To ensure a speedy recovery that benefits all, the improvement of the business environment and skills should be on top of the policy agenda. State-intervention and regulatory barriers hamper market entry and dampen productivity. Low graduation rates from tertiary education, weak vocational training outcomes and high drop-out rates lower employment prospects of young adults, who are at risk of long-term scarring given the impact of the pandemic on the labour market.

Economic Policy Reforms 2021

Hungary

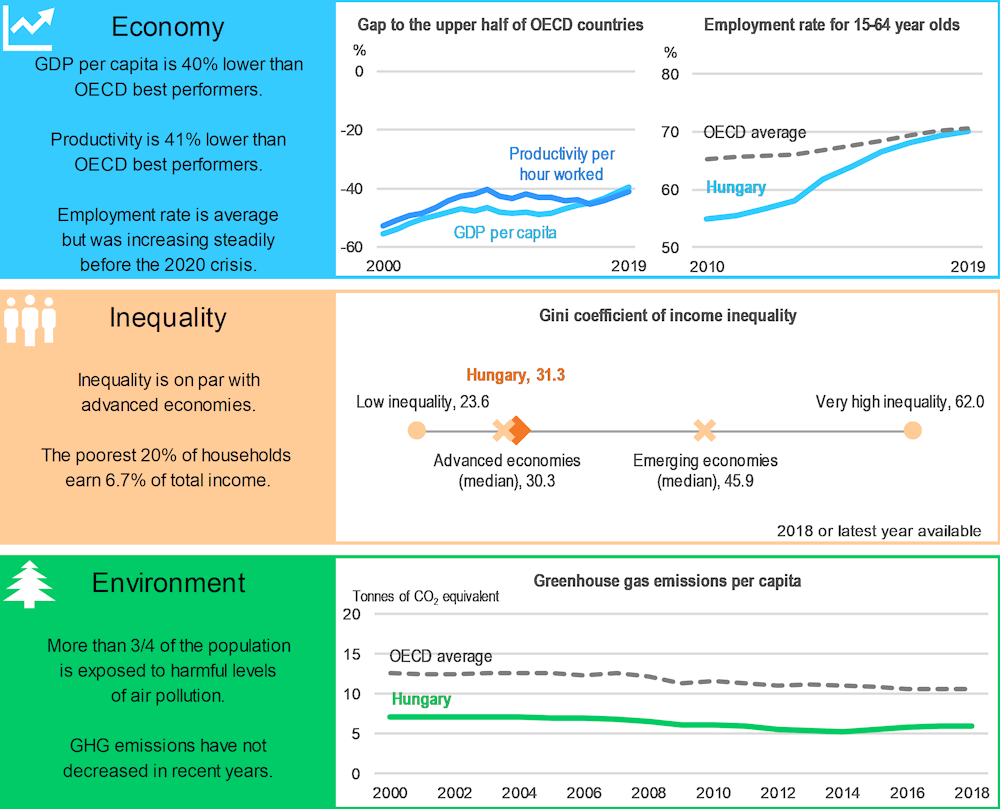

Hungary: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

Boosting business dynamics and skills

Reforms to strengthen product market competition should be a priority. State-intervention and regulatory barriers hamper market entry and efficient reallocation of resources in service and network sectors. The competition authority needs more powers to reduce barriers to competition, and room remains to cut red tape further to improve the business environment. Streamlined insolvency procedures would facilitate market exit and support efficient reallocation of resources to the most productive companies during the recovery. Currently, all these barriers risk dampening productivity growth.

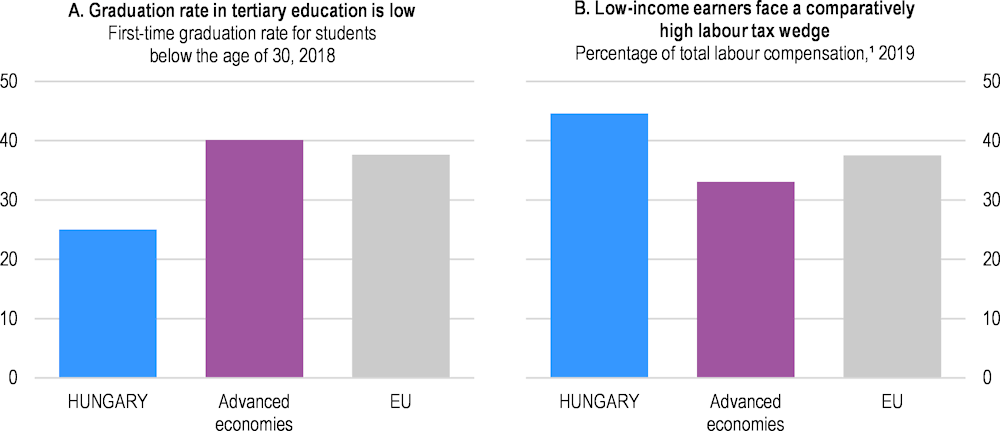

Reforms of the education system should continue to improve vocational training outcomes, reduce high drop-out rates and raise low tertiary graduation rates in order to improve employment prospects of the young (Panel A). An increase in the compulsory school-leaving age could enhance general skills and promote equity in outcomes. A continued roll-out of crèches and kindergarten in Roma communities is key to their better integration in early childhood education and care. To modernise the education system, digital skills and ICT use in school curricula should be enhanced. Moreover, training of the unemployed and low skilled workers needs to improve.

