The pandemic highlighted gaps in the social safety net and risks aggravating the situation for disadvantaged students and vulnerable workers. Increasing the coverage of out-of-work benefits should become the top policy priority. Strengthening efforts to provide individualised support to students at risk remains crucial, as does upskilling of large parts of the workforce, especially with digital skills.

Economic Policy Reforms 2021

Portugal

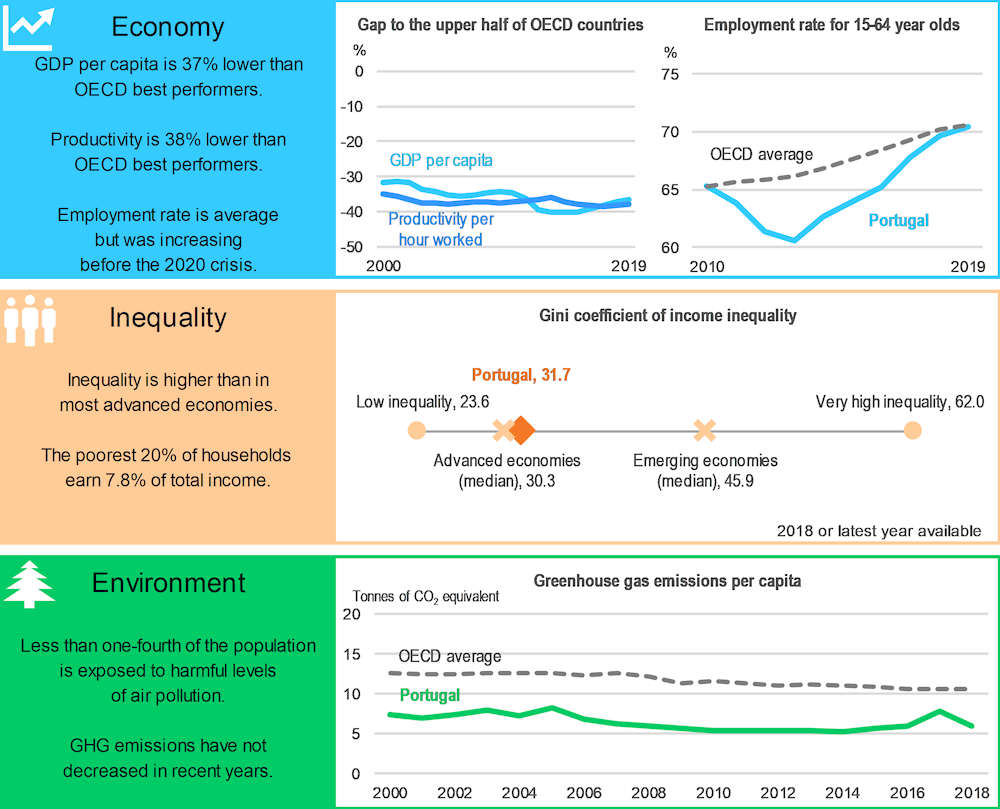

Portugal: Performance prior to the COVID-19 crisis

Economy: Percentage gap with respect to the population-weighted average of the highest 18 OECD countries in terms of GDP per capita (in constant 2015 PPPs).

Inequality: The Gini coefficient for disposable income measures the extent to which the distribution of disposable income among households deviates from perfect equal distribution. A value of zero represents perfect equality and a value of 100 extreme inequality.

Environment: Greenhouse gas (GHG) emissions include emissions or removals from land-use, land-use change and forestry (LULUCF). A high exposure to air pollution refers to above 10 μg/m3 of PM2.5.

Source: Economy: OECD, National Accounts, Productivity and Labour Force Statistics Databases; Inequality: OECD, Income Distribution Database and World Bank, World Development Indicators Database; Environment: OECD, Environment Database and United Nations Framework Convention on Climate Change (UNFCCC) Database.

