A strong, resilient and inclusive recovery from the COVID-19 crisis requires improving productivity growth, by boosting digitalisation, innovation, and investment in intangible capital, as well as creating high-quality jobs, by addressing structural problems in labour markets. The pandemic’s implications reinforced long-standing vulnerabilities of the Spanish economy: a labour market characterised by high unemployment, insufficient skills, large regional variation and a large share of workers on non-regular contracts.

Economic Policy Reforms 2021

Spain

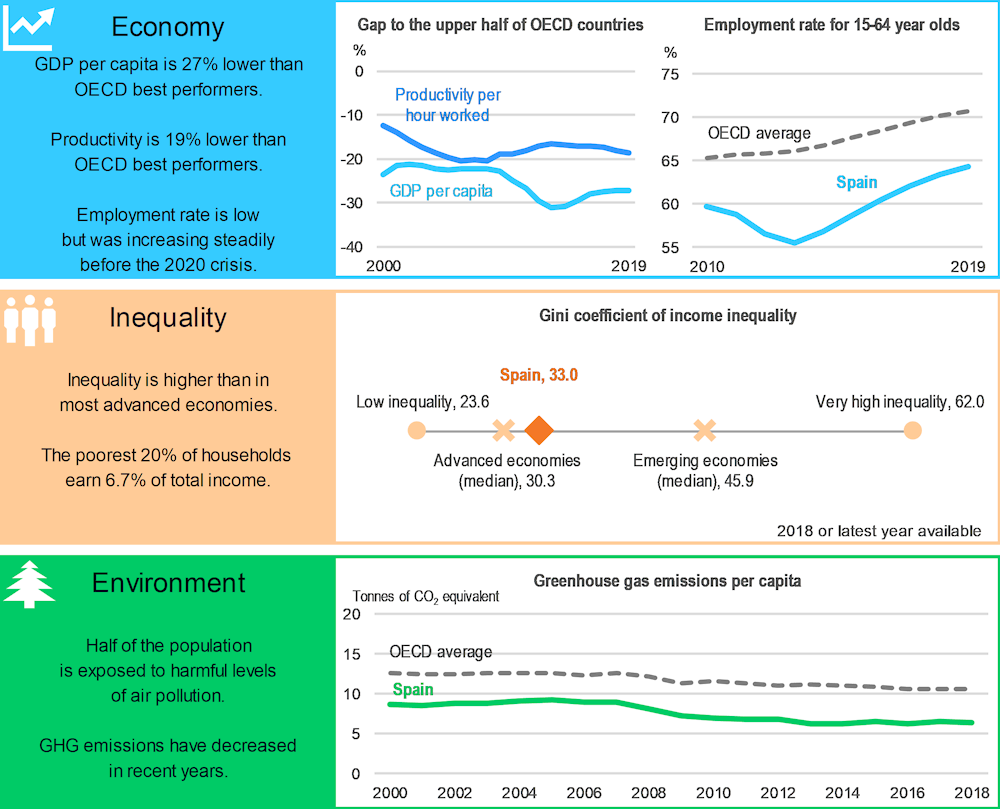

Spain: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

Creating job opportunities and helping workers take advantage of them

Regional regulatory differences pose barriers to achieving a truly single market and slow down firm growth, hindering productivity and job creation. The top policy priority should be removing such barriers to firm growth, notably by the implementation of the Market Unity Law, and increasing awareness about the law among firms. To this end, cooperation and coordination across different levels of government have to improve, which will also help with swift absorption of the EU Next Generation Funds to support the recovery. Out-of-court restructuring proceedings, especially for small and medium-sized enterprises, should be introduced to facilitate restructuring.

Spain is lagging on the uptake and use of digital technologies. Higher innovation capacity can be built by strengthening the ex-post evaluation of innovation policies and taking them into account for the renewal of grants. Further increasing coordination of regional and national innovation policies, for example by strengthening the role of the R&D Public Policy Network, will avoid duplication of activities. To boost basic research quality, universities’ competitive funding based on performance should increase. This can help to align their strategies to labour market needs, in particular ICT skills. Partnerships between firms and research institutes can enhance the innovation capacity of SMEs. Implementing fully the newly developed plans to digitise the public administration will also help in this respect.

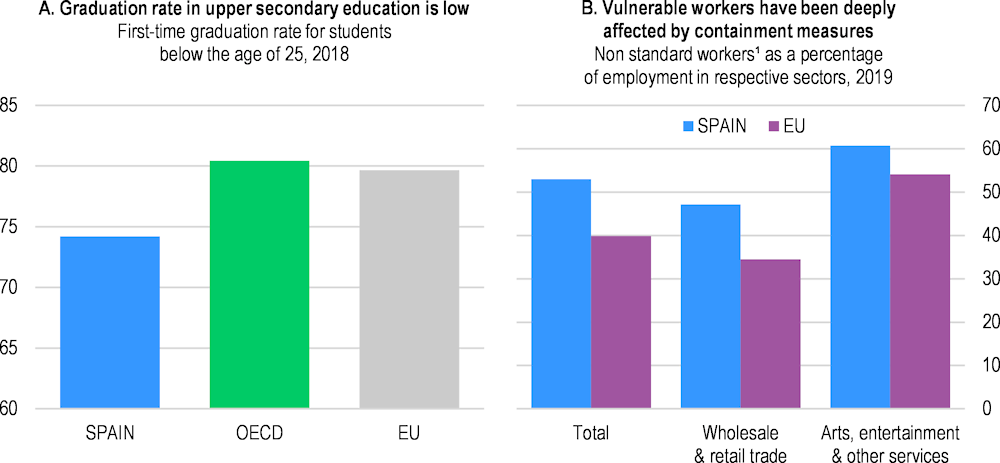

The changing nature of work, including due to the COVID-19 crisis, higher-quality jobs and faster productivity growth require a skilled labour force. However, skill proficiency is low and skill mismatch is high in Spain. High rates of early school drop-out and grade repetition need to be reduced to improve basic skills (Panel A). A modernisation of vocational education and training can contribute to aligning education to labour market needs and reducing existing skill mismatches. Key areas to be addressed are improvements in the university education and on-the-job training of teachers, and effective implementation of the 2020 Modernisation Plan for Vocational Training, in particular by promoting cooperation with firms to help identify skill needs as well as place vocational education students in firms.

Spain: Vulnerabilities and areas for reform

1. Non-standard workers refer to self-employed, workers in temporary contracts and in part-time jobs.

Source: Panel A: OECD, Education at a Glance Database; Panel B: OECD calculations based on European Union Labour Force Survey Database.

Non-standard (e.g. temporary) and low-skilled workers have been affected disproportionately by the COVID-19 crisis as they tend to be more concentrated in the worse-hit sectors (tourism, hospitality) and in certain parts of the country (Panel B). Reforms to boost job creation need to be accompanied by improvements in the efficiency of active labour market policies and, once the recovery is firmly in place, by measures to reduce the use of temporary contracts. Increasing the allocation of active labour market policies spending towards training and raising the quality of training and its connection to the labour market by increasing the coordinating role of public employment services with employers and training providers is key. Lack of integrated support for jobseekers lowers the effectiveness of social and labour market policies, so a single contact point for social and employment services should be introduced. Developing public job training programmes targeted to low-skilled and older workers for specific purposes, such as promoting ICT skills, can enable the upskilling of workers.

In the medium term, a more effective tax system could lower inequalities, curb pollution and emissions and provide financing for reforms in labour markets, education and innovation. However, any tax increases should be implemented only once the recovery is firmly underway, and may need to be accompanied by targeted, time-limited compensatory measures for the most vulnerable households.

