The pandemic took a particularly heavy toll on young businesses and highlighted existing education inequalities. The recovery brings an opportunity to boost innovation and reallocation, necessary to face the challenges of digitalisation and meet climate change targets in a cost-efficient way. It also provides a chance to boost educational opportunities for disadvantaged students and refocus on improving the living standards of Indigenous communities.

Economic Policy Reforms 2021

Australia

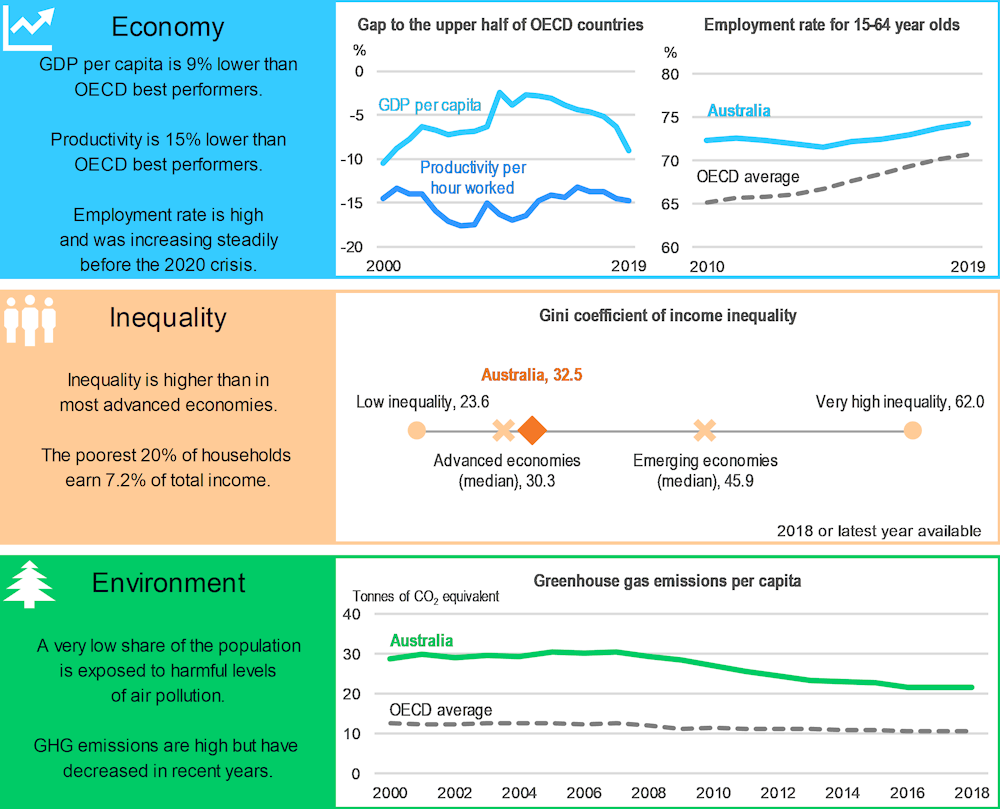

Australia: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

The recovery is an opportunity to address long-standing challenges of inclusiveness and sustainability

Business dynamism was on a decline going into the pandemic and, once COVID-19 hit, the employment losses were heaviest in young businesses. Improving business framework conditions and strengthening competition would benefit innovation and productivity growth. Legislating automatic mutual recognition of occupational licenses across jurisdictions would boost labour mobility, increasing opportunities for workers and competition by fostering reallocation of resources. Any future reform efforts to reduce the scope of occupational licensing more broadly could have the same effect. Continuing to adopt international product standards would reduce regulatory red tape, better allowing promising businesses to expand and reconfigure operations to seize new opportunities. Total gross domestic R&D spending and direct government funding of business R&D have been lagging behind OECD countries. Boosting direct business R&D funding and ensuring measures are designed to induce additional private R&D investment would elevate long-term potential growth. The environment for innovation can be further improved by strengthening university-business linkages.

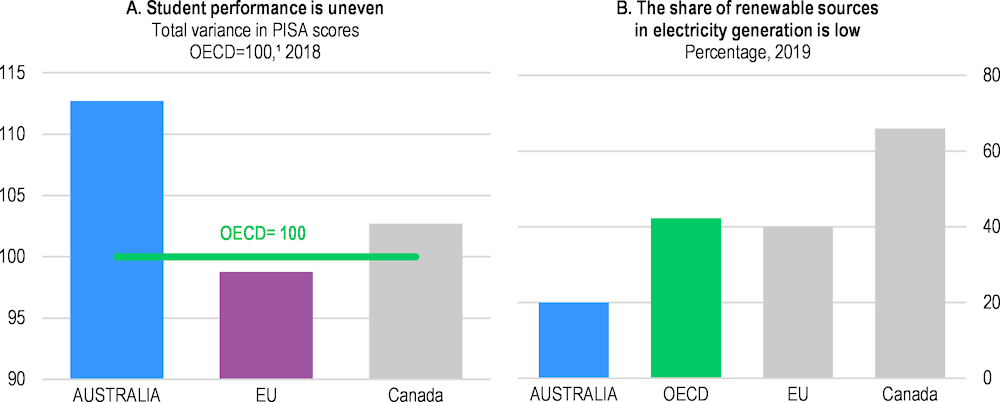

Educational attainment and student performance are high, however educational outcomes vary widely (Panel A), weighing on the equality of opportunities in the labour market. The pandemic resulted in remote learning that further exacerbated the existing disparities in student learning outcomes across socioeconomic groups. Improving the outcomes of disadvantaged students in schools and early childhood education will raise the future growth capacity of the economy and preserve inclusiveness. To support disadvantaged students, including those that live in remote areas, and prepare for advances in digitalisation, access to high-quality online courses and the use of Open Educational Resources need to be boosted. To help mitigate the adverse impact of educational disparities on employment and income prospects, better information on education choices, including through a single platform with career information, education pathways and employment outcomes, should be provided.

Australia: Vulnerabilities and areas for reform

1. The variance components in mathematics, science and reading were estimated for all students in participating countries with data on socio-economic background and study programmes. The variance in student performance is calculated as the square of the standard deviation of PISA scores in reading, mathematics and science for the students used in the analysis.

Source: Panel A: OECD, PISA Database; Panel B: International Energy Agency, Renewables Information 2019.

Severe drought and catastrophic bushfires emphasised the need to act on climate mitigation policies. Adopting and implementing an integrated national energy and climate policy framework for 2030 based on a low-emission development strategy for 2050 would help achieve the goals of the Paris Climate Agreement. There is ample room to boost the electrification of transport by improving the charging infrastructure and further increasing the share of renewable sources in electricity generation, partly through the use of market-based mechanisms (Panel B). Improving the monitoring of water resources, abstraction and quality across river basins and addressing water pollution from agriculture will help achieve the right balance between environmental and consumptive uses of water.

Shifting the tax mix away from heavy taxation of incomes to consumption and land taxes would further enable the necessary labour mobility amid the pandemic and boost growth. Moving away from taxes on property transactions, such as stamp duty, and replacing them gradually with a recurrent land tax would reduce pro-cyclicality of state budgets. The high corporate tax rates for large businesses should be aligned with those on SMEs since a two-rate system risks distorting how firms are structured and how they behave around the threshold between the two rates. Once the recovery is firmly in place, there is scope to increase the Goods and Services Tax, while offsetting the regressive impacts for low-income households.

Well-being gaps between Indigenous communities and the rest of the population remain large, notably in educational attainment, life expectancy and employment rates. Giving Indigenous communities a greater role in policy design and implementation and introducing a whole-of-government evaluation strategy for policies affecting these communities would make growth more inclusive. Ensuring a greater role and autonomy in policy design by Indigenous communities could particularly spur growth potential in rural areas that are populated with younger Indigenous populations. Policy evaluation would be enhanced by increased capacity to collect statistics on Indigenous business and economic development issues.

Australia: Summary of Going for Growth and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Competition and regulation: Boosting productivity growth requires attention to the framework conditions in which businesses operate |

|

|

☑ The government proposed to automatically recognise occupational licenses across regions in 2020, subject to legislation by individual jurisdictions. ☑ The government introduced reforms in 2020 that will streamline and digitise a range of regulatory procedures to reduce red tape and make liquidation for small businesses less costly and more debtor-friendly. ☑ The government has increased the refundable R&D tax offset in 2020. ☑ The government reserved medium-term funding in 2020 to create a Strategic University Reform Fund which will help universities align their innovative reform projects with priority areas as defined by their local communities. |

□ Legislate automatic mutual recognition of occupational licenses across jurisdictions. □ Continue to adopt international product standards more widely to reduce red tape. □ Boost direct business R&D funding and design measures to induce additional private R&D investment. □ Strengthen university-business linkages to improve the environment for innovation. |

|

Education and skills: Inequality in education and the level of skills limit the growth capacity of the economy |

|

|

☑ The recovery from COVID-19 measures ramped up spending in 2020 to boost programmes that improve the educational outcomes of disadvantaged students and school leavers. ☑ The government has supported the delivery of 50 000 higher education short courses in 2020 to reskill and upskill workers for enhanced labour reallocation. |

□ Implement education programmes that are targeted at making up for the pandemic-induced losses in learning hours of disadvantaged students in schools and early childhood education. □ Boost disadvantaged students’ access to high-quality online courses and Open Educational Resources, including those that live in remote areas. □ Provide better information for education choices. This should include a single platform with career information, education pathways and employment outcomes. |

|

Environmental policy: Limited co-ordination of greenhouse-gas reduction measures across states and territories make it difficult to achieve the Paris Climate Agreement goals |

|

|

☑ The Western Australian Government issued the environmental approval for the first stage of The Asian Renewable Energy Hub project, which will be the world’s largest solar and wind farm. ☑ The government released the Technology Investment Roadmap in 2020, which includes co-investment to help develop a range of low emission technologies. ☑ Electric vehicle charging infrastructure has been highlighted as a priority in the Future Fuels Strategy currently being developed by the government. ☑ The government has increased investment in 2020 to improve the Murray-Darling Basin’s river health. The allocated funds will also be used in the creation of a new Inspector-General of Water Compliance. |

□ Adopt and implement an integrated national energy and climate policy framework for 2030 based on a low-emission development strategy for 2050, in line with the Paris Agreement objective. □ Continue to increase the share of renewable sources in electricity generation, partly through the use of market based mechanisms. □ Boost the electrification of transport by improving the charging infrastructure. □ Improve the monitoring of water resources, abstraction and quality across river basins and address water pollution from agriculture. |

|

Tax system: Comparatively heavy taxation on incomes relative to consumption makes the tax mix less growth-friendly |

|

|

☑ The government reduced household and business income taxes in 2020 as part of the COVID-19 response package. ☑ The government of New South Wales has proposed to replace stamp duty with annual property taxes. |

□ Reduce corporate tax rates for large businesses to align them with those on SMEs. □ Once the recovery is underway, gradually increase the Goods and Services Tax rate. □ Replace stamp duty with a recurrent land tax. |

|

Inclusiveness: Well-being gaps between Indigenous communities and the rest of the population remain large, notably in educational attainment, life expectancy and employment rates. |

|

|

☑ The Australian Productivity Commission appointed an Indigenous Policy Evaluation Commissioner in 2020. ☑ The Australian Productivity Commission published a draft report in 2020 detailing a whole-of-government evaluation strategy for policies related to reducing well-being gaps of Indigenous communities. ☑ The government has committed to embedding formal partnerships and shared decision making with Aboriginal and Torres Strait Islander people as a priority reform as part of the National Agreement on Closing the Gap. |

□ Give Indigenous communities a greater role in policy design and implementation. □ Introduce a whole-of-government evaluation strategy for policies affecting Indigenous communities. □ Increase statistical capacity to collect evidence on Indigenous business and economic development issues. |

Recent progress on structural reforms

Recent progress has been particularly visible in reforms favouring conditions for doing business and aiming at boosting productivity growth. The government has reformed the insolvency framework, introducing a debtor-friendly, lower cost and faster liquidation model for small businesses in January 2021. There has been some progress in reducing red tape. The government’s post-pandemic recovery plan in October 2020 included welcome elements to streamline and digitise a range of regulatory procedures and improve framework conditions for businesses. The recovery plan also proposes to automatically recognise occupational licenses across jurisdictions to enhance labour mobility. Partly to promote environmental priorities, the federal government recently granted the Asian Renewable Energy Hub a “major project” status and the local government of Western Australia granted environmental clearance to it. The project will constitute the largest solar and wind farm in the world aiming to produce green hydrogen. On Indigenous issues, the Australian Productivity Commission appointed an Indigenous Policy Evaluation Commissioner and published a draft report in May 2020 detailing a whole-of-government evaluation strategy for policies related to reducing well-being gaps of Indigenous communities.