The pandemic highlighted job insecurity of non-standard work contracts, which represent a considerable share of employment. To prevent a long-lasting impact on workers, the top policy priority should be to improve the targeting of active labour market policies. Increasing resilience and inclusiveness of the labour market will necessitate rebalancing the employment protection on various types of contracts in the longer term.

Economic Policy Reforms 2021

Netherlands

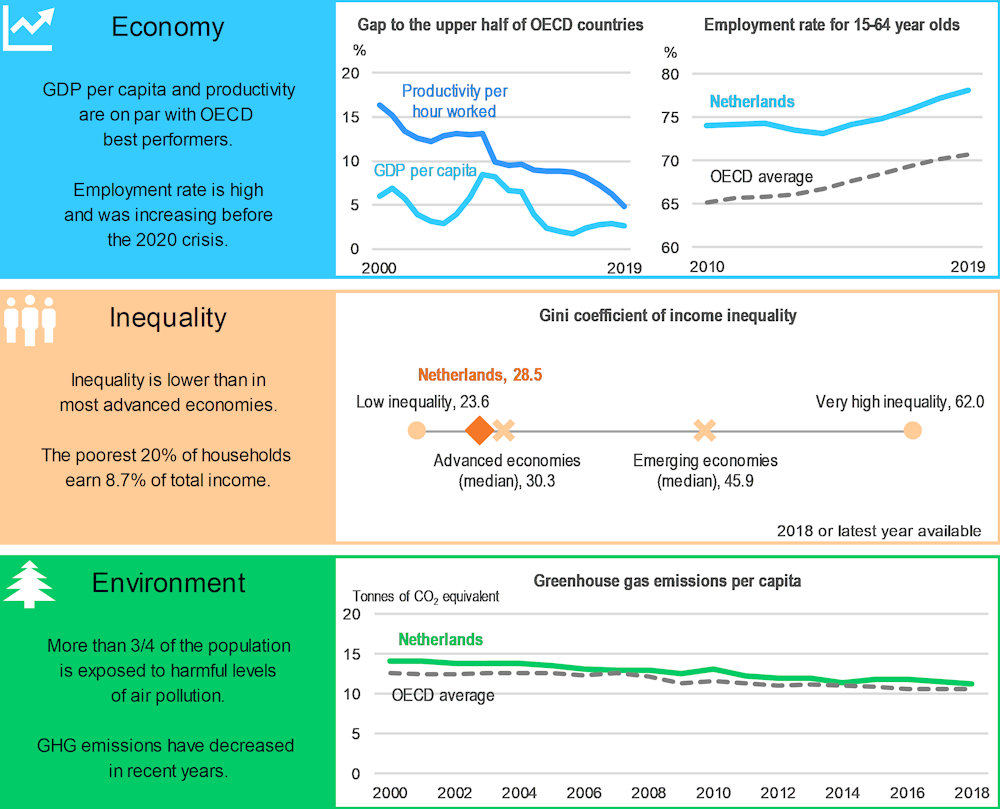

Netherlands: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality. The latest available data for the Netherlands is 2016.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

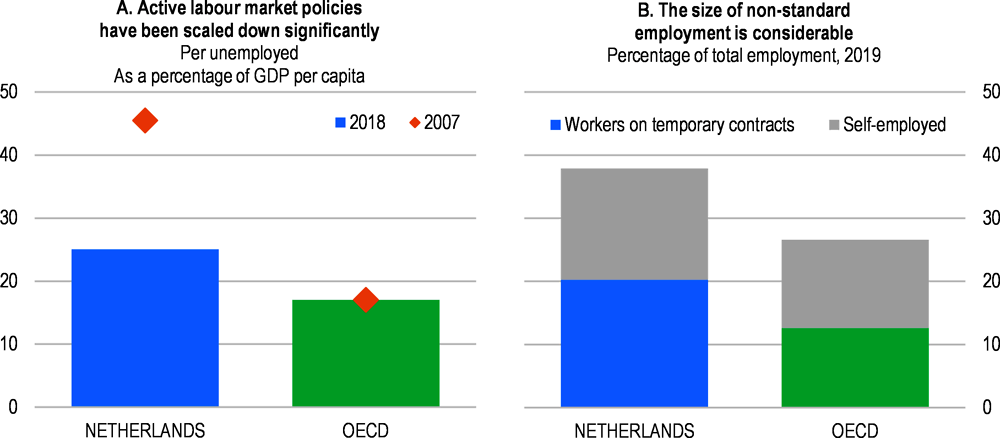

Improving resilience of the labour market

To facilitate reallocation from sectors hit hard by the pandemic but also to cope with skill-biased technological change, automation and digital advances in the longer term, targeting of active labour market policies should improve, focusing on low-skilled and disadvantaged workers, including individuals already in work who are less likely to receive training. Despite still being above OECD average, active labour market policies have been scaled down significantly (Panel A), which at the current juncture could be felt disproportionally by disadvantaged groups, who have greater difficulties finding work and have been hit hard by the pandemic.

