[22] Acharya, V. et al. (2022), Exorbitant privilege? Quantitative easing and the bond market subsidy of prospective fallen angels, https://www.bis.org/publ/work1002.pdf.

[12] Bank of England (2023), Asset Purchase Facility: Bank of England concludes corporate bond sales programme – Market Notice 6 June 2023, https://www.bankofengland.co.uk/markets/market-notices/2023/june/apf-boe-concludes-corporate-bond-sales-programme-6-june.

[11] Bank of England (2022), Monetary Policy Summary and minutes of the Monetary Policy Committee meeting ending on 2 February 2022, https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-summary-and-minutes/2022/february-2022.pdf.

[9] Banque du Japon (2022), Statement on Monetary Policy, https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2022/k220318a.pdf.

[10] Banque du Japon (2022), Statement on Monetary Policy, https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2022/k221220a.pdf.

[8] BCE (s.d.), Asset purchase programmes, https://www.ecb.europa.eu/mopo/implement/app/html/index.en.html (consulté le janvier 2024).

[7] BCE (s.d.), Pandemic emergency purchase programme (PEPP), https://www.ecb.europa.eu/mopo/implement/pepp/html/index.en.html (consulté le janvier 2024).

[21] Çelik, S., G. Demirtaş et M. Isaksson (2020), Corporate Bond Market Trends, Emerging Risks and Monetary Policy, https://www.oecd.org/corporate/ca/Corporate-Bond-Market-Trends-Emerging-Risks-Monetary-Policy.pdf.

[13] Federal Reserve Bank of New York (s.d.), Secondary Market Corporate Credit Facility, https://www.newyorkfed.org/markets/secondary-market-corporate-credit-facility (consulté le janvier 2024).

[23] Friewald, N., R. Jankowitsch et M. Subrahmanyam (2012), Illiquidity or credit deterioration: A study of liquidity in the U.S. corporate bond market during financial crises, pp. 18-36, https://doi.org/doi.org/10.1016/j.jfineco.2012.02.001.

[15] Gagnon, J. et al. (2011), « The Financial Market Effects of the Federal Reserve’s Large-Scale Asset Purchases », International Journal of Central Banking, vol. 7/1, https://www.ijcb.org/journal/ijcb11q1a1.pdf.

[26] Koont, N. et al. (2022), Steering a Ship in Illiquid Waters: Active Management of Passive Funds, https://www.nber.org/system/files/working_papers/w30039/w30039.pdf.

[16] Krishnamurthy, A. et A. Vissing-Jorgensen (2011), The Effects of Quantitative Easing on Interest Rates: Channels and Implications for Policy, https://doi.org/10.3386/w17555.

[18] Lo Duca, M., G. Nicoletti et A. Martinez (2014), Global Corporate Bond Issuance: What Role for US Quantitative Easing?, https://doi.org/doi.org/10.2139/ssrn.2397787.

[19] Minsky, H. (1995), Financial Factors in the Economics of Capitalism, pp. 197-208, https://doi.org/doi.org/10.1007/BF01051746.

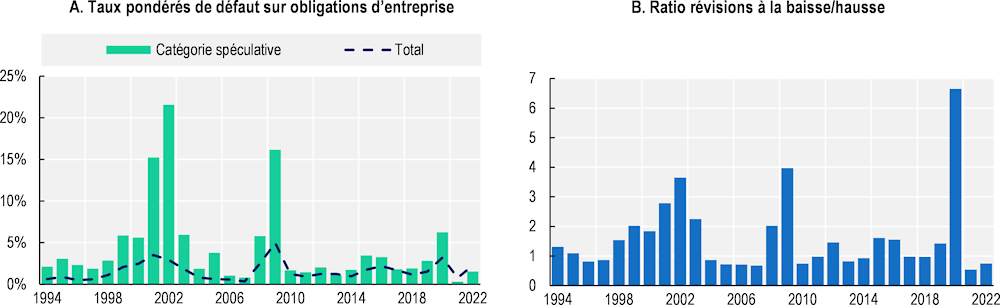

[5] MIS (2023), Annual default study: Corporate default rate will rise in 2023 and peak in early 2024, https://www.moodys.com/research/Default-Trends-Global-Annual-default-study-Corporate-default-rate-will--PBC_1357792.

