To attain a strong and inclusive recovery top policy priority should be on boosting formal jobs creation, with reforms ranging from removing obstacles to firm entry and competition, to improving the quality of education and training.

Economic Policy Reforms 2021

Costa Rica

Costa Rica: Performance prior to the COVID-19 crisis

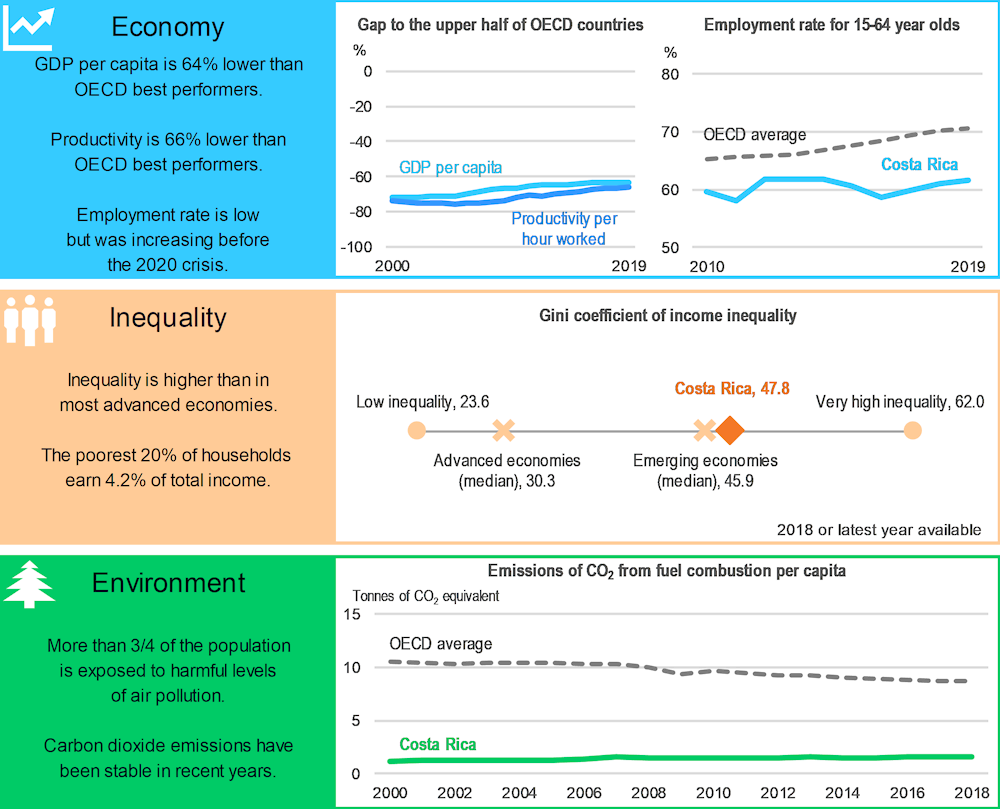

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality. The latest available data for Costa Rica is 2019.

Environment: A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment and Energy Databases.

Boosting formal job creation for a strong and inclusive recovery

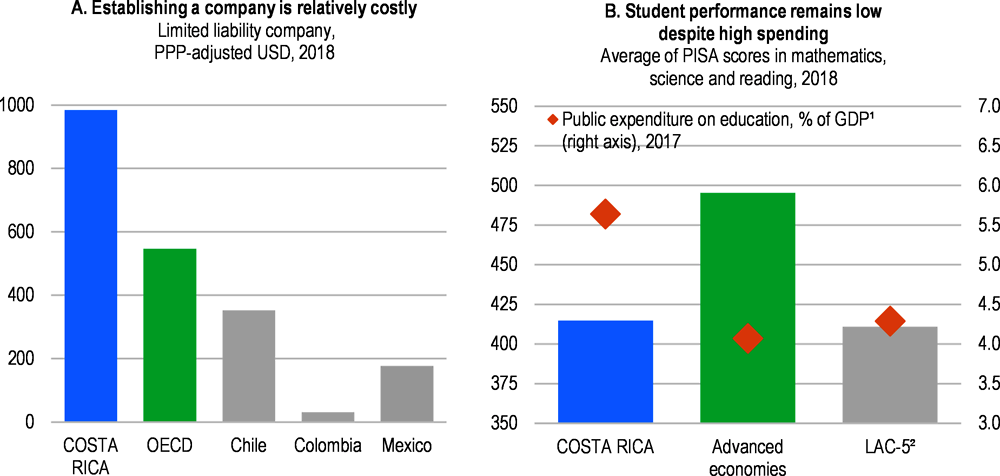

Informality has already been high before the crisis, especially among women and low-skilled workers, and has now further increased. To make growth more inclusive, a comprehensive strategy to reduce informality is needed. This should include simplifying the minimum wage, gradually shifting part of the tax burden from social security contributions to other taxes (such as property taxes), improving the quality of education and training, and simplifying administrative procedures to lower costs for firm entry and formalisation (Panel A). Administrative burden for firm entry can be reduced by introducing online one-stop mechanisms for licenses and permits and widening the scope of silence-is-consent rules.

Formal job creation relies on a dynamic business environment, but domestic firms lag behind those in free-trade zones in terms of innovation and integration into global value chains. Hence, the business environment needs to improve on several fronts. More competition in the domestic network and service sectors would lower input prices for firms. Competitive and performance-based funding in public research would strengthen cooperation between universities and domestic businesses and foster innovation among SMEs. Centralising public planning procedures for infrastructure projects using cost-benefit analysis could help to improve infrastructure and reduce transport costs for domestic firms.

Low competition in many key sectors, such as banking, food, electricity or transport, leads to higher prices and lower quality of essential goods and services, harming consumers and hindering business dynamics and employment creation. Boosting competition can be achieved by ensuring full and timely implementation of the competition law, phasing out remaining exemptions and ensuring the independence and sufficient resources of the competition authority. Finally, transparent monitoring of the performance of prevalent state-owned enterprises should be established.

Costa Rica: Vulnerabilities and areas for reform

1. 2018 for Costa Rica.

2. LAC-5 refer to Argentina, Brazil, Chile, Colombia and Mexico.

Source: Panel A: OECD, Product Market Regulation Database 2018; Panel B: OECD, PISA and Education at a Glance 2020 Databases.

The pandemic has exacerbated fiscal vulnerabilities, highlighting the need for raising public spending efficiency. This should include simplifying the system of public employment remuneration and introducing performance-based incentives, centralising public procurement, reducing the duplication of public agencies, and better targeting social spending. In particular, although education spending as a share of GDP is significantly higher than in advanced economies, educational outcomes remain low (Panel B). Dropout rates are high, especially among students from disadvantaged households. Improving the quality of education requires updating curricula and improving teacher recruitment, selection and training. Rebalancing education spending towards early childhood and secondary education, further increasing affordable childcare and strengthening targeted support for students with higher drop-out risks would improve job opportunities for all students.

Costa Rica: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

Labour market: Reduce barriers to the formalisation of workers and firms |

|

|

☑ Single window mechanisms for business registration and licensing are gradually being deployed, but do not cover all permits. ☑ Employer and employee’s social security contribution have been lowered for informal companies that become formal (temporary and only for small firms). ☑ The number of different minimum wages has been reduced from 26 to 16, with a medium-term objective to reduce it further to 11, reducing administrative burden. ☑ Sectoral pilot programmes to reduce informality for domestic workers and some agro activities (coffee) have been deployed and there are plans for including the fishing sector, street vendors and part-time workers. |

□ Introduce online one-stop mechanisms and ensure physical ones cover all licences and permits and are present in all major cities. Widen the scope of silent is consent rules and remove the administrative requirement to apply for its application. □ Eliminate the requirement for using a notary to register a company. Make the electronic signature mechanism more user-friendly to support online firm registrations. □ Establish a comprehensive strategy to reduce informality, including shifting part of the tax burden from social security contributions to property taxes and strengthening enforcement mechanisms. □ Further simplify the minimum wage system. |

|

Competition and regulation: Promote domestic firms’ participation in global-value chains |

|

|

☑ A National Committee on Trade Facilitation was created, comprising public and private stakeholders, to improve conditions at borders, ports and airports and to streamline procedures. Joint custom facilities with Panama are being established, and information exchange and coordination for border control activities with Nicaragua are being improved. ☑ The fiscal reform of 2018 has simplified the tax system through the introduction of a VAT which has the potential to reduce costs for domestic firms. |

□ Finance public research based on competitive and performance-based criteria and establish independent evaluation mechanisms. Thereby, improve the coordination between universities and the domestic business sector to support innovation outside the free trade zones. □ Improve road, rail and port infrastructure, particularly through centralising public planning procedures using cost-benefit analysis. □ Reform the electricity sector to improve service quality and reduce prices. Increase the share of private-sector electricity generation, allow private participation in distribution and retail supply and remove barriers to foreign participation. Introduce legal or ownership separation between generation, transmission and retail supply. □ Continue to improve trade facilitation, including by simplifying and harmonising documents, automating and streamlining border procedures, and improving co-ordination of the relevant national agencies. |

|

Competition and regulation: Strengthen competition |

|

|

☑ A bill has been approved, providing the competition authority with more independence, a higher budget and the ability to focus more on investigating anti-competitive conduct. The new competition reform act has reduced exemptions to 5 sectors. ☑ The governance of SOEs has improved through the removal of high-level government officials from boards and the strengthening of selection mechanisms for board members. ☑ A deposit insurance and a comprehensive resolution mechanism covering all banks have been established. |

□ Ensure full and timely implementation of the competition reform road map. □ Gradually phase out remaining exemptions to the competition law in rice, sugar, coffee, maritime services and professional services. □ Establish and monitor performance indicators for SOEs, including their financial health. Ensure full implementation of international accounting standards for SOEs. □ Deploy training on competition issues for judges and court staff. Boost competition in the legal profession by deregulating lawyer’s fees. □ Gradually reduce existing regulatory distortions affecting public and private banks that limit competition in the banking sector. |

|

*Public sector: Improve spending efficiency and the performance of the public sector* |

|

|

*New priority * |

□ Simplify public employment remuneration through adopting a single salary scale, streamlining incentives schemes and making them performance-based. □ Centralise purchases by all public entities using the central procurement system and limit the use of exceptions for direct contracting. □ Conduct a public sector reform reducing the duplication of public agencies and SOEs, defining clear responsibilities and improving coordination. □ Target social spending on low-income individuals. □ Eliminate tax exemptions benefiting more affluent taxpayers. |

|

Education and skills: Enhance the quality and efficiency of the education system |

|

|

☑ Spending related to early education has been classified as part of total mandated spending on education in Budget 2020, which facilitates a future redirection of spending to early childhood education. Enrolment rates for children of age 5 have increased ☑ New training programmes for teachers have been introduced. A special unit to provide support to drop-outs has been created. ☑ The new dual vocational training bill creates an apprenticeship system that closely involves |

□ Rebalance education spending towards early childhood and secondary education. Continue to increase the supply of affordable childcare and to strengthen targeted support for at-risk students. □ Fully implement the newly designed learning standards. □ Continue plans to move to a performance-based education system and establish educational outcomes as the main policy target instead of spending. Improve teacher recruitment, selection and training based on regular teacher and student evaluations. □ Link part of universities funding to responding to current and future labour market needs. |

Recent progress on structural reforms

Progress in structural reforms has been very good in recent years, particularly driven by the OECD accession process of Costa Rica. The COVID-19 pandemic has intensified fiscal imbalances leading to heightened political discussions on fiscal policy reforms, including reforms of the public employment scheme, public procurement processes and the organisation of the public sector, which are currently discussed in Congress. In 2020, a range of reform initiatives not included in the reform priorities has been approved. To support household incomes during the crisis, the authorities have introduced a direct cash transfer programme (Bono Proteger), targeted at formal and informal workers who lost their job or faced reduced working hours. In 2019, a fiscal reform was implemented, which introduced a fiscal rule, created a new VAT and two new income brackets in the personal income tax scheme, and reduced revenue earmarking. The independence of the Central Bank and financial market supervision have been strengthened.