The COVID-19 pandemic exposed long-standing vulnerabilities of the Chilean economy: high inequality and a high share of small and mid-size companies with weak productivity performance. Solid COVID-19 related government interventions are cushioning some of the negative effects, but structural policy action is needed to prevent the crisis effects undoing some of the progress in reducing poverty and inequality achieved through the past decades and to strengthen economic resilience and growth in the future.

Economic Policy Reforms 2021

Chile

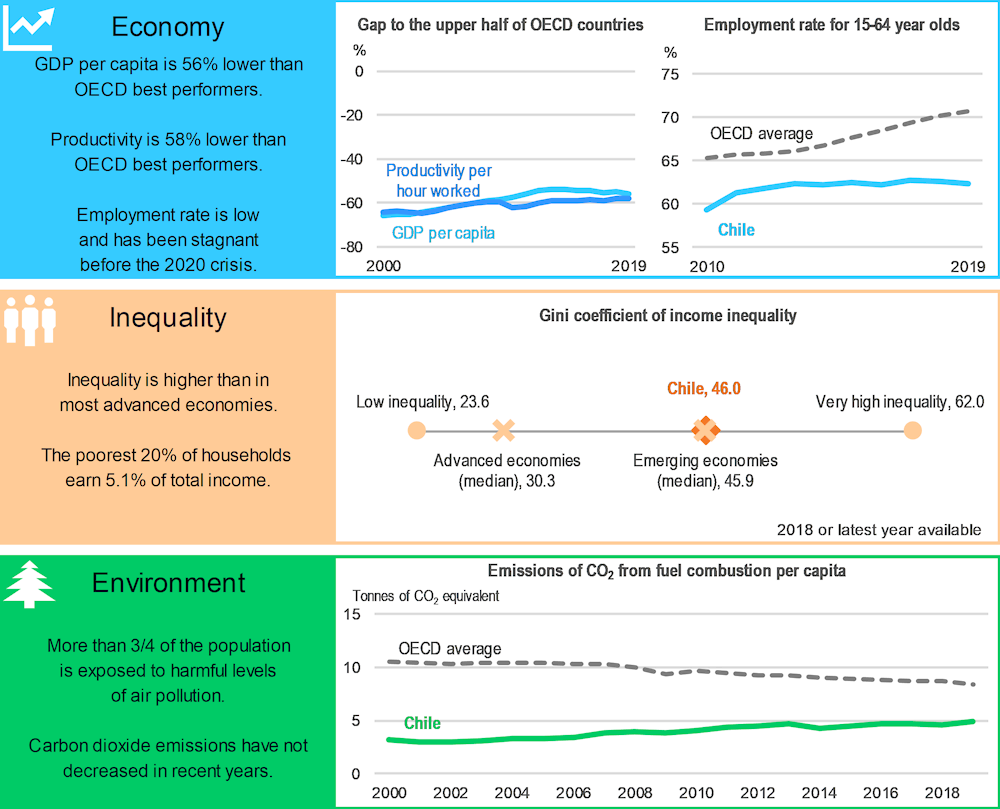

Chile: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality. The latest available data for Chile is 2017.

Environment: A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment and Energy Databases.

A strong and inclusive recovery

A more effective tax and transfer system can be a strong catalyst for reducing inequality and inclusive recovery. The redistributive impact of the current personal income tax is weak. To improve income distribution, higher conditional cash transfers towards vulnerable populations and more spending on family, health or education-related transfers should be considered. Transforming the temporary measures that strengthen protection for unemployed workers into permanent ones, or automatically triggered once unemployment reaches certain thresholds, would also constitute progress in this direction. In the medium term, lowering the thresholds at which the bottom and top bracket apply would lead both to a significant increase in revenue as well as a reduction in income inequality.

The crisis highlighted disparities in digital skills and technology access and use. One of the biggest connectivity challenges is access to high-speed internet. Improvements in legal, regulatory and governance frameworks in the communication sector could accelerate both fixed and mobile network deployment and improve access to high-speed broadband services at competitive prices. Firms’ adoption of digital tools is still lagging behind other OECD countries, mainly for SMEs. More targeted programmes for SMEs, designed in close collaboration with the private sector, would allow them to adopt digital tools. Despite significant progress on the competition framework over the recent years, in some key sectors, such as digital services and maritime transport, complex regulatory procedures remain an impediment to an efficient reallocation of resources. Such regulations should be reviewed to reduce their complexity, thereby supporting a swift recovery from the COVID-19 recession, overall firm growth (notably among SMEs), and boosting productivity.

