[20] Acalin, J. et L. Ball (2023), « Did the U.S. really grow out of its World War II debt? », National Bureau of Economic Research, vol. Working Paper No. 31577, http://www.nber.org/papers/w31577.

[68] Bank of England (2022), « Asset Purchase Facility: Gilt Sales », Market Notice 1 September 2022, https://www.bankofengland.co.uk/markets/market-notices/2022/september/apf-gilt-sales-market-notice-1-september-2022 (consulté le 16 January 2024).

[50] Baranova, Y. et al. (2023), « The potential impact of broader central clearing on dealer balance sheet capacity: a case study of UK gilt and gilt repo markets », BoE Staff Working Paper No. 1,026, https://www.bankofengland.co.uk/-/media/boe/files/working-paper/2023/the-potential-impact-of-broader-central-clearing-on-dealer-balance-sheet-capacity.pdf.

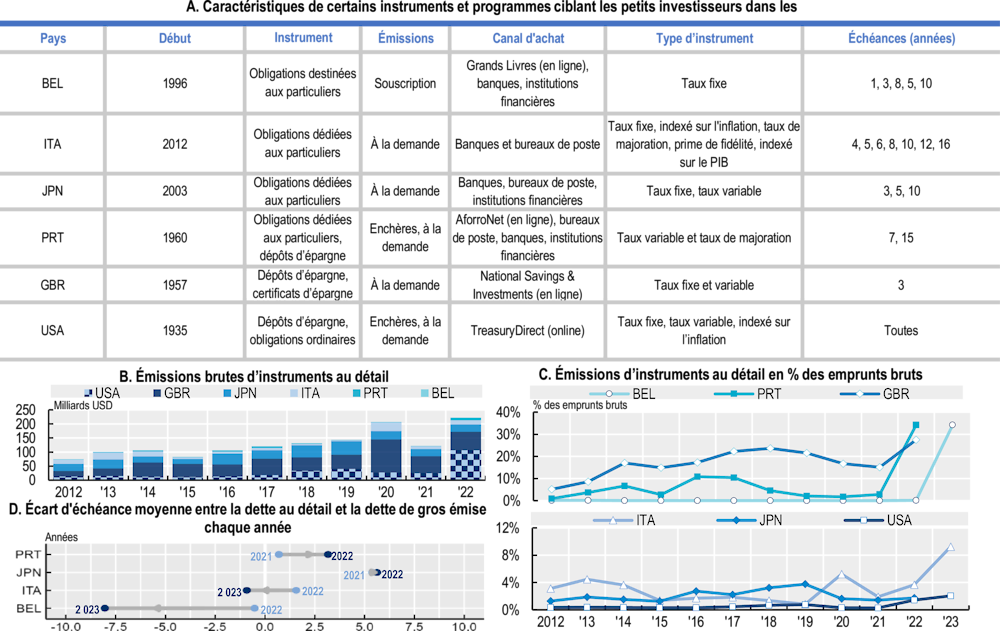

[12] Belgian Debt Agency (2023), Bons d’Etat, https://www.debtagency.be/fr/productsbeinfo.

[30] Belhocine, N., A. Bhatia et J. Frie (2023), « Raising Rates with a Large Balance Sheet: The Eurosystem’s Net Income and its Fiscal Implications », IMF Working Paper 23/145, https://www.imf.org/en/Publications/WP/Issues/2023/07/07/Raising-Rates-with-a-Large-Balance-Sheet-The-Eurosystems-Net-Income-and-its-Fiscal-535549.

[28] Bell, S. et al. (2023), « Why are central banks reporting losses? Does it matter? », BIS Bulletin 68, https://www.bis.org/publ/bisbull68.htm.

[35] BIS (2023), « Central bank asset purchases in response to the Covid-19 crisis », Committee on the Global Financial System Papers No. 68, https://www.bis.org/publ/cgfs68.pdf.

[21] BIS (2023), Central bank policy rates, https://www.bis.org/statistics/cbpol.htm (consulté le 20 December 2023).