Upskilling of the workforce for digital transformation and resilience

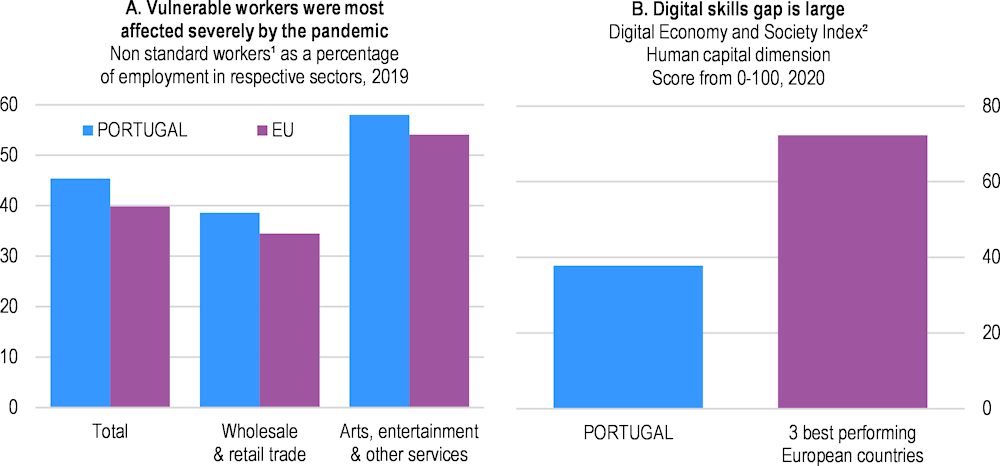

The crisis is hitting disproportionately those on non-standard work contracts and is likely to increase inequalities by accentuating labour market dualism (Panel A). Improving access to and coverage of unemployment benefits for non-standard workers can help to alleviate poverty risks. As the pandemic continues, increasing the coverage of minimum-income benefits should become a crucial part of governments’ strategy to support people, as this can stabilise their incomes, tackle inequality, and relieve acute economic needs. Portugal has undertaken important reforms to address labour market segmentation and foster collective bargaining. The emphasis of active labour market policies on targeted training showed positive results. Short-term working schemes helped to sustain incomes and jobs of standard workers during the crisis but non-standard employees often fail to meet the contributory requirements to access unemployment benefits.

The pandemic highlighted the dire need to equip large parts of the workforce with digital skills. Developing a coherent adult-learning strategy, in particular digital literacy programmes, and improving its attractiveness through better career guidance will foster the digital transformation and promote inclusion (Panel B). Education will play an important role in facilitating the recovery from the pandemic and fostering resilience. Developing on-the-job training in the vocational education and training system can improve its efficiency. Given the pandemic-induced disruptions of schooling, students at risk of falling behind should receive more support.

Portugal: Vulnerability and areas for reform

1. Non-standard workers refer to self-employed, workers in temporary contracts and in part-time jobs.

2. The Digital Economy and Society Index (DESI) is a composite index that summarises relevant indicators on Europe's digital performance and tracks the evolution of EU Member States, across five main dimensions: Connectivity, Human Capital, Use of Internet, Integration of Digital Technology, Digital Public Services. DESI Human Capital Dimension is calculated as the weighted average of the two sub-dimensions: Internet User Skills (50%) and Advanced Skills and Development (50%).

Source: Panel A: OECD calculations based on European Union Labour Force Survey Database; Panel B: European Commission, Digital Scoreboard.

Low productivity weighs on Portugal’s income convergence to OECD best-performing countries. Strict regulations in some services sectors, in particular legal and transport, create barriers to entry and hinder productivity growth. Setting up an independent supervisory body to ensure that regulations in the legal profession are in the public interest would help pin down reforms to raise efficiency. In transport, current regulations and practices reduce competition between private operators in ports. Renegotiating existing port concessions and undertaking new public tenders could ensure lower port user costs and thereby boost export competitiveness, especially for firms that rely on such infrastructure to reach end markets.

Despite considerable deleveraging since the financial crisis, the pandemic arrived against a backdrop of high corporate indebtedness, which risks curtailing investment and job creation. There is scope to improve the bankruptcy procedures, notably via reducing the time to discharge and exempting more of the debtor’s assets from bankruptcy proceedings for heavily indebted individuals.

A more effective tax system can free up resources for investment in education, health, and infrastructure. The use of consumption tax exemptions and reduced rates narrows the tax base and should be minimised. Once the recovery is underway, less distortionary forms of taxation, such as property and environmental taxes, should be increased. This will help to strengthen the revenue-raising capacity of the tax system. Increasing the prices of pollution sources can help to direct private innovation spending towards more environmentally friendly outcomes. Spending on, for example, energy efficiency measures to retrofit existing buildings, or green R&D to unlock novel clean technologies, can provide demand stimulus and help curb carbon emissions.

Portugal: Summary of Going for Growth priorities and recommendations

|

2019-2020 Reforms |

Recommendations |

|---|---|

|

*Labour market: Reinforce social protection for non-standard employment to reduce precariousness and poverty* |

|

|

*New priority * |

□ Increase resources on the more effective labour market programmes. □ Extend the coverage of the unemployment benefit for non-standard employment and raise the coverage and the benefit level of the minimum income support scheme. □ Mitigate labour market duality by reducing the gap between employment protection legislation for permanent and temporary contracts to improve job quality and strengthen training incentives. |

|

Education and skills: Raise skills to strengthen productivity, foster the creation of higher quality jobs, and improve equity and well-being |

|

|

☑ Following an impact assessment the Specific Tutorial Support programme, providing an individualized support to all students with more than one grade retention, was extended in 2020. ☑ The second phase of Indústria 4.0 (a 2017 initiative aimed at increasing digital adaptation of technologies though skill development and investment) was launched in April 2019. |

□ Continue efforts to provide more individualised support to students at risk of falling behind to reduce grade repetition and drop-out rates. □ Develop the dual vocational education and training (VET) system. □ Develop adult-learning further, including digital literacy programmes, and improve its alignment with labour market needs. |

|

Competition and regulation: Strengthen competition in non-manufacturing sectors to bolster export competitiveness and productivity |

|

|

☑ The Portuguese Competition Authority (AdC) has taken steps adopting the OECD recommendations from the Competition Review from 2018. ☑ A strategy for increasing the competitiveness of the port network has been developed and published in 2019. |

□ Reduce entry barriers in regulated professions, monitor entry and price regulation by professional bodies to safeguard competition. □ Renegotiate port concessions and undertake new public tender processes to ensure that lower port labour costs translate into lower port user costs. |

|

Insolvency: Reduce high corporate leverage to raise investment and promote job creation |

|

|

☑ The adoption of the EU Directive 2019/1023 on preventive restructuring frameworks and on discharge of debt is currently on-going. |

□ Promote access to equity capital by modernising the regulatory framework to reduce debt overhang risk. □ Make bankruptcy a viable solution for heavily indebted individuals, reducing the time to discharge and exempting more of the debtor’s assets from bankruptcy proceedings. |

|

Tax system: Reduce exemptions and special rates to enhance efficiency of the tax system and strengthen public finance sustainability |

|

|

☑ The Ministry of Finance is currently undertaking a comprehensive review of every tax exemption. Abolishing reviewed exemptions is expected to bring revenues of €90M per year. ☑ In 2020, the government has split the highest tax bracket of the Real Estate Transfer tax in two, thus increasing the burden on the acquisition of real estate above €1M (7.5% in 2020 from 6% in 2019). |

□ Reduce tax exemptions and special rates to simplify the tax code, broadening the tax base once the recovery is firmly underway. □ Increase the share of less distortionary forms of taxation, such as property taxes, in the tax mix. |

Recent progress on structural reforms

Portugal continues to improve its mechanisms for quality assurance in vocational education and training (VET) and its analysis of skills needs. It made good progress in increasing the number of higher education graduates and reducing grade repetition and drop-out rates bringing it closer to the EU average.