Pre-existing structural challenges of the Dutch economy accentuated the impact of the pandemic: workers on temporary work contracts, contingent workers and freelancers have been affected disproportionally, exacerbating income inequalities (Panel B). Employment protection between different types of contracts should be rebalanced to encourage the use of permanent contracts. This can make growth and the labour market more inclusive and resilient. Such measures should align tax and social security contributions between contract types, create more flexibility for employers to adapt jobs, workplace and working hours of regular employees, lower further the cap on severance payments for regular workers and ensure that the dismissal system works efficiently. Such measures can lead to increased layoffs as well as hirings, so should be conditional on recovering labour market and coupled with efficient support of people moving in between jobs.

Netherlands: Vulnerabilities and areas for reform

Source: Panel A: OECD, Labour Market Programmes Database; Panel B: OECD, Labour Force Statistics and Economic Outlook Databases.

The current housing market may hinder labour mobility, in particular that of middle-income households – thereby slowing down the post-COVID-19 recovery, generating congestion and hampering productivity. To support the supply of market rental housing, the size of the regulated rental social housing sector should be reduced by abolishing the points system and targeting social housing to those most in need. Further reduction of tax subsidies on owner-occupied housing and moving towards tax neutrality between owner-occupied housing, rental housing and other wealth can free capital to more productive uses, curb housing price growth and boost the non-regulated rental sector.

Fiscal stimulus and investment programmes in response to the COVID-19 crisis should also focus on green transition. Further, proposed measures in the Climate Act (2019) should be fleshed out in detail and quickly advanced.

Netherlands: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Labour market: Strengthen ALMPs to provide workers with effective training and support their reallocation |

|

|

☑ Funding to municipalities to provide targeted activation and support programs has been bolstered. |

□ Target ALMPs, focusing on low-skilled and disadvantaged workers, including individuals already in work, who are less likely to receive training. □ Work towards a more co-ordinated approach in implementing activation policies across regions. |

|

Labour market: Reduce the use of temporary contracts and encourage the transition to permanent contracts |

|

|

☑ The Balanced Labour Market Act entered into force in January 2020, phasing out the permanent self-employment tax deduction and introducing a minimum coverage for disability insurance for all workers. |

□ Align taxes and social security contributions between contract types for workers doing similar jobs. □ Create more flexibility for employers to adapt jobs, workplace and working hours of regular employees. □ Continue lowering the cap on severance payments for regular workers and ensuring that the dismissal system works efficiently to encourage the use of permanent contracts. |

|

Housing: Support the supply of market rental housing |

|

|

☑ Starting 2021, municipalities will have more control over zoning and the planning of the private rental market. |

□ Reduce the size of the regulated rental social housing sector substantially by abolishing the points system and targeting social housing to those most in need. □ Separate the part of housing corporations dealing in the non-social housing sector into independent companies operating on market terms. |

|

Tax system and housing: Reduce tax subsidies on owner-occupied housing |

|

|

☑ The mortgage deduction rate is being reduced by 3 percentage points a year from 52% (2018) to reach 37% in 2023, but the effectiveness of the policy is dampened by a parallel reduction of imputed rents. |

□ Move towards tax neutrality between owner-occupied housing, rental housing and other wealth. □ The gradual reduction of the mortgage rate deductibility should be continued beyond current plans. |

|

*Environmental policy: Reduce exposure to air pollution* |

|

|

*New priority * |

□ In response to the COVID-19 crisis, focus on green recovery measures in the fiscal stimulus and investment programmes. □ Concretise and accelerate advancing measures proposed in the Climate Act. |

Recent progress on structural reforms

At the end of 2019, the Dutch Supreme Court ruled that the government must reduce emissions immediately in line with its human rights obligations. Subsequently, the government introduced several measures, including a reduction and phasing out of coal-powered electricity production. In addition, the COVID-19 crisis reduced greenhouse gas emissions, mainly through lower mobility and transport, industry, and to a lesser extent also in electricity generation. To address structural challenges in the labour market, the government set up a commission (Borstlap commission), which has provided recommendations to level the playing field for regular and irregular work contracts in its final report in 2020. When and whether the recommendations will translate into law remains to be seen.