Germany faces two major transitions in the medium term. The COVID-19 crisis is likely to accelerate digitalisation with new business models and increases in demand for teleworking, telehealth services and remote learning. The energy transition requires changes in behaviour, consumption and production. In order to face these challenges while supporting the recovery, Germany needs to boost investment in infrastructure and knowledge-based capital, revive business dynamics and address skills bottlenecks.

Economic Policy Reforms 2021

Germany

Germany: Performance prior to the COVID-19 crisis

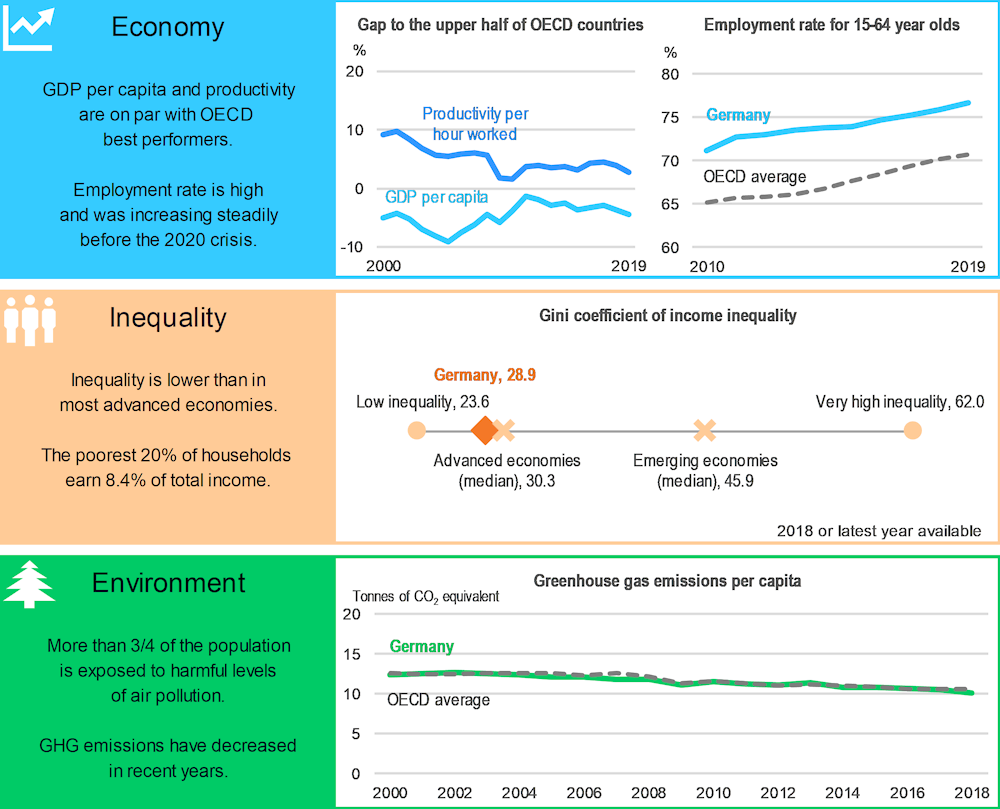

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

Recovery policies to foster a digital and green transition

Germany lags in infrastructure investment. Mobile and fixed broadband connection speed, crucial for the digital transformation, trails behind leading countries due to few fibre connections and slow performance in small and rural municipalities. The phase out of fossil-based heating and electricity generation and a more rapid move to low-emission transport also suffers from infrastructure bottlenecks. Boosting infrastructure investment would help with these two key structural challenges while supporting short-term demand in the recovery phase. This requires streamlining infrastructure planning processes, shortening approval times and improving public procurement through better data collection and compilation. Increased financial support for good municipal investment projects, accelerated disbursement of public funding for broadband infrastructure and strengthening administrative capacity through inter-municipal cooperation, training and expanding staffing in key technical roles would reduce constraints to infrastructure delivery.

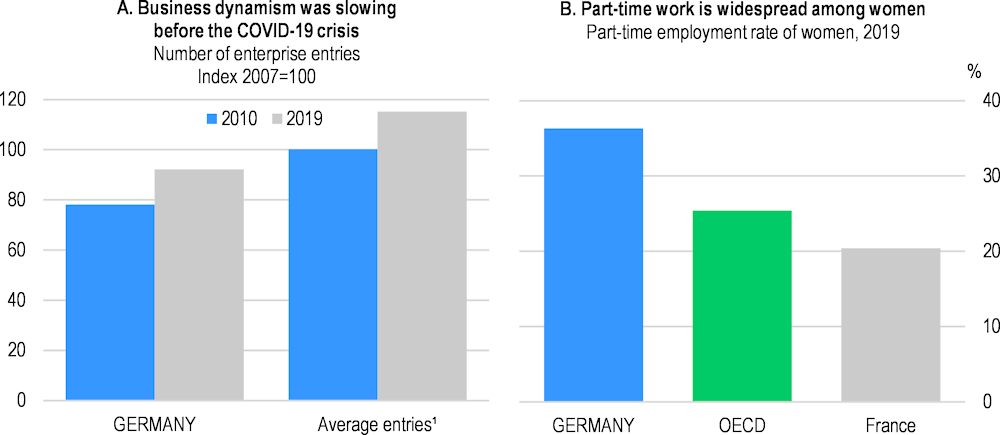

At the same time, low levels and sluggish growth of investment in knowledge-based capital undermine the innovation potential of German firms. Business dynamism has fallen over the past decade, with a decline in new business starts (Panel A). In order to unleash the potential of German firms, barriers to firm entry and growth in expanding industries need to be removed. Occupational entry requirements affect a significant share of the workforce and can slow employment transitions, and hence should be reformed, though caution needs to be taken to prioritise reforms where this will not excessively reduce incentives to acquire skills through vocational education in particular. Increasing access to later-stage venture capital, increasing the cap on R&D tax incentives, scaling up programmes to support investment in digital services and promoting strategic digital security risk management can contribute to knowledge-based capital investment and business dynamism, in particular in digital activities.

