The crisis laid bare high poverty rates and a relatively weak labour market integration of less-skilled workers, heightening the need to tackle these long-standing problems to protect vulnerable groups more effectively.

Economic Policy Reforms 2021

Lithuania

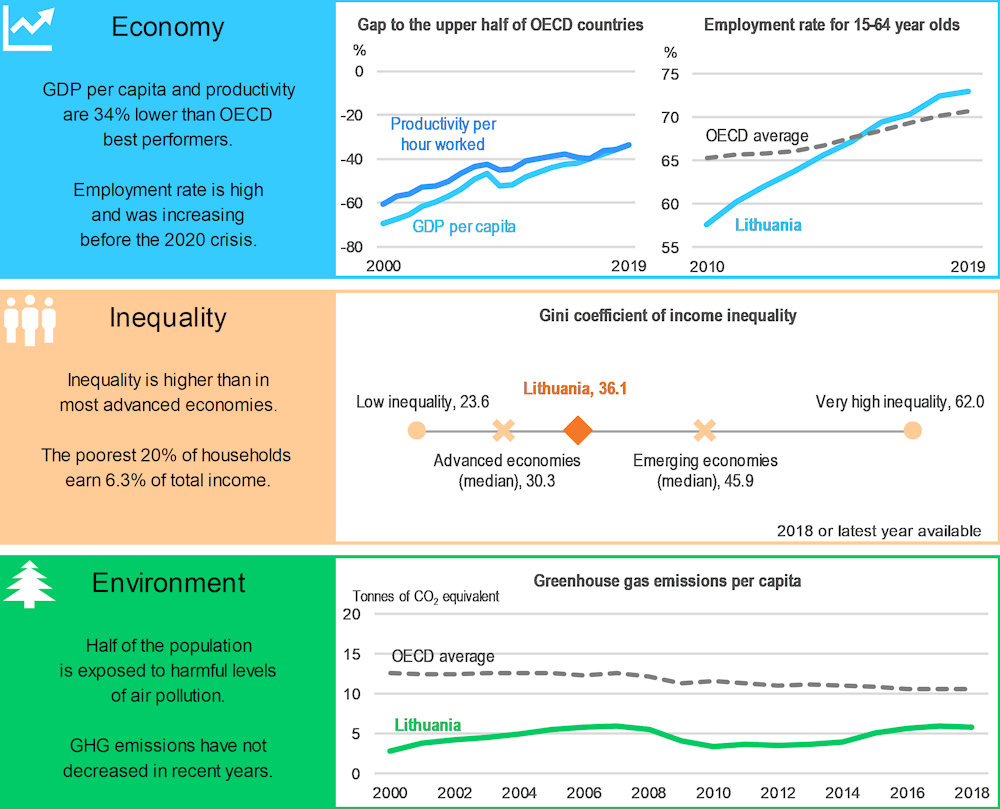

Lithuania: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

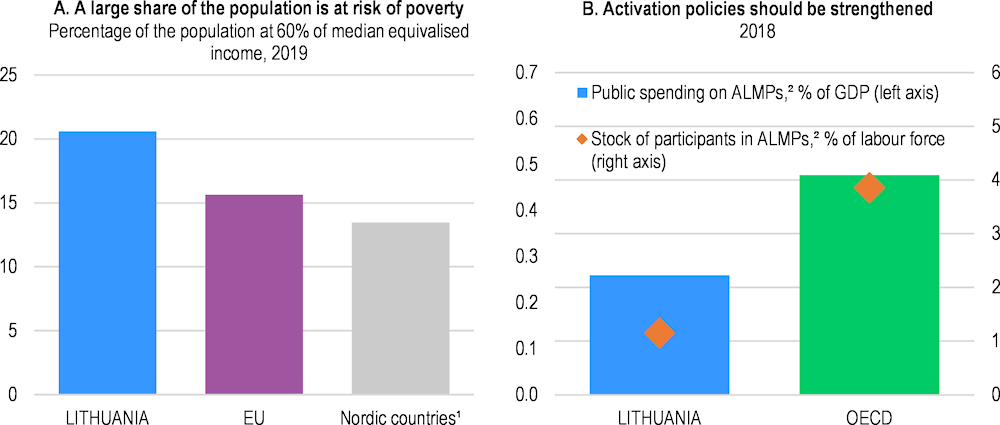

Bolstering social safety net and skills to address future challenges

Over 20% of the population lives below the poverty threshold and groups such as the elderly, disabled, lone parents, and the unemployed are particularly affected (Panel A). Further increases and better tailoring of social support to individuals’ needs are necessary. The adequacy of social benefits should be strengthened, while maintaining work incentives, and an individualised approach to the provision of benefits and social services needs to be developed. This is essential to cushion the impact of the pandemic and better address the needs of the vulnerable groups, reducing deficits in important areas such as child care, long-term care and social housing. At the same time, to improve the labour market integration of less skilled workers, the tax wedge needs to be lowered further and activation policies strengthened. As spending and participation are low, the effectiveness of active labour market programmes remains limited (Panel B). Activation policies should be increased, upon a close monitoring of programme outcomes, with additional emphasis on funding for training to help labour reallocation and recovery.

