tremendous potential to continue its highly successful development path. Continuous reforms, a willingness to improve on the performance of past decades, and a culture that values hard work and education are tremendous assets for Viet Nam’s future development. The country’s openness to trade and investment and its recent success in improving its fiscal situation have put it in a good position to benefit from current changes in trade and investment patterns in the region. Many export and investment opportunities that in the past would have gone to China, are currently moving to Viet Nam, driven by trade disputes between China and the United States as well as rising wages in China and Viet Nam’s attractive position. Moreover, given proximity and increasing integration between the two markets, the trade volume with China is likely to continue increasing (IMF, 2019[29]).

However, the window of opportunity is potentially quite short and the future outlook is uncertain. The global economic outlook is increasingly sluggish (OECD, 2019[30]) and presents a significant risk for Viet Nam’s future exports and FDI receipts (IMF, 2019[31]). Over the longer term, increasing automation in manufacturing poses challenges related to back-shoring and potential reductions in global trade and investment flows. Climate change is accelerating and does not stop at borders. The recent success in fiscal consolidation notwithstanding, the overall financing situation remains challenging, especially given significant needs for infrastructure, on the one hand, and social spending on the other. As noted earlier, Viet Nam’s society is ageing and many social services including health and education need improvements.

Viet Nam’s future strategy must be two-pronged, combining improvements to the domestic market with upgrading in GVCs. Resilience to external uncertainty will require a strong domestic market that can drive development. With a population size approaching over 100 million and a middle class with consumption power forecast to reach over VND 40 million in the 2030s, there is potential for domestic demand to counterbalance global uncertainty. At the same time, Viet Nam should strive to make more of its position as an assembly hub in GVCs. While China, for example, boasts a dense network of domestic private firms that engage in production for international exporters and constitute the backbone of its success in GVCs, Viet Nam shows few signs of such integration, as yet, but could choose to emulate this model.

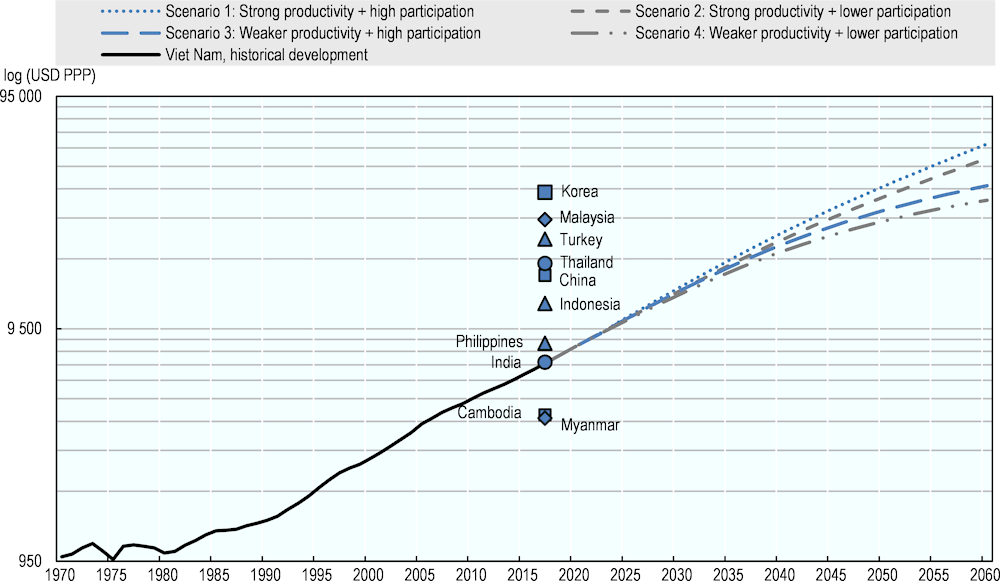

Recommendations for creating an integrated, transparent and sustainable economy

With the necessary reforms, Viet Nam has the potential to reach high-income status in about 30 years. Simulations of various scenarios (Figure 1.14) show that sustaining productivity growth will be essential, as well as reacting to the challenge of an ageing population with measures to retain people at work by increasing the statutory retirement ages. If productivity growth and labour participation are maintained at present levels, per capita GDP (currently similar to India’s) would reach the current level of Malaysia in 2043 and Korea by 2049. In contrast, allowing these growth drivers to decline would postpone achievement of Malaysia’s per capita by eight years, and Viet Nam would never achieve the level of Korea’s development during the projection period.

Figure 1.14. Structural reforms would boost Viet Nam’s long-term growth

Note: GDP at constant prices in local currency were converted into USD PPP using 2017 PPP. The per capita GDP of Myanmar and Cambodia were almost at the same level in 2017. The long-term scenarios (2018-60) for Viet Nam are based on total and working-age population data from the United Nations Division Population (UNDP) medium variant estimates combined with the various scenarios below.