[3] Bjellerup, M. et J. Rådahl (2023), « Debt Office Commentary: Long-term conditions for debt management », Swedish National Debt Office, vol. 2023 Number 3, https://www.riksgalden.se/contentassets/ea257dc12453430186b47e2bcfe20376/debt-office-commentary-long-term-conditions-for-debt-management.pdf.

[58] Blanchard, O., Á. Leandro et J. Zettelmeyer (2021), « Redesigning EU Fiscal Rules: From Rules to Standards », Economic Policy, vol. 36/106, https://doi.org/10.1093/epolic/eiab003.

[32] BoC (2022), « Understanding quantitative easing », Bank of Canada, https://www.bankofcanada.ca/2022/06/understanding-quantitative-easing/#:~:text=QE%20helps%20stabilize%20the%20economy,interest%20they%20pay%20to%20bondholders.

[37] BoE (2022), « Asset Purchase Facility: Gilt Sales – Market Notice 20 October 2022 », Bank of England, https://www.bankofengland.co.uk/markets/market-notices/2022/october/asset-purchase-facility-gilt-sales-market-notice-20-october-2022.

[15] Boitreau, S. et L. Secunho (2020), « Retail investors in government debt: Can fintech bring about cheaper, more inclusive programs? », World Bank Blog, https://blogs.worldbank.org/psd/retail-investors-government-debt-can-fintech-bring-about-cheaper-more-inclusive-programs.

[23] BoJ (2023), « Statement on Monetary Policy October 31 », https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2023/k231031a.pdf.

[31] Castro, M. et J. Jordan-Wood (2023), « The Fed’s Remittances to the Treasury: Explaining the ’Deferred Asset », Federal Reserve Bank of ST. Louis, https://www.stlouisfed.org/on-the-economy/2023/nov/fed-remittances-treasury-explaining-deferred-asset.

[54] Chaboud, A. et al. (2022), « All-to-All Trading in the U.S. Treasury Market », New York Fed Staff Report No. 1036, https://www.newyorkfed.org/research/staff_reports/sr1036.

[52] Chen, J. et al. (2022), « Potential netting benefits from expanded central clearing in Canada’s fixed-income market », Bank of Canada Staff Analytical Note 2022-8, https://www.bankofcanada.ca/2022/06/staff-analytical-note-2022-8/.

[22] Cohen, B., H. P. et D. Xia (2018), « Term premia: models and some stylised facts », BIS Quarterly Review, September 2018, https://www.bis.org/publ/qtrpdf/r_qt1809h.htm.

[42] CRS (2023), « Bank Capital Requirements: Basel III Endgame », Congressional Research Service, https://crsreports.congress.gov/product/pdf/R/R47855.

[47] Duffie, D. et al. (2023), « Dealer Capacity and U.S. Treasury Market Functionality », New York Fed Staff Report No. 1070, https://doi.org/10.59576/sr.1070.

[67] EC (2023), « Commission adopts report on the functioning of the Money Market Funds Regulation (MMF) », News Article, https://finance.ec.europa.eu/news/commission-adopts-report-functioning-money-market-funds-regulation-mmf-2023-07-20_en.

[25] ECB (2023), « Overall amount of unrealised losses in euro area banks’ bond portfolios contained », Press Release, https://www.bankingsupervision.europa.eu/press/pr/date/2023/html/ssm.pr230728_1~4d466b8b80.en.html.

[33] ECB (2023), « Quantitative tightening: rationale and market impact », European Central Bank Speech, https://www.ecb.europa.eu/press/key/date/2023/html/ecb.sp230302~41273ad467.en.html.

[43] Eren, E., A. Schrimpf et F. Xia (2023), « The demand for government debt », BIS Working Paper No. 1105, https://www.bis.org/publ/work1105.htm.

[55] Escolano, J. (2010), « A Practical Guide to Public Debt Dynamics, Fiscal Sustainability, and Cyclical Adjustment of Budgetary Aggregates », IMF Technical Notes and Manuals, https://www.imf.org/external/pubs/ft/tnm/2010/tnm1002.pdf.

[66] European Parliament (2023), « Debt sustainability analysis as an anchor in EU fiscal rules », Economic Governance and EMU Scrutiny Unit, https://www.europarl.europa.eu/RegData/etudes/IDAN/2023/741504/IPOL_IDA(2023)741504_EN.pdf.