Lithuania: Vulnerabilities and areas for reform

1. Average of Denmark, Finland, Norway and Sweden.

2. ALMPs refer to active labour market policies.

Source: Panel A: Eurostat, based on EU-SILC data; Panel B: OECD, Labour Market Programmes Database.

While the pandemic is likely to have temporarily alleviated skills mismatch pressures in the labour market, the challenge of ensuring job-relevant skills to raise productivity and adjust to the post-crisis era remains. Recent reforms of higher education funding should be followed by strengthening the competencies of teachers in the vocational education and training (VET), including through improving the quality of cooperation between companies and VET instistutions. The length of apprenticeships regulated by the Labour Code should be linked to the level of acquired competences. Firms' participation in training provision can be encouraged by widening the financial support options for companies. Recent reforms to improve the collaboration between the business and research sectors on innovation are welcome and need to continue to enhance knowledge diffusion. To compete in international markets, Lithuanian firms need to build higher innovation capacity. Streamlining of the innovation system, by consolidating agencies and programmes where overlaps exist, should continue. Increasing awareness of the tax incentives scheme and reducing its complexity can help to improve its take-up.

The scope of state-owned enterprises (SOE) remains comparatively large and governance should improve further, as highlighted by the fact that only half of the SOEs met their financial targets in 2018. To this end, the government should press on with implementing the Reorganisation and optimisation plan.

Lithuania: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

*Social protection: Reduce high poverty rates and increase social support to individuals according to needs* |

|

|

*New priority * |

□ Increase further the level of minimum-income benefits, while maintaining work incentives. □ Develop an individualised approach to the provision of social benefits and services. |

|

Labour market: Improve the labour market integration of less-skilled workers |

|

|

☑ A reform in labour taxation in 2019 lowered the tax wedge for low paid workers. ☑ The amount of in-work benefits increased in 2020 and differentiated according to the duration of payments. ☑ A job search benefit was introduced in 2020, as part of the crisis-related package, targeted to those not eligible for unemployment insurance benefit. ☑ A project underway strengthens the tool developed by the Public Employment Service to evaluate performance of activation programmes by adding job quality to the set of monitoring indicators. |

□ Lower further the tax wedge for low paid workers, bringing it closer to the OECD average, while ensuring that benefits are maintained. □ Increase investment in active labour market programmes, upon monitoring outcomes, with a focus on training. |

|

Education and skills: Reduce skills mismatch |

|

|

☑ The curricula of vocational education and training continue to be reformed. ☑ Since 2020, special grants are provided for students who chose programmes providing skills in demand, such as teacher training programmes. |

□ Strengthen vocational education and training by deepening the competencies of teachers, including though improving the quality of cooperation between companies and VET institutions. □ Link the length of apprenticeships regulated by the Labour Code to the level of acquired competences. |

|

R&D and digitalisation: Enhance innovation capacity |

|

|

☑ A new funding formula for research institutions was introduced in 2019 taking into account science-business collaboration and the activities related to international R&D programmes. ☑ Measures were taken in 2019 to improve co-ordination of the innovation policy. These include the creation of a Science, Technology, and Innovation Council and the gradual consolidation of business and innovation support agencies under a unified agency by end-2021. |

□ Make R&D tax incentives more effective by reducing the scheme's complexity and increasing its awareness among firms. □ Continue reforms towards strengthening business-research collaboration on innovation. □ Continue efforts towards improving the co-ordination in the innovation system through consolidating agencies and programmes where overlaps exist. |

|

*Competition and regulation: Strengthen the corporate governance of state owned enterprise* |

|

|

☑*New priority * |

□ Strengthen the corporate governance of state- owned enterprises. □ Proceed with the implementation of “State-Owned Enterprises Reorganisation and Optimisation Plan. |

Recent progress on structural reforms

The government is implementing a social agenda aiming to fight poverty and social exclusion. The COVID-19 crisis triggered additional (to a large extent temporary) measures to support the needy, along with initiatives to preserve jobs and incomes, maintain business liquidity and boost investment projects. The government has also embarked on reforms of innovation, introduced changes in 2019 in competition legislation, especially network industries, and adopted a new insolvency regime in 2020. The labour taxation reform of 2019 lowered the tax wedge for low-paid workers but it remains above the OECD average.

The state-supported income was indexed in 2019 to the amount of minimum consumption needs. A universal child benefit was introduced in 2018. The provision and access to social services were strengthened through the introduction in 2019 of a basic family service package, encompassing 14 types of services, and the exemption since mid-2020 of certain vulnerable social groups from co-payments for pharmaceutical and medical expenses.