Spain: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Competition and regulation: Eliminate regulatory barriers that depend on the size of firms and barriers to operating across regions |

|

|

☑ In 2019-20, measures were taken to improve the implementation of the Market Unity Law, including training of officials, awareness campaigns and improved cooperation between national, regional and local authorities. |

□ Eliminate the existing regulations that depend on the size of firms. □ Continue to implement the Market Unity Law, increase its transparency, and increase cooperation across different levels of government for its effective implementation. □ Improve the functioning and governance of bodies related to professional services. |

|

R&D and digitalisation: Increase R&D spending to boost innovation and productivity growth |

|

|

☑ The Cervera Program that promotes technology transfer, cooperation between different agents linked to R&D and evaluation criteria was launched. ☑ The R&D Public Policy Network published guidance on monitoring and evaluation of smart specialisation of regions. ☑ University Sexennium on Knowledge Transfer was created to promote scientific transfer among university teachers. ☑ Strategy on Science, Technology and Innovation 2021-2027 were introduced to consolidate and reinforce the science, technology and innovation system in all fields, including digital technologies. ☑ National Plan for Digitalisation of Public Administration was introduced in 2021. |

□ Promote the ex-post evaluation of R&D grants and loans and take them into account for the renewal of grants. □ Give the R&D Public Policy Network a strong mandate to further increase coordination of regional and national innovation policies to avoid duplication. □ Strengthen Technology Centres capacity to effectively conduct R&D through partnerships between firms, especially SMEs, and research institutes. □ Enhance incentive mechanisms by increasing universities’ competitive funding based on performance, which can help align their strategies to labour market needs, in particular, ICT skills. □ Fully roll out the National Plan for Digitalisation of Public Administration. |

|

Education and skills: Improve basic skills and align them with labour market needs |

|

|

☑ The new education law (LOMLOE) includes measures to reduce school segregation and limit grade repetition. ☑ In response to the online teaching needs created by COVID-19, teacher training courses on distance teaching were reinforced in 2020. ☑ Individualised support was improved in the context of the Program for Guidance and Reinforcement for the Advancement and Support in Education in 2019 and -the Program for Educational Guidance, Progress and Enrichment in 2020. ☑ Modernisation Plan for Vocational Training was adopted in 2020. It includes the introduction of a single vocational training system integrating the existing two systems (educational and vocational training for employment) under single authority. ☑ National Plan for Digital Skills, a broad plan to improve digital skills and the digital transformation of education, was adopted in 2021. |

□ Strengthen the content and links to career development of further training of teachers. □ Increase individualised support to students at the risk of failing at an early stage. □ Ensure an effective implementation of the plan for the modernisation of vocational education and training (VET). Promote co-operation with firms, by developing such initiatives as Centres of Vocational Excellence, to help identify skill needs and place VET students in firms. |

|

Labour market: Improve activation policies and reduce the use of temporary contracts |

|

|

☑ In 2019, several working groups and pilot projects were created to enhance coordination between social and employment services. The deployment of the “social card”, which includes all non-contributory benefits received regardless of its source (national, regional or local) continued in 2019. In 2021, the resources allocated to active labour market policies was increased by 30%, with a focus to increase training for digital skills. ☑ Capacity of labour inspectorates was strengthened under the Master Plan for Decent Work in 2019. |

□ Increase spending on training in active labour market policies and improve the quality of training courses. □ Introduce a single point of contact for social and employment services. □ Shift job training subsidies to individuals at least partially, or develop public job training programmes targeted to low-skilled and older workers for specific purposes, such as promoting ICT skills. □ Continue efforts to fight against the abuse of temporary contracts. □ Target existing hiring incentives to specific vulnerable groups and link them to training programmes. Simplify the menu of contracts firms can choose from. |

|

Tax system: Improve the effectiveness of the tax system |

|

|

☑ In 2020, a spending review on tax benefits identified areas for tax reform. ☑ In 2021, the VAT on sweetened beverages was raised, a financial transaction tax and a tax on digital services were introduced. |

□ Broaden the tax base by narrowing exemptions to income taxes. □ Limit the use of reduced VAT rates and exemptions over the medium term. □ Over the medium term, increase taxation of fuels to better reflect emissions of CO2, together with redistribution towards poorer households. |

Recent progress on structural reforms

Following a wide-ranging agenda of important structural reforms between 2012 and 2015, successive minority governments have slowed down the pace of reform. However, in response to the COVID-19 crisis, a number of measures have been taken, including those to improve digitalisation in education and the resources of public employment services. In addition, the introduction of the minimum income guarantee scheme was brought forward to May 2020 to address imminent crisis-related challenges. The National Recovery Plan 2021-23, based on the use of the Next Generation EU Funds, outlines an ambitious reform agenda.