[44] Fang, X., B. Hard et K. Lewis (2023), « Who holds sovereign debt and why it matters », BIS Working Papers No. 1099, https://www.bis.org/publ/work1099.pdf.

[61] FCA (2022), « Resilience of Money Market Funds », UK Financial Conduct Authority, https://www.fca.org.uk/publications/discussion-papers/dp22-1-resilience-money-market-funds.

[36] Fed (2022), « Plans for Reducing the Size of the Federal Reserve’s Balance Sheet », Board of Governors of the Federal Reserve System, https://www.federalreserve.gov/newsevents/pressreleases/monetary20220504b.htm.

[51] Fleming, M. et F. Keane (2021), « The Netting Efficiencies of Marketwide Central Clearing », New York Fed Staff Report No. 964, https://www.newyorkfed.org/research/staff_reports/sr964.

[41] FSB (2023), « Promoting Global Financial Stability », 2023 FSB Annual Report, https://www.fsb.org/wp-content/uploads/P111023.pdf.

[59] FSB (2023), « Thematic Peer Review on Money Market Fund Reforms: Summary Terms of Reference and request for public feedback », Annoucement, https://www.fsb.org/2023/08/thematic-peer-review-on-money-market-fund-reforms-summary-terms-of-reference-and-request-for-public-feedback/.

[65] FSB (2022), « Enhancing the Resilience of Non-Bank Financial Intermediation », Progress report, https://www.fsb.org/2022/11/enhancing-the-resilience-of-non-bank-financial-intermediation-progress-report-2/.

[49] FSB (2022), « Liquidity in Core Government Bond Markets », Report, https://www.fsb.org/2022/10/liquidity-in-core-government-bond-markets/.

[57] Garcia-Macia, D. (2023), « The Effects of Inflation on Public Finances », IMF Working Paper WP/23/93, https://www.imf.org/en/Publications/WP/Issues/2023/05/05/The-Effects-of-Inflation-on-Public-Finances-533099.

[8] Government of Canada (2022), Update on the 2022-23 Debt Management Strategy, https://www.budget.canada.ca/fes-eea/2022/report-rapport/anx2-en.html.

[39] IMF (2023), « Foreign Exchange Reserves », IMF Data, https://data.imf.org/?sk=e6a5f467-c14b-4aa8-9f6d-5a09ec4e62a4.

[40] IMF (2023), « IMF Sovereign Debt Investor Base for Advanced Economies », IMF Data, https://www.imf.org/-/media/Websites/IMF/imported-datasets/external/pubs/ft/wp/2012/Data/_wp12284.ashx.

[2] IMF (2023), World Economic Outlook (October 2023), https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/OEMDC/ADVEC/WEOWORLD (consulté le 1 December 2023).

[9] Italian Ministry of Economy and Finance (2023), « Press releases », MeF Website, https://www.mef.gov.it/en/ufficio-stampa/comunicati/2023/index.html.

[53] Kutai, A., D. Nathan et M. Wittwer (2023), « Exchanges for Government Bonds? Evidence during COVID-19 », Bank of Israel, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3882548.

[56] Lybek, T. (2023), « Hungarian Monetary Policy Operations Before, During, and After the Pandemic: Hungary », IMF, https://www.elibrary.imf.org/view/journals/018/2023/005/article-A001-en.xml.

[10] Ministry of Finance of Japan (2023), « Debt management report », MoF website, https://www.mof.go.jp/english/policy/jgbs/publication/debt_management_report/index.htm.

[11] National Savings & Investments (2023), , Annual report, https://nsandi-corporate.com/performance/annual-reports.

[16] OECD (2024), OECD Economic Outlook, Interim Report February 2024: Strengthening the Foundations for Growth, OECD Publishing, Paris, https://doi.org/10.1787/0fd73462-en.

[18] OECD (2023), Government at a Glance 2023, OECD Publishing, Paris, https://doi.org/10.1787/3d5c5d31-en.

[26] OECD (2023), OECD Economic Outlook, Volume 2023 Issue 1, OECD Publishing, Paris, https://doi.org/10.1787/ce188438-en.

