The recovery offers an opportunity to improve active labour market policies and reskilling and facilitate resource reallocation to restore productivity growth, notably through lowering internal barriers to competition.

Economic Policy Reforms 2021

Switzerland

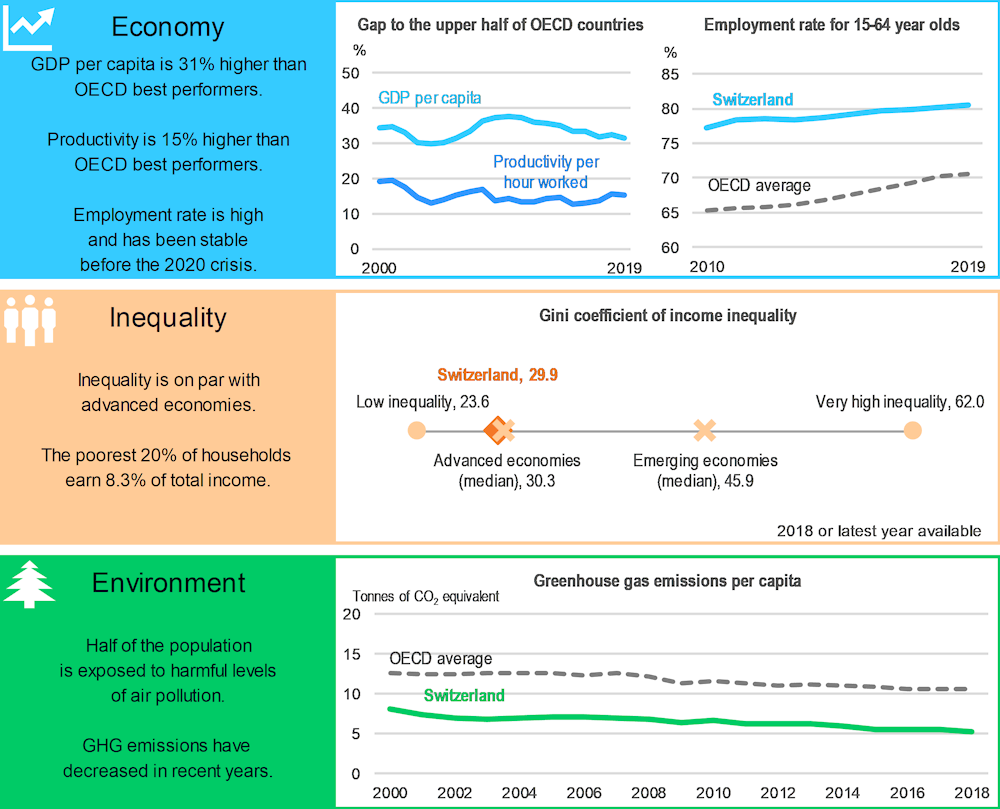

Switzerland: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality. The latest available data for Switzerland is 2017.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

Reskilling and reinvigorating business dynamism for inclusive recovery

To facilitate resource reallocation during economic recovery better-targeted adult learning is needed. Along with higher equity in education, upskilling would ensure that everyone benefits from the ongoing increased demand for high-skilled jobs. The low-skilled adults have lower access to adult learning compared to their high-skilled counterparts hampering their professional mobility. Students from disadvantaged socio-economic background (especially from immigrant families) underperform and have significantly lower participation in tertiary education. Participation of children of age four and below in early childhood education is low. Increasing the skills of the disadvantaged, that should start already at the pre-school age and continue throughout the entire education, will boost productivity growth and can improve their labour market prospects making growth more inclusive.