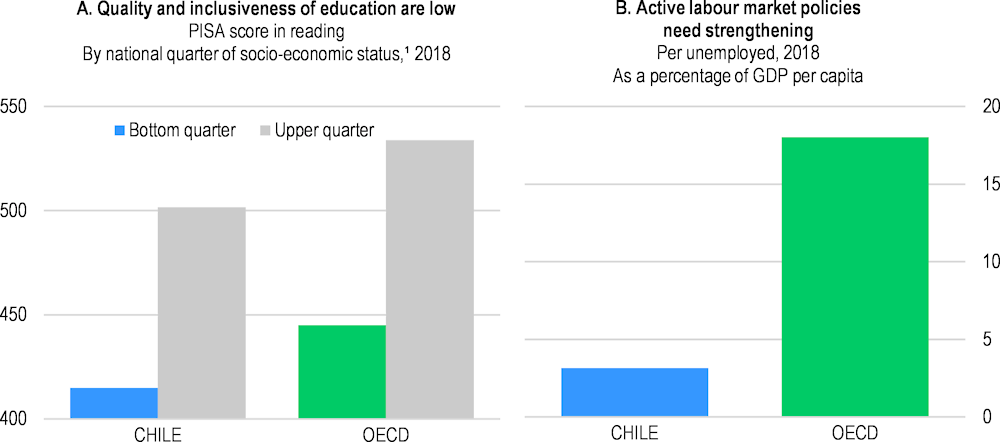

Chile: Vulnerabilities and areas for reform

1. A student’s socio-economic status is estimated by the PISA index of economic, social and cultural status (ESCS), which is derived from several variables related to students’ family background: parents’ education, parents’ occupations, a number of home possessions that can be taken as proxies for material wealth, and the number of books and other educational resources available in the home.

Source: Panel A: PISA Database; Panel B: OECD, Public expenditure and participant stocks on LMP and Economic Outlook Databases.

To boost growth and to make it inclusive the quality and equity of the education system across all levels needs to improve (Panel A). The actions taken by the government to enhance digital means and online resources for education in the first months of the pandemic are welcome. Expanding the provision of high-quality childcare including public early childhood education would give children from disadvantaged backgrounds a more equal start in education. Looking ahead, boosting skills across the population requires enhancing workplace training, as part of vocational education and training programmes, and ensuring its relevance by updating the curricula, in collaboration with employers.

To reduce unemployment and help workers find jobs in the formal sector, strong activation, job search and training policies should be put in place. Strengthening active labour market policies and embarking on a full revision of training policies would help face the challenges of the digital transformation and ensure that all workers, particularly the most vulnerable, have adequate opportunities for retraining and finding good-quality jobs. Financing childcare through general revenues would raise female employment and wages, helping to reverse the stark increase of the gender labour participation gap during the pandemic.

Chile: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

*Social protection: Make the tax and transfer system more friendly to redistribution* |

|

|

*New priority * |

□ Strengthen the redistributive impact of the personal income tax by lowering the thresholds at which the bottom and top brackets apply. □ Expand cash benefits, including conditional cash transfers, employment subsidies and unemployment- and health-insurance support. □ Make the temporary measures to increase protection for unemployed workers permanent or automatically triggered when unemployment reaches certain thresholds. |

|

Competition and regulation: Enhance competition and ease regulatory procedures |

|

|

☑ In December 2019, measures to facilitate the installation of telecommunications infrastructure in public spaces, deployment of 5G technology, and competition in the cabotage freight transport were announced. ☑ Authorities have put in place a portal where SMEs can denounce bureaucratic obstacles to entrepreneurship. A digital platform now acts as a single digital window for all sectorial permits that a project requires for its approval, allowing the coordination and monitoring of all agencies. |

□ Systematically review competitive pressures in key sectors, such as telecommunications and maritime services, by conducting market studies and applying the guidelines of the OECD’s Competition Assessment Toolkit. □ Implement zero-licensing procedures for permits. |

|

*R&D and digitalisation: Boost the digital transformation* |

|

|

*New priority * |

□ Create a simplified licensing procedure through which operators are authorised to provide all types of telecommunication services. □ Boost public support to SMEs, in cooperation with the private sector, through targeted programmes to facilitate the adoption of digital tools. |

|

Labour market: Enhance lifelong learning and active labour market policies, while boosting female labour participation |

|

|

☑ In March 2019, a bill to modernise the training and public employment system was submitted to Congress. ☑ A new law passed during the pandemic defines rules for teleworking and working from a distance by bringing working conditions in line with those of the on-site workers. |

□ Embark on a full revision of the tax-credit programme financing firm-provided training to improve relevance, quality and targeting to vulnerable workers. □ Eliminate the requirement for firms to finance childcare once they employ 20 female workers or more to boost female labour force participation. |

|

Education and skills: Improve quality and equity of the education system |

|

|

☑ In March 2019, the government announced the extension of ‘a full-day programme’ in some public kindergartens and nurseries to achieve high coverage with 35 800 young children during 2019 (5% of the public system coverage). ☑ The government implemented an agenda to modernise professional technical education, including new schools of excellence, the abolition of fees for low-income families, more scholarships and the establishment of state technical training centres in five regions. |

□ Expand the provision of high-quality childcare including public early childhood education. □ Enhance work-based learning through apprenticeships. □ Strengthen vocational education by Update the curricula of vocational training in line with changing job market needs. |

Recent progress on structural reforms

The social protests at the end of 2019 triggered an agenda of structural reforms. This included higher pensions for the most vulnerable, a minimum guaranteed income, a new health plan, and the creation of a new tax bracket in the personal income tax for high income taxpayers, addressing in part some of the inequality issues. In October 2020, a referendum approved a new elected constitutional assembly to rewrite the constitution, which could lead to more structural reforms. The COVID-19 crisis could add to this renewed appetite for discussing further structural reforms.