Scenario 1 assumes a gradual decrease of labour productivity growth from 6% to 4%, while the employment-to-population ratio remains constant at 75%.

Scenario 2 assumes a gradual decrease of labour productivity growth from 6% to 4% associated with a progressive fall in the employment-to-population ratio from 75% to 65%.

Scenario 3 assumes a gradual decrease of labour productivity growth from 6% to 2%, while the employment-to-population ratio remains constant at 75%.

Scenario 4 assumes a gradual decrease of labour productivity growth from 6% to 2% associated with a progressive fall in the employment-to-population ratio from 75% to 65%.

Source: Asian Productivity Organization, APO Productivity database; (World Bank, 2019[2]; UNDESA, Population Division, 2017[32]); International Labour Organization, Labour Force Participation, ILO modelled estimates.

Building on its strong track record of discipline and readiness to reform, Viet Nam must prepare to switch from accumulation to innovation and efficiency gains as drivers of development. The country’s success has been built on discipline and continuous willingness to reform in the face of challenges. This has allowed Viet Nam to transition from a low to middle-income country in record time, focusing on accumulation through heavy investment and structural transformation from agriculture to manufacturing. This process was driven by an increasing reliance on market forces and a focus on attracting foreign investment, alongside a strong role for public investment, SOEs and public banks. As Viet Nam sets its sights on higher levels of income, it needs to follow the example of highly successful countries such as Korea, Malaysia or even China that have made the switch from accumulation to efficiency and innovation, with market-based incentives and a strong performance culture as the main drivers of growth.

However, without a dedicated push for a more integrated economy with equal opportunity, Viet Nam risks becoming stuck in a dualistic economic structure typical of the middle-income trap. Many countries that got stuck along the path from middle to high income continue to struggle with economic structures where some export-related segments of the economy are highly productive and internationally competitive, while many other parts of the economy, especially those focused on the domestic market, remain characterised by lower performance and protected special interests. In this scenario, productivity gains are increasingly difficult to obtain and informal employment will remain disproportionally large.

Creating strong domestic firms will require equal opportunities for all players in all sectors. Today, SOEs, FDI firms and a few large private groups enjoy significant advantages over other domestic firms. Foreign investors often receive tax and other incentives not available to local firms, while many SOEs continue to enjoy special access to financing and protective regulation. The resulting soft budget constraints allow inefficiencies to continue and use up resources and opportunities that could be put to more productive use elsewhere. On the other hand, a considerable number of local firms (other than large national champions) often face unequal treatment and obstacles such as cumbersome post-registration bureaucracy, corruption and a lack of transparency. Many improvements have been enacted in this area in the form of laws and regulations, but implementation remains fairly scattered.

Agriculture employs 40% of the workforce and holds significant potential for transformation. At present, restrictions, particularly on land use and transactions, drive fragmentation of land and inhibit efficiency gains, as well as more environmentally sustainable forms of land use. Better integration of smallholders into agricultural supply chains should be a core policy objective and may help Viet Nam gain a competitive edge on global markets, while at the same time improving incomes in rural areas.

In the context of GVCs, efforts to further integrate services with manufacturing hold significant potential for Viet Nam’s economy. This will require a more transparent and conducive market environment that provides equal opportunity to all firms and allows space for innovation. Within this environment, public support should help to attract the types of FDI that facilitate the creation of new capabilities and help Vietnamese firms prepare for linkage opportunities. The Chinese experience highlights the importance of a dense network of domestic private firms that engage in production for international exporters as well as for the domestic market. Viet Nam’s emerging national champions (large private domestic groups that span multiple sectors) are very important players in this regard as they are capable to invest in advanced capabilities and benefit from economies of scale. At the same time, however, as market power becomes concentrated among a few large groups, the risk of political and regulatory capture increases and must be controlled in the favour of contestable markets and opportunities for innovation by all firms.

To encourage growth among the most innovative and productive firms, Viet Nam should work towards a competitive market environment that provides equal opportunity to all firms. The existing legal framework is sufficient in this regard; however, in practice, the capacity for implementation is often missing. E-government could help address this issue.

Viet Nam’s prospects for further FDI look excellent in the near term. The country can afford to focus on attracting quality FDI that offers opportunities for Viet Nam to integrate deeper into supply chains. At present, multinational companies demonstrate only limited integration with the local economy, and rely mostly on a low-skilled labour force and low-value suppliers. Going forward, Viet Nam should aim to attract FDI that provides economic benefits and opportunities to enhance capabilities at low social and environmental cost. A single strategic investment promotion framework would be useful to chart common goals for FDI attraction, streamline incentives and national and subnational efforts to reach out to foreign investors. Following the successful examples of other countries, investment promotion agencies should also go beyond basic match-making and proactively help domestic suppliers of goods and services develop the skills that multinationals seek.

