The economy recovered strongly, supported by large policy stimulus and an effective response to COVID-19, but some sectors hardest hit by border restrictions, notably tourism, lag behind. The pandemic highlighted a number of structural challenges. A key priority is to address the deteriorating access to affordable housing, which weakens financial resilience, hampers labour mobility and reduces inclusiveness.

Economic Policy Reforms 2021

New Zealand

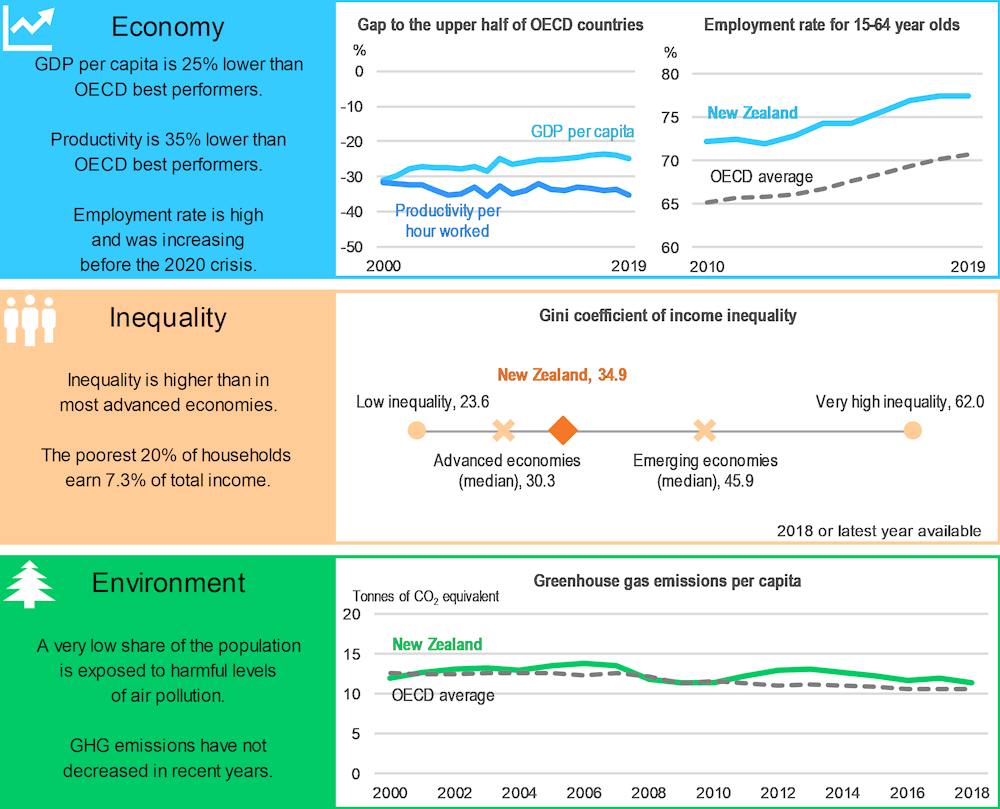

New Zealand: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs). Labour productivity is likely to be underestimated in New Zealand as there is no correction for over-reporting of hours worked, in contrast to the practice in most other OECD countries.

