The pandemic-related collapse of foreign tourism and international travel, which account for almost a fifth of GDP, highlighted the need to diversify the economy. Iceland needs to improve resilience and find new drivers of productivity and employment growth, in particular given the objective of emission reductions. Boosting skills across the population is hence the top priority, along with reforms to strengthen competitive forces.

Economic Policy Reforms 2021

Iceland

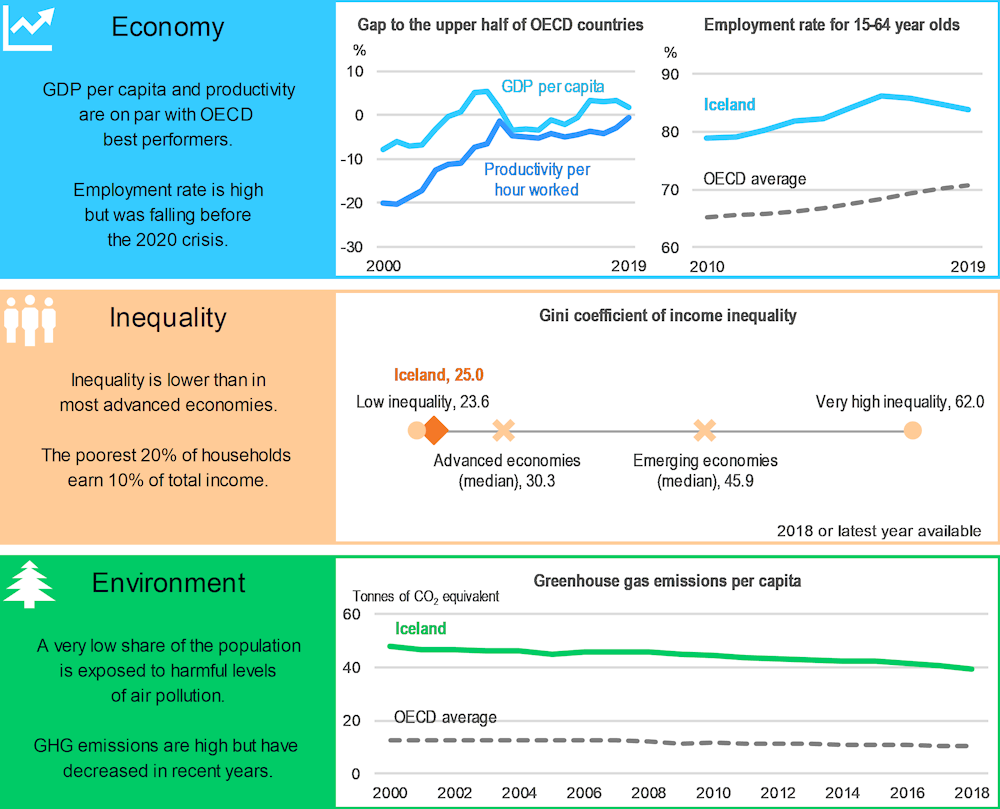

Iceland: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality. The latest available data for Iceland is 2017.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

Boosting skills for a transition to a more innovative and sustainable economy

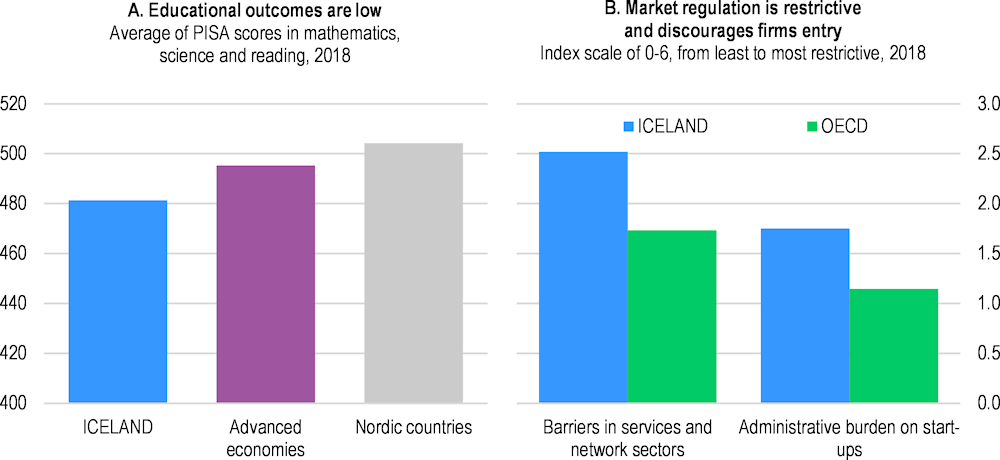

Iceland’s economy needs more knowledge and better innovation inducing skills, to overcome scarring after the COVID-19 pandemic and to boost productivity growth. Boosting skills will also make Iceland more prepared for facing digital and green transition challenges. However, despite high spending on education, outcomes are disappointing (Panel A) and a skills gap remains between immigrant and native students. The qualification of the labour force is not commensurate with the needs of the business sector and the country needs to foster strong and relevant skills at all education levels. To improve teaching quality in compulsory education, practical training and more opportunities for teachers’ professional development need to be provided. Vocational education would benefit from better integrating work and school-based training. Finally, Iceland also needs to better link university funding to students’ labour market outcomes and to broaden collaboration between research institutions and firms.