Reforming the governance of SOEs would contribute significantly to productivity gains and equal opportunity. A conservative estimate suggests that SOE reform in Viet Nam would mobilise about 2.5% of GDP annually in efficiency gains alone, without even considering the longer term gains from creating opportunities for new market entrants. The creation of the Commission for the Management of State Capital (CMSC) was an important step in this regard. A crucial next step will be to define a state ownership policy and financial and non-financial performance objectives for all SOEs. These should be transparent to all citizens and the CMSC should be given the power and resources to ensure compliance. Additional important steps include the professionalisation of the management boards of SOEs, increasing transparency of operations and results, and protection of the rights of minority shareholders.

Viet Nam should continue to upgrade its tertiary education sector to provide the labour force and firms with the skills for a modern economy. Viet Nam aspires to develop a generation of tertiary educated graduates with outstanding technical knowledge and the broad skills that permit continuous adaption to new technologies and business conditions. So far, it has aimed to achieve this skill profile in graduates through policies that encourage the importation of a new educational model, and through targeted support for individual tertiary education institutions. With more than two million students in tertiary education, an approach that will reach only thousands of learners is not sufficient. Instead, Viet Nam needs to reflect on how innovative, high quality and relevant provision can be broadly dispersed across its tertiary education system, at scale. Tertiary institutions have acquired more autonomy and responsibilities, but co-ordination and peer-to-peer support are necessary to make the most of this new environment. Teachers need support to develop the knowledge and skills that students require to succeed in the labour market. At the same time, a stronger information system may help guide student choice and tailor educational offer. Finally, establishing the right links between universities and firms could encourage innovation ambitions.

Environmental sustainability must become a priority of Viet Nam’s future strategy, in order to use available natural resources efficiently and to ensure a high level of quality of life for citizens. The current growth path has given rise to challenges: the annual mean concentration of fine particles in the air continues to rise and water quality is deteriorating. At the same time, the consequences of extreme water-related events are dramatic. The creation of an integrated and sustainable economy will depend on making the environment a priority (i.e. a core target for provincial and local leaders). It will also require streamlining existing environmental laws, instruments and targets; investment in implementation capacity at the local level for environmental laws; and greater citizen participation in monitoring and developing solutions.

Finally, Viet Nam could better diversify its sources of energy to take on the challenge of faster growth. Today, the country lacks the capacity to keep up with the increasing demand for energy and will risk significant and frequent power outages by the beginning of 2021. To compensate, Viet Nam is relying increasingly on coal-fired power plants, which are key contributors to poor air quality (through higher NOx and SOx emissions), and thus premature mortality, higher morbidity and, ultimately, decreasing labour productivity. A sustainable growth path requires a more forward-looking and dynamic power development plan, energy efficiency and efficient capital markets to finance energy diversification.

Complementary recommendations from the initial assessment: Strengthening social security, health care and sustainable financing of development

The initial assessment of this report (Part I) provides further recommendations that concern the sustainability and inclusivity of the social security system, strengthening the fiscal capacity of the country and pursuing the fight against corruption. These recommendations are not developed further in Part II due to time constraints and limitations of space. However, they remain highly relevant for Viet Nam’s future strategy.

Viet Nam’s social security system needs to expand its coverage base and be placed on a more sustainable footing. Coverage is low at present, especially among informal workers, poor elderly and women. However, the Social Insurance Fund’s expenditure is exceeding revenues and the present value of projected expenditure surpasses the present value of its projected revenues. A single policy framework would help enhance the current fragmented system which consists of many small regulations across agencies and tiers of government. Moreover, an integrated payment platform and a corresponding unique national identification system (a recent ID card did not include biometric data) would accelerate efficiency and accountability. To expand the contribution base, the government could lower household enterprises’ cost of contribution to the system, ease registration for employers and avoid punitive measures for belatedly registering employees. Management of the Social Insurance Fund will also need to pursue higher returns, potentially expanding investment options beyond government bonds.

The health system will need upgrading. In spite of generally good health outcomes, uneven health insurance coverage raises concerns about the future resilience of the system, especially while disease patterns are changing. Health insurance covers around 87% of the population, but informal workers, the near-poor and older persons remain excluded. This drives high out-of-pocket expenditures that further exacerbate the vulnerability of the poorest. The quality of clinics, especially in rural areas, is poor and leads to the overcrowding of urban facilities. Agencies involved in the different aspects of health insurance and delivery need to co-ordinate to build an integrated and more efficient system. More investments in infrastructure and competition between public and private clinics, especially in rural areas, could ensure broader coverage and ease the pressure on already overcrowded urban facilities.

Viet Nam needs to upgrade its capabilities to finance its development. Better-structured and efficient capital markets could attract private capital and stimulate productive activities. They are, moreover, essential to mobilise resources to finance the transition to a low-carbon economy, and to ensure that the equitisation process proceeds smoothly. Long-term investors such as insurance companies would be important for a more diversified financial system.

