The recovery offers an opportunity to focus on productivity-enhancing investment and upskilling, including better targeting of R&D support and improved business environment.

Economic Policy Reforms 2021

Czech Republic

Czech Republic: Performance prior to the COVID-19 crisis

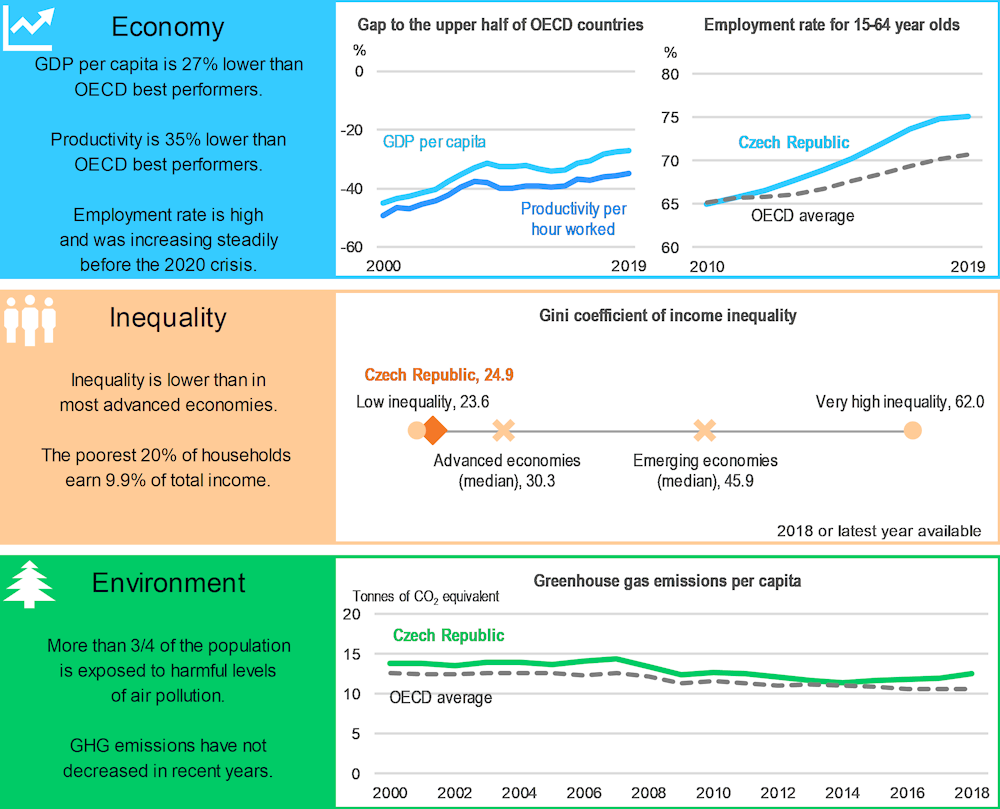

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

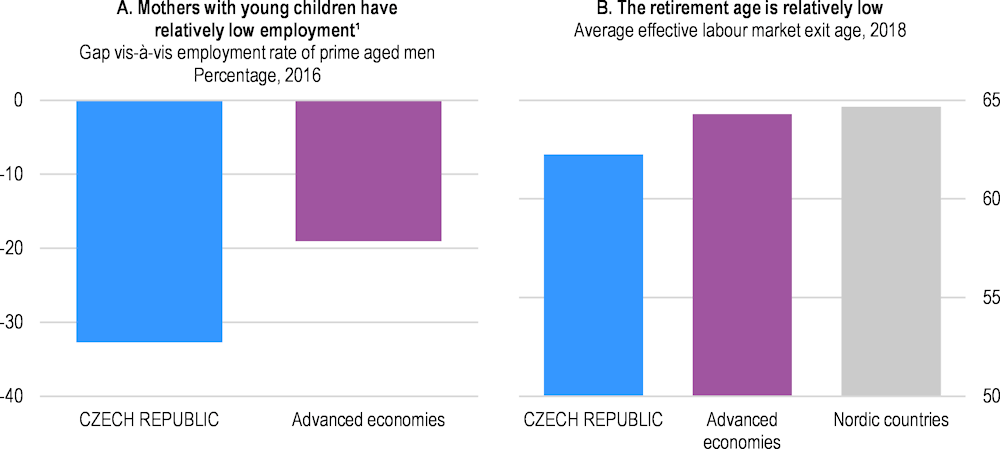

Facing new challenges requires skills and productivity upgrades

An overall need for digital upskilling, as well as potential scarring impact of the pandemic on youth, call for an increase in public spending on active labour market policies, notably training. Shortage of skilled labour, an impediment to growth before the pandemic, can weigh on digitalisation and the greening of the economy where new skills will be in need. There is scope to attach training conditions to the job retention scheme, as well as target counselling and upskilling to those at a risk of losing a job or the self-employed. Providing more childcare facilities, shortening the maximum duration of parental leave and encouraging fathers to take more of the leave would help to draw mothers back to the labour market earlier, addressing partly the skills shortages, enhancing inclusiveness as well as boosting growth (Panel A).

Increasing public support to business R&D and targeting it to young dynamic firms can help spur innovative activities in the local SMEs that tend to be slow in adopting more sophisticated technologies, holding back their digital transformation. Improving further business conditions, such as obtaining construction permits and opening a company, can help private investment. Meanwhile, public investment should target transport and energy projects that improve energy efficiency and reduce carbon emissions and air pollution.

Czech Republic: Vulnerabilities and areas for reform

1. Mothers with young children refer to working-age mothers with at least one child aged 0 to 14 years. The employment gap is the difference between the employment rate of prime-age men (25-54 year-olds) and that of mothers with young children, expressed as a percentage of the employment rate of prime-age men.

Source: Panel A: OECD (2018), OECD Employment Outlook 2018; Panel B: OECD, Pensions at a Glance Database.

A shift to less polluting and more energy-efficient activities is needed. Once the recovery is under way, environmental taxes should be increased and harmonised to better reflect the environmental and health costs of emissions.

In the medium term, the Czech Republic faces significant challenges from population ageing while the effective age of retirement remains significantly below the OECD average (Panel B). Increasing it would slow the steep increases in pension-related spending and increase the labour market participation of older workers.

Introducing financial and non-financial incentives for municipal mergers as well as making inter-municipal co-operation mandatory and multi-purpose at the level of micro-regions would help to counter the small size of municipalities and highly fragmented local government that impedes effective provision of public services and investment.

Czech Republic: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Labour market: Make the labour market more fluid and inclusive |

|

|

☑ The government has kept expanding early childhood education and childcare capacities and has strived to ensure quality. ☑ Job sharing was introduced in 2020 to offer greater flexibility to combine work and family life. |

□ Keep expanding the supply of affordable and high-quality childcare facilities. □ Reduce the maximum duration of parental leave and incentivise fathers to take more of the parental leave. □ Boost well-targeted active labour market policies to facilitate employment transitions, by increasing spending on activation, training and reskilling programmes. |

|

R&D and digitalisation: Enhance R&D investment and improve business environment |

|

|

☑ Government spending on R&D through grants has been rising (by 20% between 2016 and 2019 in terms of PPP). In April 2019, the government simplified claims for the R&D tax allowance. ☑ The government has prepared a New Building Act, a comprehensive overhaul of the legislation and regulation around construction permits that is in the final stages of the legislative procedure. |

□ Increase government support for business R&D spending and target it better towards small and young dynamic firms. □ Adopt the new Building Act and reduce the time and number of procedures for starting a business. |

|

*Environmental policy: Pursue greener growth* |

|

|

*New priority * |

□ Increase environmental taxation; notably, introduce an explicit carbon tax. □ Make carbon price signals stronger and more consistent across all sectors of the economy. □ Promote investment to facilitate the transition to low-emission technologies and increase energy efficiency. |

|

Labour market: Reform the pension system and promote longer working lives |

|

|

No action taken. |

□ Continue to raise the retirement age and link it more tightly to increases in longevity. □ Promote a healthier lifestyle and further develop education, disease prevention and screening programmes. |

|

Public sector efficiency: Improve public sector efficiency by consolidating local government services |

|

|

☑ The government continues implementing the Public Procurement Digitisation Strategy for 2016–2020. In particular, it has expanded further the use of electronic public marketplaces, including by proposing a mandatory use of the National Electronic Instrument for selected contracting authorities. ☑ The Civil Service Act was amended in 2019, to further professionalise the civil service and to incentivise professional development of civil servants with the aim to increase the quality of the civil service. |

□ Introduce financial and non-financial incentives for municipal mergers. □ Make inter-municipal co-operation mandatory and multi-purpose at the level of micro-regions with clearly specified tasks. Encourage self-funding of inter-municipal co-operation (from own tax sources and by member municipalities). □ Gather information on the quality of services provided at the local level to increase understanding of best practices and allow the use of benchmarking. |

Recent progress on structural reforms

Progress on structural reform has been limited. The government has kept expanding childcare capacities and has raised flexibility to help parents combine work and family life. A new building act is in preparation to reduce the burden of obtaining construction permits, and public support to R&D has been on the rise.