Iceland is known for its pristine nature and low exposure to air pollution. But the country also produces among the OECD’s highest greenhouse gas emissions per capita because of geothermal energy drilling and aluminium smelting. To reach its own ambitious 2030 climate targets, the government should increase the taxes on carbon and fluorinated gases, and consider taxing other greenhouse gases and boost green investment, into the fishing fleet, charging grids for electric vehicles and research into carbon capture technologies for polluting industries, which could also help the recovery.

Iceland: Vulnerabilities and areas for reform

Source: Panel A: OECD, PISA Database; Panel B: OECD, Product Market Regulation Database 2018.

Iceland’s agriculture is one of the most protected and subsidised in the OECD, with the vast majority of subsidies linked to production - the most economically distorting and environmentally damaging form of income support. De-linking agricultural support from production will help lower carbon emissions from livestock and reducing damage from soil erosion. Reforms should aim to lower tariffs and excise duties, abolish quotas on agricultural products, and link income support to environmental performance.

Diversifying the economy and embarking on a low-carbon path would benefit from more business dynamism. Iceland has among the highest barriers to entry in goods and service markets in the OECD (Panel B), which can slow down the economic recovery and pose a drag on productivity growth in the medium term. Excessive occupational licensing in the construction sector and a high administrative burden in tourism dent competition and hold back productivity. A broad-based regulatory reform to remove barriers to domestic and foreign entry would help the country to reallocate resources. In particular, Iceland needs to reduce the administrative burden for young and innovative start-ups, and it should remove restrictions holding back foreign direct investment.

Iceland’s tax-benefit system is well-targeted, yet high marginal tax rates, in particular for low-income earners, discourage a return to or taking up full-time work. Many young people are not in employment, education or training. The government needs to lower the tax wedge, especially for low-income earners. Child benefits should become universal or tapered at much higher income levels.

Iceland: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Education and skills: Foster strong and relevant skills |

|

|

☑ Since 2019 a teacher competency framework establishes standards to guide teacher appraisal and professional development. |

□ Improve teaching quality in compulsory education by fostering practical training and by providing more opportunities for teachers’ professional development. □ Strengthen vocational skills by better integrating work and school based training. □ Link university funding to the success of students on the labour market. |

|

*Environmental policy: Move towards a low-carbon economy* |

|

|

*New priority * |

□ Further increase the carbon tax and introduce taxes on other greenhouse gases, and redistribute tax revenue to vulnerable households and firms. □ Invest in a low-carbon land transport infrastructure and fishing fleet, and in carbon capture measures in industry. |

|

Agriculture: Reduce agricultural support |

|

|

☑ The government slightly reduced subsidies linked to agricultural production in 2019. |

□ Further decouple subsidies from agricultural production and link them to sustainable land management and the production of environmental amenities. |

|

*Competition and regulation: Remove barriers to domestic and foreign entry* |

|

|

*New priority * |

□ Reduce the regulatory burden, especially in the service sector and the network industries. □ Reduce barriers to foreign investments. □ Reduce the administrative burden for start-ups. |

|

Tax system: Lower the marginal tax wedge |

|

|

☑ The government reduced personal income tax rates for low-income earners in 2020. |

□ Reform the disability system by shifting the focus labour market integration of benefit claimants. □ Abandon means-testing for child benefits (i.e. introduce a universal child benefit), or considerably reduce tapering of benefits when incomes rise. □ Reduce the duration of unemployment benefits and increase the period of work needed before a worker becomes eligible to receive benefits. |

Recent progress on structural reforms

The current government, which came to power in 2017, was elected on a relatively modest reform platform. The government has embarked on climate action, in particular by more than doubling the taxation of GHG emissions within two years. Following the COVID-19 crisis the government also launched a programme to boost public investment and to build up low-carbon infrastructure. By reducing income tax rates for low-income earners the government reduced the tax wedge. Soon after the beginning of the crisis, the government (temporarily) eased the insolvency framework, facilitating reallocation of capital and labour towards new sectors and activities. In the other priority areas reform has been shy.