Germany: Vulnerabilities and areas for reform

1. Average entries of fifteen OECD countries.

Source: Panel A: OECD, Enterprise Statistics Database; Panel B: OECD, Labour Market Statistics Database.

The use of ICT in schools lags behind most OECD countries and computational thinking and programming skills have much scope to improve. To achieve a successful digital transformation, limit negative job market effects and help people make the most out of new opportunities, it is critical to strengthen skills to cope with technological change. Introducing computational thinking earlier in schools can improve problem solving and digital competencies, with particular benefits for girls. Germany also needs to improve the skills of teachers to use digital technologies and invest in the roll out of digital technologies in schools. Further support for life-long learning and recognition of skills is particularly important to help low-skilled adults adjust to the changing labour market.

The success of the digital and green transformations will hinge on their inclusiveness. For women, improved work incentives and more flexible working hours would enable better use of skills and contribute to career development after having children (Panel B). Reducing tax wedges on labour income and shifting taxation towards less distortive taxes would improve work incentives and increase the efficiency of the tax system, while increasing environmental taxes can provide incentives for the private sector to accelerate the green transition. Such increases need to be prepared and communicated in advance and the roll out of tax increases beyond those already determined should wait until the recovery is sufficiently strong.

Germany: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Infrastructure: Boost infrastructure investment |

|

|

☑ Additional investment in high-speed broadband networks and low-emission transport infrastructure, including as part of the June 2020 recovery package. |

□ Streamline infrastructure planning processes (including access to rights of way for communications infrastructure) and improve public procurement through better data collection and compilation □ Provide more financial support for good municipal investment projects. □ Strengthen local administrative capacity through inter-municipal cooperation, training and expanding staffing in key technical roles □ Improve housing supply in dynamic cities by fostering densification in urban areas, reducing stringency of rent control and increasing social housing investment. |

|

Competition and regulation: Promote reallocation by removing barriers to firm growth and incentivising investment in expanding industries |

|

|

☑ The debt relief process for personal bankruptcy will be shortened to three years from 2020. ☑ R&D tax incentive introduced in 2020, with a cap of EUR 2 million per year expanded to EUR 4 million until 2025. |

□ Liberalise occupational entry conditions while preserving the strengths of the vocational education and training system. □ Scale up public support for later-stage venture capital, without increasing complexity. □ Improve conditions for investment in knowledge-based capital, including by reviewing the cap for R&D tax incentives. |

|

Education and skills: Strengthen skills to cope with technological change |

|

|

☑ National Skills Strategy introduced in 2019 aligns programmes with market needs, improves training statistics, quality assurance, recognition of skills and counselling services, and expands training opportunities for individuals whose jobs are affected by structural change. ☑ Acceleration of investment program to extend full day primary education from 2020. |

□ Strengthen general education within vocational schools while maintaining the strong labour market orientation of vocational education and training. □ Offer more training programmes for the modular acquisition of qualifications in lifelong learning and foster the recognition of skills acquired on-the-job. □ Increase ICT training for teachers to ensure effective use of ICTs. □ Introduce computational thinking earlier and avoid gender stereotypes in education and career guidance. □ Raise quality standards in childcare and early childhood education while further expanding availability and flexibility of care. |

|

Labour market: Make it easier for parents to choose flexible working hours |

|

|

☑ Additional funding of over EUR 5 billion for 2020 to 2022 for measures to improve childcare quality, reduce fees, and adapt to local needs, as well as capacity expansion in kindergartens, day-care centres and crèches. |

□ Further lower the tax burden on the wage income of second earners. □ Increase the minimum amount of time, from the current two months, that the second parent has to take parental leave for the couple to receive the maximum leave entitlement. □ Strengthen legal rights to flexible working hours for all employees, including teleworking where possible. |

|

Tax system: Reduce tax wedges on labour income and shift taxation towards less distortive taxes |

|

|

☑ Introduction of carbon pricing in transport and heating from 2021. ☑ Real estate tax valuations to be updated by 2025. ☑ A ceiling for social security contributions (40% of wage) introduced in 2020 and 2021. |

□ Lower social security contributions, especially for low-wage workers. □ Remove inheritance and capital income tax exemptions. □ Raise the tax rates applying to household capital income towards marginal income tax rates applying to other income sources. □ Introduce taxation of NOx emissions. □ Make emissions pricing more consistent across sectors and fuels while ramping up prices. |

Recent progress on structural reforms

The government’s response to the coronavirus pandemic focused first on protecting health, jobs and firms, followed by measures to support consumption and boost public and private investment in digitalisation, education, health, public transport and green energy. The latter included important reforms to improve the debt relief process after bankruptcy and expand support for research and development. There has been progress on reducing labour income taxation and increasing environmental taxation, but labour tax wedges remain high by OECD comparison.