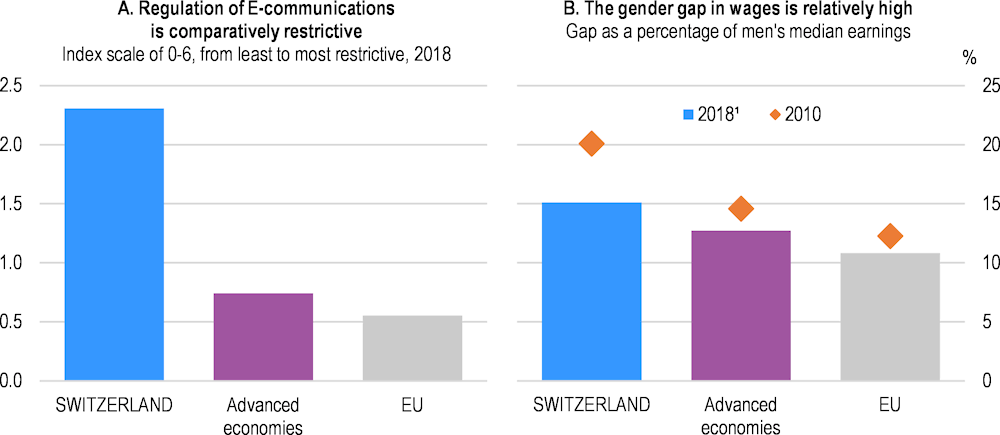

Barriers to entry, including obstacles to inter-cantonal trade, as well as government involvement in network sectors, notably in e-communications, should be lowered (Panel A). The powers of sector regulators could be strengthened to reduce prices for consumers and promote higher take-up of digital technologies. Currently, weak competitive pressures hamper the take up of digital technologies and potentially the COVID-19 recovery.

Switzerland: Vulnerabilities and areas for reform

1. 2018 or latest year available. The gender wage gap is unadjusted and is defined as the difference between median earnings of men and women relative to median earnings of men. Data refer to full-time employees and to self-employed.

Source: Panel A: OECD, Product Market Regulation Database 2018; Panel B: OECD, Gender and Labour Force Statistics Databases.

To deal with mounting spending pressures related to old-age pensions and health care, the statutory retirement age should increase. Also, disincentives to hiring and retaining older workers (such as seniority wages) should be eliminated, introducing targeted training programmes and increasing financial incentives for working beyond the age of 65.

Once the recovery is under way, shifting taxation from direct towards indirect taxes, can strengthen growth. Low accessibility and high costs of childcare services as well as second-earner taxation dissuade many spouses from taking full-time jobs. Reforming tax and benefits to better incentivise labour participation of second-earners, introducing parental leave that can be shared between fathers and mothers and increasing public spending on childcare would further boost the labour force participation of women.

Switzerland: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Education and skills: Increase skills of the disadvantaged |

|

|

☑ The Basic Skills in the Workplace programme offers subsidies to companies that provide basic skills training to their staff. ☑ Federal pilot programs provide tailor job-search assistance to older workers and people having difficulties to find a job, facilitate apprenticeship access for young migrants and asylum seekers, and subsidy employment of low-skilled immigrants. |

□ Enhance subsidy programs to encourage participation in continuing education and training, in particular of low-skilled adults (and immigrants). □ Boost public spending on early childhood education and care, especially for children from disadvantaged socio-economic backgrounds. □ Improve access to tertiary education for students from lower socio-economic and immigrant backgrounds through special financial support (e.g. means-tested grants). |

|

*Competition and regulation: Boost economic dynamism by increasing competition* |

|

|

*New priority * |

□ Simplify occupational licensing across cantons and reduce the cost of starting a company. □ Increase private ownership and remove barriers to entry, including restrictions on the number of competitors, in energy, telecommunications and transport. |

|

Labour market: Reduce the burden of ageing |

|

|

☑ A 2020 pension reform increased funding for the first pillar by 0.3 percent of GDP, annually. The additional financing comes from raising mandatory social security contributions paid by employers and employees, increasing the federal transfer and from earmarking VAT. |

□ Set the retirement age at 65 for both genders and thereafter link it to life expectancy. □ Increase financial incentives to work longer before retiring and promote lifelong training, career planning and tailored job-search assistance for older workers. □ Promote healthy working lives, including via preventive health care programmes. |

|

Tax system: Shift taxation from direct towards indirect taxes |

|

|

No actions taken. |

□ Increase the standard value-added tax rate, remove VAT exemptions and lower personal income taxes, taking into account the federal structure of the tax system. □ Remove exemptions to the CO2 levy and other green taxes. Redesign the federal vehicle tax to strengthen price incentives to purchase low-emission vehicles. |

|

Labour market: Facilitate full-time labour force participation of women |

|

|

☑ Federal programme providing additional childcare places is on-going. ☑ Paternity leave of 10 days was introduced in 2020. |

□ Improve accessibility and quality of childcare services. □ Reform the tax benefit system to incentivise second-earners to participate more in the labour market. □ Introduce parental leave that can be shared between fathers and mothers. |

Recent progress on structural reforms

Paternity leave of two weeks has been introduced and the federal government continues supporting new childcare facilities. Subsidies to companies that provide basic skills training to their staff introduced.