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

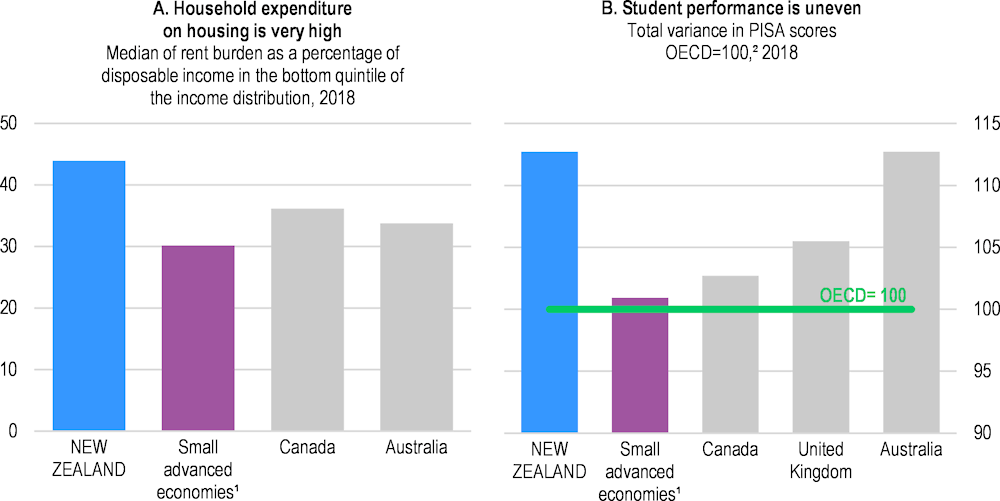

Improving housing affordability for a more inclusive and resilient recovery

Shortages of affordable housing have resulted in high rent payments for low-income households (Panel A), undermining wellbeing and raising poverty risks. High housing prices also increase financial vulnerabilities and hamper labour mobility, which reduces productivity growth. The authorities are taking measures to reign in speculative housing demand and to increase housing supply, but further reforms are needed to achieve sustained improvements in housing affordability. Housing supply needs to be increased by streamlining restrictive and complex land-use regulations, giving local governments greater access to capital for infrastructure investment and aligning their investment incentives with the benefits of well-planned and well-regulated growth. Refocusing the role of KiwiBuild from delivering modestly priced homes to supplying land through aggregating fragmented land holdings and de-risking development sites for developers would increase efficiency in supplying affordable housing. Boosting the supply of social housing, which is low compared with other OECD countries, would reduce poverty by increasing incomes after housing costs.

Productivity performance has been poor, despite generally favourable policy settings. This partly owes to low trade intensity and the small domestic market, which limit returns to innovation and the adoption of new technologies. Innovation support should be geared toward exports and integration in global value chains to boost innovation activities aimed at capturing foreign markets. Innovation support should also target firms that seek to integrate into global supply chains by attracting FDI or supplying to local subsidiaries of multinational enterprises. Lengthy FDI screening processes should be streamlined, for instance by introducing a fast track for FDI that facilitates exports or knowledge transfer.

New Zealand: Vulnerabilities and areas for reform

1. The group of small advanced economies includes OECD countries with less than ten million inhabitants (in panel B, data are missing for Israel, Ireland and Lithuania).

2. The variance components in mathematics, science and reading were estimated for all students in participating countries with data on socio-economic background and study programmes. The variance in student performance is calculated as the square of the standard deviation of PISA scores in reading, mathematics and science for the students used in the analysis.

Source: Panel A: OECD, Affordable Housing Database; Panel B: PISA Database.

Productivity growth can also be boosted through better allocation of resources. Facilitating the movement of workers toward sectors with larger labour demand and high-paying job opportunities improves both productivity and employment. However, the means-tested income support for unemployed jobseekers (the Jobseeker Support) offers less generous compensation for lost labour earnings compared to earnings-related unemployment insurance in other OECD countries. Support for workers during job transitions should be strengthened through reforms to the existing welfare system (the Jobseeker Support), introduction of unemployment insurance, or some hybrid approach, and wider provision of training measures like the existing COVID-19 related scheme that retrains workers in hospitality and aviation for jobs in construction, agriculture, manufacturing and healthcare.

While educational achievement is high on average, Māori and Pasifika children underperform considerably, and the influence of socio-economic background on educational outcomes remains higher than in many OECD countries (Panel B). Improving educational achievement among specific groups by following through the ongoing governance system reform, increasing enrolment in early childhood education and enhancing school-to-work transitions would strengthen inclusiveness by improving educational achievement and reducing the high relative poverty rate among Māori and Pasifika.

Child poverty concerns 15% of children in New Zealand when measured based on the 50% poverty line for income, ranking in the mid-range of OECD countries. Amid the increase in unemployment in the wake of the COVID-19, the government should ensure that progress towards meeting the long-term target remains on track by monitoring the impact of the crisis on child poverty and stepping up support if needed.

New Zealand: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|

|---|---|---|

|

Housing: Increase supply and quality of affordable housing |

||

|

☑ The Buy-Off the Plans operations of Kiwibuild were transferred to another organisation in October 2019. ☑ The National Policy Statement on Urban Development 2020 came into effect in August 2020, providing national guidance to local governments on land-use regulations and urban planning that is strongly oriented toward growth. ☑ The Urban Development Act 2020 came into effect in August 2020 to facilitate urban development by streamlining processes and providing stronger public powers and duties to the Urban Development Agency. ☑ The Infrastructure Funding and Financing Act 2020 came into effect in August 2020 and increases the ways to fund and finance infrastructure for urban growth to support the functioning of urban land markets. ☑ Large public infrastructure investment under the New Zealand Upgrade Programme and the Shovel Ready fund is geared toward increasing housing supply and urban development. ☑ The Residential Tenancies Amendment Act 2020 strengthened the rights of tenants through Healthy Home Standards and modernising tenancy laws. |

□ Ensure that strict regulatory containment policies by local government are replaced with the clear rules on land-use and spatial planning outlined in the National Policy Statement on Urban Development 2020. □ Strengthen the financing of infrastructure investment by local governments through user charges for water and roads and project-specific financing through special purpose vehicles to be repaid by targeted local taxes. □ Re-focus KiwiBuild on enabling the supply of land through aggregating fragmented land holdings and de-risking development sites. Give greater priority to new rental housing. □ Accelerate the provision of social housing in areas with shortages. |

|

|

Innovation: Promote innovation in tandem with export and foreign direct investment |

||

|

☑ As part of the COVID-19 fiscal response, the government brought forward the change in R&D tax credits initially planned in 2021, which allows firms with a tax loss position or insufficient income tax to pay to use all R&D tax credits to have R&D tax credits refunded in cash. |

□ Support innovation activities by firms seeking to expand exports or to participate in global supply chains. □ Streamline the lengthy and non-transparent FDI screening process. Consider introducing a fast-track for FDI with high potential for export opportunities and knowledge transfer. □ Co-ordinate immigration and education policies with business skills needs for innovation. |

|

|

*Labour market: Introduce a short-time work scheme and enhance support for unemployed jobseekers* |

||

|

*New priority * |

□ Consider introducing a short-time work scheme. Make employers bear a part of the costs of hours not worked to reduce support for non-viable jobs. □ Increase training and apprenticeships that help workers move to jobs in fields that are well paid and have low unemployment. □ Strengthen support for unemployed jobseekers through reforms to Jobseeker Support, the introduction of unemployment insurance or some hybrid approach. |

|

|

Education: Improve outcomes for students from vulnerable socio-economic backgrounds |

||

|

☑ In November 2019, the government announced comprehensive reforms of the school governance system under which the Ministry of Education will provide more integrated local support to schools through the newly-established Education Service Agency. Training and guidance will be provided to boards of trustees to improve their capacity and teacher education will be strengthened, with emphasis on meeting the demands of Māori learners. ☑ The government provided, as a part of the COVID-19 fiscal response, free vocational education and training as well as apprenticeships between July 2020 and end-2022. A new programme offering paid on-the-job training aimed at acquiring an industry qualification was also introduced. |

□ Proceed with the reform of the Tomorrow’s Schools governance system. □ Boost the participation to early childhood education by disadvantaged groups by ensuring high quality and conveying the improved educational outcomes from such participation. □ Improve the school-to-work transition by enhancing the quality of teaching and career advice. Facilitate participation of disadvantaged youth in training and apprenticeships. |

|

|

Child poverty: Monitor the impact of the COVID-19 crisis on income and material hardship and step up support if needed |

||

|

☑ The Child Poverty Reduction Act 2018 was enacted in December 2018, requiring the government to set long-term (10-year) and intermediate (3-year) targets, report annually on the set of child poverty measures and how government is progressing towards its targets. The targets were set in May 2019, and include reducing the share of children in low-income households from 15% to 10.5% by the 2020/21 financial year and to 5% by the 2027/28 financial year. ☑ The Budget 2019 included changes in income support that directly impacts child poverty, such as the indexation of all main benefits to average wage growth. The policy response against the COVID-19 crisis in March 2020 included a permanent NZD 25 per week increase in social benefits and a one-off doubling of the Winter Energy Payment for 2020. Budget 2020 included an extension of eligibility for In Work Tax Credits amounting to 1% of GDP. |

□ Monitor the consequence of the COVID-19 crisis on the primary measures of child poverty. Should the intermediate targets not be achieved in the 2020/21 financial year, set a clear plan for achieving them. □ Monitor the development of housing costs faced by low-income households. Step up income support should housing costs, particularly rents, rise rapidly. |

|

Recent progress on structural reforms

Significant actions were taken in all reform priority areas highlighted in the 2019 edition of Going for Growth, except in reducing barriers to FDI. In other areas, the COVID-19 crisis accelerated reforms as the government included several important measures in the areas of poverty reduction, education and innovation in its fiscal response package. In housing, measures taken this year to quell demand include re-instating and, in some cases, reducing loan-to-value limits on housing loans, phasing out mortgage interest deductions against residential rental income by 2025 and increasing the holding period for the non-taxation of capital gains on residential property other than the primary residence to 10 years. In March, the government also announced measures to increase housing supply, such as creation of a housing acceleration fund (NZD 3.8 billion) to provide contestable grants to municipalities to help fund infrastructure for housing development, the creation of a fund (NZD 2 billion) to purchase land for social housing and increased funding for apprenticeships in the construction sector.