Viet Nam’s tax revenue system has a lot of space for improvement and a thorough review of the current structure and collection process is advisable. A breakdown of Viet Nam’s tax revenues points to a number of avenues for improving the tax structure and preparing it for future changes. Personal income tax and indirect taxes on goods and services (VAT or sales tax) generate a limited share of revenue compared to other countries (around 43% of revenue between 2015 and 2017). Trade taxes accounted for around 12% of revenue between 2015 and 2017, but have been declining since then with Viet Nam’s participation in a range of trade agreements that involve an increasing number of tariff eliminations (in 2017, the trade taxes amounted to 10.2% of total revenue). Thus, a broader tax base and an updated tax structure will be essential to finance Viet Nam’s future development needs.

Simplification of tax collection could also boost revenues. Despite progress and the possibility to file taxes electronically, it still takes almost 500 hours (equivalent to 12.5 weeks of full-time work) to pay taxes. This enormous administrative burden implies ample use of informal short cuts or full tax evasion even among businesses and individuals that might be willing to pay taxes.

It all comes down to implementation

Implementation is everything. Without it any policy, law or regulation, as well as the strategic recommendations of this report, will remain just proof of good intentions. Implementation is also the most challenging part of any strategy. Viet Nam has a unique combination of strengths and shortcomings with regard to implementation which are highlighted in this report.

To date, the current system of governance has been an effective driver of development. The state, controlled by the Communist Party of Viet Nam, is at the core of the country’s ability to implement change through its control of state functions, its ownership of firms and resources, and its regulatory powers. The Party makes decisions regarding promotions based on available information, triggering competition among cadres at central and provincial level. Ideally, this system provides space for and rewards entrepreneurialism in policy reform: leaders that are willing to experiment gain visibility and promotion if they succeed.

Despite this system’s effectiveness, the reliance on top priorities and upward accountability has in-built weaknesses that become more pronounced as the complexity of the development challenge increases. Four such effects are crucial for effective implementation of the recommendations made in this report. First, as with any public governance system, the existence of a principal-agent problem based on information asymmetry plays an important role and in its current form creates adverse incentives. Second, the ability to process multiple performance indicators is limited and needs upgrading. Third, the current number and size of subnational government structures is not well adapted to the upward accountability system. Fourth, the system depends crucially on the ability of the centre to enforce performance and merit as the defining criteria for promotion.

To improve the capacity of the system to deliver, Viet Nam should address the following priorities.

First, to better align incentives with performance and national welfare, Viet Nam should establish objective mechanisms to monitor the performance of cadres competing for promotion. Officials at the subnational level have more information about their performance than the central government. Information asymmetry is such that the central government is unable to monitor consistently whether subnational officials are pursing national welfare or their own goals. A public scorecard used as a basis for promotions would allow everyone to compare the performance of provinces and other sub-units, facilitate the flow of information in the system and create a fully aligned incentive system. The indicators on such a scorecard would have to be easily and independently verifiable, both by the central leadership and by citizens.

Second, Viet Nam has a large number of provinces and municipalities, the leaders of which all compete for visibility on simple indicators like growth and investment. Rationalising this system by creating larger regions could help obtain a better balance between competition and co-ordination. Larger regions would also allow for better comparability of performance and more useful policy experiments.

Consolidation and amalgamation of subnational administrative units (and therefore of the number of officials competing for promotion) could moreover simplify the information asymmetry problem.

Third, Viet Nam needs to strengthen its system of rule making to simplify and reduce red tape. Overlapping and unclear laws and regulations undermine the implementation of reforms across all the strategic themes in this report. In addition, the judiciary should be granted greater independence to help the market economy reach its full potential.

Fourth, Viet Nam needs to improve the efficiency of its public administration. Improving salaries would help professionalise public administrators and minimise the need for rent-seeking. Progression should be based on experience and performance, rather than seniority and age. Moreover, a rationing of public sector employees (including workers in parastatal organisations) may help control the state payroll and free up the resources necessary for a significant increase in remunerations. Rotation mechanisms could also improve the efficiency of the public administration, working against overly tight links between officials and areas of origin, which often function as sources of capture and rent extraction.

Fifth, Viet Nam needs to commit to fight more strongly against corruption. In spite of significant efforts to address malfeasance, the anti-corruption legislative framework is not yet coherent, and prosecutions are sporadic and politically driven in a number of cases. One major improvement would be the establishment of a single and autonomous anti-corruption law or reforms that make the Communist Party’s Anticorruption Commission independent from external influence.

Recommendations and priority actions

Reflecting the preceding strategic outlook, this report proposes 7 main strategic goals to create a more integrated, transparent and sustainable economy, strengthen financing for the future, and improve governance and regulatory capabilities: