Digital and green transitions require reducing barriers to mobility, such as inefficiencies in the housing market and weak competitive pressures in some markets. Improving education and integration of minorities would increase inclusion and the capacity of migrants to make the most of labour market opportunities.

Economic Policy Reforms 2021

Denmark

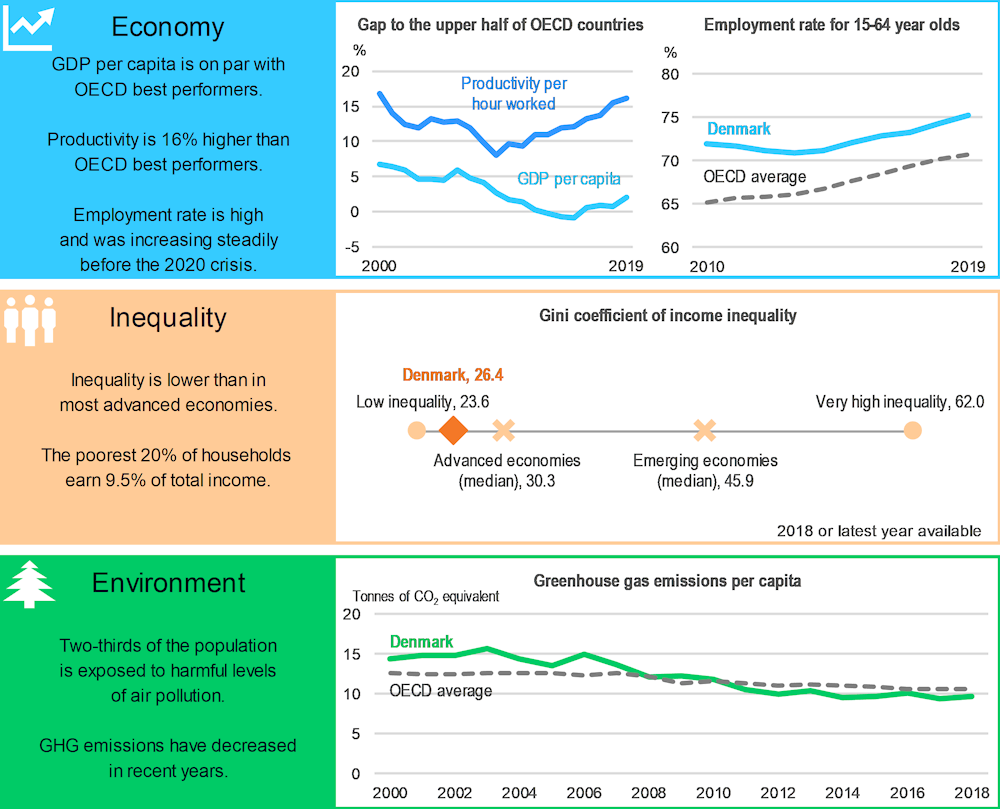

Denmark: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality. The latest available data for Denmark is 2017.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

Enhancing reallocation and integration

Housing market inefficiencies hinder reallocation of resources that may be needed in the recovery. Strict rent regulation and housing subsidies hamper growth of the private rental market and result in inefficient use of the housing stock, constraining labour mobility. While recent analysis is lacking, historical data indicate that, among renters, the biggest beneficiaries from regulated rent have been high-income households. Moreover, the underdeveloped rental market puts upward pressure on house prices in the largest cities. Reducing distortions in the housing market would support the recovery and improve well-being through a larger supply of affordable flats. This can be achieved by deregulating, reducing housing subsidies and improving their targeting.

The structure of the competition framework and determination of anticompetitive practices are complex. This hampers enforcement of competition, particularly in some service markets, and could hold back the creation of new firms and jobs in response to changing demands from the COVID-19 pandemic shock. Strengthening competition and making consumer markets more efficient would be conducive to a strong economic recovery. To this end, the competition authorities should have a greater power to impose administrative fines and structural remedies. Entrepreneurship, investment and job creation would be supported by shifting the tax structure towards housing (e.g. raising property taxation) and lowering high top marginal tax rates on labour and capital incomes. Such a reform should take distributional concerns into account and the implementation of tax increases should be postponed until the recovery is well advanced.