[1] OCDE (2022), Corporate Finance in Asia and the COVID-19 Crisis, Éditions OCDE, Paris, https://doi.org/doi.org/10.1787/87861cf0-en.

[3] OCDE (2021), The rise of non-bank financial intermediation in real estate finance: Post COVID-19 trends, vulnerabilities and policy implications, Éditions OCDE, Paris, https://www.oecd.org/daf/fin/financial-markets/The-rise-of-non-bank-financial-intermediation-in-real-estate-finance.pdf.

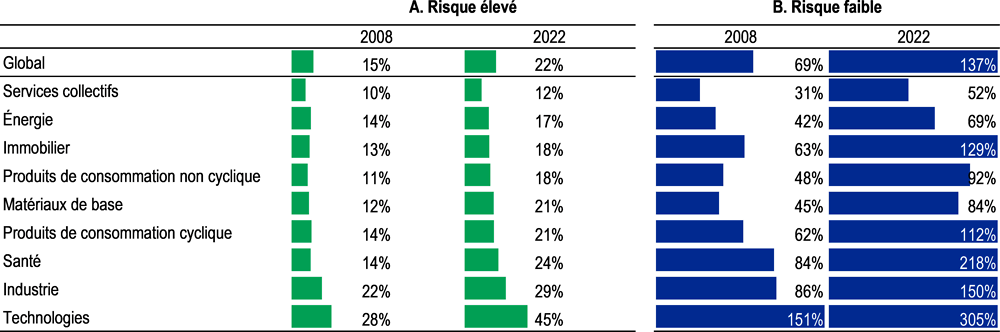

[4] Palomino, F. et al. (2019), The information in interest coverage ratios of the US nonfinancial corporate sector, https://www.federalreserve.gov/econres/notes/feds-notes/information-in-interest-coverage-ratios-of-the-us-nonfinancial-corporate-sector-201901.

[6] S&P (2023), Default, Transition, and Recovery: 2022 Annual Global Corporate Default And Rating Transition Study, https://www.spglobal.com/ratings/en/research/articles/230425-default-transition-and-recovery-2022-annual-global-corporate-default-and-rating-transition-study-12702145 (consulté le janvier 2023).

[20] S&P Global Ratings (2023), Default, Transition, and Recovery: 2022 Annual Global Corporate Default And Rating Transition Study, https://www.spglobal.com/ratings/en/research/articles/230425-default-transition-and-recovery-2022-annual-global-corporate-default-and-rating-transition-study-12702145.

[24] Shim, J. et K. Todorov (2021), ETFs, illiquid assets, and fire sales, https://www.bis.org/publ/work975.pdf.

[25] Todorov, K. (2021), The anatomy of bond ETF arbitrage, https://www.bis.org/publ/qtrpdf/r_qt2103d.pdf.

[17] Todorov, K. (2020), Quantify the quantitative easing: Impact on bonds and corporate debt issuance, pp. 340-358, https://doi.org/doi.org/10.1016/j.jfineco.2019.08.003.

[2] Trepp (2023), Trepp CMBS Delinquency Report, CMBS Research, https://www.trepp.com/hubfs/Trepp%20Delinquency_Report%20June%202023.pdf?hsCtaTracking=5d28d466-3d72-4d81-bb6d-c700ff3c607b%7Cc4b810e3-d869-4647-a4d8-1aa55e62943c.

[14] US Federal Reserve System (s.d.), The Federal Reserve’s response to the financial crisis and actions to foster maximum employment and price stability, https://www.federalreserve.gov/monetarypolicy/bst_crisisresponse.htm (consulté le janvier 2024).