[1] OECD (2023), OECD Economic Outlook, Volume 2023 Issue 2, OECD Publishing, Paris, https://doi.org/10.1787/7a5f73ce-en.

[34] OECD (2023), OECD Economic Surveys: Israel 2023, OECD Publishing, Paris, https://doi.org/10.1787/901365a6-en.

[24] OECD (2023), OECD Sovereign Borrowing Outlook 2023, OECD Publishing, Paris, https://doi.org/10.1787/09b4cfba-en.

[45] OECD (2023), Pensions at a Glance 2023: OECD and G20 Indicators, OECD Publishing, Paris, https://doi.org/10.1787/678055dd-en.

[4] OECD (2022), OECD Economic Outlook, Volume 2022 Issue 2, OECD Publishing, https://www.oecd-ilibrary.org/economics/oecd-economic-outlook/volume-2022/issue-2_f6da2159-en.

[38] OECD (2019), OECD Sovereign Borrowing Outlook 2019, OECD Publishing, Paris, https://doi.org/10.1787/aa7aad38-en.

[46] OECD (2018), OECD Sovereign Borrowing Outlook 2018, OECD Publishing, Paris, https://doi.org/10.1787/sov_b_outlk-2018-en.

[14] Portuguese Treasury and Debt Management Agency (2023), « Government Debt Statistics », IGCP, https://www.igcp.pt/en/1-4-399/statistics/government-debt/.

[19] Rawdanowicz, Ł. et al. (2021), « Constraints and demands on public finances: Considerations of resilient fiscal policy », OECD Economics Department Working Papers, n° 1694, OECD Publishing, Paris, https://doi.org/10.1787/602500be-en.

[64] RBA (2022), « From QE to QT – The next phase in the Reserve Bank’s Bond Purchase Program », Reserve Bank of Australia Speech, https://www.rba.gov.au/speeches/2022/sp-ag-2022-05-23.html.

[62] RBNZ (2022), « Reserve Bank details planned sales of New Zealand Government Bonds », Reserve Bank of New Zealand, https://www.rbnz.govt.nz/hub/domestic-markets-media-releases/reserve-bank-details-planned-sales-of-new-zealand-government-bonds.

[27] Reis, R. (2013), « The Mystique Surrounding the Central Bank’s Balance Sheet », American Economic Review 103(3), pp. 135–140, https://doi.org/10.1257/aer.103.3.135.

[63] SRB (2022), « Press Releases », Sveriges Riksbank, https://www.riksbank.se/en-gb/press-and-published/notices-and-press-releases/press-releases/2022/policy-rate-raised-by-1-percentage-point/.

[5] TBAC (2023), « Explaining the recent market moves across the Treasury yield curve », TBAC Presentation, https://home.treasury.gov/system/files/221/TBACCharge1Q42023.pdf.

[6] TBAC (2023), « Outlook for demand for US Treasuries », TBAC Presentation, https://home.treasury.gov/system/files/221/TBACCharge2Q42023.pdf.

[7] UK DMO (2024), « Minutes of annual consultation meetings with GEMMs and gilt investors held at HM Treasury on 29 January 2023 », The UK Debt Management Office’s financing remit 2024-25, https://www.dmo.gov.uk/media/rihkgdsg/sa300124.pdf.

[29] UK Office for Budget Responsibility (2023), « Economic and fiscal outlook », https://obr.uk/efo/economic-and-fiscal-outlook-november-2023/.

[48] US DMO (2023), « Treasury’s Current Views on the Operational Design of a Regular Buyback Program », The Department of the Treasury, https://home.treasury.gov/system/files/221/TreasurySupplementalQRQ32023.pdf.

[60] US SEC (2023), « SEC Adopts Money Market Fund Reforms and Amendments to Form PF Reporting Requirements for Large Liquidity Fund Advisers », Press Release, https://www.sec.gov/news/press-release/2023-129.

[17] US Treasury (2023), Upcoming Auctions, https://www.treasurydirect.gov/auctions/upcoming/ (consulté le 1 November 2023).

[13] US Treasury Department (2023), « Securities issued in TreasuryDirect », Fiscal Data Treasury Website, https://fiscaldata.treasury.gov/datasets/securities-issued-in-treasurydirect/.