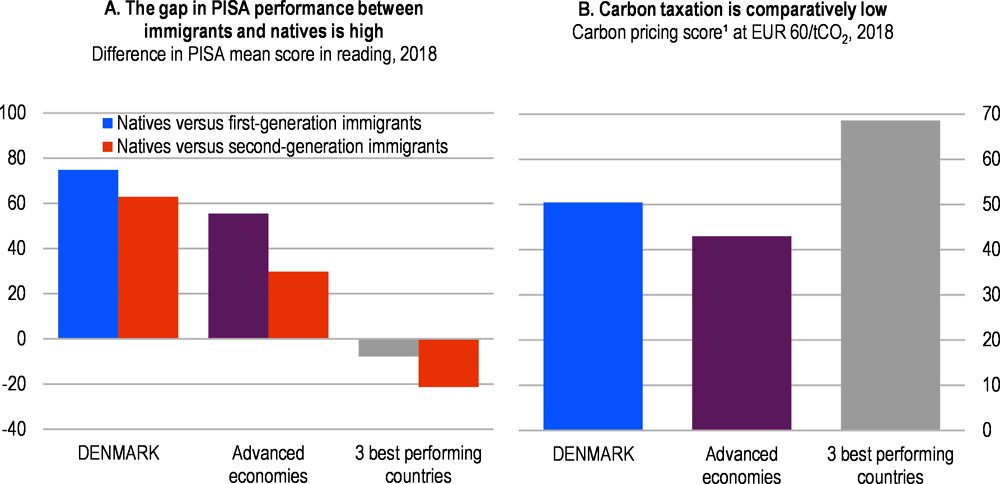

Denmark: Vulnerabilities and areas for reform

1. The carbon pricing score (1- carbon pricing gap) shows how close countries are to pricing carbon in line with carbon costs. EUR 60 is a midpoint estimate for carbon costs in 2020, a low-end estimate for 2030. Pricing all emissions at least at EUR 60 in 2020 shows that a country is on a good track to reach the goals of the Paris Agreement to decarbonise by mid-century economically.

Source: Panel A: OECD, PISA Database; Panel B: OECD, Effective Carbon Rates 2021 Database.

A large gap in employment rates between foreign-born and natives persists. Differences in achievement start early in life with sizeable PISA performance gaps between foreign-born and natives and the second-highest school segregation of immigrant students across OECD countries (Panel A). A broad integration strategy in the education system to address school segregation and performance gaps should be implemented. Many of the foreign-born, often with low levels of education, work in the hospitality and service sector, which was badly affected by the impact of the pandemic. Sustaining high inclusion requires improved integration of refugees and migrants. Their labour market participation is unequal across municipalities and not linked to differences in local spending on integration policies. Spreading best practices in integration policy could reduce differences and help to mitigate scarring effects from the COVID-19 crisis.

The economic recovery presents an opportunity to accelerate progress towards ambitious policy goals. Addressing climate change cost-efficiently requires consistency across policy tools while taking into account risks of carbon leakage. Effective carbon pricing in Denmark is low and unequal across sectors and energy sources, while a high content of imported biomass poses challenges for the sustainability of renewables (Panel B). Carbon taxes should be increased and harmonised, while working towards technology-neutral taxes and subsidies for renewables. Adverse distributional consequences need to be avoided through offsetting transfers or reductions in regressive taxes.

Denmark: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Housing: Reduce distortions in the housing market |

|

|

☑ In 2020 favourable tax conditions for parents to buy-to-let flats to their children were removed. ☑ In 2019 regulation of social housing was eased to facilitate public-private partnerships in the construction of new social housing. |

□ Deregulate the rental market by easing special rent regulation for flats in buildings constructed before 1990. □ Reduce housing subsidies and improve targeting to support a better use of the housing stock. |

|

Competition and regulation: Strengthen competition |

|

|

No action taken. |

□ Provide greater power to competition authorities to impose administrative fines and structural remedies within constitutional constraints. □ Develop clearer standards for exemptions from the Competition Act and involve competition authorities in their determination. |

|

Tax system: Shift the tax structure towards immovable capital |

|

|

No action taken. |

□ Reduce deductibility of mortgage interest expenses in personal income taxation and raise property and land tax rates. □ Reduce top marginal tax rates on labour and capital income. |

|

Education and skills and labour market: Improve integration of refugees and migrants |

|

|

☑ In 2019 the integration training programme for refugees and newly arrived family reunifications was improved and extended to 2022. |

□ Spread best integration practices across municipalities and strengthen co-ordination of services such as language training and subsidised work to ease integration. □ Implement a broad integration strategy in the education system to address school segregation and performance gaps to natives. |

|

*Environmental policy: Address climate change cost-efficiently* |

|

|

*New priority * |

□ Implement the most cost-efficient emission reductions, taking into account implications for global emissions. □ Harmonise and increase carbon taxation across all sources of greenhouse gas emissions. For sectors covered by the EU-ETS, provide a rebate equal to the permit price to avoid double taxation. Use transfers or tax cuts to avoid adverse distributional consequences. □ Implement planned measures to only credit sustainable biomass as emission neutral. Ensure that taxes and subsidies for renewables are technology- neutral. |

Recent progress on structural reforms

General elections in 2019 paused policy-making and resulted in a change of government, while the COVID-19 pandemic caused disruptions throughout 2020. Nonetheless, the structural reform effort continued with notable action in the following areas: a long-awaited revision of the transfer system to equalise revenues across municipalities, a primary school reform package and an early retirement scheme for people with reduced work capacities. The statutory pension age will increase to 69 years in 2035 and the early retirement age to 66 years in 2032.