Unemployed and low-skilled workers have few incentives to enter employment or increase work efforts, as high income taxes erode their income gains (Panel B). Low-skilled persons from poor regions are particularly hard hit by long-term unemployment. Reforms of tax and social benefits can raise labour market participation, in particular of low-skilled workers, and lower inequalities. These measures should entail the adjustment of unemployment benefits to improve labour mobility, especially from poor regions into growing labour markets and a further lowering of the labour tax wedge. In addition, to improve labour market participation of mothers, the expansion of childcare facilities for children below the age of three should continue.

Hungary: Vulnerabilities and areas for reform

1. Average tax wedge for a single person without child, at 67% of average earnings. Labour taxes include personal income tax and employee plus employer social security contributions and any payroll tax less cash transfers.

Source: Panel A: OECD, Education at a Glance Database; Panel B: OECD, Taxing Wages Database.

Further pension reform is needed in light of the ageing of the Hungarian population and old-age poverty, where as much as a fifth of pensioners receive pension benefits below the poverty line. An adequate basic state pension could guarantee a minimum income for all pensioners. Linking the statutory retirement age to gains in life expectancy could improve fiscal sustainability.

Hungary: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Competition and regulation: Reduce barriers to entry and competition and streamline insolvency procedures |

|

|

☑ Some measures to simplify administrative procedures have been implemented in 2020, e.g. online tax invoicing. ☑ In 2020, the government launched a new online business portal for business. |

□ Implement regulatory impact assessments to ensure regulations do not unnecessarily hamper market entry and competition. □ The competition authority should systematically review all new legislation for barriers to competition. □ Increase transparency in public policy formulation. □ Insolvency procedures should be streamlined and effective reorganisation proceedings put in place; the time before formal closure should be reduced and market exit facilitated. |

|

Education and skills: Improve students’ educational outcomes and employability |

|

|

☑ A Digital Education Strategy for 2017-2020 has been adopted by the government to enhance digital literacy and usage, covering all levels of education from early education to adult learning. ☑ In 2020, the government introduced a 0% interest-bearing loan for adult learning and a student loan scheme with a 0% interest rate for university students. |

□ Integrate the use of ICT across most subject matters. □ Extend support to disadvantaged students in tertiary education. □ Extend the compulsory education age to enhance general skills and promote equity in outcomes. □ Continue better integrating Roma children in early childhood education and care. □ Allow vocational education and training schools greater freedom to specialise and adjust courses and curriculums to the needs of the local labour market. □ Increase upskilling of the unemployed and low skilled adults. |

|

Tax system: Adjust the tax-benefit system to strengthen work incentives for low-income earners |

|

|

☑ Social security contributions were reduced for employers between 2017 and 2020, taking the total reduction to 11.5 percentage points since 2016. ☑ Families with two children receive increased benefits from 2019. |

□ Continue to lower the tax wedge while increasing the reliance on consumption taxes by moving towards a single VAT rate; improve targeting of social transfers to help low-income households. □ Increase the reliance on road tolls and car taxes that take vehicles’ environmental performance into account; introduce congestion charges and strengthen public transport. |

|

Labour market: Improve participation of low-skilled workers and women |

|

|

☑ Spending on training and education programmes was increased for the period 2020-2022. ☑ Since 2018, NGOs cooperating with public employment services provide counselling and mentoring services for disadvantaged jobseekers to foster their re-entering into the labour market. ☑ The Family Protection Plan from 2019 expanded the availability of childcare facilities for children below the age of three further. |

□ Extend duration of unemployment benefits; provide geographical mobility support and expand activation programmes. □ Continue to reduce public work schemes and to enhance training of participants and other jobseekers in programmes that improve their employability. □ Enhance incentives for mothers to participate in the labour market in order to reduce the effective length of parental leave, while providing incentives for longer paternity leave. □ Continue to expand the availability of childcare facilities for children below the age of three. |

|

Social protection and labour market: Tackle old-age poverty and keep older workers in the labour market |

|

|

☑ The statutory retirement age will be gradually increased from 62 to 65 by 2022. ☑ From 2019 social contribution taxes are no longer charged for old-age pensioners who remain in the labour market, only the 15% personal income tax. Working retirees and their employers became exempt from social security contributions. |

□ Link increases of the statutory retirement age to gains in life expectancy. □ Introduce a basic state pension to guarantee a minimum income for all pensioners. |

Recent progress on structural reforms

The pace of structural reforms has slowed in 2020 as the COVID-19 crisis has demanded the government’s attention, making reforms all the more urgent. Progress in reducing overly burdensome product market regulations has been limited. Progress has been achieved with reforms of employers’ social security contributions, which saw a cut from 17.5 to 15.5% in 2020. Reforms to vocational training led to a stronger involvement of the private sector in developing curricula of vocational institutions with the aim to better matching skills with labour market needs. To improve labour market participation of mothers, the government expanded further the availability of childcare facilities for children below the age of three. Moreover, a pension reform is gradually increasing the statutory retirement age from 62 to 65 by 2022. Despite this progress, room remains to link the retirement age with gains in life expectancy and tackle old-age poverty.